Celebrity Money Habits That Surprise People

When we think of celebrities, images of private jets, sprawling mansions, and designer wardrobes instantly come to mind. The entertainment industry thrives on spectacle, and social media amplifies this perception by showcasing only the most glamorous moments. However, the reality of celebrity money habits often tells a dramatically different story. Behind the red carpets and paparazzi flashes, many high-earning celebrities practice financial discipline that would surprise their fans. Fame creates unique financial pressures—irregular income streams, short career spans, and the constant temptation of lifestyle inflation. While some celebrities do live extravagantly, an increasing number have adopted surprisingly frugal and strategic approaches to managing their wealth. These celebrity money habits reveal important lessons about financial security that apply far beyond Hollywood. In this article, we’ll explore the most unexpected ways celebrities handle money, from billionaires living in modest homes to A-listers who still track every dollar they spend.

Which Celebrities Live Far Below Their Means Despite Massive Wealth?

Some of the world’s wealthiest celebrities have become famous not just for their achievements, but for their surprisingly modest lifestyles. Warren Buffett, worth over $100 billion, still lives in the same Omaha house he purchased in 1958 for $31,500. Keanu Reeves, despite earning millions per film, is frequently spotted riding the subway and wearing the same clothes for years. Similarly, Sarah Jessica Parker has been open about clipping coupons and shopping sales despite her substantial wealth from “Sex and the City.”

These celebrity money habits stem from a fundamental understanding of wealth preservation. Avoiding lifestyle inflation—the tendency to increase spending as income rises—protects long-term financial security. High earners who choose modesty recognize that “looking rich” often creates financial vulnerability through unnecessary expenses and social pressure. They understand that true wealth isn’t about displaying status symbols but about maintaining financial independence and flexibility.

Celebrity Money Habits Comparison Table

| Celebrity | Net Worth | Modest Habit |

|---|---|---|

| Warren Buffett | $100B+ | Lives in the original 1958 home |

| Keanu Reeves | $380M | Rides public transit regularly |

| Tyra Banks | $90M | Uses coupons and hunts for deals |

| Ed Sheeran | $200M | Rarely carries cash, minimal spending |

This approach protects against the financial disasters that have befallen celebrities who overspent during peak earning years.

Why Do Some A-List Celebrities Still Budget Like Middle-Class Households?

Despite earning millions annually, several high-profile celebrities maintain strict budgets that rival middle-class financial planning. Jennifer Lawrence has discussed tracking her expenses meticulously, while Tobey Maguire is known for his detailed financial oversight. These celebrity money habits aren’t about necessity—they’re about maintaining control over unpredictable income streams.

Entertainment income is notoriously irregular. An actor might earn $20 million for one film, then wait two years for the next major role. This volatility makes budgeting even more critical than for salaried workers. Financial advisors to celebrities emphasize creating spending frameworks that account for both lean and abundant periods. Monthly expense tracking helps identify unnecessary costs and prevents gradual lifestyle creep that can drain wealth during career gaps.

Interestingly, budgeting becomes more important as income rises, not less. With higher earnings come more complex tax situations, increased investment opportunities, and greater temptation to overspend. Celebrities who budget effectively treat each dollar as an employee—giving it a specific job rather than allowing random spending. This disciplined approach to celebrity money habits ensures that temporary fame translates into permanent financial security, regardless of how long their earning potential lasts.

What Everyday Expenses Do Celebrities Surprisingly Avoid?

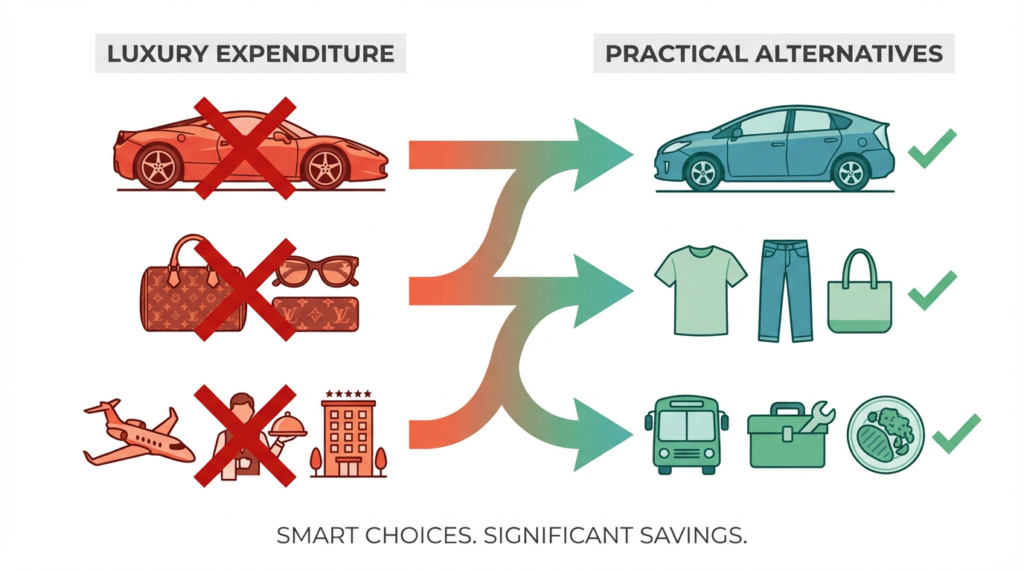

While fans might expect celebrities to indulge in every luxury, many intentionally avoid specific categories of spending that seem like obvious choices for the wealthy. High-maintenance assets top this list—exotic cars requiring expensive upkeep, vacation homes with year-round costs, and luxury boats that depreciate rapidly while demanding constant maintenance.

These celebrity money habits reflect a sophisticated understanding of recurring costs. A $200,000 sports car might seem affordable to a millionaire, but insurance, maintenance, storage, and depreciation can cost $30,000-$50,000 annually. Similarly, vacation homes incur property taxes, utilities, security, and upkeep whether occupied or not. Savvy celebrities recognize these “money pits” and choose alternatives—renting exotic cars when desired, staying in luxury hotels instead of owning vacation properties, or investing that capital in appreciating assets instead.

The hidden expenses behind flashy lifestyles accumulate quickly. Designer wardrobes require tailoring, storage, and insurance. Full-time household staff create long-term payroll obligations. Private club memberships demand annual fees for facilities rarely used. By cutting these small but persistent expenses, celebrities following these money habits can redirect hundreds of thousands of dollars annually toward investments that actually build wealth rather than merely display it.

Why Do Some Celebrities Still Fly Economy or Use Public Transport?

Few celebrity money habits surprise people more than seeing millionaires in economy class or on public transportation. Yet celebrities from Keanu Reeves to Ed Sheeran regularly choose practical over premium travel options. These decisions aren’t about affordability—they reflect value-based spending aligned with personal priorities rather than social expectations.

For some celebrities, the cost difference is simply unjustifiable. A cross-country first-class ticket might cost $5,000 compared to $400 for economy—a 1,150% premium for a few hours of comfort. Private jets amplify this exponentially, costing $20,000-$100,000 per flight depending on distance. Celebrities making practical travel choices calculate whether that premium price delivers proportional value, often concluding it doesn’t.

Beyond cost efficiency, routine and privacy sometimes favor ordinary travel. Some celebrities find economy class allows them to blend in rather than drawing attention, while others genuinely enjoy the normalcy of public transport. Security concerns do influence decisions, but many celebrities successfully navigate public spaces without incident. These celebrity money habits reveal an important principle: spending should align with genuine needs and values, not with maintaining appearances. When a $400 ticket serves the same purpose as a $5,000 ticket, choosing the expensive option is simply wealth destruction.

What Money Fears Do Wealthy Celebrities Still Have?

Common Financial Fears Among High-Earning Celebrities

| Fear | Percentage Who Experience It | Root Cause |

|---|---|---|

| Income suddenly stopping | 78% | Career volatility |

| Making poor investments | 65% | Lack of financial expertise |

| Supporting extended family | 52% | Cultural/familial pressure |

| Lifestyle unsustainable | 48% | Peak earning period awareness |

Surprisingly, financial anxiety doesn’t disappear with wealth—it often intensifies. These celebrity money habits include conservative spending specifically because of persistent money fears. The fear of income drying up after peak fame haunts many entertainers who’ve watched colleagues struggle after their moment in the spotlight faded. Athletes face similar anxiety, knowing their earning window might close before age 35.

Past financial trauma powerfully shapes celebrity money habits. Many celebrities grew up in poverty or watched their parents struggle financially. These experiences create lasting psychological impacts that influence spending regardless of current wealth. Rapper Jay-Z has spoken about how his childhood shaped his approach to money, while actor Jim Carrey’s family experience with homelessness influences his financial decisions decades later.

The entertainment industry is littered with bankruptcy stories that serve as cautionary tales. Nicolas Cage, Johnny Depp, and Mike Tyson all faced severe financial difficulties despite earning hundreds of millions during their careers. These examples reinforce that high income doesn’t guarantee financial security—disciplined management does. Even billionaires understand that circumstances can change, markets can crash, and careers can end unexpectedly. This awareness drives the conservative celebrity money habits that prioritize preservation over consumption.

Why Do Some Celebrities Invest in “Boring” Assets Like Index Funds?

While entertainment news highlights celebrity investments in trendy startups, cryptocurrency, or restaurant chains, many of the wealthiest celebrities quietly pour money into unglamorous index funds and bonds. These celebrity money habits prioritize wealth protection over exciting ventures that make headlines.

Index funds offer diversification, low fees, and consistent long-term returns averaging 8-10% annually over decades. For celebrities whose primary income depends on personal brand and performance—both unpredictable—these stable investments provide crucial balance. Rather than concentrating wealth in fame-dependent ventures, sophisticated celebrity investors ensure that even if their career ends tomorrow, their portfolio continues generating returns.

The preference for “boring” investments reflects hard-won wisdom about wealth preservation. Many celebrities who’ve lost fortunes chased high-risk, high-reward opportunities that seemed like can’t-miss propositions. Restaurant investments, for example, fail at alarming rates despite celebrity involvement. Meanwhile, a simple S&P 500 index fund has delivered reliable returns for decades without requiring the celebrity to manage anything.

Celebrity Investment Approach Table

| Investment Type | Risk Level | Typical Celebrity Users | Primary Benefit |

|---|---|---|---|

| Index Funds | Low | Ashton Kutcher, Jay-Z | Stable long-term growth |

| Real Estate | Medium | Ellen DeGeneres, Leonardo DiCaprio | Tangible assets, rental income |

| Tech Startups | High | Nas, Justin Timberlake | High growth potential |

| Bonds | Very Low | Many prefer anonymity | Capital preservation |

These celebrity money habits teach an important lesson: wealth protection matters more than wealth chasing. Flashy investments make interesting stories, but consistent, diversified, low-fee investing builds lasting financial security.

Why Do Some Famous Millionaires Rent Instead of Buying Homes?

Conventional wisdom suggests wealthy people always buy property, yet numerous celebrities intentionally rent their residences despite easily affording purchases. These celebrity money habits stem from a sophisticated understanding of flexibility, market risk, and opportunity cost.

Renting provides mobility that ownership doesn’t. Celebrities whose careers require relocating—filming in different cities, touring internationally, or following professional opportunities—face significant complications with owned properties. Selling real estate involves transaction costs of 8-10% between agent fees, closing costs, and capital gains taxes. Renting eliminates these friction costs while preserving flexibility to move as circumstances change.

Maintenance costs represent another factor in celebrity money habits around housing. Homeownership includes property taxes, insurance, repairs, utilities, landscaping, security systems, and staff—easily exceeding $100,000 annually for luxury properties. Rental agreements typically shift many maintenance responsibilities to landlords, converting unpredictable ownership costs into fixed monthly expenses.

The liquidity advantage particularly appeals to investment-minded celebrities. Money tied up in a $10 million home isn’t working elsewhere. If that capital earns 8% annually in diversified investments, it generates $800,000 per year—potentially covering luxury rental costs while preserving principal and maintaining upside investment potential. For celebrities prioritizing financial flexibility over property ownership, renting often represents the smarter choice, challenging conventional assumptions about wealth and real estate.

Which Celebrity Money Habit Actually Works for Normal People?

Not all celebrity money habits translate to average earners, but several prove remarkably applicable regardless of income level. Budgeting stands out as universally beneficial—whether tracking $5,000 monthly income or $500,000. The principles remain identical: understanding where money goes, eliminating waste, and ensuring spending aligns with priorities.

Lifestyle control represents another transferable habit. Celebrities who avoid lifestyle inflation despite rising income demonstrate discipline that benefits anyone receiving raises or bonuses. Instead of immediately increasing expenses when income grows, maintaining previous spending levels accelerates wealth building exponentially. A middle-class worker who banks raises rather than spends raises the same principle that keeps billionaires living modestly.

Applicable Celebrity Money Habits for Regular Earners

| Celebrity Habit | How to Apply It | Expected Benefit |

|---|---|---|

| Strict budgeting | Track every dollar monthly | 15-25% spending reduction |

| Avoiding lifestyle inflation | Bank raises/bonuses | Accelerated wealth building |

| Index fund investing | Automatic monthly contributions | Long-term financial security |

| Value-based spending | Question every purchase | Aligned spending with priorities |

| Emergency fund priority | 6-12 months’ expenses saved | Reduced financial anxiety |

Long-term investing through index funds works identically whether contributing $500 or $50,000 monthly—the power of compound returns doesn’t discriminate by amount. Similarly, avoiding debt-driven lifestyles protects financial health regardless of income bracket. The celebrity money habits that prioritize paying cash, avoiding unnecessary borrowing, and living below means apply universally.

The key insight is that celebrity discipline matters more than celebrity income. Someone earning $60,000 annually who budgets carefully, invests consistently, and avoids lifestyle inflation will build more wealth than someone earning $200,000 who spends everything. The celebrity money habits worth emulating aren’t about specific dollar amounts—they’re about the behavioral patterns and decision-making frameworks that create financial security at any income level.

Conclusion: What Celebrity Money Habits Teach Us About Real Wealth

The most surprising celebrity money habits reveal a fundamental truth: real wealth is often quiet, disciplined, and invisible to outsiders. While social media showcases luxury and excess, celebrities who build lasting financial security typically do so through boring consistency rather than exciting splurges. They budget meticulously, invest conservatively, avoid unnecessary expenses, and prioritize long-term security over short-term status displays.

The crucial distinction these celebrity money habits illustrate is between income and financial security. High earnings create opportunities, but only disciplined management converts those opportunities into lasting wealth. Conversely, modest earners who apply these same principles—budgeting, controlling lifestyle inflation, investing consistently—build financial security that outlasts many high-earning peers who spent everything.

Several key takeaways emerge that readers can implement immediately: track spending to identify waste, resist increasing expenses when income rises, invest in boring but reliable assets, and base spending decisions on personal values rather than social expectations. These celebrity money habits work because they’re rooted in timeless financial principles, not unique celebrity circumstances.

Perhaps most importantly, these examples should reframe how we define success. The celebrity living modestly while building wealth demonstrates more financial sophistication than the celebrity showcasing luxury while accumulating debt. Real financial success means having options, reducing stress, and building security—goals accessible to anyone willing to prioritize discipline over display. The celebrity money habits that truly surprise people are those that reveal wealth isn’t about looking rich; it’s about being financially free.

FAQs

Q. Do celebrities really budget their money?

- Yes. Many celebrities use strict budgeting systems because their income is irregular and dependent on contracts, endorsements, and public demand.

Q. Why do some celebrities live frugal lifestyles?

- Frugality helps celebrities protect wealth, manage uncertainty, and avoid bankruptcy, which is common in entertainment industries.

Q. Do rich celebrities worry about money?

- Absolutely. Fame does not guarantee long-term income, and many celebrities fear losing relevance, contracts, or financial stability.

Q. What investments do celebrities prefer?

- Many celebrities favor low-risk investments such as index funds, real estate, and diversified portfolios over high-risk speculation.

Q. Can normal people copy celebrity money habits?

- Yes. Habits like budgeting, avoiding lifestyle inflation, and long-term investing are practical and effective for any income level.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.