Why Finance Content Is Dominating Social Media Feeds

The Problem Everyone Is Quietly Obsessing Over

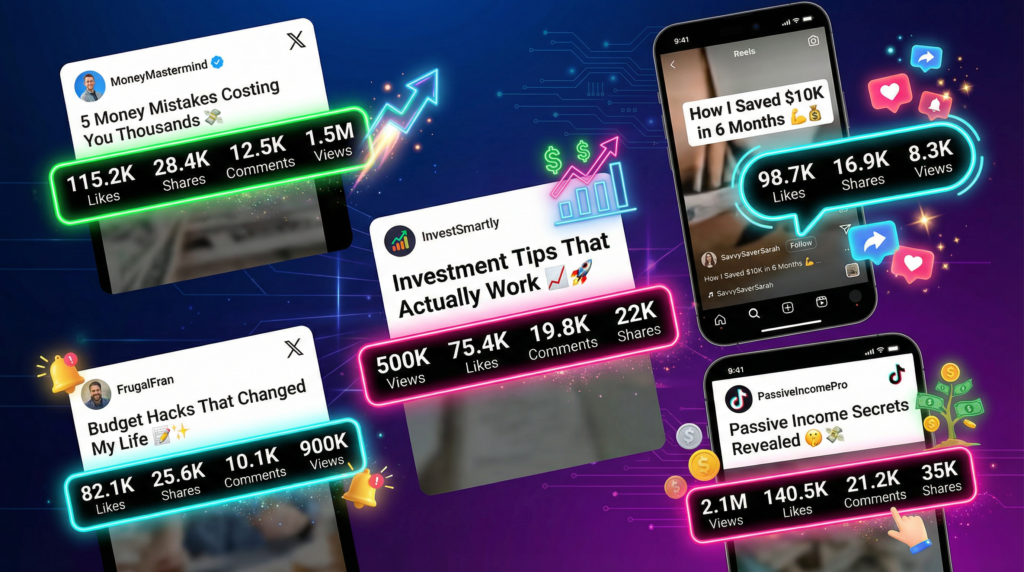

Something fundamental has shifted in the way we scroll. Open Instagram or TikTok right now, and you’ll notice a pattern: between the dance challenges and travel vlogs, there’s an overwhelming surge of budget breakdowns, salary reveals, and money confessions. This isn’t random. People are not scrolling for entertainment anymore—they are scrolling for financial survival.

The numbers tell a stark story. With inflation hitting household budgets harder than ever, stagnant salaries failing to keep pace with rising costs, and financial anxiety becoming a defining feature of modern life, social media behavior has transformed. Users don’t just pause on money-related content—they stop scrolling entirely. A “salary reveal” video or “I’m broke at 27” confession now regularly outperforms polished lifestyle influencers with millions of followers.

Why? Because finance posts trigger something unique: urgency, fear, and hope, all at once. They promise answers to the question keeping millions awake at night: “Am I going to be okay financially?”

Finance content is dominating because it’s filling a gap that traditional education, employers, and financial institutions failed to address.

Why Younger Audiences Are Driving the Finance Content Boom

The Generational Shift in Content Consumption

Millennials and Gen Z aren’t just consuming finance content—they’re driving its explosive growth. But understanding why requires looking at the economic landscape they inherited.

| Generation | Economic Context | Financial Education Source | Content Preference |

|---|---|---|---|

| Baby Boomers | Post-war prosperity | Traditional banking | Financial advisors |

| Gen X | Economic stability | Personal finance books | Expert columns |

| Millennials | 2008 recession entry | Self-taught + peers | Relatable creators |

| Gen Z | Pandemic economy | Social media | Peer-led video content |

These younger audiences entered adulthood during unprecedented economic instability. The 2008 financial crisis, student debt epidemic, and pandemic-era job market created a generation acutely aware of financial fragility. Yet traditional education systems failed them spectacularly—most graduated without knowing how to file taxes, build credit, or negotiate salaries.

The result? A massive preference for peer-led learning over institutional advice. A 24-year-old breaking down their $45,000 salary budget resonates more than a financial advisor in a suit. Finance content is dominating this demographic because it speaks their language, addresses their reality, and comes from people who look and sound like them.

Case Study: Budget Breakdown Videos

Creator @thefinancialdiet on TikTok gained 2.3 million followers by posting unfiltered budget breakdowns from everyday people earning $35,000-$65,000 annually. These videos consistently receive 5-10x more engagement than celebrity financial advice, proving a critical insight: relatable struggle plus authenticity beats polished expertise every time.

How Social Media Algorithms Amplify Finance Content

Finance content doesn’t just perform well organically—platforms actively reward it through their recommendation systems. Here’s why:

High Watch Time Metrics:

- Users watch finance videos to completion (crucial for TikTok and Reels)

- The curiosity gap (“How much do they earn?”) keeps viewers engaged

- Complex topics require rewatching, boosting retention signals

Strong Engagement Signals:

- Save rates on money tips exceed most content categories

- Share rates spike as users send advice to friends and family

- Comment sections become financial support communities

Repeat Viewing Behavior:

- Users bookmark budgeting templates and tax tips

- The algorithm interprets this as high-value content

- Content gets pushed to broader audiences

Example in Action:

A 15-second Instagram Reel titled “3 money mistakes killing your savings” by @moneywitkkatie accumulated:

- 4.2 million views

- 387,000 saves

- 89,000 shares

- Watch time averaging 14 seconds (93% completion rate)

The algorithm saw these engagement patterns and pushed the content to users who’d never followed finance accounts before. Within 48 hours, finance content is dominating their feeds based on this single interaction.

The Psychology Behind Why Money Content Is So Shareable

Emotional Triggers That Drive Virality

Finance content taps into psychological mechanisms that make it inherently shareable. Understanding these triggers explains why money-related posts spread faster than almost any other content type.

Key Psychological Drivers:

- Fear of Missing Out (FOMO): “Everyone knows this tax loophole except me.”

- Validation Seeking: “I’m not the only one struggling with credit card debt.”

- Social Comparison: “How does their budget compare to mine?”

- Identity Formation: Money habits become part of the self-concept.

- Tribal Belonging: Finding “your people” through shared financial situations.

The most viral finance content exploits these triggers deliberately. Posts framed as “If you earn under $50k, this is for you” create instant in-group identification. They’re not just sharing information—they’re validating experiences and building community.

Why Relatable Problems Outperform Aspiration:

| Content Type | Average Engagement | Share Rate | Audience Sentiment |

|---|---|---|---|

| “How I became a millionaire.” | Moderate | Low | Skepticism/envy |

| “Broke at 30: my reality.” | High | Very High | Validation/support |

| “Investment strategies” | Low-Moderate | Low | Intimidation |

| “Paycheck-to-paycheck budgeting” | Very High | Very High | Relief/connection |

Finance content is dominating because creators have learned that vulnerability and relatability trump aspiration. People don’t share content that makes them feel inadequate—they share content that makes them feel understood.

Short-Form Video Changed How We Learn About Money

The Democratization of Financial Education

TikTok and Instagram Reels didn’t just create a new content format—they revolutionized financial literacy delivery. Complex topics that once required hour-long seminars or dense textbooks now fit into 60-second videos.

The Short-Form Advantage:

Bite-Sized Financial Education

- Breaking down compound interest in 30 seconds

- Visual demonstrations of the “latte factor.”

- Quick wins that build confidence

Visual Breakdowns of Complex Topics

- Animated debt payoff timelines

- Screen recordings of budget apps in action

- Before/after net worth transformations

Dopamine-Driven Learning Loops

- Quick tips provide instant gratification

- The algorithm serves related content immediately

- Learning feels effortless and entertaining

Transformation Example:

Traditional approach: A 300-page personal finance book explaining budget creation.

Short-form approach: A 45-second TikTok showing an aesthetic budget spreadsheet being filled out in real-time, set to trending audio, with overlay text explaining each category.

Result: The TikTok reached 8.7 million people in one week. The book might sell 10,000 copies in a year.

Finance content is dominating educational spaces because it meets people where they are—on their phones, during lunch breaks, before bed—and makes learning feel like scrolling.

Why Real-Life Finance Stories Outperform Traditional Advice

The Power of Imperfect Authenticity

The most compelling finance content doesn’t come from certified financial planners or economists. It comes from anonymous creators sharing messy, real debt payoff journeys. This shift from instruction to storytelling has fundamentally changed what resonates.

Storytelling vs. Instruction:

Traditional financial advice follows a predictable pattern: identify the problem, present the solution, and explain implementation. It’s educational but sterile.

Real-life finance stories follow human narrative arcs: struggle, mistakes, small victories, setbacks, progress. They’re messier but magnetic.

Why Strangers Build Trust Faster Than Credentials:

- Transparency creates connection: Sharing exact salary figures and debt amounts feels radically honest

- Imperfection signals authenticity: Budget fails, and money mistakes make creators relatable

- Shared struggle builds community: “We’re in this together” resonates more than “Let me teach you.”

Case Study: Anonymous Debt Payoff Journeys

Creator @debtfreecommunity (anonymous) documented paying off $78,000 in student loans over 4 years:

- Posted monthly updates with exact numbers

- Shared setbacks (medical emergency adding $3,000 debt)

- Showed genuine emotion in video diaries

- Never promoted products or courses

Result: 890,000 followers, average engagement rate of 18% (industry average is 1-3%), and thousands of comments from people starting their own debt payoff journeys.

The content worked because it wasn’t advice—it was proof that real people overcome real financial challenges. Finance content is dominating because audiences crave this authenticity over polished expertise.

Economic Pressure Is Fueling the Finance Content Explosion

When Survival Becomes Content

The surge in finance content isn’t happening in a vacuum—it’s a direct response to unprecedented economic pressure. Inflation, housing costs, and job insecurity have turned everyday financial decisions into viral content topics.

The Inflation-to-Content Pipeline:

Rising Costs = Viral Topics

- Grocery haul comparisons showing $200 barely filling a cart

- Rent reveal videos highlighting the housing crisis

- Gas price rants are turning into financial solidarity movements

Economic Anxiety = Audience Demand

- “How to survive on $X per month” searches spike

- Emergency fund content surges during layoff waves

- Side hustle content explodes during recessions

Real Numbers:

| Economic Indicator | Content Response | Engagement Increase |

|---|---|---|

| 7% inflation rate (2023) | Grocery budget videos | +340% |

| Housing costs up 30% | Rent negotiation tips | +280% |

| Tech layoffs 2023 | Side hustle content | +420% |

| Student loan restart | Debt management posts | +510% |

Side Hustles as Financial Safety Nets:

“How I make an extra $500/month” videos aren’t just performing well—they’re becoming survival guides. Content showing DoorDash earnings, Etsy shop breakdowns, or freelance income transparency gains massive traction because it addresses a fundamental fear: “What if my job isn’t enough?”

Finance content is dominating during economic downturns because it transforms anxiety into actionable information. Every inflation report, every layoff announcement, and every rent increase creates fresh demand for content addressing these pressures.

The Creator Economy Is Rewarding Finance Content

Why Finance Creators Are the New Influencers

Finance content isn’t just popular—it’s profitable. Creators in this niche are experiencing growth rates that rival or exceed traditional influencer categories, and the reasons are purely economic.

The Finance Creator Advantage:

High Advertiser Demand

- Banks and fintech companies pay premium CPMs

- Affiliate programs for financial tools offer 20-50% commissions

- Sponsored content rates 2-3x higher than lifestyle niches

Easy Monetization Pathways

- Budget templates selling for $15-50

- Digital courses on debt payoff strategies

- App partnerships and referral bonuses

- Financial coaching services

Lower Barrier to Entry

- Don’t need expensive equipment

- Face-on-camera optional (text + voiceover works)

- Screen recordings and spreadsheets perform well

Success Example:

Creator @budgetwithjess started posting Excel budget templates on TikTok in 2022:

- Month 1-3: Built audience with free budgeting tips (0-15,000 followers)

- Month 4: Launched $27 digital budget template (87 sales)

- Month 8: Expanded to 5 templates ($12,000/month revenue)

- Year 2: Full-time creator with digital product suite ($75,000+ annual revenue)

Her content never required fancy production—just clear information, consistent posting, and genuine expertise. Finance content is dominating the creator economy because it offers faster, more sustainable monetization than traditional influencer paths.

Market Data:

Finance creators with 50,000+ followers report average monthly earnings of $4,500-8,000, compared to $1,200-2,500 for equivalent lifestyle creators. The niche also shows higher follower loyalty and lower unfollow rates.

The Risk Side: Misinformation and False Hope

The Dark Side of Finance Content Domination

With great reach comes great responsibility—and great potential for harm. The same algorithmic forces that amplify helpful finance content also spread dangerous misinformation at unprecedented speed.

Why “Get Rich Quick” Content Keeps Resurfacing:

- Algorithm rewards sensational claims: “Turn $100 into $10,000 in 30 days” gets clicks

- Low financial literacy increases vulnerability: People can’t distinguish scams from legitimate strategies

- Emotional desperation overrides logic: Economic pressure makes people susceptible to false hope

How Misinformation Spreads:

Finance misinformation spreads faster than other niches because:

- Complex topics are oversimplified to fit short formats

- Results can’t be immediately verified (unlike cooking or fitness content)

- Survivorship bias—only winners share their stories

- Crypto and trading content create echo chambers

Recent Examples:

AI Trading Bot Scam (2024)

- Viral videos promised automated trading profits

- 230+ TikTok videos promoting the same service

- Combined reach: 47 million views

- Estimated victim count: 15,000+ people

- Average loss: $500-2,000 per person

“Cash Stuffing” Tax Misinformation

- Popular budgeting method misrepresented as tax avoidance

- Creators incorrectly claim cash transactions aren’t taxable

- Widespread confusion about IRS reporting requirements

Warning Signs of Problematic Finance Content:

- Guaranteed returns or income promises

- Pressure to act immediately (“Limited spots available”)

- Requiring upfront payment for “exclusive” information

- Dismissing traditional financial advice as “outdated.”

- No disclosure of risks or potential losses

Finance content is dominating social media, but this dominance includes both helpful education and harmful misinformation. Platforms struggle to moderate financial advice, and users must develop critical evaluation skills.

Future Outlook: Will Finance Content Keep Dominating?

The Evolution of Money Content

Finance content isn’t slowing down—it’s evolving. Understanding emerging trends helps predict where this niche is headed over the next five years.

Factors Supporting Continued Dominance:

Economic Realities Aren’t Changing

- Affordability crisis persists

- Gig economy continues expanding

- Financial anxiety remains high

- Traditional financial education is still inadequate

Technology Enabling New Formats

- AI-assisted budgeting tools are becoming mainstream

- Real-time financial tracking integrated into content

- Augmented reality budget visualizations

- Interactive financial calculators in videos

Emerging Sub-Niches to Watch:

| Sub-Niche | Why It’s Growing | Target Audience | Example Content |

|---|---|---|---|

| Low-stress income | Burnout culture backlash | Millennials/Gen Z | “How I earn $60k working 30 hrs/week.” |

| Quiet wealth | Anti-hustle movement | 30-45 age range | “Building wealth without social media.” |

| Climate finance | ESG investing interest | Gen Z/young millennials | “Sustainable investing for beginners” |

| Neurodivergent money | ADHD/autism awareness | Disabled communities | “ADHD-friendly budgeting systems” |

| Inheritance planning | Boomer wealth transfer | Millennial heirs | “What to do when you inherit money.” |

Predicted Shifts:

- From Quick Wins to Sustainable Systems. The “hack” culture is giving way to realistic, long-term strategies. Content like “How I built a 6-month emergency fund in 18 months” performs better than “Emergency fund in 30 days.”

- Rise of Niche Micro-Finance Communities Broad finance advice is fragmenting into hyper-specific communities: finance for artists, divorced parent budgeting, etc.

- Platform Diversification Finance creators are building presence across TikTok, YouTube, Instagram, and emerging platforms, recognizing that algorithm dependence is risky.

Finance content is dominating now and will continue dominating, but the format, tone, and approach will mature alongside audience needs and economic conditions.

Conclusion: Why Money Content Isn’t a Trend—It’s a Symptom

Understanding What Finance Content Really Represents

When we see finance content flooding our feeds, we’re not witnessing a temporary trend or a passing fad. We’re observing a societal response to systemic failure.

Finance content is dominating social media because:

- Traditional financial education abandoned entire generations

- Economic systems created widespread financial insecurity

- Institutions failed to provide accessible, relatable guidance

- People turned to each other when experts couldn’t relate

- Social media became the world’s informal financial classroom

The 23-year-old teaching budgeting on TikTok isn’t replacing financial advisors—they’re filling a void that should never have existed. The viral salary reveal videos aren’t entertainment—they’re radical transparency in response to wage secrecy that benefits employers. The debt payoff journeys aren’t content—they’re mutual aid in digital form.

This dominance will persist because:

- Financial anxiety isn’t going anywhere

- Peer-to-peer learning builds more trust than institutional advice

- Economic pressure continues to create demand for practical solutions

- Younger generations prefer video-based, authentic education

The Real Question:

We shouldn’t be asking “Why is finance content dominating social media?” We should be asking, “Why did it take social media to give people the financial education they desperately needed?”

As long as financial anxiety exists, as long as systems fail to adequately prepare people for economic reality, finance content will remain at the center of the feed—not as entertainment, but as a lifeline.

FAQs

Q. Why is finance content suddenly everywhere on social media?

- Finance content is rising because people are dealing with inflation, job insecurity, and financial stress. Social media fills the gap left by traditional financial education.

Q. Why do salary reveal and budgeting videos go viral?

- These videos trigger curiosity, relatability, and comparison—three strong psychological drivers that increase watch time, shares, and saves.

Q. Which platform is best for finance content?

- Short-form platforms like TikTok and Instagram Reels perform best for finance hooks, while YouTube works well for deeper financial explanations.

Q. Why do people trust finance advice from strangers online?

- Viewers often trust real-life experiences more than formal expertise. Transparency and storytelling create faster emotional trust.

Q. Will finance content continue to dominate social media?

- As long as financial uncertainty exists, finance content is likely to remain dominant—especially content focused on realistic money habits and income stability.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

I’d love to see a video version of this!