How Is Elon Musk So Rich? The Complete Story Behind His Fortune

Elon Musk’s name has become synonymous with extraordinary wealth. As one of the richest people on the planet, with a net worth that has exceeded $200 billion at various points, the question “how is Elon Musk so rich?” fascinates millions. Unlike traditional billionaires who built their fortunes in finance or retail, Musk’s wealth stems from revolutionary companies in electric vehicles, space exploration, and technology. His journey from a South African entrepreneur to the world’s wealthiest person offers lessons in risk-taking, innovation, and the modern creation of wealth through equity ownership.

Where Did Elon Musk’s Wealth Come From?

Did Elon Musk come from a wealthy family?

Contrary to popular belief, Elon Musk’s path to billions wasn’t paved entirely by family wealth. While his father was an engineer in South Africa and the family lived comfortably middle-class, Musk wasn’t born into billions. He moved to Canada at age 17 with limited resources, working odd jobs to pay his way through school. His early wealth came from his own entrepreneurial ventures, not inheritance.

What was Elon Musk’s first major source of wealth?

Musk’s first significant financial success came from Zip2, a web software company he co-founded with his brother Kimbal in 1995. The company provided online city guides and maps for newspapers. When Compaq acquired Zip2 in 1999 for approximately $307 million, Musk received about $22 million from the sale. This windfall became the seed capital for his next ventures.

How did PayPal make Elon Musk rich?

Understanding how Elon Musk is so rich requires examining his PayPal success. Musk invested $10 million from his Zip2 proceeds into X.com, an online financial services company he founded in 1999. X.com merged with Confinity, which had developed a money transfer service called PayPal. When eBay acquired PayPal in 2002 for $1.5 billion, Musk, as the largest shareholder with 11.7%, received approximately $180 million. This substantial sum provided the capital he needed to invest in Tesla and SpaceX.

Which Companies Make Elon Musk Rich Today?

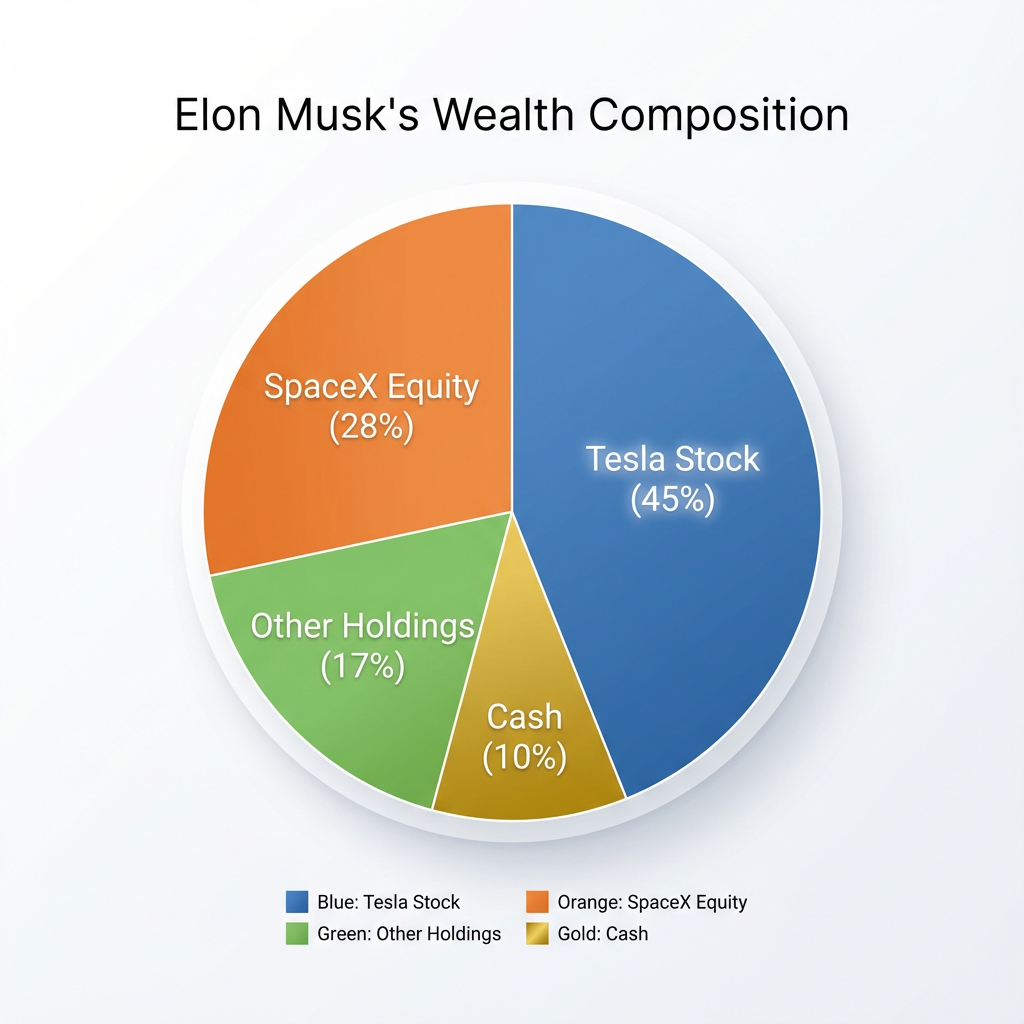

Elon Musk’s current fortune comes primarily from his ownership stakes in several companies:

| Company | Musk’s Ownership | Primary Contribution to Wealth |

|---|---|---|

| Tesla | ~13-20% | Largest contributor (60-75% of net worth) |

| SpaceX | ~42-48% | Second largest (15-25% of net worth) |

| X (formerly Twitter) | ~79% | Significant but reduced overall net worth |

| The Boring Company | ~90% | Smaller contribution |

| Neuralink | Substantial stake | Minimal contribution currently |

| xAI | Majority stake | Growing but nascent |

How much of Elon Musk’s wealth comes from Tesla?

Tesla represents the lion’s share of how Elon Musk is so rich. His stake in the electric vehicle manufacturer accounts for the majority of his net worth. When Tesla’s stock price surged from around $100 per share in early 2020 to over $1,200 per share (split-adjusted) in 2021, Musk’s net worth increased by over $100 billion. Tesla’s market capitalization has at times exceeded $1 trillion, making it more valuable than most traditional automakers combined.

What role does SpaceX play in Elon Musk’s net worth?

SpaceX, Musk’s private aerospace company, contributes significantly to his wealth despite being unlisted on public stock exchanges. The company’s valuation has grown from a few hundred million in its early years to over $150 billion in recent valuations. SpaceX has revolutionized space travel with reusable rockets, secured billions in NASA contracts, and launched the Starlink satellite internet service, which alone could be worth tens of billions.

How Does Elon Musk Make Money Without a Big Salary?

Does Elon Musk take a salary?

One fascinating aspect of how Elon Musk is so rich is that he takes virtually no salary. Musk declined traditional CEO compensation at Tesla for years. His official salary has been listed as California’s minimum wage, which he never actually collects. Unlike typical executives who earn millions in annual salary and bonuses, Musk’s compensation is entirely performance-based and tied to company achievements.

How do stock options and equity make Elon Musk so rich?

Musk’s wealth generation comes from stock options and equity compensation rather than cash. In 2018, Tesla’s board approved an unprecedented compensation package that could grant Musk up to $55 billion worth of stock options if the company hit specific market capitalization and operational milestones. These tranches vested only when Tesla reached targets like a $650 billion market cap or specific revenue and profitability goals. This structure meant Musk only got paid if shareholders benefited massively.

Why is most of Elon Musk’s wealth tied to stock instead of cash?

The answer to how Elon Musk is so rich lies in equity ownership, not liquid assets. Stock ownership offers several advantages:

- Unlimited upside potential: As company valuations grow, so does his wealth

- Tax efficiency: Stock isn’t taxed until sold, allowing wealth to compound

- Maintained control: Retaining shares preserves decision-making power

- Aligned interests: His fortune rises and falls with company success

This approach means Musk’s wealth exists primarily on paper, tied to the market value of his company shares rather than sitting in bank accounts.

Why Does Elon Musk’s Net Worth Change So Often?

Why does Elon Musk’s net worth fluctuate daily?

Understanding how Elon Musk is so rich also means understanding why his fortune can swing by billions in a single day. Because his wealth is predominantly held in publicly traded stock (Tesla) and private company equity (SpaceX), daily market movements directly impact his net worth. A 5% move in Tesla’s stock price can change his wealth by $10-15 billion or more.

How does Tesla’s stock price affect Elon Musk’s wealth?

Tesla’s stock is notoriously volatile, and this volatility directly translates to Musk’s net worth fluctuations:

| Tesla Stock Movement | Impact on Musk’s Net Worth (approximate) |

|---|---|

| +10% increase | +$15-20 billion |

| -10% decrease | -$15-20 billion |

| +50% annual gain | +$75-100 billion |

| -50% annual drop | -$75-100 billion |

These swings explain why Musk has alternated between being the world’s richest person and dropping to second or third place based on daily trading.

What market factors impact Elon Musk’s net worth the most?

Several factors drive the dramatic changes in how Elon Musk became so rich:

- Interest rates: Higher rates pressure growth stock valuations, including Tesla

- EV competition: New electric vehicle competitors affect Tesla’s market dominance

- Production and delivery numbers: Quarterly results move the stock significantly

- Musk’s public statements: His tweets and public comments can move markets

- Broader market sentiment: Tech stock trends and overall market conditions

- Regulatory environment: Government policies on EVs and autonomous driving

How Is Elon Musk’s Wealth Different From Other Billionaires?

How is Elon Musk’s wealth different from that of traditional billionaires?

When examining how Elon Musk is so rich compared to other billionaires, several distinctions emerge. Unlike Warren Buffett, who built wealth through diversified investments, or Bernard Arnault, who manages luxury goods conglomerates, Musk’s fortune is concentrated in companies he actively runs. His wealth is more volatile, less diversified, and deeply tied to his personal involvement in cutting-edge technology sectors.

Traditional billionaires often derive wealth from stable, mature industries. Musk’s fortune comes from sectors that barely existed two decades ago or are still emerging, like consumer electric vehicles and commercial space flight.

How does Elon Musk’s net worth compare to Jeff Bezos or Mark Zuckerberg’s?

| Billionaire | Primary Source | Wealth Stability | Industry Focus |

|---|---|---|---|

| Elon Musk | Tesla/SpaceX equity | High volatility | Transportation/Space/Energy |

| Jeff Bezos | Amazon equity | Moderate volatility | E-commerce/Cloud computing |

| Mark Zuckerberg | Meta equity | Moderate-high volatility | Social media/Metaverse |

| Bernard Arnault | LVMH luxury goods | Lower volatility | Luxury retail |

| Warren Buffett | Berkshire Hathaway | Lower volatility | Diversified investments |

Musk’s wealth has shown more extreme swings than most peers, growing faster but also experiencing sharper declines during market downturns.

How Does Elon Musk Use Risk and Innovation to Build Wealth?

What risks has Elon Musk taken that increased his fortune?

A crucial element of how Elon Musk is so rich involves his willingness to take extraordinary risks. In 2008, during the financial crisis, both Tesla and SpaceX faced potential bankruptcy. Musk invested his last remaining funds from the PayPal sale, splitting approximately $40 million between the two companies. He has described this period as choosing which company would die first, essentially betting his entire fortune on their survival.

Other major risks include:

- Investing heavily in unproven electric vehicle technology when traditional automakers dismissed it

- Entering the aerospace industry as a newcomer against established giants like Boeing and Lockheed Martin

- Building the Gigafactory before Tesla had proven mass-market demand

- Acquiring Twitter for $44 billion, which temporarily reduced his net worth significantly

How does innovation contribute to Elon Musk’s financial success?

Innovation isn’t just a buzzword for Musk—it’s the engine behind how Elon Musk is so rich. His companies have achieved several groundbreaking firsts:

- Tesla: Made electric vehicles desirable and profitable at scale

- SpaceX: Created reusable orbital rockets, reducing launch costs by up to 90%

- Tesla Energy: Advanced battery storage technology for grid-scale applications

- Starlink: Deployed thousands of satellites for global internet coverage

Each innovation opened massive new markets or dramatically reduced costs in existing markets, creating enormous economic value that translated into company valuations and personal wealth.

How Does Elon Musk Actually Use His Money?

How much cash does Elon Musk really have?

Despite being worth hundreds of billions on paper, Musk holds relatively little cash. Most wealth estimates suggest he maintains only a few billion in liquid assets at any given time. When he purchased Twitter for $44 billion, he had to sell Tesla stock and secure loans against his shares to fund the acquisition. This demonstrates a key aspect of how Elon Musk is so rich—his wealth is predominantly illiquid, tied up in company equity rather than available for immediate spending.

How does Elon Musk spend his money?

Musk’s spending patterns differ markedly from stereotypical billionaire lifestyles:

Major Expenditures:

- Business investments (reinvesting billions into Tesla, SpaceX, and other ventures)

- Twitter/X acquisition ($44 billion)

- Real estate (though he claimed to sell most properties)

- Private jet travel for business purposes

What he doesn’t spend on:

- Multiple mansions (he claimed to live in a modest rental)

- Yachts, extensive art collections, or traditional luxury items

- Significant charitable foundations (compared to Gates or Buffett)

Musk has stated that he intends to use his wealth to help make humanity a multi-planetary species and accelerate sustainable energy adoption rather than accumulating luxury possessions.

Could Elon Musk Lose His Wealth?

Could Elon Musk lose most of his wealth?

Yes, understanding how Elon Musk is so rich also means understanding how he could lose it. Because his fortune is concentrated in stock holdings of volatile companies, significant losses are possible. In 2022, Musk’s net worth dropped by over $200 billion as Tesla’s stock fell from its peak, demonstrating that paper wealth can evaporate quickly.

What would have to happen for Elon Musk’s net worth to fall significantly?

Several scenarios could substantially reduce Musk’s wealth:

| Scenario | Potential Impact on Net Worth |

|---|---|

| Tesla loses competitive edge to rivals | -50% to -70% reduction |

| SpaceX mission catastrophe | -10% to -20% reduction |

| Major recall or safety crisis at Tesla | -30% to -50% reduction |

| An extended stock market bear market | -40% to -60% reduction |

| Loss of investor confidence in leadership | -30% to -50% reduction |

| Regulatory actions against his companies | -20% to -40% reduction |

The concentration of his wealth in a few companies means he lacks the diversification that would protect against industry-specific or company-specific crises.

What Can People Learn From Elon Musk’s Wealth Journey?

What can entrepreneurs learn from how Elon Musk built his wealth?

Studying how Elon Musk is so rich offers several lessons for entrepreneurs:

Key Takeaways:

- Reinvest relentlessly: Musk consistently put profits from one venture into the next, compounding his success

- Maintain significant ownership: He kept large equity stakes rather than cashing out early

- Think exceptionally long-term: His goals extend decades into the future, not just quarterly earnings

- Accept calculated risks: He bet on industries that others considered impossible or impractical

- Solve meaningful problems: His companies address significant challenges like climate change and space exploration

- Performance-based compensation works: Aligning pay with company success creates massive incentives

Is Elon Musk’s path to wealth replicable for ordinary people?

The honest answer is that Musk’s specific path to extreme wealth is not easily replicable. His journey involved:

- Exceptional timing (entering online payments and EVs at ideal moments)

- Access to capital from early successes (the Zip2 and PayPal windfalls)

- Tolerance for extreme risk (betting everything in 2008)

- Rare combination of technical knowledge and business acumen

- Willingness to work extreme hours for decades

- Some luck alongside skill and determination

However, the principles behind how Elon Musk is so rich can be adapted:

- Build equity in businesses rather than just earning a salary

- Focus on creating real value and solving problems

- Reinvest profits rather than extracting them

- Think long-term despite short-term pressures

- Take calculated risks when opportunities arise

For most people, building significant wealth through equity ownership, whether in their own business or through stock investments, following sound principles over decades, offers a more realistic path than trying to replicate Musk’s specific trajectory.

Conclusion

So, how is Elon Musk so rich? The answer is a combination of vision, ownership, risk-taking, and timing. His wealth stems primarily from maintaining large equity positions in revolutionary companies—especially Tesla and SpaceX—that have achieved extraordinary valuations. Unlike traditional executives who earn salaries, Musk built his fortune through stock ownership that aligned his interests completely with company performance.

His willingness to take extraordinary risks, including investing his last dollars during near-bankruptcy moments, separated him from more cautious entrepreneurs. The innovations his companies pioneered in electric vehicles, reusable rockets, and battery technology created massive new markets and disrupted established industries.

Yet Musk’s wealth is also precarious. Concentrated in volatile stocks, his net worth can swing by tens of billions based on daily market movements. He holds relatively little cash and has demonstrated a willingness to deploy his wealth toward ambitious goals rather than traditional luxury consumption.

The question of how Elon Musk is so rich ultimately reveals a modern wealth-creation story built on equity ownership in transformative technology companies, extreme risk tolerance, relentless reinvestment, and the pursuit of ambitious visions that captured investor imagination. While his specific path may not be replicable for most, the underlying principles of creating value, maintaining ownership, and thinking long-term offer lessons for anyone seeking to build wealth through entrepreneurship and innovation.

FAQs

Q. Is Elon Musk’s wealth mostly cash?

- No, most of Elon Musk’s wealth is tied to company shares and stock options, not cash or liquid assets.

Q. What company made Elon Musk the most money?

- Tesla has contributed the largest share to Elon Musk’s net worth due to its massive stock price growth.

Q. Why does Elon Musk’s net worth change so often?

- Because his wealth depends heavily on stock prices, especially Tesla, his net worth fluctuates daily with the market.

Q7. Is Elon Musk self-made?

- Elon Musk is considered largely self-made, having built his fortune through startups and reinvestment rather than inheritance.

Note: Net worth figures and ownership percentages fluctuate based on market conditions and corporate actions. The information presented reflects general ranges and principles rather than exact real-time values.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.