How Do Banks Make Money? A Complete Guide to Banking Revenue Streams

Every day, millions of people walk into banks, swipe their debit cards, apply for mortgages, and check their account balances online. Banks have become so woven into the fabric of our daily lives that we rarely stop to ask a fundamental question: how do banks make money? Understanding how banks make money isn’t just an academic exercise—it affects the interest rate on your savings account, the fees you pay, and even the stability of the entire financial system. Whether you’re a consumer trying to make smarter banking decisions or an investor eyeing financial stocks, knowing how banks make money is essential.

In this comprehensive guide, we’ll explain how banks make money by breaking down the primary revenue streams that keep them profitable, exploring the risks they face, and showing why this knowledge is important for your financial well-being.

Primary Ways Banks Make Money

Interest Income: The Foundation of Banking Profits

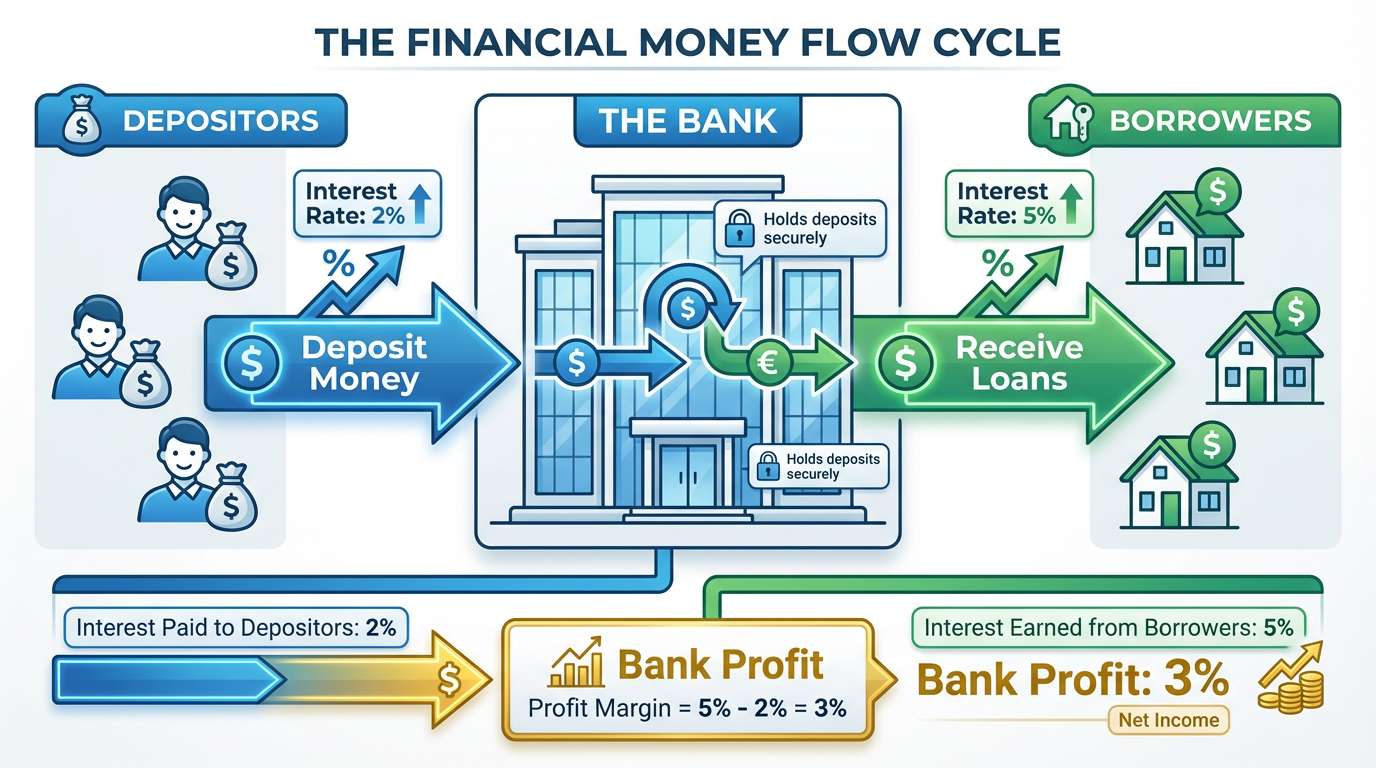

At its core, banking operates on a beautifully simple principle: banks borrow money from depositors at low rates and lend it to borrowers at higher rates. This difference, known as the net interest margin, is how banks make money through their most fundamental activity.

When you deposit $10,000 in a savings account paying 0.5% annual interest, the bank doesn’t just store that money in a vault. Instead, it lends that money to someone taking out a mortgage at 7% interest or a business seeking a loan at 9%. The bank pays you $50 in interest for the year while earning $700 or $900 from the borrower. The difference represents the bank’s gross profit from that transaction.

Real-World Example: Consider JPMorgan Chase, one of America’s largest banks. In 2023, the bank reported net interest income of approximately $89 billion, representing more than half of its total revenue. This massive figure came from billions of dollars in loans, mortgages, credit cards, and other lending products.

| Loan Type | Average Interest Rate Charged | Typical Deposit Rate Paid | Net Interest Margin |

|---|---|---|---|

| Mortgage | 6.5% – 7.5% | 0.5% – 2.0% | 4.5% – 7.0% |

| Personal Loan | 10% – 15% | 0.5% – 2.0% | 8% – 14.5% |

| Credit Card | 18% – 24% | 0.5% – 2.0% | 16% – 23.5% |

| Auto Loan | 5% – 8% | 0.5% – 2.0% | 3% – 7.5% |

| Business Loan | 7% – 12% | 0.5% – 2.0% | 5% – 11.5% |

How Do Interest Rates Affect a Bank’s Profits?

Interest rates act as a double-edged sword for banks. When the Federal Reserve raises rates, banks can charge more for loans, but they also must pay more to attract deposits. The key is the timing and magnitude of these adjustments. Banks typically raise lending rates faster than deposit rates, temporarily expanding their profit margins. However, in a declining rate environment, the opposite occurs, and net interest margins can compress, reducing profitability.

Fees: The Hidden Revenue Generator

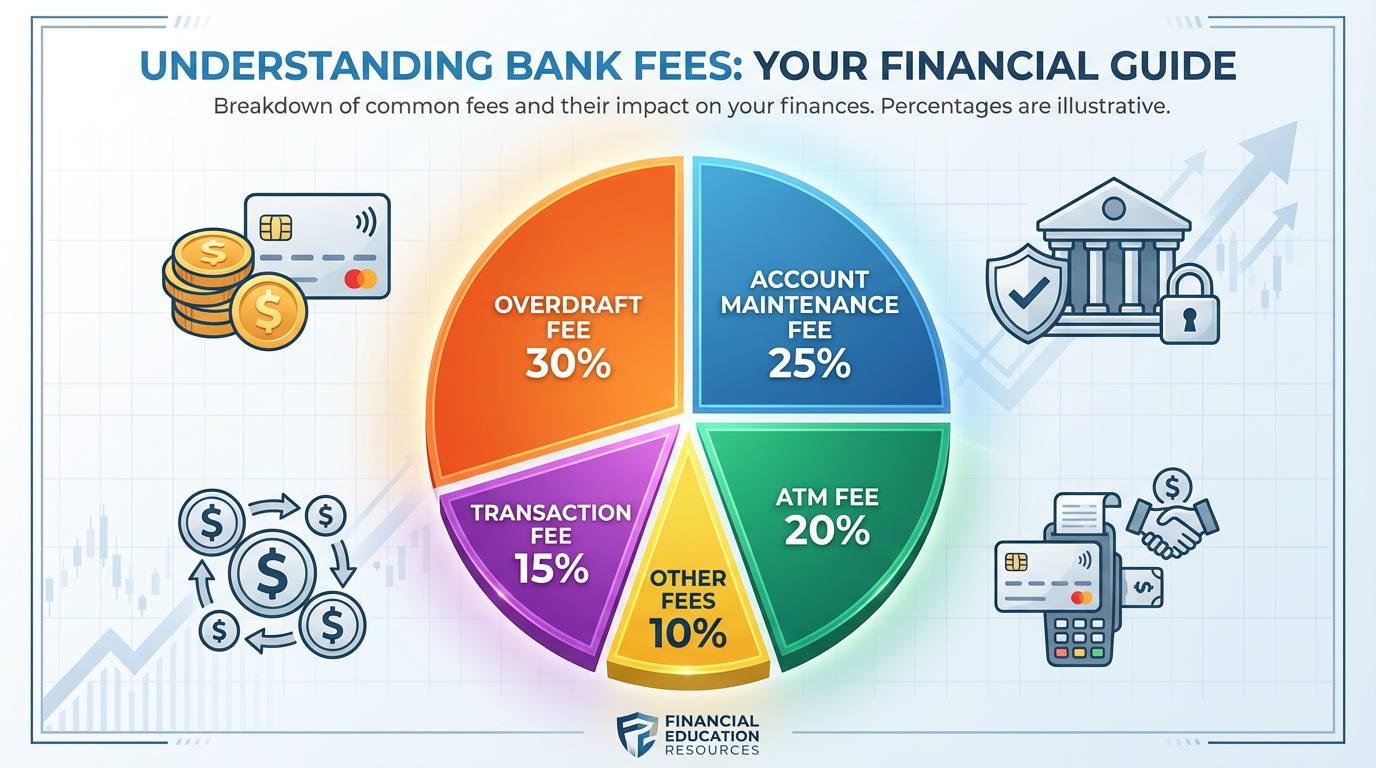

While interest income forms the backbone of banking profits, fees and charges are another major way banks make money. But many people wonder, how do banks make money from these fees? These charges appear in various forms throughout your banking relationship, from the obvious to the obscure.

Banks levy fees for dozens of services: monthly account maintenance, overdraft protection, ATM usage (especially out-of-network), wire transfers, paper statement delivery, insufficient funds, early account closure, cashier’s checks, and safe deposit boxes. For many banks, particularly large retail institutions, this is exactly how banks make money, with fee income sometimes representing 20–30% of total revenue.

Real-World Example: Bank of America generated approximately $12 billion in service charges in recent years, with overdraft and insufficient funds fees historically representing a substantial portion. However, following regulatory pressure and competitive dynamics, many banks have reduced or eliminated certain controversial fees.

| Fee Type | Average Charge | Annual Revenue Impact (Industry-wide) |

|---|---|---|

| Overdraft/NSF Fees | $30-$35 per occurrence | $15 billion+ |

| Monthly Maintenance | $10-$15 per month | $8 billion+ |

| ATM Fees (out-of-network) | $3-$5 per transaction | $5 billion+ |

| Wire Transfer Fees | $15-$30 domestic, $40-$50 international | $3 billion+ |

| Late Payment Fees | $25-$40 | $2 billion+ |

Which Fees Are the Most Profitable for Banks?

Overdraft and insufficient funds fees have traditionally been the most lucrative, generating billions annually despite affecting a relatively small percentage of customers. Many people ask, how do banks make money from these charges, and the answer lies in their low cost and high profitability. Credit card late fees and foreign transaction fees also generate substantial revenue with minimal expense to the bank. However, these fees face increasing scrutiny from regulators and consumer advocacy groups, pushing banks to diversify their fee structures and focus more on value-added services.

Investment and Trading Activities: High Risk, High Reward

Major banks don’t just facilitate financial transactions—they actively participate in financial markets. Many people wonder, how do banks make money beyond traditional lending? The answer lies in activities such as proprietary trading, market making, underwriting securities, and facilitating mergers and acquisitions.

Investment banking divisions help companies raise capital by issuing stocks or bonds, earning substantial fees for their services. Trading desks buy and sell securities, currencies, and derivatives, profiting from price movements and bid-ask spreads. Wealth management arms invest client assets in various instruments, collecting management fees and performance bonuses—another key way how do banks make money in addition to loans and fees.

Real-World Example: Goldman Sachs, a premier investment bank, generated approximately $58.70 billion in total revenue in 2025, with a significant portion coming from trading and investment activities. During volatile market periods, trading revenues can surge as banks capitalize on price swings and increased client activity.

| Investment Activity | Description | Typical Revenue | Risk Level |

|---|---|---|---|

| Proprietary Trading | Bank trades with its own capital | Variable, potentially billions | Very High |

| Market Making | Facilitating trades, earning bid-ask spread | Steady, billions annually | Medium-High |

| Underwriting | Helping companies issue securities | 3-7% of deal value | Medium |

| M&A Advisory | Advising on mergers and acquisitions | 1-2% of deal value | Low-Medium |

| Asset Management | Managing client portfolios | 0.5-2% of assets annually | Low-Medium |

How Risky Are Investment Activities for Banks?

Investment activities carry substantially more risk than traditional lending. Proprietary trading can generate massive profits during favorable markets but can also lead to catastrophic losses, as evidenced by the 2008 financial crisis. The failure of Lehman Brothers and the near-collapse of Bear Stearns illustrated how quickly trading losses can spiral out of control. In response, regulations like the Volcker Rule have restricted banks’ ability to engage in certain types of risky trading, forcing them to balance profitability with prudent risk management.

Wealth Management and Advisory Services: Catering to the Affluent

Wealthy individuals and institutions need specialized financial services, and banks happily provide them—for a fee. Many people ask, how do banks make money from high-net-worth clients? Wealth management is the answer, generating revenue through personalized financial planning, investment management, estate planning, tax strategies, and exclusive banking services.

Private banking clients typically have investable assets exceeding $1 million, and ultra-high-net-worth clients (those with $30 million or more) receive even more exclusive treatment. Banks charge annual fees based on assets under management (AUM), typically ranging from 0.5% to 2%, depending on the service level and asset size—another way how do banks make money beyond traditional loans and fees.

Real-World Example: Morgan Stanley’s Wealth Management division manages over $6 trillion in client assets and generates approximately $26 billion in annual revenue. With an average fee of around 0.8-1% of AUM, this division represents a stable, recurring revenue stream with relatively low capital requirements compared to lending operations.

| Service Category | Target Client | Typical Fee Structure | Annual Revenue Potential |

|---|---|---|---|

| Private Banking | $1M – $10M assets | 0.75% – 1.5% of AUM | High |

| Family Office Services | $30M+ assets | 0.5% – 1.0% of AUM + flat fees | Very High |

| Financial Planning | $100K – $1M assets | Flat fee or 1% – 2% of AUM | Medium |

| Retirement Planning | Varies | Flat fee or percentage | Medium |

| Insurance Products | Varies | Commissions 1% – 6% | Medium-High |

How Do Banks Balance Revenue from Advisory Services Versus Traditional Lending?

Banks increasingly view wealth management as a strategic priority, and many people ask, how do banks make money from this segment. Wealth management generates stable, fee-based revenue that is less sensitive to interest rate fluctuations and economic cycles. Unlike lending, which requires significant capital and carries credit risk, advisory services generate high-margin revenue with minimal capital requirements. Major banks have invested billions in acquiring wealth management firms and hiring experienced advisors, recognizing that affluent clients often need multiple banking services—creating cross-selling opportunities across lending, investment, and advisory divisions, another way how do banks make money.

Other Income Sources: Innovation and Diversification

Banks continuously evolve, and many people ask, how do banks make money in today’s financial landscape? Understanding this requires looking beyond traditional models. Modern banks generate revenue through currency exchange services, securitization of loans, credit card interchange fees, payment processing, fintech partnerships, and even cryptocurrency services—demonstrating multiple ways in whichbanks make money beyond loans, fees, and investment activities.

Securitization involves bundling loans (mortgages, auto loans, credit card debt) and selling them to investors as mortgage-backed securities or asset-backed securities. Banks earn fees for originating, servicing, and securitizing these loans while transferring the credit risk to investors.

Currency exchange generates profit through the spread between buying and selling rates. International banks handle trillions in currency transactions annually, earning fractions of a percent on each transaction—amounts that accumulate to billions.

Interchange fees occur when you swipe your credit or debit card. The merchant’s bank pays the cardholder’s bank a small fee (typically 1.5-3% of the transaction), which the banks share with payment networks like Visa or Mastercard.

Real-World Example: Visa and Mastercard facilitated over $14 trillion in transaction volume globally, with banks earning billions in interchange fees. Meanwhile, banks like Bank of America earn over $500 million annually just from securitization activities.

| Revenue Source | Mechanism | Growth Potential | Industry Revenue |

|---|---|---|---|

| Credit Card Interchange | Percentage of each transaction | Stable | $90 billion+ annually |

| Currency Exchange | Spread on buy/sell rates | Growing with globalization | $30 billion+ annually |

| Securitization | Fees from bundling and selling loans | Moderate | $15 billion+ annually |

| Payment Processing | Transaction fees from merchants | High | $50 billion+ annually |

| Fintech Partnerships | Revenue sharing, licensing | Very High | $10 billion+ (rapidly growing) |

What Are Some Emerging Revenue Streams for Banks in the Digital Age?

Digital transformation is reshaping the financial industry, and many people ask, how do banks make money in this new era. Banks now earn revenue from API access, allowing fintech companies to build applications on banking infrastructure. Some banks offer Banking-as-a-Service (BaaS), providing backend banking capabilities to non-bank companies. Cryptocurrency services, while controversial, represent another frontier, with banks offering custody, trading, and advisory services for digital assets. Subscription-based banking models, where customers pay monthly fees for premium features, are also gaining traction. Additionally, data monetization—selling anonymized, aggregated financial insights to third parties—represents another emerging, albeit ethically complex, way that banks make money.

Risks and Challenges in Bank Revenue

Understanding how banks make money is incomplete without acknowledging the significant risks and challenges they face. Banking profitability isn’t guaranteed, and numerous factors can dramatically impact revenue streams, affecting the very ways in whichbanks make money.

Economic Downturns: Recessions increase loan defaults, reducing interest income and requiring banks to set aside larger reserves for potential losses. The 2008 financial crisis demonstrated how quickly loan losses can overwhelm profits. During COVID-19, banks set aside over $100 billion in loan loss provisions, anticipating widespread defaults (many of which didn’t materialize as government support programs prevented the worst-case scenario).

Regulatory Changes: Banks operate in one of the most heavily regulated industries. Capital requirements (how much money banks must hold relative to their assets), stress tests, consumer protection laws, and restrictions on certain activities all impact profitability. The Dodd-Frank Act, passed after the 2008 crisis, significantly increased compliance costs and limited certain revenue-generating activities. Regulatory compliance now costs large banks over $10 billion annually.

Competition: Traditional banks face mounting competition from credit unions, online-only banks, and fintech companies. These competitors often have lower overhead costs and can offer better rates or lower fees. Companies like Chime, SoFi, and Robinhood have attracted millions of customers, particularly younger demographics, by offering fee-free banking and innovative digital experiences. This competitive pressure forces traditional banks to reduce fees and increase technology investments, compressing profit margins.

Interest Rate Environment: The Federal Reserve’s monetary policy dramatically affects bank profitability. Extended periods of low interest rates compress net interest margins, making lending less profitable. Conversely, rapid rate increases can reduce loan demand and increase defaults, as borrowers struggle with higher payments.

Technology Disruption: Maintaining and upgrading banking technology requires massive investments. Legacy banks spend billions annually on technology, trying to match the user experience offered by digital-native competitors while maintaining secure, compliant systems managing trillions in assets.

Conclusion

So, how do banks make money? The answer is multifaceted: primarily through the interest spread between what they pay depositors and charge borrowers, but also through fees, investment activities, wealth management services, and an increasingly diverse array of modern revenue streams.

For consumers, understanding how banks make money empowers better financial decisions. Knowing that banks profit significantly from overdraft fees might motivate more careful account monitoring or selecting banks with friendlier fee structures. Recognizing that savings account interest rates are a bank’s cost helps explain why they’re often frustratingly low.

For investors, understanding banking revenue models is crucial for evaluating financial stocks. Banks with diversified revenue streams typically weather economic storms better than those overly reliant on interest income alone. The shift toward fee-based, capital-light businesses like wealth management represents a strategic evolution worth monitoring, and is another example of how banks make money in ways beyond traditional lending.

The banking industry continues evolving, balancing traditional strengths with digital innovation, regulatory compliance with profitability, and shareholder returns with customer satisfaction. As consumers and investors, staying informed about how banks make money helps us navigate this complex financial landscape more effectively.

Take Action: Review your banking relationships. Are you paying unnecessary fees? Could you earn better interest rates elsewhere? If you’re an investor, research how different banks generate and diversify their revenue streams before investing. Understanding how banks make money is the first step toward making your money work harder for you.

Frequently Asked Questions

Q. Do banks make more money from loans or fees?

- Traditional banks generate the majority of their revenue—typically 50-70%—from interest income on loans. However, fees represent an increasingly important revenue stream, contributing 20-30% of total income for many retail banks. Investment banks have a different profile, with trading and advisory services often exceeding lending income. The exact mix varies significantly by bank type and business model.

Q. Why do banks pay such low interest rates on savings accounts if they make so much money?

- Banks pay low savings rates because they can. In an environment where deposits exceed lending opportunities and where deposits are essentially guaranteed by FDIC insurance (making them very attractive to risk-averse savers), banks face limited pressure to pay competitive rates. Additionally, many customers prioritize convenience and established relationships over maximizing interest income, reducing competitive pressure. Online banks, with lower overhead costs, often pay significantly higher rates to attract deposits.

Q. Are big banks more profitable than small banks?

- Not necessarily, though they have different advantages. Large banks benefit from economies of scale, diversified revenue streams, and the ability to offer a full suite of services. However, they also face higher regulatory costs and complexity. Community banks and credit unions often enjoy strong customer loyalty, lower overhead, and specialization in local markets. Profitability metrics like return on equity (ROE) and return on assets (ROA) vary more by individual bank strategy and management than by size alone.

Q. How do banks make money when interest rates are near zero?

- Near-zero interest rates present significant challenges to bank profitability by compressing net interest margins. During such periods, banks shift focus to other revenue sources: increasing fees, expanding wealth management and advisory services, engaging in trading activities to capture market volatility, reducing costs through branch closures and digitalization, and sometimes taking on slightly more credit risk to generate higher-yielding loans. The extended low-rate environment of 2008-2016 forced many banks to fundamentally restructure their business models.

Q. Can banks lose money, and what happens if they do?

- Yes, banks can and do lose money, especially during economic crises or due to poor management decisions. When banks face significant losses, they first absorb them through their capital reserves. If losses exceed reserves, regulators may step in, requiring capital raises (selling new shares to investors), asset sales, or operational restructuring. In extreme cases, banks can fail, with deposits up to $250,000 per account protected by FDIC insurance. Systemically important banks may receive government bailouts to prevent broader economic collapse, as occurred during the 2008 financial crisis, though this approach remains politically controversial and regulations now require banks to develop “living wills” detailing how they could be unwound without taxpayer support.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: What Is Peer-to-Peer Lending? How It Works, Benefits, Risks & Returns

Pingback: What Is an IPO? Meaning, Process, Benefits & Risks Explained

Pingback: What Is an ATM? Meaning, Types, Fees, and How ATMs Work

Pingback: How to Save Money: Smart, Simple & Proven Tips

Pingback: What Is Inflation? Causes, Types, Inflation Rate & How It’s Measured

Pingback: Dina Powell McCormick Net Worth, Career & Global Finance Role

Pingback: How Minimum Balance Rules Work in Savings Accounts

Pingback: How Movies and TV Shows Portray Money (and What We Can Learn)