Introduction

Budgeting is a fundamental aspect of personal finance management. It helps individuals track their income, expenses, and savings, ensuring that financial goals are met and resources are allocated effectively. By creating a budget, people gain a clearer understanding of their financial situation, which empowers them to make informed decisions, reduce financial stress, and achieve long-term stability.

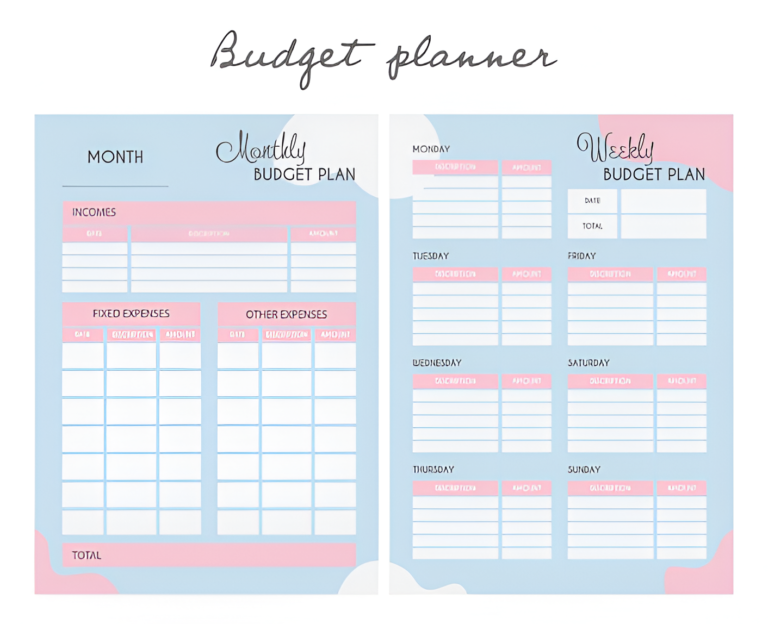

In today’s digital age, budgeting tools come in many forms, with the two most common being digital platforms and paper planners. Digital tools offer convenience, automation, and advanced features like synchronization with bank accounts, while paper planners, such as a budget planner, provide a tactile, focused experience that some individuals find more intuitive and manageable.

Understanding Budgeting Methods

Budgeting involves planning how to allocate your money to meet your financial goals. It helps track income, manage expenses, and set aside savings. Whether using a digital tool or a paper planner, the goal is the same: to take control of your finances.

Budget Planners: Digital vs. Paper

Digital Budget Planners:

- Automation: Syncs with bank accounts for automatic tracking.

- Accessibility: Can be accessed on smartphones, tablets, or computers.

- Advanced Features: Offers budgeting categories, spending alerts, and reports.

- Cloud Storage: Data is backed up and accessible from anywhere.

- Integration: Some apps connect with other financial services.

Paper Budget Planners:

- Tactile Experience: Writing by hand can feel more personal.

- Simplicity: A straightforward layout for income, expenses, and savings.

- Focus: No distractions from apps or notifications.

- Customization: Personalizable to fit individual needs.

The Basic Principle of Budgeting

The core of budgeting involves three key elements:

- Tracking Income: Know how much money is coming in, including salary or other sources.

- Tracking Expenses: Account for both fixed (e.g., rent) and variable (e.g., groceries) expenses.

- Setting Savings Goals: Allocate part of your funds to savings for future needs.

Both digital and paper planners help you manage these aspects, making it easier to control your finances and achieve your financial goals.

Benefits of Digital Budget Planners

Convenience and Accessibility:

- Accessible across multiple devices, including phones, tablets, and computers, allowing for on-the-go tracking.

- Syncs across platforms with cloud storage, ensuring your data is always backed up and available.

Automation and Features:

- Automatically tracks expenses and inputs data, saving time and reducing errors.

- Offers budgeting suggestions based on spending patterns and financial goals.

- Integrates seamlessly with bank accounts and financial apps for easy monitoring.

Customization and Flexibility:

- Customize categories, set up recurring payments, and adjust budgets as needed.

- Visual representations like graphs and charts make it easier to understand spending trends.

Environmentally Friendly:

- Digital planners are paperless, reducing waste and promoting sustainability.

Real-Time Tracking:

- Provides instant updates on your financial status, allowing you to adjust your spending in real time.

Benefits of Paper Budget Planners

Tactile and Hands-On Experience:

- Writing by hand enhances memory and focus, making budgeting feel more personal and intentional.

No Technology Dependence:

- Perfect for those who want to disconnect from screens and avoid digital distractions.

- No need for an internet connection or dealing with technical issues.

Simplicity and Low-Cost:

- One-time purchase, no subscriptions or apps required.

- Easy to use with minimal setup, offering a straightforward budgeting approach.

Privacy and Security:

- No risk of data breaches or online privacy concerns, as all information remains offline.

Creative Space for Personalization:

- Provides freedom to draw, design, and customize your planner to match your style and budgeting needs.

Drawbacks of Digital Budget Planners

Learning Curve and Setup:

- May take time to familiarize yourself with the platform or app, especially if it’s a complex tool.

Potential for Data Privacy Concerns:

- Risk of hacking, data theft, or privacy breaches from third-party platforms and cloud storage.

Distraction and Over-Dependence on Devices:

- Constant notifications and digital distractions can make it difficult to stay focused on budgeting goals.

Drawbacks of Paper Budget Planners

Lack of Real-Time Tracking:

- Cannot quickly adjust or track changes during the month, leading to less immediate insights into your financial status.

Limited Automation:

- Requires manual entry of expenses and income, which can be time-consuming and prone to human error.

Physical Storage Needs:

- Takes up physical space, requiring storage for multiple planners, receipts, and other related documents.

Easier to Lose or Damage:

- Risk of losing the planner or damaging it (e.g., torn pages, water damage), which can lead to the loss of important financial information.

Key Considerations When Choosing Between Digital and Paper Budget Planners

Personal Preferences:

- Do you prefer the convenience and flexibility of digital tools or the tactile experience of physically writing things down?

Tech-Savviness:

- Are you comfortable using apps and digital platforms, or would you prefer a more hands-on, analog approach to managing your finances?

Financial Habits:

- Do you need real-time updates and instant tracking, or do you prefer a slower, more mindful approach to tracking your spending?

Budgeting Goals:

- Are you focused on tracking daily expenses or working toward long-term savings and financial planning?

Budgeting Style:

- Are you a visual person who enjoys graphs and charts, or do you prefer the structure and simplicity that comes with a paper-based system?

Conclusion

Both digital and paper budget planners offer unique advantages and drawbacks. Digital planners provide convenience, real-time tracking, automation, and advanced features, but may come with privacy concerns, distractions, and a learning curve. On the other hand, paper planners offer a tactile, distraction-free experience with simplicity, privacy, and creative flexibility, but lack real-time updates and require manual entry.

Ultimately, the best choice depends on your personal preferences, lifestyle, and financial goals. If you value flexibility and technology, digital budget planners might be the right fit. If you prefer simplicity and mindfulness, a paper planner may suit you better.

FAQs

Q. What is a budget planner?

- A budget planner is a tool used to manage personal finances by tracking income, expenses, and savings. It helps individuals set financial goals, monitor spending habits, and ensure they stay within their financial means.

Q. Are digital budget planners safe?

- Reputable digital budget planners often use encryption and other security measures to protect your data. However, it’s essential to choose a trusted platform and use strong passwords.

Q. How often should I update my budget planner?

- It’s best to update your budget planner regularly—daily or weekly—to ensure accuracy and keep track of your finances effectively.

Q. What features should I look for in a digital budget planner?

- Bank synchronization.

- Expense categorization.

- Budget forecasting tools.

- Data export options.

- Notifications or alerts for bill payments.

Q. Can I create my own budget planner?

- Absolutely! Many individuals customize their own budget planners, especially paper ones, to cater to their unique needs and preferences.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

This post has been incredibly helpful for me, thank you.

Your enthusiasm is infectious. It is challenging not to become enthused about the topics you discuss.