Introduction

In today’s fast-paced world, maintaining financial well-being is more important than ever. A Budget planner serves as a cornerstone for achieving financial stability, helping individuals and families allocate resources effectively, save for the future, and avoid unnecessary debt.

Thanks to advancements in technology, budgeting has become simpler and more accessible than ever before. Budget planners and budgeting apps have revolutionized the way we manage our money, offering innovative tools that take the guesswork out of tracking expenses and planning finances.

Criteria for Selection

When choosing a budget planner app, it’s important to consider key features that will make managing your finances easier and more effective. Here are the main factors to keep in mind:

1. User-Friendly Interface

The app should be intuitive and easy to navigate, making it simple to add transactions and track your finances without confusion.

2. Bank Account Integration

Look for apps that sync automatically with your bank accounts. This eliminates the need for manual entry and ensures accurate, up-to-date information.

3. Customizable Categories

A good budgeting app allows you to customize categories (e.g., groceries, savings) to match your unique spending habits, making it easier to track your financial priorities.

4. Real-Time Tracking

Real-time updates give you instant insights into your spending and balance, helping you stay on top of your budget as it evolves.

5. Reports and Analytics

Look for apps that provide detailed reports and spending analytics to help you analyze your financial behavior and identify areas for improvement.

6. Cost-Effectiveness and Free Versions

Many apps offer free versions with essential features. For premium options, ensure the cost aligns with the value and extra features provided.

7. Cross-Platform Compatibility

Make sure the app works across multiple devices (iOS, Android, web) so you can access and manage your finances from anywhere.

By focusing on these features, you can select a budgeting app that best fits your needs and supports your financial goals.

Top 10 Budget Planner Apps

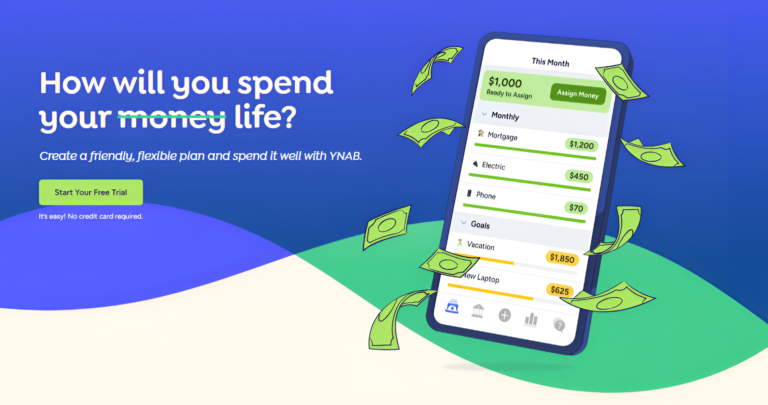

1. YNAB (You Need a Budget)

Features:

- Goal-Oriented Budgeting: YNAB focuses on helping users set specific financial goals (e.g., saving for a vacation, paying off debt) and create a tailored budget to meet those goals.

- Debt Tracking: The app offers tools to help you track and pay off debt faster by allocating funds toward your debt reduction goals.

- Proactive Planning: YNAB encourages forward-thinking budgeting, where you allocate money to upcoming expenses before they occur, ensuring you’re always prepared.

Pricing:

YNAB operates on a subscription model, with a free trial period (usually 34 days). After the trial, the app costs around $14.99 per month or $109 per year.

Pros:

- Focuses on proactive budgeting and long-term financial goals.

- Helps reduce debt with clear tracking and actionable strategies.

- Offers educational resources and tools to improve your financial habits.

- Syncs with bank accounts and supports real-time updates.

Cons:

- The subscription cost may be considered expensive compared to other apps.

- The learning curve can be steep for beginners due to the app’s unique approach.

- Limited customization options for categories compared to some other apps.

YNAB (You Need A Budget) is a great budget planner for those who are serious about getting control over their finances and are willing to invest time in learning its system.

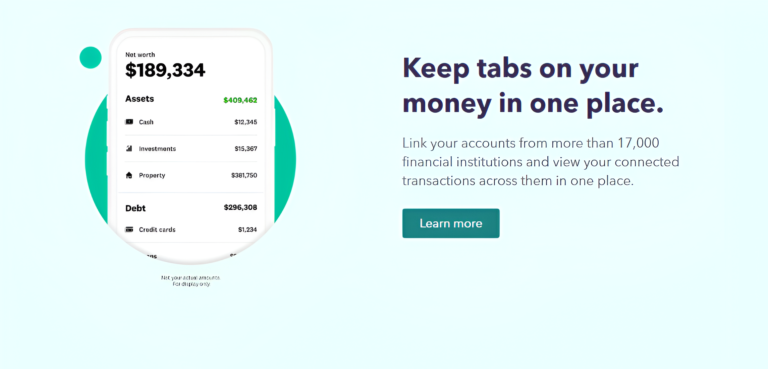

2. Mint

Features:

- All-in-One Budgeting: Mint allows you to track all your expenses, categorize transactions, and set up a personalized budget in one place.

- Bill Tracking: The app automatically tracks bills and due dates, helping you avoid late fees by sending reminders.

- Credit Score Monitoring: Mint provides free access to your credit score and tracks factors that affect it, offering insights into ways to improve your credit.

Pricing:

Mint is free to use, but it includes ads within the app.

Pros:

- Completely free to use with robust features.

- Easy-to-use interface with automatic transaction categorization.

- Provides a comprehensive view of your finances, including bank accounts, investments, and credit scores.

- Bill tracking and reminders help prevent missed payments.

Cons:

- Ads can be intrusive for some users.

- Limited customization for budgeting categories.

- Some users report syncing issues with certain banks or accounts.

- Occasional delays in real-time data updates.

Mint is a great budget planner option for those looking for a free, all-in-one budgeting tool with added features like credit score monitoring and bill tracking. However, the ads and occasional syncing issues may be drawbacks for some.

3. PocketGuard

Features:

- Easy Spending Limit Tracking: PocketGuard helps you track your spending by automatically categorizing transactions and showing you how much you have left to spend after accounting for bills and savings goals.

- Safe-to-Spend Feature: This feature shows you how much money is “safe to spend” after considering your expenses and financial goals, helping you avoid overspending.

Pricing:

PocketGuard offers both a free version and a premium version. The premium version is priced at around $12.99 per month or $74.99 per year.

Pros:

- Simple and intuitive interface, making it easy to track daily spending.

- The “Safe-to-Spend” feature helps users avoid financial missteps and overspending.

- Budgeting is automatically done, with minimal input needed from the user.

- The free version covers basic budgeting needs, while the premium version offers advanced features.

Cons:

- Limited features in the free version compared to the premium one.

- Premium subscription can be pricey for those looking for basic budgeting.

- Some users find the app’s transaction categorization too rigid or inaccurate at times.

PocketGuard is perfect as a budget planner for users who want a straightforward approach to budgeting with clear spending limits, especially those aiming to avoid overspending. However, the free version is quite basic, and premium features come at a cost.

4. EveryDollar

Features:

- Zero-Based Budgeting: EveryDollar follows the zero-based budgeting method, where every dollar is assigned a purpose, ensuring you plan for all income and expenses.

- Simple Expense Tracking: The app allows users to quickly track expenses and categorize them, making it easy to stay on top of spending throughout the month.

Pricing:

EveryDollar offers both a free version and a premium version. The premium version costs around $17.99 per month or $79.99 per year.

Pros:

- Simple and easy-to-use interface for beginners.

- Zero-based budgeting approach helps users give every dollar a purpose.

- Integrates with bank accounts for automatic transaction syncing (premium version).

- The free version offers essential budgeting tools.

Cons:

- Limited features in the free version, especially when it comes to bank syncing.

- The premium version can be considered pricey for those just starting with budgeting.

- Lacks advanced features like investment tracking or credit score monitoring available in other apps.

EveryDollar is an excellent budget planner for those who prefer a straightforward zero-based budgeting method. The free version is useful for basic budgeting, but those who need more features may find the premium version worthwhile.

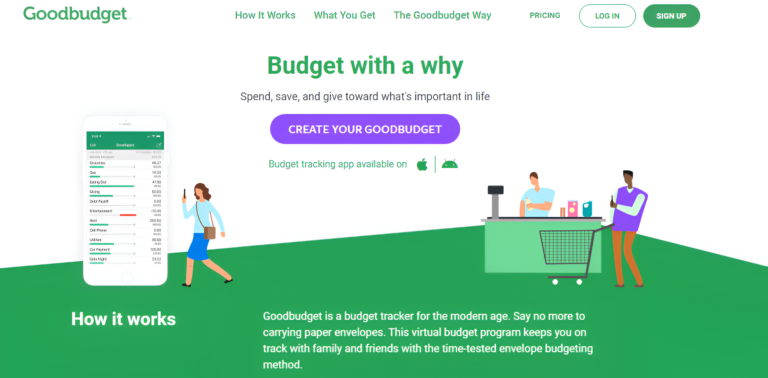

5. Goodbudget

Features:

- Envelope Budgeting System: Goodbudget uses the traditional envelope method, where you allocate funds to different categories (e.g., groceries, rent) and track spending within those limits.

- Manual Input: Unlike many apps that automatically sync with bank accounts, Goodbudget requires manual entry of transactions, giving you full control over your budgeting.

Pricing:

Goodbudget offers both a free version and paid plans. The premium plan is priced at around $10 per month or $80 per year.

Pros:

- Embraces the classic envelope budgeting system, ideal for those who prefer a hands-on approach.

- Free version allows users to create up to 20 envelopes.

- Works across multiple devices, allowing you to sync your budget on iOS, Android, and the web.

- No need for bank account integration, offering a more privacy-focused approach.

Cons:

- Manual entry of transactions can be time-consuming and less convenient.

- Limited number of envelopes in the free version, requiring an upgrade for more flexibility.

- Lack of automatic bank syncing makes it less seamless compared to other apps.

Goodbudget is an ideal budget planner for those who enjoy a hands-on approach to budgeting and prefer the envelope system. However, the manual input required and the limited features in the free version may be drawbacks for users seeking a more automated solution.

6. Zeta

Features:

- Designed for Couples: Zeta is specifically tailored for couples, allowing them to manage joint finances, share accounts, and track shared expenses in one place.

- Shared Accounts and Expenses: Couples can link shared accounts, track common expenses, and set goals together, making it easier to stay on the same page financially.

- Individual and Joint Budgeting: It allows users to create both individual and shared budgets, helping couples keep track of personal spending while also managing joint goals.

Pricing:

Zeta is completely free to use.

Pros:

- Tailored for couples, making joint budgeting and expense tracking easy and efficient.

- Free to use with no hidden costs.

- Supports both individual and shared budgeting, allowing couples to manage finances collaboratively.

- Simple, intuitive interface designed for ease of use.

Cons:

- Limited to couples and may not be useful for individuals or those managing finances alone.

- Some advanced features, like bill splitting, may require manual entry or additional work.

- Lacks some of the advanced investment and retirement planning features found in other apps.

Zeta is a great budget planner for couples looking to streamline their financial management together, offering easy tools for shared budgeting and expenses. However, it’s not suited for individuals or those needing complex financial planning tools.

7. Honeydue

Features:

- Budgeting for Couples: Honeydue is designed for couples to manage joint finances, track shared expenses, and set budgets together.

- Bill Splitting: The app allows couples to split bills and expenses, making it easy to see who owes what and when.

- Reminders: Honeydue sends reminders for upcoming bills and payments, helping couples stay on top of their financial obligations.

Pricing:

Honeydue is free to use, with no subscription or hidden fees.

Pros:

- Completely free with a focus on budgeting for couples.

- Bill splitting feature helps ensure fairness in shared expenses.

- Reminders for bills help prevent missed payments and late fees.

- Simple, user-friendly interface designed for ease of use.

Cons:

- Limited features compared to other budgeting apps, especially for those looking for investment or retirement planning tools.

- Some couples may find the app too basic if they need advanced financial tracking.

- Lack of advanced features like automatic syncing with bank accounts (can be limited depending on financial institutions).

Honeydue is an excellent budget planner for couples who want an easy way to manage joint finances, split bills, and track budgets together. However, it may not be sufficient for those looking for more comprehensive financial planning features.

8. Spendee

Features:

- Family Budgeting: Spendee allows families to track shared expenses, set up household budgets, and monitor spending across all members.

- Group Budgets: Users can create group budgets, making it ideal for managing finances with friends or partners, such as for trips or shared events.

- Expense Tracking: The app automatically categorizes expenses, helping users track their spending and identify trends.

Pricing:

Spendee offers both free and paid versions. The premium version costs around $2.99 per month or $22.99 per year.

Pros:

- Great for family and group budgeting, allowing shared access and collaborative tracking.

- Easy-to-use interface with automatic expense categorization.

- Supports multiple currencies for international users.

- Free version offers basic budgeting features for personal use.

Cons:

- Some advanced features (e.g., budget reports and syncing across devices) require the paid version.

- The free version has limited customization and functionality compared to paid plans.

- Lacks in-depth investment or retirement planning tools.

Spendee is an ideal budget planner for families or groups looking for an easy way to manage shared finances and track spending together. While the free version is useful, the premium version unlocks more advanced features for those needing deeper financial insights.

6. Conclusion

Budget planners and budgeting apps have revolutionized personal finance management, offering tools to track expenses, set goals, and plan for the future with ease. Whether you’re saving for a dream vacation, tackling debt, or just aiming to manage day-to-day spending, these tools make the process simpler and more accessible.

Taking the first step toward financial stability doesn’t have to be overwhelming. Start by trying one of the budget planners or apps mentioned in this guide—many offer free versions or trials, so you can find the one that fits your needs without any commitment.

FAQs

Q. What is the best budgeting app for beginners?

- Mint is a great choice for beginners because it’s free, user-friendly, and offers automatic expense tracking and categorization.

Q. Are budgeting apps safe to use?

- Most budgeting apps use bank-level encryption and security measures. Always check the app’s privacy policy and ensure it doesn’t store sensitive data.

Q. Can I use a budgeting app without linking my bank account?

- Yes, apps like Goodbudget and EveryDollar allow manual expense tracking, so you don’t have to link your accounts.

Q. Can I switch apps later if I’m not satisfied?

- Absolutely! Your data can often be exported or manually transferred to a new app if your needs change.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: 10 Things to do with Money this Month - Paisewaise

Your expressions seamlessly transport my imagination. I automatically picture every aspect you depict.

Pingback: Is Zero-Based Budgeting Right for You?