Introduction

An effective functioning of finances and a smooth-running business are well taken care of with the best business bank account. If it happens to be your first start or if you have long years of experience as a business owner, it is the right kind of bank account to streamline transactions, maximize savings, and give you financial tools to grow your business. In this guide, we will discuss the best business bank accounts, and, in particular, we are focusing on features and benefits as well as the right business type that will suit it.

Why Choosing the Best Business Bank Accounts Matters

Choosing the best business bank account is one of the top decisions that can make a huge difference for your business’s health and operational efficiency. A dedicated business account separates your personal and business finances, which can play an important role in tax purposes, bookkeeping, and building customers and vendors‘ credibility with you.

This means that with the correct business account, one is exposed to so many financial tools, such as access to business loans, credit lines, and merchant services, which helps your company scale effectively.

1. Best Business Bank Accounts for Small Businesses

Small businesses need an account that is low-cost and easy to manage. Most accounts have no fees, easy access to your money, and all the key banking services you need. Ideally, some of the best options for small businesses include online banking, minimal required opening deposits, and scalable service as your business grows.

Top Picks for Small Businesses:

1. Chase Business Complete Banking: Ideal for Small Businesses; no monthly service fee with certain conditions.

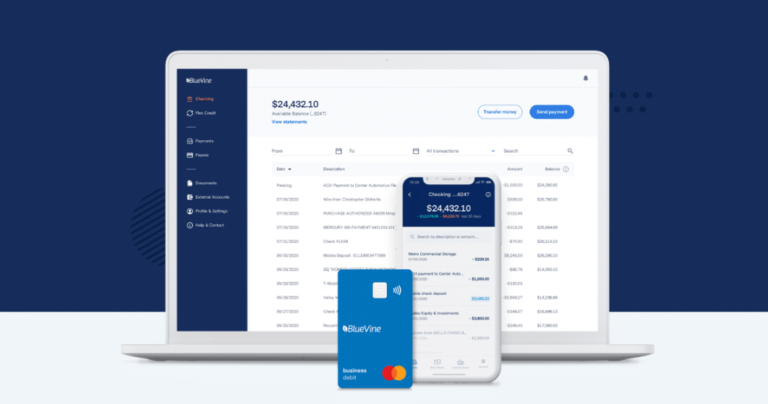

2. BlueVine Business Checking: Comes with a great interest rate to balances up to $100,000, making it just right for cash savings.

2. Best Business Bank Accounts for Startups

An easy and flexible business bank account with low fees should be available to help a startup through the early years of a business. Choosing the best business bank accounts can provide great support for growth, along with access to tools to help manage cash flow, which is vital in these early years.

Top Picks for Startups:

1. Novo Business Account: A fully digital bank that has a straight forward setup process with free transfers and payments.

2. NorthOne: It is best suited for those start-ups that want simple, easy-to-use current and savings accounts that would integrate easily with business tools.

3. Best Business Bank Accounts for Large Businesses

Large businesses requires large companies to process significant numbers of transactions, such as payroll management, and access business loans and lines of credit. Choosing the best business bank accounts ensures that these essential features are available to support the needs of your large business.

Top Picks for Large Businesses:

1. Wells Fargo Business Choice Checking: It is a high-performance account with customizable services for large businesses.

2. Bank of America Business Advantage: For large businesses requiring a comprehensive range of business services, including merchant services, payroll solutions, and lending options.

4. Best Business Bank Accounts with High Interest Rates

Some businesses prefer accounts with high interest rates, which will complement cash in the business bank account to earn passively. Choosing the best business bank accounts will often suit the needs of businesses that keep large cash balances and seek to maximize their earnings through interest.

Top Picks for High-Interest Business Accounts:

1. BlueVine Business Checking: BlueVine has a great interest rate; hence, it is ideal for businesses keeping large cash balances.

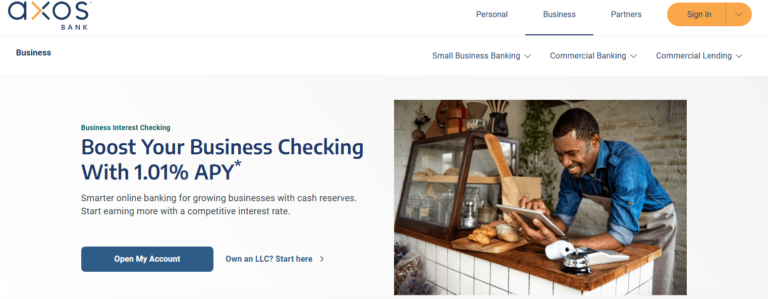

2. Axos Bank Business Interest Checking: Currently, it gives competitive interest to businesses that keep a higher average balance.

5. Best Business Bank Accounts for Online Businesses

For an e-business, an advanced account with digital banking tools available both on the mobile phone and integrated into your e-commerce platform is a necessity. Choosing the best business bank accounts will ensure that transactions are smooth, fast, and secured with these accounts.

Top Picks for Online Businesses:

1. PayPal Business Account: Best for e-commerce businesses, especially if you are doing PayPal payments on your website.

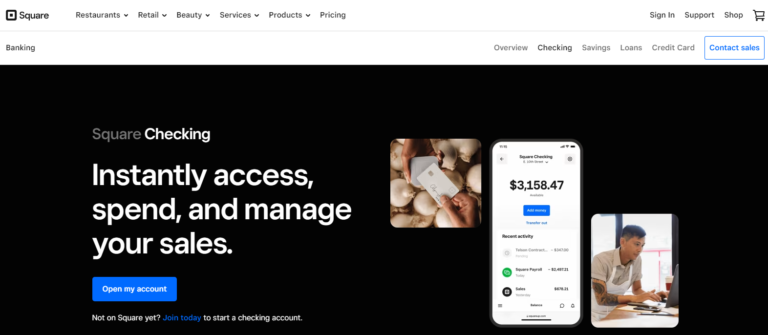

2. Square Business Checking: This is ideal to integrate with the point of sale of Square, especially for businesses that make most of their payments via this platform.

6. Best Business Bank Accounts for Nonprofits

The nonprofit will benefit from the best business bank accounts, specially tailored for special needs, fee-free services, and efficient management of donations as well as grants. The right account will provide you with the best usage of funds and maintain tax compliance.

Top Picks for Nonprofits:

1. Capital One Spark Business Checking: It provides fee-free banking to non-profits and useful reporting tools.

2. U.S. Bank Nonprofit Checking: It provides some waived fees and other benefits that help in the efficient management of funds relating to charity.

Factors to Consider When Choosing the Best Business Bank Account

The following criteria will be used to rate the various business bank accounts:

- Fees: Look for accounts with minimal fees, for example, a monthly maintenance charge or even transaction fees.

- Accessibility: The online and mobile banking services must be accessible and user-friendly.

- Interest Rates: If you will carry a large cash balance, look for accounts with good interest rates.

- Additional Services: More services would include payment processing, business credit, and lending.

Conclusion

A business bank account is therefore very essential to the effective management of funds in a company. There are small business accounts with low fees up to sophisticated large enterprise options; there is therefore always a bank account suited for your business needs. So weigh the benefits of each account type according to your business needs to make an informed decision.

Choosing the best business bank accounts can provide all you need to increase your business, save cash, or efficiently manage cash flow. Research your options with a view toward an informed choice that will best suit your current needs.

FAQs

Can I apply for a business bank account online?

- Yes, most banks offer the option to apply for a business bank account online. You will typically need to provide essential business details like your Employer Identification Number (EIN), business address, and personal identification. Accounts like Novo and NorthOne are fully digital, allowing you to complete the entire process from your computer or mobile device.

Can I get a business credit card with my business bank account?

- Yes, many business bank accounts offer the option to apply for a business credit card. Business credit cards help with cash flow management, build your business credit, and often come with rewards or cashback on purchases. Banks like Chase and American Express offer business credit card options when you open a business account with them.

What should I look for when comparing business bank accounts?

- When comparing business bank accounts, consider factors like monthly fees, transaction limits, interest rates, online banking features, and additional services like merchant tools or access to loans. It’s essential to choose an account that suits your business’s size, cash flow needs, and future growth potential.

Amazing content! I truly liked reading it and picked up some useful tips. Keep up the good work!

Pingback: Best Budgeting Apps 2026 | Free & Paid