How Americans Are Using AI Expense Tracking Tools to Take Control of Their Spending

Americans are feeling the financial squeeze from every direction. Grocery bills are up, rent has surged in major cities, and credit card balances hit a record $1.13 trillion in early 2024, according to the Federal Reserve. Budgeting is no longer optional — it’s a survival skill.

But here’s the problem: most people still manage money the old-fashioned way. Mental math, occasional bank app glances, and end-of-month panic. That approach simply doesn’t hold up anymore.

AI expense tracking is changing that. Millions of Americans are now using AI-powered tools to automatically monitor every transaction, detect wasteful patterns, and get real-time alerts — all without touching a spreadsheet. This isn’t just a tech trend. It’s a practical shift in how everyday people take back control of their finances.

In this guide, we’ll cover what AI expense tracking actually is, why it’s growing fast, how it works behind the scenes, real-world examples of how Americans are using it, the benefits, the risks, and how to get started safely.

What Is AI Expense Tracking?

AI expense tracking is the use of machine learning and automation to monitor, sort, and analyze your financial transactions — without you lifting a finger. It’s the intelligent upgrade to traditional budgeting apps.

Old budgeting apps required you to manually enter purchases, assign categories, and remember to check in. AI budgeting tools flip that model. They connect to your accounts, pull your transaction data automatically, and apply smart algorithms to make sense of your spending behavior in real time.

Here’s what the AI is actually doing under the hood:

| AI Function | What It Does for You |

|---|---|

| Automatic Categorization | Tags every purchase — groceries, dining, transport, etc. — without manual input |

| Subscription Detection | Identifies recurring charges, including forgotten ones |

| Spending Pattern Recognition | Learns your habits over time and flags changes |

| Predictive Alerts | Warns you before you overspend a category |

| Fraud Detection | Flags unusual transactions that don’t match your normal behavior |

This combination of functions makes AI expense tracking fundamentally different from a digital budget spreadsheet. It doesn’t just record data — it interprets it and acts on it.

Why More Americans Are Turning To AI To Track Spending

There are very practical reasons why AI budgeting tools are gaining traction across the U.S. right now:

- Time savings — The average person spends 3 to 5 hours a month on manual budgeting. AI automates most of that work instantly.

- Reduction of human error — Miscategorized expenses, forgotten bills, and overlooked subscriptions add up. AI eliminates those blind spots.

- Behavioral nudges — These tools don’t just report spending. They prompt better decisions at the right moment, before money is gone.

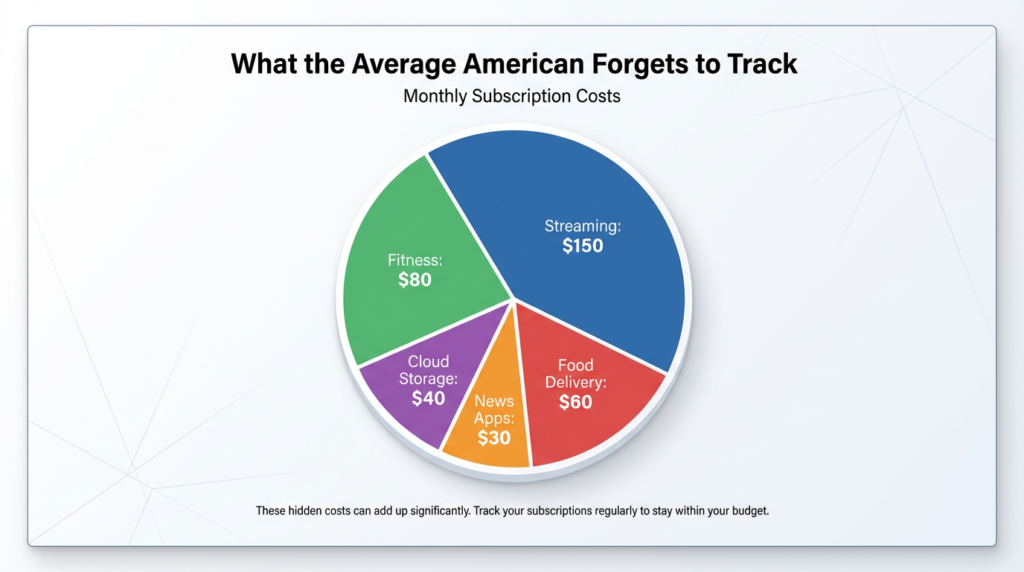

- Subscription overload — The average American pays for 4 to 6 digital subscriptions but can rarely name all of them. AI subscription tracking apps catch what we forget.

- Rise of fintech adoption — Over 65% of U.S. adults now use digital banking, making AI integration a natural next step in managing money.

There’s also a broader cultural shift worth acknowledging. The pandemic forced millions of Americans into digital-first financial behavior almost overnight — mobile payments, app-based banking, and contactless everything became the new normal. That shift created the perfect environment for AI expense tracking to grow. People were already living financially inside their phones. Adding intelligence to that experience was the obvious next move.

How AI Expense Tracking Actually Works (Behind The Scenes)

You connect your bank account — and then what? Here’s a simplified breakdown of the technology that powers automated expense tracking:

- Step 1 — Bank Account Syncing via APIs: AI budgeting tools use secure financial data APIs, such as Plaid or MX, to connect to your bank or credit card accounts. These connections are read-only. The app can see your transactions, but cannot move or withdraw money.

- Step 2 — Transaction Data Analysis Once connected, the AI immediately ingests your recent transaction history — often pulling months of past data right away. It reads merchant names, amounts, dates, and transaction types across all linked accounts.

- Step 3 — Pattern Recognition Model:s Machine learning models scan for recurring patterns. Your rent is due on the 1st of every month. You spend around $85 at coffee shops weekly. Your gym auto-renews every quarter. The AI learns all of this.

- Step 4 — Spending Categorization Logic Using natural language processing, the AI maps transactions to categories automatically. A charge from “WHOLEFDS MKT #10451” becomes “Groceries.” A payment to “NFLX” becomes “Entertainment.”

- Step 5 — Anomaly Detection When something breaks your pattern — a larger-than-usual purchase, a charge from an unfamiliar merchant, or a duplicate transaction — the system flags it and sends an alert. This is what makes AI expense tracking genuinely protective, not just informational.

This entire pipeline runs continuously in the background, giving you a living picture of your finances at any moment.

Real Examples of How Americans Use AI For Budgeting

How Americans Use AI For Budgeting — Finding Hidden Subscriptions

Case Study: Sarah, a 34-year-old marketing manager from Austin, Texas, connected her credit card to an AI budgeting app and, within 48 hours, discovered she was still paying for a photo editing app she trialed 16 months ago, two overlapping cloud storage plans, a premium news subscription she never read, and an unused fitness app. Total monthly leak: $67. That’s $804 a year — gone silently. The AI surfaced all of it without her doing any manual searching.

How Americans Use AI For Budgeting — Identifying Spending Leaks

Case Study: Marcus, a 29-year-old teacher in Cleveland, Ohio, assumed his biggest discretionary expense was dining out. When his AI expense tracking tool broke down his spending by subcategory, the real story emerged. Small, untracked convenience store stops, delivery fees stacked on top of food orders, and impulse app purchases collectively outspent his restaurant budget by 43%. He had no idea until the AI showed him.

How Americans Use AI For Budgeting — Setting Smarter Budget Limits

Rather than setting arbitrary limits — “I’ll spend $300 on food this month” — AI budgeting tools analyze 3 to 6 months of real spending history and suggest limits grounded in actual behavior. A person who consistently spends $390 on groceries and $160 on dining gets a budget built on real data, not optimistic guessing.

How Americans Use AI For Budgeting — Predicting End-of-Month Shortfalls

AI tools can project your remaining balance at month-end by combining your current spending pace with known upcoming expenses like rent, car payments, and subscriptions. If you’re on pace to overdraft by $200, the app tells you on the 15th — not the 31st, when it’s too late.

Popular AI Expense Tracking Tools In The U.S.

Rather than recommending specific brands, here’s a breakdown of the main categories of money management tools available to Americans and what to look for in each:

| Tool Category | Key AI Features | Best Suited For |

|---|---|---|

| AI-Powered Budgeting Apps | Auto-categorization, goal tracking, predictive alerts, subscription detection | Individuals building a budget from scratch |

| Banking Apps with Built-In AI | Real-time spending insights, savings round-ups, transaction alerts | Users who prefer everything inside one bank interface |

| Standalone Financial Management Platforms | Multi-account aggregation, net worth tracking, investment, and cash flow visibility | Families and investors with complex financial pictures |

| Subscription Tracking Apps | Recurring charge detection, renewal reminders, and cancellation assistance | Anyone with digital subscriptions or unused services |

When evaluating any personal finance app, prioritize tools that clearly disclose their data encryption standards, offer read-only account access, publish transparent privacy policies, and are reviewed or certified by recognized financial security organizations.

Benefits of Using AI Expense Tracking Tools

The advantages of AI expense tracking go well beyond saving time. Here’s what consistent users actually gain:

- Real-time spending visibility — Know exactly where you stand at any moment, not just at month-end when damage is already done.

- Personalized insights — Unlike generic financial tips, AI surfaces recommendations based on your specific behavior and spending patterns.

- Reduced financial stress — Research in behavioral finance consistently shows that people feel less anxious about money when they feel informed and in control. Visibility reduces fear.

- Better savings optimization — AI tools identify months when you naturally spend less and prompt you to redirect that surplus toward savings goals.

- Automation of repetitive tasks — No more manually sorting 80 transactions or building spreadsheets to understand where your paycheck went.

The behavioral finance connection here matters. AI expense tracking works not just because it’s efficient, but because it removes the friction that stops people from budgeting in the first place. When tracking spending with AI is effortless, people actually do it consistently. And consistent financial awareness leads to consistently better decisions.

Potential Risks And Limitations

A balanced view is essential. AI budgeting tools are genuinely powerful — but they aren’t perfect, and it’s important to understand their limitations:

- Data privacy concerns — Linking financial accounts to third-party apps means sharing sensitive data. Not all providers handle it with equal care or transparency.

- Overreliance on automation — AI can create a false sense of security, causing some users to disengage from actively thinking about their money.

- Categorization inaccuracies — AI gets it wrong sometimes. A home improvement store purchase might be miscategorized as “Personal Care,” or a business expense tagged as personal spending.

- Security risks — Third-party data aggregators represent an additional security layer that introduces potential exposure if the provider experiences a breach.

- Subscription model costs — Many AI budgeting tools are not free. Paying $10 to $15 per month for a budgeting app is an additional expense that should factor into your decision.

None of these risks is a reason to avoid AI expense tracking altogether. There are reasons to choose tools carefully and stay engaged even when automation is handling the heavy lifting.

Is AI Expense Tracking Safe?

For most users, yes — with the right precautions. Here’s what to understand:

Encryption Standards — Reputable AI budgeting tools use 256-bit AES encryption, the same standard used by major banks and government institutions, to protect your data in transit and at rest.

Read-Only Bank Access — Most tools connect via read-only API access. This means the app can view your transactions, but has zero ability to initiate transfers or move funds.

How to Choose Reputable Apps — Look for apps that are transparent about their data-sharing practices, have been independently security-audited, carry strong user reviews, and clearly explain how they monetize their service (ads vs. subscription vs. data sales).

Tips for Protecting Your Financial Data:

- Use a unique, strong password for each financial app

- Enable two-factor authentication wherever offered

- Regularly review which apps have access to your accounts

- Remove access from apps you no longer use

- Avoid connecting accounts over public Wi-Fi networks

Being informed about how these tools work is the best defense. AI expense tracking is generally safe when used with reputable platforms — but doing a quick background check on any app before linking your accounts is always a smart move.

Who Should Use AI Expense Tracking?

AI expense tracking tools aren’t just for finance obsessives or tech enthusiasts. Here’s who benefits most:

- Young professionals (25–35) managing their first real income, student loan payments, and growing lifestyle costs simultaneously

- Families tracking multiple income streams, household bills, kids’ activities, and shared expenses across multiple accounts

- Side hustlers and gig workers with variable income who need to stay on top of irregular cash flow and separate personal from business expenses

- Investors who want a complete picture of cash flow and liquidity alongside their investment portfolio

- Beginners in personal finance who have no existing budgeting system and want an automated starting point rather than a blank spreadsheet

If money moves through your accounts and you don’t always know exactly where it goes, AI expense tracking is built for you.

How To Get Started With AI Expense Tracking

Getting started is simpler than most people expect. Follow these six steps:

- Choose a Secure App — Research a few options in each category (budgeting app, bank-integrated tool, or standalone platform). Read the privacy policy and check what encryption and security certifications they carry.

- Connect Your Accounts — Link your primary checking account, savings account, and any credit cards you use regularly. The more accounts connected, the more complete your spending picture.

- Review Auto-Categorized Transactions — In the first week, go through the AI’s categorizations and correct any errors. The more feedback you provide early, the more accurate the tool becomes over time.

- Set Spending Alerts — Configure alerts for category thresholds that matter to you — dining, shopping, entertainment. Let the AI warn you before you hit limits, not after.

- Monitor Weekly Insights — Set aside 10 minutes each week to review the AI’s spending summary. Look for patterns or flags you wouldn’t have noticed on your own.

- Adjust Based on Data — Use the insights to set realistic limits for the following month. Let the data guide your decisions, not assumptions about how you think you spend.

The Future Of AI In Personal Finance

AI expense tracking is just the beginning of what’s coming in personal finance automation. Here’s where the industry is heading in the next three to five years:

- Predictive Cash Flow Forecasting — AI will move from reporting the past to accurately predicting the future, giving users a rolling 30 to 90-day financial outlook based on real behavioral data.

- AI Financial Coaching — Rather than just surfacing data, next-generation tools will offer personalized, conversational guidance — essentially a financial advisor experience available 24/7 through an app.

- Personalized Investment Nudges — AI will bridge the gap between budgeting and investing, automatically suggesting micro-investments or savings transfers when surplus cash is detected.

- Integration with Tax Tools — AI platforms will eventually connect expense data directly to tax preparation software, automatically flagging deductible expenses and preparing financial summaries for tax season.

Fintech trends in the U.S. suggest that AI won’t replace financial advisors or human decision-making — but it will dramatically lower the barrier to informed financial management for people who previously had no access to professional guidance.

Conclusion

AI expense tracking has moved from a niche tool for early adopters to a mainstream solution for everyday Americans trying to manage money smarter. Between rising costs, subscription overload, and the complexity of modern financial life, having an automated system that monitors your spending in real time is no longer a luxury — it’s a practical advantage.

That said, AI is a tool, not a substitute for financial literacy. The best outcomes happen when smart technology is paired with an aware, engaged user. AI can show you where your money is going — but understanding why, and deciding what to change, still requires your judgment.

If you’ve never tracked your spending with AI before, the best place to start is simply picking one reputable app and connecting your most-used account. Within a week, the insights alone are likely to surprise you. Audit your subscriptions, review your categories, and let the data tell the story your bank statements never clearly have.

Your spending habits are already generating data. AI expense tracking just finally makes that data work for you.

FAQs

Q. What is AI expense tracking?

- AI expense tracking uses machine learning algorithms to automatically categorize transactions, detect spending patterns, and provide budgeting insights in real time.

Q. Is AI expense tracking safe?

- Most reputable AI budgeting tools use bank-level encryption and read-only access. However, users should choose regulated platforms and enable multi-factor authentication.

Q. How does AI categorize my expenses?

- AI systems analyze transaction descriptions, merchant data, and historical patterns to automatically assign categories like groceries, rent, dining, or subscriptions.

Q. Can AI help me find hidden subscriptions?

- Yes. Many AI expense tracking tools scan recurring payments and flag subscriptions you may have forgotten about.

Q. Do I need financial knowledge to use AI budgeting tools?

- No. Most AI tools are designed for beginners and provide automated insights without requiring advanced financial expertise.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.