Introduction

The rise of AI-driven investing tools has fundamentally changed how millions of people manage their money. From robo-advisors that rebalance your portfolio overnight to budgeting apps that predict your cash flow before you even check your bank account, technology is reshaping personal finance at a pace few expected.

But as these platforms grow more sophisticated, one question keeps surfacing in boardrooms, Reddit threads, and family dinner conversations alike: can AI replace a financial planner?

It’s a fair question — and an increasingly urgent one. Traditional financial planners charge significant fees, require in-person meetings, and aren’t always accessible to everyday investors. AI platforms, on the other hand, promise lower costs, 24/7 availability, and data-driven objectivity. The answer, as you’ll see, isn’t black and white. Can AI replace a financial planner entirely? In some cases, yes. In others, not even close.

This article breaks down the costs, performance data, personalization limits, and real-world results to help you decide which path fits your financial life.

What Does a Financial Planner Actually Do?

Before answering whether can AI replace a financial planner is even the right question, it helps to understand what human advisors actually bring to the table.

Core Services

A licensed financial planner typically provides:

- Retirement planning — projecting savings needs, Social Security timing, and withdrawal strategies

- Tax optimization — Roth conversions, tax-bracket management, capital gains sequencing

- Estate planning — wills, trusts, beneficiary coordination, generational wealth transfer

- Risk management — insurance gap analysis, liability coverage, asset protection

- Behavioral coaching — keeping clients from panic-selling during market downturns

Fiduciary Responsibility

Not all advisors are created equal. A fiduciary financial advisor is legally required to act in your best interest — this is the gold standard. Fee-only planners charge directly for advice and earn no commissions. Commission-based advisors, however, may recommend products that benefit them more than you. Understanding this distinction matters enormously when evaluating the human side of the ” Can AI replace a financial planner debate.

What Is AI in Personal Finance?

Robo-Advisors

Robo-advisors are algorithm-driven platforms that build and manage investment portfolios automatically. The two most recognized names are:

- Betterment — offers goal-based investing, automatic rebalancing, and tax-loss harvesting starting at 0.25% AUM annually

- Wealthfront — adds features like direct indexing, automated financial planning, and a cash account with competitive yields

Both platforms have grown dramatically. As of 2024, Betterment managed over $45 billion in assets; Wealthfront crossed $70 billion. These aren’t niche tools anymore — they’re mainstream.

AI Budgeting & Portfolio Tools

Beyond robo-advisors, AI is powering a broader ecosystem of financial tools:

- Automated rebalancing — portfolios are adjusted to target allocations without human intervention

- Tax-loss harvesting — losing positions are sold strategically to offset gains and reduce tax liability

- Predictive cash flow modeling — apps like Monarch Money or Copilot forecast upcoming expenses based on spending patterns

Cost Comparison — AI vs Financial Planner

This is where the can AI replace a financial planner question gets genuinely compelling. The cost gap is substantial.

Typical Financial Planner Fees

| Fee Model | Typical Cost |

|---|---|

| AUM (Assets Under Management) | ~1% per year |

| Flat annual retainer | $2,000–$7,500/year |

| Hourly advisory | $200–$400/hour |

AI Platform Costs

| Platform | Annual Cost |

|---|---|

| Betterment (Digital) | 0.25% AUM |

| Wealthfront | 0.25% AUM |

| Empower (formerly Personal Capital) | 0.49%–0.89% AUM |

| Subscription apps (e.g., Facet) | $2,000–$6,000/year |

10-Year Cost Projection Example

Assume a $250,000 portfolio with 7% average annual growth:

| Advisor Type | Annual Fee | Total Fees Paid (10 Years) | Ending Portfolio Value |

|---|---|---|---|

| Human Planner (1% AUM) | ~$3,200/yr avg | ~$39,000 | ~$449,000 |

| Robo-Advisor (0.25% AUM) | ~$800/yr avg | ~$10,000 | ~$478,000 |

| DIY Index Investing | ~$50/yr | ~$600 | ~$487,000 |

Over a decade, choosing a robo-advisor over a traditional planner could save a $250,000 investor nearly $30,000 in fees alone. This is the core financial argument for why AI canreplace a financial planner and deserves serious consideration.

Performance — Does AI Beat Human Advisors?

Portfolio Construction Differences

AI platforms primarily use passive ETF investing — low-cost funds that track market indexes. Research consistently shows that most actively managed funds underperform their benchmark index over 10+ year periods, once fees are factored in. The S&P SPIVA report, published annually, shows that over 90% of active managers underperform the S&P 500 over 20-year periods.

Algorithm-based allocation removes the guesswork. Robo-advisors build diversified portfolios based on your risk tolerance and time horizon — and they stick to the plan.

Market Volatility Behavior

Here’s a critical real-world result: human behavior is often the enemy of good investing. During the March 2020 COVID crash, Betterment reported that the majority of its users made no changes to their portfolios. Many human-advised clients, however, pushed their advisors to sell — locking in losses right before one of the fastest market recoveries in history.

Automation removes emotional decision-making. When asking if AI can replace a financial planner, this is one category where AI demonstrably wins.

Personalization — Can AI Handle Complex Situations?

This is where the honest answer to whether AI can replace a financial planner becomes more nuanced.

AI platforms are built for the common case. They handle standard retirement accounts, basic tax optimization, and portfolio rebalancing with impressive efficiency. But consider these scenarios:

- Business owners navigating SEP-IRAs, solo 401(k)s, and business succession planning

- High-net-worth individuals dealing with concentrated stock positions, alternative investments, or equity compensation

- Estate planning complexity involving irrevocable trusts, charitable remainder trusts, or multi-state property

- Multi-generational wealth requires coordination between tax attorneys, estate lawyers, and CPAs

In these cases, can AI replace a financial planner? Not yet. The interdependencies are too complex, and the stakes too high, for algorithmic solutions alone.

Where AI Clearly Wins

- Lower fees — the 0.25% vs 1% AUM gap compounds dramatically over time

- Accessibility — anyone with $1 can start investing on platforms like Betterment

- 24/7 automation — rebalancing, harvesting, and monitoring never sleep

- Younger investors — those with simpler financial lives get sophisticated portfolio management at minimal cost

- Consistency — no advisor is having a bad day, making an impulsive call, or distracted by incentives

Where Human Financial Planners Still Win

- Tax strategy depth — Roth conversion ladders, business deductions, and multi-year tax planning require human judgment

- Behavioral coaching — a good planner talks you off the ledge during a market crash in a way no app can replicate

- Complex retirement planning — pension elections, Social Security optimization, and healthcare cost sequencing benefit from personalized analysis

- Estate & legacy structuring — trust design, charitable giving strategies, and family governance require legal and emotional intelligence that AI doesn’t have

A 2023 Vanguard study, known as “Advisor’s Alpha,” estimated that a skilled human advisor can add approximately 3% in net returns annually — not through better stock picking, but through behavioral coaching, tax optimization, and financial planning guidance. That reframes can AI importantly replace a financial planner: it’s not just about portfolio management.

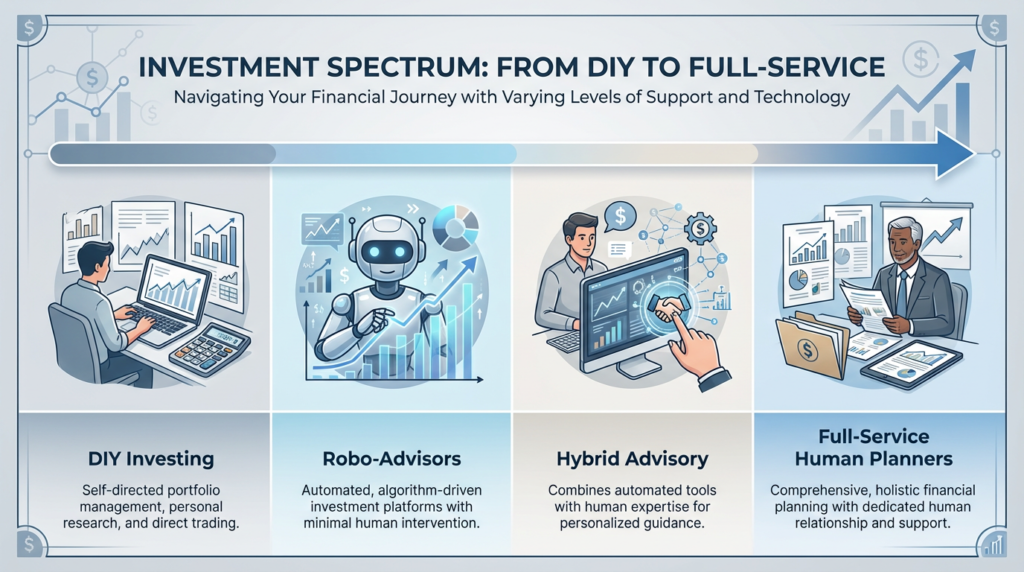

Hybrid Model — The Future of Wealth Management?

The most compelling answer to whether AI can replace a financial planner may be: it doesn’t have to choose sides.

Hybrid models are emerging rapidly. Firms like Facet, Ellevest, and Vanguard Personal Advisor Services blend algorithm-driven portfolio management with human financial planning access. You get robo-efficiency at the portfolio level and human judgment for complex decisions.

The industry trend is clear: large wirehouses like Morgan Stanley and Goldman Sachs are integrating AI tools into their advisory practices, not replacing advisors with them. The future likely looks like AI handling the execution layer while human planners focus on strategy, relationships, and complexity.

Who Should Choose AI?

You’re probably a strong candidate for an AI financial advisor if:

- Your investable assets are under $100,000

- You’re a DIY-oriented saver comfortable with technology

- Your financial situation is straightforward — W-2 income, standard retirement accounts, no business interests

- You’re a passive index investor who believes in low-cost, market-tracking strategies

- You’re just starting out and want to build good habits affordably

Who Still Needs a Financial Planner?

A human fiduciary financial advisor likely makes more sense if:

- Your net worth exceeds $500,000, especially with complex asset mixes

- You have complex tax situations — business income, equity compensation, real estate portfolios

- You’re an emotional decision-maker who has historically sold at the wrong time

- You need estate planning involving trusts, business succession, or charitable strategies

- You’re navigating a major life transition — divorce, inheritance, retirement, or selling a business

Final Verdict — Can AI Replace a Financial Planner?

So, can AI replace a financial planner? Here’s the honest, conditional answer:

For most everyday investors — yes, partially and powerfully. AI platforms deliver sophisticated portfolio management, tax efficiency, and disciplined investing at a fraction of the cost. For a 30-year-old building a retirement nest egg with straightforward finances, a robo-advisor likely outperforms a commission-based human advisor after fees.

For complex financial lives — no, not yet. When taxes, estates, business interests, and behavioral coaching intersect, human judgment remains essential. The nuance, relationship trust, and coordinated expertise a skilled planner brings isn’t something an algorithm replicates today.

Decision Framework Checklist

| Question | AI May Suffice | Human Planner Recommended |

|---|---|---|

| Investable assets | Under $250K | Over $500K |

| Tax situation | Simple W-2 | Business, equity, real estate |

| Estate needs | Basic beneficiaries | Trusts, multi-generational |

| Emotional investing | Disciplined, hands-off | History of panic selling |

| Life stage | Accumulation phase | Near/in retirement |

| Financial complexity | Single income, simple goals | Divorce, inheritance, exit |

The question can AI can replace a financial planner will only get more interesting as technology advances. But today, the smartest move for many people isn’t choosing one or the other — it’s understanding exactly where each excels, and building a financial strategy that uses both intelligently.

This article is for informational purposes only and does not constitute financial advice. Consult a licensed financial professional before making investment decisions.

FAQs

Q. Can AI completely replace a financial planner?

- AI can automate investing, rebalancing, and tax-loss harvesting, but it cannot fully replace personalized tax strategy, estate planning, or behavioral coaching provided by a human planner.

Q. Is AI cheaper than hiring a financial planner?

- Yes. Most robo-advisors like Betterment or Wealthfront charge around 0.25%–0.40% annually, compared to the typical 1% fee charged by traditional planners.

Q. Do robo-advisors perform better than human advisors?

- Performance is usually similar because most robo-advisors use diversified ETF portfolios. The key difference is cost and behavioral coaching.

Q. Who should use AI financial tools?

- Beginner investors, passive index investors, and those with under $100,000 in investable assets often benefit most from AI-driven platforms.

Q. When should you hire a human financial planner instead?

- If you have complex taxes, a business, estate planning needs, or a high net worth, a fiduciary financial planner is typically more suitable.

Q. Can AI replace a financial planner for retirement planning?

- AI can assist with retirement projections, portfolio allocation, and automated rebalancing. However, it may not fully replace a financial planner when complex tax strategies, Social Security timing, or estate planning decisions are involved.

Q. Can AI replace a financial planner for high-net-worth individuals?

- For high-net-worth investors, AI tools alone are usually insufficient. While platforms like Betterment offer automated management, affluent individuals often require customized tax optimization, trust structuring, and multi-generational wealth planning that a human advisor provides.

Q. Can AI replace a financial planner for tax planning?

- AI can optimize portfolios through tax-loss harvesting and automated asset location strategies. However, it cannot fully replace a certified tax professional or comprehensive financial planner when dealing with business income, estate taxes, or complex deductions.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.