How to Increase Credit Score: Your Complete Guide to Better Financial Health

Your credit score is more than just a number—it’s your financial reputation distilled into three digits. Whether you’re dreaming of buying your first home, financing a new car, or simply want access to better credit card rewards, understanding how to increase your credit score is essential for achieving your financial goals.

Introduction

A credit score is a numerical representation of your creditworthiness, ranging from 300 to 850. Think of it as your financial report card that lenders, landlords, and even some employers use to evaluate how responsibly you manage debt and financial obligations.

Why maintaining a good credit score matters:

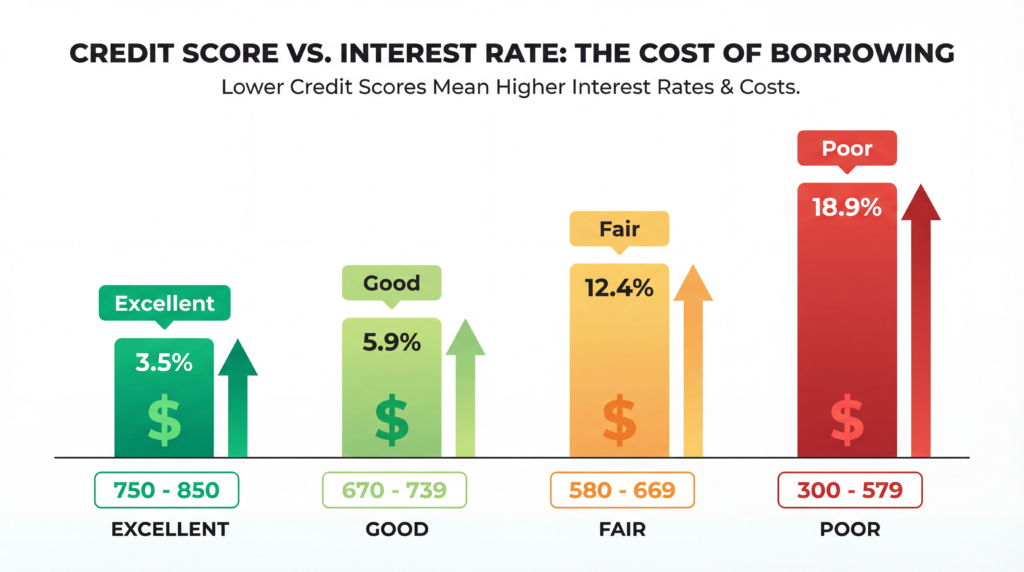

Your credit score impacts virtually every major financial decision you’ll make. Learning how to increase your credit score can save you tens of thousands of dollars over your lifetime through lower interest rates, better loan terms, and increased approval odds. Conversely, a poor credit score can lock you out of opportunities or force you to pay premium prices for basic financial services.

How a good credit score impacts financial opportunities:

- Lower interest rates on mortgages, auto loans, and credit cards

- Higher credit limits and better card rewards

- Easier apartment approvals with lower security deposits

- Better insurance rates in some states

- Improved job prospects in certain industries

- Access to premium financial products and services

Understanding how to increase your credit score opens doors to all these benefits and more.

What Credit Score Do You Start With?

Here’s a common misconception: you don’t actually start with a credit score of zero. In fact, you don’t have a credit score at all until you’ve established some credit history. Knowing how to increase your credit score from the beginning sets you up for long-term success.

For first-time borrowers:

When you first open a credit account—whether it’s a credit card, student loan, or auto loan—you won’t immediately receive a credit score. Most scoring models require at least one account that’s been open for six months and at least one account reported to the credit bureaus within the past six months before generating a score.

Your initial score typically falls somewhere in the 500-700 range, depending on how you manage that first account. If you make on-time payments and keep your balance low, you’ll start on the higher end of this spectrum. This early stage is crucial for anyone learning how to increase their credit score effectively.

Factors affecting your initial credit score:

- Payment history from day one: Even your first payment matters when considering how to increase your credit score

- Credit utilization: How much of your available credit are you using

- Type of first credit account: Credit cards vs. installment loans

- Whether you’re an authorized user, being added to someone else’s account can jumpstart your score

How credit history begins:

Your credit journey officially starts when a lender reports your account information to one or more of the three major credit bureaus (Equifax, Experian, and TransUnion). This creates your credit file, which becomes the foundation for calculating your credit score. Understanding this process is the first step in learning how to increase your credit score systematically.

How Credit Score Is Calculated

Understanding how your credit score is calculated is crucial for learning how to increase your credit score effectively. The most widely used scoring model, FICO, breaks down your score into five key components. Mastering these components is essential for anyone serious about how to increase their credit score.

Credit Score Components Breakdown

| Component | Weight | What It Measures |

|---|---|---|

| Payment History | 35% | Whether you pay bills on time |

| Credit Utilization | 30% | How much credit are you using vs. available |

| Length of Credit History | 15% | How long have you had credit accounts |

| Credit Mix | 10% | Variety of credit types (cards, loans, etc.) |

| New Credit Inquiries | 10% | Recent applications for new credit |

Breaking Down Each Factor

Payment History (35%): This is the most important factor when figuring out how to increase your credit score. Every on-time payment strengthens your score, while late payments, collections, bankruptcies, and foreclosures can devastate it. Even one payment that’s 30+ days late can drop your score by 50-100 points.

Credit Utilization Ratio (30%): This measures how much of your available credit you’re using. For example, if you have a credit card with a $10,000 limit and carry a $3,000 balance, your utilization is 30%. When learning how to increase credit score, experts recommend keeping this below 30%, with under 10% being ideal for the best scores.

Length of Credit History (15%): The longer you’ve had credit accounts, the better. This factor considers both the age of your oldest account and the average age of all your accounts. This is why closing old credit cards can sometimes hurt your score, and it’s a key consideration in how to increase your credit score.

Credit Mix (10%): Lenders like to see that you can handle different types of credit—revolving accounts (credit cards) and installment loans (mortgages, auto loans, student loans). Having a diverse mix shows financial versatility and is part of understanding how to increase a credit score comprehensively.

New Credit Inquiries (10%): When you apply for new credit, lenders perform a “hard inquiry” that temporarily dings your score by a few points. Multiple inquiries in a short period (especially for different types of credit) can signal financial distress. Managing inquiries wisely is crucial when learning how to increase your credit score.

Example Calculation Scenario

Let’s look at two hypothetical borrowers to illustrate how to increase a credit score through different approaches:

Sarah’s Profile:

- Payment history: Perfect for 5 years

- Credit utilization: 8% ($800 used of $10,000 available)

- Oldest account: 8 years old

- Credit mix: 2 credit cards, 1 auto loan, 1 student loan

- Hard inquiries: 1 in the past year

- Estimated Score: 780-820

Mike’s Profile:

- Payment history: 2 missed payments in the past 2 years

- Credit utilization: 75% ($7,500 used of $10,000 available)

- Oldest account: 3 years old

- Credit mix: 1 credit card only

- Hard inquiries: 5 in the past 6 months

- Estimated Score: 580-620

The difference in their financial opportunities would be substantial. Sarah’s example demonstrates effective strategies for how to increase credit score, while Mike needs to implement several improvements to raise his score.

What Credit Score Is Considered Good?

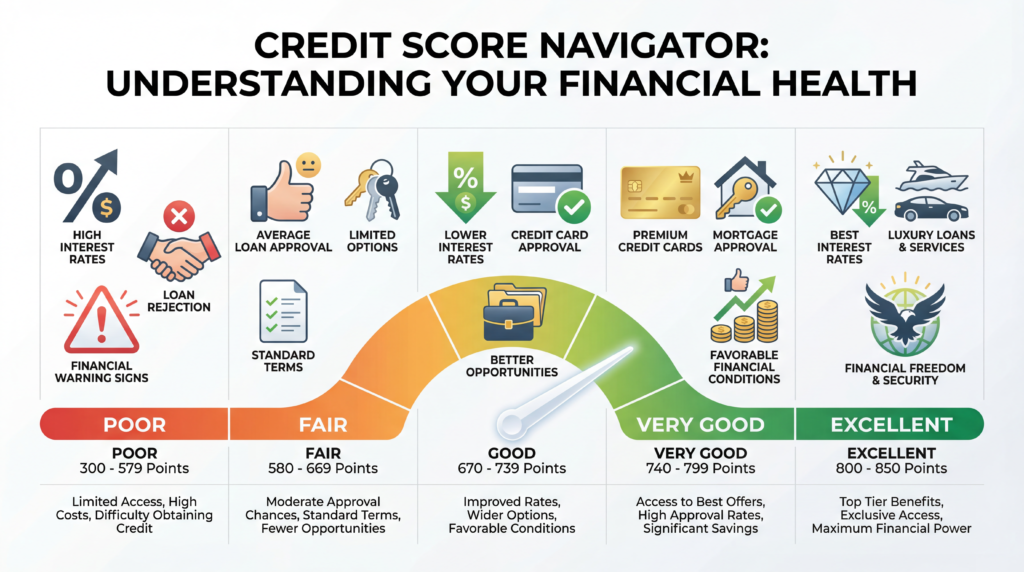

Credit scores fall into distinct ranges, and understanding where you stand is essential for setting realistic goals about how to increase your credit score to reach your target level.

Credit Score Ranges (FICO Model)

| Score Range | Rating | What It Means | % of Population |

|---|---|---|---|

| 800-850 | Exceptional | Best rates and terms guaranteed | 21% |

| 740-799 | Very Good | Excellent borrowing opportunities | 25% |

| 670-739 | Good | Most lenders approve | 21% |

| 580-669 | Fair | Subprime borrowing, higher rates | 17% |

| 300-579 | Poor | Difficult to get approved | 16% |

Why a “good” credit score matters:

A score of 670 or above generally qualifies you as a “good” borrower. If you’re below this threshold, understanding how to increase your credit score becomes critical for opening doors to:

- Competitive interest rates on mortgages and auto loans

- Credit cards with rewards and perks

- Higher credit limits

- Lower insurance premiums

- Better negotiating power with lenders

FICO vs. VantageScore comparison:

While FICO is the industry standard (used in 90% of lending decisions), VantageScore is gaining traction. Both use the 300-850 scale, but their calculations differ slightly. Regardless of which model you focus on, the fundamentals of how to increase your credit score remain consistent:

| Feature | FICO | VantageScore |

|---|---|---|

| Minimum credit history | 6 months | 1 month |

| Payment history weight | 35% | 40% |

| Recent data emphasis | Moderate | Higher |

| Scoring consistency | 28+ versions | Fewer versions |

Most lenders still primarily use FICO scores, so that’s where you should focus your attention when learning how to increase your credit score.

What Credit Score Is Needed to Buy a Car

Buying a car is often one of the first major credit purchases people make, and your credit score significantly impacts both your approval odds and the interest rate you’ll pay. Knowing how to increase your credit score before shopping for a car can save you thousands.

Auto Loan Credit Score Requirements

| Credit Score | Loan Category | Typical APR | Monthly Payment* |

|---|---|---|---|

| 720+ | Super Prime | 5-7% | $444 |

| 680-719 | Prime | 6-9% | $460 |

| 620-679 | Near Prime | 9-13% | $485 |

| 580-619 | Subprime | 13-18% | $520 |

| Below 580 | Deep Subprime | 18-21%+ | $550+ |

*Based on a $25,000 loan over 60 months

How lenders evaluate creditworthiness for car loans:

Auto lenders don’t just look at your credit score. They consider multiple factors, which is why understanding how to increase a credit score is just one part of the equation:

- Debt-to-income ratio: Your monthly debt payments divided by gross income (lenders prefer below 40%)

- Down payment: A larger down payment (10-20%) reduces lender risk and can offset a lower score

- Employment history: Stable employment signals reliable income

- The vehicle itself: Newer cars are easier to finance than older ones

- Loan term: Shorter loans (36-48 months) may have lower rates than 72+ month loans

Tips to improve your score before applying for a car loan:

If you’re planning to buy a car in the next 6-12 months, here’s how to increase your credit score for better terms:

- Pay down credit card balances to reduce utilization below 30%

- Make all payments on time for at least 6 months before applying

- Avoid opening new credit accounts that could temporarily lower your score

- Check your credit reports for errors and dispute any inaccuracies

- Consider a co-signer if your score is borderline (but only if you’re confident you can make payments)

- Get pre-approved with multiple lenders to compare rates (do this within 14 days to minimize hard inquiry impact)

Learning how to increase your credit score before you need financing gives you negotiating power at the dealership.

What Credit Score Is Needed to Buy a House

Buying a home is the largest financial commitment most people will make, and your credit score plays a pivotal role in whether you’ll qualify and how much you’ll pay. This makes understanding how to increase a credit score absolutely critical for aspiring homeowners.

Mortgage Credit Score Requirements by Loan Type

| Loan Type | Minimum Score | Ideal Score | Down Payment | Key Features |

|---|---|---|---|---|

| Conventional | 620 | 740+ | 3-20% | Best rates at 740+ |

| FHA | 580 | 580+ | 3.5% | More flexible approval |

| VA | No minimum | 620+ | 0% | For veterans/military |

| USDA | 640 | 640+ | 0% | Rural properties only |

| Jumbo | 700 | 740+ | 10-20% | High-balance loans |

How different mortgage types affect score requirements:

- Conventional loans offer the best rates but require higher scores. With a 740+ score, you’ll qualify for the lowest rates. Below 680, you’ll face higher fees and rates. Understanding how to increase your credit score to reach 740+ can save you enormous amounts.

- FHA loans are government-backed and more forgiving. You can qualify with a 580 score if you put 3.5% down, or even with a 500 score if you can manage 10% down. However, FHA loans require mortgage insurance that can be costly.

- VA loans technically have no minimum score, but most lenders prefer 620+. These are excellent options for eligible service members with zero down payment required. Still, knowing how to increase your credit score improves your chances and terms.

The real cost of a low credit score:

Consider this example on a $300,000 mortgage to see why how to increase credit score matters so much:

| Credit Score | Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| 760-850 | 6.5% | $1,896 | $382,560 |

| 700-759 | 6.7% | $1,932 | $395,520 |

| 680-699 | 6.9% | $1,970 | $409,200 |

| 660-679 | 7.1% | $2,008 | $423,360 |

| 640-659 | 7.5% | $2,098 | $455,280 |

| 620-639 | 8.0% | $2,201 | $492,360 |

The difference between a 760 score and a 620 score? Over $109,000 in additional interest over 30 years. This illustrates exactly why learning how to increase credit score is one of the most valuable financial skills.

Importance of credit score in mortgage approval:

Beyond interest rates, your credit score affects:

- Loan approval odds: Higher scores mean faster, easier approval

- Down payment requirements: Lower scores may require larger down payments

- Private mortgage insurance (PMI): Required on conventional loans with less than 20% down

- Closing costs: Some lenders offer credits to borrowers with excellent scores

- Negotiating power: Better scores give you leverage to shop for the best deal

If you’re serious about homeownership, learning how to increase your credit score should be a top priority, potentially starting 1-2 years before you plan to buy.

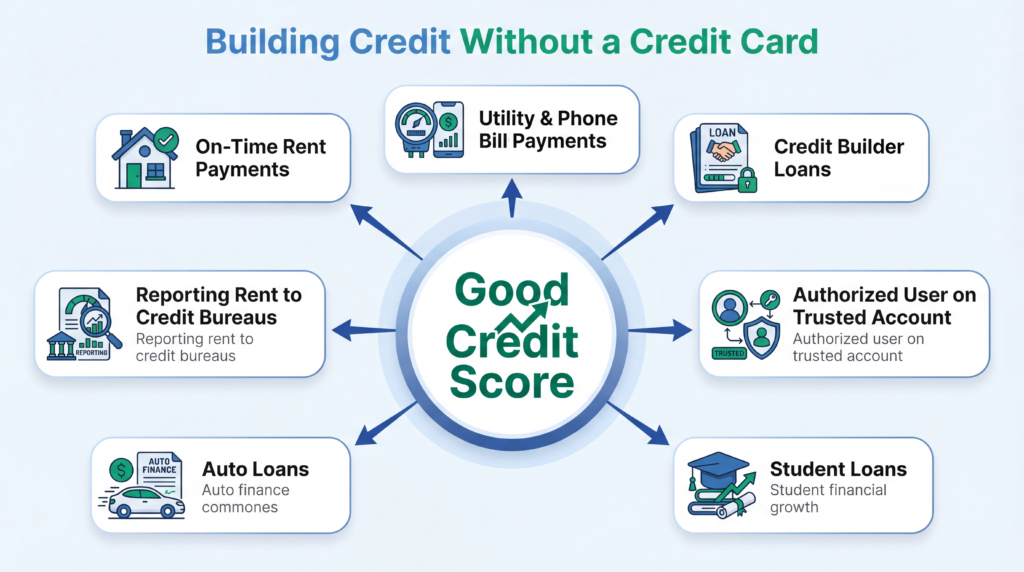

How to Increase Credit Score Without a Credit Card

Not everyone wants or can qualify for a credit card, but that doesn’t mean you can’t build excellent credit. Here are proven alternative methods for how to increase your credit score without relying on credit cards:

Alternative Credit-Building Methods

1. Secured Loans

Secured loans require collateral (like a car or savings account) but are easier to qualify for. By making consistent on-time payments, you build a positive payment history. This is an excellent strategy for how to increase a credit score when credit cards aren’t an option.

Pros:

- Lower interest rates than unsecured options

- A fixed payment schedule makes budgeting easy

- Builds credit while achieving other goals (like saving)

Cons:

- Requires upfront collateral

- Risk losing collateral if you can’t pay

- May have fees and restrictions

2. Credit-Builder Loans

These unique loans are designed specifically for building credit and are perfect for anyone learning how to increase their credit score from scratch. The lender holds the loan amount in a savings account while you make payments. Once paid off, you receive the money.

Pros:

- No credit check required (usually)

- Forces savings while building credit

- Typically offered by credit unions at low rates

Cons:

- You don’t get the money upfront

- May have fees

- Requires monthly payments, you might not “feel” immediately

3. Paying Bills on Time (Utilities, Rent, Phone)

Traditional bills don’t automatically report to credit bureaus, but services like Experian Boost, RentTrack, and Rental Kharma allow you to add these payments to your credit file. This is an underutilized method for increasing a credit score.

Pros:

- Uses bills you’re already paying

- Can provide an immediate score boost

- Free or low-cost services available

Cons:

- Not all scoring models consider this data

- Requires manual setup with reporting services

- Late payments could also be reported

4. Becoming an Authorized User

When someone adds you as an authorized user on their credit card, that account’s history typically appears on your credit report. If they have excellent payment history and low utilization, it can boost your score. This is a quick-start method for how to increase your credit score.

Pros:

- Can provide a significant immediate score increase

- No financial responsibility (usually)

- Benefit from someone else’s good credit habits

Cons:

- Their bad habits hurt your score, too

- Requires finding someone willing to add you

- Some scoring models discount authorized user accounts

- Relationship complications if things go wrong

5. Reporting Rent and Utility Payments

Services like RentReporters ($95/year) and Rental Kharma ($8.95/month) report your rent payments to credit bureaus, turning your largest monthly expense into a credit-building tool. This represents another avenue for how to increase credit score using existing expenses.

Pros:

- Leverages your largest monthly payment

- Can add retroactive payment history (sometimes)

- Relatively affordable

Cons:

- Subscription fees add up

- Not recognized by all scoring models

- Landlord cooperation is sometimes required

Comparison Table: Non-Credit Card Credit Building Methods

| Method | Setup Cost | Monthly Cost | Credit Impact | Time to See Results |

|---|---|---|---|---|

| Secured Loan | $500-2,000 | Varies | High | 3-6 months |

| Credit-Builder Loan | $0 | $25-150 | High | 6-12 months |

| Rent Reporting | $50-100 | $5-15 | Moderate | Immediate |

| Authorized User | $0 | $0 | High | Immediate-3 months |

| Bill Reporting | $0 | $0 | Low-Moderate | 1-3 months |

Each of these methods provides a viable path for how to increase a credit score without traditional credit cards.

How to Increase Credit Score to 800

Reaching the 800 club—a credit score of 800 or higher—puts you in elite financial territory. Only about 21% of Americans achieve this milestone, but it’s entirely possible with the right strategies. Understanding how to increase a credit score to this level requires commitment and patience.

Strategies to Reach an Excellent Credit Score

1. Maintaining Low Credit Utilization (Under 10%)

While 30% is acceptable, those with 800+ scores typically keep utilization under 10%. This is a critical aspect of how to increase a credit score to elite levels. If you have $20,000 in available credit, keep your balances below $2,000 total across all cards.

Pro tip: Pay down balances multiple times per month, not just before the due date, to keep your reported utilization low.

2. Consistently Paying Bills on Time (100% On-Time Payment History)

This is non-negotiable when considering how to increase a credit score to 800+. People with 800+ scores have years—often decades—of perfect payment history. Set up automatic payments for at least the minimum due to avoid any slip-ups.

Strategy: Set payment reminders 3 days before due dates, even if you have auto-pay enabled, as a double-check system.

3. Avoiding Unnecessary Hard Inquiries

Those seeking 800+ scores are strategic about new credit applications. They might apply for a new card every 12-24 months at most, and they time applications carefully. This discipline is essential for how to increase credit score to exceptional levels.

Best practice: Only apply for credit when you have a specific financial goal, not just because you received a pre-approval offer.

4. Keeping Old Accounts Open to Lengthen Credit History

The average person with an 800+ score has a credit history spanning 10-20+ years. Your oldest accounts are precious—they extend your average account age significantly. This patience is fundamental to how to increase credit score to the highest tier.

What to do: Keep old cards active by making one small purchase per year and paying it off immediately. This prevents the issuer from closing the account due to inactivity.

5. Diversifying Your Credit Mix

An ideal mix includes:

- 2-3 credit cards

- 1 auto loan or mortgage

- Perhaps a personal loan or student loan

This demonstrates you can manage various credit types responsibly—another key element of how to increase your credit score to 800+.

Long-Term Planning Tips for 800+ Scores

| Timeline | Goal | Action Steps |

|---|---|---|

| Months 1-6 | Foundation | Pay everything on time; reduce utilization below 30% |

| Months 7-12 | Momentum | Reduce utilization below 10%; dispute any report errors |

| Years 2-3 | Building | Maintain perfect payment history; strategically add one new account if needed |

| Years 4-5 | Optimization | Keep the oldest accounts active; let age work for you |

| Years 6+ | Elite Status | Maintain habits; 800+ score achieved and sustained |

The 800+ Mindset:

Achieving an 800+ credit score isn’t just about tactics—it’s about adopting a financial mindset. Understanding how to increase credit score at this level means embracing:

- Patience: This is a marathon, not a sprint

- Consistency: Perfect habits maintained over the years

- Prevention: Never missing a payment is easier than recovering from one

- Restraint: Only borrowing what you can easily repay

- Vigilance: Regular monitoring to catch issues early

Remember: An 800+ score is impressive, but even a 760 gets you the best rates. Don’t obsess over reaching 800 if you’re already in the “excellent” range. Focus instead on the financial habits that got you there. The journey of how to increase a credit score to this level builds character and financial discipline.

Additional Tips to Boost Credit Score

Beyond the major strategies, these additional tactics can help accelerate your progress in learning how to increase your credit score:

Regularly Monitoring Your Credit Report for Errors

About 20% of credit reports contain errors that could hurt your score. This makes monitoring an essential part of how to increase a credit score. Check your reports from all three bureaus (Equifax, Experian, TransUnion) at least annually through AnnualCreditReport.com.

Common errors to watch for:

- Accounts that aren’t yours

- Incorrect late payment marks

- Wrong account balances or credit limits

- Duplicate accounts

- Outdated negative information (most should drop off after 7 years)

Disputing Inaccuracies with Credit Bureaus

If you find errors, dispute them immediately—this is a crucial step in how to increase credit score when errors are dragging you down:

- Gather documentation proving the error (bank statements, payment receipts, etc.)

- File disputes online with each bureau reporting the error (fastest method)

- Follow up in writing with certified mail for serious errors

- Allow 30-45 days for investigation

- Verify corrections once the dispute is resolved

Avoiding Closing Old Accounts Unnecessarily

Closing credit cards reduces your available credit (increasing utilization) and can lower your average account age—both hurt your score. Understanding this is vital for how to increase credit score effectively.

When closing might make sense:

- The card has a high annual fee that you can’t justify

- You have self-control issues with available credit

- The card is causing marital or financial conflicts

Better alternative: Keep the card but lock it away, setting up one small recurring charge (like a streaming service) and autopay to keep it active.

Responsible Borrowing Practices

The foundation of excellent credit is simply being a responsible borrower. This principle underlies all strategies for how to increase credit score:

- Borrow only what you need and can comfortably repay

- Understand terms before signing any credit agreement

- Build an emergency fund so unexpected expenses don’t force you to miss payments

- Don’t co-sign loans unless you’re prepared to pay them yourself

- Read your credit card statements monthly to catch fraud or errors quickly

- Avoid payday loans and high-interest debt that can trap you in a cycle

Quick Wins for Immediate Score Improvement

These tactics represent actionable steps in how to increase credit score relatively quickly:

| Action | Potential Score Impact | Time to Implement |

|---|---|---|

| Pay down cards below 30% utilization | 10-40 points | 1 billing cycle |

| Dispute and remove credit report errors | 10-100+ points | 30-45 days |

| Become an authorized user on the old, positive account | 20-50 points | Immediate-1 month |

| Set up autopay to avoid late payments | Prevents drops | 30 minutes |

| Request credit limit increase (don’t increase spending) | 5-20 points | Immediate |

Each of these represents a concrete action in your journey to increase your credit score.

Conclusion

Learning how to increase your credit score is one of the most valuable financial skills you can develop. Your credit score impacts everything from the interest rate on your mortgage to whether you’ll be approved for that dream apartment, and it can literally save you hundreds of thousands of dollars over your lifetime.

Key strategies to remember about how to increase your credit score:

- Payment history is king: Never miss a payment—set up autopay and reminders

- Keep utilization low: Aim for under 30%, ideally under 10%

- Think long-term: Building excellent credit takes years, not months

- Monitor regularly: Check your reports annually and use free monitoring services

- Be patient with yourself: Recovery from mistakes takes time, but it’s always possible

- Avoid gimmicks: There are no shortcuts; consistent good habits win

The path forward for how to increase credit score isn’t complicated, but it requires commitment:

Whether you’re starting from scratch, rebuilding after financial difficulties, or pushing from good to excellent, the principles of how to increase your credit score remain the same. Pay your bills on time. Keep your debts manageable. Monitor your credit regularly. Be patient.

Track your progress and celebrate milestones:

- First time breaking 650? Celebrate!

- Reached 700 and qualified for your first rewards card? That’s worth acknowledging!

- Achieved 800+? You’re in elite company!

Remember, your credit score is a reflection of your financial habits, not your worth as a person. When you understand how to increase your credit score, you realize it can always be improved, no matter where you’re starting from.

The journey of how to increase credit score starts with a single on-time payment. Start today, stay consistent, and watch your financial opportunities expand as your score climbs. Your future self—sitting in that new home or driving that car with a rock-bottom interest rate—will thank you for the work you put in today to master how to increase your credit score.

Ready to take action on how to increase your credit score? Start by pulling your free credit report today at AnnualCreditReport.com, and identify one or two areas where you can improve. Then commit to implementing the strategies you’ve learned here about how to increase your credit score. Your financial future is in your hands—make it a bright one by mastering how to increase your credit score today!

FAQs

Q. How to increase credit score without using a credit card?

- You can increase your score without a credit card by paying loans on time, using secured loans, and ensuring utility or rent payments are reported to credit bureaus.

Q. How to increase credit score after late payments?

- The best way to increase your score after late payments is to make consistent on-time payments going forward and lower your credit utilization.

Q. How to increase credit score to 700 or higher?

- To reach a 700+ score, focus on maintaining low balances, avoiding new hard inquiries, and keeping older credit accounts active.

Q. How to increase credit score to 800 over time?

- Reaching an 800 credit score requires long-term discipline, including perfect payment history, low utilization, and a strong credit mix.

Q. How to increase credit score before applying for a loan?

- Before applying, pay down existing debt, avoid opening new accounts, and review your credit report for any errors that can be disputed.

Q. How to increase credit score with existing debt?

- You can still increase your score by prioritizing on-time payments, lowering your debt-to-credit ratio, and avoiding missed payments.

Q. How to increase credit score naturally without credit repair services?

- Improving your credit score naturally involves responsible financial habits such as timely payments, low credit usage, and regular monitoring of your credit report.

Q. How to increase credit score and maintain it long term?

- To increase and maintain your score, practice consistent financial discipline, limit unnecessary borrowing, and review your credit report regularly.

Q. How to increase credit score after paying off a loan?

- After paying off a loan, you can increase your score by continuing on-time payments on other accounts and maintaining a healthy credit mix.

Q. How to increase credit score by checking credit reports regularly?

- Regularly reviewing your credit report helps identify errors and fraud, which, when corrected, can positively impact your credit score.

Q. How to increase credit score and avoid common mistakes?

- Avoid late payments, frequent hard inquiries, and closing old accounts to steadily improve and protect your credit score.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.