What Is a Credit Card APR? A Complete Guide to Understanding Your Card’s Costs

Confused about your credit card statement? APR is the key number to know.

If you’ve ever looked at your credit card statement and wondered why your balance grew even though you only made a small purchase, the answer likely lies in your APR. Understanding what a credit card APR is can save you hundreds—or even thousands—of dollars in interest charges over time. This guide breaks down everything you need to know about APR in simple, practical terms.

What Is APR?

APR stands for Annual Percentage Rate—it’s the yearly cost of borrowing money on your credit card, expressed as a percentage. Think of it as the price tag for carrying a balance from month to month.

APR vs. Interest Rate: What’s the Difference?

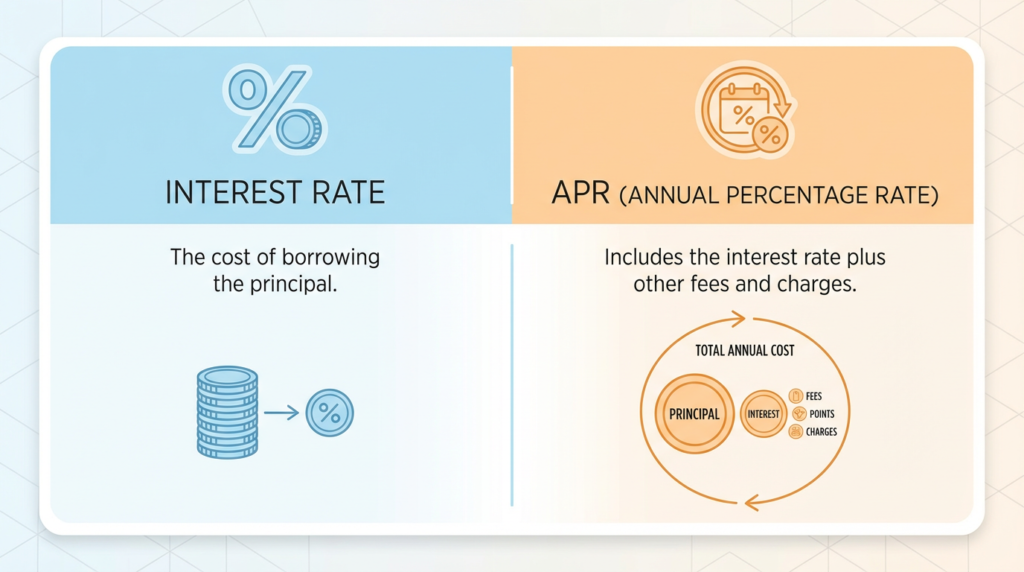

While often used interchangeably, APR and interest rate aren’t quite the same:

- Interest rate: The base percentage charged on your outstanding balance

- APR: Includes the interest rate plus additional fees (like annual fees), giving you the true cost of borrowing

For credit cards, however, APR and interest rate are typically identical since most card fees are charged separately.

Common Credit Card Types and Their APRs

Different cards come with different APR structures:

- Rewards cards: Usually 18-25% APR, higher due to perks

- Balance transfer cards: Often 0% introductory APR for 12-21 months

- Secured cards: Typically 20-28% APR, designed for credit building

How APR Is Calculated

Understanding what a credit card APR means requires knowing how it translates into actual charges.

The Simple Formula

Monthly Interest = (APR ÷ 12) × Outstanding BalanceCredit cards use daily APR for precision:

Daily Interest = (APR ÷ 365) × Daily BalanceExample Calculation

Let’s say you have:

- Balance: $1,000

- APR: 18%

- Days in billing cycle: 30

Daily periodic rate: 18% ÷ 365 = 0.0493%

Daily interest: $1,000 × 0.0493% = $0.49

Monthly interest: $0.49 × 30 = $14.70

If you only pay the minimum and keep charging, this compounds quickly.

Types of Credit Card APRs

Not all APRs are created equal. Your card likely has several different rates:

| APR Type | Typical Range | When It Applies |

|---|---|---|

| Purchase APR | 15-25% | Regular purchases that aren’t paid in full |

| Balance Transfer APR | 0-18% | Transferred balances from other cards |

| Cash Advance APR | 25-30% | ATM withdrawals or cash-like transactions |

| Penalty APR | 29.99% | Triggered by late payments (60+ days) |

Introductory vs. Regular APR

Many cards offer 0% introductory APR for 6-21 months on purchases or balance transfers. After this period, the regular APR kicks in—often jumping to 18-25%. Always know when your intro period ends.

Case Study: Sarah transferred a $5,000 balance to a card with 0% APR for 15 months. She paid $333 monthly and cleared the debt interest-free. Had she used a card with 20% APR, she would’ve paid approximately $520 in interest over the same period.

Why APR Matters

Impact on Monthly Payments

Here’s how APR affects what you actually pay:

| Balance | 15% APR | 25% APR | Monthly Interest Difference |

|---|---|---|---|

| $1,000 | $12.50 | $20.83 | $8.33 |

| $5,000 | $62.50 | $104.17 | $41.67 |

| $10,000 | $125.00 | $208.33 | $83.33 |

How High APR Increases Debt

With minimum payments (typically 2-3% of the balance), a high APR creates a debt trap. On a $5,000 balance at 22% APR with minimum payments:

- Time to pay off: 15+ years

- Total interest paid: Over $6,000

- Total amount paid: $11,000+

Tips to Lower APR or Avoid High Charges

1. Pay Your Balance in Full

The best way to beat APR is to avoid it entirely. Pay your full statement balance by the due date to enjoy a grace period with zero interest.

2. Use 0% APR Offers Strategically

Balance transfer cards can save you money if:

- You have a plan to pay off the balance before the intro period ends

- The transfer fee (usually 3-5%) is less than the interest you’d pay otherwise

3. Negotiate with Your Issuer

Call your credit card company and ask for a lower rate. This works best if you:

- Have a good payment history

- Received offers from competitors with lower rates

- Have you improved your credit score since opening the account

Success rate: Approximately 70% of people who ask receive some reduction.

Common APR Myths

Myth #1: “APR and interest rate are the same thing.

“Truth: For credit cards, they’re nearly identical, but APR technically includes fees. For other loans (mortgages, auto loans), APR is significantly higher than the interest rate.

Myth #2: “APR doesn’t matter if I pay on time.”

Truth: Paying on time avoids late fees, but you still pay interest on any unpaid balance. Only paying in full avoids APR charges.

Myth #3: “My APR is fixed forever”.

Truth: Variable APRs (most common) fluctuate with the prime rate. Card issuers can also increase rates with 45 days’ notice, or immediately if you’re 60+ days late.

Frequently Asked Questions

Q. Is APR the same for everyone?

- No. Your APR is based on your creditworthiness. People with excellent credit (750+ score) may get rates as low as 13-15%, while those with fair credit might face 22-28% APR.

Q. Can my APR change?

- Yes. Variable APRs adjust with market rates. Additionally, missing payments by 60+ days can trigger a penalty APR near 30%, which may stay in effect for at least six months.

Q. Does APR apply to all transactions?

- Different transactions have different APRs. Cash advances always accrue interest immediately with no grace period—even if you pay other purchases in full.

Take Control of Your Credit Card Costs

Now that you understand what a credit card APR is and how it impacts your finances, you’re equipped to make smarter decisions. Your action steps:

- Check your current APR – Find it on your latest statement or call your issuer

- Calculate your monthly interest – Use the formula above to see what you’re actually paying

- Make a payoff plan – Focus on high-APR debt first

- Consider a balance transfer – If you have good credit and a clear repayment strategy

Remember: The best APR strategy is paying your balance in full each month. When that’s not possible, knowing your APR helps you minimize interest and get out of debt faster.

Check out our guide:

How to Increase Credit Score: Tips to Raise Your Score to 800 & Without a Credit Card

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: What Is a Mortgage Quote? A Complete Guide for Homebuyers