Introduction

One way individuals are building long-term wealth is through investing in index funds. With their low fees, broad diversification, and consistent returns, index funds, such as the Vanguard Total Stock Market Index Fund (VTSAX) or the Fidelity 500 Index Fund (FXAIX), may seem to be a cornerstone of a solid investment strategy. But so many alternatives have been offered in the market lately; what is one to do? This guide takes you through everything you need to know concerning how to choose the best index fund for your portfolio.

What is an Index Fund?

An index fund is a mutual fund or exchange-traded fund that replicates the performance of a given market index, such as the S&P 500, the NASDAQ-100, or the Dow Jones Industrial Average. Unlike actively managed funds chosen by the initiative of a particular fund manager based on individual stocks, an index fund auto-invests in the same stock that forms part of the index it replicates.

Why Choose the Best Index Fund?

The best index fund can certainly be the difference-maker in your eventual investment performance. Here are a few reasons why index funds would top any investor’s priority list:

- Low Fee: Most index funds have a lower expense ratio than actively managed funds, so you keep more of your earnings.

- Diversification: Investing in an index fund automatically diversifies a portfolio because the fund holds an extensive collection of stocks or bonds.

- Consistent Performance: The index funds, for instance, have to date delivered a consistent return that replicates the general market’s performance.

- Passive Management: Index funds invest in everything, as no stock picking is involved. This is appropriate for an investor who does not want a high degree of involvement.

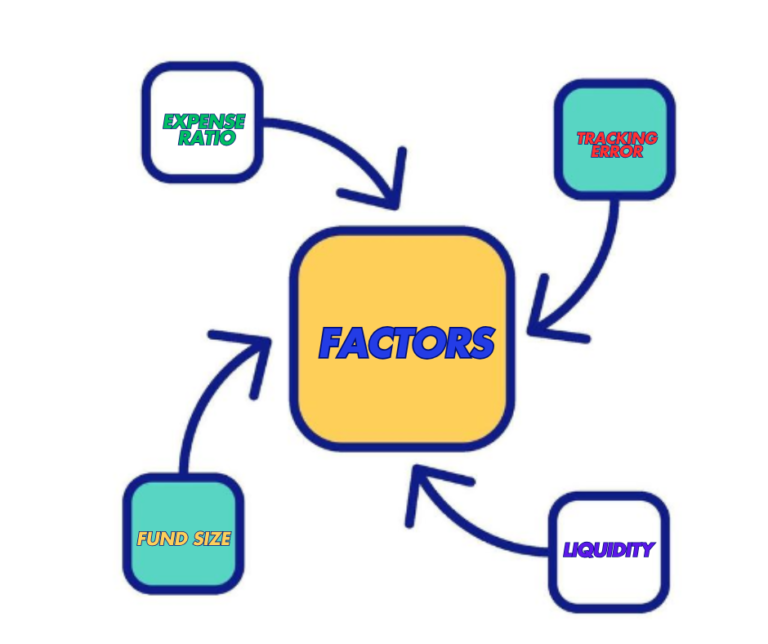

Factors to Consider When Choosing the Best Index Fund

When you are out to evaluate the best index fund for your needs, consider:

- Expense ratio: This is the cost of running fund. The expense ratio is desirable in that it allows you to retain more of your investment returns. Lower is more desirable.

- Tracking error: A tracking error is the difference in the performance of the index fund and the index being tracked. Therefore, a low tracking error implies that the fund is more effective at replicating the performance of the index.

- Size of Fund: Smaller funds can provide higher growth potential in certain situations, but larger funds tend to be steadier and generally have lower expense ratios. You should find what suits your investment goals.

- Liquidity: Liquidity is the ease at which you can sell or buy shares of the fund. Tightly priced funds with high liquidity will have smaller bid-ask spreads, which means smaller trading costs.

Top Index Funds

Now that you have some tips, here are a few of the very best index funds to consider. Here are the most popular and well-rated index funds:

1. Vanguard 500 Index Fund (VFIAX)

This provides access to 500 of the largest U.S. companies, with a broad-based history of long-term high performance. Therefore, it is one of the most favorite index funds among investors seeking stability and growth, with a low-expense-ratio investment.

2. Schwab U.S. Large Cap ETF SCHX

SCHX is suitable for cost–sensitive investors who are interested in large-cap U.S. stocks; it has a small expense ratio and an almost incredibly comprehensive portfolio. It is ideal for long-term investors.

3. Fidelity Total Market Index Fund (FSKAX)

If you want to diversify your entire US stock market, FSKAX provides you with small, mid, and large-cap stock exposure. It is perfect for that investor who wants a well-rounded, low-cost index fund.

4. SPDR S&P 500 ETF (SPY)

One of the most liquid and popular S&P 500-tracking ETFs is SPY. It is highly liquid and easy to trade, making it an excellent choice for active traders or investors looking for an easy means of gaining exposure to the U.S. stock market.

How to Invest in the Best Index Fund

Index fund investing is easy. Here’s how to get started:

- Open an investment account: You‘ll want to open a brokerage account with a firm such as Fidelity, Vanguard, Schwab, and the like.

- Research Your Options: Compare a number of index funds against one another and select one that best fits your needs.

- Amount to Invest: Decide how much you feel comfortable investing and how frequently you want to contribute—be it quarterly or monthly.

- Order Now: Invest in the index fund that best serves your interest and watch your investment grow over time.

Conclusion

Clearly, the best index fund for you depends on specific financial goals, risk tolerance, and investment preferences. Regardless of whether it’s extremely low fees, very broad diversification, or steady growth, an index fund is probably an excellent choice for you if you’re a long-term investor. Of course, when selecting an index fund, you will consider factors like expense ratios, tracking errors, and liquidity.

FAQs

Are Index Funds a Good Investment for Beginners?

- Yes, index funds are an excellent choice for beginners due to their simplicity and low cost. They allow new investors to diversify their investments and benefit from overall market growth without the need for advanced knowledge or frequent trading. They are also less risky than picking individual stocks.

How Much Money Should I Invest in an Index Fund?

- The amount you should invest in an index fund depends on your financial goals, time horizon, and risk tolerance. As a general rule, it’s a good idea to start with an amount you are comfortable investing long-term and consider dollar-cost averaging, where you invest a fixed amount regularly (e.g., monthly or quarterly) to reduce the impact of market volatility.

Can I Lose Money with Index Funds?

- While index funds generally have lower risks compared to individual stocks, they are still subject to market fluctuations. If the market or the index they track goes down, the value of your investment may also decrease. However, over the long term, index funds have historically provided steady returns that typically outperform individual stock picking.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: Real Estate vs Stock Market: Which is Better? - Paisewaise

Your communication style gracefully captures your authentic self, making readers feel connected and heard.

Your blog has quickly become my preferred site for motivation. I can’t express enough gratitude!