I Tried the No-Buy Trend for a Month—Was It Worth It?

Let’s be honest: have you ever checked your bank account mid-month and wondered where all your money went? You didn’t buy anything “big,” yet somehow your balance is significantly lower than expected. Those $8 coffees, $15 takeout orders, and “just browsing” online shopping sessions add up faster than you realize. Enter the no-buy trend—a social media movement that’s exploded across TikTok and Instagram, promising not just savings, but something deeper: financial clarity and intentionality.

Unlike restrictive budgeting methods that require complex spreadsheets, the no-buy challenge operates on one simple principle: stop buying non-essential items for a set period. But here’s the real question: Can eliminating discretionary spending for 30 days actually transform your relationship with money, or is it just another viral challenge that looks better on camera than in real life? I decided to find out, and what I discovered went far beyond the dollar amount I saved.

What the No-Buy Trend Really Means

The no-buy trend isn’t about depriving yourself of basic needs—it’s about distinguishing between necessity and impulse. At its core, this challenge requires you to temporarily eliminate all non-essential purchases while maintaining your regular bills and true necessities.

For my 30-day experiment, I established clear boundaries:

| Category | Status | Details |

|---|---|---|

| Housing costs | ✅ Allowed | Rent, mortgage, utilities |

| Groceries | ✅ Allowed | Food for home cooking only |

| Transportation | ✅ Allowed | Gas, public transit, and necessary car maintenance |

| Healthcare | ✅ Allowed | Prescriptions, medical appointments |

| Clothing | ❌ Banned | Unless replacing a genuinely broken essential |

| Food delivery | ❌ Banned | No takeout, no restaurant meals |

| Entertainment | ❌ Banned | Streaming subscriptions, events, concerts |

| “Small treats” | ❌ Banned | Coffee shops, impulse purchases, sales items |

| Online shopping | ❌ Banned | Everything from books to home décor |

Why clarity mattered more than perfection: I chose to be strict but realistic. If my winter coat literally tore beyond repair, I’d replace it. If I wanted a new coat because it was on sale? That was precisely what the no-buy trend was designed to prevent. The key was asking: “Do I need this to function, or do I just want it right now?”

Why I Decided to Try the No-Buy Challenge

My wake-up call came on a rainy Tuesday afternoon when I logged into my banking app and stared at the transaction history with genuine confusion. How had I spent $180 in just five days on things I couldn’t even remember buying? A closer look revealed the culprits: two coffee shop visits ($22), three food delivery orders ($67), an “essential” organizational basket from Target ($28), a book I hadn’t started reading ($16), and various subscription renewals I’d forgotten existed ($47).

The frustration wasn’t about the money alone—it was the lack of awareness. I considered myself financially responsible. I paid my bills on time and contributed to savings. Yet these small, seemingly harmless purchases were happening on autopilot, driven by boredom, convenience, or the momentary dopamine hit of clicking “buy now.”

I didn’t want to become ultra-frugal or never enjoy anything again. I simply wanted to understand where my money was actually going and regain a sense of control. The no-buy trend promised exactly that: a reset button for mindless spending habits.

The First Week Reality Check

Week one hit differently than I expected. I thought the hardest part would be resisting big purchases, but the real challenge was battling muscle memory spending—those automatic behaviors I’d developed without realizing it.

What surprised me most:

- My phone knew my patterns better than I did. Around 3 PM daily, I’d unconsciously open food delivery apps. My thumb would hover over DoorDash before my brain caught up with what I was doing.

- Boredom triggered spending. During commercial breaks or while waiting for files to load at work, I’d mindlessly scroll through shopping apps. It wasn’t about needing anything; it was pure habit.

- The “treat yourself” mentality was deeply ingrained. After a stressful meeting, my first thought was “I deserve a latte.” After finishing a project, it was, “I should order something nice for dinner.”

The purchases hardest to avoid:

- Coffee shop visits – Not for the caffeine (I had coffee at home), but for the ritual and break from routine

- Lunch out with coworkers – FOMO was real when everyone else was ordering from the new Thai place

- The “just $5” purchase – Small items felt justified because they were “cheap.”

The mental resistance during this first week was exhausting. Every decision required conscious thought. But this discomfort was precisely the point—it forced me to see how much of my spending was completely disconnected from actual need or even genuine want.

How Much Money Did I Actually Save?

Let’s talk numbers, because that’s what everyone wants to know about the no-buy trend.

My Spending Comparison

| Category | Normal Month | No-Buy Month | Savings |

|---|---|---|---|

| Food delivery/restaurants | $340 | $0 | $340 |

| Coffee shops | $95 | $0 | $95 |

| Online shopping | $180 | $0 | $180 |

| Entertainment/outings | $120 | $0 | $120 |

| Random purchases | $85 | $0 | $85 |

| Total discretionary | $820 | $0 | $820 |

I saved $820 in one month. That’s nearly $10,000 annually if sustained—a number that genuinely shocked me.

But here’s what those numbers don’t show: where the savings actually came from wasn’t about denying myself things I truly valued. Breaking down the $820:

- $340 from food delivery was mostly convenience spending when I was too lazy to cook food already sitting in my fridge

- $95 from coffee shops could be replaced with a $15 bag of quality coffee beans that lasts three weeks

- $180 from online shopping included items I’d already forgotten I ordered by the time they arrived

- $120 from entertainment was often activities I agreed to out of social obligation rather than genuine interest

The real insight: I wasn’t saving money by eliminating joy from my life. I was eliminating waste, mindlessness, and purchases that added zero value to my daily experience. This realization alone made the no-buy trend worth attempting.

The Hidden Costs Nobody Talks About

While scrolling through #nobuychallenge videos on social media, everyone celebrates the money saved. What they don’t always show are the hidden costs that come with this level of intentionality.

- Time investment: Meal planning became non-negotiable. Without the crutch of food delivery, I spent 2-3 hours every Sunday planning meals, grocery shopping, and meal prepping. This wasn’t necessarily bad—home-cooked meals were healthier and cheaper—but it required dedicated time I’d previously spent on other things.

- Mental fatigue: Every invitation required mental math. “Can I attend this birthday dinner without spending money? Should I suggest alternatives? Will I seem cheap?” The constant decision-making was genuinely exhausting during the first two weeks.

- Social awkwardness: Explaining why I couldn’t join coworkers for lunch or grab drinks after work sometimes felt uncomfortable. Most people were supportive, but there were definitely moments of feeling left out or having to over-justify my choices.

- Occasional frustration: When my book club selected a new release ($28), I couldn’t participate fully without breaking my rules. I found a workaround (library wait-list), but it meant reading the book three weeks later than everyone else.

These costs were real, but temporary. By week three, many of these challenges had smoothed out as I developed new routines and my social circle adjusted to my temporary constraints.

The Mindset Shift That Made the Difference

Around day 17, something clicked. I was scrolling through Instagram when a targeted ad appeared for a desk organizer that looked perfect for my workspace. The old me would have clicked “add to cart” within seconds, justifying it as a “productivity investment.”

Instead, I paused. Did I need this organizer, or did I just want the feeling of buying something new? My desk functioned fine. Papers were organized. The “problem” this product solved was manufactured by clever marketing, not my actual life.

That moment marked a fundamental shift from feeling deprived to feeling empowered. The no-buy trend stopped being about restriction and became about intentionality.

How My Money Mindset Changed

Before the challenge:

- Spending felt automatic and somewhat mysterious

- “Treating myself” was a daily occurrence

- Shopping was a boredom cure

- Purchases happened impulsively, justified later

During the challenge:

- Spending required conscious decision-making

- Genuine treats felt rare and special

- Boredom demanded creative solutions

- Impulses were examined before becoming purchases

The difference between wanting and needing became crystal clear. I wanted many things—that feeling didn’t disappear. But I needed very few of them. Once I could distinguish between the two, the no-buy trend felt less like deprivation and more like liberation from the constant pressure to consume.

I didn’t feel deprived. I felt more in control than I had in years.

Spending Triggers I Couldn’t Ignore Anymore

The no-buy challenge forced me to confront my spending triggers head-on. Without the option to make purchases, I had to sit with the feelings that usually prompted them.

My Top Spending Triggers

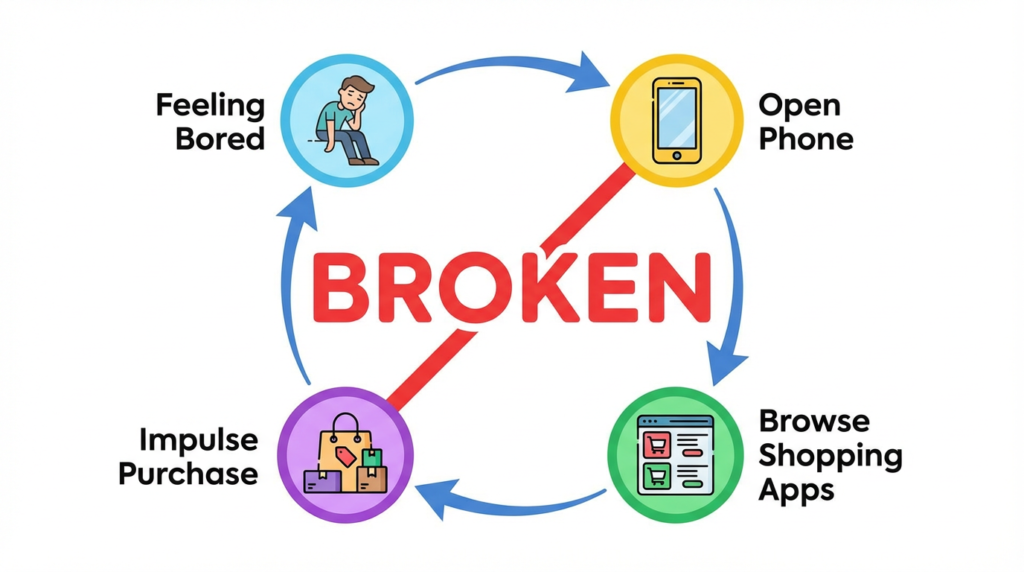

1. Boredom Spending

- What it looked like: Scrolling shopping apps during TV commercials, waiting rooms, or work breaks

- The truth: I wasn’t shopping because I needed anything; I was shopping because I was understimulated

- The fix: I deleted shopping apps from my phone and replaced scrolling time with reading articles or podcasts

2. Stress Purchases

- What it looked like: “I had a terrible day, I deserve this candle/book/takeout.”

- The truth: The purchase provided 30 seconds of relief, but the stress remained

- The fix: I created a list of free stress-relievers (walking, calling a friend, journaling) and tested them when stress hit

3. Social Media Influence

- What it looked like: Seeing influencers showcase products that suddenly felt “essential.”

- The truth: My life was fine before I saw that aesthetic coffee table book or trending skincare product

- The fix: I limited Instagram to 15 minutes daily and unfollowed accounts that made me feel like I was missing out

4. Sale FOMO (Fear of Missing Out)

- What it looked like: “This is 40% off—I’m actually saving money by buying it!”

- The truth: You don’t save money by spending it, even at a discount

- The fix: I instituted a 72-hour rule: if I still thought about the item three days later, it might be worth considering post-challenge

Long-Term Impact on Impulse Buying

Did the no-buy challenge reduce impulse buying permanently? Partially, yes. Even after the month ended, I found myself pausing before purchases in a way I never had before. The automatic “add to cart” reflex had been interrupted.

However, old habits didn’t disappear entirely. What changed was my awareness. I could now recognize when I was about to make an emotional purchase versus a practical one, and that awareness alone cut my impulse buying by an estimated 60-70%.

Social Life, Pressure, and Real Life Challenges

One of my biggest concerns before starting the no-buy trend was how it would affect my social life. Would I become the friend who never participates? Would I miss out on important moments?

The reality was more nuanced than I expected.

How I Navigated Social Situations

- Birthday dinners: I attended but explained I was doing a financial challenge. Most friends were supportive. I brought a thoughtful card and offered to host the birthday person for a home-cooked meal later.

- After-work drinks: I suggested alternatives like walking in the park or having coffee at my place. Surprisingly, several coworkers admitted they also wanted to cut back on spending and appreciated the free option.

- Weekend plans: Instead of defaulting to “dinner and a movie” ($60+), I proposed free activities: hiking, museum free days, and game nights at home. These often led to more meaningful conversations than sitting in a dark theater.

- The unexpected gift: Many social activities became simpler and better. Without the pressure to spend money, gatherings focused on actual connection rather than consumption. Some of my favorite moments that month were completely free: watching sunset from a local viewpoint, hosting a potluck, having hours-long conversations on friends’ porches.

When It Was Genuinely Hard

I won’t pretend that the no-buy trend made daily life easier across the board. There were definitely challenges:

- A wedding required a gift (I considered this a necessary exception and set a strict budget)

- Car maintenance emerged unexpectedly (also necessary, not discretionary)

- Feeling left out when coworkers bonded over trying the new lunch spot

The key was preparation and communication. When I explained what I was doing without over-apologizing, most people respected it. The few who didn’t probably weren’t the friends I needed to prioritize anyway.

Is a No-Buy Month Actually Sustainable?

Here’s the honest truth: a strict no-buy month isn’t sustainable long-term for most people, and it’s not supposed to be.

Who the No-Buy Trend Works Best For

Ideal candidates:

- Serial impulse buyers who’ve lost track of their spending

- People in financial transition (saving for a house, paying off debt, career change)

- Anyone needing a reset after overspending periods (post-holidays, after vacation)

- Individuals with stable incomes who can plan for a month without emergency spending

Where it breaks down:

| Situation | Why No-Buy Is Challenging |

|---|---|

| Families with children | Kids have unpredictable needs; strict rules create stress |

| Irregular income | Restricting spending during earning periods may backfire |

| High-stress jobs | May rely on convenience spending for time management |

| Medical conditions | Unexpected health costs can’t be predicted or eliminated |

Why Flexibility Matters

The most successful approach I discovered was treating the no-buy trend as a diagnostic tool rather than a permanent lifestyle. It revealed where my money was going, which purchases added value, and which were pure waste.

After the month, I didn’t continue with zero discretionary spending. Instead, I implemented what I call “conscious spending“—keeping the awareness I’d gained while allowing room for genuine joy and convenience when it made sense.

For families specifically, A modified approach works better. Rather than banning all non-essentials, try a “one discretionary purchase per week” rule or “no-buy weekdays” while allowing weekend flexibility.

What Happened After the Month Ended

Day 31 arrived, and I faced my first test: what would I actually buy now that I could?

The surprising answer: not much.

Habits That Stuck

Even though I was “allowed” to resume normal spending, several changes remained:

✓ Coffee at home became my default – I still enjoy the occasional coffee shop visit, but it’s now a weekly treat rather than a daily habit. Savings: ~$75/month

✓ Meal planning continued – The routine of Sunday prep had actually simplified my weeknights. I kept it up, ordering takeout only once weekly instead of 3-4 times. Savings: ~$200/month

✓ The 72-hour rule stuck – For any non-essential purchase over $30, I wait three days. If I still want it, I consider buying it. About 70% of the time, the urge passes. Savings: ~$120/month

✓ Deleted shopping apps – They’re still gone from my phone. If I genuinely need something, I can access websites, but the friction of opening a browser instead of tapping an app reduces impulse purchases significantly.

Did I Relapse Into Old Patterns?

Partially, yes—but with awareness. My first post-challenge purchase was a $45 cookbook I’d genuinely researched and wanted. I enjoyed it without guilt because the purchase was intentional, not impulsive.

However, by month two after the challenge, I noticed my spending creeping up again. Not to previous levels, but enough to remind me that old habits die hard. The difference was that I noticed it happening and could course-correct.

What I learned: The no-buy trend isn’t about perfection afterward. It’s about creating enough space from your habits to see them clearly, then making conscious choices going forward.

Some months, I’m stricter with spending. Other months, I’m more relaxed. The key is that it’s now a choice, not an unconscious pattern.

Who Should—and Shouldn’t—Try the No-Buy Trend

Before jumping into a no-buy challenge, it’s crucial to honestly assess whether this approach makes sense for your situation.

Who Should NOT Try the No-Buy Trend

❌ If you’re living paycheck to paycheck: The no-buy trend assumes you have discretionary spending to eliminate. If you’re already cutting every corner to cover basics, this challenge won’t help—it may just add stress and shame.

❌ If you have a restrictive mindset around money: People with histories of extreme frugality or deprivation may use the no-buy trend to reinforce unhealthy patterns rather than develop healthier ones.

❌ If you’re in a mental health crisis: Financial stress during depression, anxiety, or other conditions requires professional support, not a trendy challenge that might worsen feelings of deprivation.

❌ If your family isn’t on board: Forcing a no-buy month on an unsupportive household creates conflict, not clarity.

Who Should Consider It

✓ If you’re genuinely confused about where your money goes ✓ If you’ve tried budgeting but keep overspending ✓ If you want to save for a specific goal ✓ If you’re ready for honest self-reflection

Safety-first money approach: If you’re struggling financially, focus first on creating a basic emergency fund, addressing debt with sustainable strategies, and seeking support from financial counselors (many offer free services). The no-buy trend can come later, as a refinement tool, not a crisis intervention.

Final Verdict: Was the No-Buy Trend Worth It?

Would I do another no-buy month again? Absolutely—but with modifications.

Knowing what I know now, I’d approach it slightly differently:

What I’d keep:

- The 30-day timeframe (long enough for habit disruption, short enough to sustain)

- Strict rules on impulse purchases and food delivery

- The practice of sitting with discomfort instead of shoving through it

What I’d modify:

- Allow one “intentional treat” per week (a coffee shop visit or meal out with friends)

- Build in flexibility for genuine social connection expenses

- Plan for one free “joy activity” to replace paid entertainment

Is the No-Buy Trend Actually Worth It?

For me: Yes, but not for the reasons I expected.

I thought the value would be in the $820 I saved. That was nice, but it wasn’t transformative.

The real value was:

- Clarity about my spending patterns – I could finally see where money was leaking out of my life

- Breaking the autopilot – Purchases stopped being unconscious defaults

- Discovering what I actually value – Turns out, most of my spending didn’t align with my stated priorities

- Building confidence – Proving to myself I could control my financial choices

Who Benefits Most From Trying It Once

The no-buy trend works best as a reset, not a lifestyle. Think of it like a financial juice cleanse—not something you do forever, but a way to interrupt patterns, gain insights, and recalibrate.

You’ll benefit most if you:

- Have lost track of your spending

- Feel controlled by your habits rather than in control of them

- Want concrete data about your financial patterns

- Are you ready to challenge your consumption defaults

Final takeaway: The no-buy challenge isn’t about deprivation. It’s about creating enough space between your impulses and your actions to choose intentionally. For one month, I stopped being a passive consumer and became an active decision-maker. That shift—more than the money saved—made the no-buy trend for a month completely worth the effort.

FAQs

Q. What is the no-buy trend?

- The no-buy trend is a personal finance challenge where you stop all non-essential spending for a set period, usually 30 days.

Q. Does a no-buy month actually save money?

- Yes, most people save money—but the biggest benefit is learning where your money leaks actually come from.

Q. Is the no-buy challenge realistic for normal life?

- It can be, if you set clear rules and allow essentials. Strict no-buy rules work best as a short-term reset.

Q. What are the hardest parts of a no-buy challenge?

- Avoiding impulse purchases, social pressure, and boredom spending are the biggest challenges.

Q. Is the no-buy trend better than budgeting?

- It’s not a replacement for budgeting, but it can reset spending habits and make budgeting easier afterward.

Q. Who should avoid trying a no-buy month?

- People with unstable income or essential cash-flow issues should focus on flexible budgeting instead of strict no-buy rules.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.