How Long Does a Credit Card Refund Take? Exact Timeline Explained (2026)

Refund Processed… But Where’s the Money?

Picture this: You ordered a laptop online for $1,200, but it arrived damaged. You immediately initiated a return, and within hours, you received an email from the retailer: “Your refund has been processed successfully!” Relieved, you check your credit card balance expecting to see the credit, but nothing has changed. Days pass, and still, your account shows the original charge.

Sound familiar? You’re not alone. Millions of American cardholders experience this frustrating gap between “refund processed” and actually seeing their money back. The confusion stems from a complex system involving merchants, payment networks, and banks—each playing a role in your credit card refund journey.

In this comprehensive guide, you’ll discover the exact timelines for credit card refunds, understand who controls each delay in the process, and learn precisely what to do when your refund seems stuck in limbo.

The Real Problem: Why Credit Card Refunds Feel Slow

Understanding why credit card refunds take time requires looking at the three-party process involved. When you receive a credit card refund, the money doesn’t travel directly from the merchant back to your account. Instead, it moves through: the merchant who initiates the refund, the card network (Visa, Mastercard, American Express, or Discover) that processes the transaction, and your issuing bank that posts the credit to your account.

Here’s the critical distinction many American consumers miss: “refund initiated” does not equal “refund credited.” When a merchant processes your refund, they’re simply starting the journey—not completing it. The refund must then pass through settlement batches, verification protocols, and posting schedules. Business days matter significantly here; transactions initiated on Friday might not begin processing until Monday.

Real-World Example: Sarah from Austin, Texas, returned a dress to an online boutique on Wednesday. The boutique processed her credit card refund that same day and sent her a confirmation email. However, the boutique’s payment processor batches refunds only once daily at 6 PM EST. From there, the refund entered the card network’s queue, which took 2 business days to clear. Finally, her Wells Fargo card received the credit on Monday, but didn’t post it to her visible balance until Tuesday morning—a full 6 days after the merchant “processed” her refund.

This layered system explains why in-store purchase refunds often appear faster than online returns. In-store transactions at major U.S. retailers like Target or Walmart frequently process through the same terminal used for purchases, potentially reducing one intermediary step.

How Long Does a Credit Card Refund Usually Take?

The standard credit card refund timeline varies based on several factors, but here’s what you can typically expect:

| Stage | Timeline | What Happens |

|---|---|---|

| Merchant Processing | 1–3 business days | Merchant initiates a refund, processes it through their payment system, and submits it to the card network |

| Card Network Processing | 1–3 business days | Visa/Mastercard/Amex validates the transaction and routes it to the issuing bank |

| Bank Posting | 2–5 business days | Your bank receives credit, verifies details, and posts to your account |

| Total Average Time | 5–10 business days | Complete credit card refund cycle from initiation to visible credit |

Best-Case Scenario: You might see a credit card refund in as little as 3-5 business days when dealing with major U.S. retailers who process refunds immediately, during mid-week transactions, and with banks that have expedited posting schedules.

Worst-Case Scenario: Credit card refunds can take 10-14 business days (or even longer) when processing during U.S. federal holidays (Thanksgiving, Christmas, New Year’s), dealing with small merchants who batch refunds weekly, or when refunds require additional verification for fraud prevention.

Case Study Comparison:

Clothing Return (Fast): Jennifer from Denver returned an $85 sweater to Target on a Tuesday. Target processed the credit card refund immediately at the customer service desk. The refund appeared as “pending” on her Chase Visa card by Thursday and was posted completely by Friday—just 3 business days total.

Flight Cancellation (Slow): Mark from Chicago canceled a $650 domestic flight with a budget airline on Monday. The airline’s policy states refunds take 7-10 business days to process. They batched his refund on Friday, which then took 3 days to clear through Mastercard’s network. His Bank of America card received it the following Wednesday, but held it for verification due to the amount. Mark saw his complete credit card refund 13 business days after cancellation.

Is a Credit Card Refund Instant?

No, truly instant credit card refunds are largely a myth in the United States. While some merchants advertise “instant refunds,” what they typically mean is instant processing on their end—not instant appearance in your account. The multi-party system governing U.S. credit card transactions simply doesn’t support real-time crediting in most cases.

However, same-day credit card refunds can occur under specific circumstances. Some premium American credit cards (like certain American Express Platinum or Chase Sapphire Reserve cards) offer provisional credits for disputed transactions, major U.S. retailers with direct banking relationships might expedite certain refunds, and in-store returns using the same terminal as purchase are occasionally processed within hours.

Tips to Speed Up Your Credit Card Refund:

Choose the original payment method when offered multiple refund options—alternative methods may introduce additional delays. Avoid initiating refunds on weekends or federal holidays (Memorial Day, Independence Day, Labor Day, Thanksgiving, Christmas, New Year’s); processing won’t begin until the next business day. Large, established U.S. merchants like Amazon, Walmart, and Best Buy typically have more efficient refund systems than small sellers. Request refunds earlier in the day (before 3 PM EST) to catch same-day processing batches. Keep documentation of your refund request to expedite any disputes.

Many American e-commerce platforms now show estimated refund timelines at checkout or during returns. Amazon, for instance, typically states “refund processed in 3-5 business days,” setting realistic expectations from the start. Your credit card refund speed often depends more on the merchant’s processing schedule than the actual banking infrastructure.

Why Your Refund Says “Processed” but Isn’t Credited

This is perhaps the most common source of confusion with credit card refunds among U.S. consumers. When a merchant tells you your refund is “processed,” they’re describing their internal status—not your account status. Understanding the difference between authorization, settlement, and posting is crucial.

- Refund Authorization: The merchant approves your refund and generates a transaction in their system. This is when you receive the “refund processed” email.

- Settlement: The refund moves from the merchant’s processor to the card network (usually 1-3 days later). During settlement, the transaction is verified, batched with other refunds, and prepared for delivery to your bank.

- Posting to Statement: Your issuing bank receives the settled refund and posts it to your account (another 2-5 days). Only at this final stage does the credit card refund become visible in your balance.

- Pending vs. Posted Credits: Many U.S. banking apps (Chase Mobile, Bank of America app, Citi Mobile, Capital One) now show “pending credits” alongside pending debits. A pending credit card refund means your bank has received notification but hasn’t finalized the transaction. Posted credits are complete and fully available to reduce your balance or increase your available credit.

Real Example – Amazon Refund Timeline:

- Day 1 (Monday): You drop off your return at a UPS Store or Whole Foods (Amazon return location). Amazon sends “Refund Processed” email at 4 PM EST

- Day 2-3: Amazon’s payment processor batches the refund and submits it to the Visa network

- Day 4 (Thursday): Visa completes settlement and notifies your bank (Bank of America)

- Day 5-6: Your bank shows “pending credit” in your app, but not in the available balance

- Day 7 (Monday): Credit card refund fully posts; you see the credit in your statement balance

Check your card issuer’s mobile app or website—most major U.S. banks now distinguish between “pending” and “posted” transactions, giving you visibility into credit card refunds that are in progress.

What If the Refund Is Issued After the Billing Cycle?

Timing matters significantly with credit card refunds, especially when they cross billing cycles. If a refund is processed after your statement closing date but before your payment due date, it appears as a statement credit on your next billing cycle—not the current one.

Here’s how it impacts your account: The refund reduces your total balance owed, potentially lowering or eliminating what you need to pay. However, it typically doesn’t affect your current statement’s minimum payment. You’re still required to pay the minimum shown on your current statement to avoid late fees and negative credit reporting to the three major U.S. credit bureaus (Equifax, Experian, and TransUnion).

Example Scenario:

Your credit card statement closes on the 15th of each month, with payment due on the 10th of the following month. On March 20th, you returned a $300 item purchased at Macy’s and received confirmation of your credit card refund. Your March 15th statement shows:

- Previous balance: $1,200

- New purchases: $400

- Minimum payment due: $50

- Payment due date: April 10th

On March 22nd, the $300 refund posts to your account. Here’s what happens:

- Your new total balance: $1,300 (not $1,600)

- April 10th payment still required: $50 minimum (from March statement)

- Next statement (April 15th): Will show the -$300 credit

If you had already paid your March statement in full ($1,600) before the credit card refund posted, you’d now have a $300 credit balance on your account. This credit would automatically apply to future purchases or could be requested as a check refund from most major U.S. issuers (Chase, Citi, Capital One, Bank of America typically mail refund checks within 7-10 business days upon request).

What If Your Credit Card Refund Is Delayed?

When your credit card refund exceeds the standard 10 business-day window, it’s time to take action. Follow this step-by-step approach to resolve delayed refunds:

- Step 1: Confirm the Refund Initiation Date. Check your email for the merchant’s refund confirmation. Note the exact date and any reference numbers provided. Calculate business days only—weekends and U.S. federal holidays don’t count (New Year’s Day, Martin Luther King Jr. Day, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, Christmas). Verify you’re checking the correct credit card account (especially if you have multiple cards from different issuers).

- Step 2: Wait for the Standard Processing Window. Allow a full 7-10 business days from the merchant’s confirmation before escalating. Some credit card refunds legitimately take this long, particularly for international transactions or purchases from overseas merchants. During peak shopping seasons (Black Friday through New Year’s, post-Christmas returns), processing may extend to 14 business days due to high volume.

- Step 3: Contact the Merchant First Call the merchant’s customer service and provide your order number and refund reference. Ask for: the exact date they submitted the refund to their payment processor, the refund amount, the transaction ID, and confirmation of which credit card was credited (last 4 digits). Many U.S. merchants can provide a payment processor reference number useful for bank inquiries. Major retailers like Amazon, Walmart, and Target typically have dedicated refund status hotlines.

- Step 4: Contact Your Issuing Bank. If the merchant confirms they processed the credit card refund, but you haven’t received it, contact your card issuer. Major U.S. banks provide multiple contact options:

- Chase: 1-800-432-3117 (on back of card)

- Bank of America: 1-800-732-9194

- Citi: 1-800-950-5114

- Capital One: 1-800-227-4825

- American Express: 1-800-528-4800

- Discover: 1-800-347-2683

Provide them with: merchant name and transaction details, original purchase date and amount, refund initiation date from the merchant, and any reference numbers from the merchant. U.S. banks can often see pending credits not yet visible to customers in their online banking portals.

- Step 5: File a Dispute or Chargeback As a last resort, if 15-20 business days pass without resolution, initiate a chargeback under the Fair Credit Billing Act (FCBA), which protects U.S. consumers. This formal dispute process investigates the transaction and can result in a provisional credit while the investigation proceeds. Most U.S. card issuers allow chargebacks within 60 days of the statement date showing the charge, though some extend this to 120 days.

Important Note: Some premium U.S. credit cards offer buyer protection programs that may provide faster resolution for delayed credit card refunds. American Express, Chase Sapphire, and certain premium cards from Citi and Capital One include enhanced purchase protection. Check your card benefits guide or call the number on the back of your card for specific protection coverage.

Consumer Rights: Under federal law, U.S. consumers have strong protections for billing disputes. The FCBA requires card issuers to investigate disputes within 30 days and resolve them within two billing cycles (but not more than 90 days).

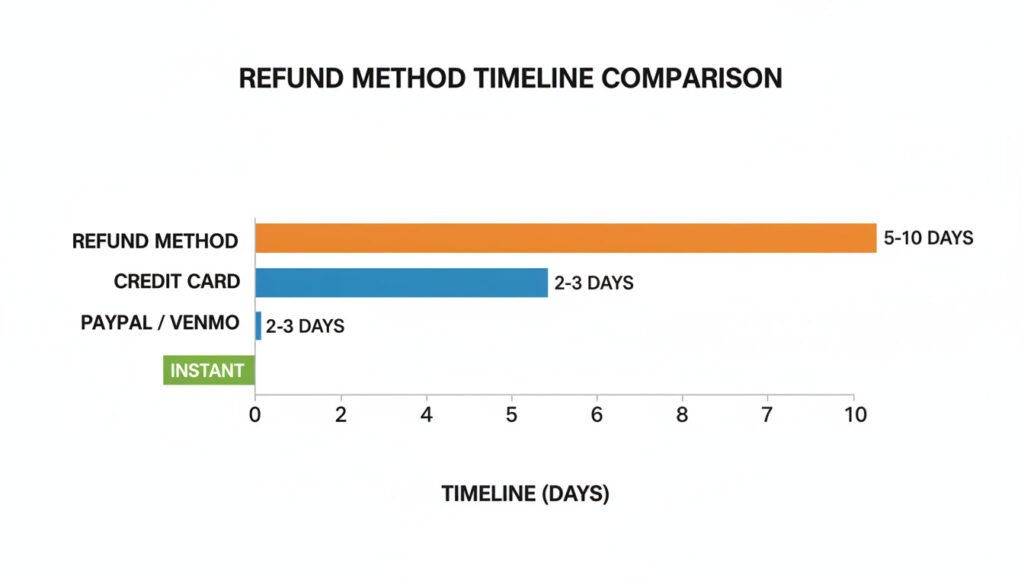

Credit Card vs Other Refund Methods: What’s Faster?

Not all refund methods are created equal in the United States. Understanding your options can help you choose the fastest path to getting your money back.

| Refund Method | Typical Timeline | Pros | Cons |

|---|---|---|---|

| Credit Card Refund | 5-10 business days | Automatic reversal, no action needed, dispute protection under FCBA, doesn’t affect the checking account | Slower than digital wallets, crosses multiple intermediaries |

| Debit Card Refund | 3-7 business days | Slightly faster than credit cards, direct to bank account | Fewer fraud protections during processing may impact the available checking balance, covered under a different law (EFTA vs FCBA) |

| PayPal Refund | Instant to 3 days | Often instant for PayPal-to-PayPal, visible immediately in the app, and common among U.S. online merchants | May require an additional 1-3 day transfer to the bank, $1.50 fee for instant cashout under $25 |

| Venmo/Cash App | Instant to 3 days | Instant for wallet balance, widely used in the U.S., free standard transfer | 1.75% fee for instant bank transfer, limited merchant adoption |

| Store Credit | Instant | Immediate use, no waiting period, often bonus incentive (extra 10-20% at some retailers) | Limited to a single merchant, no cash value |

Credit Card vs. Debit Card Refunds: While both follow similar processing paths, debit card refunds often appear 1-2 days faster because they settle directly to your checking account rather than through a credit line. However, credit card refunds offer superior fraud protection under the FCBA (maximum $50 liability) compared to debit cards under the Electronic Fund Transfer Act (EFTA), which requires reporting within 2 days for $50 liability protection.

Digital Wallet Advantage: PayPal, Venmo, and Cash App process refunds faster because they bypass the traditional card network infrastructure. When a U.S. e-commerce platform refunds to your PayPal wallet, the credit often appears within hours because the refund occurs within the same payment ecosystem. However, transferring from the wallet to your bank account adds 1-3 business days (or costs a fee for instant transfer).

Store Credit Consideration: While store credit provides instant gratification, it locks your money into a single retailer. Many major U.S. retailers (Nordstrom, REI, L.L.Bean) offer incentives like an extra 10-20% credit for choosing store credit over card refunds. Choose store credit when you definitely plan to shop there again; otherwise, waiting for your credit card refund preserves spending flexibility.

Real-World Example: Mike from Seattle ordered shoes from Zappos (owned by Amazon) with three refund options: credit card refund (5-7 business days), PayPal refund (1-3 business days), or store credit (instant). He chose PayPal refund and received his $125 back in his PayPal balance within 6 hours—significantly faster than the credit card refund timeline. He then initiated a standard transfer to his checking account (free, arrived in 2 business days).

Many U.S. e-commerce platforms now display estimated refund times for each payment method during the return process. Amazon shows “2-3 business days to your Amazon gift card balance” versus “5-7 business days to your Visa card,” helping customers make informed decisions.

How to Avoid Refund Delays in the Future

Prevention is always better than resolution when it comes to credit card refund delays. Implementing these proactive strategies can minimize future waiting periods and frustration.

- Track Refund Reference Numbers: Always save confirmation emails with tracking or reference numbers. Screenshot or photograph the refund confirmation screen before closing the window. Create a dedicated email folder for purchase and refund confirmations. Note the refund date on your calendar with a reminder to check in 10 business days. Many U.S. retailers provide both an order number and a separate return merchandise authorization (RMA) number—keep both.

- Save Refund Confirmation Emails: These emails serve as proof if disputes arise. They typically contain merchant transaction IDs, refund amounts, processing dates, and expected timelines. Forward important refund confirmations to a backup email address for redundancy. Print or PDF important confirmations for purchases over $500, as you may need them for credit card dispute documentation.

- Use Cards with Better Customer Support: Premium U.S. credit cards often provide dedicated customer service lines with shorter wait times. American Express is particularly known for exceptional customer service with 24/7 support. Chase Sapphire Reserve and Preferred cards offer dedicated phone lines. Some issuers offer 24/7 support for refund inquiries and disputes via online chat (Capital One, Discover). Cards with concierge services (Amex Platinum, Chase Sapphire Reserve, Citi Prestige) can sometimes escalate refund issues more quickly. Research your card issuer’s reputation for customer service before applying—consumer sites like NerdWallet and The Points Guy regularly rank U.S. card issuers.

- Avoid Split Payments and EMIs: When purchases are split across multiple payment methods, credit card refunds become more complex. Merchants must allocate refunds proportionally across payment methods, adding processing time. While EMI (Equated Monthly Installment) programs are less common in the U.S. than international markets, similar installment programs (Affirm, Afterpay, Klarna) particularly complicate refunds as they involve additional stakeholders. For items you might return, use a single payment method.

Refund delays are common but usually temporary. According to the Consumer Financial Protection Bureau (CFPB) and industry data, over 95% of credit card refunds are processed successfully within 14 business days. The vast majority of delays result from processing procedures rather than merchant or bank errors.

Pro Tip: Consider maintaining a spreadsheet for high-value purchases and returns, tracking purchase dates, return initiation dates, refund confirmation dates, and expected posting dates. This organization helps you identify patterns and catch delays early. Apps like Mint or Personal Capital can also help track pending credits.

Know Your Rights: U.S. consumers have strong federal protections. The FCBA requires credit card issuers to investigate billing disputes, the CFPB accepts complaints about unfair credit card practices, and many states have additional consumer protection laws. If you experience persistent issues, filing a CFPB complaint can expedite resolution.

Quick Summary: Understanding Your Credit Card Refund Timeline

Most credit card refunds take 5-10 business days from merchant processing to appearing in your account. This timeline isn’t arbitrary—it reflects the necessary steps for money to travel through merchants, card networks (Visa, Mastercard, American Express, Discover), and U.S. banks, with each party verifying and processing the transaction according to federal regulations and industry standards.

Delays beyond 10 business days are usually system-based rather than fraudulent. Processing queues, weekend timing, U.S. federal holiday schedules, and verification protocols account for most extended wait times. Your money isn’t “lost”—it’s moving through established financial channels designed to protect both American consumers and merchants.

Remember: “Refund processed” means the journey has begun, not ended. Pending credits are visible signs your credit card refund is approaching. Posted credits are finalized and fully applied to your balance. Different refund methods offer different speeds—evaluate your options when available. U.S. consumer protection laws provide strong safeguards if issues arise.

If you’re currently waiting for a credit card refund, check your transaction date, count business days accurately (excluding weekends and federal holidays), and verify you’re monitoring the correct account. Most refunds resolve without intervention when you allow the full processing window. Major U.S. banks (Chase, Bank of America, Citi, Capital One, Wells Fargo) typically provide transaction tracking tools in their mobile apps.

Bookmark this guide or share it with anyone waiting for a refund—understanding these timelines can turn anxiety into patience and help you take appropriate action only when truly necessary.

FAQs

Q. Why do credit card refunds take so long?

- Refunds must pass through the merchant, card network, and bank, which adds verification and settlement time.

Q. Is a credit card refund instant?

- No. While some merchants process refunds instantly, banks still need time to post the credit to your account.

Q. What does “refund processed” but not credited mean?

- It means the merchant has approved the refund, but your bank hasn’t completed the posting yet.

Q. What if the refund is issued after the billing cycle?

- The refund appears as a statement credit and may reduce your next bill instead of the current one.

Q. How long should I wait before contacting my bank?

- Wait at least 7–10 business days after the refund initiation date before contacting your bank.

Q. Can I dispute a missing credit card refund?

- Yes. If the refund doesn’t arrive after the standard timeline, you can raise a dispute or chargeback with your bank.

Q. Are debit card refunds faster than credit card refunds?

- In many cases, yes. Debit card and UPI refunds often process faster than credit card refunds.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.