If Superheroes Had Budgets: Analyzing the Spending Habits of Fictional Characters

What if superheroes had budgets? The question sounds absurd at first—these are characters who regularly save the world, after all. But examining the financial lives of our favorite heroes offers a surprisingly effective lens for understanding real-world money management. When we strip away the capes and superpowers, we’re left with individuals making daily financial decisions that range from brilliantly strategic to catastrophically reckless.

Analyzing fictional spending habits transforms dry financial concepts into entertaining thought experiments. Instead of generic advice about emergency funds, we can ask whether Spider-Man could afford his rent while web-slinging through New York. Rather than abstract discussions about wealth sustainability, we can debate whether Batman’s vigilante operation represents sound financial planning or generational wealth squandering.

This exploration sits somewhere between satire and practical economics. While these characters exist in worlds with alien invasions and magic hammers, their financial choices often mirror real human behaviors—the overspending, the lack of planning, the tension between values and bank accounts. By holding up this fictional mirror, personal finance becomes more relatable, more memorable, and significantly more fun.

Where Does the Money Come From? Income Sources of Superheroes

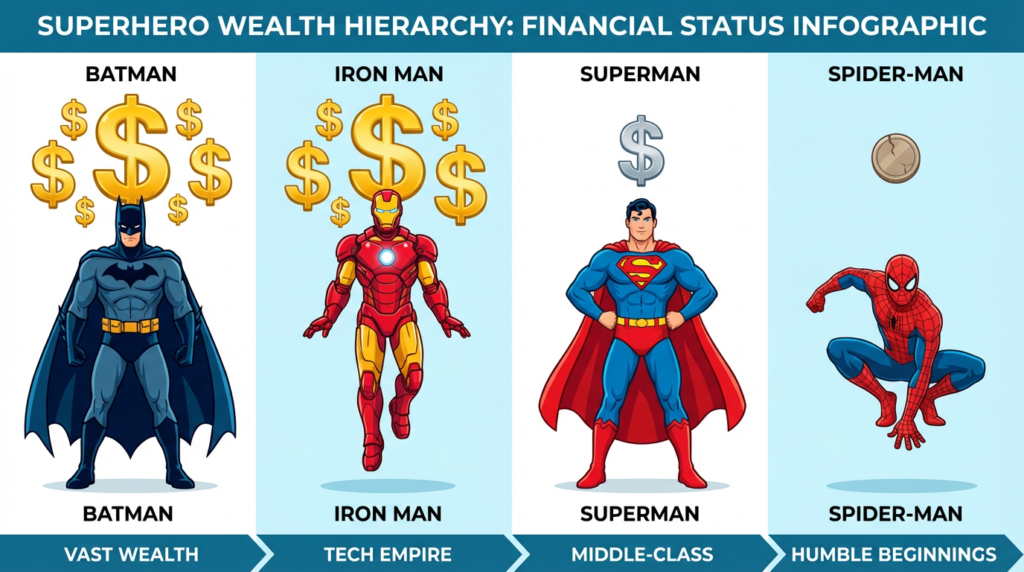

Before analyzing spending, we must understand earnings. Our heroes represent vastly different economic realities, and their income sources reveal much about their financial vulnerability.

Bruce Wayne (Batman) enjoys the ultimate financial cushion: generational wealth. Wayne Enterprises provides both substantial dividend income and a corporate apparatus that can absorb his vigilante expenses as “R&D costs.” His income diversification is exceptional—real estate holdings, technology patents, defense contracts, and investment portfolios spread across global markets. Even if one sector collapsed, Batman would remain financially secure.

Tony Stark (Iron Man) similarly benefits from inherited wealth, but with a crucial difference: he’s actively involved in running Stark Industries. His income depends partly on his continued innovation and business leadership. While his wealth seems limitless, it’s more tied to company performance than Bruce Wayne’s more passive income streams.

Clark Kent (Superman) represents the middle-class worker, earning a journalist’s salary from the Daily Planet. His income is entirely employment-based, making him vulnerable to layoffs, industry disruption, or workplace injuries. Unlike his billionaire counterparts, Superman has no financial safety net beyond his paycheck—unless you count his ability to literally mine diamonds from coal through compression.

Peter Parker (Spider-Man) operates at the economic margins, juggling freelance photography gigs, part-time work, and occasional scientific consulting. His income is irregular, unpredictable, and frequently interrupted by hero duties. Of all our subjects, Spider-Man faces the greatest income volatility and would struggle most during economic downturns.

| Character | Primary Income Source | Secondary Income | Diversification Level | Income Vulnerability |

|---|---|---|---|---|

| Batman | Investment returns, dividends | Wayne Enterprises profits | Very High | Very Low |

| Iron Man | Stark Industries CEO salary/equity | Patents, licensing | High | Low |

| Superman | Daily Planet salary | None | Very Low | High |

| Spider-Man | Freelance photography | Part-time jobs | Low | Very High |

The True Cost of Being a Hero: Major Spending Categories

If superheroes had budgets, the “cost of heroism” line item would dominate their spreadsheets. Each character faces unique expense profiles based on their powers and methods.

Housing costs vary dramatically. Bruce Wayne maintains Wayne Manor, a sprawling estate requiring staff, security, utilities, and maintenance—easily costing millions annually. The Batcave adds specialized climate control, supercomputer infrastructure, and reinforced construction. Tony Stark’s Malibu mansion (and its replacements after various attacks) carries similar costs, plus the arc reactor power system and workshop facilities. Clark Kent rents a modest Metropolis apartment, probably spending 30-40% of his journalist salary on housing—financially stressful but manageable. Peter Parker represents the true housing crisis: a Queens apartment that consumes most of his irregular income, with frequent late rent payments.

Transportation expenses follow similar patterns. Batman’s vehicle fleet—Batmobile, Batwing, Batcycle, and various specialized craft—requires not just purchase costs but ongoing maintenance, fuel (or power), insurance (if even available), and regular replacement due to combat damage. Conservative estimates put annual transportation costs in the tens of millions. Iron Man’s suits represent both transportation and equipment, with each iteration costing what a military jet fighter might—$100 million or more in materials, manufacturing, and testing. Superman’s transportation costs are literally zero. Spider-Man swings free, though web fluid materials and his homemade web-shooters require modest ongoing expenses.

Equipment and costume maintenance create the widest variance. Batman’s utility belt alone probably costs more than most people’s annual salary, and he goes through multiple Batsuits per year. Iron Man’s armor represents cutting-edge nanotechnology with astronomical R&D costs. Superman needs only durable fabric (Kryptonian or otherwise), and Spider-Man sews his own suits, spending perhaps a few hundred dollars annually on materials.

The highest “cost of being a hero” clearly belongs to Batman, followed by Iron Man. Both spend what small nations allocate to defense. Superman’s hero costs are negligible. Spider-Man’s costs are low in absolute terms but devastating relative to his income—a financial death by a thousand web-cartridge purchases.

Character-by-Character Spending Analysis

Superman: The Low-Expense Powerhouse

Clark Kent represents a financial paradox: unlimited physical power combined with modest economic means. His near-zero “super” expenses create an unusual advantage. While Batman and Iron Man hemorrhage money on equipment, Superman’s powers are biological—they require no maintenance costs, no fuel, no upgrades. His Kryptonian physiology is the ultimate frugal asset.

This low-expense reality should theoretically enable substantial wealth accumulation. A journalist earning $50,000-$70,000 annually with virtually no hero-related expenses could build impressive savings through consistent investing. Over a 20-year career, assuming modest 7% returns and 20% savings rate, Clark could accumulate $300,000-$400,000. Not billionaire wealth, but solid financial security.

Yet Superman demonstrates a curious lack of wealth accumulation in most storylines. This raises an interesting question: Does having unlimited power reduce financial discipline? When you can survive anything, when no disaster can harm you personally, does the motivation to build emergency funds diminish? Clark could work more lucrative jobs—corporate communications, scientific consulting, even subtle use of his powers for legitimate commercial purposes—but chooses journalism for idealistic reasons.

This actually reinforces positive financial values. Superman lives within his means, doesn’t overspend on status symbols, and chooses purpose over profit maximization. If superheroes had budgets, Superman’s would be the most balanced and sustainable. His financial life models contentment over consumption—a lesson many real people struggle to learn. The invulnerable alien somehow demonstrates the most human approach to money: earn honestly, spend modestly, save consistently.

Batman: Can Billionaire Vigilantism Last Forever?

Bruce Wayne’s financial sustainability question isn’t “Can he afford this?” but rather “How long can even a fortune this large sustain this burn rate?” Wayne inherited billions, yes, but his vigilante operation has annual costs that would make defense contractors blush.

Consider the expenses: prototype vehicles destroyed monthly, cutting-edge technology requiring constant R&D investment, property damage from Batcave expansions and repairs, ongoing costs for maintaining surveillance networks across Gotham, and the inevitable lawsuits from collateral damage. Conservative estimates suggest Batman’s operation costs $200-300 million annually. Even with a $10 billion fortune and assuming 7% annual investment returns, he’s facing potential wealth depletion within decades if Wayne Enterprises doesn’t perform exceptionally.

Is Bruce Wayne a smart investor or just an elite spender with good PR? The evidence suggests both. His continued wealth indicates Wayne Enterprises generates strong returns—probably through defense contracts, technology commercialization, and strategic investments. He’s diversified across sectors and geographies. This is sophisticated wealth management.

However, his personal spending suggests someone insulated from normal financial consequences. Batman doesn’t comparison shop for grappling hooks or negotiate bulk discounts on body armor. He builds custom solutions regardless of cost. This works only because his income sources are so robust that they can absorb unlimited spending.

Without generational wealth, Batman’s approach would be catastrophic. His financial strategy isn’t replicable—it’s the equivalent of “step one: inherit billions, step two: spend freely, step three: hope your investments outpace expenditures.” For most people, this is a recipe for bankruptcy. Batman survives financially not through brilliance but through having started with more money than he could possibly spend.

Iron Man: Genius Innovation or Excessive Burn Rate?

Tony Stark presents a different billionaire case study. Unlike Batman’s inherited passive wealth, Stark actively runs a technology company while using company resources for his superhero activities. This creates fascinating questions about corporate governance and personal spending.

Each Iron Man suit reportedly costs $100-200 million in materials and development. Stark destroys or abandons suits regularly—in caves, in oceans, in space. If these were personal expenses, even his multi-billion-dollar fortune would evaporate quickly. But Stark cleverly classifies Iron Man technology as Stark Industries R&D, effectively making shareholders subsidize his heroism. The suits then get commercialized into defense products, theoretically justifying the expense.

How realistic is this compared to modern tech billionaires? Consider that Jeff Bezos spends over $1 billion annually on Blue Origin, and Elon Musk similarly on SpaceX development. These entrepreneurs justify enormous R&D spending through long-term vision and eventual commercialization. Stark’s approach mirrors this: bleed money short-term on moonshot technology, commercialize it later for massive returns.

The question becomes whether innovation justifies unlimited spending. Stark’s defenders would note that his technology has saved the world multiple times—surely that justifies any cost. His critics might observe that excessive spending, even on noble goals, can destroy shareholder value and eventually undermine the very resources needed to continue the mission.

Stark’s real financial risk isn’t bankruptcy—it’s losing control of his company. If Stark Industries’ board decided his spending was irresponsible, they could remove him as CEO. His wealth would survive, but his ability to fund Iron Man operations would be severely limited. This makes Stark more financially vulnerable than Batman despite similar wealth levels, because his hero funding depends on maintaining corporate control.

If superheroes had budgets, Tony Stark’s would be marked “under audit.” His genius generates both enormous costs and enormous returns, creating a high-risk, high-reward financial profile that works brilliantly until it doesn’t.

D. Spider-Man: Living Paycheck to Paycheck as a Hero

Peter Parker represents the financial reality most Americans actually face: insufficient income to cover expenses, no safety net, and additional responsibilities that make improving the situation nearly impossible. Spider-Man’s finances are a case study in what happens when responsibility outweighs earning power.

Could Spider-Man realistically balance rent, education, and hero duties on a limited income? The math is brutal. Queens rent for a modest apartment runs $1,500-$2,500 monthly. Community college or university costs thousands per semester. Food, transportation, web materials, and basic living expenses add hundreds monthly. This requires roughly $30,000-$40,000 annual net income minimum.

Peter’s freelance photography might generate $1,000-$2,000 monthly when work is available—perhaps $15,000-$25,000 annually. Part-time work adds maybe $10,000-$15,000. On paper, he’s earning just barely enough. In reality, hero duties constantly interrupt work, causing missed shifts, blown deadlines, and lost income opportunities. His actual earning capacity is probably $20,000-$25,000 annually, well below the survival threshold for New York.

This creates a vicious cycle. Peter can’t work more hours because of Spider-Man responsibilities. He can’t quit being Spider-Man because of moral obligation. He can’t afford education to get better jobs without working more hours. He’s trapped in poverty by his own heroism.

What happens when responsibility outweighs earning power? Exactly what we see with Spider-Man: chronic stress, delayed life milestones, damaged relationships, and constant financial crisis. He represents millions of real people who do the right thing at personal cost—caring for elderly parents while working, taking lower-paying nonprofit jobs, sacrificing career advancement for family responsibilities.

If superheroes had budgets, Spider-Man’s would be printed in red ink with “OVERDRAWN” stamped across it. His financial situation isn’t a character flaw—it’s a structural impossibility. He demonstrates that moral courage without economic resources creates suffering, not sustainability.

Risk, Insurance, and Financial Blind Spots

The insurance question for superheroes reveals massive financial blind spots. Traditional insurance assumes relatively predictable risk profiles. Superheroes break every actuarial model.

What would their premiums look like? For Batman, assuming an insurer would even accept him, comprehensive coverage might cost $50-100 million annually. His risk profile includes: guaranteed property destruction, high probability of serious injury despite armor, liability for collateral damage to Gotham property, and potential wrongful death claims from criminals or bystanders. No standard insurer would touch this. Batman likely self-insures, setting aside reserves to cover claims—adding millions more to annual costs.

Iron Man faces similar challenges, with the added complication that his suits are mobile destruction zones. His liability insurance for the New York battle alone would be impossible to calculate. Stark probably has Stark Industries absorb these risks through corporate structures designed to limit personal liability, but lawsuits could still pierce the corporate veil, given his direct involvement.

Superman theoretically has lower insurance needs—he’s nearly indestructible personally—but property damage follows him everywhere. His battles level buildings regularly. If he purchased liability coverage, premiums would be astronomical based on historical claim frequency. Superman likely carries no insurance at all, relying on his heroism’s goodwill to avoid lawsuits. This is legally and financially reckless.

Spider-Man couldn’t afford insurance even if available. His finances don’t allow for $500 monthly health insurance premiums, let alone hero-related liability coverage. He operates completely exposed to legal and financial consequences. A single lawsuit for property damage during a battle would bankrupt him permanently.

Which character takes the most financial risk without adequate safeguards? Spider-Man, unquestionably. The billionaires can absorb lawsuits and claims, even if expensive. Superman’s alien status might provide some legal protections. But Spider-Man is a regular citizen with no resources and no protection, engaging in activities guaranteed to generate liability. One determined lawyer could destroy his life financially.

| Character | Estimated Annual Premium (if insurable) | Self-Insurance Capacity | Legal Vulnerability | Financial Risk Rating |

|---|---|---|---|---|

| Batman | $50-100M | High | Medium | Medium |

| Iron Man | $75-150M | High | Medium-High | Medium |

| Superman | $30-75M | Low | Low-Medium | Medium-High |

| Spider-Man | $10-25M | None | Very High | Extreme |

Retirement, Emergency Funds, and Long-Term Planning

Financial advisors recommend 3-6 months of expenses in emergency funds and consistent retirement savings starting in your 20s. How do our heroes measure up?

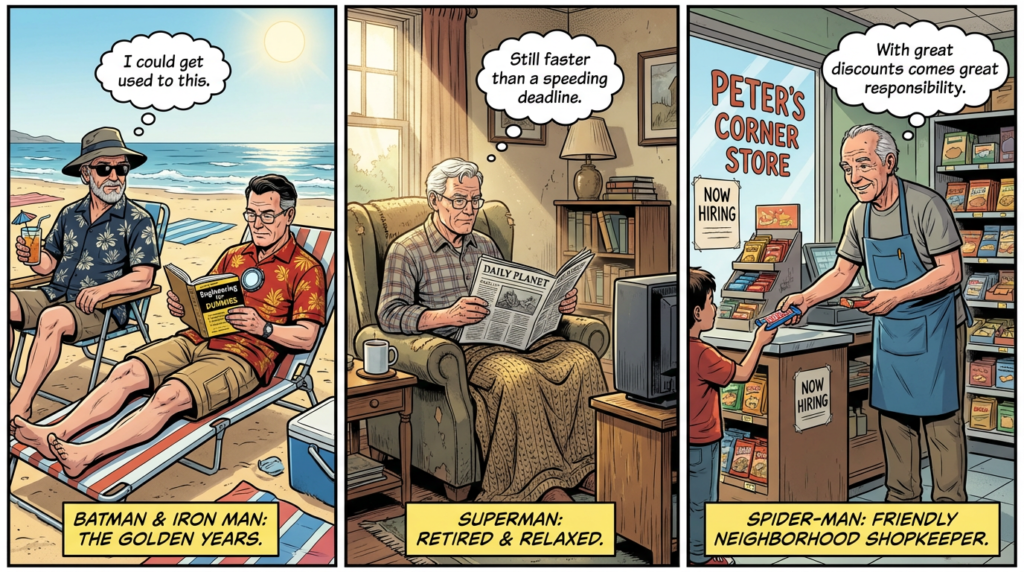

Batman and Iron Man undoubtedly have emergency funds, though not in the traditional sense. Their liquid assets probably exceed most people’s lifetime earnings. Their retirement planning is handled through trust funds, investment portfolios, and dynasty trusts designed to preserve wealth across generations. They could retire tomorrow and maintain their lifestyles indefinitely. Their financial planning is sophisticated and comprehensive.

Superman probably has minimal emergency savings despite stable employment. His expenses are low, which helps, but we see little evidence of disciplined wealth accumulation. He likely has a 401(k) through the Daily Planet with modest contributions—maybe $50,000-$100,000 accumulated by his 30s. This isn’t bad for a middle-class worker, but it’s not impressive either. If Clark stopped working, his savings would deplete within a few years. His retirement planning appears adequate but not exceptional.

Spider-Man has no emergency fund. His financial situation is too tight for savings. Any unexpected expense—medical emergency, equipment failure, legal trouble—would be catastrophic. He has no retirement savings whatsoever. If Peter Parker is still Spider-Man in his 60s, he’ll be a 60-year-old with no nest egg, no home equity, no retirement income. He’s headed for elderly poverty unless something dramatically changes.

Who is best prepared for retirement? Batman and Iron Man are both set for multiple lifetimes. Who is clearly not? Spider-Man is facing financial disaster in old age. Superman sits between them—probably fine if nothing goes wrong, but vulnerable to disruption.

What happens to heroes when the fighting stops? For the wealthy, nothing changes financially. For Superman, normal retirement. For Spider-Man, potential destitution. The financial consequences of heroism become most apparent at the end, when physical abilities fade, but bills don’t.

This reveals a cruel truth: superheroism, like many forms of service work, doesn’t pay. Teachers, social workers, nonprofit employees, and yes, friendly neighborhood Spider-Men sacrifice earning power for purpose. Without deliberate planning and external support, this sacrifice leads to financial hardship in later life.

Money Lessons Readers Can Learn from Fictional Heroes

If superheroes had budgets, which would teach us the best financial habits? Surprisingly, Superman—not the billionaires—demonstrates the soundest personal finance principles. He lives within his means, doesn’t succumb to lifestyle inflation despite having the power to acquire anything, maintains steady employment, and prioritizes purpose over profit. These are textbook financial wellness behaviors.

The lesson: frugality and contentment beat high income with high spending. Superman earns modest money but wants little. Batman earns enormous money but spends it freely. In terms of financial stress and sustainability, Superman’s approach is healthier. Readers should internalize that financial security comes from the gap between earning and spending, not from absolute income levels.

Batman and Iron Man unknowingly model one good principle: income diversification. Batman’s multiple revenue streams—investments, dividends, business profits—protect against any single income source failing. This is wise. However, their terrible lesson is that spending doesn’t matter if you’re rich enough. For 99.9% of people, spending absolutely matters. Don’t model Batman’s “buy whatever solves the problem” approach unless you have billions in the bank.

Spider-Man teaches through negative example. His bad money habit—prioritizing short-term obligations over long-term financial health—is incredibly common and incredibly destructive. Many people work themselves to exhaustion on immediate necessities while never building savings or investing in skills that could increase future income. Spider-Man shows where this leads: chronic crisis and no escape route.

The meta-lesson is that superpowers don’t exempt you from financial laws. Even Superman needs to pay rent. Even billionaires can theoretically deplete their fortunes through excessive spending. Financial principles—spend less than you earn, diversify income, build emergency reserves, invest for the future—apply universally.

How can fictional examples simplify real-world financial decisions? They remove the complexity and shame. Instead of “Why haven’t I saved for retirement?” becoming a personal failing, we can ask “What would Spider-Man do wrong, and how can I do better?” Fiction creates distance that allows honest self-examination. We can critique Batman’s spending more easily than our own, but the lessons transfer.

Key Takeaways from Superhero Finances

| Lesson | Positive Example | Negative Example | Application |

|---|---|---|---|

| Live within your means | Superman’s modest lifestyle | Batman’s unlimited spending | Track expenses, avoid lifestyle inflation |

| Diversify income sources | Batman’s multiple revenue streams | Spider-Man’s single freelance income | Develop side income, invest in multiple assets |

| Build emergency reserves | Iron Man’s resource depth | Spider-Man’s zero savings | Automate savings, target 6 months’ expenses |

| Align spending with values | Superman’s purpose-driven choices | Iron Man’s ego-driven suits | Distinguish wants from needs before buying |

| Plan for the long term | Batman’s dynasty trusts | Spider-Man’s lack of retirement planning | Start retirement savings early, compound interest matters |

The beauty of analyzing superhero finances is that it makes these dry principles memorable. You’ll remember “don’t pull a Spider-Man” faster than you’ll remember “maintain adequate liquidity reserves.” Both mean the same thing, but one sticks in your mind.

Conclusion: What Superheroes Teach Us About Money (Without Realizing It)

Why do fictional finances resonate more than traditional money advice? Because stories stick where statistics don’t. Financial educators have known for decades that people make emotional, not rational, decisions about money. Traditional advice—save 15% for retirement, maintain a 50/30/20 budget, diversify your portfolio—is logically sound but emotionally inert. It doesn’t create behavior change because it doesn’t engage our narrative-driven brains.

When we examine whether superheroes had budgets, we’re not just having fun—we’re encoding financial principles in story form. You might forget the recommended emergency fund size, but you’ll remember Spider-Man’s constant financial panic and think “I don’t want to be Spider-Man” next time you’re tempted to skip savings. You might not internalize abstract warnings about unsustainable spending, but you’ll remember Batman’s hundreds of millions in annual burn rate and think twice before that impulse purchase.

Humor improves financial awareness and engagement by removing the fear and shame that typically surround money discussions. Admitting you’re bad with money feels embarrassing. Joking that you “went full Spider-Man on your budget this month” feels acceptable, even funny, while communicating the same reality. Humor creates permission to acknowledge financial mistakes and discuss solutions without the emotional weight that causes people to avoid these conversations entirely.

This concept works as a recurring content series because the superhero universe is vast and the financial angles are endless. We could analyze the Avengers’ organizational budget (who pays for the damage?), examine Wonder Woman’s transition from Paradise Island to consumer capitalism, investigate the X-Men’s school funding sources, or explore the economics of Wakanda’s resource management. Each character and storyline offers fresh perspectives on universal financial challenges.

The deepest lesson from superhero finances isn’t about budgeting or investing—it’s about the relationship between values and resources. Superman chooses purpose over profit. Batman weaponizes wealth against crime. Iron Man commercializes heroism. Spider-Man sacrifices financial security for responsibility. Each reflects a different philosophy about what money is for and how resources should be allocated.

If superheroes had budgets, they’d reveal the same truth we all face: money is a tool, not a goal, and how we use our resources reflects who we are. The heroes we admire aren’t defined by their bank accounts but by their choices—including their financial ones. In making those fictional choices visible and analyzable, we create space to examine our own relationship with money, spending, and values.

That’s ultimately why this analysis matters. Not because anyone will actually create a Batsuit budget spreadsheet, but because thinking about these questions—sustainability, priorities, trade-offs, long-term planning—in a low-stakes fictional context makes it easier to think about them in our own lives. And maybe, just maybe, remembering that even Superman has to balance a budget will make our own financial challenges feel a little more manageable.

The next time you’re making a financial decision, ask yourself: Am I being Superman-smart or Spider-Man-reckless? Am I Batman-sustainable or burning through resources? Your budget might not come with superpowers, but it still tells a story about who you are and what you value. Make sure it’s a story you’re proud of.

FAQs

Q: Can superheroes actually have realistic budgets?

- While fictional, analyzing superheroes’ spending highlights interesting lessons about budgeting, risk, and wealth management in a fun, relatable way.

Q: Which superhero would be the best at managing money?

- Superman’s low expenses make him surprisingly frugal, while Batman invests heavily in tech—but both offer unique insights into finance.

Q: Can humor make finance more understandable?

- Yes! Using pop culture and superheroes makes complex financial concepts easier to digest and more engaging for readers.

Q: Does this article offer practical finance tips?

- While mainly entertaining, it subtly teaches lessons on budgeting, emergency funds, spending habits, and financial planning.

Q: Will there be a series on other fictional characters?

- Yes, future articles can explore villains, anime characters, or even everyday fictional figures to continue the fun financial analysis.

The article balances humor with genuine financial insights, making personal finance concepts accessible through beloved characters. Each hero represents a different financial archetype that readers can relate to their own situations.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.