Let me guess—you need a small business loan, and you’re reading this because your business needs cash. Maybe it’s that new equipment that’ll double your output, or inventory for the busy season, or just enough runway to cover payroll while you wait for clients to actually pay their invoices. (Why does everyone take 60 days when the invoice clearly says 30? But I digress.)

Here’s the thing about small business loans: they’re not nearly as mysterious as banks want you to believe. Yes, there’s paperwork. Yes, there are hoops. But once you understand how the game works, getting funded becomes less about luck and more about strategy.

I’ve watched countless business owners tie themselves in knots over financing, convinced they’re not “bankable” or that their credit score from that rough patch in 2019 has permanently blacklisted them. Spoiler alert: it hasn’t. The lending landscape has changed dramatically, and if you know where to look, there’s probably a business loan for small business owners that fits your situation—even if that situation is… let’s call it “complicated.”

So grab your coffee (or something stronger—I’m not judging), and let’s demystify this whole thing.

What Exactly Is a Small Business Loan, and Why Should You Care?

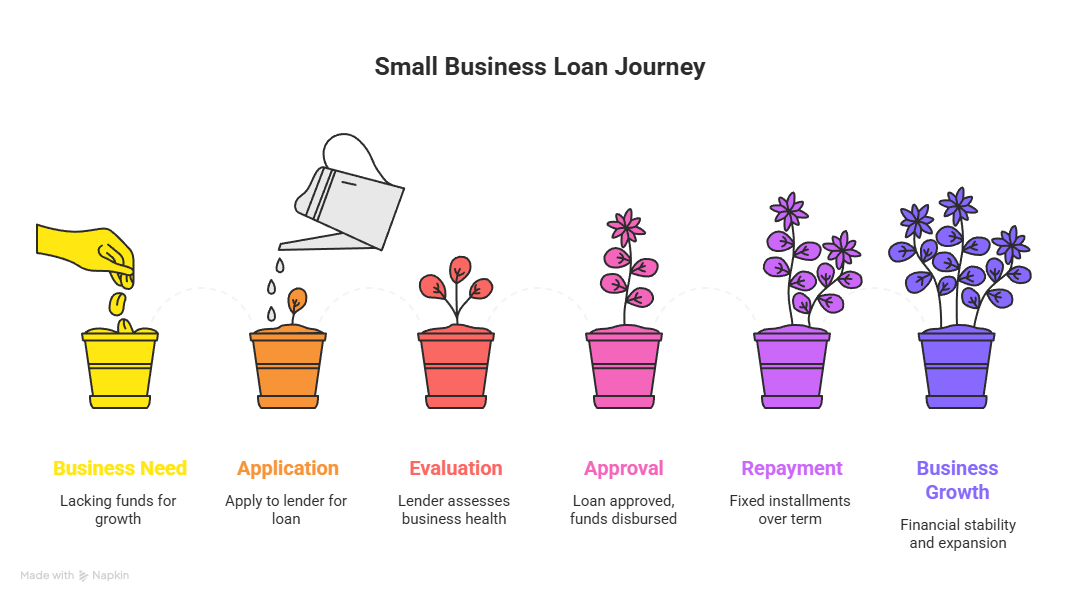

A small business loan is exactly what it sounds like: money you borrow specifically for your business, with the promise to pay it back over time, plus interest. Think of it as your business’s growth fuel—except instead of pumping it into a tank, you’re pumping it into equipment, inventory, marketing, or whatever keeps your operation humming.

Here’s how it works in practice: You apply with a lender (could be a bank, could be an online fintech platform, could even be a government-backed program). They evaluate your business health, your credit, and your revenue and decide whether you’re a good bet. If approved, you get a lump sum, and you repay it in fixed installments—usually monthly—over a set term. It could be six months, it could be five years, depends on the loan type and what you’re using it for.

The beauty of a working capital small business loan, for instance, is that it gives you breathing room. You’re not scrambling to make payroll or choosing between paying your supplier and keeping the lights on. It’s financial cushioning that lets you run your business instead of constantly firefighting cash crunches.

Who Actually Qualifies for a Small Business Loan?

Let’s cut through the mystique. Lenders want to see three things: that your business makes money (or will soon), that you’re not drowning in debt already, and that you have some kind of track record or plan.

The typical eligibility checklist looks like this:

- Time in business: Most traditional banks want at least 2 years of operations. Online lenders? Some will work with you after just 6 months.

- Annual revenue: Many lenders set minimums—often $50,000 to $100,000 yearly. But don’t let that scare you off; small business startup loan products and micro-loans exist specifically for smaller revenue streams.

- Credit score: Here’s where it gets interesting. Banks typically want 680+. But if you’re hunting for a small business loan for bad credit, plenty of fintech lenders will consider scores in the 500s—they’ll just charge higher interest.

- Collateral: Depends on the loan. Traditional term loans? Often secured. But unsecured small business loan options are everywhere now, especially for amounts under $50k.

Can startups with zero business credit history get funded? Absolutely—but you’ll lean harder on your personal credit and possibly need a co-signer or some form of guarantee. And yes, there are specialized small business loans for startups with no history programs designed exactly for this scenario.

The Document Treasure Hunt: What You’ll Need to Apply

I won’t sugarcoat this—documents required for small business loan applications can feel like you’re preparing for an audit. But it’s manageable if you get organized up front.

Here’s your standard packet:

For the business:

- Business registration and licenses

- Tax returns (typically last 2 years)

- Bank statements (usually 3-6 months)

- Profit & loss statements

- Balance sheet

- Business plan (especially for startups or expansion loans)

For you personally:

- Personal tax returns (last 1-2 years)

- Personal credit report

- Photo ID and proof of address

- Personal financial statement

Some lenders—particularly online small business loan platforms—use automated underwriting and might ask for less. They’ll often plug directly into your accounting software or bank account to pull real-time data. It’s faster but requires you to give access, which some owners find uncomfortable. Your call.

Pro tip: Before you even apply, pull your own credit report and business credit report (yes, your business has one too—check Dun & Bradstreet or Experian Business). Fix any errors. A 20-point bump in your score can mean thousands in interest savings.

How Much Can You Actually Borrow?

The range is wide. At the low end, microloans might give you $500 to $50,000. At the high end, SBA 7(a) loans (a popular government small business loan in the US) go up to $5 million.

What you’ll qualify for depends on:

- Your revenue (lenders often cap loans at 10-30% of annual revenue)

- Your debt-service coverage ratio (fancy term for “can you afford the payments”)

- Collateral, if it’s a secured loan

- The loan’s purpose

| Loan Type | Typical Amount Range | Best For |

|---|---|---|

| Micro-loan | $500 – $50,000 | Very small businesses, home-based, first-timers |

| Unsecured term loan | $5,000 – $250,000 | Service businesses, quick needs, no collateral |

| Bank term loan | $25,000 – $500,000+ | Expansion, equipment, and established businesses |

| SBA 7(a) | Up to $5,000,000 | Major growth, real estate, large projects |

| Business line of credit | $10,000 – $500,000 | Flexible access for variable cash flow |

| Equipment financing | $5,000 – $5,000,000+ | Machinery, vehicles, tech—equipment itself is collateral |

Want to run the numbers yourself? Use a small business loan calculator online—plug in the amount, term, and rate to see what monthly payments look like before you commit.

Let’s Talk Money: Interest Rates and What You’ll Really Pay

Ah, small business loan interest rates—the number that determines whether this loan supercharges your growth or quietly bleeds you dry.

Current landscape? Rates vary wildly:

- Traditional bank loans: 6% to 13% APR for solid borrowers

- SBA loans: 11% to 13% (these are government-backed small business loans, so rates are capped and favorable)

- Online/fintech lenders: 10% to 80% APR—yes, you read that right. The speed and convenience come at a price.

- Merchant cash advances: Effective APRs often exceed 100%. Use these only in emergencies.

What affects your rate?

- Your credit score—every 50 points matters

- Time in business—more history = lower risk

- Loan amount and term—larger, longer loans sometimes get better rates

- Collateral—secured loans are cheaper

- Industry risk—restaurants pay more than accounting firms (sorry, restaurateurs)

If you’re hunting for a low-interest small business loan, focus on:

- Government guarantee schemes (SBA in the US, Mudra/MSME in India, Start Up Loans in the UK)

- Traditional banks, if you’ve got strong financials

- Credit unions, which often beat big banks on rates

The Collateral Question: Can You Get Funded Without It?

Short answer: yes. Small business loans without collateral options have exploded in the last decade, thanks mostly to fintech lenders who use data analytics instead of property deeds to assess risk.

These unsecured loans work great for:

- Service-based businesses (consultants, agencies, SaaS)

- Businesses without physical assets

- Owners who don’t want to risk their house

The catch? Higher interest rates and usually lower loan amounts. If you’re looking at $200k+ and have assets, you’ll probably get better terms going secured.

Some middle-ground options:

- Invoice financing—your unpaid invoices are the “collateral.”

- Equipment financing—the equipment you’re buying secures the loan

- Merchant cash advance—repaid from daily sales (though personally, I’d avoid these unless you’re desperate; the costs are brutal)

Speed Matters: How Long Until You Actually Get the Money?

One of the biggest pain points I hear: “I need cash now, but the bank says 6-8 weeks.” Yeah, traditional lenders move like molasses.

Here’s the reality check:

Traditional bank term loans: 4-8 weeks

- Multiple rounds of underwriting

- Committees and approvals

- Lots of back-and-forth on documentation

SBA loans: 6-12 weeks (sometimes longer)

- Government backing means extra compliance steps

- Worth it for the rates, but don’t use this for urgent needs

Online lenders: 24 hours to 2 weeks

- Automated underwriting

- Faster documentation review

- Some offer small business loans with same-day funding if you’re pre-qualified

Business line of credit: 1-3 weeks for approval, instant draws after that

- Once approved, access funds immediately as needed

- Great for recurring or unpredictable needs

If speed is critical, filter your search by “online small business loan application” and look for lenders advertising quick turnarounds. Just don’t sacrifice rate shopping for speed unless you absolutely must.

Small Business Loan vs. Line of Credit: What’s the Difference?

People mix these up constantly, so let’s clarify.

A term loan gives you a lump sum upfront. You start paying it back immediately, in fixed installments. The interest clock starts ticking on the full amount on day one.

A line of credit gives you access to funds up to a limit, but you only borrow (and pay interest on) what you actually use. Think of it like a credit card for your business—you draw, repay, and can draw again.

| Feature | Term Loan | Line of Credit |

|---|---|---|

| Funding | Lump sum upfront | Draw as needed |

| Interest | On the full amount from day 1 | Only on the outstanding balance |

| Repayment | Fixed monthly payments | Flexible, minimum payments |

| Best for | Specific one-time projects | Ongoing, variable expenses |

| Example use | Buy equipment, expand location | Cover payroll gaps, seasonal inventory |

Most established businesses benefit from having both: a term loan for big planned expenses, and a line of credit for the surprises (because in business, there are always surprises).

Government-Backed Loans: Your Secret Weapon

If there’s one piece of advice I’d tattoo on every small business owner’s forehead, it’s this: explore government small business loan programs. These schemes exist specifically to make lending more accessible and affordable.

In the United States:

SBA 7(a) loans—the workhorse program, up to $5M, versatile use cases SBA 504 loans—for buying commercial real estate or heavy equipment SBA Microloans—up to $50k for smaller needs

In India:

Mudra loans—up to ₹10 lakh for micro-enterprises, MSME loans through CGTMSE—government guarantee reduces collateral requirements Stand-Up India—specifically for SC/ST and women entrepreneurs

In the UK:

Start Up Loans—government-backed loans for startups, 6% fixed rate. Recovery Loan Scheme—post-pandemic support for SMEs

The magic of these programs? The government guarantees a portion of the loan, which means banks take less risk, which means they’ll lend to businesses they’d otherwise reject—and at better rates. If you qualify, government-backed small business loans for MSME or equivalent programs in your country should be your first stop.

Insert image: Map showing government loan schemes by country

Special Lending Programs Worth Knowing About

Beyond the mainstream, there are niche programs that might fit your situation perfectly:

For women entrepreneurs, Many countries have dedicated small business loans for women entrepreneurs with preferential terms. In India, look at Mudra’s Mahila Udyam Nidhi. In the US, check grants and loans through the Women’s Business Centers.

For retail: Small business loans for retail shop owners often come with features like seasonal repayment flexibility or inventory-specific financing.

For specific industries: Healthcare, restaurants, e-commerce—all have specialized lenders who understand the unique cash flow and risk profiles.

Don’t sleep on industry-specific small business loan programs. A lender who specializes in your sector will evaluate you more fairly and might offer better terms than a generalist bank.

Why Do Applications Get Rejected? (And How to Avoid It)

Let’s talk about rejection, because it happens. A lot. And it’s rarely personal.

Common reasons small business loan applications are rejected:

- Insufficient cash flow—lenders want to see that you can afford the payments

- Too much existing debt—your debt-to-income ratio is too high

- Poor credit history—especially recent delinquencies or bankruptcies

- Weak business plan—particularly for startups

- Incomplete or inconsistent documentation—missing docs or numbers that don’t add up

- Red flags in bank statements—lots of NSFs, irregular deposits, and gambling transactions

- High-risk industry—some lenders won’t touch certain sectors

- Too new—less than 6-12 months in operation

How to improve your chances of being approved for a small business loan:

Before you apply:

- Clean up your credit (both personal and business)

- Pay down existing debt where possible

- Build up 3-6 months of operating cash as a cushion

- Get your financial statements professionally prepared

- Open business bank and credit accounts if you haven’t (establish that business credit profile)

When you apply:

- Apply only where you fit the criteria—don’t waste time with lenders who want 2 years when you have 6 months

- Be honest and transparent—lying or omitting info will tank your app

- Have a clear, specific use of funds—”I need $50k for… stuff” doesn’t work

- Show how the loan will generate ROI—”This equipment will increase production by 40%, adding $80k in annual revenue”

- Consider a co-signer if your profile is borderline

If you get rejected:

- Ask why—specific feedback helps you fix the issues

- Look at alternative lenders with different criteria

- Consider starting smaller—maybe a $10k micro-loan to build history before asking for $100k

Alternative Financing: When Traditional Loans Aren’t the Answer

Sometimes a conventional loan just doesn’t fit. Here are angles worth exploring:

Invoice financing/invoice discounting: If you’re sitting on $100k in unpaid invoices, you can borrow 80-90% of that value immediately. Perfect for B2B businesses with long payment cycles.

Merchant cash advance: You get money upfront, repaid as a percentage of daily credit card sales. Fast and easy to qualify, but expensive—use only if you have strong daily sales and need cash fast.

Equipment financing: Buying a $50k machine? The lender uses the equipment itself as collateral. Approval is easier, and often 100% of the purchase price is financed.

Business credit cards: For smaller needs (under $25k), a 0% intro APR business card can be cheaper than a loan—if you can pay it off before the promo ends.

Crowdfunding / revenue-based financing: Newer models where you raise funds from customers (crowdfunding) or investors who take a percentage of future revenue instead of fixed payments.

Putting It All Together: Your Action Plan

Alright, you’ve made it through the weeds. Here’s your step-by-step game plan:

Step 1: Define your need

- How much do you need? Be specific.

- What for? Equipment, working capital, expansion?

- When do you need it? Tomorrow or next quarter?

Step 2: Assess your profile

- Pull your credit scores (personal and business)

- Calculate your revenue, cash flow, and existing debt

- Gather 6 months of bank statements and financial statements

Step 3: Match yourself to loan types

- Need $10k fast? → Online lender or micro-loan

- Need $200k for equipment? → Equipment financing or bank term loan

- Need flexible access to $50k? → Business line of credit

- Startup with no history? → SBA micro-loan or small business startup loan programs

Step 4: Shop and compare

- Get quotes from at least 3-5 lenders

- Compare APR (not just interest rate), fees, and terms

- Read reviews and check BBB ratings

Step 5: Apply with your best-fit option

- Have all documentation ready

- Be responsive—lenders often time-out apps if you go silent

- Ask questions if anything’s unclear

Step 6: Use the funds strategically

- Stick to your stated purpose

- Track ROI—is this loan driving revenue/savings?

- Build in a repayment cushion, so you’re never scrambling

Final Thoughts: It’s Just Money (But Also, It’s Your Business)

Look, the best small business loan isn’t about finding some mythical perfect product—it’s about finding what works for your situation, right now. Maybe that’s a no-frills bank term loan at 8%. Maybe it’s a fintech lender at 25% because you need cash in 48 hours, and you know you’ll turn it around fast.

The lending world has opened up dramatically. There are more options, more competition, and more lenders willing to look past a less-than-perfect credit score or a business that’s only been around 18 months. You don’t need to be a Fortune 500 company to get funded anymore.

But you do need to be smart. Understand what you’re signing. Read the fine print. Know what that monthly payment really looks like when you’re having a slow month. And for the love of all that’s profitable, do not take out a loan just because you can—take it out because it’s going to make you money or save your business from a fixable problem.

You’ve got this. You built a business from scratch (or you’re nurturing one someone else started and making it your own). Getting the right financing? That’s just another problem to solve. And now you’ve got the map.

Frequently Asked Questions

Q. What is a small business loan, and how does it work?

- A small business loan is borrowed capital specifically for business purposes, repaid over time with interest. You receive a lump sum (or access to a credit line), use it for agreed-upon business needs, and make regular payments—usually monthly—over a set term ranging from a few months to several years.

Q. Who is eligible for a small business loan?

- Eligibility varies by lender but typically includes: at least 6-24 months in business, minimum annual revenue ($50k-$100k+ depending on lender), acceptable credit score (500-680+ depending on loan type), and sufficient cash flow to cover loan payments. Startups may qualify through government-backed programs or with strong personal credit.

Q. What documents are required for a small business loan application?

- Standard documents include: business tax returns (2 years), bank statements (3-6 months), profit & loss statements, balance sheet, business licenses, personal tax returns, credit reports, photo ID, and often a business plan. Online lenders may require fewer documents or pull data directly from your accounting software.

Q. How much can I borrow with a small business loan?

- Loan amounts range from $500 (micro-loans) to $5 million+ (SBA 7(a) loans). Most small businesses access $10k-$250k. Your borrowing capacity depends on annual revenue, creditworthiness, collateral, and the lender’s risk appetite—many cap loans at 10-30% of annual revenue.

Q. What is the typical interest rate for a small business loan?

- Rates vary widely: traditional banks (6-13% APR), SBA loans (11-13% APR), online lenders (10-80% APR), and merchant cash advances (100%+ effective APR). Your rate depends on credit score, time in business, loan amount, collateral, and lender type.

Q. Can I get a small business loan without collateral?

- Yes, unsecured small business loans are widely available, especially from online lenders. They’re ideal for service businesses and borrowers without physical assets. Expect higher interest rates and typically lower loan amounts (under $250k) compared to secured loans.

Q. Can startups with no business credit history get a small business loan?

- Yes, though it’s harder. Options include: SBA microloans, startup-specific lenders, government programs for new businesses, and loans based on personal credit plus a solid business plan. You may need a co-signer or personal guarantee, and expect smaller amounts initially to build business credit history.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

I take pleasure in, result in I found just what I was looking for. You have ended my 4 day long hunt! God Bless you man. Have a nice day. Bye