The $50,000 Credit Card Trap: How Sarah’s “Rewards Strategy” Became a Financial Nightmare

Sarah Mitchell, a 34-year-old marketing manager from Austin, Texas, earned a comfortable $85,000 annually and prided herself on being financially savvy. She read personal finance blogs, listened to investment podcasts, and believed she had discovered the ultimate wealth-building hack: maximizing credit card rewards while carrying strategic balances to “build credit faster.”

What began as an ambitious plan to earn cashback and travel points spiraled into $50,000 of high-interest debt within three years. Sarah’s story isn’t unique—according to recent Federal Reserve data, the average American household carries over $7,000 in credit card debt, with many believing they’re playing the system when the system is actually playing them. Her mistake represents one of the most common financial mistakes people make in modern consumer culture: confusing credit card optimization with actual wealth building, a trap that ensnares millions of Americans every year who fall victim to similar financial mistakes people make.

The Financial Mistake That Changed Everything

Sarah’s critical error was treating credit cards as a financial tool for “building wealth” rather than recognizing them as a debt instrument. She fell victim to what financial experts call “rewards rationalization”—the psychological trap where consumers justify unnecessary purchases because they’ll earn 2% cashback or airline miles. This represents one of the classic financial mistakes people make when they prioritize short-term rewards over long-term financial health.

Her strategy seemed logical on paper: she opened seven premium credit cards, each promising substantial signup bonuses and ongoing rewards. She charged everything possible to maximize points—groceries, gas, dining, subscriptions, and even rent through third-party payment services with added fees. The plan was to pay off balances monthly, but “strategic” exceptions began appearing. A $3,000 vacation charge would earn triple points, so she’d carry that balance for “just a few months.” A $2,500 furniture purchase offered 18 months interest-free, so why not take advantage?

This mistake affects approximately 45% of American credit card holders who carry balances month-to-month, according to creditcards.com data. What makes it particularly insidious is that it feels intelligent—you’re earning rewards, building credit history, and enjoying immediate gratification while convincing yourself you’re practicing sophisticated financial management. Understanding the financial mistakes people make in this context is crucial for avoiding the same trap.

Early Warning Signs That Were Ignored

The red flags appeared within the first six months, but Sarah rationalized each one—a common pattern among the financial mistakes people make when denial overrides logic. Her minimum monthly payments climbed from $200 to $850, yet she told herself this was temporary. When she needed to use one credit card to pay another’s minimum payment—a practice called “credit card juggling”—she dismissed it as cash flow management.

The clearest warning came when Sarah checked her credit utilization ratio and discovered it had jumped to 68% across all cards. Financial advisors recommend keeping this below 30%, but she convinced herself that her excellent payment history would offset the high utilization. Her credit score began dropping—from 740 to 680 within a year—but she attributed this to “algorithm changes” rather than her behavior.

Why do people ignore these signals? Behavioral economist Dan Ariely’s research on “predictable irrationality” explains that humans excel at self-deception when admitting the truth would require painful lifestyle changes. Sarah would have needed to acknowledge that her apartment, car, and social life were all subsidized by debt disguised as rewards optimization. This self-deception is among the most dangerous financial mistakes people make because it prevents early intervention.

The Real Reason People Make This Mistake

Sarah’s mistake wasn’t driven by a single factor but by a perfect storm of psychological and social pressures. The primary driver was lifestyle inflation masked as financial sophistication. In her social circle, frequent travel, trendy restaurants, and premium experiences weren’t luxuries—they were expected participation in adult life. This social pressure contributes to many of the financial mistakes people make in their 30s and 40s.

Social media amplified this pressure. Sarah’s Instagram feed showcased friends’ exotic vacations, designer purchases, and enviable experiences. What she couldn’t see were the credit card statements funding these displays. Research from the University of Illinois found that heavy social media users carry 40% more consumer debt than light users, primarily due to comparison-driven spending—one of the most pervasive financial mistakes people make in the digital age.

Financial illiteracy played the supporting role. Sarah understood interest rates but failed to grasp the mathematical reality of compound interest working against her. She knew 18.99% APR was “high” but didn’t calculate that a $5,000 balance would cost $950 annually in interest if she only made minimum payments. This knowledge gap represents one of the fundamental financial mistakes people make: confusing awareness with understanding.

The credit card industry’s deliberate obfuscation compounds this ignorance. Terms like “minimum payment,” “available credit,” and “rewards points” are carefully engineered to obscure the fundamental transaction: borrowing money at exorbitant interest rates. When Sarah saw “$8,000 available credit,” her brain registered spending power, not debt capacity.

Overconfidence completed the trifecta. Sarah had read enough personal finance content to feel knowledgeable, which paradoxically made her more vulnerable. She believed she was smarter than the average consumer, immune to the psychological traps that ensnared others. This is the Dunning-Kruger effect in action—knowing just enough to be dangerous. Overestimating one’s financial sophistication ranks among the costliest financial mistakes people make.

The Hidden Cost of the Mistake

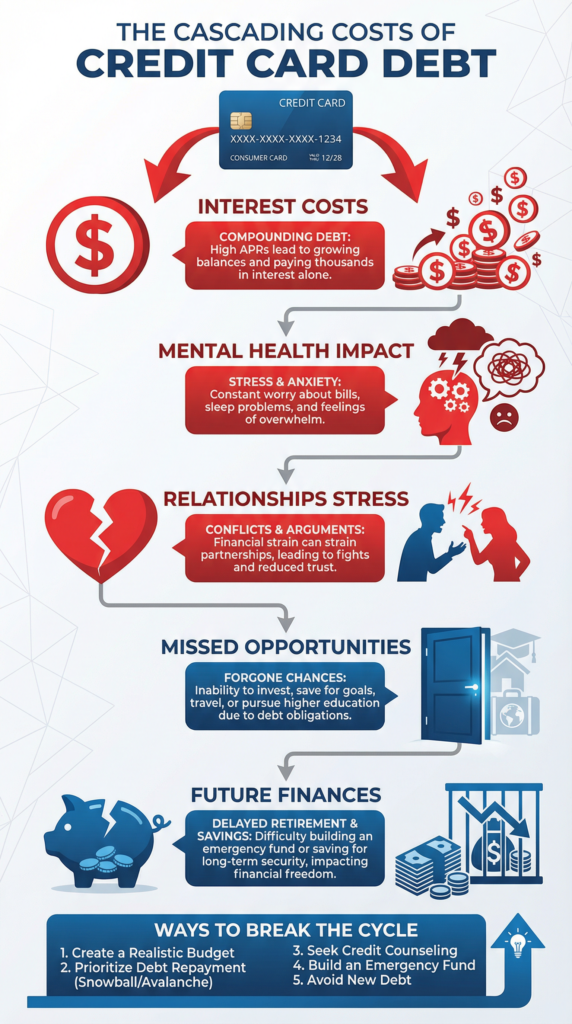

The immediate financial damage was quantifiable: Sarah accumulated $50,000 in credit card debt across seven cards, with average interest rates of 21.5%. At minimum payments, she was paying approximately $1,075 monthly—just to service debt, not reduce principal. Over five years, this would cost her over $64,000 in total payments for purchases originally worth $50,000. This compounding effect illustrates why credit card mismanagement is among the most expensive financial mistakes people make.

But the hidden costs exceeded the financial ones. Sarah developed anxiety-induced insomnia, waking at 3 AM to mentally calculate whether she could afford groceries before her next paycheck. Her relationship with her partner deteriorated as financial stress created constant tension. She turned down a friend’s wedding because she couldn’t afford the travel, damaging a decade-long friendship.

The Compounding Impact

| Time Period | Financial Cost | Emotional/Relational Cost | Opportunity Cost |

|---|---|---|---|

| Year 1 | $4,200 in interest | Stress, hiding statements from partner | Lost $5,000 emergency fund contribution |

| Year 2 | $8,800 in interest | First panic attack, declined social invitations | Missed employer 401(k) match: $3,400 |

| Year 3 | $11,200 in interest | Relationship counseling needed ($2,400) | Career opportunity requiring relocation was rejected |

| Total | $24,200 | Anxiety disorder diagnosis, strained relationships | $48,000+ in missed retirement growth |

The most devastating hidden cost was time. At age 34, Sarah should have been building wealth through investments. Instead, every dollar went to correcting past mistakes. Financial advisors estimate this three-year detour would delay her retirement by approximately 7-10 years, assuming aggressive recovery efforts. This demonstrates how the financial mistakes people make in their 30s can derail decades of future prosperity.

The Turning Point: Realizing Something Had to Change

Sarah’s moment of reckoning came not from a financial event but from an emotional breaking point. At a friend’s birthday dinner, when the check arrived, Sarah experienced a full-blown panic attack. While others casually split the $400 bill, she mentally calculated whether her cards had enough available credit and whether this purchase would trigger an over-limit fee.

That night, she did something she’d avoided for eighteen months: she created a comprehensive spreadsheet of every debt, interest rate, minimum payment, and total balance. Seeing “$49,847.32” in a single cell—the sum of all her credit card debt—forced confrontation with reality she’d been avoiding through willful ignorance and compartmentalization.

The external trigger that sealed her commitment to change came two weeks later when she was denied a car loan despite her “good” credit score. The loan officer explained that her debt-to-income ratio was too high. The car she needed for a potential promotion remained out of reach—not because she lacked income but because she’d spent her borrowing capacity on restaurant meals and vacations she could barely remember.

Accepting the mistake was brutal. Sarah had to admit to her partner that she’d hidden the debt’s true extent, acknowledge to herself that she’d wasted years of earning potential, and confront the reality that her “sophisticated financial strategy” was identical to the debt trap she’d judged others for entering. This acceptance—admitting when you’ve made significant financial mistakes people make—is often the hardest but most necessary step toward recovery.

Fixing the Damage: Steps Toward Financial Recovery

Sarah’s recovery required systematic action across multiple fronts. Her first step was creating complete financial transparency—she shared every account, balance, and statement with her partner and committed to weekly money meetings. This accountability prevented backsliding into old patterns and helped her avoid repeating the financial mistakes people make when operating in secrecy.

Sarah’s Debt Elimination Strategy

| Month | Action Taken | Monthly Payment | Balance Reduction | Psychological Win |

|---|---|---|---|---|

| 1-3 | Avalanche method: tackled 24.99% APR card first | $2,200 | $5,247 paid off | First card closed! |

| 4-6 | Consolidated two cards to 12.99% balance transfer | $2,200 | Additional $4,600 | Interest savings: $89/month |

| 7-12 | Side hustle (freelance consulting) added | $2,850 | $15,200 total eliminated | Debt below $35,000 |

| 13-24 | Maintained aggressive payments, no new debt | $2,400 | Additional $26,800 | Three more cards cleared |

| 25-36 | Final push on remaining balances | $2,100 | Final $9,000 eliminated | Completely debt-free |

The habit replacements were equally important. Sarah implemented a “48-hour rule”—any non-essential purchase over $50 required a 48-hour waiting period. She deleted all saved credit card information from online retailers, adding friction to impulse purchases. Most critically, she shifted to a debit card and cash system, making spending psychologically real again.

Recovery took exactly three years—36 months of living well below her means, working side jobs, and watching friends continue the lifestyle she’d abandoned. But by month 36, Sarah was debt-free with a $15,000 emergency fund, contributing 15% to retirement, and experiencing financial peace she’d never known during her “rewards optimization” phase.

How to Avoid This Financial Mistake in Your Own Life

Recognizing this mistake early requires honest self-assessment. Ask yourself: “If I couldn’t use this credit card for six months, would my lifestyle change dramatically?” If yes, you’re living beyond your means. Check your credit card statements—if you’re surprised by the total spent last month, you’ve lost spending awareness, the first step toward Sarah’s trap. Learning to spot the financial mistakes people make before they become catastrophic is an essential life skill.

Prevention Action Plan

| Risk Factor | Early Detection Question | Preventive Action |

|---|---|---|

| Rewards rationalization | “Am I buying things I don’t need to earn points?” | Only use rewards cards for planned purchases already in the budget |

| High utilization | “Is my balance over 30% of my limit?” | Set automatic alerts at 20% utilization; pay mid-cycle |

| Minimum payment trap | “Am I carrying balances month-to-month?” | Automate full balance payment; if impossible, stop using the card |

| Multiple cards | “Do I have more than 2-3 active credit cards?” | Close unnecessary accounts; consolidate to 1-2 cards maximum |

| Lifestyle inflation | “Has my spending increased with every raise?” | Implement the 50/30/20 rule: save 50% of every raise |

The mindset shift is fundamental: credit cards are payment tools, not income supplements. If you cannot pay the full balance when the statement arrives, you cannot afford the purchase—regardless of rewards, points, or cashback. This simple rule, if followed religiously, makes credit card debt mathematically impossible and helps you avoid one of the most common financial mistakes people make.

Implement the “one-card rule”: choose a single card with reasonable rewards, use it exclusively for budgeted expenses, and pay it in full every month. This approach captures genuine benefits while eliminating the complexity that enables self-deception. By maintaining this discipline, you automatically sidestep numerous financial mistakes people make with credit.

Conclusion: The One Lesson Most People Learn Too Late

Sarah’s story teaches a brutal truth in one sentence: debt marketed as a wealth-building tool is still debt, and no rewards program can compensate for compound interest working against you. This lesson encapsulates one of the most expensive financial mistakes people make: believing they can outsmart mathematical reality through clever tactics.

If Sarah had recognized her mistake in month six rather than year three, she would have saved approximately $18,000 in interest payments, preserved her credit score, avoided relationship strain, and maintained three years of retirement contributions now worth an estimated $30,000 with compound growth. The ten-minute calculation she avoided for thirty months cost her nearly $50,000 in direct and opportunity costs.

Yet people continue repeating the same financial mistakes people make because the credit card industry has perfected the art of making borrowing feel like winning. Those “rewards” trigger dopamine responses that override rational financial calculation. The statement showing “You earned $47.32 in cashback!” obscures the $156.84 paid in interest that same month.

The uncomfortable reality: until individuals develop genuine financial literacy and emotional resistance to consumer culture’s constant pressure to spend, these financial mistakes people make will persist across generations, transferring wealth from those who can least afford it to financial institutions that profit from mathematical ignorance and psychological manipulation.

Key Takeaway Box: The credit card debt trap isn’t about lack of income—it’s about the dangerous intersection of lifestyle expectations, financial illiteracy, and sophisticated marketing that makes borrowing feel like earning. Among all the financial mistakes people make, this one combines immediate gratification with long-term devastation. Recognition is the first step; ruthless honesty about your actual financial position is the only path to recovery.

FAQs

Q. What are the most common financial mistakes people make?

- The most common mistakes include overspending, not saving early, relying on credit, avoiding budgeting, and delaying investments.

Q. Why do people keep making the same money mistakes?

- Most financial mistakes are driven by emotions, social pressure, lack of financial education, and short-term thinking.

Q. How can I avoid making financial mistakes?

- You can avoid financial mistakes by tracking expenses, building an emergency fund, investing early, and developing disciplined money habits.

Q. Can financial mistakes be fixed?

- Yes, most financial mistakes can be corrected with the right strategy, consistent habits, and time.

Q. What is the biggest financial lesson people learn too late?

- The biggest lesson is that small financial decisions, repeated daily, have a massive long-term impact.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.