How Do Rich People Invest Their Money? A Complete Guide to Wealth-Building Strategies

The path to substantial wealth isn’t just about earning more—it’s about investing smarter. While the average investor might dabble in stocks or maintain a basic savings account, wealthy individuals approach investing with sophisticated strategies, disciplined diversification, and a long-term vision that transforms their capital into lasting wealth.

Understanding how rich people invest their money reveals a fundamental truth: wealth accumulation follows specific principles that anyone can learn and apply. The ultra-wealthy don’t possess secret knowledge, but they do employ proven strategies, access specialized opportunities, and maintain the discipline to let their investments compound over decades.

This comprehensive guide explores the investment strategies, asset allocation methods, and wealth-building habits that distinguish high-net-worth individuals from average investors. Whether you’re beginning your investment journey or looking to elevate your portfolio strategy, these insights offer valuable lessons for building and preserving wealth.

What Types of Alternative Investments Do Wealthy People Prefer?

When examining how rich people invest their money, alternative investments stand out as a cornerstone of their portfolios. Unlike traditional stocks and bonds, alternative investments include asset classes such as private equity, hedge funds, venture capital, fine art, collectibles, cryptocurrencies, and commodities.

Why the wealthy gravitate toward alternatives

Alternative investments offer several compelling advantages that attract high-net-worth individuals. First, they provide access to higher potential returns that aren’t correlated with public market performance. When stock markets experience downturns, many alternative investments maintain their value or even appreciate, offering crucial portfolio stability.

Second, alternatives serve as an effective hedge against inflation. Tangible assets like real estate, art, and commodities historically preserve purchasing power when currency values decline. Third, these investments offer diversification beyond traditional asset classes, reducing overall portfolio risk through non-correlated returns.

Popular alternative investments among the wealthy

| Alternative Investment | Typical Characteristics | Appeal to Wealthy Investors |

|---|---|---|

| Private Equity | 5-10 year lock-ups, high minimum investments | Higher returns than public markets, operational control |

| Hedge Funds | Various strategies, absolute return focus | Downside protection, sophisticated risk management |

| Venture Capital | Early-stage company investments | Exponential growth potential, innovation exposure |

| Fine Art & Collectibles | Tangible assets, passion investments | Inflation hedge, aesthetic enjoyment, legacy building |

| Commercial Real Estate | Direct property ownership or syndications | Income generation, appreciation, and tax benefits |

| Cryptocurrencies | Digital assets, high volatility | Portfolio diversification, technological innovation |

The key insight is that wealthy investors typically allocate 25-50% of their portfolios to alternative investments, compared to less than 5% for average investors. This allocation reflects both their higher risk tolerance and access to opportunities requiring substantial minimum investments.

How Do Rich People Diversify Their Investment Portfolios?

Diversification represents one of the most critical principles governing how rich people invest their money. Rather than concentrating wealth in a single asset class or investment, wealthy individuals spread their capital across multiple categories to manage risk while optimizing returns.

The strategic approach to asset allocation

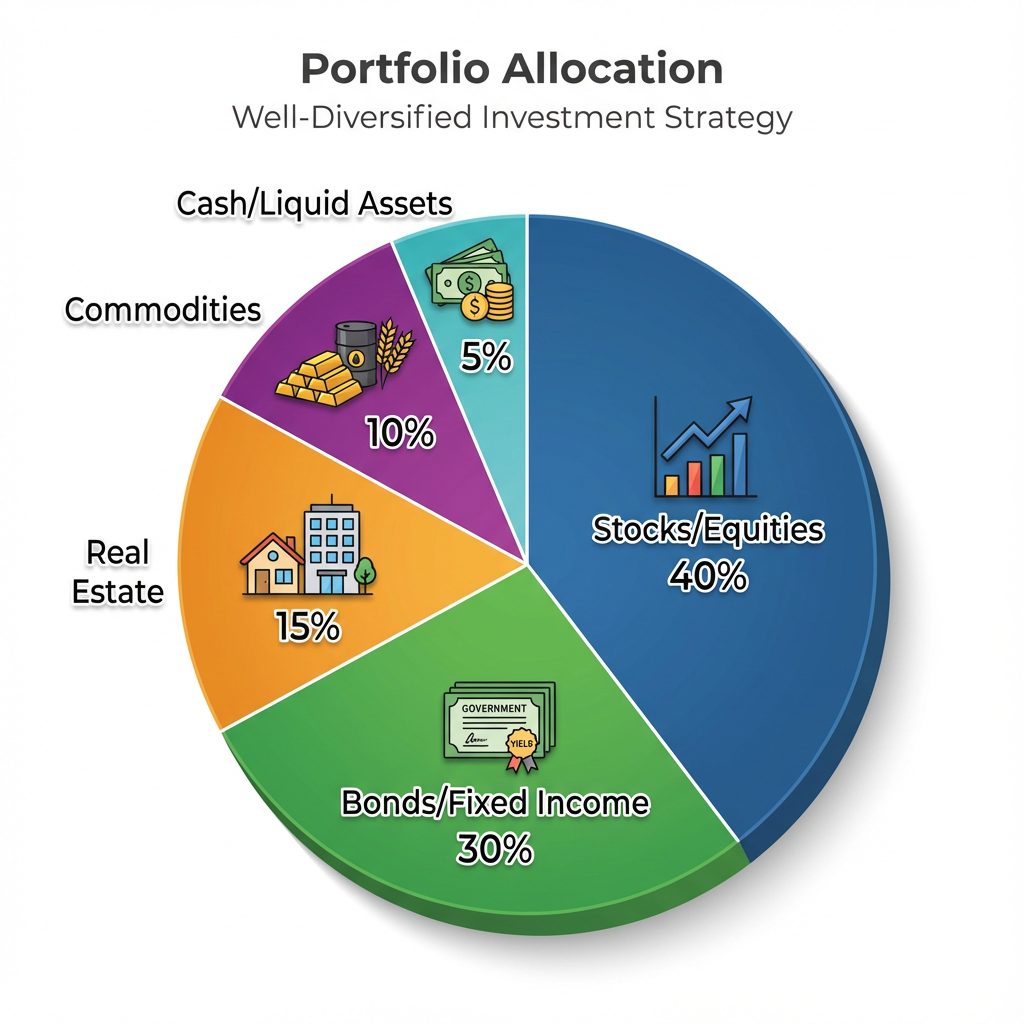

High-net-worth individuals typically structure their portfolios across six primary categories: equities (stocks), fixed income (bonds), real estate, alternative investments, cash equivalents, and commodities. The specific allocation depends on factors including age, risk tolerance, income needs, and market conditions.

A typical diversified portfolio for wealthy investors might look like this:

| Asset Class | Allocation Range | Primary Purpose |

|---|---|---|

| Public Equities | 20-40% | Long-term capital appreciation |

| Fixed Income | 10-25% | Income generation, capital preservation |

| Real Estate | 15-30% | Income, appreciation, inflation hedge |

| Alternative Investments | 20-35% | Enhanced returns, diversification |

| Cash & Equivalents | 5-10% | Liquidity, opportunistic purchases |

| Commodities & Precious Metals | 5-15% | Inflation protection, crisis hedge |

How diversification protects wealth during market volatility

The 2008 financial crisis and the 2020 pandemic market crash demonstrated the power of diversification. While stock-heavy portfolios suffered devastating losses, well-diversified portfolios that included real estate, commodities, and alternative investments recovered more quickly and in some cases even generated positive returns.

Consider the example of a wealthy investor who allocated their $10 million portfolio as follows: 30% stocks, 20% bonds, 25% real estate, 15% private equity, and 10% cash. During the 2020 market crash, while their stock holdings temporarily declined 30%, their real estate maintained value, bonds appreciated as interest rates fell, and they used cash reserves to purchase undervalued assets—emerging from the crisis with enhanced long-term wealth.

The wealthy understand that diversification isn’t about maximizing returns in any single year—it’s about consistent growth across decades while protecting against catastrophic losses that can derail wealth-building plans.

Why Do Wealthy Investors Focus on Long-Term Investments?

A defining characteristic of how rich people invest their money is their unwavering commitment to long-term investment strategies. While novice investors often chase quick profits through day trading or speculative ventures, wealthy individuals recognize that sustainable wealth builds through patient, disciplined investing over extended periods.

The advantages of long-term investing

Compound interest—what Albert Einstein allegedly called the eighth wonder of the world—works most powerfully over long time horizons. When wealthy investors commit capital for 10, 20, or 30 years, they harness exponential growth that transforms modest returns into substantial wealth.

Tax efficiency represents another compelling reason. Long-term capital gains receive preferential tax treatment compared to short-term trades, allowing wealthy investors to keep more of their returns. Additionally, strategies like tax-loss harvesting and strategic withdrawal timing further enhance after-tax returns.

Psychological benefits shouldn’t be overlooked. Long-term investors avoid the stress, time commitment, and emotional turmoil associated with constantly monitoring markets and making rapid trading decisions. This approach frees wealthy individuals to focus on their businesses, relationships, and enjoying life while their investments grow steadily.

Classic long-term investments favored by the wealthy

- Blue-chip stocks: Companies like Apple, Microsoft, Johnson & Johnson, and Berkshire Hathaway have created enormous wealth for patient investors willing to hold through market cycles.

- Real estate holdings: Rental properties and commercial real estate generate income while appreciating over decades, creating both cash flow and equity growth.

- Index funds: Warren Buffett, one of history’s most successful investors, repeatedly recommends low-cost index funds for long-term wealth building, praising their diversification and minimal fees.

- Retirement accounts: Wealthy individuals maximize contributions to tax-advantaged accounts like 401(k)s, IRAs, and specialized retirement vehicles, allowing investments to compound tax-free or tax-deferred for decades.

The lesson is clear: wealthy investors think in decades, not days. This patience, combined with consistent contributions and reinvested returns, explains much of the wealth gap between affluent individuals and average investors.

How Do Rich People Use Financial Advisors to Grow Their Money?

Professional guidance plays an instrumental role in how rich people invest their money. Rather than managing investments alone, wealthy individuals leverage the expertise of financial advisors, wealth managers, certified financial planners, and family offices to optimize their investment strategies.

The comprehensive role of financial professionals

Wealth managers provide far more than simple investment recommendations. They create holistic financial plans encompassing investment strategy, tax optimization, estate planning, insurance analysis, philanthropic giving, and intergenerational wealth transfer. This integrated approach ensures all aspects of a wealthy individual’s financial life work harmoniously toward their goals.

For ultra-high-net-worth families (typically $100 million or more), family offices provide dedicated teams managing every aspect of the family’s financial affairs, from investment management to bill payment, property oversight, and coordinating with attorneys and accountants.

Customized strategies and tax efficiency

| Service Category | Value Provided | Impact on Wealth |

|---|---|---|

| Asset Allocation | Risk-adjusted portfolio construction | Optimized risk/return profile |

| Tax Strategy | Tax-loss harvesting, timing, and account selection | 1-2% annual return enhancement |

| Estate Planning | Trust structures, gifting strategies | Preserves wealth across generations |

| Alternative Access | Private deals, hedge funds, VC opportunities | Access to institutional-grade investments |

| Risk Management | Insurance, hedging, diversification | Protection against catastrophic loss |

| Behavioral Coaching | Emotional discipline during volatility | Prevents costly investment mistakes |

How Do Rich People Generate Passive Income from Investments?

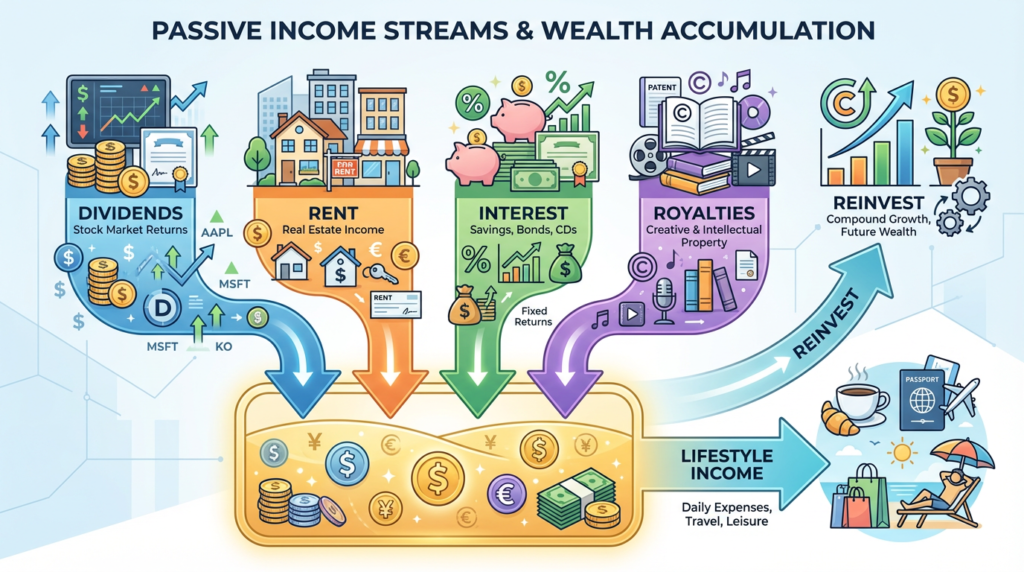

Passive income generation represents a fundamental principle of how rich people invest their money. Rather than solely pursuing capital appreciation, wealthy investors structure their portfolios to generate consistent cash flow that supports their lifestyle without requiring active labor.

Understanding passive income streams

Passive income refers to earnings generated from investments or assets that require minimal ongoing effort. Once established, these income sources provide regular cash flow while the underlying assets potentially appreciate in value, creating a powerful wealth-building combination.

Common passive income sources

- Dividend-paying stocks: Quality companies in sectors like utilities, consumer staples, and financials often distribute 2-6% of their stock price annually as dividends. A $5 million allocation to dividend stocks yielding 4% generates $200,000 annually in passive income.

- Real estate rental properties: Investment properties generate monthly rental income while the property appreciates. After accounting for expenses, many rental properties provide 5-8% annual cash-on-cash returns, plus equity growth through appreciation and mortgage paydown.

- Royalties and intellectual property: Wealthy individuals often invest in or create intellectual property that generates ongoing royalties—whether from book publishing, music, patents, or licensing agreements.

- Bond interest: Fixed-income investments like corporate bonds, municipal bonds, and Treasury securities provide predictable interest payments, offering stability and income predictability.

- Business ownership: Passive stakes in operating businesses, whether through private equity, limited partnerships, or silent ownership positions, can generate substantial distributions without requiring active management involvement.

| Passive Income Source | Typical Annual Yield | Liquidity | Risk Level |

|---|---|---|---|

| Dividend Stocks | 2-6% | High | Medium |

| Rental Real Estate | 5-10% | Low | Medium |

| Corporate Bonds | 3-7% | Medium | Low-Medium |

| REITs | 3-8% | High | Medium |

| Private Business Stakes | 8-15%+ | Very Low | High |

| Royalties/IP | Highly Variable | Low | Medium-High |

The compounding effect of reinvested passive income

Many wealthy investors reinvest their passive income during wealth-accumulation phases, creating a snowball effect. Dividend payments purchase additional shares, rental income funds property improvements or additional acquisitions, and business distributions get reinvested into new opportunities—accelerating wealth growth exponentially.

The strategic pursuit of passive income explains how rich people invest their money not just for net worth growth but for financial freedom—the ability to live abundantly without depending on employment income.

How Do Wealthy Investors Balance Income and Capital Growth?

Sophisticated investors understand that how rich people invest their money involves balancing two distinct objectives: generating current income and achieving long-term capital appreciation. This balance shifts throughout different life stages and according to individual financial goals.

Income-focused versus growth-focused investing

Income-focused strategies prioritize current cash flow through dividends, interest payments, and rental income. These approaches suit investors seeking to fund current lifestyle expenses, retirees, or those pursuing financial independence. The trade-off is typically slower capital appreciation.

Growth-focused strategies emphasize capital appreciation over current income, reinvesting profits to maximize long-term wealth accumulation. These approaches suit younger investors, those with sufficient income from other sources, or individuals in wealth-accumulation phases.

Strategies achieving both objectives

- Dividend growth stocks: Companies like Procter & Gamble, Coca-Cola, and Johnson & Johnson provide growing dividend income while their stock prices appreciate over time, delivering both current income and capital growth.

- Real Estate Investment Trusts (REITs): These vehicles distribute 90% of taxable income as dividends (providing income) while the underlying real estate appreciates (providing growth), making them ideal for balanced objectives.

- Balanced private equity: Some private equity funds structure distributions to provide current income while retaining sufficient capital for growth investments, satisfying both needs.

- Convertible bonds: These securities pay interest like traditional bonds but can convert to equity, offering income protection with growth participation if the company succeeds.

Portfolio adjustment across life stages

| Life Stage | Typical Age | Income Focus | Growth Focus | Rationale |

|---|---|---|---|---|

| Wealth Accumulation | 25-45 | 20% | 80% | Maximize compound growth |

| Pre-Retirement | 45-60 | 40% | 60% | Build income streams, maintain growth |

| Early Retirement | 60-70 | 60% | 40% | Fund lifestyle, preserve capital |

| Later Retirement | 70+ | 75% | 25% | Stability, income, legacy planning |

A 35-year-old entrepreneur who sold their business for $10 million might allocate 80% toward growth investments (growth stocks, venture capital, development real estate) and 20% toward income (dividend stocks, bonds) to maximize long-term wealth. Conversely, a 65-year-old retiree with the same $10 million might reverse that allocation, prioritizing sustainable income to fund retirement while maintaining some growth exposure to combat inflation.

Understanding how to calibrate this balance based on personal circumstances represents a hallmark of sophisticated investing and explains much about how rich people invest their money across different life phases.

What Habits Make Rich People Successful Investors?

Beyond strategies and asset allocation, specific behavioral habits distinguish how rich people invest their money from those of average investors. These disciplines and practices compound over time, creating substantial advantages in wealth accumulation.

Continuous learning and market awareness

Wealthy investors dedicate time to understanding markets, economic trends, and investment opportunities. They read financial publications, attend conferences, study annual reports, and stay informed about geopolitical developments affecting their holdings. This knowledge enables them to make informed decisions and identify opportunities others miss.

Warren Buffett reportedly spends 80% of his day reading and thinking—a habit that has contributed to his becoming one of history’s wealthiest individuals. While most people don’t need to dedicate that much time, successful investors consistently prioritize financial education.

Disciplined investing and emotional control

The wealthy maintain strict investment discipline, following predetermined strategies rather than reacting emotionally to market fluctuations. When markets crash and fear dominates, disciplined investors recognize opportunities to purchase quality assets at discounted prices. When euphoria drives markets to excessive valuations, they exercise restraint or take profits.

This emotional discipline prevents the classic mistake of buying high (when everyone is excited) and selling low (when panic strikes)—a pattern that destroys wealth for undisciplined investors.

Long-term planning and goal-setting

Successful wealthy investors establish clear financial goals with specific timelines and required returns. They create detailed investment plans aligned with these objectives and review progress regularly. This clarity prevents aimless investing and ensures every decision advances their ultimate financial vision.

Networking and learning from peers

The wealthy actively network with other successful investors, sharing insights, opportunities, and lessons learned. Mastermind groups, investment clubs, and professional organizations provide access to collective wisdom that enhances individual decision-making.

Key habits comparison

| Habit | Wealthy Investors | Average Investors |

|---|---|---|

| Research Time | 5-10+ hours weekly | Minimal or sporadic |

| Investment Horizon | 10-30+ years | 1-5 years |

| Emotional Response to Volatility | Opportunistic, calm | Fearful, reactive |

| Professional Guidance | Regularly utilize experts | DIY or occasional consultation |

| Diversification | Extensive across asset classes | Limited, often stock-heavy |

| Continuous Education | Ongoing priority | Occasional interest |

These habits aren’t innate abilities—they’re learned behaviors anyone can develop. Understanding and implementing them provides insight into how rich people invest their money successfully over decades.

How Do Rich People Handle Investment Risks Differently from Average Investors?

Risk management represents a critical distinction in how rich people invest their money compared to typical investors. Rather than avoiding risk entirely or taking reckless chances, wealthy investors calculate, manage, and strategically accept risks that offer favorable reward potential.

Understanding calculated risk versus recklessness

Wealthy investors recognize that all investments carry risk—even supposedly “safe” options like cash erode in value due to inflation. The question isn’t whether to accept risk, but which risks offer appropriate compensation for the potential downside.

Before committing capital, sophisticated investors conduct thorough due diligence, analyzing potential returns against possible losses, probability of outcomes, time horizons, and how the investment fits within their broader portfolio. They accept risks they understand and can afford, while avoiding those that could cause catastrophic losses.

Risk management strategies

- Diversification: As discussed earlier, spreading investments across uncorrelated assets reduces the impact of any single investment failure.

- Hedging: Wealthy investors use options, futures, and other derivative instruments to protect against downside risk in their holdings. For example, purchasing put options on stock holdings provides insurance against market crashes.

- Position sizing: Rather than betting everything on a single opportunity, wealthy investors limit position sizes. A common rule suggests no single investment should represent more than 5-10% of total portfolio value, ensuring that even complete losses don’t devastate overall wealth.

- Insurance: Beyond investment hedging, wealthy individuals protect their assets through comprehensive insurance coverage—life, disability, liability, property, and specialized policies protecting against unique risks.

Psychological approach to volatility

Perhaps the most significant difference lies in mindset. When markets decline, average investors panic and sell at a loss, fearing further drops. Wealthy investors view these same declines as opportunities to purchase quality assets at discount prices.

This perspective stems from long-term thinking and sufficient liquidity reserves. Because wealthy investors don’t need to access all their capital immediately, temporary price declines become buying opportunities rather than threats.

| Risk Scenario | Average Investor Response | Wealthy Investor Response |

|---|---|---|

| Market drops 30% | Panic selling, fear | Strategic buying, opportunity |

| Investment underperforms | Immediate sale, frustration | Analysis, patience, or rebalancing |

| A new opportunity appears | FOMO-driven impulse buying | Due diligence, risk assessment |

| Portfolio volatility | Constant monitoring, stress | Periodic review, calm assessment |

Understanding how rich people invest their money requires recognizing that they don’t avoid risk—they manage it systematically, viewing market turbulence as an inherent characteristic of wealth-building rather than something to fear.

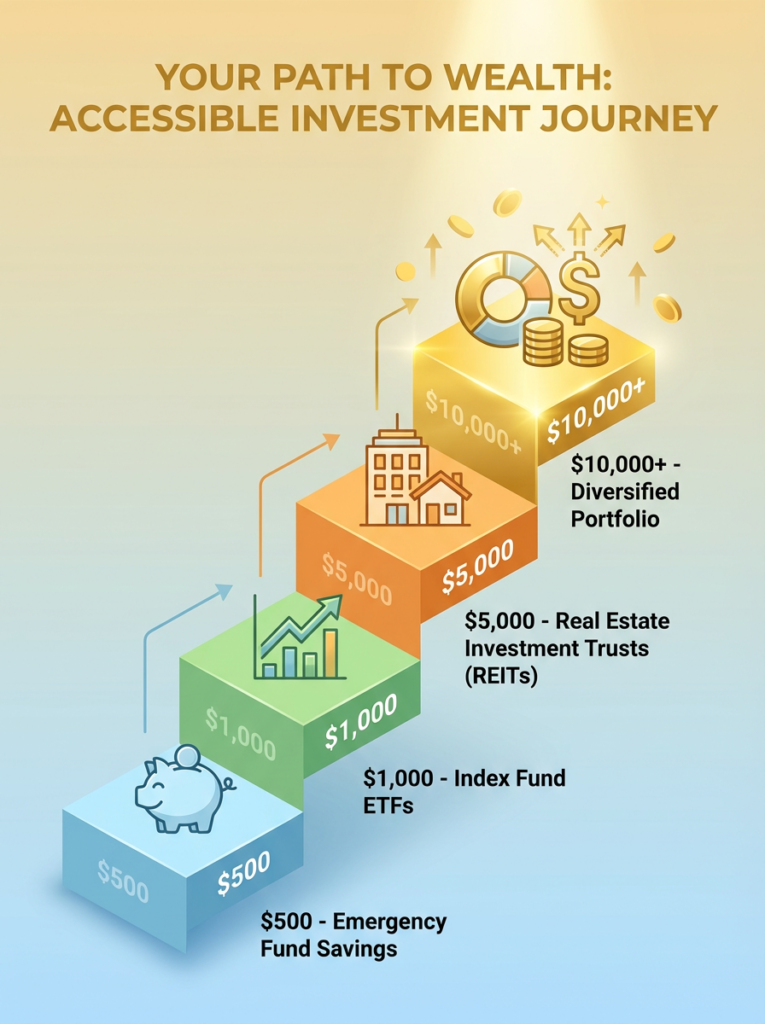

How Can Middle-Class Investors Adopt Strategies Used by the Wealthy?

While examining how rich people invest their money might seem like observing a distant, inaccessible world, many wealth-building strategies can be adapted by middle-class investors. The principles of how rich people invest their money scale across different portfolio sizes. Understanding how rich people invest their money reveals strategies that work regardless of starting capital.

The way rich people invest their money follows principles accessible to investors at all wealth levels. How rich people invest their money demonstrates that success comes from disciplined application of sound strategies, not from exclusive access to secret opportunities. Learning how rich people invest their money empowers middle-class investors to build substantial wealth over time.

Accessible alternatives to exclusive investments

- Instead of private equity, how rich people invest their money in private equity can be replicated through publicly traded private equity firms, business development companies (BDCs), or interval funds. The way rich people invest their money in private equity offers similar exposure with lower minimums for middle-class investors.

- Instead of hedge funds, how rich people invest their money in hedge funds can be approximated through liquid alternative mutual funds or ETFs employing similar strategies. The way rich people invest their money in long-short equity, managed futures, or market-neutral approaches becomes accessible through these vehicles.

- Instead of direct real estate, how rich people invest their money in direct property ownership can be replicated through REITs, real estate crowdfunding platforms (Fundrise, RealtyMogul), or real estate syndications. The way rich people invest their money in real estate becomes accessible with minimums as low as $500-$5,000.

- Instead of venture capital, how rich people invest their money in early-stage companies can be accessed through equity crowdfunding platforms (StartEngine, Republic) or publicly traded venture capital funds. The way rich people invest their money in startups becomes available to smaller investors through these democratized platforms.

- Instead of expensive financial advisors, how rich people invest their money with professional guidance can be replicated through robo-advisors offering algorithm-driven portfolio management. The way rich people invest their money with advisors becomes accessible through fee-only financial planners charging hourly rates.

Practical implementation strategies

| Wealthy Strategy | Middle-Class Adaptation | Minimum Investment |

|---|---|---|

| Direct private equity | BDC funds, interval funds | $1,000-$2,500 |

| Hedge fund investments | Liquid alternative ETFs | Cost of 1 share (~$25-$100) |

| Direct property ownership | REITs, real estate crowdfunding | $500-$1,000 |

| Venture capital funds | Equity crowdfunding, VC ETFs | $100-$500 |

| Art & collectibles | Fractional ownership platforms (Masterworks) | $1,000-$10,000 |

| Family office services | Robo-advisors, fee-only planners | $0-$500 minimum |

Building wealth through consistent investing

How rich people invest their money can be emulated through dollar-cost averaging consistently. While examining how rich people invest their money might show large, periodic investments, middle-class investors can invest smaller amounts regularly, monthly or even with each paycheck. The way rich people invest their money, principles apply equally to systematic small investments.

This systematic approach in how rich people invest their money automatically buys more shares when prices are low and fewer when prices are high, reducing the impact of market timing. How rich people invest their money demonstrates that a 30-year-old investing $500 monthly in a diversified portfolio earning 8% annually would accumulate approximately $745,000 by age 65—proving how consistent application of sound principles builds substantial wealth regardless of starting point.

The core lesson in how rich people invest their money follows principles—diversification, long-term focus, disciplined saving, risk management—that work at any wealth level. How rich people invest their money shows that starting small doesn’t prevent eventually achieving substantial wealth through patient, consistent application of these strategies. The way rich people invest their money can be replicated by anyone committed to following proven wealth-building principles.

What Mistakes Do Rich People Avoid That Average Investors Often Make?

Understanding how rich people invest their money requires examining not just what they do, but what they avoid. The way rich people invest their money involves sidestepping common pitfalls that derail wealth-building for many individuals. How rich people invest their money successfully comes partly from avoiding mistakes that destroy wealth for undisciplined investors.

Wealthy investors have typically learned—either through personal experience or observation—the costly mistakes to avoid. How rich people invest their money demonstrates wisdom gained from understanding what doesn’t work. The way rich people invest their money prioritizes avoiding errors as much as making correct decisions.

Avoiding high-interest consumer debt

How rich people invest their money recognizes that paying 15-25% interest on credit card debt or consumer loans makes building wealth mathematically impossible. The way rich people invest their money strategically uses leverage for investments or business opportunities, but avoids expensive consumer debt that drains resources without generating returns.

Before investing, how rich people invest their money ensures they’ve eliminated high-interest debt—a principle middle-class investors should prioritize equally. The strategy of how rich people invest their money puts debt elimination before portfolio building when dealing with high-interest obligations.

Resisting emotional trading

The average investor buys when markets reach peaks (driven by greed and fear of missing out) and sells when markets bottom (driven by panic and loss aversion). How rich people invest their money avoids this emotional pattern that guarantees buying high and selling low—the opposite of successful investing.

How rich people invest their money maintains predetermined strategies and sticks to them regardless of emotional impulses. The way rich people invest their money is that successful investing requires acting counter to emotions—buying when fear is high and selling or rebalancing when euphoria dominates.

Avoiding trend chasing

When cryptocurrency, cannabis stocks, or meme stocks dominate financial news, average investors often pile in at peak valuations. How rich people invest their money recognizes that by the time an investment trend reaches mainstream consciousness, early opportunities have typically passed.

Rather than chasing trends, how rich people invest their money conducts fundamental analysis, identifying quality investments trading below intrinsic value, regardless of current popularity. The way rich people invest their money focuses on value, not popularity.

Maintaining diversification

Average investors often concentrate holdings in their employer’s stock, their local real estate market, or a handful of favored companies. How rich people invest their money spreads risk across numerous investments, asset classes, and geographic regions. The way rich people invest their money ensures no single failure significantly impacts overall wealth.

Prioritizing tax planning

Many average investors focus solely on gross returns, ignoring the critical impact of taxes on actual wealth accumulation. How rich people invest their money structures investments tax-efficiently, utilizing retirement accounts, tax-loss harvesting, qualified dividend strategies, and long-term capital gains treatment. The way rich people invest their money minimizes tax burdens through strategic planning.

Conducting thorough due diligence

Average investors often invest based on tips, headlines, or superficial research. How rich people invest their money conducts extensive due diligence—reading prospectuses, analyzing financial statements, understanding business models, and assessing management quality before committing capital.

Common mistakes in comparison

| Mistake | Impact on Wealth | Wealthy Investor Approach |

|---|---|---|

| High-interest debt | Compounds losses, prevents growth | Eliminate before investing |

| Emotional trading | Buy high, sell low pattern | Predetermined strategy, discipline |

| Trend chasing | Enter at peaks, poor timing | Fundamental analysis, patience |

| Poor diversification | Concentration risk, catastrophic loss potential | Broad diversification across assets |

| Tax inefficiency | 1-3% annual drag on returns | Strategic tax planning, account selection |

| Insufficient research | Avoidable losses, missed red flags | Thorough due diligence, professional advice |

| Lack of patience | Transaction costs, missed compounding | Long-term focus, minimal trading |

By understanding what to avoid, investors at any wealth level can eliminate self-inflicted obstacles and better replicate how rich people invest their money successfully. The way rich people invest their money demonstrates that avoiding mistakes matters as much as making correct decisions. How rich people invest their money shows that wealth preservation through error avoidance contributes significantly to long-term success.

How Do Wealthy People Invest in Real Estate vs. the Stock Market?

Real estate and equities represent two fundamental pillars of how rich people invest their money. Rather than choosing one over the other, how rich people invest their money typically allocates to both, recognizing their complementary characteristics. Understanding how rich people invest their money across both asset classes reveals sophisticated portfolio construction that maximizes risk-adjusted returns.

The way rich people invest their money balances real estate and stock market investments strategically. How rich people invest their money demonstrates that these asset classes serve different roles within diversified portfolios. Examining how rich people invest their money reveals that combining both provides superior results compared to concentrating in either exclusively.

Real estate investment strategies

How rich people invest their money in real estate employs multiple strategies:

- Rental properties: How rich people invest their money in single-family homes, multi-family buildings, or apartment complexes generates monthly income while appreciating over time. The way rich people invest their money in rental real estate often achieves 10-15% total annual returns after accounting for mortgage paydown, appreciation, tax benefits, and cash flow.

- Commercial real estate: How rich people invest their money in office buildings, retail centers, industrial warehouses, and self-storage facilities offers higher income potential. The way rich people invest their money in commercial properties provides longer-term leases than residential properties, though requiring larger capital commitments and specialized knowledge.

- Real estate development: How rich people invest their money in purchasing land, developing properties, and selling at completion offers substantial profit potential. The way rich people invest their money in development carries a higher risk and requires significant expertise and capital.

- REITs and real estate funds: For passive exposure, how rich people invest their money includes publicly traded REITs or private real estate funds managed by professionals. The way rich people invest their money in these vehicles provides real estate exposure without direct management responsibilities.

Stock market investment approaches

- Individual stocks: How rich people invest their money often involves concentrated positions in companies they understand deeply. The way rich people invest their money focuses particularly on sectors where they have professional expertise.

- Index funds and ETFs: Following Warren Buffett’s advice, how rich people invest their money maintains substantial index fund positions. The way rich people invest their money in index funds provides diversified market exposure with minimal fees.

- Dividend aristocrats: How rich people invest their money in companies with histories of consistent dividend growth provides income and capital appreciation. The way rich people invest their money in dividend aristocrats offers balanced returns.

- Growth stocks: How rich people invest their money is allocated to high-growth technology, healthcare, or emerging industry companies. The way rich people invest their money in growth stocks provides portfolio appreciation potential.

Comparing real estate and stock markets

| Characteristic | Real Estate | Stock Market |

|---|---|---|

| Liquidity | Low (weeks to months to sell) | High (seconds to minutes) |

| Volatility | Lower, gradual changes | Higher, rapid fluctuations |

| Income Generation | Monthly rent, predictable | Quarterly dividends, variable |

| Tax Benefits | Depreciation, 1031 exchanges | Qualified dividends, long-term gains |

| Leverage Opportunity | High (70-80% loan-to-value common) | Limited (50% margin maximum) |

| Management Requirement | Active (tenants, maintenance) | Passive (minimal involvement) |

| Typical Returns | 8-12% total return | 10-12% historical average |

| Inflation Protection | Excellent (rents rise with inflation) | Good (varies by sector) |

Balancing both for optimal wealth building

How rich people invest their money recognizes that real estate and stocks offer different advantages. The way rich people invest their money in real estate provides tangible assets, tax benefits, leverage opportunities, and inflation protection. How rich people invest their money in stocks offers liquidity, diversification, minimal management requirements, and easier entry/exit.

A balanced approach in how rich people invest their money might allocate 60% to stocks (providing liquidity and growth) and 40% to real estate (providing income, tax benefits, and diversification). How rich people invest their money this way captures the strengths of both asset classes while mitigating their respective weaknesses.

Understanding how rich people invest their money across both real estate and stock markets reveals that diversification across asset classes—not concentration in a single investment type—creates optimal risk-adjusted returns over time. The way rich people invest their money demonstrates that combining these complementary assets builds wealth more effectively than choosing one exclusively.

How Do Rich People Invest in Startups and Private Companies?

Venture capital and angel investing represent distinctive elements of how rich people invest their money, offering exposure to innovation and potentially exponential returns. The way rich people invest their money in startups provides access to opportunities unavailable in public markets. Understanding how rich people invest their money in early-stage companies reveals high-risk, high-reward strategies that can significantly accelerate wealth accumulation.

How rich people invest their money in startups carries substantial risk, but their inclusion in diversified portfolios can generate outsized gains. The way rich people invest their money through venture capital and angel investing demonstrates sophisticated risk management while pursuing asymmetric return opportunities.

Understanding venture capital and angel investing

How rich people invest their money through angel investing involves individuals providing capital to early-stage startups, typically in exchange for equity or convertible debt. The way rich people invest their money as angel investors ranges from $25,000 to $500,000 per company, often made by successful entrepreneurs or executives with relevant industry expertise.

How rich people invest their money in venture capital firms pools money from wealthy individuals and institutions to make larger investments ($1 million to $100 million+) in startups. The way rich people invest their money accesses venture capital by investing in VC funds, becoming limited partners in the fund’s portfolio.

Evaluation criteria for startup investments

- Scalability: How rich people invest their money in startups seeks businesses capable of growing revenues exponentially without proportionally increasing costs. The way rich people invest their money recognizes that software, technology platforms, and digital businesses typically offer superior scalability.

- Management team: How rich people invest their money evaluates that the quality, experience, and track record of founders and executives often matter more than the initial product or idea. The way rich people invest their money backs exceptional teams capable of navigating challenges and pivoting strategies when necessary.

- Market opportunity: How rich people invest their money targets startups addressing large, growing markets with inadequate existing solutions. The way rich people invest their money recognizes that a superior product in a small, stagnant market has limited upside regardless of execution quality.

- Competitive advantages: How rich people invest their money seeks sustainable competitive moats—proprietary technology, network effects, brand strength, and regulatory barriers. The way rich people invest their money looks for protections from competition that enable long-term value creation.

- Traction and metrics: How rich people invest their money examines evidence of product-market fit through customer growth, retention rates, revenue growth, and unit economics. The way rich people invest their money assesses whether a startup has genuine potential or merely an interesting concept.

Risk, reward, and diversification

How rich people invest their money in startups follows a power law distribution: most investments fail completely, some generate modest returns, and a tiny percentage produce extraordinary gains. The way rich people invest their money expects 50-70% of startup investments to fail, 20-30% to return capital or modest profits, and 5-10% to generate returns of 10x, 50x, or even 100x their investment.

This return distribution in how rich people invest their money necessitates broad diversification. The way rich people invest their money typically spreads across 15-30+ startups across different sectors and stages, recognizing that identifying the few massive winners in advance is impossible.

Startup investment allocation

| Investment Stage | Typical Check Size | Risk Level | Potential Return | Time Horizon |

|---|---|---|---|---|

| Pre-seed/Seed | $25K-$250K | Extremely High | 50-100x possible | 7-10 years |

| Series A | $250K-$1M | Very High | 20-50x possible | 5-8 years |

| Series B/C | $500K-$5M | High | 10-20x possible | 4-7 years |

| Late Stage | $1M-$10M+ | Medium-High | 3-10x possible | 2-5 years |

Understanding how rich people invest their money in startups reveals that they accept high failure rates in exchange for asymmetric return potential. The way rich people invest their money demonstrates that successful investments generate gains far exceeding all losses combined, dramatically accelerating overall wealth accumulation. How rich people invest their money in venture capital and angel investing represents sophisticated portfolio allocation that balances risk with extraordinary upside potential.

How Do Rich People Invest in International Markets?

Global diversification represents an essential component of how rich people invest their money in today’s interconnected economy. By allocating capital across different countries and regions, how rich people invest their money accesses high-growth opportunities and reduces concentration risk. The way rich people invest their money internationally protects against domestic economic or political challenges while capturing global growth opportunities.

Understanding how rich people invest their money globally reveals sophisticated diversification strategies that enhance returns while managing risk. How rich people invest their money across international markets demonstrates that geographic diversification provides similar benefits to asset class diversification.

Benefits of international diversification

- Exposure to faster-growing economies: How rich people invest their money recognizes that while developed markets like the United States and Europe grow 2-3% annually, emerging markets in Asia, Africa, and Latin America often experience 5-8% GDP growth. The way rich people invest their money captures these superior growth rates through international allocation.

- Currency diversification: How rich people invest their money holds assets denominated in multiple currencies, protecting against domestic currency devaluation. The way rich people invest their money provides exposure to strengthening foreign currencies while hedging against dollar weakness.

- Reduced portfolio volatility: How rich people invest their money across international markets that don’t move in perfect correlation with domestic markets reduces overall portfolio volatility. When U.S. markets decline, the way rich people invest their money demonstrates that foreign markets may remain stable or even appreciate.

- Access to unique opportunities: How rich people invest their money recognizes that certain industries, resources, or innovations concentrate in specific regions. The way rich people invest their money globally ensures access to opportunities unavailable domestically—from European luxury brands to Asian technology companies to African mobile payment platforms.

Methods for international exposure

- International stocks and ADRs: How rich people invest their money to purchase individual foreign companies through American Depositary Receipts (ADRs) or directly on foreign exchanges. The way rich people invest their money provides targeted exposure to specific companies or sectors.

- International ETFs and mutual funds: How rich people invest their money in funds tracking international indexes (MSCI EAFE, MSCI Emerging Markets) offers instant diversification. The way rich people invest their money is across dozens or hundreds of foreign companies with single transactions.

- International real estate: How rich people invest their money to purchase properties in growing foreign markets, either directly or through international real estate funds. The way rich people invest their money in global real estate captures appreciation in high-growth regions.

- Emerging market bonds: How rich people invest their money in government and corporate bonds from developing nations offers higher yields. The way rich people invest their money recognizes that these provide greater returns than developed market equivalents, though with additional risk.

Geographic allocation strategy

| Region | Typical Allocation | Primary Appeal | Key Considerations |

|---|---|---|---|

| United States | 40-60% | Stability, liquidity, innovation | Home bias, already the largest holding |

| Developed International | 15-25% | Established markets, stability | Slower growth, aging demographics |

| Emerging Markets | 10-20% | High growth, demographics | Higher volatility, political risk |

| Frontier Markets | 5-10% | Exceptional growth potential | Very high risk, limited liquidity |

Managing foreign exchange and geopolitical risks

How rich people invest their money internationally introduces currency risk—even if foreign investments perform well, unfavorable exchange rate movements can reduce returns. The way rich people invest their money manages this through hedging strategies using currency futures or options, or by maintaining some currency exposure as a natural diversifier.

How rich people invest their money considers geopolitical risks—political instability, regulatory changes, nationalization, or conflicts—requiring careful assessment. The way rich people invest their money researches political climates, diversifies across multiple countries, and often consults with international experts or specialized fund managers with local knowledge.

Understanding how rich people invest their money globally reveals that geographic diversification, like asset class diversification, reduces risk while expanding opportunity. The way rich people invest their money demonstrates that international allocation represents a fundamental principle for building and preserving wealth across generations. How rich people invest their money across global markets provides exposure to the world’s growth while protecting against domestic concentration risk.

Conclusion

Examining how rich people invest their money reveals a consistent set of principles that transcend specific market conditions, economic cycles, or individual circumstances. Understanding how rich people invest their money shows that wealth building doesn’t depend on secret strategies or exclusive opportunities. The way rich people invest their money demonstrates disciplined application of time-tested investment principles that anyone can learn and implement.

How rich people invest their money prioritizes diversification across asset classes, geographies, and investment types, protecting against catastrophic losses while positioning for consistent growth. The way rich people invest their money maintains unwavering long-term focus, allowing compound growth to work its exponential magic over decades. How rich people invest their money leverages professional expertise to optimize strategies, minimize taxes, and avoid costly behavioral mistakes.

Perhaps most importantly, how rich people invest their money views investing as a continuous journey requiring ongoing education, emotional discipline, and adaptation to changing circumstances. The way rich people invest their money embraces calculated risks, manages them systematically, and views market volatility as an opportunity rather than a threat.

The encouraging reality of how rich people invest their money is that these principles scale across all wealth levels. Whether starting with $1,000 or $10 million, how rich people invest their money demonstrates that the fundamentals remain constant: diversify broadly, invest consistently, think long-term, control emotions, minimize costs and taxes, and continuously learn.

How rich people invest their money shows that building substantial wealth rarely happens overnight. The way rich people invest their money results from patient, disciplined application of sound investment principles over many years. By understanding and implementing how rich people invest their money—through diversified portfolios, long-term focus, professional guidance, and disciplined habits—investors at any wealth level can set themselves on a path toward financial security.

The journey of how rich people invest their money begins not with large capital but with the decision to apply these proven strategies consistently. How rich people invest their money demonstrates that wealth follows naturally from commitment to strategic, thoughtful investing aligned with your unique goals and timeline. The way rich people invest their money provides a blueprint that anyone can follow to build lasting wealth.

Learning how rich people invest their money and applying these principles transforms financial futures. How rich people invest their money proves that with discipline, patience, and strategic thinking, substantial wealth accumulation becomes achievable for dedicated investors at any starting point.

FAQs

Q. How do rich people usually invest their money?

- Rich people typically invest across multiple asset classes, including stocks, real estate, private businesses, and alternative investments. Their focus is on diversification, long-term growth, and consistent passive income rather than short-term gains.

Q. Do wealthy people invest more in stocks or real estate?

- Wealthy investors usually invest in both. Stocks provide liquidity and long-term growth, while real estate offers stable cash flow and asset appreciation. Most rich investors balance these two based on risk tolerance and financial goals.

Q. Why do rich people prefer long-term investments?

- Long-term investments allow wealthy investors to benefit from compounding, reduce tax liabilities, and minimize the impact of market volatility. This approach helps preserve and grow wealth steadily over time.

Q. What types of alternative investments do rich people choose?

- Common alternative investments among wealthy individuals include private equity, venture capital, hedge funds, commodities, art, collectibles, and sometimes cryptocurrencies. These assets help diversify portfolios and enhance returns.

Q. Can middle-class investors use the same strategies as rich people?

- Yes, middle-class investors can adopt similar strategies by investing consistently, focusing on long-term growth, using low-cost index funds, diversifying assets, and improving financial education over time.

Q. Is investing the main reason rich people stay wealthy?

- Yes, investing plays a major role in maintaining and growing wealth. Wealthy individuals reinvest profits, focus on asset ownership, and allow their money to compound over time.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.