What Is a Mortgage? A Beginner-Friendly Guide to Buying a Home

The Homeownership Dilemma

Picture this: You’ve found your dream home. The neighborhood is perfect, the schools are excellent, and you can already imagine your family growing there. There’s just one problem—the $300,000 price tag.

Like most people, you don’t have that kind of cash sitting in your bank account. The idea of being in debt for 15, 20, or even 30 years feels overwhelming. Questions flood your mind: How do monthly payments work? What if I lose my job? Will the bank really own my home until it’s paid off?

You’re not alone in this confusion. First-time homebuyers face a mountain of uncertainty, from understanding interest rates to decoding legal jargon.

Here’s the good news: A mortgage isn’t as complicated as it seems. It’s simply a financial tool that bridges the gap between your current savings and your homeownership goals. In this guide, we’ll break down everything you need to know about mortgages—with clear explanations, real-world examples, and zero confusing terminology.

What Is a Mortgage?

In simple terms, a mortgage is a loan specifically designed to help you buy a home. You borrow money from a lender (usually a bank), buy the property, and then repay the loan over time—typically 15 to 30 years—with interest.

How a Mortgage Works Step by Step:

- You apply for a mortgage with a lender

- The lender evaluates your finances (income, credit score, debts)

- You get approved for a specific loan amount

- You buy the home using the borrowed money

- You make monthly payments until the loan is fully repaid

- The lender holds a lien on your property until you’ve paid everything back

Why it’s called “secured debt”: Your home itself serves as collateral. If you stop making payments, the lender has the legal right to take possession of the property through foreclosure.

Example:

Let’s say you want to buy a $300,000 home. With a mortgage, you might put down $60,000 (20% down payment) and borrow $240,000. Over 30 years at 6.5% interest, you’d pay roughly $1,517 per month. Without a mortgage? You’d need $300,000 in cash upfront, which most people simply don’t have.

What Is a Mortgage Loan?

You might hear people use “mortgage” and “mortgage loan” interchangeably—and technically, they’re referring to the same thing, but with a slight nuance.

- A mortgage is a legal agreement that gives the lender a security interest in your property

- A mortgage loan is the actual money you borrow to purchase that property

Think of it this way: The loan is the money, and the mortgage is the legal claim the lender has on your home until you repay that money.

Who Provides Mortgage Loans?

- Traditional banks (Chase, Bank of America, Wells Fargo)

- Credit unions (member-owned financial institutions)

- Non-bank lenders (Rocket Mortgage, Better.com)

- NBFCs (Non-Banking Financial Companies in some countries)

While banks call it a “home loan” for marketing simplicity, the legal documentation always refers to it as a mortgage because of the secured nature of the debt.

What Is a Mortgage Company?

A mortgage company is a financial institution that specializes in creating, selling, and sometimes servicing home loans. Unlike traditional banks that offer checking accounts, savings accounts, and credit cards, mortgage companies focus exclusively on home financing.

What Mortgage Companies Do:

- Originate loans: They process your application and approve your mortgage

- Fund the purchase: They provide the money you need to buy your home

- Service the loan: They collect your monthly payments (or sell this right to another company)

- Sell loans: Many mortgage companies bundle and sell loans to investors

Mortgage Companies vs. Banks

| Mortgage Companies | Traditional Banks |

|---|---|

| Specializes only in home loans | Offer multiple financial products |

| Often offer competitive rates | May have relationship-based benefits |

| May sell your loan to another servicer | More likely to keep servicing in-house |

How They Make Money:

Mortgage companies profit through interest payments (the extra you pay over the loan’s lifetime) and origination fees (upfront charges for processing your loan, typically 0.5%–1% of the loan amount).

What Is a Mortgage Broker?

A mortgage broker acts as a middleman between you and potential lenders. Instead of applying to one bank at a time, a broker shops your application to multiple lenders, finding you the best rates and terms.

Broker vs. Direct Lender

| Mortgage Broker | Direct Lender |

|---|---|

| Represents multiple lenders | Represents only their institution |

| Shops for the best rates on your behalf | Offers only their own products |

| Charges a broker fee (1%–2% of the loan) | May have lower fees but fewer options |

Pros and Cons of Using a Mortgage Broker

Pros:

- Access to multiple lenders and loan products

- Saves you time shopping around

- Can help borrowers with credit challenges find approval

- Handles paperwork and negotiations

Cons:

- Broker fees add to your costs

- Not all brokers work with all lenders

- Some brokers may push products with higher commissions

Example:

Sarah has a credit score of 680—not terrible, but not excellent. Going directly to her bank, she’s offered a 7.2% interest rate. Her mortgage broker, however, finds a credit union willing to offer 6.7% based on her stable employment history. Over 30 years, this 0.5% difference saves Sarah over $30,000.

What Costs Are Included in a Mortgage?

Understanding what a mortgage payment is actually made of is crucial for budgeting. Your monthly mortgage isn’t just about paying back what you borrowed—several components combine to create your total payment.

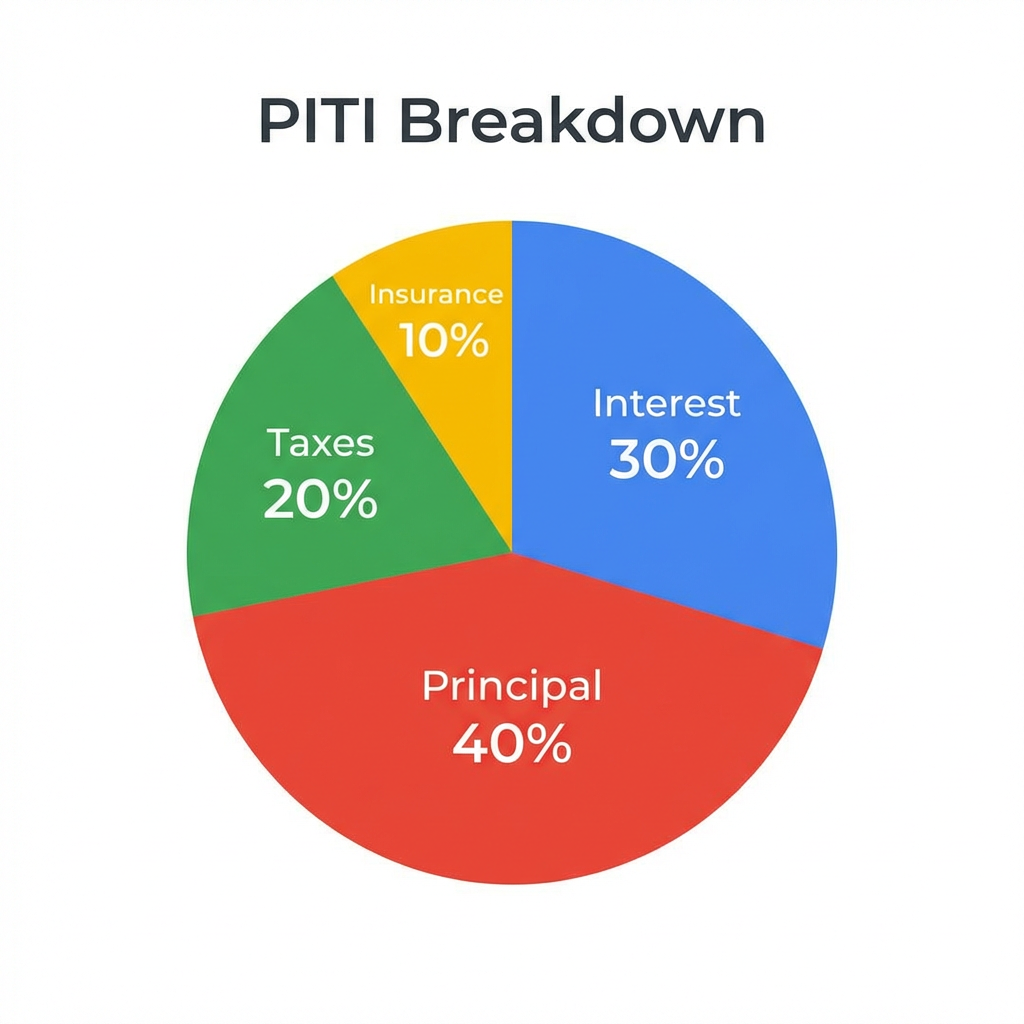

The PITI Breakdown

Most mortgage payments include four main components, commonly called PITI:

| Component | What It Covers | Example (on $240,000 loan) |

|---|---|---|

| Principal | The actual loan amount being repaid | ~$600/month |

| Interest | The lender’s profit from lending you money | ~$900/month (at 6.5%) |

| Taxes | Property taxes paid to your local government | ~$300/month |

| Insurance | Homeowners’ insurance protects the property | ~$150/month |

Total Monthly Payment: ~$1,950

What Is a Down Payment?

A down payment is the upfront cash you pay when buying a home—it’s your initial investment that reduces the amount you need to borrow.

- Conventional loans: Typically require 5%–20% down

- FHA loans: As low as 3.5% down

- VA loans: Often $0 down for qualifying veterans

- Larger down payment = lower monthly payments and better interest rates

Closing Costs

Beyond your down payment, expect to pay closing costs (2%–5% of the home price) for:

- Appraisal fees

- Title search and insurance

- Attorney fees

- Loan origination fees

- Recording fees

Example Monthly Payment Breakdown:

For a $300,000 home with 20% down ($60,000), borrowing $240,000 at 6.5% for 30 years:

- Principal + Interest: $1,517

- Property Taxes: $300

- Homeowners Insurance: $150

- Total: $1,967/month

What Types of Mortgages Exist?

Not all mortgages are created equal. Understanding what a mortgage type that fits your situation can save you thousands of dollars.

Fixed-Rate Mortgage

What it is: Your interest rate stays the same for the entire loan term.

Best for:

- People who plan to stay in their home long-term

- Those who want predictable monthly payments

- Buyers in a low-interest-rate environment

Common terms: 15-year, 20-year, or 30-year

Adjustable-Rate Mortgage (ARM)

What it is: Your interest rate can change over time based on market conditions.

How it works: It typically starts with a lower “teaser” rate for 5, 7, or 10 years, then adjusts annually.

Best for:

- People planning to sell or refinance before the rate adjusts

- Those expecting income to increase significantly

- Buyers in high-interest-rate markets are betting on future decreases

Which Mortgage Suits You?

| Your Situation | Best Mortgage Type |

|---|---|

| First home, planning to stay 10+ years | 30-year fixed-rate |

| High income, want to pay off quickly | 15-year fixed-rate |

| Relocating in 5–7 years | 7/1 ARM |

| Tight budget now, expecting raises | ARM with manageable caps |

Risk vs. Stability: Fixed-rate mortgages offer peace of mind but may have higher initial rates. ARMs offer lower starting payments but carry the risk of future increases—sometimes substantial ones.

What Is a Mortgage Bond?

In some countries, particularly South Africa, a mortgage bond is the legal document that secures the lender’s interest in your property. In the United States, this is typically called a “mortgage” or “deed of trust.”

How Mortgage Bonds Secure Lender Interest:

- They create a legal claim (lien) on the property

- They’re registered with government authorities

- They give lenders the right to foreclose if you default

- They’re only released once the loan is fully repaid

The term “mortgage bond” emphasizes the debt nature of the arrangement—you’re essentially in bondage to the lender until the loan is satisfied.

Where Mortgage Bonds Are Common:

- South Africa (standard terminology)

- Some European countries

- Historical usage in the UK

What Is a Mortgage Deed?

A mortgage deed (or deed of trust) is the legal document that transfers property interest to your lender until your loan is paid off.

Key Elements of a Mortgage Deed:

- Property description: Legal description of your home

- Loan terms: Amount borrowed, interest rate, repayment schedule

- Lender’s rights: What happens if you default

- Borrower’s obligations: Your responsibilities as the homeowner

Legal Rights: Lender vs. Borrower

While you’re paying the mortgage:

- You live in and use the property

- You’re responsible for maintenance and taxes

- You build equity with each payment

- The lender holds a lien but doesn’t own the home

Once you’ve paid off the mortgage:

- The lender releases the deed

- You receive a “satisfaction of mortgage.”

- You own the property outright

Importance of Signing and Registering:

The mortgage deed must be signed by you, notarized, and recorded with your local government (usually the county recorder’s office). This public recording protects both you and the lender by creating an official record of the debt and the property claim.

What Happens If You Miss Mortgage Payments?

Life is unpredictable. Understanding the consequences of missed payments—and your options—is crucial when considering what a mortgage commitment really means.

Early-Stage Consequences (1–3 Months Late):

- Late fees: Typically 4%–5% of your monthly payment

- Credit score damage: Each missed payment can drop your score 50–100 points

- Lender contact: Expect calls and letters about bringing your account current

Mid-Stage Consequences (3–6 Months Late):

- Default notice: Formal declaration that you’ve violated the loan terms

- Acceleration clause: Lender may demand the entire remaining balance

- Pre-foreclosure: Lender begins legal proceedings

Long-Term Risk: Foreclosure

What is foreclosure? It’s the legal process where your lender takes possession of your home and sells it to recover the money you owe.

The foreclosure process:

- Notice of default (after 90+ days of non-payment)

- Notice of sale (your home will be auctioned)

- Auction or bank repossession

- Eviction (you must vacate the property)

How to Protect Yourself:

- Contact your lender immediately if you’re struggling

- Request forbearance: Temporary pause or reduction in payments

- Seek loan modification: Permanently restructure your loan terms

- Consider refinancing: If you have equity and decent credit

- Explore selling before foreclosure damages your credit further

Can You Pay Off or Change a Mortgage?

One common misconception about what a mortgage is that you’re locked into your terms for decades. In reality, you have flexibility.

Paying Off Your Mortgage Early

Pros:

- Save thousands (or tens of thousands) in interest

- Achieve debt-free homeownership faster

- Increase financial security

Cons:

- Opportunity cost (investing might yield better returns)

- Less liquidity (money tied up in home equity)

- Some loans have prepayment penalties

What Is Mortgage Refinancing?

Refinancing means replacing your existing mortgage with a new one—ideally with better terms.

When refinancing makes sense:

- Interest rates have dropped significantly (1%+ lower than your current rate)

- Your credit score has improved substantially

- You want to switch from an ARM to a fixed-rate mortgage

- You want to tap into home equity for renovations or debt consolidation

- You want to shorten your loan term (30-year to 15-year)

Example:

Marcus bought his home in 2020 with a 30-year mortgage at 7.5% interest on $300,000. In 2023, rates dropped to 6%. By refinancing, he saves $265 per month—over $95,000 over the life of the loan, even after paying $3,000 in refinancing costs.

Mortgage vs. Renting: Which Is Better?

This is one of the most debated questions in personal finance. Understanding what a mortgage is compared to renting helps you make the right choice for your situation.

Financial Comparison

| Factor | Mortgage | Renting |

|---|---|---|

| Monthly cost | Mortgage + taxes + insurance + maintenance | Rent (typically fixed) |

| Equity building | Yes—you own more of your home each month | No—payments go to the landlord |

| Upfront costs | Down payment + closing costs (significant) | Security deposit + first/last month |

| Flexibility | Difficult to move quickly | Easy to relocate |

| Maintenance | Your responsibility (and expense) | Landlord’s responsibility |

| Tax benefits | Mortgage interest may be deductible | None |

Short-Term vs. Long-Term Costs

Renting is often cheaper in the short term because:

- No down payment required

- No maintenance expenses

- No property tax bills

Mortgages build wealth long-term because:

- You gain equity (ownership) with each payment

- Property typically appreciates over time

- Fixed payments hedge against rising rents

Lifestyle Factors

Choose a mortgage if:

- You’re ready to settle in one location for 5+ years

- You want control over your living space (renovations, pets, etc.)

- You’re financially stable with emergency savings

- You want to build generational wealth

Choose renting if:

- Your job requires frequent relocation

- You’re still exploring where you want to live

- You prefer not to handle maintenance

- Your finances are uncertain, or you’re building credit

Final Thoughts: Is a Mortgage a Good or Bad Idea?

So, what is a mortgage ultimately—a tool for building wealth or a trap that ties you down?

The answer: It depends entirely on your situation.

Mortgages as Tools, Not Traps

A mortgage is fundamentally a financial tool. Like any tool, it can be incredibly useful when used correctly, or harmful when misused.

A mortgage is a good idea when:

- You’ve found a home in a location where you want to stay

- You have a stable income and emergency savings (6+ months of expenses)

- Your housing payment (including PITI) is under 28% of your gross income

- You understand the full costs and responsibilities of homeownership

- Interest rates and home prices align with your budget

A mortgage might be a bad idea when:

- You’re uncertain about your job or location

- You’re stretching beyond your comfortable budget

- You haven’t saved for unexpected home repairs

- You’re buying primarily as an investment without understanding the market

- You’re feeling pressured by others or market FOMO

Your Next Steps

Before you apply for a mortgage:

- Calculate your true affordability using online mortgage calculators

- Check your credit score and work to improve it if needed

- Save for a down payment (aim for at least 10–20%)

- Get pre-approved to understand what lenders will offer you

- Budget for all costs—not just the mortgage, but maintenance, utilities, and emergencies

Homeownership is one of life’s biggest financial decisions. The more you understand about what is a mortgage and how it works, the more confident and successful you’ll be in making that decision.

Ready to explore your options? Use a mortgage calculator to see what you can afford, and consider speaking with a trusted mortgage broker or lender to discuss your specific situation.

FAQs

Q. What is a mortgage in simple terms?

- A mortgage is a loan used to buy a home, where the property itself is used as security until the loan is fully repaid.

Q. Is a mortgage the same as a home loan?

- Yes, a mortgage is commonly called a home loan, but legally it includes a contract that gives the lender rights over the property.

Q. How does a mortgage work?

- You borrow money from a lender, repay it monthly with interest, and the lender keeps legal rights to the home until the loan is paid off.

Q. What does a mortgage broker do?

- A mortgage broker compares lenders and helps borrowers find better interest rates and loan terms based on their financial profile.

Q. What costs are included in a mortgage payment?

- Mortgage payments usually include principal, interest, property taxes, and home insurance.

Q. What happens if you stop paying your mortgage?

- If payments are missed for a long time, the lender can take legal action and repossess the property through foreclosure.

Q. Can you pay off a mortgage early?

- Yes, most mortgages allow early repayment, though some may charge prepayment penalties.

Q. Is taking a mortgage a good idea?

- A mortgage can be a smart financial tool if the payments fit your income and long-term goals.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.