Imagine waking up to find money in your bank account—money you earned while sleeping, traveling, or spending time with family. That’s the promise of passive income, and it’s not just a pipe dream reserved for the wealthy elite. In today’s digital economy, building multiple income streams has become more accessible than ever, offering financial security, freedom, and the potential to achieve true financial independence. Whether you’re looking to supplement your current income or eventually replace your 9-to-5 entirely, understanding passive income is your first step toward a more flexible financial future.

What is Passive Income?

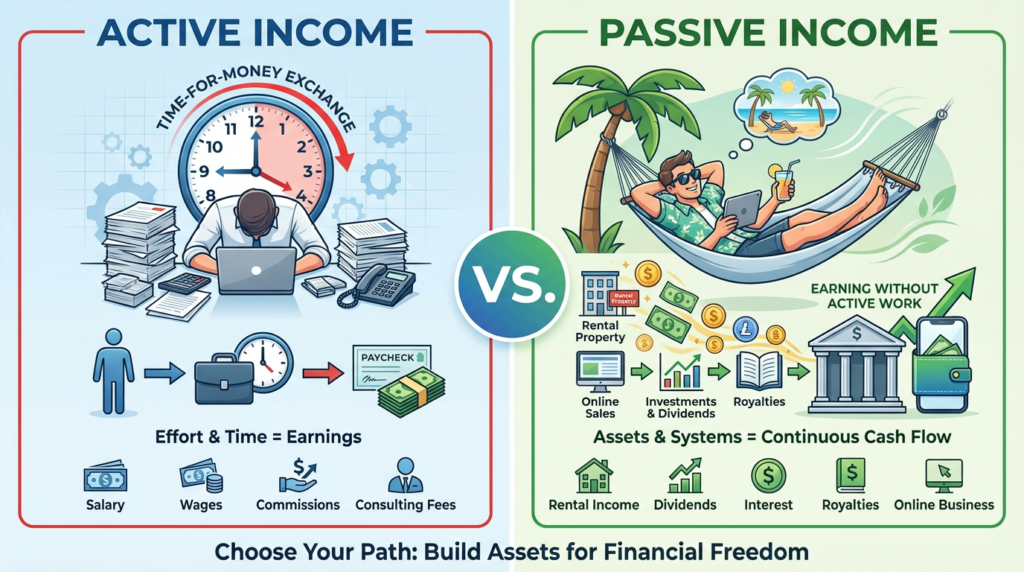

Passive income is money earned with minimal ongoing effort after an initial investment of time, money, or both. Unlike active income—where you trade hours for dollars—passive income continues flowing even when you’re not actively working.

Examples of passive income include:

- Rental income from real estate properties

- Dividend payments from stocks and ETFs

- Royalties from books, music, or patents

- Affiliate marketing commissions

- Interest from savings accounts or peer-to-peer lending

The key distinction between passive and active income lies in the effort-to-earnings ratio. With active income, you stop earning when you stop working. Passive income, on the other hand, can generate returns long after the initial work is complete.

Common misconceptions about passive income:

Many people mistakenly believe passive income is completely effortless or a get-rich-quick scheme. The reality is more nuanced. While passive income doesn’t require constant active work, it typically demands significant upfront effort, whether that’s capital investment, time spent creating content, or building systems. Additionally, most passive income streams require some level of maintenance, monitoring, and occasional updates to remain profitable.

Examples of Passive Income

Let’s explore some of the most popular and proven passive income streams:

Dividend Stocks and ETFs

Dividend-paying stocks distribute a portion of the company’s profits to shareholders regularly. When you invest in dividend stocks or dividend-focused ETFs (Exchange-Traded Funds), you receive periodic payments—typically quarterly—simply for holding the investment.

Advantages: Relatively liquid, potential for capital appreciation alongside dividend income, and diversification options through ETFs.

Real Estate Rental Income

Owning rental properties allows you to collect monthly rent from tenants. This can include residential properties, commercial spaces, or vacation rentals through platforms like Airbnb.

Advantages: Tangible asset, potential tax benefits, hedge against inflation, and property value appreciation.

Online Businesses, Digital Products, and Courses

Creating and selling digital products—such as e-books, online courses, templates, or software—can generate ongoing income with minimal overhead costs once the product is created.

Advantages: Low ongoing costs, unlimited scalability, global market reach, and high profit margins.

Peer-to-Peer Lending and Royalties

Peer-to-peer lending platforms connect you with borrowers, allowing you to earn interest on loans. Royalties come from creative works like books, music, photography, or patents that pay you each time they’re used or sold.

Advantages: Diversification opportunities, potential for recurring payments, relatively hands-off management.

How to Start Passive Income With Little Money

You don’t need thousands of dollars to begin building passive income streams. Here are accessible entry points:

Low-Cost Investment Options

| Method | Starting Investment | Difficulty Level | Time to First Income |

|---|---|---|---|

| High-Yield Savings Account | $1-$100 | Very Easy | Immediate |

| Dividend ETFs | $50-$500 | Easy | 3-6 months |

| REITs (Real Estate Investment Trusts) | $100-$1,000 | Easy | 3-6 months |

| Peer-to-Peer Lending | $25-$1,000 | Moderate | 1-3 months |

| Affiliate Marketing | $0-$100 | Moderate | 3-12 months |

Side Hustles That Can Turn Into Passive Streams

Start with active work that can eventually become passive. For example, create a blog with affiliate links, build a YouTube channel that generates ad revenue, or develop a course based on your expertise. The initial work is active, but over time, these assets can generate income with minimal ongoing effort.

Platforms and Tools to Get Started

- Investment platforms: Robinhood, Vanguard, Fidelity, Fundrise (for real estate)

- Digital product marketplaces: Gumroad, Teachable, Udemy, Amazon KDP

- Affiliate networks: Amazon Associates, ShareASale, ClickBank

- Content platforms: YouTube, Medium (Partner Program), Substack

How Much Money Can You Make From Passive Income?

Earnings from passive income vary dramatically based on your investment, effort, and chosen strategy.

Average Earnings and Realistic Expectations

| Income Stream | Typical Annual Return | Investment Required | Risk Level |

|---|---|---|---|

| Dividend Stocks | 2-6% | $10,000+ | Medium |

| Rental Property | 6-12% (net) | $20,000-$100,000+ | Medium-High |

| Online Course | $500-$50,000+ | $0-$5,000 (time investment) | Low-Medium |

| High-Yield Savings | 3-5% | Any amount | Very Low |

| REITs | 4-8% | $500+ | Medium |

Factors Affecting Income Potential

Your passive income potential depends on several variables: the amount of capital or time you can invest upfront, your risk tolerance, market conditions, your expertise in a particular area, and how well you maintain and optimize your income streams.

Case Study Example

Sarah, a graphic designer, started creating digital templates in her spare time. She invested $200 in design software and 6 months of evening work. After uploading 50 templates to Etsy and Creative Market, she now earns $2,500-$3,500 monthly with just 2-3 hours of maintenance work per week. Her total time investment was approximately 480 hours upfront, but she now earns over $30,000 annually from this single passive stream.

Is Passive Income Really Passive?

The term “passive” can be misleading. While passive income doesn’t require constant active work, it’s rarely completely hands-off.

Initial Effort and Time Required

Most passive income streams demand significant upfront investment. Writing a book might take 6-12 months, building a dividend portfolio requires research and capital accumulation, and establishing rental properties involves property search, financing, and setup. This initial phase is often entirely active work with no immediate returns.

Maintenance and Scaling Considerations

Even established passive income streams need occasional attention. Rental properties require maintenance and tenant management (or hiring a property manager). Investment portfolios need periodic rebalancing. Digital products may need updates to stay competitive. The good news is that maintenance typically requires far less time than the initial creation phase—often just a few hours per month.

Common Mistakes to Avoid

Many beginners fail because they underestimate the upfront work required, spread themselves too thin across too many income streams simultaneously, neglect to reinvest earnings for growth, or give up too quickly before their efforts compound. The most successful passive income builders focus on one or two streams initially, then expand once those are established.

Best Passive Income Ideas

The passive income landscape continues to evolve. Here are the most promising opportunities for this year:

Stocks, ETFs, and Dividend Strategies

Dividend growth investing remains a solid foundation for passive income. Consider dividend aristocrats—companies that have increased dividends for 25+ consecutive years—or dividend-focused ETFs like SCHD or VYM. With inflation concerns persisting, dividend stocks provide both income and potential inflation protection.

Real Estate: Rentals and REITs

Traditional rental properties continue to generate strong returns in many markets, particularly with housing shortages in urban areas. For those without capital for physical properties, REITs offer exposure to real estate returns with much lower entry costs. Fractional real estate platforms like Fundrise and RealtyMogul have made real estate investing more accessible than ever.

Digital Products, E-books, and Online Courses

The online education market continues to expand, with more people seeking skills development and self-improvement resources. E-books, templates, stock photos, music, printables, and comprehensive online courses all present opportunities. Platforms like Teachable and Kajabi make course creation increasingly accessible.

Other Trending Streams

| Opportunity | Description | Potential |

|---|---|---|

| Print-on-Demand | Design products sold through platforms like Printful | Low-Medium |

| YouTube Automation | Outsourced content channels generating ad revenue | Medium |

| NFT Royalties | Ongoing royalties from digital art sales | High Risk/High Reward |

| App Development | Create useful apps with ad revenue or subscription models | Medium-High |

| Vending Machines | Physical machines in high-traffic locations | Medium |

Timeline to Profitability

Understanding realistic timelines helps set proper expectations and prevents premature abandonment of promising income streams.

Short-Term vs Long-Term Income

Short-term options (3-6 months to first income):

- High-yield savings accounts (immediate)

- Dividend stocks (first dividend within 3 months)

- Peer-to-peer lending (1-3 months)

- Affiliate marketing with existing audience (3-6 months)

Long-term options (6-24 months to meaningful income):

- Rental properties (6-12 months, including acquisition)

- Online courses (6-18 months,s including creation and marketing)

- Blog monetization (12-24 months to substantial income)

- YouTube channels (12-24+ months to monetization and growth)

How Long Before Streams Become Sustainable

| Income Stream | Time to First Dollar | Time to $500/month | Time to $2,000/month |

|---|---|---|---|

| Dividend Stocks | 1-3 months | Requires $150,000+ invested | Requires $600,000+ invested |

| Rental Property | 1-6 months | 1-2 properties | 3-5 properties |

| Online Course | 3-12 months | 6-18 months | 12-24 months |

| Blog/Affiliate | 6-12 months | 12-24 months | 18-36 months |

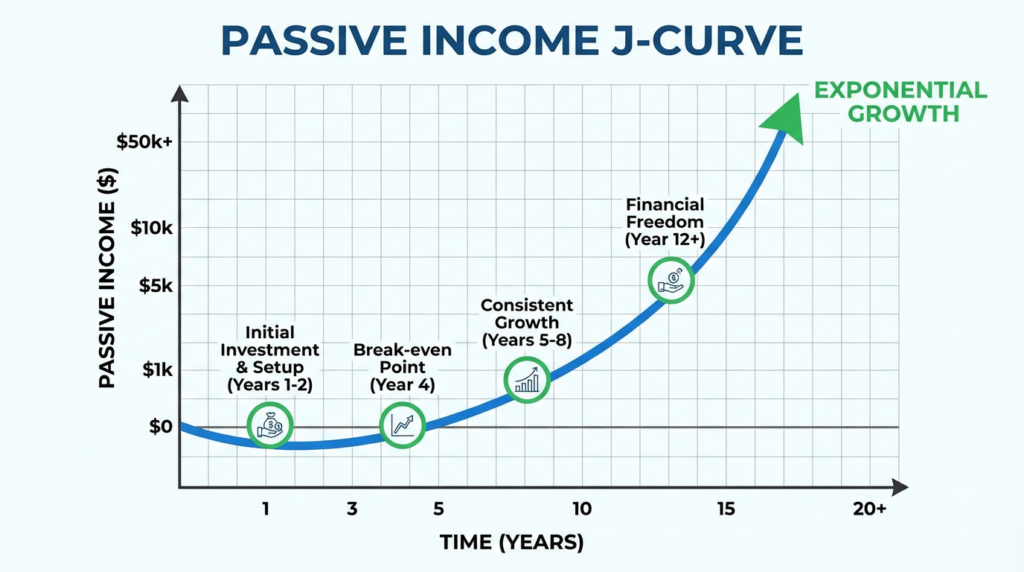

Most passive income streams follow a J-curve pattern: slow or negative returns initially, followed by accelerating growth as your efforts compound. Patience and persistence are crucial during the early phases.

Risks and Challenges of Passive Income

No investment or income strategy is without risks. Understanding these challenges helps you prepare and mitigate potential problems.

Investment Risks

All investment-based passive income carries market risk. Stock dividends can be cut during economic downturns, real estate values can decline, and peer-to-peer lending involves default risk. Diversification across multiple income streams and within each category helps reduce overall risk exposure.

Market Volatility

Economic conditions significantly impact passive income. Recessions may reduce rental demand and stock dividends, while inflation can erode the purchasing power of fixed-income streams. However, some passive income sources—like real estate and dividend growth stocks—can actually benefit from inflationary environments.

Legal and Tax Considerations

Passive income has tax implications that vary by source and jurisdiction. Dividend income, rental income, and royalties may be taxed differently from earned income. Some strategies offer tax advantages (like real estate depreciation), while others may face higher tax rates. Consulting with a tax professional is essential as your passive income grows.

Risk mitigation strategies:

- Diversify across multiple income streams and asset classes

- Maintain an emergency fund covering 6-12 months of expenses

- Regularly review and rebalance your income portfolio

- Stay informed about market conditions and adjust strategies accordingly

- Consider insurance where appropriate, such as landlord insurance for rental properties

Can Passive Income Replace Your Full-Time Job?

The ultimate question for many aspiring passive income earners: Can you actually quit your day job?

Financial Independence Scenarios

Achieving financial independence through passive income is possible, but requires realistic planning. The general rule suggests you need passive income covering 100-120% of your expenses (the extra buffer accounts for taxes and unexpected costs) before considering leaving traditional employment.

Example calculation:

- Monthly expenses: $4,000

- Target passive income needed: $4,800-$5,000

- Annual passive income required: $57,600-$60,000

To generate this through dividends at a 4% yield, you’d need approximately $1.5 million invested. Through rental properties averaging $500 net monthly profit each, you’d need 10 properties. Through digital products, you’d need consistent monthly sales to generate this revenue.

Steps to Transition From Active to Passive Income Reliance

| Phase | Goal | Timeline | Key Actions |

|---|---|---|---|

| Phase 1: Foundation | Build the first passive stream | 6-12 months | Choose a strategy, start investing, or creating |

| Phase 2: Growth | Reach $500-$1,000/month | 12-24 months | Reinvest earnings, optimize existing streams |

| Phase 3: Diversification | Add 2-3 more streams | 24-36 months | Diversify income sources, scale what works |

| Phase 4: Acceleration | Reach 50% of expenses covered | 36-60 months | Increase investment, consider reducing work hours |

| Phase 5: Independence | Full expense coverage + buffer | 60+ months | Transition planning, build a 12-month safety net |

The most successful transitions happen gradually. Many people first reduce to part-time work while building passive income, testing their systems before making the full leap. This approach reduces risk and maintains some active income security during the transition period.

Conclusion

Passive income isn’t a magical solution that creates wealth overnight, but it is a proven strategy for building financial security and independence. From dividend stocks and rental properties to digital products and online courses, numerous paths exist for generating income that doesn’t require trading your time for money on a daily basis.

The key takeaways: passive income requires upfront effort, whether through capital investment or time spent creating assets. Most streams need some ongoing maintenance, but far less than traditional employment. Diversification across multiple income sources reduces risk and increases stability. Realistic expectations and patience are essential—most meaningful passive income takes 1-3 years to develop.

The best time to start building passive income was yesterday. The second-best time is today. Begin with one strategy that aligns with your skills, interests, and available resources. Start small, learn as you go, and reinvest your earnings to accelerate growth. Whether your goal is an extra $500 per month or complete financial independence, every journey begins with a single step.

Explore the passive income opportunities that resonate with you, commit to consistent action, and watch as your financial future transforms one income stream at a time.

FAQs (Frequently Asked Questions)

Q. What is the easiest passive income to start?

- High-yield savings accounts and dividend ETFs are among the easiest passive income streams to start because they require minimal knowledge and can begin with small amounts of money. You simply deposit funds and earn interest or dividends automatically. For those without capital, affiliate marketing or print-on-demand services can be started with little to no money, though they require more time and effort upfront.

Q. Can passive income really replace a full-time job?

- Yes, but it typically requires years of consistent effort and significant investment. Most people who successfully replace their full-time income do so by building multiple passive income streams over 5-10 years, reinvesting earnings consistently, and living below their means during the accumulation phase. It’s more achievable than many think, but also takes longer than most people initially expect.

Q. How much money do I need to start earning passive income?

- You can start with as little as $0-$100, depending on your chosen strategy. Digital products, affiliate marketing, and content creation can begin with minimal financial investment (though they require time). Dividend investing can start with $50-$100, while real estate typically requires $20,000-$50,000 for a down payment, though REITs can be purchased for much less.

Q. Is passive income taxable?

- Yes, all passive income is taxable, though the tax treatment varies by source. Dividend income may be taxed at preferential rates if they’re qualified dividends. Rental income can benefit from depreciation deductions. Interest income is typically taxed as ordinary income. Consult a tax professional to understand your specific situation and optimize your tax strategy.

Q. How long does it take to see results from passive income?

- This varies widely by strategy. High-yield savings and dividend stocks can produce income within days to months. Rental properties might generate income within 3-6 months after purchase. Digital products and content-based income typically take 6-18 months to produce meaningful returns. Most substantial passive income streams take 1-3 years of consistent effort to become significant.

Q. What are the best online passive income ideas?

- The most effective online passive income ideas include creating and selling online courses on platforms like Teachable or Udemy, affiliate marketing through blogs or YouTube channels, selling digital products such as templates or e-books, building ad revenue through content creation, developing and monetizing mobile apps, and print-on-demand products through services like Printful or Redbubble.

Q. Are there any risks with passive income streams?

- Absolutely. Investment-based passive income carries market risk and potential loss of principal. Rental properties face vacancy risk, maintenance costs, and property value fluctuations. Digital products face competition and platform dependency. Peer-to-peer lending involves default risk. Every passive income strategy has unique risks that should be understood and managed through diversification and proper planning.

Q. Do I need special skills to earn passive income?

- Not necessarily, though having relevant skills certainly helps. Investment-based passive income primarily requires financial literacy and disciplined saving. Creating digital products benefits from expertise in a specific area, but you can learn as you go. Many successful passive income earners started as complete beginners and developed skills through practice and persistence. The most important “skill” is consistency and willingness to learn.

Q. Can passive income work for beginners?

- Yes, passive income strategies exist for every experience level. Beginners should start with simpler options like high-yield savings accounts, dividend ETFs, or REITs before progressing to more complex strategies. The key is to start small, learn continuously, and avoid overcomplicating things initially. Many beginners make the mistake of trying too many strategies at once—focus on mastering one before adding others.

Q. How do I maintain and scale my passive income streams?

- Maintenance varies by income type but generally involves monitoring performance monthly, reinvesting a portion of earnings back into growth, updating or refreshing content and products periodically, diversifying into new but related income streams, and automating or delegating routine tasks where possible. Scaling typically means increasing investment in what’s already working rather than constantly chasing new opportunities. Track your metrics, optimize what works, and eliminate what doesn’t.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.