7 Money Habits That Look Boring but Work Surprisingly Well

The Unsexy Truth About Building Wealth

Tired of flashy financial hacks that promise quick wealth but leave your wallet empty? We’ve all been there—downloading the latest budgeting app with 47 features, chasing cryptocurrency tips from influencers, or trying to decode complex investment strategies that require a finance degree to understand. The irony? Most of these exciting approaches fail spectacularly.

The truth is, the most effective money habits that look boring are exactly what wealthy people have been using for decades. They’re not sexy. They won’t make you feel like a financial genius at dinner parties. But they work—reliably, consistently, and surprisingly well.

While everyone else is searching for the next big financial trend, people who master these simple routines are quietly building serious wealth. No drama. No complexity. Just proven habits that compound over time. Ready to discover why boring beats flashy every single time? Let’s dive into seven money habits that might make you yawn but will definitely make your bank account smile.

Habit 1: Automate Your Savings

Why do boring financial habits outperform trendy financial hacks?

Here’s the problem: most people have excellent intentions about saving money. They promise themselves they’ll set aside whatever’s “left over” at the end of the month. Spoiler alert—there’s rarely anything left over. Life happens, expenses pop up, and that commitment to save gets pushed to next month (and the month after that).

The solution is beautifully simple: set up automatic transfers to your savings or investment accounts. This is one of those money habits that look boring but deliver incredible results because it removes the human element—our tendency to procrastinate, forget, or make excuses.

Here’s what automation looks like in practice

If you automatically save $100 a week, in a year, that’s $5,200—without thinking about it once. Over five years? That’s $26,000, and that’s before any interest or investment returns. The beauty of automation is that you never see this money in your checking account, so you never miss it.

Real-World Case Study

Sarah, a 28-year-old teacher, set up automatic transfers of $150 every payday (twice monthly) to a high-yield savings account. She honestly forgot about it for two years. When she finally checked, she had accumulated $7,200 plus interest—money she would have definitely spent on “necessary” purchases if it had stayed in her checking account.

Benefits Beyond the Numbers

- Reduces decision fatigue and stress

- Prevents overspending by limiting available funds

- Creates a “set it and forget it” wealth-building system

- Works regardless of willpower or motivation levels

Habit 2: Track Every Expense

![]()

Why do most people ignore habits that actually build wealth?

Most people dramatically underestimate how much they spend on small, daily expenses. That morning coffee, the impulse Amazon purchase, the subscription you forgot to cancel—these “little things” add up to shocking amounts that silently drain your financial progress.

The unglamorous solution? Track every single expense. Yes, everyone. Use a simple app, spreadsheet, or even a notebook. The method doesn’t matter; the awareness does.

Consider this eye-opening example

| Expense | Daily Cost | Annual Cost |

|---|---|---|

| Coffee shop coffee | $5 | $1,825 |

| Lunch out | $12 | $3,120 |

| Streaming services (3) | $1.33 | $485 |

| Convenience store snacks | $3 | $1,095 |

| Total | $21.33 | $6,525 |

A coffee habit of $5 per day costs $1,825 per year. When you see that number staring back at you, suddenly brewing coffee at home doesn’t seem like such a sacrifice. This is precisely why tracking expenses ranks among the most powerful money habits that look boring yet produce dramatic results.

The Minimum Viable Tracking Approach

You don’t need to become obsessive. Even minimal tracking—spending just 5 minutes at the end of each day reviewing your transactions—is enough to gain awareness and control. Many people report that simply knowing they’ll have to write down their purchase stops them from making unnecessary buys.

Quick win: Track for just one month. Most people discover at least $200-500 in “leaks” they didn’t realize existed.

Habit 3: Pay Yourself First

Can boring money habits make you financially free faster?

Here’s where most people get the money equation backwards. The typical approach is: Income – Expenses = Savings. This leaves saving as an afterthought, dependent on whatever’s left over (usually nothing).

Wealthy people flip this equation: Income – Savings = Expenses. They pay themselves first, treating savings like a non-negotiable monthly expense that gets priority over everything else.

The Power of 10%

Setting aside 10% of every paycheck before paying bills creates a growing safety net that builds faster than you’d imagine. Here’s what this looks like at different income levels:

| Annual Income | 10% Saved Monthly | 5-Year Total | 10-Year Total |

|---|---|---|---|

| $40,000 | $333 | $20,000 | $40,000 |

| $60,000 | $500 | $30,000 | $60,000 |

| $80,000 | $667 | $40,000 | $80,000 |

Note: These figures don’t include interest or investment returns, which would significantly increase totals.

Case Study: Marcus’s Transformation

Marcus earned $45,000 annually and felt like he could never save. He started paying himself first—just $150 per paycheck (about 8%). Within six months, he had $1,800 saved. More importantly, he adjusted his lifestyle around the reduced income and didn’t even notice the difference. Two years later, his emergency fund stood at $7,200, and he’d started investing the excess.

The psychology behind this habit: When you pay yourself first, you force yourself to budget with what remains. It’s surprisingly easy to adapt, and this is precisely why it’s among the money habits that look boring but create financial freedom faster than any get-rich-quick scheme.

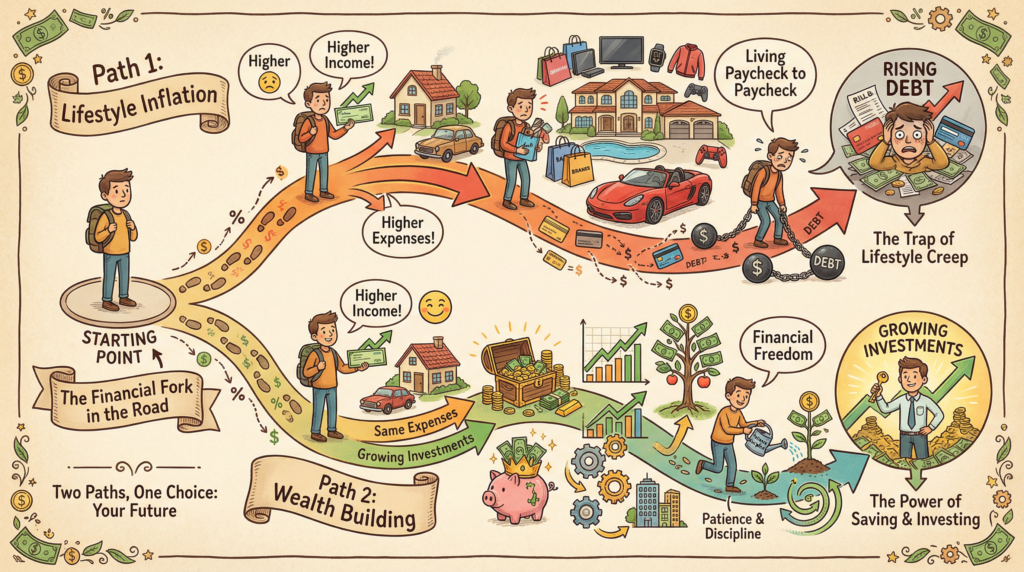

Habit 4: Avoid Lifestyle Inflation

Are boring money habits better than side hustles?

Getting a raise feels amazing—until you realize six months later that you’re not any wealthier than before. This phenomenon is called lifestyle inflation, and it’s the silent killer of wealth accumulation. As income rises, spending rises faster, preventing any real wealth growth.

The antidote is deceptively simple: keep your lifestyle constant even as your income grows, and invest the difference.

Real Numbers, Real Impact

Scenario: Someone earning $50,000 per year receives a promotion to $70,000 per year.

Option A (Lifestyle Inflation)

- Upgrade apartment: +$500/month

- New car lease: +$400/month

- More dining out and travel: +$300/month

- Total increase: $1,200/month or $14,400/year

- Result: Same financial stress, no wealth building

Option B (Avoiding Lifestyle Inflation)

- Keep the same apartment, car, and spending

- Invest the $20,000 difference annually

- Result after 10 years: Approximately $262,000 (assuming 7% average return)

This is exactly why avoiding lifestyle inflation belongs among the most powerful money habits that look boring. There’s nothing flashy about driving the same reliable car or staying in your comfortable but modest apartment. But wealth builds quietly when you resist the urge to “spend more because you earn more.”

The 50% Rule

Here’s a practical compromise: when you get a raise or bonus, save or invest at least 50% of the increase. You can enjoy some lifestyle improvement with the other 50%, but you’re still accelerating wealth building significantly.

Habit 5: Review Subscriptions and Recurring Expenses

![]()

How do boring habits protect you during financial crises?

Hidden subscriptions are financial vampires—they silently drain money from your account every month, often for services you’ve forgotten you’re even paying for. Most people are shocked when they actually audit their recurring expenses.

The Subscription Audit Process

- Pull up three months of bank and credit card statements

- Highlight every recurring charge

- Ask yourself: “Have I used this in the past month?”

- Cancel ruthlessly

Common subscription leaks

| Service Type | Average Cost | If Unused Annually |

|---|---|---|

| Streaming services | $15 each | $180 each |

| Gym membership | $40 | $480 |

| Meal kit service | $60 | $720 |

| App subscriptions | $10 each | $120 each |

| Magazine/news subscriptions | $12 each | $144 each |

Cancelling just five subscriptions at $15 each saves $900 per year. That’s $900 that can go into your emergency fund or investment account instead.

Case Study: The Williams Family

The Williams family did a subscription audit and discovered they were paying for:

- Three streaming services that they barely used

- Two gym memberships (they worked out at home now)

- A meal kit service they’d cancelled—or so they thought

- Four app subscriptions they’d forgotten about

Total monthly waste: $127 Annual savings from cancellations: $1,524

That found money went straight into their children’s college fund. This perfectly illustrates why seemingly mundane money habits that look boring—like quarterly subscription reviews—create real financial breathing room.

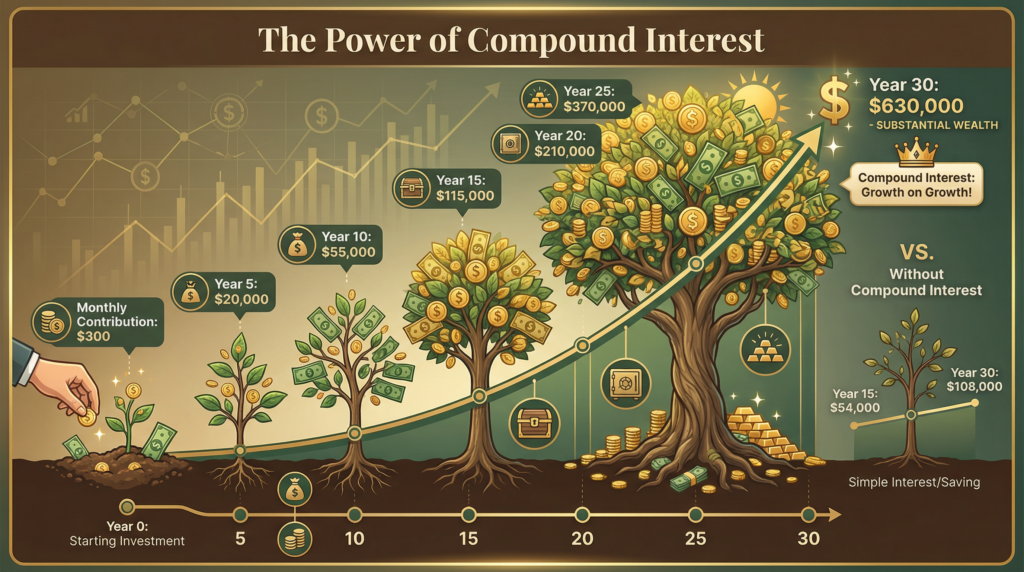

Habit 6: Invest Consistently

Can boring habits replace complex investing strategies?

People love to overcomplicate investing. They wait to “time the market,” chase hot stock tips, or research until they’re paralyzed by information overload. Meanwhile, wealth-building opportunities pass them by.

The boring truth? Regular, consistent investing in simple vehicles like index funds, ETFs, mutual funds, or retirement accounts outperforms almost every clever strategy over the long term.

The Power of Consistency

Example: $200 per month invested consistently over 20 years, assuming a conservative 7% average annual return:

- Total contributions: $48,000

- Ending balance: Approximately $104,000

- Earnings from compound growth: $56,000

Over 30 years with the same monthly investment:

- Total contributions: $72,000

- Ending balance: Approximately $244,000

- Earnings from compound growth: $172,000

Dollar-Cost Averaging in Action

By investing the same amount regularly regardless of market conditions, you automatically:

- Buy more shares when prices are low

- Buy fewer shares when prices are high

- Remove emotion from investing decisions

- Build wealth through market ups and downs

Case Study: Janet vs. Michael

Janet invested $300 monthly into an S&P 500 index fund starting at age 25, never changed her strategy, and didn’t try to time the market.

Michael waited for the “perfect time” to invest, tried to pick winning stocks, and jumped in and out of the market based on news and feelings.

After 25 years, Janet had nearly $320,000 while Michael had about $180,000, despite both having invested similar total amounts. The difference? Janet’s boring, consistent approach eliminated costly mistakes.

The habit of consistency beats intelligence in investing every single time. This is perhaps the ultimate example of money habits that look boring but deliver extraordinary results.

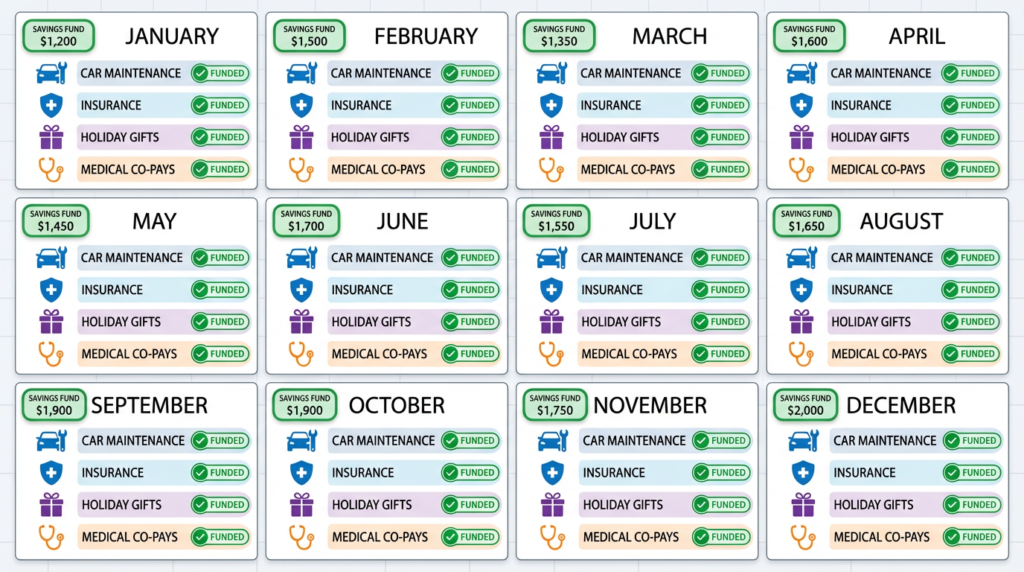

Habit 7: Plan for Irregular Expenses

How long does it take to see results from boring money habits?

Unexpected bills are the landmines of personal finance. Car repairs, medical expenses, annual insurance premiums, holiday gifts, home maintenance—these costs are actually completely predictable. They’re not “emergencies.” They’re irregular expenses that we fail to plan for.

The result? These bills wipe out months of progress, force us into debt, or drain emergency funds that should be reserved for true emergencies (job loss, major medical issues).

The Sinking Fund Solution

A sinking fund is simply money set aside specifically for irregular expenses. Here’s how to build one:

Step 1: List your irregular expenses

| Expense | Annual Cost | Monthly Savings Needed |

|---|---|---|

| Car insurance | $1,200 | $100 |

| Car maintenance/repairs | $800 | $67 |

| Medical/dental | $600 | $50 |

| Holiday gifts | $800 | $67 |

| Home/appliance repairs | $500 | $42 |

| Total | $3,900 | $326 |

Step 2: Divide by 12 and save that amount monthly

Step 3: When the expense occurs, use the fund—no stress, no debt

Real-World Example

Saving just $50 per month for irregular costs builds a $600 annual buffer. When the car needs a $400 repair, you pull from this fund rather than your emergency savings or credit card. This simple foresight prevents financial emergencies from derailing your wealth-building journey.

The compound benefit: By handling irregular expenses through planning rather than panic, you:

- Protect your emergency fund for true emergencies

- Avoid high-interest debt

- Reduce financial stress dramatically

- Maintain momentum on your other financial goals

This is exactly the kind of unglamorous planning that separates people who build wealth from people who perpetually struggle—a perfect example of money habits that look boring but provide invaluable financial stability.

The Boring Path to Financial Freedom

These seven habits won’t make you rich overnight. They won’t give you exciting stories to share on social media. They’re not innovative, cutting-edge, or trendy. They’re boring.

And that’s exactly why they work.

Your Quick Recap:

- Automate your savings – Let technology build your wealth on autopilot

- Track every expense – Awareness creates control and reveals hidden leaks

- Pay yourself first – Prioritize savings before spending

- Avoid lifestyle inflation – Keep expenses stable as income rises

- Review subscriptions regularly – Eliminate silent money drains

- Invest consistently – Time in the market beats timing the market

- Plan for irregular expenses – Prevent “surprises” from derailing progress

Boring may seem slow, but these money habits that look boring quietly grow your wealth faster than flashy hacks ever will. The compound effect of doing simple things consistently over time is the closest thing to magic in personal finance.

Your Challenge

Don’t try to implement all seven habits at once—that’s a recipe for overwhelm and failure. Instead, pick just one or two habits to start this month. Maybe it’s automating $100 to savings or doing a subscription audit this weekend.

Start boring. Start simple. Start today.

The wealthy people you admire didn’t get there through exciting financial acrobatics. They got there by mastering these unsexy fundamentals and sticking with them long enough to let compound growth work its magic.

What’s your first “boring money win” going to be? The best time to start was yesterday. The second-best time is right now.

FAQs

Q: Why do boring money habits outperform flashy financial tips?

- Because consistency and simplicity compound over time, creating long-term financial stability without relying on risky trends.

Q: How long does it take to see results from these money habits?

- Many habits, like automating savings and tracking expenses, show noticeable results within months, while long-term wealth grows steadily over the years.

Q: Can low-income earners benefit from these habits?

- Absolutely. Small, consistent habits like paying yourself first or tracking expenses compound over time, regardless of income level.

Q: Are boring money habits better than side hustles?

- Yes. While side hustles can add income, simple habits like avoiding lifestyle inflation and investing consistently create sustainable wealth without extra stress.

Q: What’s the most important boring money habit to start with?

- Automating savings and paying yourself first are often the easiest and most effective habits to kickstart your financial growth.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.