How Much Mortgage Can I Afford?

Buying a home is exciting—until you start wondering if you can actually afford it. The truth? Most people either overestimate what they can borrow or get shocked when the bank says “no.” This guide breaks down exactly how much mortgage you can afford based on your real income, debts, and financial situation.

Mortgage Affordability Calculation

Before we dive into the details, here’s what you need to calculate how much mortgage you can afford:

What You’ll Need:

Income Information:

- Your gross monthly income (before taxes)

- Any additional income (bonuses, side hustles, rental income)

Debt Information:

- Monthly car payments

- Student loan payments

- Credit card minimum payments

- Personal loan payments

- Any other recurring debt

Home Purchase Details:

- How much can you put down as a down payment

- Current interest rate (as of January 2026, rates average 6.5-7.2%)

- Loan term you’re considering (15 or 30 years)

Quick Calculation Example:

Let’s say you earn $5,000/month with $400 in monthly debts:

| Factor | Your Numbers | Bank’s Limit |

|---|---|---|

| Monthly income | $5,000 | – |

| Front-end ratio (28%) | $5,000 × 0.28 = $1,400 | Max housing payment |

| Back-end ratio (36%) | $5,000 × 0.36 = $1,800 | Max total debt |

| Current debts | $400 | – |

| Available for a mortgage | $1,400 | ($1,800 – $400 = $1,400) |

Result: You can afford approximately $1,400/month in total housing costs.

How Lenders Decide What You Can Afford

Banks don’t just look at your income and hand you money. They use strict formulas to determine how much mortgage you can afford without risking default.

The 28/36 Rule Explained Simply

This is the golden rule lenders use:

The 28% Rule (Front-End Ratio): No more than 28% of your gross monthly income should go to housing costs (mortgage, property taxes, insurance, HOA fees).

The 36% Rule (Back-End Ratio): No more than 36% of your gross monthly income should go to ALL debts combined (mortgage + car loans + student loans + credit cards).

Why Banks Approve Less Than You Expect

Here’s the reality check most homebuyers face:

- You think: “I make $80,000/year, so I can afford a $400,000 house!”

- The bank thinks: “After debts, property taxes, and insurance, you can safely afford $280,000.”

The gap? Banks account for:

- Your existing debt load

- Property taxes in your area

- Homeowners insurance costs

- Potential interest rate increases (for ARMs)

- Economic uncertainty

Income vs Mortgage Amount Quick Reference

| Annual Income | 28% Monthly Budget | Safe Mortgage Amount | Realistic Home Price |

|---|---|---|---|

| $40,000 | $933 | $100,000-$130,000 | $150,000 |

| $60,000 | $1,400 | $160,000-$200,000 | $230,000 |

| $80,000 | $1,867 | $215,000-$270,000 | $310,000 |

| $100,000 | $2,333 | $270,000-$340,000 | $390,000 |

Assumes 7% interest rate, 30-year loan, 10% down payment, $300/month property tax, and insurance

How Much Mortgage You Can Afford by Income (Complete Table)

This is the section that answers your exact question based on your salary. We’ve calculated how much mortgage you can afford at different income levels, assuming moderate debt.

| Annual Income | Monthly Gross Income | Max Monthly Mortgage Payment (28%) | Max Home Price (20% Down) | Max Home Price (10% Down) | Max Home Price (5% Down) |

|---|---|---|---|---|---|

| $30,000 | $2,500 | $700 | $110,000 | $100,000 | $95,000 |

| $40,000 | $3,333 | $933 | $160,000 | $145,000 | $135,000 |

| $50,000 | $4,167 | $1,167 | $205,000 | $185,000 | $175,000 |

| $60,000 | $5,000 | $1,400 | $250,000 | $225,000 | $210,000 |

| $75,000 | $6,250 | $1,750 | $315,000 | $285,000 | $265,000 |

| $100,000 | $8,333 | $2,333 | $425,000 | $385,000 | $360,000 |

| $125,000 | $10,417 | $2,917 | $535,000 | $485,000 | $455,000 |

| $150,000 | $12,500 | $3,500 | $645,000 | $585,000 | $545,000 |

Based on 7% interest rate, a 30-year fixed mortgage, $0 monthly debt, property tax 1.2%, and insurance 0.5%

What This Means for You:

If you earn $60,000 per year with no debt, you can afford:

- Monthly payment: $1,400

- Home price: Around $225,000 (with 10% down)

- Total mortgage: Approximately $202,500

But if you have $500/month in debt (car + student loans), your affordable home price drops to about $185,000.

Real-Life Scenarios (What You Can Actually Afford)

Let’s look at real people in real situations to see how much mortgage you can afford when life gets messy.

Scenario 1: $50,000 Income, No Debt, First-Time Buyer

Meet Sarah:

- Annual income: $50,000

- Monthly gross: $4,167

- Monthly debts: $0

- Down payment saved: $15,000

How much mortgage can Sarah afford?

| Calculation | Amount |

|---|---|

| 28% of monthly income | $1,167 |

| Minus property tax ($200) | -$200 |

| Minus insurance ($100) | -$100 |

| Minus HOA ($50) | -$50 |

| Available for mortgage payment | $817 |

| Maximum loan amount (7%, 30 years) | $122,000 |

| Home price (with $15,000 down) | $137,000 |

Sarah’s Reality: She can afford a modest starter home in affordable markets like Louisville, KY or Cleveland, OH, but would struggle in cities like Austin or Denver.

Scenario 2: $75,000 Income with Student Loans

Meet Marcus:

- Annual income: $75,000

- Monthly gross: $6,250

- Monthly debts: $650 ($400 student loans + $250 car payment)

- Down payment saved: $25,000

How much mortgage can Marcus afford?

| Calculation | Amount |

|---|---|

| 36% total debt rule | $2,250 |

| Minus existing debts | -$650 |

| Available for all housing costs | $1,600 |

| Minus property tax ($250) | -$250 |

| Minus insurance ($125) | -$125 |

| Available for mortgage payment | $1,225 |

| Maximum loan amount (7%, 30 years) | $183,500 |

| Home price (with $25,000 down) | $208,500 |

Marcus’s Reality: His student loans cut his buying power by nearly $100,000 compared to someone with the same income and no debt.

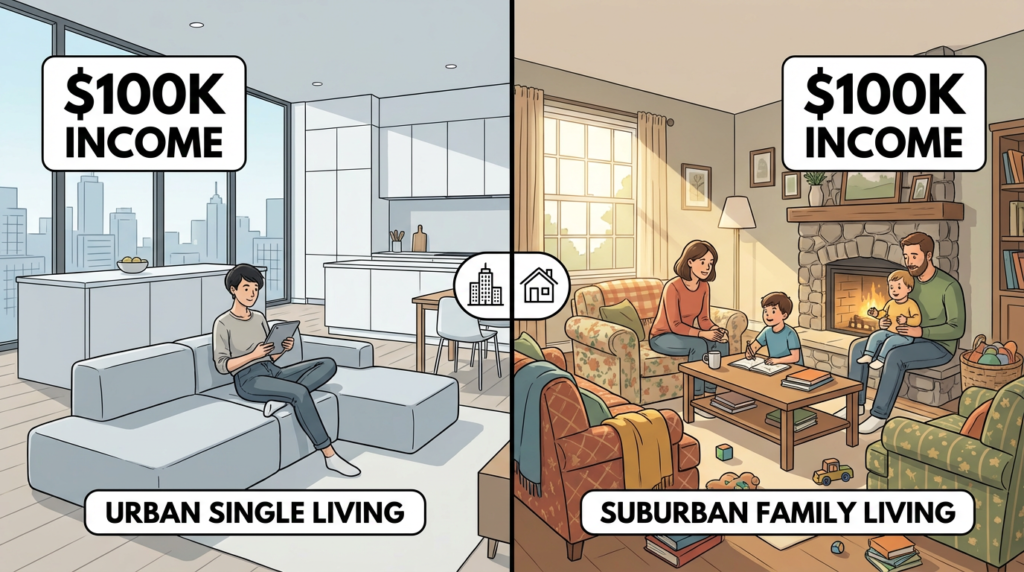

Scenario 3: $100,000 Income, Single vs. Family of Four

Single Professional (Alex):

- Can allocate more to housing

- Lower insurance needs

- More flexibility with location

- Comfortable home price: $360,000-$400,000

Family of Four (The Johnsons):

- Need a larger home (higher property taxes)

- Daycare costs: $1,200/month (reduces DTI)

- Higher utility bills

- Emergency fund priority

- Realistic home price: $280,000-$320,000

Even with identical $100,000 incomes, family obligations can reduce how much mortgage you can afford by $80,000 or more.

Hidden Costs Most Calculators Ignore

Online calculators tell you how much mortgage you can afford, but they leave out expenses that’ll hit your wallet every month.

The Real Monthly Costs Beyond Your Mortgage

1. Property Taxes (The Budget Killer)

| State | Average Annual Tax | Monthly Impact |

|---|---|---|

| New Jersey | $9,345 | $779 |

| Texas | $4,260 | $355 |

| Florida | $2,338 | $195 |

| California | $4,440 | $370 |

A $300,000 home in New Jersey costs you $584 more per month than the same home in Florida, just in property taxes.

2. Homeowners Insurance

- National average: $1,200-$2,400/year ($100-$200/month)

- Hurricane zones (FL, TX coast): $3,000-$6,000/year

- Earthquake zones (CA): Add $800-$2,000/year

3. HOA Fees (The Sneaky Drain)

- Condos: $200-$600/month

- Planned communities: $50-$300/month

- Luxury developments: $500-$1,200/month

4. Maintenance Buffer (The 1% Rule)

Set aside 1% of your home’s value annually for repairs:

- $200,000 home = $2,000/year = $167/month

- $400,000 home = $4,000/year = $333/month

This covers:

- HVAC repairs ($500-$8,000)

- Roof replacement ($8,000-$20,000 every 20 years)

- Water heater ($1,200-$2,500 every 10 years)

- Plumbing emergencies

- Appliance replacements

The True Cost Example:

$300,000 home with a $270,000 mortgage (10% down):

| Expense | Monthly Cost |

|---|---|

| Mortgage (P&I at 7%) | $1,796 |

| Property tax | $300 |

| Homeowners insurance | $150 |

| HOA fee | $200 |

| Maintenance buffer | $250 |

| Total monthly housing cost | $2,696 |

Most calculators only show you the $1,796 mortgage payment. The real cost? $900 more per month.

To afford this home, you’d need:

- Monthly income of $9,629 (using 28% rule)

- Annual income: $115,550

What Happens If You Buy Too Much House?

Let me tell you about Jennifer. She makes $85,000 and got approved for a $375,000 home. The bank said yes. Her real estate agent said it was “a great opportunity.” She thought she could afford it.

Six Months Later:

Jennifer’s life looked like this:

- 58% of her take-home pay went to housing (way above the safe 28%)

- She put groceries on credit cards

- Her emergency fund: $0

- The car needs new brakes: Can’t afford it

- Friends invite her to dinner: “Sorry, I’m broke.”

- Stress level: Through the roof

The Stress Spiral

Months 1-3: The Honeymoon

- “I love my house!”

- Minor panic when bills arrive

- Start skipping savings contributions

Months 4-6: The Reality

- Credit card balancesare creeping up

- Can’t afford to furnish rooms

- Saying “no” to everything social

- Constant money anxiety

Months 7-12: The Crisis

- One emergency away from disaster

- Consideringa second job

- Resenting your “dream home.”

- Some people lose the house entirely

The Emotional Toll

What the numbers don’t show:

- Relationships suffer: 67% of house-poor couples report money fights

- Health impacts: Chronic stress from financial pressure

- Career limits: Can’t take risks or switch jobs

- Life on pause: No vacations, no hobbies, no breathing room

The Break-Even Point

Financial experts say you’re house-poor if:

- Housing costs exceed 30% of take-home pay

- You have less than 3 months of emergency savings

- You regularly use credit cards for basic expenses

- You can’t contribute to retirement

Final Affordability Rule of Thumb

Forget complicated calculators. Here’s how to know how much mortgage you can afford in three simple steps:

Step 1: Calculate Your Safe Monthly Payment

Annual income ÷ 12 months × 0.25 = Safe monthly housing paymentExample: $70,000 ÷ 12 × 0.25 = $1,458/month

(We use 25% instead of 28% to build in a safety buffer)

Step 2: Subtract the Hidden Costs

Safe monthly payment - Property tax - Insurance - HOA - Maintenance = Actual mortgage paymentExample: $1,458 – $200 – $125 – $100 – $150 = $883/month for actual mortgage

Step 3: Work Backwards to Home Price

Use a mortgage calculator or this rough formula:

Actual mortgage payment × 150 = Maximum loan amountExample: $883 × 150 = $132,450 loan

Add your down payment to get the maximum home price.

The Bottom Line: How Much Mortgage Can You Really Afford?

Here’s the truth that banks won’t tell you: Just because you can get approved doesn’t mean you can afford it.

The Conservative Approach (Sleep Well at Night):

- Keep housing at 25% of gross income

- Have 6 months emergency fund AFTER the down payment

- Factor in ALL costs, not just mortgage

- If it feels tight, it’s too expensive

The Balanced Approach (Most People):

- Housing at 28% of gross income

- 3 months emergency fund

- Room for life beyond housing

- Comfort with the monthly number

The Aggressive Approach (Higher Risk):

- Push to 30-33% of gross income

- Bet on future income increases

- Tight budget with little margin

- Works if you’re disciplined and stable

Your Action Plan:

- Calculate your 28% number (that’s how much mortgage you can afford according to banks)

- Subtract your monthly debts from the 36% rule

- Factor in the hidden costs (taxes, insurance, HOA, maintenance)

- Build in a 10% buffer for life’s surprises

- Shop for homes 15-20% below your max to leave breathing room

The home you can afford isn’t the one that maxes out your approval—it’s the one that lets you build wealth, enjoy life, and sleep soundly at night.

Remember: The bank calculates how much mortgage you can afford based on maximum risk. You should calculate based on maximum peace of mind.

Ready to start house hunting? Use these numbers as your guide, not your limit. Your future self will thank you for buying what you can truly afford—not just what the bank says you can borrow.

FAQs

Q. How much mortgage can I afford based on my income?

- How much mortgage you can afford depends on your monthly income, existing debts, interest rate, loan term, and down payment. Most affordability estimates are based on keeping housing costs within a certain percentage of your income.

Q. How much house can I afford with a $5,000 monthly income?

- With a $5,000 monthly income, affordability varies based on debts and interest rates. Many calculators estimate housing costs using income-to-expense ratios rather than a fixed number.

Q. What percentage of income should go to a mortgage?

- A commonly used affordability guideline estimates that housing costs fall within 25%–30% of gross monthly income, though this varies by financial situation.

Q. Does debt affect how much mortgage I can afford?

- Yes. Existing debts, such as car loans, credit cards, or student loans, reduce the amount available for housing expenses in affordability calculations.

Q. Is a mortgage affordability calculator accurate?

- Mortgage affordability calculators provide estimates based on inputs like income and expenses. Actual affordability may differ depending on taxes, insurance, and market conditions.

Q. Does a credit score affect mortgage affordability?

- A credit score can indirectly affect affordability by influencing interest rates, which impacts monthly payments in affordability calculations.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will

I just like the helpful information you provide in your articles

Nice post. I learn something totally new and challenging on websites

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

I just like the helpful information you provide in your articles

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

I like the efforts you have put in this, regards for all the great content.

Pretty! This has been a really wonderful post. Many thanks for providing these details.

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

I appreciate you sharing this blog post. Thanks Again. Cool.

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

very informative articles or reviews at this time.

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.