This Viral Money Challenge Is Helping People Save Thousands — Here’s How It Works

Why So Many People Can’t Save Money Right Now

“I make money, but I never have money.”

If that thought has crossed your mind, you’re not alone. Thousands of Americans are sharing the same frustration across social media platforms, and it’s sparking a wave of desperation for solutions that actually work.

The problem isn’t just about not earning enough. Rent keeps climbing across major cities from New York to Los Angeles. Groceries that used to cost $150 now hit $250. Subscription services pile up. And somehow, even when you’re careful, the money just… disappears.

Traditional budgeting advice doesn’t help much either. Tracking every single expense in a spreadsheet? Exhausting. The 50/30/20 rule? Confusing when your income varies. “Just spend less”? Thanks for nothing.

People who struggled to save for years are suddenly putting away thousands. They’re not using complicated financial strategies or cutting out every small pleasure. They’re following something simpler: a savings challenge that’s spreading like wildfire because it actually feels doable.

The appeal is obvious. It’s gamified, social, and doesn’t require you to become a finance expert overnight. You just start, follow simple rules, and watch the numbers grow.

What Exactly Is This Viral Money Challenge?

This trending savings method is a behavior-based approach where you commit to setting aside money using an incremental system over a fixed period—typically 30, 90, or 365 days.

Unlike traditional budgeting that asks you to track categories and percentages, this approach focuses on one thing: the habit of saving consistently.

Here’s why it’s exploding right now: Americans don’t want another boring budget. They want something that feels like progress, something they can share on TikTok or Instagram, something that gives them quick wins.

The word “challenge” matters more than you’d think. Challenges have a start and end date. They feel temporary and manageable. A budget feels permanent and restrictive. That psychological difference is huge.

Most variations follow the same core principle: you save a small amount that increases gradually, or you save the same amount daily without fail. The money adds up faster than people expect, which creates momentum.

No complicated apps required. No shame if you’re starting from zero. No judgment about your income level.

It works because it removes the biggest barrier to saving: the overwhelming feeling that you need to overhaul your entire financial life before you can start.

How the Money Saving Challenge Works Step by Step

The beauty of this system is its simplicity. Here’s exactly how people are doing it:

Step 1: Choose Your Time Frame

Most people start with either a 30-day challenge or a full 365-day version. The 30-day option is perfect for testing whether you can stick with it. The year-long version maximizes your savings potential.

Pick based on your current situation, not what sounds most impressive. You can always repeat it.

Step 2: Select Your Savings Pattern

There are two popular approaches:

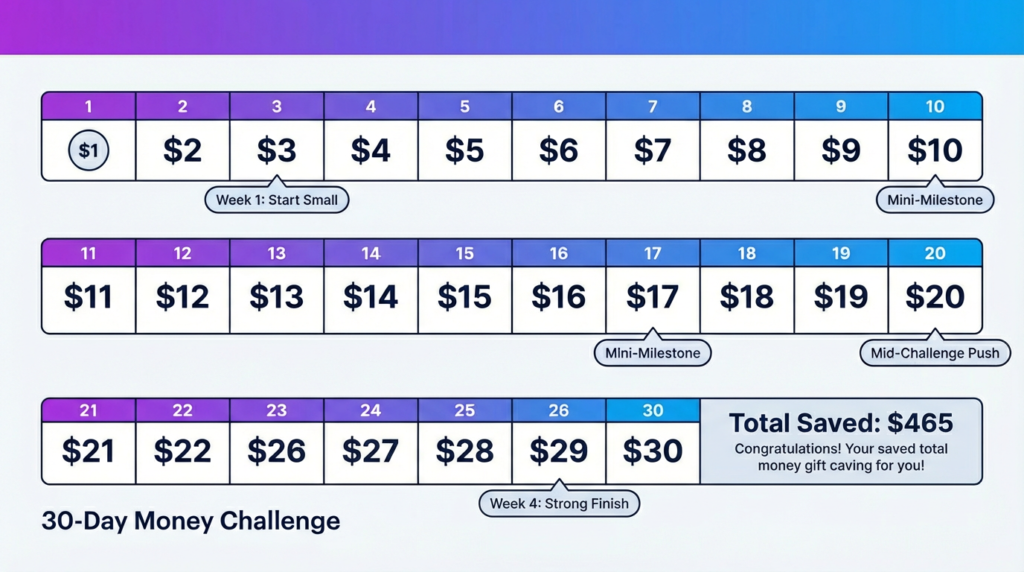

The incremental method means you save $1 on day one, $2 on day two, $3 on day three, and so on. By day 30, you’re saving $30 in a single day.

The fixed method means you save the same amount every single day without fail—$5, $10, or $20, depending on what you can manage.

Step 3: Automate When Possible

Set up automatic transfers if your bank allows it. Many American banks, like Chase, Bank of America, or Ally, offer scheduled transfers. If not, create a physical jar or use a separate savings account. The key is making the money difficult to access casually.

Step 4: Track Progress Visually

Use a simple chart, a notes app, or even a printed calendar where you check off each day. Apps like Mint or YNAB can help, but even a basic spreadsheet works. The visual progress is surprisingly motivating.

Step 5: Don’t Break the Chain

Miss a day? Don’t quit. Just pick up where you left off. The goal is building the habit, not achieving perfection.

The process ends when your time frame is complete, but many people immediately start again because they’ve experienced what consistent saving feels like.

How Much Money Can You Realistically Save?

The numbers depend entirely on which variation you choose and how long you stick with it.

| Challenge Type | Duration | Potential Savings |

|---|---|---|

| $1 daily (fixed) | 30 days | $30 |

| $10 daily (fixed) | 30 days | $300 |

| $1 incremental | 30 days | $465 |

| $5 incremental | 30 days | $2,325 |

| $10 daily (fixed) | 365 days | $3,650 |

| $1 incremental | 365 days | $66,795 |

Let’s be realistic: most beginners won’t jump straight into the year-long incremental version that ends with you saving hundreds per day. That’s not sustainable for average American earners.

But even saving $10 per day adds up faster than most people expect. In three months, that’s $900—enough for an emergency fund, covering car insurance, or breathing room during a tough month.

The magic happens around week two. That’s when you start checking your savings total and realize it’s actually working. The momentum builds from there.

People typically see noticeable results within the first 15 to 20 days. Not life-changing amounts, but enough to prove the system works and motivate them to continue.

According to a 2023 Bankrate survey, 56% of Americans couldn’t cover a $1,000 emergency expense from savings. This method directly addresses that gap.

Can You Do This Challenge on a Low Income?

Absolutely. In fact, this approach might work better for people on tight budgets than traditional saving advice ever did.

Here’s why: you control the starting amount completely. If $10 per day feels impossible, start with $5. If $5 is too much, start with $1.

The income level doesn’t matter. The habit does.

Most people quit saving because they start too big. They read articles saying “save 20% of your income” and feel defeated before they begin. This flips that script.

Beginners with no savings habits can absolutely follow this. There’s no prerequisite knowledge needed. You don’t need to understand compound interest or investment portfolios. You just need to put money aside and leave it there.

One crucial point: if you’re struggling to afford basic necessities like rent, food, or utilities, forcing yourself into a savings program might add stress rather than relief. The method works best when you have at least a small margin in your budget, even if it’s tiny.

For low-income participants, the fixed daily method usually works better than incremental because you’re not pressured to save increasingly larger amounts as days progress.

With the federal minimum wage at $7.25 per hour (and many states have higher wages), even saving $2-3 daily is achievable for many workers and creates meaningful results over time.

Real-Life Examples: How People Are Using This Challenge

The most compelling part of this trending method is hearing from regular Americans who made it work.

The College Student in Texas

A 22-year-old student at UT Austin started with $2 daily while living on a tight budget. After 30 days, she had $60 saved—the first time she’d ever had money she didn’t immediately spend. She described it as “proof I’m not terrible with money, I just needed a system.”

The Freelance Designer in Portland

A freelancer with inconsistent income used the savings method during good months to build a buffer. On days when client payments came in, he’d save $20. On slow days, he’d skip or save $5. After 90 days, he had $1,200 set aside—enough to cover rent during a lean month in Oregon’s expensive housing market.

The Salaried Employee in Chicago

A 29-year-old working in tech committed to $10 daily for a full year. She automated the transfer right after payday using her Chase account. By month eight, she had over $2,400 saved and felt a level of financial control she’d never experienced before.

What matters most isn’t the money itself at first. It’s the confidence. The sense of “I can actually do this.” The proof that small actions compound into real results.

The biggest benefit people report is consistency. Not perfection, not massive amounts, just the simple fact that they showed up for themselves every single day.

Why This Works Better Than Traditional Budgeting

Traditional budgeting asks you to divide your income into categories, track every expense, and analyze where your money went at month’s end. For some people, this works great. For most, it’s exhausting.

This trending savings approach takes a completely different angle: habit-based saving.

Instead of tracking, you’re acting. Instead of analyzing, you’re building consistency. Instead of feeling restricted, you’re gamifying the process.

| Traditional Budgeting | Daily Savings Challenge |

|---|---|

| Requires detailed tracking | Requires only one daily action |

| Focuses on restricting spending | Focuses on building a savings habit |

| Can feel overwhelming | Feels manageable and clear |

| Progress is abstract | Progress is immediately visible |

| Easy to abandon after mistakes | Easier to resume after slip-ups |

The 50/30/20 rule (50% needs, 30% wants, 20% savings) sounds logical but requires you to calculate percentages, categorize expenses, and make constant judgment calls about what counts as a “need” vs. a “want.”

This method just says: save this amount today. Done.

People stick with these challenges longer because there’s a finish line. When you know it’s 30 days or 90 days, you can push through difficult moments. A budget feels endless.

The social element helps too. When something trends on platforms like TikTok and Instagram, people share their progress, which creates accountability and motivation that budgets rarely inspire.

Common Mistakes That Make People Fail the Challenge

Even simple systems have failure points. Here’s what causes Americans to quit:

Starting Too Aggressively

Jumping into a $50 daily commitment when you’ve never saved consistently is like trying to run a marathon without training. Start smaller than you think you need to. Build up gradually.

Skipping Days and Quitting

You miss day five. Then you think, “Well, I already failed, so why bother?” This all-or-nothing thinking kills more saving attempts than actual inability to save. Missing one day doesn’t erase four successful days. Just continue.

Treating It as Short-Term Only

Some people view this as a one-time thing to save for a specific purchase—maybe a new iPhone or holiday gifts. That’s fine, but the real value comes from turning it into a permanent habit. Think of it as training wheels for lifelong saving.

Not Separating the Money

Keeping your savings in your regular checking account is like keeping cookies in your hand while trying to diet. Move the money to a separate savings account, ideally at a different bank or a high-yield savings account like those offered by Ally, Marcus, or Capital One 360.

Comparing Yourself to Others

Someone on Instagram saved $5,000 in three months. You saved $200. Whose effort is more valuable? Yours, because you showed up for yourself with what you actually had. Comparison destroys motivation.

The key is adjusting when you struggle, not abandoning the entire effort.

Is There Any Downside to This Viral Money Challenge?

No system is perfect for everyone. Here are the honest limitations:

If you’re carrying high-interest debt—like credit card balances at 18% to 29% APR—putting money into a zero-interest savings account while paying those rates might not be your best move financially. Tackling the debt first could save you more money.

The method requires consistency. If your income is extremely irregular or you’re facing a genuine financial crisis, forcing yourself to save daily might create more stress than benefit.

Who should think twice

- People with urgent high-interest debt

- Those without a stable income or housing

- Anyone experiencing a genuine financial emergency

- Someone is already behind on essential bills

Who should definitely try

- People who’ve never built a savings habit

- Those living paycheck to paycheck with a small margin

- Anyone frustrated by traditional budgeting

- Workers with steady income who just can’t seem to save

This isn’t a complete financial strategy. It won’t teach you about investing, retirement planning, or tax optimization. It does one thing: builds the muscle of consistent saving.

For most Americans, that one thing is exactly what they need before anything else matters.

What Should You Do With the Money You Save?

You’ve completed your 30 or 90 days. You have hundreds or thousands saved. Now what?

- Emergency Fund: The most practical first step is building a buffer for unexpected expenses. Car repairs, medical co-pays, sudden job loss—having $1,500 to $3,000 set aside transforms these from catastrophes into inconveniences. The Federal Reserve reports that 37% of Americans would struggle to cover a $400 emergency, making this buffer critical.

- Short-Term Goals: Maybe you’ve been wanting to take a certification course, visit family across the country, or replace your failing laptop. The savings can fund these goals without credit card debt or stress.

- High-Yield Savings Account: Transfer your accumulated savings to an account earning 4-5% APY (rates as of 2024-2025). Banks like Ally, Marcus by Goldman Sachs, and American Express offer competitive rates. Your money keeps growing even when you’re not actively adding to it.

- Stress-Free Buffer: Some people just keep the money as breathing room. Knowing it’s there reduces anxiety around every financial decision. That psychological benefit is worth more than any interest rate.

- Repeat the Process: Many participants immediately start another round, this time with the goal of reaching a higher total or saving for a specific purpose like a vacation or down payment.

The beauty is having options. When you’ve never had savings before, suddenly having choices feels like financial freedom.

Final Takeaway: Is This Savings Method Worth Trying?

Remember that opening frustration—making money but never having money? This approach addresses exactly that feeling.

It won’t solve every financial problem. It won’t make you wealthy overnight. It won’t replace comprehensive financial planning or advice from a certified financial planner.

But it will prove something crucial: you’re capable of saving. You can build consistency. Small actions really do compound into meaningful results.

The method works because it removes the barriers that make traditional saving feel impossible. No complicated tracking. No guilt about your income level. No requirement to become a finance expert.

Just one simple action, repeated daily, until it becomes automatic.

Is it worth trying? The only real risk is proving to yourself that you can actually do it. And if thirty days from now you have more money saved than you did last month, even if it’s just $50, that’s thirty days of proof that change is possible.

Try it for seven days. Just seven. Set aside whatever amount feels manageable—$1, $5, $10—and see how it feels to choose yourself consistently for one week.

The thousands of others’ savings started exactly the same way: with day one.

FAQs

Q. What is the viral money challenge?

- The viral money challenge is a simple savings method that encourages small, consistent actions instead of strict budgeting, making saving money easier to stick with.

Q. How does the viral money challenge work?

- It works by saving small amounts regularly over a set period, gradually building momentum and making saving feel manageable rather than restrictive.

Q. Can you really save thousands with this challenge?

- Many participants report saving significant amounts over time, especially when they remain consistent and avoid common mistakes like starting too aggressively.

Q. Is the viral money challenge good for low-income earners?

- Yes. The challenge is flexible and can be adjusted to any income level, making it accessible even for beginners or people living paycheck to paycheck.

Q. How long should you try the money challenge?

- Most people start with 30 days, but longer periods like 90 days or one year tend to deliver the biggest results.

Q. Is this better than traditional budgeting?

- For many people, yes. It focuses on habits and behavior rather than tracking every expense, which helps improve long-term consistency.

Q. Are there any risks with this savings challenge?

- The main risk is inconsistency. It may also not be ideal for people dealing with high-interest debt that requires immediate attention.

Q. What should you do with the money saved?

- Common uses include building an emergency fund, covering unexpected expenses, or creating a stress-free financial buffer.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.