Introduction to Student Loan Refinancing for Doctors and Dentists: A Complete Guide

Medical professionals graduate with some of the highest student loan debt in the country. For doctors and dentists carrying six-figure balances, student loan refinancing can be a powerful tool to reduce interest rates, lower monthly payments, and save thousands over the life of the loan. This comprehensive guide explains everything medical and dental professionals need to know about refinancing student loans, from timing strategies to lender comparisons.

What Is Student Loan Refinancing and How Does It Work for Doctors and Dentists?

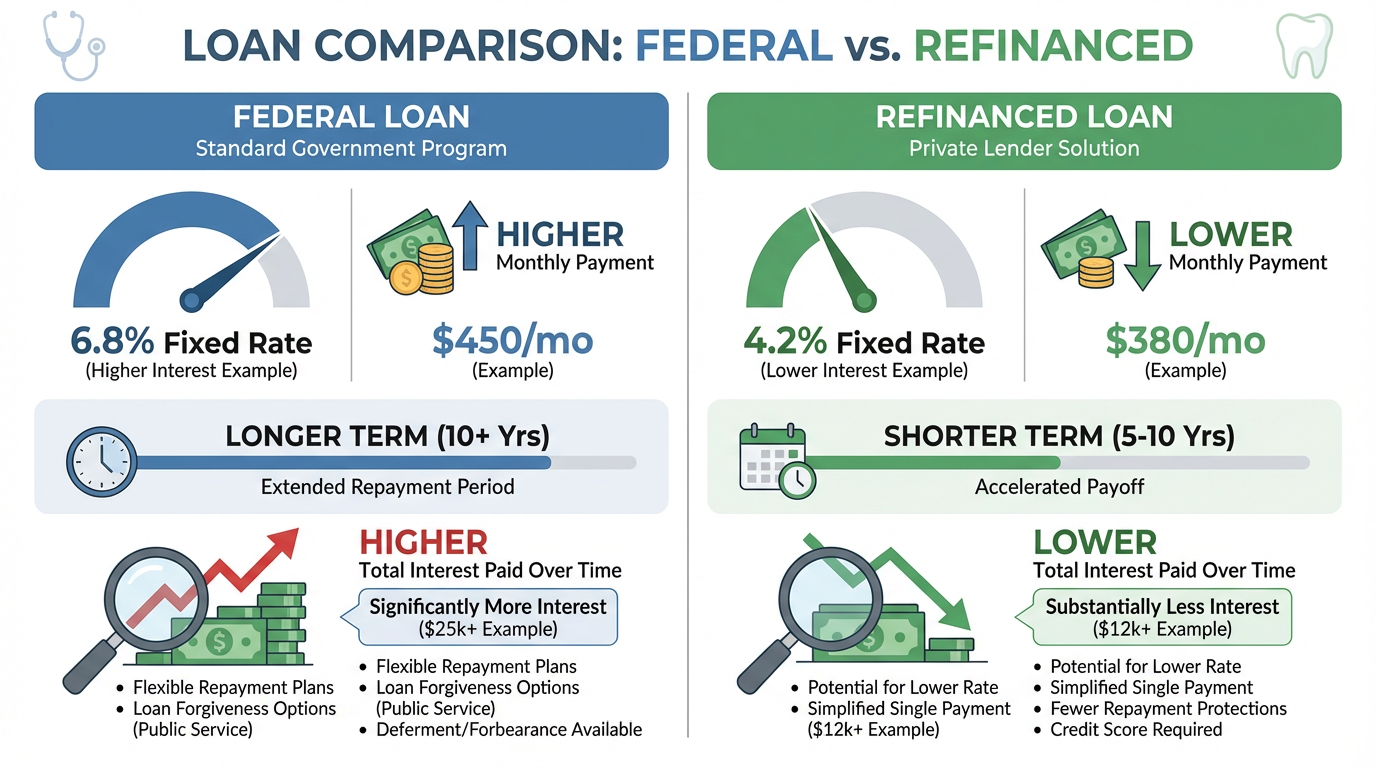

Student loan refinancing involves taking out a new private loan to pay off one or more existing student loans. The new loan typically comes with different terms—ideally, a lower interest rate, adjusted repayment period, or both. For doctors and dentists, refinancing can transform burdensome educational debt into a more manageable financial obligation.

How Refinancing Replaces Existing Loans

When you refinance student loans, a private lender pays off your current loans and issues a new loan with updated terms. You’ll make payments to the new lender going forward. The process consolidates multiple loans into a single monthly payment and, if you qualify for better rates, can significantly reduce the total interest paid over time.

Private Lenders vs Federal Loans

Federal student loans come with government-backed protections like income-driven repayment plans, deferment options, and potential loan forgiveness programs. Private refinancing loans, however, are issued by banks, credit unions, and online lenders. While private loans may offer lower interest rates for qualified borrowers, they don’t include federal protections.

Why Doctors and Dentists Qualify for Better Rates

Lenders view medical professionals as lower-risk borrowers due to high earning potential and stable career trajectories. Many refinancing companies offer physician-specific refinancing programs with competitive rates, special benefits during residency, and flexible underwriting that considers future income rather than just current salary.

Many lenders allow doctors and dentists to check refinance rates online without impacting credit. Compare offers from multiple lenders to find your best rate. “Check Your Personalized Refinance Rates Today”

Why Doctors and Dentists Have Unique Student Loan Refinancing Needs

Medical and dental professionals face distinct financial challenges that make student loan debt refinancing particularly relevant:

High Debt-to-Income Ratio

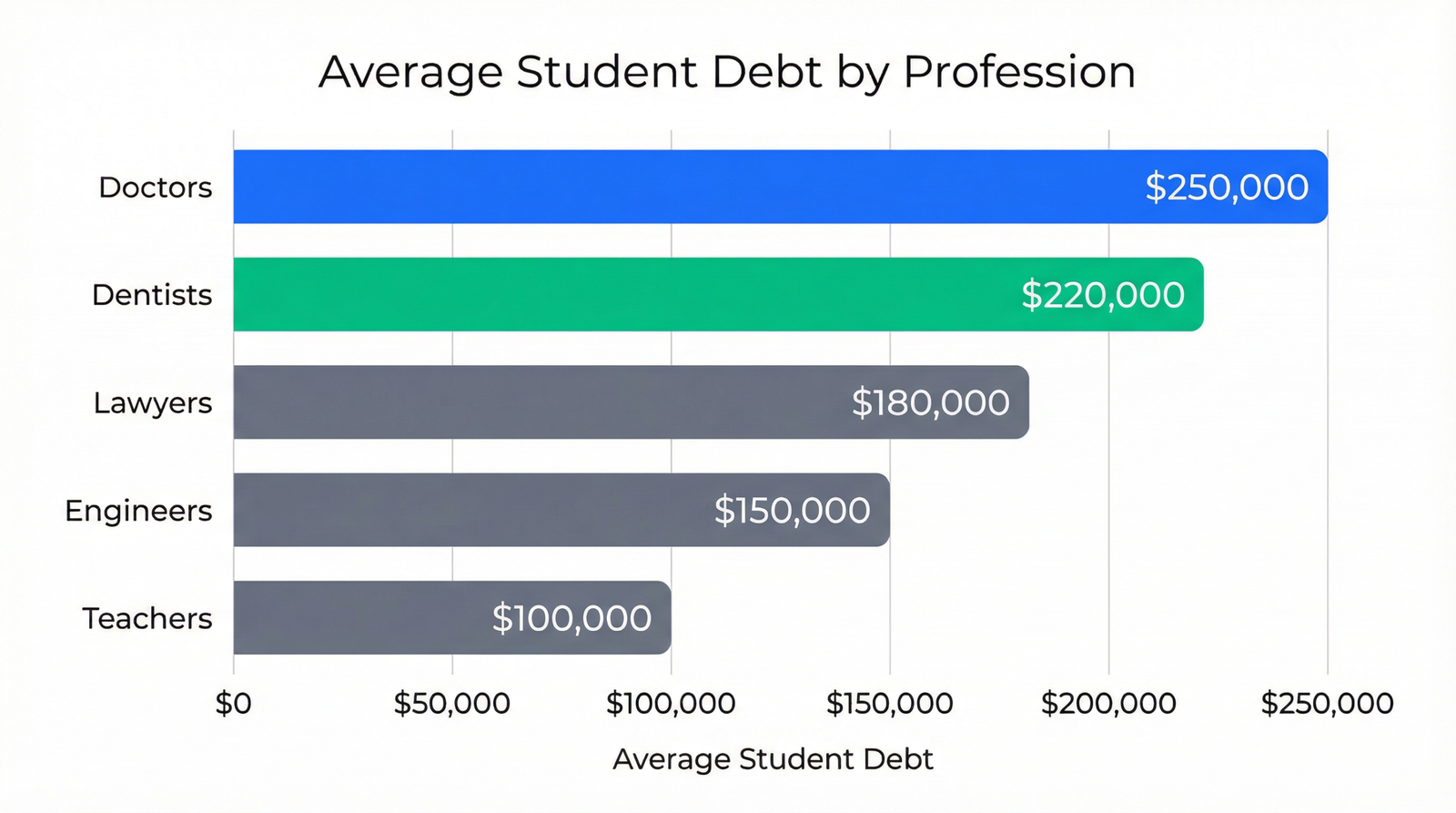

The average medical school graduate carries over $200,000 in student loan debt, while dental school graduates often exceed $300,000. These balances dwarf typical undergraduate debt and require specialized repayment strategies.

Delayed Earning Years

Unlike many professions where earning potential begins immediately after graduation, doctors spend years in residency and fellowship, earning modest salaries despite their advanced degrees. This delay in peak earnings creates unique timing considerations for refinancing.

Residency and Fellowship Challenges

During training, physicians may struggle with standard loan payments while earning $50,000-$70,000 annually. Some lenders recognize this challenge and offer residency refinancing programs with reduced payments or interest-only options during training years.

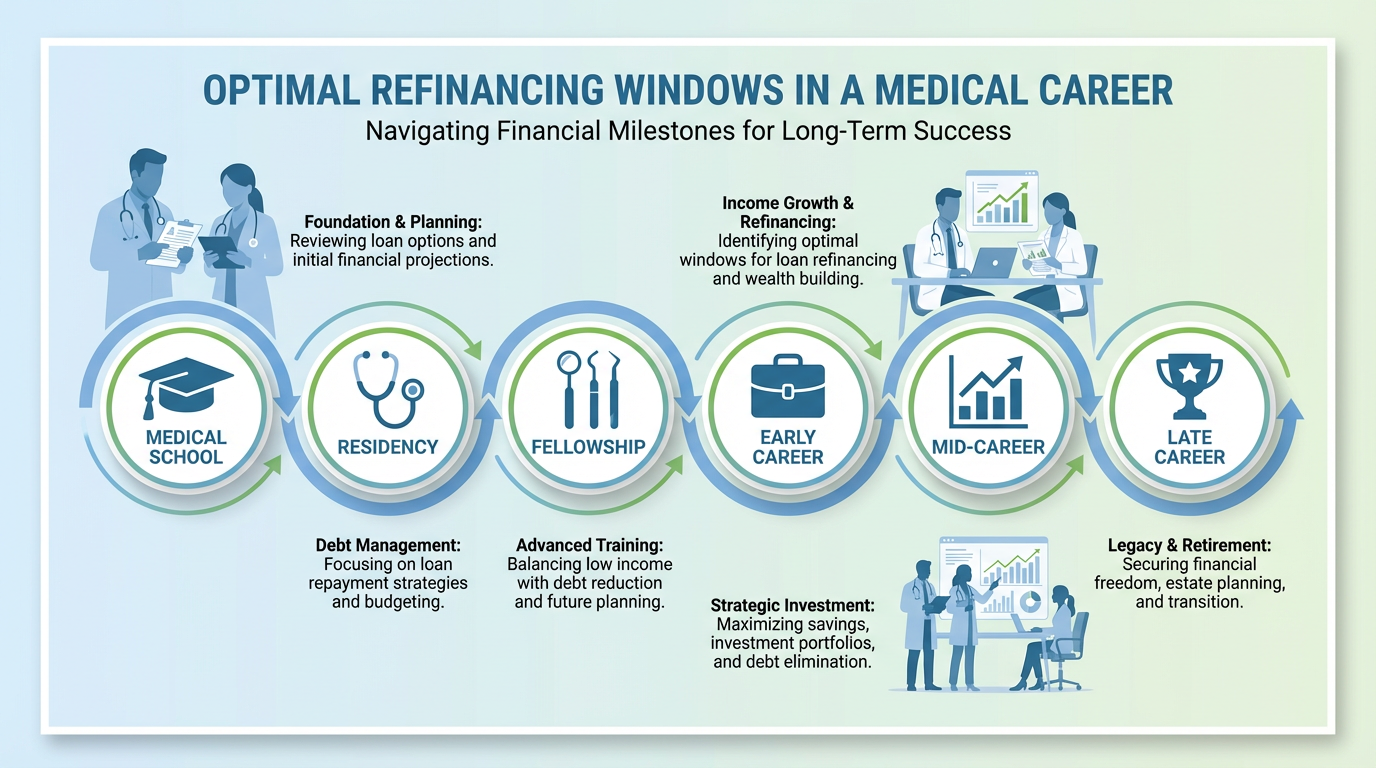

When Is the Right Time for Doctors and Dentists to Refinance Student Loans?

Timing is critical when considering when to refinance student loans. The optimal moment depends on your career stage, income, and financial goals.

Refinancing During Residency or Fellowship

Pros:

- Lock in lower rates if you have good credit

- Reduce interest accumulation during training

- Some lenders offer resident-friendly terms

Cons:

- Limited income may result in higher rates

- May need a co-signer

- Less benefit from the rate reduction on a lower salary

Refinancing After Becoming an Attending or Practice Owner

This is often the ideal time to refinance student loans after residency. Your income has increased substantially, improving your debt-to-income ratio and qualifying you for the lowest available rates. Many physicians see rate reductions of 2-4% when refinancing after completing training.

Best practices for timing:

- Wait until your attending salary is reflected on tax returns

- Ensure credit score is above 700

- Have 6-12 months of attending-level income documented

- Compare multiple offers during the rate shopping period

Comparison: Refinancing at Different Career Stages

| Career Stage | Average Income | Typical Rate Reduction | Best Strategy |

|---|---|---|---|

| Residency | $50K-$70K | 0.5-1.5% | Consider if the rate is 7%+, use a co-signer |

| Early Attending | $200K-$300K | 2-4% | Prime refinancing window |

| Established Practice | $300K+ | 3-5% | Refinance or accelerate payments |

| Practice Owner | $400K+ | 3-5% | Refinance and/or invest extra funds |

“Want the best rates for your career stage? Comparing multiple refinance offers can help you find the perfect timing—check offers now.”

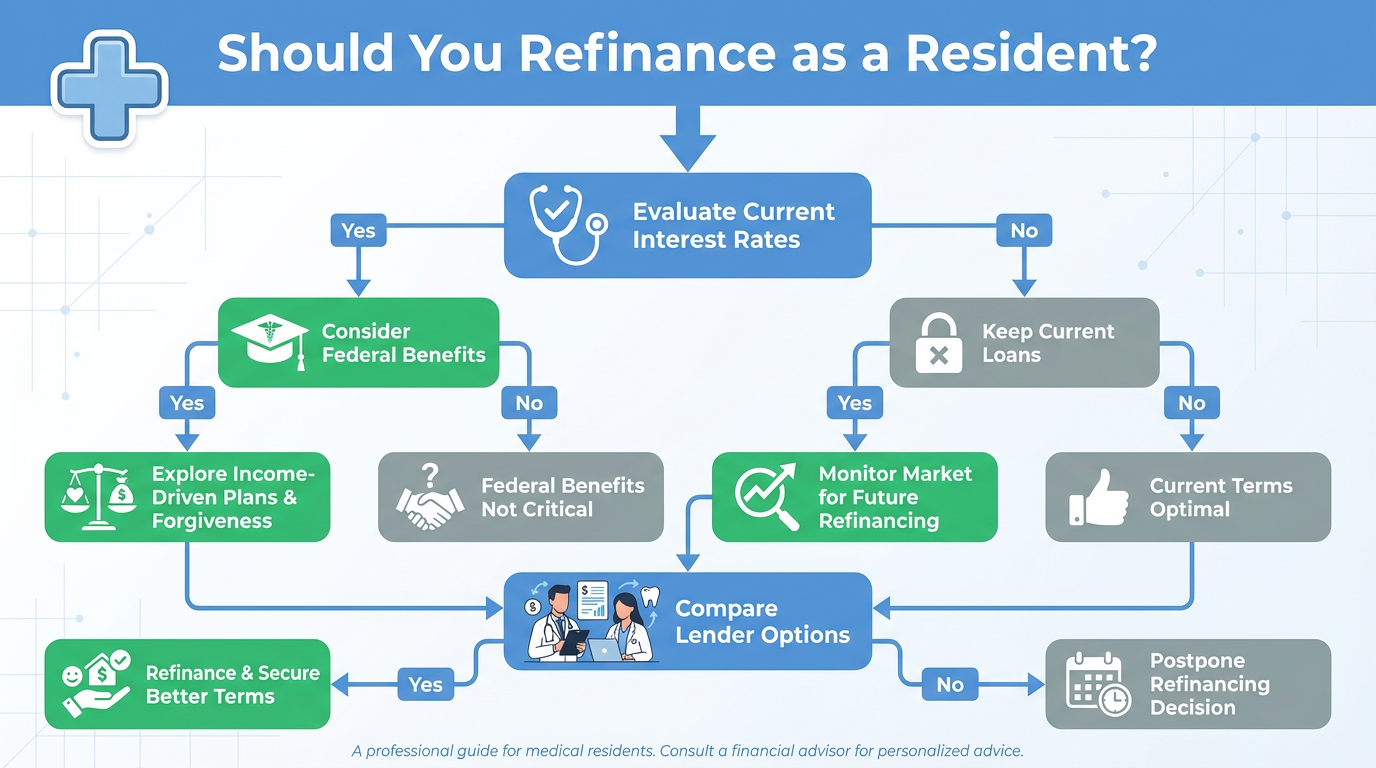

Can Medical and Dental Residents Refinance Student Loans?

Yes, student loan refinancing for dental residents is possible, though it comes with unique considerations.

Income Verification Requirements

Most lenders require proof of income, which can be challenging for a resident’s salary. However, several lenders have created programs specifically for medical residents that consider:

- Future earning potential

- Signed employment contracts

- Specialty choice (higher-earning specialties may get better terms)

- Medical school prestige

Lenders That Accept Residents

A growing number of companies offer refinance student loans during residency programs with features like:

- Interest-only payments during training

- Reduced payment options

- No prepayment penalties

- Rate discounts upon completion of training

Pros and Cons at the Early Career Stage

Advantages:

- Start saving on interest immediately

- Build a relationship with the preferred lender

- Reduce the overall debt burden sooner

Disadvantages:

- May not get the best rates with resident income

- Lose federal loan protections

- Limited cash flow for emergencies

A few lenders approve residents based on future income rather than current salary. Check if you prequalify for resident-specific programs.

How Much Can Doctors and Dentists Save With Student Loan Refinancing?

The student loan refinancing savings can be substantial for medical professionals with six-figure debt loads.

Interest Savings Breakdown

Consider a physician with $250,000 in student loans at 7% interest on a 10-year repayment plan. By refinancing to 4.5%, they could save approximately $45,000 in interest over the loan term.

Monthly Payment Reduction Examples

Example 1: Rate Reduction Only

- Original: $250,000 at 7% = $2,903/month

- Refinanced: $250,000 at 4.5% = $2,594/month

- Monthly savings: $309

Example 2: Extended Term

- Original: $250,000 at 7% over 10 years = $2,903/month

- Refinanced: $250,000 at 4.5% over 15 years = $1,913/month

- Monthly savings: $990 (but more interest paid overall)

Long-Term Repayment Scenarios

| Loan Amount | Original Rate/Term | Refinanced Rate/Term | Total Interest Saved | Payment Difference |

|---|---|---|---|---|

| $200,000 | 7% / 10 years | 4.5% / 10 years | $36,000 | $247/month |

| $300,000 | 6.5% / 10 years | 4% / 10 years | $54,000 | $339/month |

| $400,000 | 7.5% / 15 years | 5% / 15 years | $120,000 | $423/month |

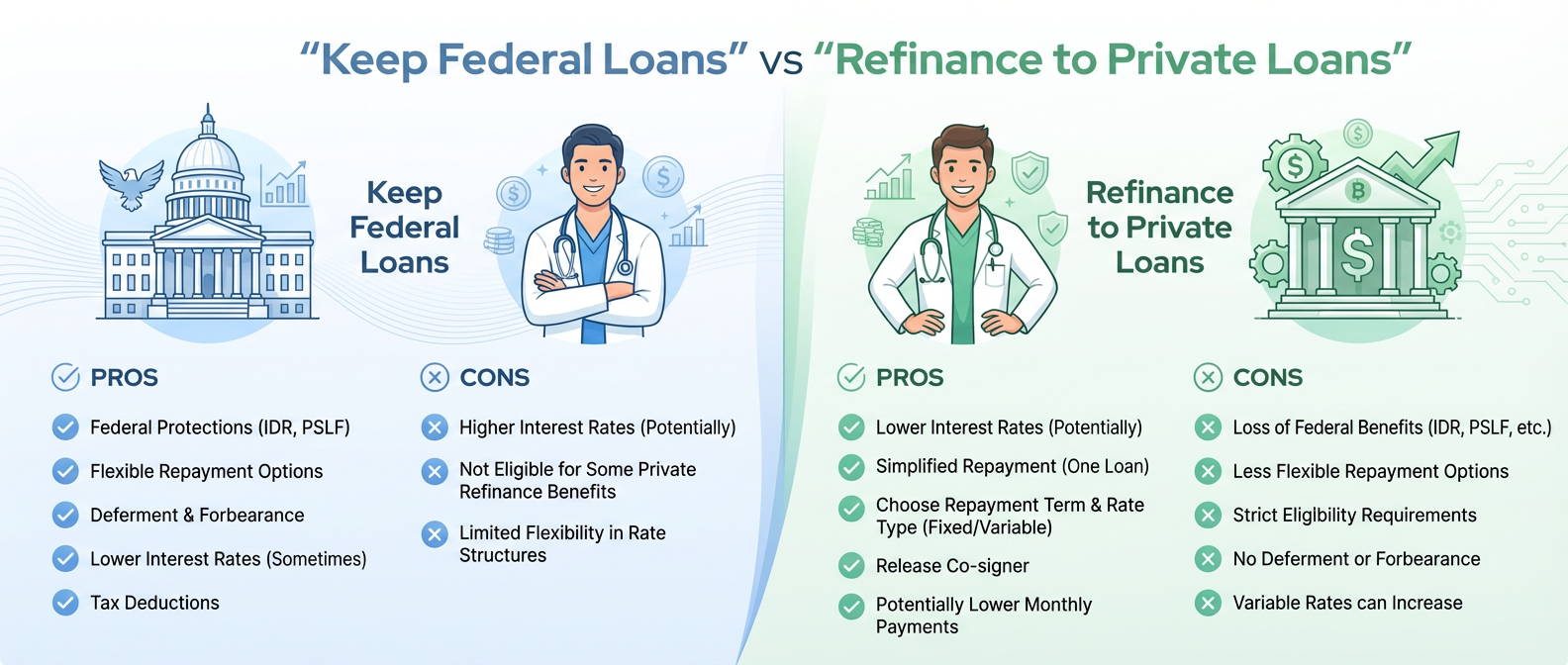

Should Doctors and Dentists Refinance Federal Student Loans?

This is one of the most important decisions in federal student loan refinancing. Once you refinance federal loans with a private lender, you permanently lose federal benefits.

Loss of Federal Protections

Federal loans offer:

- Income-Driven Repayment (IDR) plans that cap payments at 10-20% of discretionary income

- Forbearance and deferment during financial hardship

- Public Service Loan Forgiveness (PSLF) for qualifying employment

- Potential federal forgiveness after 20-25 years on IDR plans

- Death and disability discharge provisions

Private refinanced loans generally do not offer these protections, though some lenders provide limited forbearance options.

Forbearance, IDR, and Forgiveness Trade-offs

When to keep federal loans:

- You work for a nonprofit hospital and qualify for PSLF

- Your income is modest relative to debt (IDR could result in forgiveness)

- You value the security of income-based payment options

- Your specialty has uncertain income prospects

When refinancing makes sense:

- You work in private practice with no PSLF eligibility

- Your income is high enough that IDR payments equal standard payments

- You have excellent credit and qualify for rates below 5%

- You prioritize paying off debt quickly over safety nets

Student Loan Refinancing vs Income-Driven Repayment and PSLF

Understanding student loan refinancing vs PSLF is critical for doctors working in nonprofit settings.

PSLF Eligibility

Public Service Loan Forgiveness requires:

- Employment at a 501(c)(3) nonprofit or government entity

- 120 qualifying monthly payments while working full-time

- Enrollment in an income-driven repayment plan

- Direct federal loans (not private refinanced loans)

Hospital vs Private Practice Impact

Nonprofit hospital physicians:

- Often qualify for PSLF

- May benefit from keeping federal loans and pursuing forgiveness

- Can potentially have $100,000+ forgiven tax-free

Private practice physicians:

- Don’t qualify for PSLF

- Usually benefit more from refinancing to lower rates

- Pay off debt faster with higher rates eliminated

Long-Term Cost Comparison

| Scenario | Total Paid | Strategy |

|---|---|---|

| PSLF Track (nonprofit) | $150,000 paid + $150,000 forgiven | Keep federal, pursue forgiveness |

| Private Practice (No Refi) | $450,000 at 7% over 15 years | Paying the full amount + high interest |

| Private Practice (Refinanced) | $350,000 at 4% over 15 years | Best option – save $100,000 |

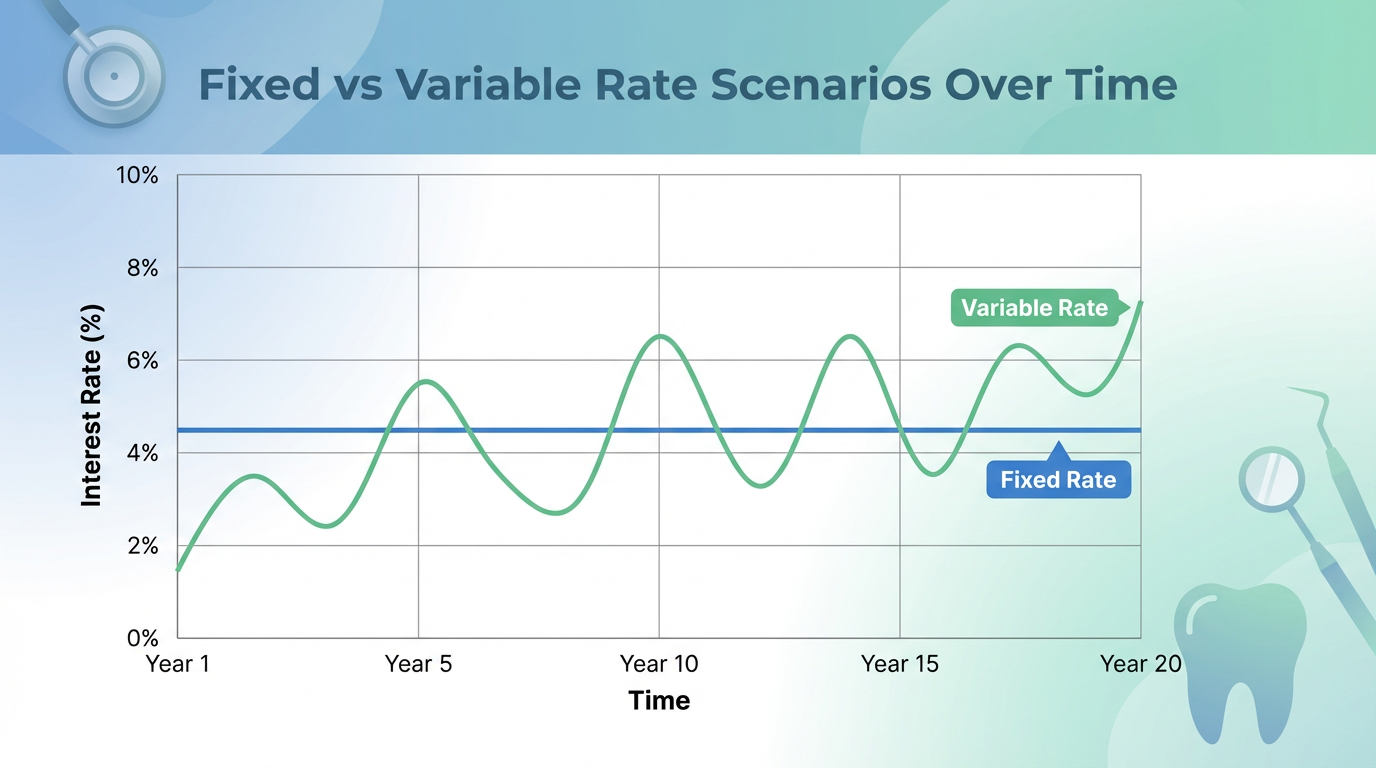

Fixed vs Variable Rates — What Should Doctors and Dentists Choose?

When exploring best interest rates for refinancing, you’ll encounter both fixed and variable rate options.

Fixed Rate Loans

Advantages:

- Predictable monthly payments

- Protection from rising interest rates

- Easier budgeting

- Peace of mind

Best for: Risk-averse borrowers, those on longer repayment terms (10+ years), or when rates are historically low

Variable Rate Loans

Advantages:

- Typically start 0.25-0.75% lower than fixed rates

- Can save money if rates remain stable or decrease

- Often better for short repayment timelines (5 years or less)

Risks:

- Payments can increase if rates rise

- Harder to budget long-term

- Potential for significantly higher costs in high-rate environments

Risk Tolerance and Market Conditions

Consider your:

- Income stability: High, predictable income can absorb rate increases

- Repayment timeline: Shorter terms = less interest rate risk

- Economic outlook: Current rate environment and Federal Reserve policy

- Personal risk comfort: Can you handle payment uncertainty?

Hybrid Strategies

Some doctors split their refinancing:

- 60-70% in fixed-rate loans for stability

- 30-40% in variable-rate loans to capitalize on potential savings

Comparison Table: Fixed vs Variable Rate Example

| Rate Type | Starting Rate | Loan Amount | 5-Year Total Cost | 10-Year Total Cost |

|---|---|---|---|---|

| Fixed | 5.0% | $200,000 | $226,600 | $254,500 |

| Variable (Best Case) | 4.25% → 4.5% | $200,000 | $220,400 | $242,000 |

| Variable (Worst Case) | 4.25% → 7.0% | $200,000 | $232,000 | $278,000 |

“Before refinancing, review both fixed and variable rate options side by side to pick the smartest strategy for your loans. Check Rates.”

What Credit Score Do Doctors and Dentists Need for Student Loan Refinancing?

Your credit score for student loan refinancing significantly impacts the rates you’ll receive.

Minimum Credit Requirements

Most lenders require:

- Minimum score: 650-680 (though rates won’t be competitive)

- Competitive rates: 700+

- Best rates: 750+

Medical professionals often have good credit due to responsible financial management during extensive education, but resident physicians with limited credit history may need to build credit before refinancing.

Debt-to-Income Expectations

Beyond credit scores, lenders evaluate:

- Debt-to-income ratio (DTI): Ideally below 50%, though specialty lenders may accept higher

- Income verification: Recent pay stubs, tax returns, employment contracts

- Employment stability: Full-time position or signed contract

Credit Score Impact on Rates

| Credit Score Range | Typical Rate Range | Annual Savings on $250K |

|---|---|---|

| 750+ | 3.5-4.5% | $6,250-$8,750 |

| 700-749 | 4.5-5.5% | $3,750-$6,250 |

| 650-699 | 5.5-7.0% | $0-$3,750 |

| Below 650 | 7.0%+ or denied | May not qualify |

Co-Signer Impact

If your credit or income doesn’t qualify you for the best rates, adding a co-signer with:

- Excellent credit (750+)

- Strong income

- Low existing debt

…can improve your rate by 1-2% and increase approval odds. Many lenders offer co-signer release after 12-24 months of on-time payments.

How to Choose the Best Student Loan Refinancing Lender for Doctors and Dentists

Selecting among the best student loan refinancing lenders requires careful comparison across multiple factors.

Rate Transparency

Look for lenders that:

- Display rate ranges clearly on their website

- Offer free rate quotes without hard credit pulls

- Provide personalized rates quickly

- Don’t charge origination or application fees

Physician-Specific Benefits

Top lenders for medical professionals offer:

- Residency forbearance: Reduced or interest-only payments during training

- Rate discounts for physicians: Special pricing for medical professionals

- Flexible underwriting: Consideration of future income and signed contracts

- No prepayment penalties: Ability to pay off loans early without fees

- Longer repayment terms: Options from 5-20 years

Customer Support and Flexibility

Evaluate:

- Forbearance options: How many months are available for hardship?

- Customer service quality: Availability, responsiveness, expert staff

- Online account management: Mobile app, autopay discounts, easy payments

- Specialty recognition: Does the lender understand physician careers?

Top Features to Compare

| Feature | Why It Matters | What to Look For |

|---|---|---|

| Interest Rate | Direct impact on savings | Lowest available for your credit profile |

| Repayment Terms | Affects the monthly payment vs total interest | 5, 7, 10, 15, 20-year options |

| Forbearance | Financial safety net | 12+ months available |

| Co-signer Release | Future flexibility | Available after 12-24 months |

| Rate Discounts | Additional savings | 0.25-0.50% for autopay, professional status |

Common Student Loan Refinancing Mistakes Doctors and Dentists Should Avoid

Understanding student loan refinancing mistakes can save you thousands and prevent regret.

Mistake #1: Refinancing Too Early

The error: Refinancing during residency or before your attending salary is reflected in your application.

The consequence: You may receive higher rates than if you waited 6-12 months for better income documentation.

The solution: Unless you have exceptionally high rates (7%+), wait until you have at least 6 months of attending salary on record.

Mistake #2: Ignoring PSLF Eligibility

The error: Refinancing federal loans without fully evaluating Public Service Loan Forgiveness eligibility.

The consequence: Losing potential six-figure forgiveness by converting to private loans.

The solution: Use a PSLF calculator to determine if your forgiveness amount exceeds refinancing savings. Never refinance if actively pursuing PSLF.

Mistake #3: Not Rate Shopping

The error: Accepting the first refinancing offer without comparing multiple lenders.

The consequence: Missing out on better rates—even 0.5% difference equals thousands in savings.

The solution: Apply to at least 3-5 lenders within a 30-day window (counts as one credit inquiry). Comparison takes 2-3 hours but can save $10,000-$50,000 over the loan term.

Mistake #4: Extending Repayment Too Long

The error: Choosing a 20-year term instead of 10 years to reduce monthly payments.

The consequence: While monthly costs drop, total interest paid skyrockets.

Example:

- $250,000 at 4.5% over 10 years = $42,000 interest

- $250,000 at 4.5% over 20 years = $91,000 interest

- Cost of convenience: $49,000

The solution: Choose the shortest term you can comfortably afford, or refinance with a longer term, but make extra principal payments.

Mistake #5: Refinancing Federal Loans Without an Emergency Fund

The error: Converting federal loans (with their income-based safety nets) to private loans without adequate savings.

The consequence: If you face income disruption, private loans offer limited forbearance, while federal loans have extensive hardship options.

The solution: Build 6-12 months of expenses in savings before refinancing federal loans to private.

Mistake #6: Ignoring the Fine Print

The error: Not reading lender terms regarding forbearance, late payment penalties, and prepayment options.

The consequence: Hidden fees, limited flexibility, or restrictions on paying off loans early.

The solution: Review the complete loan agreement, not just the interest rate. Ask questions before signing.

Frequently Asked Questions About Student Loan Refinancing for Medical Professionals

Q. What is student loan refinancing for doctors and dentists?

- Student loan refinancing for doctors and dentists is the process of replacing existing educational loans with a new private loan, typically at a lower interest rate. Medical professionals often qualify for competitive rates due to high earning potential, allowing them to reduce monthly payments and save substantially on interest over the life of the loan.

Q. Can doctors refinance student loans during residency?

- Yes, doctors can refinance student loans during residency, though it may be more challenging to secure the best rates with resident-level income. Several lenders offer specialized programs for medical residents that consider future earning potential and provide flexible payment options like interest-only payments during training years.

Q. Is student loan refinancing better than PSLF for physicians?

- It depends on your employment situation. Physicians working for nonprofit hospitals or qualifying government employers who are eligible for Public Service Loan Forgiveness (PSLF) often benefit more from keeping federal loans and pursuing forgiveness. Private practice physicians who don’t qualify for PSLF typically save more money by refinancing to lower private rates.

Q. How much can doctors save with student loan refinancing?

- Doctors can save $30,000-$100,000+ over the life of their loans through refinancing, depending on their original interest rate, loan balance, and the rate they qualify for. For example, refinancing $250,000 from 7% to 4.5% on a 10-year term saves approximately $45,000 in interest. Use a refinancing calculator to estimate your specific savings.

Q. Does student loan refinancing hurt your credit score?

- Student loan refinancing has minimal impact on your credit score. When you request rate quotes, most lenders perform a soft credit check that doesn’t affect your score. Only when you formally apply does a hard inquiry occur, typically lowering your score by 5-10 points temporarily. Multiple refinancing applications within a 30-day window count as a single inquiry.

Q. What credit score do doctors need to refinance student loans?

- Most lenders require a minimum credit score of 650-680 to refinance student loans, but doctors need a score of 700+ to access competitive rates. The best rates (typically 3.5-5%) are reserved for applicants with scores of 750 or higher. Residents or early-career physicians with limited credit history may benefit from adding a co-signer with strong credit.

Q. Should dentists refinance federal student loans?

- Dentists should refinance federal student loans if they work in private practice and don’t qualify for Public Service Loan Forgiveness. Since most dentists enter private practice with high incomes, refinancing to lower private rates typically results in significant savings. However, dentists should carefully consider the loss of federal protections like income-driven repayment and forbearance options before refinancing.

Q. Can you refinance student loans more than once?

- Yes, you can refinance student loans multiple times. Many doctors refinance once during or shortly after residency, then again once they’re established attendings with higher incomes and better credit profiles to secure even lower rates. Each refinancing opportunity allows you to capture better terms as your financial situation improves, though you should ensure the savings justify the effort.

Q. Are there student loan refinancing programs specifically for doctors?

- Yes, several lenders offer specialized student loan refinancing programs for physicians and dentists. These programs feature benefits like residency forbearance, consideration of future income rather than current salary, competitive rates for medical professionals, extended loan terms up to 20 years, and flexible underwriting that accounts for the unique financial trajectory of medical careers.

Q. Is fixed or variable refinancing better for medical professionals?

- Fixed-rate refinancing is generally better for medical professionals who prefer payment stability and plan to take 10+ years to repay loans. Variable-rate refinancing can save money if you plan to pay off loans within 5-7 years and rates remain stable. Many doctors choose fixed rates for the predictability, especially given the already significant financial demands of medical practice establishment and life planning.

Final Thoughts: Making the Right Refinancing Decision

Student loan refinancing represents one of the most impactful financial decisions doctors and dentists make after graduation. With average debt loads exceeding $200,000-$300,000, even small improvements in interest rates translate to tens of thousands in lifetime savings.

The key is approaching refinancing strategically:

Before refinancing:

- Evaluate your PSLF eligibility thoroughly

- Build your credit score to 700+

- Wait for attending-level income documentation when possible

- Build adequate emergency savings

- Compare offers from multiple lenders

When refinancing:

- Shop rates with 3-5 lenders within 30 days

- Consider both fixed and variable options

- Read all terms, especially forbearance policies

- Choose the shortest repayment term you can afford

- Understand you’re giving up federal protections

After refinancing:

- Set up autopay for rate discounts

- Make extra principal payments when possible

- Monitor for opportunities to refinance again

- Build wealth alongside debt payoff

Medical and dental professionals have unique advantages in the refinancing market—high earning potential, stable careers, and lender recognition of the value of medical training. By leveraging these advantages and avoiding common mistakes, you can transform your student loan burden into a manageable financial obligation and accelerate your path to financial freedom.

Ready to explore your refinancing options? Compare personalized rate quotes from top lenders in minutes without impacting your credit score. Most doctors save $30,000-$100,000 over their loan term by refinancing—see what you qualify for today.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor or student loan specialist to discuss your specific situation before making refinancing decisions.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: How to Save for Retirement: Your No-Nonsense Guide to Financial Freedom - Paisewaise

Pingback: How to Increase Credit Score: Tips to Raise Your Score to 800 & Without a Credit Card

You have mentioned very interesting details ! ps nice site.