Why Dividend Growth Investing Is Gaining Popularity Across the U.S.: Trends, Risks, and Long-Term Strategy

In an era defined by market swings, stubborn inflation, and an uncertain Federal Reserve outlook, a quiet but powerful strategy has been capturing the attention of investors across all age groups: dividend growth investing. Unlike chasing the hottest stock or timing the market, dividend growth investing centers on one elegant idea — owning businesses that consistently raise their dividend payments year after year, compounding income over time.

The surge in interest is no coincidence. With bond yields losing their shine against real inflation, and tech-fueled speculation leaving many investors burned, the fundamentals of dividend growth investing have never looked more attractive. Add in the aging of Baby Boomers seeking reliable income, the rise of FIRE-minded Millennials, and the explosion of low-cost dividend ETFs, and the conditions are ripe for this strategy to go mainstream.

This article explores why dividend growth investing is trending, how it stacks up against alternatives, who’s driving its adoption, and what risks investors must not ignore.

Dividend Growth vs. High-Yield Dividend Strategies

Defining the Two Approaches

Not all dividend strategies are created equal. Investors often conflate two fundamentally different approaches:

| Feature | Dividend Growth Investing | High-Yield Strategy |

|---|---|---|

| Core Focus | Consistent dividend increases | Maximum current yield |

| Typical Yield | 1.5% – 3.5% | 4% – 8%+ |

| Growth Rate | 6% – 12% annual dividend growth | Low to flat |

| Company Quality | High earnings quality, strong FCF | Variable, often mature/leveraged |

| Risk Profile | Lower volatility | Higher dividend cut risk |

| Best For | Long-term compounders | Short-term income seekers |

The Compounding Advantage

The true power of dividend growth investing only reveals itself over time. Consider this simplified example:

- Investor A buys a stock with a 5% yield that never grows.

- Investor B buys a stock with a 2.5% yield that grows dividends at 10% annually.

By year 10, Investor B’s yield-on-cost surpasses Investor A’s. By year 20, the compounding gap is dramatic — and that’s before factoring in share price appreciation, which tends to follow dividend growth.

Risk-Adjusted Performance

Dividend growth investing has historically delivered lower volatility than the broader market. Companies that qualify — those with consistent earnings, strong balance sheets, and the cash flow to sustainably raise dividends — tend to be inherently defensive. Meanwhile, high-yield strategies expose investors to “dividend traps”: stocks with elevated yields precisely because the market anticipates a cut.

Macroeconomic Drivers Behind the Surge

The Rate Environment Shift

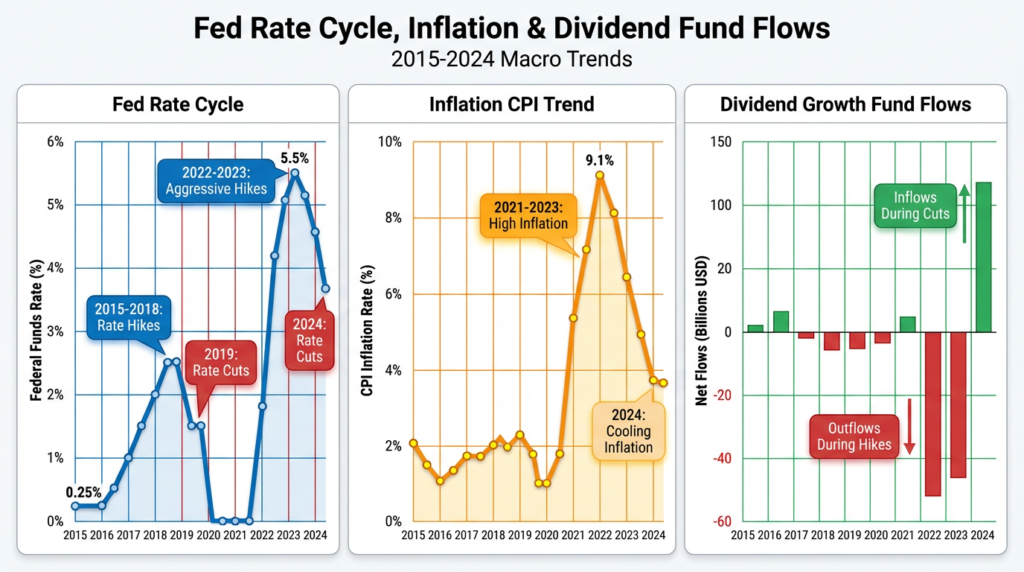

For over a decade of near-zero interest rates, dividend growth investing competed with essentially no fixed-income alternative. Now that rates have risen significantly, the comparison is more nuanced — but dividend growth investing still holds a key advantage: growth. A 10-year Treasury note locks you into a fixed coupon. A dividend growth stock that raises its payout 8% per year is a different animal entirely.

As the Fed begins or continues cutting rates, capital tends to rotate back into equities — particularly quality dividend growers, which benefit from both yield compression (rising prices) and continued earnings strength.

Inflation as a Catalyst

Fixed-income investors suffered badly during the 2021–2023 inflation spike. Real bond returns turned deeply negative. Dividend growth investing, by contrast, offers a natural inflation hedge when the underlying companies have pricing power — the ability to raise prices without losing customers.

Companies like Johnson & Johnson, Procter & Gamble, and Coca-Cola have hiked dividends through multiple inflationary cycles precisely because their brands support pricing power. This is the foundation of dividend growth investing as an inflation defense.

Market Volatility and Defensive Sectors

Periods of elevated VIX readings tend to push capital toward defensive sectors — consumer staples, healthcare, and utilities — which happen to dominate dividend growth indexes. This is not coincidental. Recession fears in 2022–2023 visibly accelerated flows into dividend growth ETFs and funds, as investors sought cash-generating quality over speculative bets.

Who Is Driving the Popularity? Generational Trends

Retirees and Near-Retirees

The largest cohort fueling the rise of dividend growth investing is the 65+ demographic. With approximately 10,000 Baby Boomers reaching retirement age daily, income replacement has become a national financial priority. Social Security covers only a fraction of pre-retirement income for most Americans, making portfolio income streams essential.

Dividend growth investing appeals here because it offers:

- Predictable, rising cash flow without requiring asset liquidation

- Lower volatility is suitable for shorter recovery time horizons

- A psychological anchor — receiving dividends during down markets reduces panic selling

Millennials and Gen Z: The FIRE Connection

Younger investors are discovering dividend growth investing through the FIRE (Financial Independence, Retire Early) movement. The appeal is logical: build a portfolio that generates enough passive income to cover living expenses, then step off the treadmill.

Platforms like Reddit’s r/dividends (over 600,000 members), YouTube finance channels, and TikTok personal finance creators have introduced dividend growth investing to millions of younger investors who previously only knew index funds or crypto.

From Speculation to Stability

The post-2021 hangover from meme stocks, SPACs, and crypto crashes drove a visible rotation in retail investor sentiment. Many investors who lost money chasing momentum pivoted toward fundamentals-based strategies. Dividend growth investing — with its emphasis on earnings quality, free cash flow, and payout consistency — became a natural landing spot.

Performance During Market Downturns

Historical Bear Market Data

One of the strongest arguments for dividend growth investing is its behavior in bear markets. During the 2008–2009 financial crisis, the S&P 500 dropped roughly 55% peak to trough. The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) — tracking companies with 25+ years of consecutive dividend increases — has historically shown shallower drawdowns than the broader index during stress periods.

| Market Event | S&P 500 Drawdown | Dividend Aristocrats (Approx.) |

|---|---|---|

| 2008–2009 Financial Crisis | ~−55% | ~−45% |

| 2020 COVID Crash | ~−34% | ~−32% |

| 2022 Bear Market | ~−25% | ~−12% |

Note: Past performance is not indicative of future results. Figures are approximate.

The Psychological Advantage

Perhaps underappreciated is the behavioral finance edge of dividend growth investing. Receiving a quarterly dividend deposit during a market collapse provides psychological reinforcement to stay the course. Investors with income-producing portfolios are demonstrably less likely to panic-sell at the bottom — one of the most costly mistakes in personal finance.

Identifying Dividend Sustainability

Not every dividend is safe. The real risk in dividend growth investing is not a market crash — it’s a dividend cut. Key metrics to evaluate:

- Payout Ratio: Under 60% for most industries signals safety; under 80% for REITs and utilities

- Free Cash Flow Coverage: Dividends should be comfortably covered by FCF, not just reported earnings

- Debt-to-Equity: High leverage amplifies the risk of a cut during earnings pressure

- Dividend Growth Streak: Consecutive years of increases signal management commitment

The Role of ETFs and Index Funds

The Rise of Dividend Growth ETFs

ETFs have democratized dividend growth investing in a profound way. Retail investors can now gain exposure to curated, rules-based portfolios of dividend growers with a single ticker. Key examples include:

| ETF | Index / Strategy | Expense Ratio |

|---|---|---|

| NOBL (ProShares) | S&P 500 Dividend Aristocrats — 25+ years of increases | 0.35% |

| VIG (Vanguard) | Dividend Appreciation Index — 10+ years | 0.06% |

| DGRO (iShares) | Dividend Growth — blend of yield + growth rate | 0.08% |

| DGRW (WisdomTree) | Quality dividend growth with earnings weighting | 0.28% |

These vehicles make dividend growth investing accessible without requiring individual stock selection, quarterly earnings reviews, or the risk of concentrating in one or two names.

Tax Efficiency Considerations

Most dividend growth stocks distribute qualified dividends, which are taxed at long-term capital gains rates (0%, 15%, or 20% depending on income) rather than ordinary income rates — a meaningful advantage over bond interest income. Smart portfolio construction places high-yield assets in tax-deferred accounts (IRAs, 401ks) and dividend growth holdings in taxable accounts to maximize after-tax returns.

Risks & Common Misconceptions

Dividend growth investing is not a guaranteed path to wealth, and investors should approach it with clear eyes.

Key risks to understand

- Growth is not guaranteed. Even storied Dividend Aristocrats have cut dividends during severe stress. GE famously cut its dividend in 2009 and again in 2018.

- Valuation risk. Popular dividend growth stocks can become expensive. Buying Johnson & Johnson at 28x earnings is a different proposition than at 18x.

- Sector concentration. Heavy weighting toward consumer staples, utilities, and healthcare can mean underperformance during tech-led bull markets.

- Dividend traps. A 7% yield on a deteriorating business is not dividend growth investing — it’s a warning sign.

- Interest rate sensitivity. When rates spike sharply, dividend growth stocks with utility-like characteristics tend to sell off in the short term, even if the long-term thesis remains intact.

Recognizing these risks is part of disciplined dividend growth investing — the goal is not to avoid them entirely but to understand when they are and aren’t priced in.

Is Dividend Growth Investing Right for You?

Dividend growth investing is not a one-size-fits-all strategy, but it fits a surprisingly wide range of investor profiles:

| Investor Type | Why Dividend Growth Fits |

|---|---|

| Pre-retirees (50–65) | Build an income base before retirement; lower volatility |

| Retirees | Reliable, rising income without forced liquidation |

| FIRE seekers | Passive income compounds toward financial independence |

| Conservative equity allocators | Quality bias, lower beta exposure |

| Beginners with long horizons | ETFs provide a simple, diversified entry point |

A simple blended portfolio example for a 45-year-old investor:

- 40% — Dividend Growth ETFs (VIG, DGRO)

- 30% — Broad Market Index Fund (S&P 500)

- 15% — International Equity Index

- 15% — Bonds / Cash

This allocation captures the compounding power of dividend growth investing while maintaining diversification and growth exposure. As retirement approaches, the dividend growth allocation can increase to tilt the portfolio toward income generation.

Conclusion

Dividend growth investing’s rising popularity is not a passing trend — it reflects a fundamental shift in what investors are demanding from their portfolios: resilience, income, and quality. In a world where market volatility is persistent, inflation erodes fixed income, and speculation has disappointed millions, the quiet compounding machine of dividend growth investing offers an increasingly compelling alternative.

Whether you’re a retiree seeking to replace your paycheck, a Millennial building toward financial independence, or a cautious investor seeking equity exposure without wild swings, dividend growth investing deserves a central place in your financial thinking.

The best time to plant a dividend growth tree was 20 years ago. The second-best time is now.

FAQs

Q. What is dividend growth investing?

- Dividend growth investing focuses on buying companies that consistently increase their dividends over time, providing both rising income and long-term capital appreciation.

Q. Is dividend growth better than high-yield investing?

- Dividend growth strategies often provide stronger long-term total returns and lower volatility compared to high-yield strategies, which may carry a higher risk of dividend cuts.

Q. Are dividend growth stocks good during a recession?

- Historically, companies with strong dividend growth records tend to be financially stable and may perform better during market downturns than speculative growth stocks.

Q. What are Dividend Aristocrats?

- Dividend Aristocrats are companies in the S&P 500 that have increased their dividends for at least 25 consecutive years, signaling financial strength and consistency.

Q. Can young investors benefit from dividend growth investing?

- Yes. Younger investors can benefit significantly from reinvesting dividends over decades, leveraging compounding to accelerate long-term wealth creation.

This article is for informational purposes only and does not constitute financial advice. Consult a qualified financial advisor before making investment decisions.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.