What Is a Car Loan? Everything You Need to Know Before You Buy

Let’s be honest—buying a car today isn’t what it used to be. With vehicle prices climbing year after year, the dream of saving up the full amount in cash feels almost impossible for most people. A decent sedan can easily cost $30,000-$40,000, and SUVs? They’re pushing $50,000 or more.

But here’s where it gets tricky: even when you decide to finance your purchase, the world of monthly payments, interest rates, loan statements, and maturity dates can feel like a maze. You hear terms thrown around at the dealership, nod along, and sign papers—only to realize months later that you’re paying far more than you thought.

What Is a Car Loan and How Does It Work?

What is a car loan? Simply put, it’s a type of secured loan where a bank, credit union, or financing company lends you money to purchase a vehicle. You then repay this amount in monthly installments over an agreed period, typically 24 to 84 months (2 to 7 years).

Here’s how the process works:

The Three Key Players

| Role | Responsibility |

|---|---|

| Lender (Bank/Credit Union/Auto Finance Company) | Provides the loan amount after verifying your creditworthiness |

| Borrower (You) | Repays the loan through monthly payments with interest |

| Dealer | Receives payment from the lender and delivers the car |

The Flow of Money

- You select a car and apply for a loan (or get pre-approved)

- The lender approves your application based on income, credit score, and down payment

- The lender pays the dealer directly (minus your down payment)

- You take possession of the car (the lender holds the title as collateral)

- You repay the lender monthly until the loan is fully paid

Real-Life Example

Let’s say you want to buy a car worth $35,000:

- Down payment (10%): $3,500 (paid by you upfront)

- Loan amount: $31,500 (financed by the lender)

- Interest rate (APR): 7% per annum

- Loan term: 60 months (5 years)

- Monthly payment: Approximately $623

Over 5 years, you’ll pay around $37,380 total, which means $5,880 goes toward interest alone.

What Most People Misunderstand

Many buyers focus only on whether they can afford the monthly payment. But the real question should be: How much am I actually paying for this car? The difference between the loan amount ($31,500) and total repayment ($37,380) is where lenders make their money—and where you need to pay attention.

What Is a Car Loan Interest Rate?

If there’s one thing that determines whether you’re getting a good deal or not, it’s the interest rate (often expressed as APR—Annual Percentage Rate). Yet most buyers obsess over monthly payment amounts while ignoring this critical factor.

What Does Interest Rate Actually Mean?

What is a car loan interest rate? It’s the percentage charged by the lender on the principal amount you borrow. The APR includes both the interest rate and any fees, giving you the true cost of borrowing.

Fixed vs Variable Interest Rates

| Type | How It Works | Best For |

|---|---|---|

| Fixed Rate | Same interest rate throughout the loan term | Most auto loans provide predictable payments. |

| Variable Rate | Interest rate changes based on market conditions | Rare for auto loans; more common in other loan types |

Factors That Affect Your Interest Rate

- Credit score: Higher score (740+) = lower interest rate

- Loan term: Longer terms often mean higher rates

- Vehicle type: New cars get better rates than used cars

- Down payment: A higher down payment can reduce your rate

- Lender type: Banks, credit unions, and dealership financing offer different rates

Why Interest Rate Matters More Than Monthly Payment

Consider this comparison for a $31,500 loan over 60 months:

| APR | Monthly Payment | Total Amount Paid | Interest Paid |

|---|---|---|---|

| 5% | $594 | $35,640 | $4,140 |

| 9% | $654 | $39,240 | $7,740 |

A mere 4% difference in APR costs you an extra $3,600 over the loan period. That’s a nice vacation, a new laptop, or several months’ worth of gas—gone.

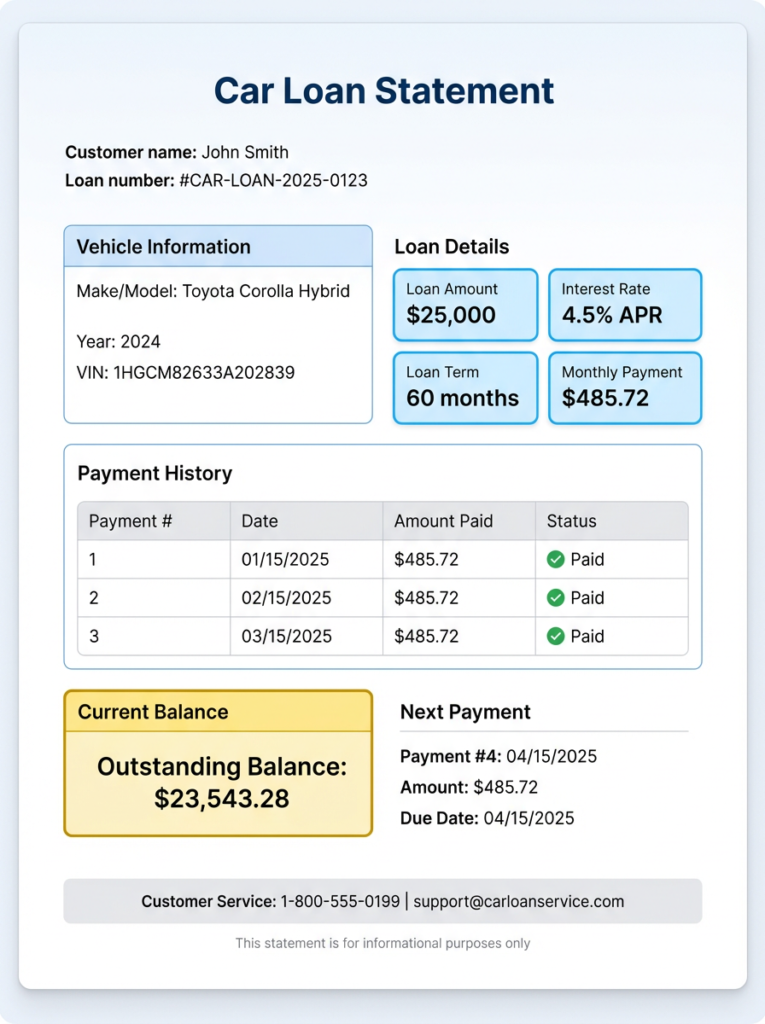

What Is a Car Loan Statement?

Here’s something most borrowers completely ignore: the car loan statement. It’s arguably the most underrated document in your entire loan journey.

What is a car loan statement? It’s a detailed document (usually monthly) that shows exactly where you stand with your loan. Think of it as your loan’s report card.

Information Included in Your Loan Statement

- Outstanding principal balance: How much of the original loan is still unpaid

- Payments made and remaining: Track record of your payments

- Interest vs principal breakdown: How much of each payment goes toward interest vs reducing the actual loan

- Due dates and late fees: Upcoming deadlines and any penalties

- Payoff amount: Total needed to close the loan early

How to Read Your Statement

Here’s what a typical statement breakdown looks like:

Month 12 of 60:

- Opening balance: $29,150

- Payment made: $623

- Principal portion: $452

- Interest portion: $171

- Closing balance: $28,698

Common Mistakes People Make

- Never opening the statement emails from their lender

- Assuming everything is automatic and not tracking progress

- Missing early payoff opportunities that could save thousands

- Not catching errors in interest calculation or payment application

How Statements Help You Plan Better

Regular statement checks allow you to:

- Identify when you’ve paid enough principal to consider early payoff

- Catch billing errors before they compound

- Plan the timing of your loan payoff

- Understand exactly when your loan will end

- Track your progress toward ownership

What Is a Car Loan Maturity Date?

Most people think the loan ends when they pay the last monthly payment. Not quite.

Understanding Maturity Date

What is a car loan maturity date? It’s the official date when your loan term ends and all obligations are settled—provided you’ve paid every payment on time.

Maturity Date vs Final Payment Date

These are usually the same, but not always:

- Final payment date: When you make your last payment

- Maturity date: When the lender officially closes your account and releases the lien

What Happens at Maturity?

Let’s walk through a 5-year (60-month) loan timeline:

Month 1: Loan disbursed, payments begin

Months 2-59: Regular monthly payments

Month 60: Final payment made

Within 10-30 days: Lender sends:

- Lien release letter

- Vehicle title (if applicable in your state)

- Loan satisfaction letter

After receiving documents, you officially own the vehicle free and clear

Common Mistakes at Maturity

❌ Assuming the loan closes automatically after the last payment

❌ Not collecting the lien release and title documents

❌ Forgetting to update your insurance (you may no longer need comprehensive coverage)

❌ Losing important documents needed for resale

Pro tip: Set a calendar reminder 2 months before your maturity date to prepare for closure formalities and request your title.

How These Four Concepts Work Together in Real Life

Understanding what a car loan is means seeing how these elements interconnect:

Interest rate (APR) → Determines your monthly payment amount

Monthly payments → Reflected each month in your loan statement

Consistent payments → Lead you to the maturity date

Regular statement checks → Help you optimize costs along the way

Two Borrower Scenarios

Borrower A (Statement tracker):

- Checks statements quarterly

- Notices she’s paid 40% of principal by year 3

- Makes a $5,000 extra payment toward principal

- Saves $2,100 in interest

- Loan closes 14 months early

Borrower B (Set-and-forget):

- Never opens statement emails

- Pays monthly payments mechanically for 5 years

- Misses early payoff opportunity

- Pays the full interest amount

- Surprised by the final total

Common Car Loan Mistakes You Should Avoid

- Choosing a low monthly payment over a low APR: A longer term with lower payments often means paying significantly more overall

- Never checking your loan statement: You’re flying blind without knowing your principal balance or payment breakdown

- Ignoring the maturity date: Missing title release can create complications when selling or refinancing

- Accepting dealer financing without shopping around: Dealers often mark up rates; banks and credit unions typically offer better deals

Conclusion: Understanding a Car Loan Before Taking One

Car loans are powerful financial tools—they make vehicle ownership accessible when paying in full isn’t practical. But like any financial product, they work best when you understand them completely.

Now that you know what a car loan is, how APR impacts your costs, why loan statements matter, and what happens at maturity, you’re equipped to make smarter decisions.

Before You Apply

✓ Check your credit score (aim for 700+, preferably 740+)

✓ Compare APRs from banks, credit unions, and online lenders

✓ Calculate total repayment, not just the monthly payment

✓ Get pre-approved before visiting dealerships

✓ Set up statement tracking from day one

Remember: the cheapest car loan isn’t the one with the lowest monthly payment—it’s the one with the lowest total cost. And the only way to know that is by understanding exactly what you’re getting into.

FAQs

Q. What is a car loan in simple terms?

- A car loan is money borrowed from a bank or lender to buy a car, which you repay in monthly installments along with interest over a fixed period.

Q. What is a car loan interest rate?

- A car loan interest rate is the cost charged by the lender for borrowing money, expressed as a percentage of the loan amount.

Q. What is a car loan statement used for?

- A car loan statement shows your outstanding balance, EMIs paid, interest charged, and upcoming due dates, helping you track repayment progress.

Q. What is a car loan maturity date?

- The car loan maturity date is the final date when your last EMI is paid, and the loan officially ends.

Q. What happens after a car loan matures?

- After maturity, the lender issues a No Objection Certificate (NOC), and the car becomes yours with no loan attached.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.