How Savings Account Interest Is Credited Monthly in Banks

Understanding how your savings account earns interest isn’t just about knowing the annual percentage yield (APY) advertised by your bank. For the millions of Americans holding savings accounts, knowing exactly when and how savings account interest gets credited to your account can make a real difference in managing your finances and maximizing returns.

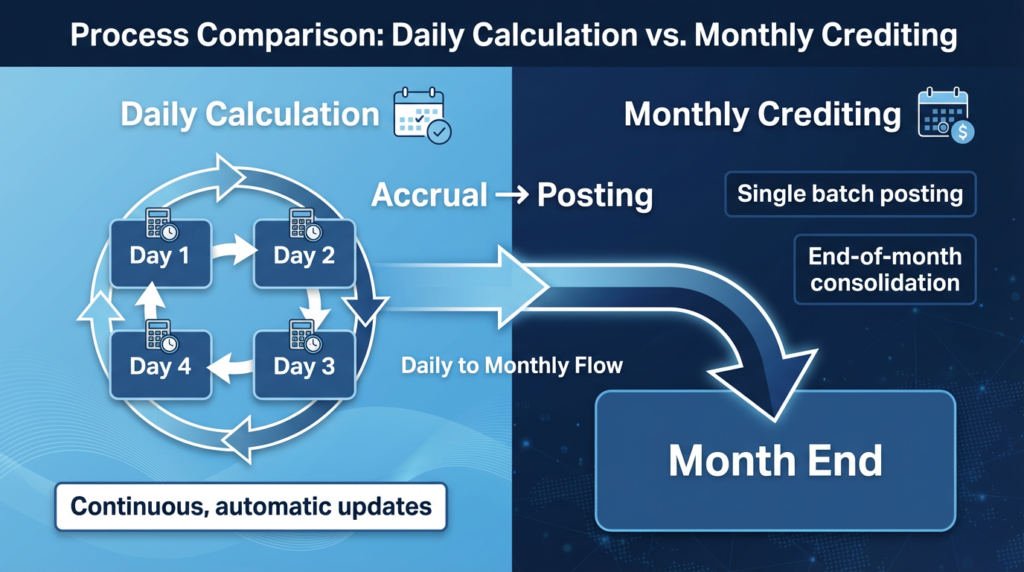

There’s an important distinction that confuses many savers: interest calculation versus interest posting. While your bank calculates savings account interest on your balance every single day, that interest typically gets added to your account—or “credited”—just once per month. This means your money is constantly earning, but you’ll only see those earnings appear in your available balance on specific dates.

In this comprehensive guide, we’ll walk through exactly how U.S. banks handle monthly interest crediting, from the behind-the-scenes daily calculations to the moment savings account interest appears in your account. You’ll learn how to verify your interest is correct, understand why timing matters, and discover how monthly crediting affects your long-term savings growth.

How Banks Calculate Savings Account Interest Daily

Before savings account interest can be credited monthly, banks must first calculate how much you’ve earned. This happens every single day, even though you won’t see the results until the month’s end.

Most U.S. banks use the Average Daily Balance (ADB) method to determine savings account interest. Here’s how it works: at the end of each day, the bank records your account balance. If you had $5,000 on Monday, deposited $1,000 on Tuesday, and withdrew $500 on Wednesday, the bank notes each of these daily balances separately. At the end of the month, all these daily balances are added together and divided by the number of days in that month to get your average daily balance.

Why does this matter? Because it means every deposit you make starts earning savings account interest the very next business day, and every withdrawal stops earning interest immediately. This daily calculation ensures fairness—you’re credited for exactly the amount of time your money sat in the account.

U.S. banks employ daily compounding even when savings account interest is credited monthly. This means that while you won’t see the interest added to your balance until the end of the month, the bank’s internal systems are calculating interest on an ever-so-slightly increasing balance each day. In practice, this difference is minimal for monthly crediting, but it becomes the foundation for the APY calculation that accounts for compound growth over a full year.

Let’s walk through a simplified example: Imagine you maintain exactly $10,000 in your savings account for the entire month of January (31 days), and your account has a 4.00% APY. The bank calculates daily interest by taking your balance, multiplying it by the daily rate (roughly 0.011% per day), and tracking this amount internally. Each day adds a small amount to your accrued interest. By January 31st, all these daily calculations are summed up, and the total savings account interest—approximately $32.88 for the month—is posted to your account.

| Key Concept | What It Means |

|---|---|

| Daily Balance | The amount in your account at the end of each day |

| Average Daily Balance | Sum of all daily balances ÷ number of days in the month |

| Daily Compounding | Interest calculated on your balance plus previously accrued interest |

| Accrued Interest | Interest earned but not yet posted to your account |

How Monthly Interest Is Credited in U.S. Bank Systems

When the designated interest crediting date arrives, your bank’s core banking system springs into action to process savings account interest. This isn’t a manual process—sophisticated software handles interest calculations for millions of accounts simultaneously.

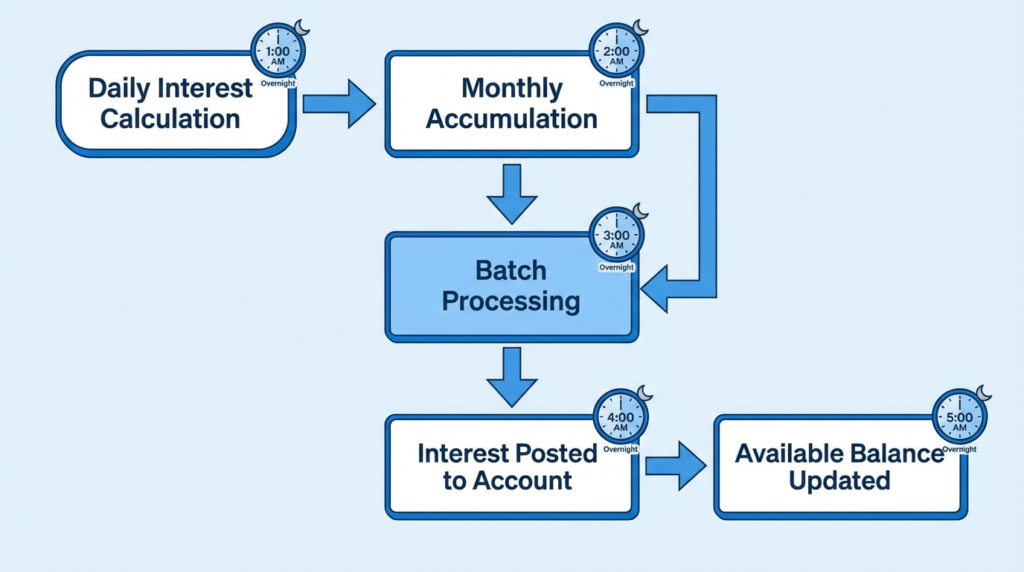

Inside the bank’s technology infrastructure, the core banking system serves as the central hub that tracks all account activities. Throughout the month, this system has been logging your daily balances and calculating accrued savings account interest behind the scenes. When it’s time to credit interest, the system runs what’s called a batch process—typically overnight or in the early morning hours.

During this end-of-cycle processing, the system does several things: it finalizes all daily interest calculations for the month, verifies the totals against regulatory requirements, and then executes what bankers call the “interest posting.” This is the moment when savings account interest moves from an internal accrued status to your actual available balance.

For most customers, this happens automatically while they sleep. You might go to bed on the last day of the month with $10,000 in your account and wake up on the first day of the next month to find $10,032.88—the interest has been credited. The transaction will appear in your account history with descriptions like “Interest Paid,” “Monthly Interest,” or “INTCR” (interest credit).

Why after midnight? Banks process these transactions during off-peak hours to avoid interfering with daytime transaction processing. This batch processing approach allows banks to handle savings account interest crediting efficiently and accurately across their entire customer base. It’s also why you might notice the interest transaction timestamped at 2:00 AM or 3:00 AM—that’s when the bank’s systems were running their overnight processes.

When and Why Monthly Interest Is Credited (Timing & Delays)

Not all banks credit savings account interest on the same day, which often confuses savers who hold accounts at multiple institutions. Some banks credit on the last calendar day of the month, others use your statement cycle date, and some choose the first business day of the following month.

The variation in posting schedules stems from different operational practices and system configurations. Banks that use calendar month crediting will post savings account interest on January 31st, February 28th (or 29th), and so on. Banks using statement cycle crediting align interest posting with your individual account’s monthly statement date—if your statement closes on the 15th, that’s when you’ll see interest credited.

U.S. federal holidays and weekends can complicate the timing. If your bank’s scheduled interest crediting date falls on a Saturday, Sunday, or federal holiday, the posting typically gets delayed until the next business day. For example, if January 31st falls on a Sunday, you’ll likely see your savings account interest credited on Monday, February 1st. This isn’t a bank error—it’s standard banking practice since most batch processing systems don’t run on non-business days.

Rare system delays can occur. Banks occasionally experience technical maintenance windows, system upgrades, or processing delays that push savings account interest crediting back by a day or two. While uncommon, these situations are usually temporary, and the bank will still credit the full amount you’re owed.

If you don’t see your expected savings account interest credited within two business days of your normal posting date, it’s worth contacting your bank. Check your recent account history first to ensure you didn’t miss the transaction. If it’s genuinely missing, customer service can investigate whether there’s a system issue or if your account experienced an unusual circumstance that affected crediting.

How Interest Rate Changes Affect Monthly Interest in the U.S.

Savings account interest rates aren’t fixed. Most U.S. savings accounts carry variable interest rates that can change at any time based on Federal Reserve actions, competitive pressures, or bank policy decisions.

When your bank changes your savings account rate mid-month, the impact on your monthly interest credit is immediate and proportional. Here’s how it works: if you earned 4.00% APY for the first 15 days of the month and your rate increased to 4.50% APY for the remaining days, your daily interest calculations will reflect both rates for their respective periods. The bank doesn’t average out the rates or apply only the final rate—instead, each day’s savings account interest accrual uses the rate that was in effect that specific day.

This daily accrual system ensures fairness during rate changes. You benefit from rate increases starting the day they take effect, and conversely, you’ll earn less when rates drop. The monthly savings account interest you receive represents the true day-by-day accumulation across whatever rates were active during that month.

Promotional and bonus interest rates follow special rules. Many high-yield savings accounts offer introductory bonus rates for the first few months. These bonuses are typically tracked separately and may be credited in addition to your base savings account interest, sometimes on different schedules. Always read the terms carefully—some promotional rates require maintaining minimum balances or completing certain activities to qualify.

Tiered savings accounts add another layer of complexity. These accounts pay different rates based on your balance level. For example, you might earn 3.50% on the first $10,000, 4.00% on amounts from $10,001 to $50,000, and 4.50% on anything above $50,000. If your balance fluctuates between tiers during the month, the daily calculations will apply the appropriate tier rate to each portion of your balance each day.

| Rate Change Scenario | How It’s Handled |

|---|---|

| Mid-month rate increase | Higher rate applies from the change date forward |

| Mid-month rate decrease | Lower rate applies from the change date forward |

| Promotional bonus rate | Often credited separately, check terms |

| Tiered balance account | Different rates apply to different balance portions daily |

Special Account Scenarios That Affect Monthly Interest

Certain account situations require special handling when it comes to monthly savings account interest crediting. Understanding these scenarios helps avoid confusion and ensures you receive what you’re owed.

Newly opened savings accounts earn interest based on partial-month rules. If you open an account on January 15th, you won’t receive a full month’s savings account interest on January 31st—you’ll receive interest for only the days your account was active. The bank calculates your average daily balance starting from your opening date through the end of the month. Some banks have a cut-off time (often 2:00 PM or 3:00 PM) for deposits to begin earning interest that same day; deposits made after the cut-off start earning savings account interest the next business day.

Account closures mid-month trigger immediate interest calculations. When you close a savings account before the normal monthly crediting date, banks typically calculate and pay any accrued savings account interest through the closure date. This interest is either added to your final withdrawal amount or issued separately, depending on the bank’s procedures. It’s important to close accounts after an interest crediting date when possible to avoid losing a few cents of accrued interest, though most banks will still pay prorated amounts.

Joint savings accounts handle savings account interest crediting in a straightforward manner—the interest is credited to the account itself, not divided between owners. All account holders share ownership of the interest earned, just as they share ownership of the principal balance. For tax reporting purposes, banks typically report all interest under the primary account holder’s Social Security number unless instructed otherwise with IRS Form W-9 modifications.

Dormant or inactive accounts usually continue to earn and receive savings account interest crediting, though some banks may eventually stop paying interest on accounts with no activity for extended periods (often 12-24 months). State escheatment laws eventually require banks to turn over abandoned account funds to the state, but this typically takes several years of complete inactivity.

U.S. Regulations Governing Savings Account Interest

Federal regulations ensure that banks follow standardized, transparent practices when crediting savings account interest. The most important regulation for savers is Regulation DD, which implements the Truth in Savings Act.

Enacted in 1991, the Truth in Savings Act requires banks to disclose how they calculate savings account interest in clear, standardized language. Under Regulation DD, banks must provide specific information when you open a savings account: the interest rate, the Annual Percentage Yield (APY), how interest is calculated, when interest begins to accrue, and the frequency of crediting.

The APY disclosure is particularly important because it provides a standardized comparison tool. While banks might calculate and credit savings account interest differently, the APY accounts for compounding frequency and gives you a true annual return percentage. A bank crediting interest monthly will show a slightly higher APY than one crediting quarterly, even with the same nominal interest rate, because of the compounding effect.

Regulation DD also mandates that banks use standardized calculation methods. While banks can choose between methods (like average daily balance versus minimum balance), they must apply their chosen method consistently and explain it clearly in account agreements. This prevents banks from using confusing or misleading calculation practices that disadvantage consumers.

If you believe your bank has made an error in crediting savings account interest, you have consumer rights under federal and state laws. The Electronic Fund Transfer Act and Regulation E require banks to investigate and respond to error claims, though interest calculation disputes may fall under general banking dispute procedures rather than Regulation E specifically. Most banks have internal processes for investigating interest discrepancies and will correct genuine errors promptly.

| Regulation DD Requirement | What It Means for You |

|---|---|

| APY Disclosure | Banks must show the true annual return, including compounding |

| Calculation Method Disclosure | You must be told how interest is calculated before opening an account |

| Standardized Methods | Banks can’t use arbitrary or unfair calculation practices |

| Statement Requirements | Monthly statements must show interest earned and APY |

How to Verify Monthly Savings Interest Is Credited Correctly

Even with regulatory protections, it’s wise to verify that your bank is crediting the correct amount of savings account interest each month. This verification process is straightforward and takes just a few minutes.

Start by reading your monthly statement carefully. Look for the savings account interest transaction, which typically appears with descriptions like “Interest Paid,” “Monthly Interest Credit,” “INTCR,” or similar wording. The statement should show both the amount of interest credited and the current APY for your account.

To verify the amount is correct, you can use this simplified approach: multiply your average daily balance by the monthly interest rate. The monthly rate is approximately your APY divided by 12 (though the actual calculation is slightly more complex due to compounding). For example, with a 4.00% APY and an average balance of $10,000, you’d expect roughly $33 in monthly savings account interest.

Many banks provide online interest calculators on their websites or within their mobile apps. These tools let you input your balance and APY to see expected earnings. Compare the calculator’s projection with your actual credited savings account interest. Small differences of a few cents are normal due to rounding and the specific number of days in the month, but larger discrepancies warrant investigation.

Your account agreement contains the specific formula and methodology your bank uses for calculating savings account interest. If you’re mathematically inclined, you can perform the exact calculation yourself using the daily balance method and your account’s stated APY. Most people find it easier to simply verify that interest appears monthly and roughly matches expectations based on their average balance.

If you spot a discrepancy in your savings account interest, contact your bank’s customer service immediately. Have your statement handy with the specific dates and amounts in question. Most interest errors are honest mistakes—perhaps a system glitch or a rate change that wasn’t applied correctly—and banks will investigate and correct them promptly when brought to their attention.

How Monthly Interest Crediting Impacts Long-Term Savings Growth

The frequency of savings account interest crediting has a real, measurable impact on how much your savings grow over time, thanks to the power of compound interest. When interest is credited monthly rather than quarterly or annually, you benefit from compounding occurring more frequently.

Here’s why it matters: when savings account interest is credited to your account, that interest immediately becomes part of your principal balance and starts earning interest itself. With monthly crediting, this compounding effect happens 12 times per year. With quarterly crediting, it happens only four times per year. Over months and years, this difference adds up.

Consider a $10,000 savings account with a 4.00% nominal annual interest rate. With monthly compounding and crediting, you’d earn approximately $407.42 in the first year (4.074% APY). With quarterly compounding, you’d earn about $406.04 (4.060% APY). The difference might seem small—just $1.38 in year one—but it grows larger as time passes and your balance increases.

This is why high-yield savings accounts that credit savings account interest monthly are particularly attractive to consistent savers. If you’re regularly adding money to your savings, monthly crediting means your new deposits start benefiting from compounding sooner. Each monthly contribution begins earning interest on interest by the following month, rather than waiting until the end of a quarter.

The contrast with traditional savings accounts is stark, not because of crediting frequency—most traditional accounts also credit monthly—but because of the vastly different interest rates. A traditional bank savings account might offer just 0.01% to 0.10% APY compared to 4.00% or higher at online banks. At such low rates, the compounding frequency barely matters; the rate itself is the issue.

For long-term savers, understanding how savings account interest compounds monthly can help you make better decisions about where to keep your emergency fund and short-term savings goals. The combination of a competitive APY and monthly crediting creates optimal conditions for growing your wealth without taking on investment risk.

| Compounding Frequency | Times Per Year | APY on 4.00% Rate | Year 1 Earnings on $10,000 |

|---|---|---|---|

| Monthly | 12 | 4.074% | $407.42 |

| Quarterly | 4 | 4.060% | $406.04 |

| Annually | 1 | 4.000% | $400.00 |

Conclusion: Key Takeaways for U.S. Savers

Understanding how monthly savings account interest crediting works empowers you to maximize your savings returns and catch any errors that might occur. The key insights to remember are that interest calculation happens daily, even though crediting occurs monthly, your average daily balance determines how much you earn, and the crediting frequency directly impacts your compound growth over time.

Common mistakes savers make include not verifying their monthly savings account interest, failing to account for partial-month interest when opening or closing accounts, and not understanding how rate changes affect their earnings mid-month. By staying informed and checking your statements regularly, you can avoid these pitfalls.

Why does all this matter? Because even small differences in savings account interest—a higher APY, more frequent compounding, or catching calculation errors—can add up to hundreds or thousands of dollars over the years you keep money in savings. The financial institutions that handle your money should work for you, and understanding the mechanics of interest crediting ensures you’re getting every penny you deserve.

Ready to take the next step? Learning how to compare APYs across different banks and finding the highest-yield savings accounts can dramatically boost your returns beyond just understanding how savings account interest is credited. By combining knowledge of the crediting process with smart account selection, you’ll be well-positioned to make your savings work harder for your financial future.

Also Read – How Banks Decide Savings Account Interest Rates

FAQs

Q. How do U.S. banks calculate interest before crediting it monthly?

- U.S. banks calculate savings account interest using the daily balance method. Interest accrues each day based on that day’s ending balance and the account’s APY, then the total accrued interest is credited to the account at the end of the month or statement cycle.

Q. Why is savings account interest credited monthly but calculated daily?

- Interest is calculated daily to accurately reflect balance changes, while monthly crediting is used for operational efficiency and standardized reporting. Daily calculation ensures deposits and withdrawals immediately affect interest earnings.

Q. What happens if the savings account interest credit date falls on a weekend or holiday?

- If the interest credit date falls on a weekend or U.S. federal holiday, banks typically post the interest on the next business day. The interest amount itself is not reduced due to the delay.

Q. How do interest rate changes affect the monthly savings interest in the U.S.?

- When a bank changes the interest rate, the new rate applies from the effective date forward. Interest earned before the change is calculated at the old rate, and interest after the change accrues at the new rate within the same month.

Q. How can I verify that my monthly savings interest was credited correctly?

- You can verify interest by checking your bank statement for entries such as “Interest Paid” or “INTCR,” comparing the credited amount with the account’s disclosed APY, and reviewing your average daily balance for the month.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.