Introduction

Credit card debt has become a growing issue for many individuals in today’s society, often accumulating quickly due to high-interest rates, minimum payments, and unplanned expenses. According to recent studies, a significant portion of the population struggles with revolving debt, which can lead to long-term financial difficulties. As credit card balances continue to rise, so do the interest charges, making it increasingly difficult to break free from this cycle.

1. Create a Comprehensive Budget

A well-structured budget is a cornerstone of effective debt repayment. It serves as a roadmap, helping you manage your finances, prioritize debt payments, and avoid overspending. By clearly understanding where your money is going, you can allocate more resources toward reducing credit card debt while ensuring that essential expenses are covered.

Steps to Create a Budget:

1. Assess Income vs. Expenses

- Calculate your total monthly income, including salary, side hustles, and any additional sources of revenue.

- List all your expenses, dividing them into essential (e.g., rent, utilities, groceries) and non-essential categories (e.g., entertainment, dining out).

- Subtract your expenses from your income to determine how much money is available for debt repayment.

2. Identify Areas to Cut Back

- Review your non-essential expenses to identify areas where you can reduce spending.

- Examples include eating out less often, canceling unused subscriptions, or finding cheaper alternatives for discretionary expenses.

- Redirect the savings toward paying off your credit card debt.

3. Utilize Tools and Apps for Budgeting

- Use budgeting apps like Mint, You Need a Budget (YNAB), or EveryDollar to streamline the budgeting process.

- These tools allow you to track expenses in real time, set spending limits, and monitor your progress toward debt repayment goals.

- Some apps also provide insights and suggestions for better money management.

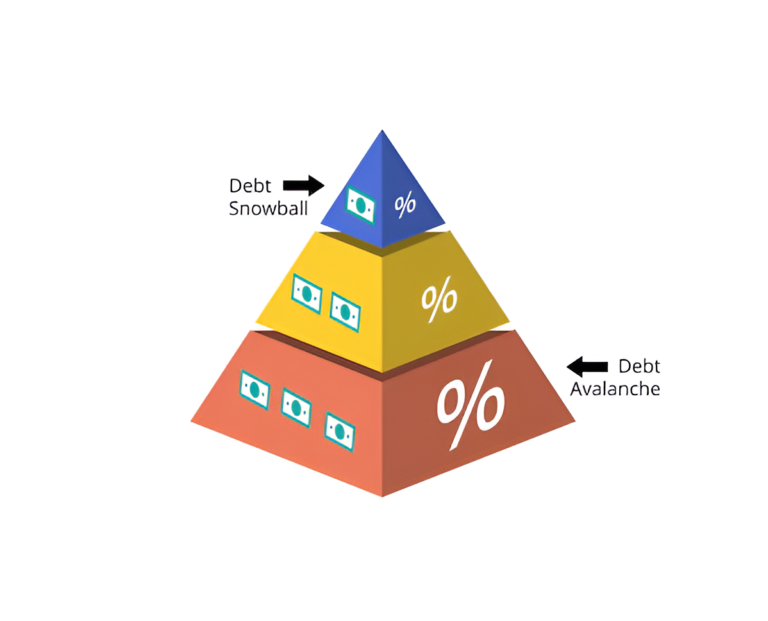

2. Focus on the Debt Snowball or Avalanche Method

When it comes to tackling credit card debt, the Debt Snowball and Debt Avalanche methods are two popular and proven strategies. Both approaches can help you pay off debt efficiently, but they differ in focus and motivation. Choosing the right method depends on your financial situation and personal preferences.

Debt Snowball Method

How it Works:

- List all your debts in order of balance, from smallest to largest, regardless of interest rate.

- Pay the minimum amounts on all debts except the smallest.

- Direct any extra money toward the smallest debt until it’s fully paid off.

- Once the smallest debt is paid, roll its payment into the next smallest debt, creating a “snowball” effect.

Pros:

- Provides quick psychological wins by eliminating small debts early.

- Boosts motivation and momentum.

Cons:

- May result in higher total interest costs if larger, high-interest debts are left for later.

Example Scenario:

- Debts: $500 (5%), $2,000 (18%), $5,000 (22%).

- Pay off the $500 debt first, regardless of its lower interest rate, to build confidence.

Debt Avalanche Method

How it Works:

- List all your debts in order of interest rate, from highest to lowest.

- Pay the minimum amounts on all debts except the one with the highest interest rate.

- Direct any extra money toward the highest-interest debt until it’s fully paid off.

- Once the highest-interest debt is paid, move on to the next highest.

Pros:

- Saves more money in the long run by minimizing interest payments.

- Ideal for those focused on financial optimization.

Cons:

- Progress may feel slower, as high-interest debts often have larger balances.

Example Scenario:

- Debts: $500 (5%), $2,000 (18%), $5,000 (22%).

- Focus on the $5,000 debt first to reduce the amount of interest accrued.

Choosing the Right Method:

- Debt Snowball is best for those who need quick wins to stay motivated.

- Debt Avalanche is ideal for those who want to save the most money over time.

3. Negotiate Lower Interest Rates

Reducing the interest rates on your credit cards can significantly accelerate credit card debt repayment by decreasing the portion of your payments that goes toward interest. This means more of your money is applied directly to reducing the principal balance, helping you eliminate credit card debt faster.

How to Approach Your Credit Card Issuer

1. Research Competitive Rates

- Check current interest rates offered by other credit card companies, especially for customers with similar credit profiles.

- Be prepared with this information to demonstrate that you’re a savvy consumer who may consider transferring balances if a better rate isn’t offered.

2. Call Customer Service with a Script or Plan

- Reach out to your credit card issuer via the number on the back of your card.

- Be polite yet firm in your request. Use a script like this:

“Hello, I’ve been a loyal customer for [X years], and I’ve consistently made payments on time. I’ve noticed that other issuers are offering lower interest rates, and I’d like to discuss the possibility of lowering my rate. This would help me manage my debt more effectively and remain a satisfied customer with your company.”

- Be persistent. If the initial representative cannot help, politely ask to speak with a supervisor.

3. Document the Agreement

- If successful, confirm the new rate in writing or via email for your records.

Benefits of 0% APR Balance Transfer Cards

Another way to lower interest is by transferring your balance to a 0% APR credit card. Many issuers offer promotional periods (typically 12–18 months) with no interest on balance transfers, giving you time to focus solely on reducing your principal.

Key Points to Consider:

Cautionary Advice:

- Balance transfers often come with fees, usually 3–5% of the transferred amount. Ensure that the fee doesn’t outweigh the potential savings on interest.

- Pay off the balance within the promotional period; otherwise, the regular APR will apply, potentially at a higher rate than your original card.

Benefits:

- Eliminates interest payments temporarily, allowing for faster debt reduction.

- Can consolidate multiple debts into a single payment, simplifying your repayment process.

4. Consolidate Debt with a Personal Loan

Debt consolidation involves combining multiple debts, including credit card debt, into a single loan with a fixed interest rate and payment schedule. This strategy simplifies payments and can potentially reduce the interest you pay on credit card debt, helping you pay off your debt faster and more efficiently.

How Personal Loans Can Simplify Payments

1. Lower Interest Rates

- Personal loans often come with lower interest rates than credit cards, especially if you have good credit.

- By consolidating high-interest credit card balances into a single loan with a lower rate, you can save on interest costs over time.

2. Streamlined Repayment

- Instead of managing multiple credit card payments with varying due dates and interest rates, a personal loan provides one fixed monthly payment.

- Fixed terms (e.g., 3–5 years) mean you know exactly when the loan will be paid off, allowing for better financial planning.

2. Improved Credit Utilization

- Paying off credit card balances with a personal loan reduces your credit utilization ratio (the percentage of available credit you’re using), which can boost your credit score.

Risks and Considerations

1. Potential Fees

- Some personal loans come with origination fees, which can range from 1–8% of the loan amount. Ensure these fees don’t negate the savings from a lower interest rate.

2. Discipline Required

- Debt consolidation isn’t a cure-all. If you continue using your credit cards and accumulate new debt, you could end up with more financial strain.

3. Interest Rate Qualifications

- The lowest interest rates are typically reserved for borrowers with excellent credit. If your credit score is lower, you may not qualify for favorable rates, making consolidation less beneficial.

4. Loan Term Impact

- While lower monthly payments can be appealing, extending the repayment term may increase the total interest paid over the life of the loan.

When Debt Consolidation Works Best

Debt consolidation with a personal loan is most effective when:

- You have a solid plan to avoid accumulating new debt.

- The new loan offers a significantly lower interest rate than your current debts.

- You’re motivated to make consistent payments and work toward financial freedom.

5. Cut Back on Non-Essential Spending

One of the quickest ways to free up money for debt repayment is by cutting back on non-essential spending. Many people unknowingly spend money on things that aren’t crucial to their daily life. By identifying and reducing these expenses, you can redirect those funds to paying down your credit card debt faster, without affecting your essential needs.

Examples of Common Non-Essential Expenses

1. Dining Out

- Eating at restaurants or ordering takeout regularly can quickly add up.

- Consider cooking at home more often and meal prepping to save money.

2. Subscriptions and Memberships

- Monthly subscriptions for streaming services, gym memberships, magazines, or apps can add up, especially if they’re underused.

- Review all your subscriptions and cancel any that aren’t necessary or frequently used.

3. Impulse Purchases

- Frequent online shopping or spontaneous buys can contribute to overspending.

- Create a shopping list and stick to it, avoiding unnecessary purchases.

4. Entertainment and Leisure

- Going to movies, concerts, or indulging in expensive hobbies might be fun but costly.

- Look for free or low-cost alternatives, such as streaming services, library books, or community events.

5. Luxury or Unnecessary Products

- Purchasing designer brands or the latest gadgets can strain your finances.

- Evaluate whether these products add long-term value and opt for more affordable alternatives.

Using Cash-Back Rewards or Incentives from Cards Responsibly

Some credit cards offer cash-back rewards or other incentives, which can provide a small financial boost. However, it’s important to use these benefits wisely to avoid falling into more debt.

1. Pay Off the Balance in Full

- If you’re using a cash-back credit card, make sure to pay off the balance each month to avoid interest charges. The rewards should be a bonus, not an excuse to carry a balance.

2. Use Cash-Back for Debt Payments

- If you receive cash-back or rewards, consider using them directly toward paying down your credit card debt. Many credit card companies allow you to apply rewards as a statement credit.

3. Avoid Overspending for Rewards

- Don’t fall into the trap of spending more just to earn cash-back or rewards. Only buy what you can afford, and let the rewards be an added benefit rather than a reason to overspend.

6. Increase Your Income

One of the most effective ways to accelerate your credit card debt repayment is by increasing your income. While cutting back on expenses is important, boosting your earnings can create a powerful combination that speeds up your journey to becoming debt-free. By generating extra income, you can direct the additional funds toward paying off your credit card balances faster.

Ideas for Generating Extra Income

1. Freelancing

- What It Is: Freelancing involves offering services based on your skills, such as writing, graphic design, web development, or social media management.

- How to Get Started: Sign up on platforms like Upwork, Fiverr, or Freelancer, where you can find clients looking for your expertise. You can set your rates and choose projects that fit your schedule.

- How It Helps: Freelancing can provide a flexible way to earn extra income, which can be directly applied to reducing your debt.

2. Selling Unused Items

- What It Is: Selling items you no longer need can quickly generate extra cash. This might include clothes, electronics, furniture, books, or collectibles.

- Where to Sell: Use platforms like eBay, Facebook Marketplace, Poshmark, or Craigslist to sell items.

- How It Helps: The money earned from selling unused or unwanted items can be a quick way to inject extra funds into your debt repayment plan.

3. Side Gigs Like Ride-Sharing or Delivery Services

- What It Is: Side gigs like Uber, Lyft, DoorDash, or Instacart allow you to make money by driving or delivering goods in your spare time.

- How to Get Started: Sign up for the platforms, set your availability, and start working when you have extra time.

- How It Helps: These services offer flexible hours and can be a great way to make extra income during evenings or weekends, which you can put toward debt repayment.

4. Renting Out Property or Assets

- What It Is: If you have a spare room, a parking spot, or even a car, you can rent them out for extra income.

- Where to Rent: Use platforms like Airbnb for space or property rental, Turo for renting out your car, or Neighbor to rent out storage space.

- How It Helps: Renting out assets can provide a steady stream of income that can be allocated toward paying down debt.

5. Tutoring or Teaching

- What It Is: If you have expertise in a particular subject, you can offer tutoring services to students. You can also teach skills such as music, languages, or even fitness training.

- Where to Tutor or Teach: Platforms like Wyzant, Chegg Tutors, or Skillshare allow you to connect with potential students.

- How It Helps: Tutoring and teaching can be highly rewarding, and the income can be used directly to pay off debt.

7. Automate Payments and Stay Consistent

One of the most effective ways to ensure timely debt repayment is by automating your payments. Consistency and discipline are key when tackling credit card debt, and automating the process can help you stay on track, avoid missed payments, and even pay off debt faster.

Benefits of Automating Payments

1. Avoid Missed Deadlines

- How it Helps: By setting up automated payments, you ensure that your credit card bills are paid on time every month, eliminating the risk of missed payments and late fees. This helps maintain a good relationship with your credit card issuer and prevents unnecessary charges.

- The Result: Timely payments will also protect your credit score, which can suffer from late or missed payments.

2. Consistency in Payments

- How it Helps: Automating payments ensures you stick to your repayment plan, whether it’s paying the minimum payment or more. You don’t have to remember to make each payment manually, as it will be deducted from your account automatically.

- The Result: Over time, the consistency of on-time payments will accelerate your progress in paying off debt.

3. Peace of Mind

- How it Helps: Automation removes the mental load of remembering when each bill is due, making it easier to focus on other aspects of your financial goals.

- The Result: Knowing your payments are taken care of can reduce stress and help you feel more in control of your finances.

Setting Up Extra Payments or Rounding Up Minimum Payments

1. Making Extra Payments

- How it Helps: If your budget allows, consider automating extra payments toward your credit card balance. Even small amounts, like $50–$100 extra each month, can have a significant impact over time by reducing your balance faster and lowering the amount of interest you pay.

- The Result: Paying extra can shorten your repayment period and save you money in interest charges.

2. Rounding Up Minimum Payments

- How it Helps: If your minimum payment is $45, round it up to $50 or $60. This small adjustment can help reduce your debt balance faster, even if it feels like a small amount. Over time, these incremental increases add up.

- The Result: You’ll pay off debt faster and reduce the amount of interest you accrue, which can lead to quicker financial freedom.

Conclusion

Eliminating credit card debt is a journey that requires determination, consistency, and a well-thought-out plan. The seven strategies outlined in this article—creating a comprehensive budget, focusing on the debt snowball or avalanche method, negotiating lower interest rates, consolidating debt with a personal loan, cutting back on non-essential spending, increasing your income, and automating payments—offer practical steps to help you tackle debt faster and more effectively.

FAQs

Q. Is debt consolidation a good option for paying off credit card debt?

- Debt consolidation can be a good option if you qualify for a personal loan with a lower interest rate than your credit cards. It simplifies payments by combining multiple debts into one loan. However, ensure that you don’t accumulate more debt and consider the fees involved before choosing this option.

Q. How can I stay motivated while paying off debt?

- To stay motivated, set small, achievable goals, celebrate milestones, and track your progress. Automate payments to avoid missing deadlines, and keep reminding yourself of the long-term benefits of being debt-free, such as financial freedom, peace of mind, and improved credit scores.

Q. What are the long-term benefits of being debt-free?

- Becoming debt-free improves your credit score, reduces stress, and gives you greater financial security. It can lead to lower interest rates on loans, more disposable income, and the ability to save and invest for future goals. Being debt-free also provides peace of mind, knowing you’re in control of your finances.

Pingback: 5 Ways to Increase Credit Limit: Boost Your Financial Flexibility - Paisewaise

Excellent composition; your passion for the topic is evident.

You’ve answered all the queries I had; I feel much more knowledgeable now.

Pingback: How Do You Qualify for a Balance Transfer Credit Card? (2025 Guide) - Paisewaise