Paisewaise - "Empower Your Finances, Explore Opportunities, and Secure Your Future"

"Mastering the Art of Wealth: Online and Offline Money-Making Strategies, Investment Insights, Business news and Financial Facts"

Latest Articles

Why Dividend Growth Investing Is Gaining Popularity Across the U.S.: Trends, Risks, and Long-Term Strategy

In an era defined by market swings, stubborn inflation, and an uncertain Federal...

Introduction: Understanding Mortgage Quotes

Buying a home is one of the most significant financial decisions most people will ever make. Before you sign anything, one of the first things...

Most Americans Are Budgeting Wrong in 2026 — Are You Making These Costly Mistakes?

64% of Americans say they follow a budget — yet nearly half end each month with less money than expected.

If...

What Is the 50/30/20 Rule? (Quick Breakdown for Beginners)

The 50/30/20 rule is a simple budgeting framework that divides your after-tax income into three categories: 50% for needs,...

How Much Mortgage Can I Afford?

Buying a home is exciting—until you start wondering if you can actually afford it. The truth? Most people either overestimate what they can borrow or...

What Is a Credit Card APR? A Complete Guide to Understanding Your Card’s Costs

Confused about your credit card statement? APR is the key number to know.

If you’ve ever looked...

I Tried Zero-Based Budgeting for 30 Days—Here’s Exactly What Happened to My Money

Why My Money Never Lasted Till Month-End

Every month felt like the same frustrating cycle. My...

What Is a Mortgage? A Beginner-Friendly Guide to Buying a Home

The Homeownership Dilemma

Picture this: You’ve found your dream home. The neighborhood is perfect, the schools are...

What Is a Car Loan? Everything You Need to Know Before You Buy

Let’s be honest—buying a car today isn’t what it used to be. With vehicle prices climbing year after year,...

UNH Stock: The Healthcare Giant Behind One of America’s Most Watched Tickers

UnitedHealth Group quietly sits behind some of the most important decisions in American healthcare. Millions...

How Long Does a Credit Card Refund Take? Exact Timeline Explained (2026)

Refund Processed… But Where’s the Money?

Picture this: You ordered a laptop online for $1,200, but it...

What Happened When I Stopped Using Credit Cards: A 90-Day Financial Experiment

I didn’t realize how much control credit cards had over my money—until I stopped using them.

For...

Living on Cash Only for 30 Days: Here’s What Changed

What if every swipe, tap, and scan disappeared overnight?

For most of us, spending money has become invisible. A quick tap of our...

I Tried the No-Buy Trend for a Month—Was It Worth It?

Let’s be honest: have you ever checked your bank account mid-month and wondered where all your money went? You didn’t...

Netflix’s $72 Billion Warner Bros. Bet: Will It Pay Off for Investors or Bust the Bank?

Imagine scrolling through your finance feed and spotting headlines screaming about Netflix,...

Why Finance Content Is Dominating Social Media Feeds

The Problem Everyone Is Quietly Obsessing Over

Something fundamental has shifted in the way we scroll. Open Instagram or TikTok...

How Instagram Aesthetics Influence Spending Decisions (And Why You Buy Things You Never Planned To)

You’re lying in bed, mindlessly scrolling through Instagram before sleep. A...

TikTok Money Trends That Actually Make Sense (What’s Worth Trying vs. What to Skip)

Everyone is suddenly a finance expert on TikTok. One video says “cash stuffing will change...

8 Things People Regret Buying After the Hype Fades (And How to Avoid the Same Mistake)

Why Hype Feels So Good—Until It Doesn’t

You’ve seen it everywhere. Your favorite influencer...

9 Simple Ways People Save Money Without Budgeting (No Apps, No Spreadsheets)

Why Budgeting Fails Most People

You make a budget on Sunday night. You download the app, categorize your...

7 Money Habits That Look Boring but Work Surprisingly Well

The Unsexy Truth About Building Wealth

Tired of flashy financial hacks that promise quick wealth but leave your wallet empty?...

How People Are Traveling More While Spending Less

Flights feel expensive. Hotels look unaffordable. Vacation packages seem out of reach for most budgets. Yet airports are fuller than...

The Real Truth About Saving Money in Your 20s (That No One Actually Tells You)

The Silent Money Struggle in Your 20s

You’re doing everything “right”—you landed a job,...

Why Earning More Money Didn’t Make Me Feel Richer

On paper, I was earning more than ever. My salary had doubled in three years. I’d climbed the ladder, collected the raises,...

This Viral Money Challenge Is Helping People Save Thousands — Here’s How It Works

Why So Many People Can’t Save Money Right Now

“I make money, but I never have money.”

If...

The “Soft Saving” Trend: Why Gen Z Is Rejecting Traditional Budgeting

For decades, personal finance experts have preached the gospel of meticulous budgeting: track every...

Couples’ Money Challenges: Who Really Wins Financial Fights?

The Fight That’s Never About Money

It’s 11 PM on a Tuesday, and the silence in your bedroom is deafening. What...

Can You Survive on $5 a Day? I Tried It—Here’s What Actually Happened

The $5-a-Day Question That Sounds Simple

Everyone thinks they can live “cheap” until they actually...

30-Day No-Spend Challenge: What I Learned

The idea of a 30-day no-spend challenge sounds simple enough: stop buying things you don’t absolutely need for 30 days. But when I first...

If Superheroes Had Budgets: Analyzing the Spending Habits of Fictional Characters

What if superheroes had budgets? The question sounds absurd at first—these are characters who regularly...

Celebrity Money Habits That Surprise People

When we think of celebrities, images of private jets, sprawling mansions, and designer wardrobes instantly come to mind. The entertainment...

How Movies and TV Shows Portray Money (and What We Can Learn)

We’ve all seen it: the struggling artist who suddenly lands in a penthouse, the tech genius who builds an empire...

SPY Stock: Everything You Need to Know About America’s Most Popular ETF

When investors talk about tracking the stock market’s pulse, one ticker symbol dominates the conversation:...

The $50,000 Credit Card Trap: How Sarah’s “Rewards Strategy” Became a Financial Nightmare

Sarah Mitchell, a 34-year-old marketing manager from Austin, Texas, earned...

Introduction

There’s nothing quite like the thrill of planning a vacation—browsing destinations, imagining yourself on a sun-soaked beach, or exploring a bustling new city. But...

Fun Ways to Save Money Without Feeling Restricted

Last week, my friend Sarah told me she’d been “saving money” by bringing lunch to work every day. When I asked how much she’d saved,...

This Simple Money Habit Is Going Viral on Social Media

People scroll past thousands of posts each day promising financial transformation through complex strategies and disciplined routines....

How to Track Your Spending Using Just Your Phone

Gone are the days of keeping receipts in shoeboxes or scribbling expenses in paper ledgers. Today, your smartphone—the device already...

How Compound Interest Works: A Complete Guide to Understanding Your Money’s Growth

Compound interest is often called the eighth wonder of the world, and for good reason. It’s...

How Is Elon Musk So Rich? The Complete Story Behind His Fortune

Elon Musk’s name has become synonymous with extraordinary wealth. As one of the richest people on the planet, with...

How Do Rich People Invest Their Money? A Complete Guide to Wealth-Building Strategies

The path to substantial wealth isn’t just about earning more—it’s about investing smarter....

Introduction: Why Transaction Tracking Matters

Savings Account Transactions are at the heart of how banks manage your money. Every deposit, withdrawal, transfer, or payment you make...

Introduction: Why Savings Accounts Have Withdrawal Limits

A Savings Account Withdrawal is designed to move money out of a savings account when needed—but not as frequently as spending...

Introduction: Why Average Monthly Balance Matters

The average monthly balance is one of the most important internal metrics U.S. banks use to manage savings and checking accounts. While...

Introduction: Why Minimum Balance Rules Matter

Minimum balance rules are one of the most misunderstood aspects of U.S. savings accounts. Many consumers open a savings account expecting...

Introduction: Why Savings Account Rates Are Not Random

Many Americans believe that savings account interest rates are simply arbitrary numbers banks post on their websites, or worse,...

How Savings Account Interest Is Credited Monthly in Banks

Understanding how your savings account earns interest isn’t just about knowing the annual percentage yield (APY) advertised...

Dina Powell McCormick: Net Worth, Career, and Influence in Global Finance

Dina Powell McCormick stands as one of the most influential figures operating at the critical intersection...

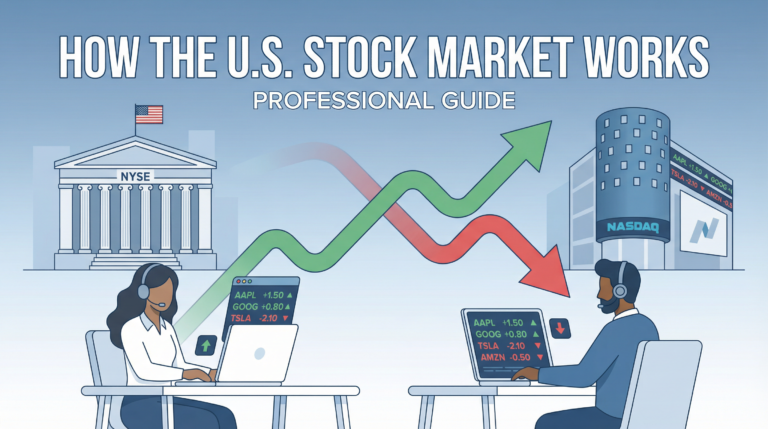

How the Stock Market Works: A Beginner’s Guide (U.S. Market Explained)

The stock market serves as a vital bridge between businesses that need capital and individuals who want...

Imagine waking up to find money in your bank account—money you earned while sleeping, traveling, or spending time with family. That’s the promise of passive income, and it’s...

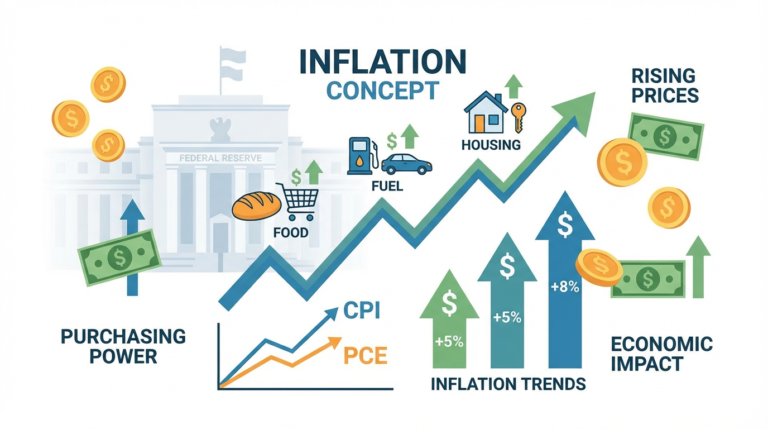

Introduction

Inflation touches every aspect of our financial lives—from the groceries we buy to the interest rates on our mortgages, from our retirement savings to government economic...

What Is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness based on your borrowing and repayment history. Lenders, landlords, and even employers...

Introduction: Why Saving Money Feels Hard (But Is Possible)

You know that feeling when payday arrives, and you promise yourself, “This time I’ll save something”? And...

Introduction

In today’s economy, where inflation impacts everything from groceries to housing, understanding personal finance isn’t just helpful—it’s essential. Yet...

How to Increase Credit Score: Your Complete Guide to Better Financial Health

Your credit score is more than just a number—it’s your financial reputation distilled into three digits....

How to Invest in the S&P 500 in the USA (Beginner-Friendly Guide)

If you’re looking to build wealth through the stock market, learning how to invest in the S&P 500 is...

Introduction: Why Most People Struggle With Money (And How a Budget Fixes It)

If you’re living paycheck to paycheck, watching your bank account dwindle before the month ends,...

Introduction to Student Loan Refinancing for Doctors and Dentists: A Complete Guide

Medical professionals graduate with some of the highest student loan debt in the country. For doctors...

Introduction: Start the New Year With Smarter New Year Financial Planning

The start of a new year feels like the ideal moment to reset your finances. Yet, many people try to overhaul...

Introduction: Why Redbubble Is Still a Smart Side Hustle

Picture a quiet evening in your home office: laptop glowing as you upload a misty Pāngani sunset design. Days later, pings arrive—sales...

Let’s be honest—retirement feels like this distant, almost mythical thing when you’re in your twenties or thirties. You’re thinking about rent, student loans, and...

Let me guess—you need a small business loan, and you’re reading this because your business needs cash. Maybe it’s that new equipment that’ll double your output, or...

Introduction

Managing money can feel overwhelming, especially with rising expenses and unpredictable incomes. Many people struggle to keep track of their spending or stick to a budget...

What Is an IPO? A Beginner’s Guide to Initial Public Offerings

Introduction

When a company like Airbnb or Rivian decides to sell shares to the public for the first time, it creates...

What Is Peer-to-Peer Lending? A Complete Guide for Beginners

The financial world is evolving rapidly, and one innovation that’s reshaping how people borrow and lend money is peer-to-peer...

Starting a Business vs. Investing in Stocks: Which Path to Wealth Is Right for You?

The age-old question that keeps aspiring wealth-builders awake at night: should you pour your savings...

How Do Banks Make Money? A Complete Guide to Banking Revenue Streams

Every day, millions of people walk into banks, swipe their debit cards, apply for mortgages, and check their account...

What Are Emergency Funds? A Complete Guide for American Households in 2025

The average American is just one unexpected expense away from a financial crisis. According to recent Federal...

Are you looking for ways to make money online using just your writing skills? The good news is that content writing isn’t just a creative outlet—it’s also a highly profitable way to...

Introduction

Most people believe earning money means a regular job, a side business, or investing for years before seeing results. But the internet and the modern gig economy have unlocked...

Introduction: The Gaming Gold Rush

Gaming isn’t just entertainment anymore—it’s a multi-billion dollar industry offering genuine income opportunities for players worldwide....

Introduction

Money is more than just a way to buy things—it shapes societies, influences our decisions, and even affects our brains. While most of us handle cash daily, there are countless...

10 Proven Ways to Monetize a Blog in the Finance Niche

The finance niche is one of the most profitable blogging niches in the world—and for good reason. People actively search for answers...

What Is an ATM? A Complete Guide to Automated Teller Machines

Imagine needing cash at midnight or wanting to check your bank balance on a Sunday morning. A few decades ago, you’d have...

Suggest Article Topics

Have a burning question or a specific topic in mind that you’d love to see covered in our articles? We welcome your input and ideas! Feel free to share your suggestions below, and we’ll do our best to provide you with valuable insights on the subjects that matter most to you. Your feedback helps us create content that truly meets your needs.