Introduction

Investment is a strong tool for wealth building, but which choice is the best for either stocks or mutual funds when trying to make this very important decision can be daunting to anyone. While both offer huge potential for returns, each offers characteristics, advantages and risks. The following article will detail these differences, so you know better which investment may serve your needs best.

Understanding Stocks and Mutual Funds

Stocks: What Are They?

Stocks, or equities, represent ownership in a company. When you buy a stock, you buy into a small piece of that company, referred to as a share. The use of stocks gives the investors a chance to reap rewards from a company‘s good fortunes in the form of increased share prices and sometimes dividends.

Mutual Funds: How Do They Work?

Mutual funds can be described as investment programs in which money is raised from many investors to make an investment in a diverse portfolio of stocks, bonds, or other securities. These mutual funds are managed professionally by fund managers and create a mix of investments while minimizing the risk associated with holding individual stocks.

Key Differences Between Stocks and Mutual Funds

Risk and Reward

- Stocks: High risk and high reward. The price of stocks is very volatile in nature and may fluctuate significantly either up or down based on the company performance, economic conditions, and the general market sentiment. Experienced investors can earn more from stocks.

- Mutual Funds: Moderate risk and moderate reward. Mutual funds, though volatile, have the diversified nature that helps reduce risks. They are stable investment options for conservative or beginning investors.

Costs and Fees

- Stocks: Since most costs are tied to transaction fees or brokerage commissions, the costs are typically lower than those of mutual funds, but trading too frequently can easily add up.

- Mutual Funds: Management fees, or more commonly known as expense ratios, apply to most mutual funds. Certain mutual funds may also employ load fees. These compensation fees are paid to the fund management for their services, meaning that the returns will still be slightly less.

Control Over Investments

- Stocks: Direct control. You have the power to select what stocks you wish to purchase, when you buy them, and when you sell. This is a direct, hands-on investment.

- Mutual Funds: Not so control. You allow other people to decide which investment products you want. Suitable for the laid-back people.

Advantages and Disadvantages

Advantages of Investing in Stocks

- Returns: Over the years, stocks have offered higher return values compared to many forms of investments.

- Liquidity: The stocks are liquid and easily bought and sold.

- Dividend Income: Stock gives most of its holder’s dividend income, as well as regular income at the dividend date.

Disadvantages of Investing in Stocks

- High Volatility: The stock prices may drop significantly and rise, resulting in riskier stocks for investors.

- Time and knowledge: Stocks require much more time and knowledge to read and follow continuously.

Advantages of Investing in Mutual Funds

- Diversification: Spread over multiple assets and therefore less prone to poor performance of one particular asset.

- Professional Management: Managers study and pick the best investments, thus an option for those without experience.

- Accessibility: Most mutual funds have a minimum investment level that is not so high and can be easily met by more people.

Disadvantages of Investing in Mutual Funds

- Management Fees: High management fees are paid for the services of the professional managers, and that reflects in the returns earned.

- Poor Control: Investors are unable to choose the specific investments. They have to rely on the fund manager developing his plan.

Tax Implications

- Stocks: Taxed on dividends and capital gains when sold at a profit. Long-term holdings—over one year—ordinarily receive lower capital gains tax rates.

- Mutual Funds: Taxation on capital gains distribution is possible, even in cases where the investor does not sell his shares. Thus, tax planning is very important.

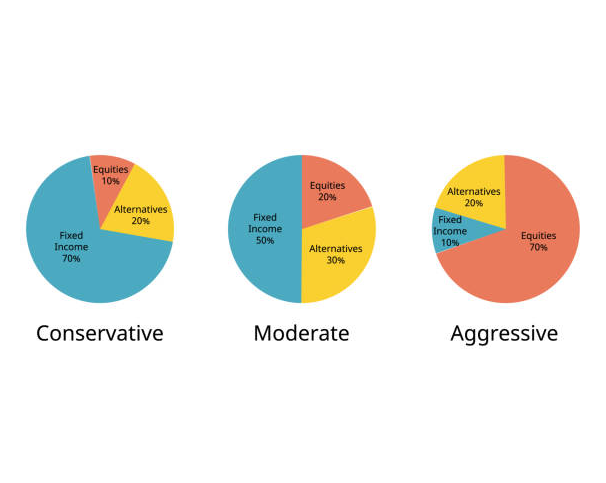

Suitability Based on Investor Profile

- Stocks: Best for Aggressive Investors

Stocks would be ideal for risk-taking people where a greater chance of better returns could be expected as the risks are higher. Best for investors who have enough time to watch how the market will go and possess, or willing to acquire, the right knowledge or skill. - Mutual Funds: Ideal for Conservative or Passive Investors

The main reason people get attracted to mutual funds is that it is the lowest-risk investment, along with being very hands-off. Mutual funds are good for an individual who needs stability in long-term growth due to professional management and diversified investments.

Conclusion

Between, either-or type, cannot be chosen. Stocks are options that face high growth prospects, and mutual funds have a diversified professionally managed option for those who want stability in their investments. Assess your goals, the level of risk you can tolerate, as well as your commitment to do your best selections for your portfolio.

FAQs

Which is riskier: stocks or mutual funds?

- Stocks are typically riskier because their value can fluctuate significantly due to market conditions, company performance, and economic factors. Mutual funds spread investments across various assets, which reduces risk through diversification. However, certain mutual funds (like stock-based mutual funds) can still carry moderate risk, though generally less than individual stocks.

Can I invest in both stocks and mutual funds?

- Yes, many investors choose a mix of both stocks and mutual funds to create a balanced portfolio. This strategy combines the growth potential of stocks with the stability and diversification benefits of mutual funds, catering to both long-term growth and risk management.

Do stocks offer better returns than mutual funds?

- Stocks have the potential to offer higher returns than mutual funds over the long term, especially if you invest in high-growth companies. However, this also comes with higher risk. Mutual funds, particularly those with a diversified portfolio, tend to have more moderate returns but are less volatile, making them appealing for conservative investors.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: Is Your Money Safe? - Paisewaise

Pingback: The Top 5 Investment Strategies - Paisewaise

Pingback: How to Invest in Stocks Like a Pro - Paisewaise

Pingback: 7 Investment Fund Myths Busted - Paisewaise

Pingback: 7 Tax-Efficient Investment Strategies for 2025 - Paisewaise

Pingback: Top 5 Investment Funds You Should Know About in 2025 - Paisewaise

Pingback: How to Start Investing Smartly and Avoid Costly Mistakes - Paisewaise

Pingback: Can You Lose Money in a Roth IRA? - Paisewaise

I’m impressed by your talent to transform mundane subjects into engaging writing. Great job!

Fantastic post! Your style is captivating and your opinions are very relevant. Thanks for sharing such useful information with us. Keep it up!