TikTok Money Trends That Actually Make Sense (What’s Worth Trying vs. What to Skip)

Everyone is suddenly a finance expert on TikTok. One video says “cash stuffing will change your life,” another promises “passive income in 30 days,” and a third claims you’re “poor because you don’t invest like this.” The result? Confusion, anxiety, and bad money decisions.

Here’s why this matters: Most viral TikTok money trends are either oversimplified, risky, or unrealistic—but a few are surprisingly practical when applied correctly. The problem isn’t TikTok itself; it’s the gap between what goes viral and what actually works in real life.

This article breaks down which TikTok money trends are actually based on sound financial principles, how to spot red flags, and how to use the good ideas safely—with real-world examples, not hype. You’ll learn to separate financial wisdom from financial theater, and discover which trends deserve your time and which ones are designed to boost views, not bank accounts.

Why Some TikTok Money Trends Actually Work

Which TikTok money trends are backed by basic financial principles?

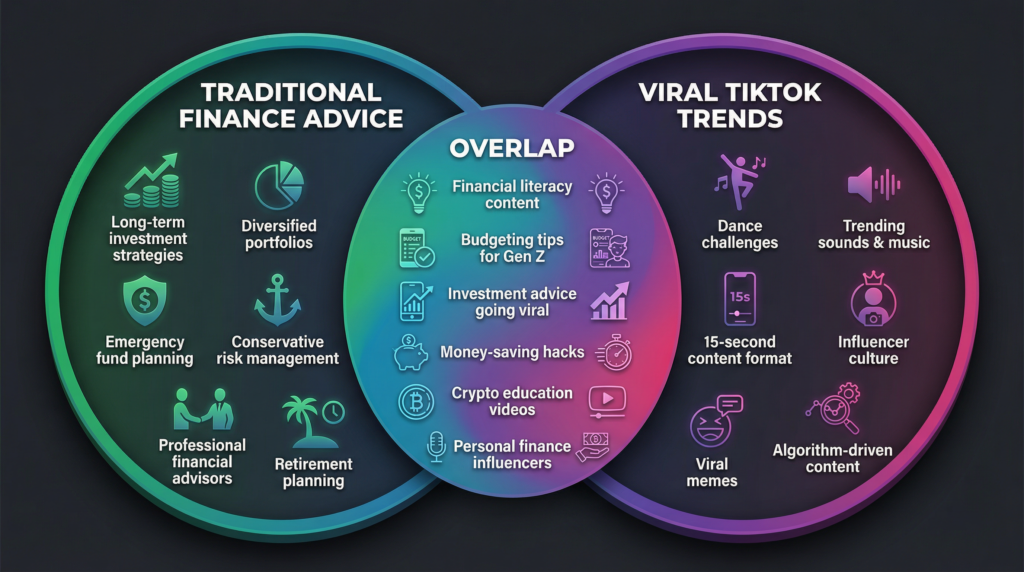

The truth is, simple ideas spread faster than complex financial advice. When a TikTok money trend goes viral, it’s usually because it’s visual, emotional, and actionable within seconds—qualities that traditional financial education often lacks. But here’s the interesting part: many viral trends are actually repackaged versions of time-tested money principles.

Consider the overlap between viral trends and traditional money rules. Budgeting, saving consistently, and tracking spending aren’t new concepts—they’ve been financial cornerstones for decades. What TikTok does is make them feel fresh, urgent, and achievable. The platform transforms “create a monthly budget” into “show me your cash stuffing routine,” and suddenly, people who never opened a spreadsheet are organizing their money.

Why does “boring” finance often work better than exciting finance? Because sustainable wealth-building is repetitive, gradual, and unglamorous. The TikTok money trends that actually succeed long-term are the ones that make boring habits feel engaging.

Example: The viral cash stuffing trend is essentially the envelope budgeting method that financial advisors have recommended since the 1980s. Both rely on the same behavioral psychology: making money tangible creates emotional connection and spending awareness. When you physically remove cash from an envelope labeled “groceries,” your brain processes loss differently than swiping a card. The TikTok version just added aesthetics, music, and community accountability—which, ironically, makes the old method work even better for some people.

How to Tell If a TikTok Money Trend Is Legit or Just Hype

Not all TikTok money trends deserve your attention—or your money. The challenge is separating genuine financial strategies from content designed purely for engagement. Here are the biggest warning signs:

Red Flags to Watch For:

| Red Flag | What It Looks Like | Why It’s Dangerous |

|---|---|---|

| Overpromising results | “Guaranteed income,” “Risk-free returns,” “Anyone can do this.” | Real investing always carries risk; guarantees are legally impossible |

| No downside discussion | Only shows wins, never losses or challenges | Creates unrealistic expectations and hides true costs |

| Influencer contradiction | They earn more from views than from the strategy itself | Their income source is selling you the dream, not the strategy |

| Urgency tactics | “Limited time,” “Act now,” “You’re missing out.” | Pressure prevents rational decision-making |

What are the biggest red flags in TikTok money advice?

Lack of transparency is the clearest warning sign. If a creator won’t discuss what could go wrong, how much time it really takes, or what skills you’ll need, they’re selling entertainment, not education.

The 3-Question Filter for Any TikTok Money Trend:

- Does it reduce spending or increase skills? Legitimate strategies help you spend less wastefully or earn more through developed abilities—not tricks or shortcuts.

- Is the risk clearly explained? Good financial advice acknowledges what you could lose, not just what you might gain.

- Can it work without going viral? If the strategy only succeeds because others watch you do it, it’s not a financial strategy—it’s content creation.

Example: A trending “side hustle” suggests buying items at thrift stores and reselling them online for profit. The TikTok version shows someone finding a $5 vintage jacket and selling it for $80 in one day. What’s missing? The 20 items they bought that didn’t sell. The storage space costs. The hours spent photographing, listing, and shipping. The platform fees. The knowledge required to identify valuable items. The saturated market was created by thousands of people trying the same trend. When you apply the 3-question filter, you realize this requires significant skills (vintage fashion knowledge, photography, marketing) and carries real risks (unsold inventory, time investment with no return).

TikTok Budgeting Trends That Help (and Why)

Does the cash-stuffing trend actually improve saving behavior?

Yes—for certain people in specific situations. Cash stuffing works because it leverages visual budgeting, which transforms abstract numbers into physical reality. When you see your entertainment envelope getting empty, your brain registers scarcity in a way that a declining bank balance simply doesn’t.

Why Visual Budgeting Works for Beginners:

- Tangible limits: Physical cash creates psychological barriers that digital spending doesn’t

- Immediate feedback: You see exactly what’s left in each category

- Reduced decision fatigue: Pre-allocated cash means fewer spending choices throughout the month

- Emotional connection: Handling physical money activates different neural pathways than tapping a card

When Cash Stuffing Fails:

| Situation | Why It Doesn’t Work | Better Alternative |

|---|---|---|

| Inconsistent income | Can’t predict envelope amounts | Percentage-based budgeting app |

| Primarily digital payments | Rent, utilities, and subscriptions can’t be paid in cash | Hybrid: cash for discretionary, digital tracking for fixed |

| High-value purchases | Carrying large amounts is unsafe | Zero-based budgeting with separate savings accounts |

| Multiple income sources | Too complex to allocate across envelopes | Digital budget with automatic categorization |

Which TikTok savings trends work best for people living paycheck to paycheck?

The “pay yourself first” micro-savings trend—saving small amounts ($5-$20) immediately when you get paid—works better than traditional advice to “save what’s left” because there’s rarely anything left when you’re living paycheck to paycheck.

Realistic Example: Maria gets paid $1,800 biweekly. Using TikTok money trends, she tries cash stuffing for variable expenses (groceries, gas, personal spending). She withdraws $600 in cash and divides it into four envelopes: $300 groceries, $150 gas, $100 entertainment, $50 personal care. Week one, she spends normally. Week two, she sees the grocery envelope getting thin and plans cheaper meals. By making money visible, she saves $80 that month—not life-changing, but $960 annually she wouldn’t have saved otherwise. The trend didn’t change her income; it changed her awareness.

Viral Challenges — Helpful Habit or Hidden Stress?

Are “no-spend challenges” effective or psychologically harmful?

The answer depends entirely on how you approach them. No-spend challenges can reset spending habits and increase awareness, but they can also create deprivation mindsets that lead to rebound overspending.

Short-Term Wins vs. Long-Term Burnout:

The viral version—”I’m spending NOTHING for 30 days!”—sounds impressive but rarely addresses why you were overspending in the first place. Without understanding the emotional or situational triggers behind spending, you’re just white-knuckling through a month. When the challenge ends, the habits return.

The Difference Between Mindful Spending and Deprivation:

- Mindful spending: “I’ll skip restaurants this week because I’m saving for concert tickets I really want.”

- Deprivation: “I can’t have coffee with friends because I’m doing a challenge.”

One builds intentionality; the other builds resentment.

The Low-Pressure Alternative:

Instead of absolute no-spend challenges, try “conscious spending weeks” where you log every purchase and rate whether it was worth it (1-10). This creates awareness without restriction, which is far more sustainable.

Modified Challenge Example: James sees the “no eating out for 30 days” challenge on TikTok. Instead of going cold turkey, he tries “planned meals out only.” He allows himself two restaurant meals per week but must choose them in advance. This reduces his monthly restaurant spending from $320 to $140 without the psychological stress of complete elimination. Six months later, he’s still following this pattern because it doesn’t feel like punishment—just intentionality. The extreme viral challenge would have lasted 30 days, maybe, followed by a spending rebound.

TikTok Side Hustle Trends — Reality Check

[Image Suggestion: Side-by-side comparison showing “TikTok Version” vs. “Reality Version” of a side hustle with actual time/money breakdown]

Are TikTok side hustle trends realistic for beginners?

Some are, most aren’t—at least not in the timeline or profit margins suggested. The problem with viral side hustle content is survivorship bias: you’re seeing the successful outliers, not the typical results.

What Hidden Costs Are Ignored in Most TikTok Money-Making Trends?

The Real Investment Required:

| Side Hustle | TikTok Version | Reality Version |

|---|---|---|

| Print-on-demand | “I made $500 my first month!” | $50-200 monthly after: design software ($30/mo), sample orders ($50), ads ($100+), platform fees (20-30%) |

| Freelance writing | “I charge $500 per article now!” | 6-12 months building portfolio, pitching 50+ clients for first paid gig, ongoing marketing time |

| Digital products | “Passive income while you sleep!” | 40-80 hours creating product, learning platform, marketing constantly—anything but passive |

| Amazon FBA | “My products are trending!” | $3,000-5,000 startup inventory, storage fees, returns, competition from existing sellers |

Why Most “Passive Income” Ideas Are Actually Active Income:

True passive income—royalties, dividend investing, rental income from professionally managed properties—requires significant upfront capital or lengthy creation time. The TikTok money trends labeled “passive” are usually active income disguised with automation tools. You’re still trading time for money; you’re just doing it asynchronously.

Who Benefits Most From These Trends?

People who already have:

- Existing audiences to sell to

- Complementary skills (design, marketing, video editing)

- Capital to invest in tools and inventory

- Time to experiment without immediate income needs

Reality Check Example: The viral “digital planner” side hustle trend shows creators making $2,000+ monthly selling Notion templates. What the 60-second TikTok doesn’t show: Sarah spent three months learning Notion’s advanced features, two months creating her first template, invested $400 in her website and email platform, posted free content daily for four months to build an audience, and made $47 her first month. Month six, she earned $320. Month twelve, she hit $1,100. It works—but the TikTok version collapses a year of work into a highlight reel. The trend itself isn’t a scam; the timeline expectations are.

TikTok Investing Advice — What Aligns With Reality

Are TikTok investing trends safe for first-time investors?

Generally, no—but the reasons are instructive. TikTok money trends in investing tend to showcase high-risk, high-volatility strategies because those create emotional, engaging content. Watching someone’s portfolio gain 40% in a month is riveting; watching someone dollar-cost average into an S&P 500 index fund is boring. But boring often wins.

Why Beginners Are Drawn to Fast-Moving Investments:

- Recency bias: Recent dramatic gains feel more real than historical average returns

- FOMO (fear of missing out): Seeing others profit creates urgency to act

- Simplification: Complex investing appears simple when reduced to “just buy this stock.”

- Entertainment value: Investing becomes a game, not a long-term wealth strategy

The Risk of Copying Trades Without Understanding:

When you copy someone’s stock pick without understanding:

- Their risk tolerance (they might be investing 5% of their portfolio; you’re investing 50%)

- Their time horizon (they’re holding for 10 years; you panic sell in 10 days)

- Their total portfolio (they’re diversified across 40 positions; this is your only one)

- Their knowledge base (they’ve researched for months; you watched a 45-second video)

You’re not following a strategy—you’re gambling based on someone else’s homework.

Where TikTok Advice Overlaps With Long-Term Investing Wisdom:

Actually Good Advice from TikTok Money Trends:

- Start investing early (compound interest explanations)

- Use tax-advantaged accounts first (Roth IRA education)

- Invest consistently regardless of market conditions (dollar-cost averaging)

- Keep fees low (index fund promotion)

- Don’t try to time the market (anti-day-trading content)

These trends align with traditional investing principles and deserve attention.

Contrast Example: Viral trend: “This penny stock is about to explode—get in now!” promotes speculation based on hype. Reality-based approach: “I invest $200 monthly into a target-date index fund regardless of market conditions” might get 1/10th the views but delivers far more reliable results. A 2024 Vanguard study showed that consistent index fund investors averaged 8-10% annual returns over the past decade, while individual stock pickers averaged 3-5% after accounting for fees and mistakes. The boring TikTok money trends about systematic investing don’t go viral, but they do build wealth.

How to Safely Try Any TikTok Money Trend

How should beginners test a TikTok money trend safely?

Treating any trend as an experiment rather than a commitment is the key to learning without financial damage. Here’s a practical framework that works for budgeting trends, saving challenges, or side hustles.

The Safe Testing Framework:

1. Start Small

- Never invest more than you can afford to lose completely

- For budgeting trends: Test with one spending category first

- For side hustles: Limit initial investment to $100 or less

- For investing trends: Use educational simulators before real money

2. Set a Time Limit

- 30 days for habit-based trends (budgeting, no-spend challenges)

- 90 days for income-based trends (side hustles, selling strategies)

- 6-12 months for investing approaches (long enough to see past volatility)

3. Measure One Simple Outcome

- Budgeting: “Did I stay within my allocated amount?”

- Saving: “How much did I save compared to previous months?”

- Side hustle: “Profit after expenses and time invested.”

- Investing: “Did I stick to the plan regardless of emotions?”

How Long Should You Try a Money Trend Before Judging Results?

| Trend Type | Minimum Test Period | Success Metric |

|---|---|---|

| Budgeting methods | 30 days | Reduced overspending in the tested category |

| Savings challenges | 60 days | Actual dollars saved, not just intention |

| Side hustles | 90 days | Positive cash flow after expenses and a realistic hourly rate |

| Investing strategies | 6 months minimum | Consistency of contributions, not returns |

30-Day Test Example: David sees the “52-week money challenge” TikTok money trend where you save $1 week one, $2 week two, building to $52 by week 52 (totaling $1,378 annually). Instead of committing to a full year, he tests the concept for 30 days. He saves $1, then $2, then $3, continuing through week four. Total saved: $10. What he learns: the incremental approach feels manageable, and watching the jar fill is motivating. But he also discovers that by week four, he needs a better tracking system to remember which week he’s on. He modifies the trend: instead of weekly increases, he rounds up every transaction to the nearest dollar and saves the difference—same psychological principle, better execution for his lifestyle. This 30-day test prevented him from committing to a year-long system that wouldn’t have worked, while preserving the useful insight about incremental saving.

The TikTok Money Trends Worth Following Going Forward

What TikTok money trends are worth following?

The trends with staying power share common characteristics: they focus on behavior change over quick wins, skill development over shortcuts, and sustainable habits over viral moments.

Trends Focused on Behavior, Not Hype:

- Visible budgeting systems (cash stuffing, budget binders, sinking funds) that make abstract money concrete

- Micro-saving automation (round-ups, percentage-based automatic transfers) that removes decision fatigue

- Intentional spending frameworks (30-day lists, cost-per-use calculations) that build awareness without restriction

- Debt payoff transparency (debt-free journeys, balance updates) that normalize discussing and tackling debt

Skill-Based Income Over Shortcuts:

The shift from “make money fast” to “build marketable skills” is perhaps the most encouraging evolution in TikTok money trends. Content teaching:

- Freelance skill development (writing, design, coding basics)

- Negotiation techniques for salary increases

- Portfolio-building for career advancement

- Long-term career strategy over side hustle hopping

Slow Wealth vs. Fast Clicks:

The emerging “boring money” trend—creators celebrating consistent, unglamorous financial habits—represents a maturation of financial content. When videos about maxing out your employer’s 401(k) match or comparing high-yield savings accounts get significant engagement, it signals that audiences are seeking substance over entertainment.

These trends won’t generate millions of views, but they’ll generate actual financial progress—which is, ultimately, the point. The future of valuable TikTok money trends lies in creators who measure success by their audience’s financial outcomes, not their own viral metrics.

Final Takeaway

TikTok isn’t the problem—blindly copying trends is. The platform has democratized financial education, making concepts accessible that were once hidden behind expensive advisors or intimidating textbooks. But accessibility without discernment leads to expensive mistakes.

The best money trends don’t promise wealth. They build habits. They don’t guarantee returns. They encourage consistency. They don’t eliminate risk. They help you understand it.

Here’s your filter for every TikTok money trend you encounter: If it makes you calmer, more consistent, and more aware of your finances, it probably makes sense. If it makes you anxious, impulsive, or overly certain about uncertain outcomes—it’s designed for views, not for your financial wellbeing.

Take what works. Test it safely. Modify it for your situation. Ignore the rest. Your financial future deserves better than viral fame—it deserves actual strategy.

FAQs

Q. Are TikTok money trends reliable?

- Some are, but many are exaggerated. Trends that focus on budgeting, saving, or skill-building are usually more reliable than “get rich quick” ideas.

Q. Is TikTok a good place to learn about money?

- TikTok can be a starting point, but advice should always be verified before applying it to your finances.

Q. Are TikTok investing trends safe for beginners?

- Most viral investing trends are risky for beginners. Safer approaches focus on long-term consistency rather than fast profits.

Q. How can I test a TikTok money trend safely?

- Start small, set a time limit, track results, and stop immediately if it causes financial stress or loss.

Q. Why do unrealistic money trends go viral?

- They promise fast results, emotional relief, and simple solutions—things the algorithm rewards, even if the advice is flawed.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.