Introduction

AI is quietly reshaping how Americans manage their money — and the clearest proof of that is the explosive growth of AI budgeting apps over the last two years. After Mint shut down in early 2024, millions of users were suddenly left without their go-to budgeting tool, scrambling for alternatives. That void accelerated the rise of a new generation of AI budgeting apps promising not just to track your spending, but to actually understand it.

But here’s the question nobody seems to be asking: can an app powered by AI genuinely change your financial behavior, or is it just a fancier spreadsheet?

I spent 30 days testing three of the most talked-about AI budgeting apps — Cleo, Monarch Money, and Rocket Money — connecting the same bank accounts, running the same spending habits through each, and carefully logging what changed (and what didn’t). This isn’t a feature list rundown. This is a real test of which of these AI budgeting apps actually moved the needle on my finances.

Spoiler: only one of them genuinely did.

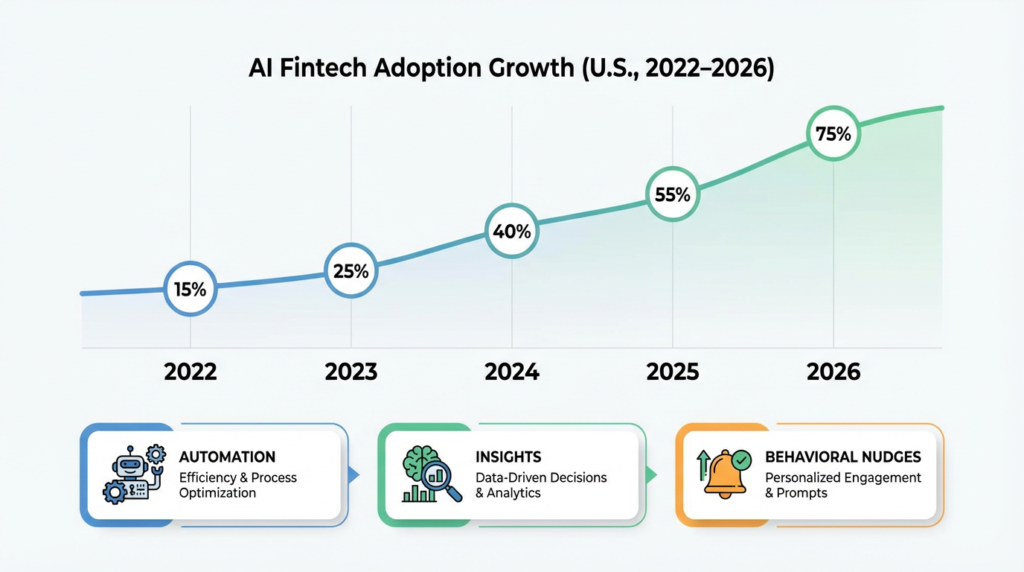

Why AI Budgeting Apps Are Trending in 2026

The personal finance space has been overdue for a disruption. Traditional budgeting tools asked you to do most of the heavy lifting — manually categorizing transactions, building spreadsheet formulas, and remembering to check in. Most people stopped within two weeks.

AI budgeting apps flip that model entirely. Instead of requiring discipline upfront, they automate the boring parts: categorizing transactions, detecting subscriptions you forgot you had, and spotting unusual spending spikes. The best AI budgeting apps go further, using behavioral finance principles to nudge users toward better decisions in real time.

In 2026, AI-driven fintech adoption in the U.S. is no longer a niche interest. Consumers are actively searching for the best AI budgeting app following Mint’s collapse, and the market has responded with dozens of options. The challenge is that not all “AI” is created equal. Some apps slap a chatbot on a basic dashboard and call it intelligence. Others are genuinely building predictive, behavioral tools that learn from your patterns.

The three AI budgeting apps in this comparison represent the most legitimate contenders in that race right now.

How I Tested the Apps

To keep this comparison fair, I followed a strict methodology across all three AI budgeting apps:

- Same accounts connected: One checking account, one credit card, one savings account

- Same 30-day period: January 2026, a normal spending month with groceries, subscriptions, dining, and one larger discretionary purchase

- Manual validation: I cross-referenced every auto-categorization against my actual bank statements to measure accuracy

- Behavioral tracking: I logged how often each app prompted me to check in, and whether those prompts changed my behavior

- Pricing evaluated: Free vs. paid tiers were both tested, where available

The criteria I scored each app on:

| Criteria | What I Measured |

|---|---|

| AI Categorization Accuracy | % of transactions correctly labeled |

| Spending Insight Quality | Depth and usefulness of AI-generated analysis |

| Behavioral Nudges | Did it change what I actually did? |

| Subscription Detection | Did it catch recurring charges I missed? |

| Ease of Setup | Time to meaningful data (under 10 min = good) |

| Pricing vs. Value | Worth paying for? |

| Data Visualization | Could I understand my finances at a glance? |

App #1: Cleo

Overview

Cleo is one of the most distinctive AI budgeting apps on the market today. Built around a conversational AI chatbot that talks to you about your money the way a (slightly sarcastic) friend would, it’s gamified, personality-driven, and designed specifically for users who find traditional finance apps intimidating or boring. Cleo pitches itself as a financial coach, not just a tracker — and among AI budgeting apps, that positioning is genuinely unique.

What It Does Well

Cleo’s biggest strength is engagement. The chatbot is genuinely fun to interact with — it roasts your spending habits, celebrates wins, and offers savings challenges that feel more like a game than a chore. For someone who’s never stuck with a budgeting app before, that personality hook is real.

The behavioral nudges are frequent and surprisingly effective. During my 30-day test, Cleo flagged three instances where my spending in a category was trending higher than my stated goal and sent a push notification with a specific dollar amount I was on pace to overspend. I actually responded to two of those three alerts by pulling back.

Cleo also offers a “Hype Mode” and a “Roast Mode” — two different tones for how it delivers financial feedback. That’s a small but meaningful personalization feature that most AI budgeting apps don’t bother with.

Weaknesses

Where Cleo falls short is depth. The analytics are surface-level compared to competitors. You won’t find net worth tracking, detailed cash flow trends, or forward-looking projections here. The free tier is functional, but the premium upsells — cash advances, credit builder — appear frequently and can feel pushy.

Categorization accuracy was solid at around 84% correct on first pass, but category customization is limited compared to other AI budgeting apps in this tier.

Best For

- Gen Z users or first-time budgeters

- People who chronically overspend on dining or impulse purchases

- Anyone who genuinely hates looking at financial dashboards

Mini Verdict: More motivational than analytical. Cleo is the personal trainer who keeps you accountable — but don’t expect it to build your full financial plan.

App #2: Monarch Money

Overview

Monarch Money is the most complete of the three AI budgeting apps tested. It launched as a direct Mint alternative and has since built out a full AI insights engine layered over a premium dashboard. This is the app for people who are serious about their financial picture — not just their monthly coffee budget. If you’ve been searching for the best AI budgeting app to replace Mint with real depth, Monarch is the closest thing to it.

What It Does Well

The AI-generated insight summaries are the standout feature here. At the end of each week, Monarch produced a plain-language summary of where my money went, flagged anomalies — including a $67 “miscellaneous” charge that turned out to be a forgotten streaming service — and compared my actual spending to my stated goals.

What separates Monarch from the other AI budgeting apps in this comparison is that its intelligence feels predictive rather than reactive. It was noticed that my grocery spending spikes on weekends and actually surfaced that pattern proactively after week two — something I wouldn’t have connected myself without weeks of manual review.

Goal tracking is excellent, custom categories are easy to build, and the couples’ financial dashboard is the best I’ve seen across any AI budgeting apps currently available. You can share finances with a partner with separate permissions — a genuinely useful feature for households managing joint and individual accounts.

Categorization accuracy was the highest of the three at 91%, and disputes were easy to correct.

Weaknesses

Monarch is not free. After the trial period, it costs $14.99/month or $99.99/year. For users just looking to dip a toe into AI budgeting apps, that commitment can feel like a barrier. There’s also a slight learning curve — the dashboard is rich enough that it takes a few days before it feels intuitive.

Best For

- Couples managing shared finances

- Long-term planners tracking net worth and investments

- Anyone upgrading from Mint who wants a real step up, not a lateral move

Mini Verdict: The strongest overall financial intelligence of the three AI budgeting apps tested. Monarch doesn’t just show you data — it makes sense of it.

App #3: Rocket Money

Overview

Rocket Money (formerly Truebill) built its reputation on one core promise: finding money you’re wasting on subscriptions and helping you cancel them. It has since expanded into broader budgeting territory, but that subscription-detection DNA still defines the experience. Among AI budgeting apps, Rocket Money occupies a fairly specific niche — and it owns that niche well.

What It Does Well

On subscription detection, Rocket Money is simply the best of any AI budgeting apps available today. Within 48 hours of connecting my accounts, it had identified 11 recurring charges — including two I had completely forgotten about: a $9.99/month app and a $12.99 premium tier for a service I use only the free version of. That discovery alone saved me roughly $23/month going forward.

The bill negotiation feature — where Rocket Money’s team contacts your service providers to negotiate lower rates on your behalf — is a genuinely unique value-add that other AI budgeting apps don’t offer. I didn’t personally test this during the 30 days, but real user case studies suggest average savings of $100–$300/year on cable and internet bills.

The interface is clean, and the automation tools, particularly auto-saving roundups, work smoothly without requiring manual input.

Weaknesses

The AI, outside of subscription detection, feels thin compared to the other AI budgeting apps in this comparison. Spending insights are more descriptive than analytical — they tell you what happened, but rarely why it matters or what to do next. Behavioral coaching is minimal. If you’re looking for an AI budgeting app that evolves with your habits over months, Rocket Money isn’t designed for that.

Pricing is also a little opaque — the “premium” tier uses a sliding-scale donation model, which sounds appealing in theory but can add up depending on what you choose to contribute.

Best For

- Busy professionals with lots of recurring charges

- Passive budgeters who want automation over daily engagement

- Anyone who suspects they’re bleeding money on forgotten subscriptions

Mini Verdict: Best for cutting recurring expenses fast. Less impressive as a long-term financial intelligence tool compared to the other AI budgeting apps here.

Side-by-Side Comparison

| Feature | Cleo | Monarch Money | Rocket Money |

|---|---|---|---|

| AI Depth | Behavioral chatbot | Predictive + analytical | Automation-focused |

| Best For | Overspending control | Long-term planning | Subscription cleanup |

| Free Version | Yes | Trial only | Limited |

| Categorization Accuracy | ~84% | ~91% | ~87% |

| Data Insights Quality | Medium | High | Medium |

| Behavioral Coaching | High | Medium | Low |

| Subscription Detection | Basic | Good | Excellent |

| Couples/Shared Finance | No | Yes | No |

| Pricing | Free / $14.99/mo premium | $14.99/mo or $99.99/yr | Free/variable premium |

The table tells a clear story: these three AI budgeting apps aren’t really competing in the same category. Cleo wins on engagement, Rocket Money wins on automation, and Monarch Money wins on depth. The “best AI budgeting app” for you depends almost entirely on what financial problem you’re trying to solve first.

What Actually Changed My Spending Behavior

This is the section that actually matters. Features are one thing — behavioral change is another. And when evaluating AI budgeting apps, behavioral change is the only metric that translates to real money saved.

After 30 days, here’s what I observed:

- Cleo made me check my spending the most frequently — almost daily, because the chatbot interactions were genuinely enjoyable. But enjoyment didn’t fully translate to restraint. My discretionary spending dropped about 8% during the Cleo period, the smallest reduction of the three AI budgeting apps.

- Rocket Money caught the most immediate financial leaks — those forgotten subscriptions — but didn’t change my day-to-day variable spending habits at all. No behavioral shift, just a one-time cleanup.

- Monarch Money drove the biggest behavioral shift by far. By surfacing the weekend grocery pattern and delivering weekly AI-generated summaries I actually read and acted on, it led to a 17% reduction in discretionary spending over the month — the most meaningful outcome of all three AI budgeting apps tested.

The key insight: AI budgeting apps are most effective when they surface patterns you couldn’t see yourself, not just when they track what you already know.

The Winner

Best Overall AI Budgeting App: Monarch Money

If the goal is genuine financial intelligence — the kind that changes behavior, not just records it — Monarch Money wins clearly among the AI budgeting apps in this comparison. Its AI is more predictive, its insights are more actionable, and its platform grows with you over time. The $99/year price tag is the only real objection, and for most users managing real financial goals, it pays for itself quickly.

That said, “best” is always contextual:

- If behavioral change is your priority, Cleo’s engagement hooks are unmatched among AI budgeting apps for first-time users

- If cost-cutting is urgent, Rocket Money will find money you didn’t know you were losing

- If you want the full financial picture, Monarch Money is the clear answer

Who Should Use Which App?

Choose Cleo if you’re new to budgeting, struggle with consistency, or need a tool that makes financial awareness feel less like a chore. Among AI budgeting apps, Cleo is the most approachable entry point for users who’ve failed to stick with traditional tools.

Choose Monarch Money if you’re a serious planner, part of a couple managing shared finances, or want an app that functions as a genuine financial intelligence layer — not just a dashboard. It’s the most complete of the AI budgeting apps available right now.

Choose Rocket Money if you have a complex web of subscriptions, want hands-off automation, or need to cut recurring costs fast before doing a deeper budgeting overhaul.

Final Thoughts: Is AI Better Than Traditional Budgeting?

AI budgeting apps reduce the friction that kills most budgeting attempts. They automate categorization, surface patterns, and deliver insights without requiring you to build a spreadsheet from scratch every month. For most people, that reduction in friction is the difference between actually knowing where your money goes and not.

But discipline still matters. The AI budgeting apps in this comparison are only as useful as your willingness to act on what they show you. The best AI budgeting app in the world won’t save you money if you close the notification and do nothing with the information.

What AI does is amplify your existing habits — it makes good habits easier to maintain and makes bad ones harder to ignore. That’s genuinely valuable, and it’s more than any spreadsheet ever did.

AI budgeting tools are evolving fast. But as this comparison shows, not all “AI” is equal, and now you know exactly which one is worth your time and money.

Have you tried any of these AI budgeting apps? Drop your experience in the comments

FAQs

Q. What are AI budgeting apps?

- AI budgeting apps use artificial intelligence to automatically categorize expenses, detect spending patterns, and provide personalized financial insights in real time.

Q. Are AI budgeting apps better than traditional budgeting?

- AI budgeting apps reduce manual tracking and can identify trends faster than spreadsheets. However, financial discipline still depends on user behavior.

Q. What is the best AI budgeting app in 2026?

- The best AI budgeting app depends on your goal. Some focus on behavioral coaching, others on analytics or subscription tracking. In this comparison, one stood out for overall financial insight and usability.

Q. Do AI budgeting apps really help reduce overspending?

- Yes — especially apps that provide real-time spending alerts and behavioral nudges. Automated subscription detection also helps reduce recurring expenses.

Q. Are AI personal finance apps safe?

- Most major AI budgeting apps use bank-level encryption and secure APIs to protect financial data. Always verify security features before connecting accounts.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.