Introduction: Understanding Mortgage Quotes

Buying a home is one of the most significant financial decisions most people will ever make. Before you sign anything, one of the first things a lender will offer you is a mortgage quote — an estimate of your loan terms, interest rate, and costs based on your financial profile.

Many buyers assume that the rates advertised on bank websites are what they’ll actually receive. They’re not. Those figures are idealized numbers built for the most creditworthy borrowers. A personalized mortgage quote, by contrast, is tailored around your specific income, debt, credit history, and the property you’re purchasing — making it a far more accurate planning tool.

Getting this estimate early helps you figure out how much home fits your budget, what your monthly payments might look like, and how much cash you’ll need at closing. This guide covers every major aspect of the process — from what goes into a lender’s estimate, to how it compares to pre-approval, to how a reverse mortgage quote works for older homeowners.

What Is a Mortgage Quote?

A mortgage quote is a lender’s estimate of the interest rate, loan terms, and closing costs they’re willing to offer based on your financial information. It is not a binding commitment — but it gives you a reliable snapshot of what borrowing will actually cost you.

Here are the key components typically included:

| Component | What It Means |

|---|---|

| Interest Rate | The base rate charged on the loan principal |

| APR (Annual Percentage Rate) | Total borrowing cost, including fees, expressed annually |

| Loan Term | Duration of the loan — 15-year, 30-year, or adjustable-rate |

| Monthly Payment | Estimated principal and interest per month |

| Estimated Taxes & Insurance | Property tax and homeowners’ insurance estimates |

| Closing Costs & Lender Fees | Origination, underwriting, and processing charges |

APR vs. Interest Rate — What’s the Difference?

One of the most important distinctions to understand when reviewing any loan estimate is APR versus interest rate. The interest rate reflects only the cost of borrowing the principal. The APR folds in lender fees and other charges to give you a single annual figure representing the true cost of the loan. When comparing offers, always look at APRs side by side — two lenders can show identical interest rates while hiding very different fee structures underneath.

Example: Lender A offers 6.8% with $4,000 in fees (APR: 7.05%). Lender B offers 6.9% with $800 in fees (APR: 6.98%). Despite the higher stated rate, Lender B is actually the cheaper option over the life of the loan.

Offers vary considerably between lenders based on their internal pricing, risk tolerance, and fee structures. Requesting estimates from at least three to five lenders before committing is widely considered a financial best practice.

What Information Do Lenders Need to Generate an Accurate Mortgage Quote?

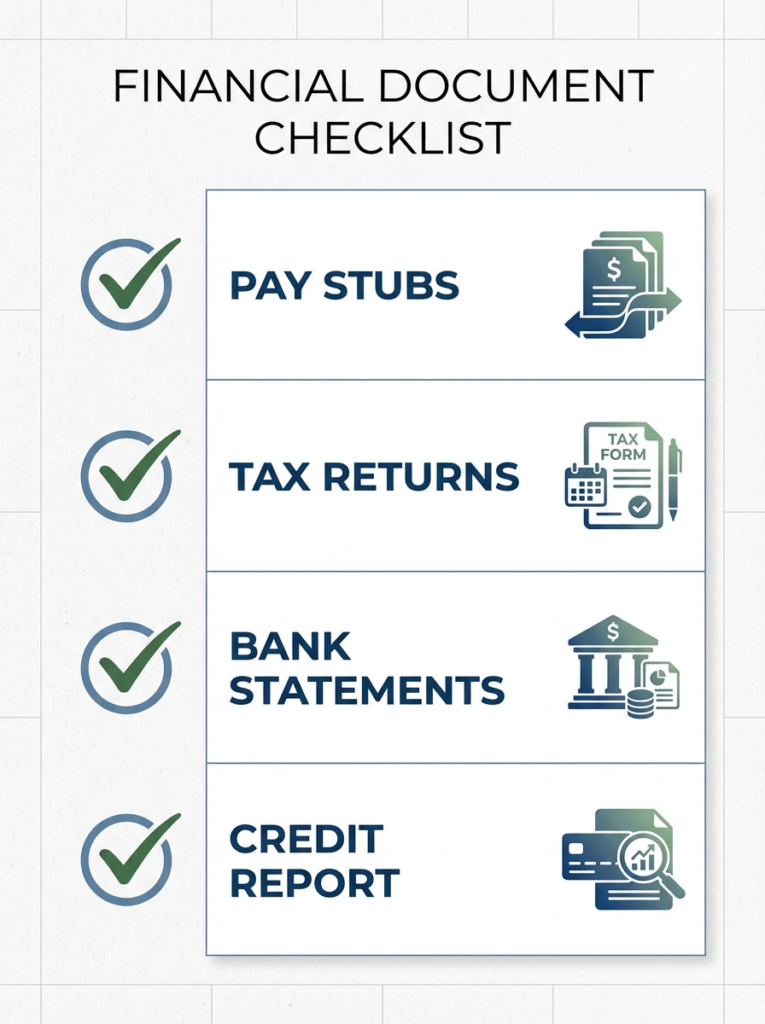

To produce a reliable mortgage quote, lenders will typically ask for the following:

- Personal identification — name, address, Social Security number

- Employment and income details — salary, bonuses, commissions, or self-employment documentation, such as two years of tax returns

- Credit score and credit history — one of the biggest drivers of the rate you’re offered

- Debt-to-income (DTI) ratio — your total monthly debt payments divided by gross monthly income

- Assets and savings — bank statements, retirement accounts, investment holdings

- Property information — purchase price, location, and property type

- Down payment amount — typically between 3% and 20% of the purchase price

Why Accuracy Matters

Overstating your income or underreporting debts may generate favorable-looking numbers that collapse during underwriting. If a lender issues a conditional estimate based on self-reported figures and those figures don’t hold up to document review, your rate — and even your approval — can change significantly. Always provide accurate information to get an estimate that genuinely reflects what you’ll be offered at closing.

How Is a Mortgage Quote Different From Pre-Qualification or Pre-Approval?

These three terms get used interchangeably, but they represent meaningfully different stages of the lending process. Understanding the distinction can save you confusion — and potentially help you win a bidding war.

| Mortgage Quote | Pre-Qualification | Pre-Approval | |

|---|---|---|---|

| Verification Level | Based on the provided data | Self-reported only | Full document review |

| Credit Check | May or may not apply | Usually soft or none | Hard credit pull required |

| Lender Commitment | Rate estimate only | No formal commitment | Conditional commitment |

| Negotiation Strength | Informational | Weak | Strong — sellers take it seriously |

| Validity Period | 10–30 days | Not applicable | 60–90 days typically |

A mortgage quote gives you a useful financial benchmark for planning your purchase. Pre-qualification is a rough ballpark. Pre-approval is what you need when you’re ready to make offers — it signals to sellers that a lender has reviewed your finances and is conditionally prepared to fund your loan. Think of the initial rate estimate as the critical step that bridges casual research and formal application.

What Fees and Closing Costs Are Typically Included?

Closing costs are where many homebuyers get caught off guard. A thorough lender estimate should break down all anticipated charges, which typically fall into four categories:

Lender Fees

- Origination fee (commonly 0.5%–1% of the loan amount)

- Underwriting fee

- Processing fee

- Application fee

Third-Party Fees

- Appraisal fee (typically $300–$600)

- Home inspection

- Title search and title insurance

- Escrow fees

Government Fees

- Recording fees

- Transfer taxes (vary significantly by state)

Prepaid Costs

- Property taxes (usually 2–3 months paid upfront)

- Homeowners insurance premium

- Private mortgage insurance (PMI) if your down payment is below 20%

When you formally apply, lenders are legally required to provide a Loan Estimate form within three business days. This standardized document details your projected monthly payment, total cash to close, and a complete fee breakdown — making it the best tool available for comparing offers from multiple lenders side by side.

How Long Is a Mortgage Quote Valid, and Can the Rate Change?

A mortgage quote is typically valid for 10 to 30 days, depending on the lender’s policy. After that window closes, you may need to request a fresh estimate based on current market conditions.

Rate Locks

Once you’ve decided to move forward, you can ask the lender to lock in the rate from your estimate. Common lock periods include:

- 30-day lock — standard for purchases nearing closing

- 45-day lock — for slightly longer timelines

- 60-day lock — for new construction or delayed closings (usually costs more)

Rate locks typically come with a small fee or a marginally higher rate. If closing is delayed beyond the lock period, extension fees apply.

When Can a Rate Change After You Receive an Estimate?

Even after locking in, your rate can shift if:

- Your credit score drops before closing

- The property appraisal comes in lower than expected

- Your DTI ratio changes — for example, if you take on new debt

- You switch loan programs

Case Study: Sarah received an initial rate of 7.1% on a $350,000 home purchase. Two weeks later, she financed a new car, pushing her DTI ratio from 38% to 46%. Her lender revised the rate to 7.45% — adding roughly $70 per month and over $25,000 in additional interest across a 30-year term. This illustrates exactly why protecting your financial profile between receiving a mortgage quote and closing day is so important.

Does Requesting a Mortgage Quote Affect My Credit Score?

This is one of the most common concerns among first-time buyers — and an important one to address before you start shopping around.

| Inquiry Type | Credit Score Impact | Typical Use Case |

|---|---|---|

| Soft Inquiry | No impact | Preliminary or online rate estimates |

| Hard Inquiry | Typically –5 to –10 points | Formal loan applications |

| Multiple Hard Inquiries (14–45 day window) | Counted as ONE inquiry | Rate shopping across multiple lenders |

Credit bureaus recognize that consumers comparison shop for home loans, so multiple hard inquiries for the same loan type within a 14–45 day window are treated as a single inquiry under the FICO scoring model. This means you can request estimates from several lenders simultaneously without worrying about cumulative score damage.

Smart Shopping Strategy: Submit all your requests within the same two-to-three week window, compare APRs rather than just stated rates, and avoid opening any new credit accounts during this period.

What Is a Reverse Mortgage Quote?

A reverse mortgage is a specialized loan available exclusively to homeowners aged 62 and older that converts home equity into cash — without requiring monthly repayments. A reverse mortgage quote estimates how much equity you can access, and it works quite differently from a standard home loan estimate.

The figure is calculated based on:

- Your age — older borrowers qualify for higher payouts

- Your home’s appraised value

- Current interest rates

- Your existing mortgage balance, if any

Components of a Reverse Mortgage Quote

| Component | Description |

|---|---|

| Principal Limit | The maximum amount you can borrow |

| Payout Options | Lump sum, monthly payments, or line of credit |

| Interest Rate | Fixed or adjustable |

| Mortgage Insurance Premium (MIP) | Required FHA insurance cost |

| Closing Costs | Similar in structure to a traditional loan |

How It Differs From a Traditional Estimate

Unlike a standard loan estimate — which centers on your monthly payment obligation — a reverse mortgage quote focuses entirely on your payout amount. There’s no DTI requirement, and repayment is only triggered when the home is sold, the borrower permanently moves out, or passes away. The risk and cost structure is fundamentally different, which is why working with a HUD-approved counselor before proceeding is strongly recommended.

This type of estimate is worth exploring if you’re planning retirement income, looking to eliminate an existing mortgage payment, covering medical costs, or supplementing Social Security benefits.

How to Compare Loan Offers Effectively

Once you’ve gathered several estimates, here’s how to evaluate them properly:

- Compare APRs, not just rates — APR reflects the true all-in cost of each offer

- Look at loan term trade-offs — a 15-year loan builds equity faster but carries higher monthly payments; a 30-year loan reduces monthly obligations but costs significantly more in total interest

- Review every fee line by line — origination fees and discount points differ widely across lenders

- Build a side-by-side comparison sheet tracking monthly payment, total interest over the loan term, and cash required at closing for each offer

Common Mistakes to Avoid

- Focusing only on the lowest interest rate without factoring in fees

- Ignoring closing costs, which typically run 2%–5% of the loan amount

- Not reviewing rate lock terms — know when the lock expires and what extensions cost

- Overlooking PMI requirements when your down payment falls below 20%

- Failing to ask about prepayment penalties before signing

Final Thoughts: Why Getting the Right Estimate Matters

The difference between a 6.8% and a 7.3% rate on a $400,000 loan isn’t just a half-point on paper — it’s nearly $45,000 in additional interest paid over 30 years. Gathering and comparing a mortgage quote from multiple lenders is one of the highest-leverage financial moves a homebuyer can make, yet many people skip it simply to save time.

Whether you’re a first-time buyer working through a standard purchase, a homeowner weighing a refinance, or a retiree exploring a reverse mortgage quote, understanding the full picture of what you’re being offered puts you firmly in control. Take the time to request and compare your options carefully — your long-term financial health depends on it.

FAQs

Q. What is a mortgage quote?

- A mortgage quote is a lender’s estimate of your loan terms, including interest rate, APR, monthly payment, and closing costs based on your financial profile.

Q. Is a mortgage quote the same as a pre-approval?

- No. A mortgage quote is an estimate of loan terms, while a pre-approval is a verified commitment from a lender after reviewing your financial documents and credit history.

Q. How long is a mortgage quote valid?

- Most mortgage quotes are valid for 10–30 days. However, interest rates can change daily unless you lock the rate with the lender.

Q. Does getting a mortgage quote hurt your credit score?

- It depends. A soft inquiry does not affect your score. A hard inquiry may lower your score slightly (typically 5–10 points), but multiple mortgage inquiries within a short period count as one.

Q. What is included in a reverse mortgage quote?

- A reverse mortgage quote includes the amount of equity you can access, interest rate, payout options, mortgage insurance premium, and estimated closing costs.

Q. What fees are included in a mortgage quote?

- Mortgage quotes typically include origination fees, underwriting fees, appraisal costs, title insurance, government fees, prepaid taxes, and insurance.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.