What Is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness based on your borrowing and repayment history. Lenders, landlords, and even employers use it to evaluate financial responsibility. By the end of this guide, you’ll understand how credit scores work, what influences them, and how to improve yours.

A credit score is a numerical representation of how likely you are to repay borrowed money. It typically ranges from 300 to 850, with higher scores indicating better creditworthiness.

Credit scores exist to help lenders quickly assess risk. When you apply for a loan or credit card, lenders use your score to decide whether to approve you and what interest rate to offer.

It’s important to understand that creditworthiness is not the same as income. You can earn a high salary but have a low credit score if you’ve missed payments or carry too much debt. Conversely, someone with a modest income can have an excellent score through responsible credit management.

How Credit Scores Work

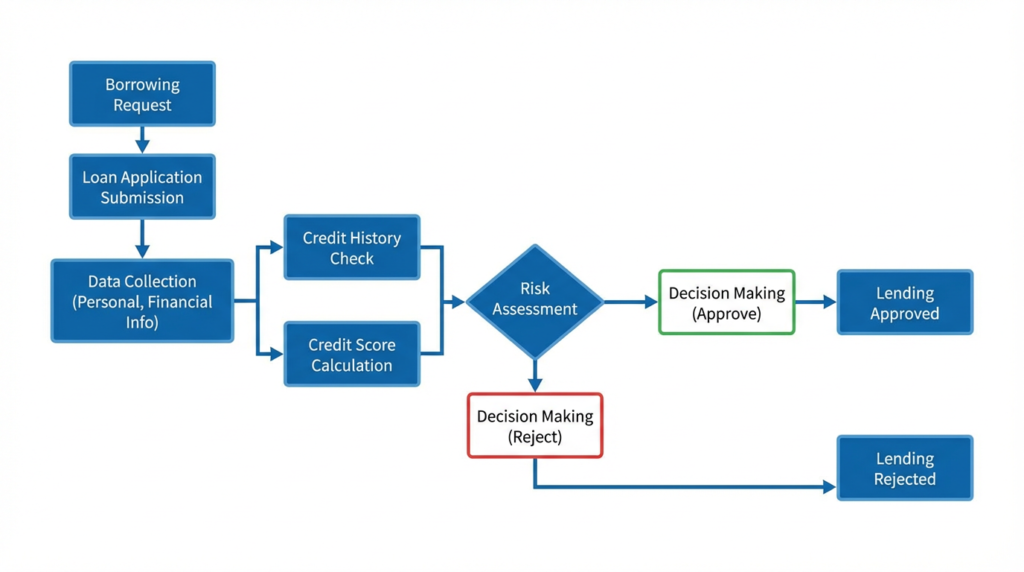

Understanding what a credit score is requires knowing how the system operates from start to finish.

- Credit bureaus collect information about your borrowing activity from lenders, creditors, and public records. The three major bureaus in the United States are Equifax, Experian, and TransUnion.

- Scoring companies like FICO and VantageScore use mathematical models to analyze this data and generate your credit score.

- Lenders interpret these scores to make lending decisions. A higher score suggests you’re less risky, which often translates to better loan terms and lower interest rates.

- Why scores differ: Two people can have different scores even with similar financial behavior because they may have different credit histories, account types, or credit ages. Additionally, each bureau may have slightly different information about you.

The credit scoring flow:

Borrowing money → Creditors report to bureaus → Bureaus compile credit reports → Scoring models calculate scores → Lenders use scores to make decisions

How Is a Credit Score Calculated?

Your credit score is calculated using information from your credit report. While the exact formulas are proprietary, the general factors are well-known.

Key Factors That Affect Your Credit Score

| Factor | Impact | Description |

|---|---|---|

| Payment history | High (35%) | Whether you pay bills on time |

| Credit utilization | High (30%) | How much credit you’re using vs. your limits |

| Credit age | Medium (15%) | Length of your credit history |

| Credit mix | Low (10%) | Variety of account types (cards, loans, mortgages) |

| New credit inquiries | Low (10%) | Recent applications for credit |

- Payment history is the most influential factor. Even one missed payment can significantly lower your score. Lenders want to see consistent, on-time payments.

- Credit utilization measures how much of your available credit you’re using. Keeping balances below 30% of your limits is generally recommended, though lower is better.

- Credit age considers both the age of your oldest account and the average age of all accounts. Longer histories provide more data points for lenders.

- Credit mix shows you can manage different types of credit responsibly, though it’s a minor factor.

- New credit inquiries can temporarily lower your score when you apply for credit, as multiple applications may signal financial stress.

Credit Score Ranges Explained

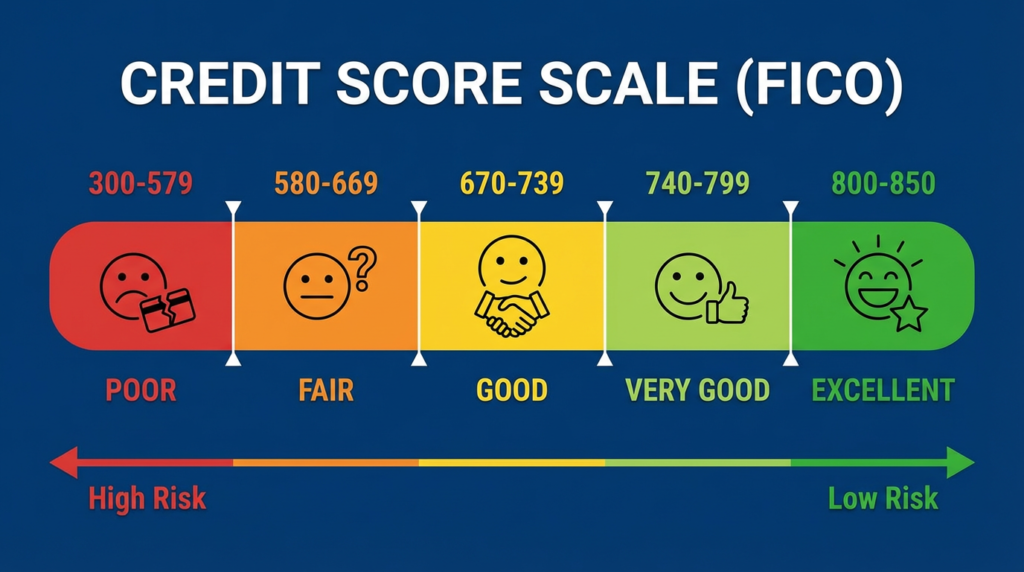

When asking what a credit score range is, it’s helpful to know how lenders typically categorize scores:

| Score Range | Rating | Typical Qualifications |

|---|---|---|

| 300–579 | Poor | Difficult to get approved; high interest rates if approved |

| 580–669 | Fair | May qualify with subprime rates; limited options |

| 670–739 | Good | Qualifies for most loans with competitive rates |

| 740–799 | Very Good | Qualifies for better-than-average rates |

| 800–850 | Excellent | Best rates and terms; premium credit card offers |

- Poor credit often results from missed payments, defaults, or bankruptcies. Borrowers in this range face significant challenges getting approved.

- Fair credit indicates some credit issues but demonstrates improvement potential. Lenders may approve applications with stricter terms.

- Good credit is where most Americans fall. This range qualifies you for standard loan products at reasonable rates.

- Very good credit unlocks preferential treatment from lenders, including lower rates and higher credit limits.

- Excellent credit represents the top tier of creditworthiness, earning you the best available terms and access to premium financial products.

Types of Credit Scores

FICO Score

The FICO score is the most widely used credit scoring model in the United States. Created by the Fair Isaac Corporation, it’s used by approximately 90% of lenders for credit decisions.

Banks, mortgage lenders, and auto financing companies typically rely on FICO scores. Multiple versions exist, including industry-specific scores for auto loans and credit cards.

VantageScore

VantageScore is an alternative scoring model created jointly by the three major credit bureaus. While less commonly used by lenders, it’s popular with credit monitoring apps and services.

VantageScore uses a similar range (300-850) but may weigh factors differently than FICO.

Why Your Credit Score Can Vary

You don’t have just one credit score. Variations occur because:

- Different bureaus may have different information about you. Not all creditors report to all three bureaus.

- Different models calculate scores using different formulas. Your FICO score will likely differ from your VantageScore.

- Different update times mean scores can change as new information is reported at different times to different bureaus.

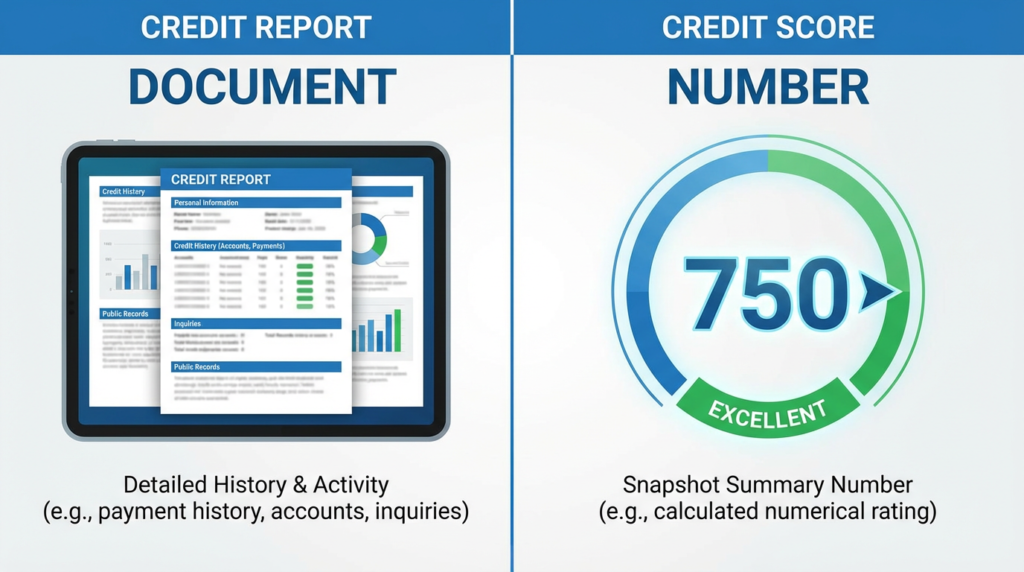

Credit Score vs Credit Report

Many people confuse these two terms when learning what a credit score.

| Aspect | Credit Score | Credit Report |

|---|---|---|

| Format | Three-digit number | Detailed document |

| Content | Summary assessment | Complete credit history |

| Purpose | Quick decision-making | Verification and review |

| Updates | Changes with report updates | Updated monthly or quarterly |

| Cost | Often free via apps/banks | Free annually from each bureau |

Your credit report is the raw data: every account, payment history, credit inquiry, and public record related to your credit. It’s the source material.

Your credit score is the calculated number derived from that report. Think of the report as a detailed transcript and the score as your GPA.

Both matter. Lenders use scores for quick decisions, but may review reports for detailed information. You should monitor both to catch errors and understand what’s influencing your score.

Why Is Your Credit Score Important?

Understanding what a credit score is means recognizing its real-world impact on your financial life.

- Loan approvals: Your score often determines whether you’ll be approved for mortgages, auto loans, personal loans, and student loan refinancing.

- Interest rates: The difference between fair and excellent credit can mean thousands of dollars in interest over the life of a mortgage or car loan.

- Credit cards: Higher scores qualify you for cards with better rewards, lower rates, and higher limits.

- Rentals and utilities: Landlords frequently check credit scores during the application process. Some utility companies use scores to determine deposit requirements.

- Insurance and employment: In some states, insurers use credit-based insurance scores to set premiums. Certain employers check credit reports for positions involving financial responsibility.

A strong credit score opens doors and saves money. A weak score creates obstacles and costs more over time.

What Affects Your Credit Score the Most?

While we’ve covered the calculation factors, certain behaviors have outsized impacts on a credit score.

- Missed payments are the most damaging single event. A 30-day late payment can drop your score by 100 points or more, and the impact worsens with longer delinquencies.

- High balances relative to your credit limits signal potential overextension. Maxing out credit cards harms your score even if you pay them off monthly.

- Closing old accounts reduces your available credit and shortens your credit age, potentially lowering your score.

- Applying for too much credit within a short period generates multiple hard inquiries, which can decrease your score and suggest financial distress.

- Errors in credit reports, such as accounts that aren’t yours or incorrect payment histories, can unfairly lower your score.

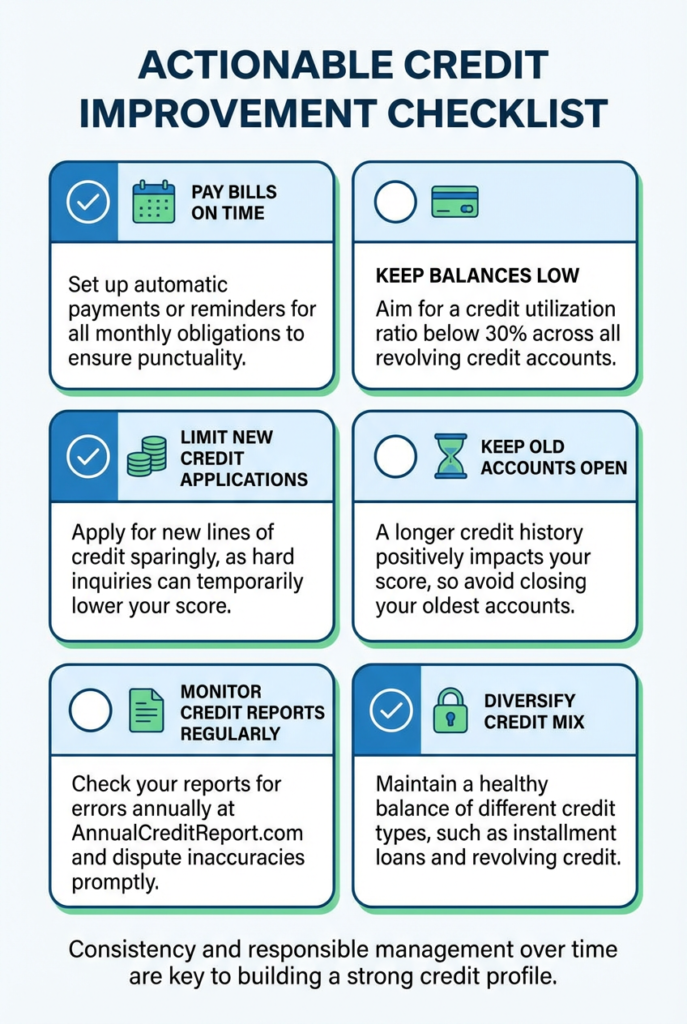

How to Improve Your Credit Score

If you’re wondering what a credit score improvement strategy is, focus on these proven approaches:

- Pay bills on time. Set up automatic payments or reminders. Payment history is the biggest factor, so consistency matters most.

- Keep utilization low. Try to use less than 30% of your available credit, ideally under 10%. Pay down balances or request credit limit increases.

- Avoid unnecessary inquiries. Only apply for credit when needed. Multiple applications in a short time can lower your score.

- Maintain old accounts. Keep older credit cards open even if you don’t use them often. They contribute to your credit age and available credit.

- Check credit reports for errors. Review your reports annually from all three bureaus. Dispute inaccuracies that could be dragging down your score.

Improvement takes time and depends on your starting point and the issues affecting your score. There’s no universal timeline or guaranteed result.

Common Credit Score Myths

Misconceptions about what a credit score is can lead to poor financial decisions.

- Myth: Checking your score lowers it

Truth: Checking your own score is a “soft inquiry” and has no impact. Only applications for credit create “hard inquiries” that can lower your score slightly. - Myth: Income affects your credit score

Truth: Your salary, savings, or net worth don’t factor into credit scores. They measure credit behavior, not financial capacity. - Myth: Closing credit cards improves your score

Truth: Closing cards typically hurts your score by reducing available credit and potentially shortening your credit age. - Myth: Being debt-free guarantees a high score

Truth: You need active credit accounts to build a score. Someone with no debt but no credit history may have a low score or no score at all.

Frequently Asked Questions

Q.What is a good credit score?

- A good credit score typically ranges from 670 to 739. Scores above 740 are considered very good, and scores above 800 are excellent.

Q. Does checking a credit score reduce it?

- No. Checking your own credit score is a soft inquiry and doesn’t affect your score. Only hard inquiries from credit applications can lower it.

Q. How often does a credit score change?

- Your credit score can change whenever new information is reported to the credit bureaus, which typically happens monthly as creditors update your accounts.

Q. Can you have multiple credit scores?

- Yes. You have different scores from each bureau and different scores depending on the model used (FICO, VantageScore, industry-specific versions).

Q. How long does negative information stay on a credit report?

- Most negative information remains for seven years. Bankruptcies can stay for up to ten years. Positive information can remain indefinitely.

Conclusion

A credit score is more than just a number—it’s a financial tool that influences major life decisions from buying a home to securing favorable loan terms. By understanding what a credit score is, how it’s calculated, and what affects it, you can take control of your financial future and make informed decisions that strengthen your creditworthiness over time.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.