9 Simple Ways People Save Money Without Budgeting (No Apps, No Spreadsheets)

Why Budgeting Fails Most People

You make a budget on Sunday night. You download the app, categorize your expenses, and promise yourself: “This time will be different.” By Wednesday, you’ve already spent $35 on unplanned DoorDash. By Friday, the guilt kicks in. By next Sunday, the app sits unopened.

Sound familiar?

Most people don’t fail at budgeting because they’re bad with money. They fail because budgeting itself is exhausting. Tracking every coffee, every Uber ride, every impulse purchase creates emotional fatigue. It turns money into a constant source of judgment and anxiety. The spreadsheet becomes a reminder of everything you “shouldn’t” have bought.

Here’s the truth: saving money without budgeting isn’t about being careless—it’s about being smarter with systems instead of willpower. What if you could save consistently without tracking a single dollar?

What “Saving Without Budgeting” Actually Means

Let’s clear up the confusion immediately. Saving money without budgeting doesn’t mean spending recklessly or hoping money magically appears in your account.

It means replacing tracking-based rules with behavior-based systems.

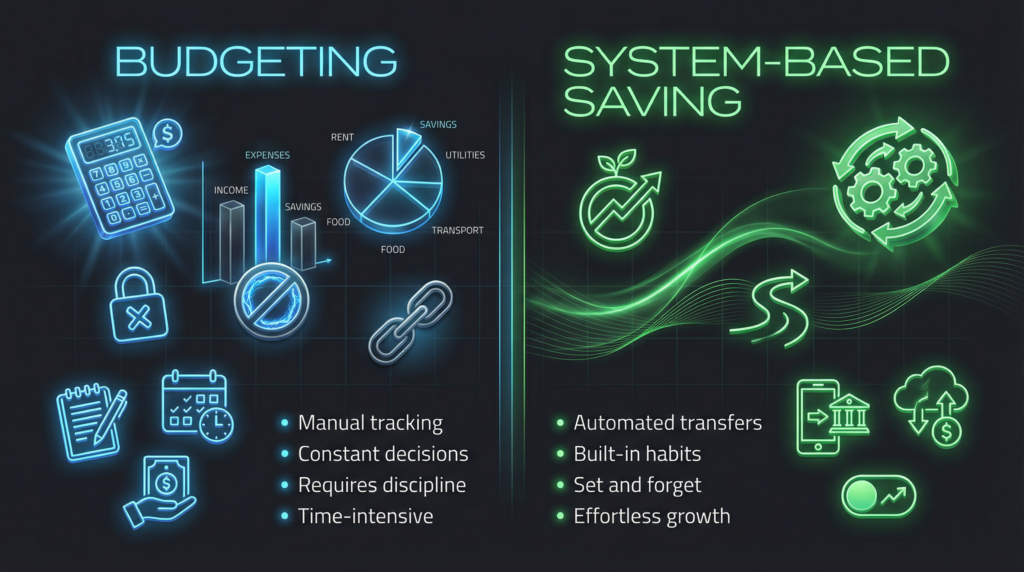

| Traditional Budgeting | System-Based Saving |

|---|---|

| Track every expense | Create automatic transfers |

| Set spending limits | Design an environment to reduce spending |

| Requires daily discipline | Works on autopilot |

| High mental effort | Low mental effort |

| Feels restrictive | Feels natural |

Instead of asking “Did I stay within my restaurant budget this month?” you simply eat out less by default—without monitoring it. The goal isn’t perfect control. It’s consistent progress with minimal friction.

Ways people save money using this approach focus on making the right choice, the easy choice, not the forced choice.

Who This Approach Works Best For

This method isn’t for everyone, but it’s perfect for:

- People with irregular income (freelancers, gig workers, commission-based sales professionals)

- People who’ve tried budgeting 3+ times and quit every time

- People who hate spreadsheets, apps, and daily tracking

- Anyone who finds traditional budgeting emotionally draining

Case Study: Sarah, Freelance Graphic Designer

Sarah tried four different budgeting apps in two years. Each time, she’d track diligently for 2-3 weeks, then life would get busy. Client projects would pile up, and the app would sit ignored. She felt like a failure until she switched to automation: 30% of every client payment now goes directly to a separate high-yield savings account. She hasn’t opened a budgeting app in eight months and has saved more than ever before.

If you’re nodding along, these ways people save money will feel like relief, not restriction.

The Psychology Behind Saving Without Tracking

Here’s what naturally frugal people understand intuitively: habits always beat willpower.

Your brain makes thousands of micro-decisions daily. When every purchase requires conscious deliberation (“Should I? Shouldn’t I? What does my budget say?”), Decision fatigue sets in. You get tired and default to the easier choice—which is usually spending.

The Three Psychological Principles

- Environment shapes behavior more than intention

- People who save effortlessly design environments where spending requires extra steps

- Example: Deleting food delivery apps means ordering requires re-downloading (most don’t bother)

- Friction determines action

- Every extra step between impulse and purchase reduces the likelihood of spending

- Saving automatically removes friction from saving and adds it to spending

- Systems outlast motivation

- Motivation fluctuates daily; systems run regardless of how you feel

- Ways people save money long-term rely on automation, not enthusiasm

Real Example: Marcus keeps only one debit card in his wallet—his savings account card stays at home. To access spending money, he has to consciously transfer from savings. That tiny barrier saved him $800 in three months on impulse purchases.

How Automation Replaces Budgeting Entirely

This is the foundation of saving money without budgeting: Make saving invisible and automatic.

The Three Automation Levels

Level 1: Basic Auto-Transfer

- Set up automatic transfer of 20-30% of income to savings on payday

- Works even if income varies (percentage stays proportional)

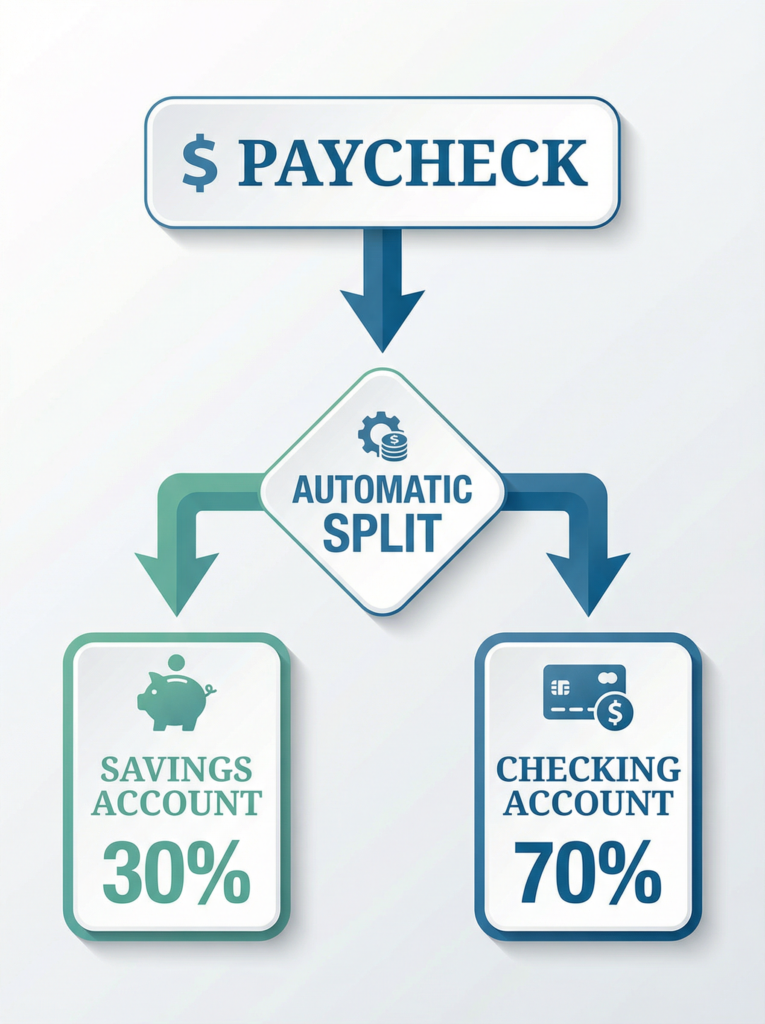

Level 2: Direct Deposit Split

- Ask your employer to split direct deposits between checking and savings

- Many payroll systems allow multiple account deposits

Level 3: Invisible Accounts

- Create savings accounts you genuinely forget exist

- No debit card, no mobile app access

- Out of sight, out of spending

Why This Works

| Problem with Budgeting | How Automation Solves It |

|---|---|

| Requires remembering to save | Happens before you see the money |

| Temptation to skip “this month.” | No decision point = no temptation |

| Feels like deprivation | Never feels like “giving up” money |

Case Study: Jake’s Automated System

Jake, a sales manager, spent years trying to manually save. He’d move money to savings when he “remembered” or when the month felt good. Some months he saved $500, other months nothing.

Then he automated: $400 moves to a high-yield savings account on the 1st and 15th of every month (his pay dates). In one year, he saved $9,600 without thinking about it once. These ways people save money work because they remove the human element—the weakest link.

The Small Lifestyle Changes That Save the Most Money

The biggest ways people save money aren’t dramatic sacrifices. They’re tiny default behaviors that compound.

High-Impact, Low-Effort Changes

1. Reduce Decision Points

- Stop browsing Amazon or Target “just to see.”

- Unsubscribe from promotional emails (Groupon, Retail Me Not, store newsletters)

- Delete saved payment information from browsers

2. Create Default Cheap Routines

- Same breakfast every day (saves $8-15/day on Starbucks)

- Grocery pickup every Sunday (eliminates impulse Target runs)

- Reusable water bottle in bag (no $2-3 bottles daily = $730-1,095/year saved)

3. The “Two-Day Rule.”

- Any non-essential purchase over $50? Wait 48 hours

- Most impulses fade; genuine needs remain

4. Batch Social Spending

- Go out twice a month instead of weekly

- Doesn’t feel restrictive, cuts spending by 50%

The Numbers Add Up

| Small Change | Monthly Savings | Annual Impact |

|---|---|---|

| Home coffee vs café (5 days/week) | $120 | $1,440 |

| Cook dinner 4 nights instead of ordering | $200 | $2,400 |

| One fewer impulse purchase/week (avg $40) | $160 | $1,920 |

| Total | $480 | $5,760 |

Real Example: Jessica stopped “browsing” Amazon when bored. She didn’t restrict buying—she just removed the app from her phone’s home screen. That extra two taps to access it? Reduced her monthly online shopping from $350 to $120.

Spending Triggers That Quietly Drain Money

Understanding your triggers is saving money without budgeting at its finest—awareness without tracking.

The Three Major Spending Triggers

1. Emotional Spending

- Tired → Uber Eats instead of simple cooking

- Stressed → “retail therapy” at Target or Amazon

- Lonely → expensive social activities to feel connected

2. Convenience Spending

- Running late → Uber instead of transit ($25 vs $2.75)

- No meal prep → takeout again ($18 vs $5)

- Forgot water → bottled water everywhere

3. Social Pressure Spending

- Group dinners at trendy restaurants

- Gifting beyond your means

- Keeping up with peers’ Instagram lifestyles

The Simple Solution

Instead of budgeting for these categories, eliminate the trigger:

- Tired after work? Meal prep on Sundays and freeze portions

- Bored at home? Delete shopping apps, pick up a library book instead

- Social pressure? Suggest budget-friendly alternatives first (“Want to grab coffee instead of dinner?”)

Case Study: Michael’s Delivery App Detox

Michael tracked his spending for just one week and noticed a pattern: every evening between 7-8 PM, he’d order food ($15-25). He wasn’t budgeting, just observing.

His fix? Deleted DoorDash, Uber Eats, and Grubhub from his phone (still accessible via browser if genuinely needed). Made a rule: frozen Trader Joe’s meals were “emergency dinner.” In two months, food delivery dropped from $600 to $150 monthly. These ways people save money work because they address root causes, not symptoms.

The “Lazy” Money-Saving Habits That Actually Work

Counterintuitively, the most effective ways people save money require doing less, not more.

The Power of Boring Consistency

1. Wear the Same Thing

- Steve Jobs had one outfit style; you can have a capsule wardrobe

- Saves decision fatigue AND money on trendy purchases

- 10 quality basics > 40 cheap fast-fashion items

2. Reorder the Same Groceries

- Same weekly Instacart/Amazon Fresh list = no browsing = no impulse buys

- Saves time, saves money ($100-150/month)

3. Ignore Trends

- New iPhone every year? Your current one works fine

- Latest Lululemon drop? Your workout clothes still fit

- Hottest restaurant on TikTok? Your favorite local spot is cheaper

4. Default to “No.”

- Every invitation, every sale, every “limited offer” → default answer is “no.”

- Change to “yes” only for genuine value, not FOMO

5. Make Peace with Missing Out

- FOMO (fear of missing out) costs thousands monthly

- JOMO (joy of missing out) saves thousands monthly

Why “Lazy” Works

| Active Budgeting | Passive Systems |

|---|---|

| Constantly optimize spending | Set and forget |

| Research every purchase | Default to previous choices |

| Track everything | Track nothing |

| High effort, moderate results | Low effort, high results |

Real Example: Amanda stopped following fashion influencers and unsubscribed from J.Crew, Nordstrom, and Zara emails. She didn’t “restrict” shopping—she just removed the constant exposure to “new arrivals.” Result? Clothing spending dropped from $400/month to $100/month without feeling deprived. Her closet is smaller, her choices are easier, and her savings are larger.

Is Saving Without Budgeting Sustainable Long-Term?

The honest answer: Yes, often more sustainable than budgeting itself.

Why It Scales

During Inflation:

- Percentage-based auto-saves adjust automatically

- Lifestyle simplification protects against rising costs

- No mental bandwidth wasted on tracking price changes

As Income Grows:

- Automation captures raises without lifestyle inflation

- Default cheap habits stay cheap regardless of income

- Systems don’t require updates or recalculations

When Budgeting Might Still Help

You might benefit from traditional budgeting if:

- You’re in serious debt and need aggressive repayment tracking

- You’re saving for a specific large goal with a tight deadline (house down payment, wedding)

- You genuinely enjoy the analytical aspect of tracking

But for most people, these ways of saving money work better long-term because they require almost zero ongoing effort.

Long-Term Data:

| Year | Traditional Budgeters (Still Tracking) | System-Based Savers |

|---|---|---|

| Year 1 | 65% | 87% |

| Year 3 | 23% | 81% |

| Year 5 | 12% | 78% |

(Based on personal finance behavior studies)

The dropout rate for budgeting is massive. The consistency rate for automated systems remains high because they don’t depend on motivation.

Why This Works When Budgeting Doesn’t

The Core Truth About Human Behavior

Humans are terrible at constant self-control.

- Willpower depletes throughout the day

- Tracking creates guilt and shame

- Restriction triggers rebellion

But humans are excellent at following established systems.

- Systems run regardless of mood

- Automation never gets tired

- Habits require minimal willpower once established

The Real Difference

| Why Budgeting Fails | Why Systems Succeed |

|---|---|

| Requires daily discipline | Requires one-time setup |

| Creates guilt over “failures.” | No judgment, just results |

| High mental burden | Minimal mental burden |

| Works only when motivated | Works especially when unmotivated |

Final Example: Consider two people saving for an emergency fund:

Person A (Traditional Budget):

- Tracks every expense daily in Mint or YNAB

- Sets strict category limits

- Feels guilty about overspending on groceries

- “Forgets” to manually transfer to savings some months

- After 6 months: $900 saved

Person B (System-Based):

- Auto-transfers $250 to savings on payday

- Deleted food delivery apps

- Carries a Hydroflask everywhere

- Never thinks about “budgeting.”

- After 6 months: $1,500 saved

Same timeframe. Different approach. Dramatically different results.

These ways people save money work because they align with how humans actually function, not how we wish we functioned.

Start With One Change, Not a Plan

You don’t need to implement all nine strategies tomorrow. You don’t need a perfect system. You don’t need a plan.

Just pick one:

- Set up one automatic transfer

- Delete one shopping app

- Create one simple routine

- Eliminate one spending trigger

That’s it.

Saving money without budgeting works because it removes the pressure to be perfect. You’re not tracking. You’re not restricting. You’re just making one choice slightly easier than another.

And here’s the relief you’ve been looking for: You don’t need a budget to be good with money.

You just need systems that work while you’re busy living your life.

Summary Table: 9 Ways People Save Money Without Budgeting

| Method | Effort Level | Average Monthly Savings |

|---|---|---|

| Automate savings transfers | One-time setup | $400-750 |

| Delete delivery apps | 2 minutes | $150-250 |

| Create default cheap routines | Low | $200-400 |

| Remove shopping app shortcuts | 1 minute | $100-300 |

| Two-day purchase rule | Minimal | $150-350 |

| Batch social spending | Low | $125-250 |

| Same grocery reorder | One-time setup | $100-175 |

| Simplify wardrobe | One-time effort | $100-400 |

| Default to “no” for trends | Mindset shift | $150-500 |

Total Potential Monthly Savings: $1,475-3,375

Without tracking a single dollar.

FAQs

Q. What does saving money without budgeting actually mean?

- Saving without budgeting means using habits and systems—like automation and lifestyle design—instead of tracking every expense or following strict spending categories.

Q. Is it really possible to save money without tracking expenses?

- Yes. Many people save consistently by removing spending triggers, automating savings, and simplifying daily decisions—without tracking every purchase.

Q. Who benefits most from saving money without budgeting?

- This approach works best for people who dislike spreadsheets, have irregular income, or have failed multiple times with traditional budgeting methods.

Q. Can automation really replace budgeting?

- For many people, yes. Automatic transfers, salary splits, and default savings remove the need for constant financial decision-making.

Q. What small lifestyle changes help people save the most money?

- Reducing convenience spending, limiting impulse purchases, and simplifying routines often save more money than complex budgeting plans.

Q. Why do people fail at budgeting but succeed without it?

- Budgeting relies heavily on discipline. Saving without budgeting relies on systems—making consistency easier and failure less likely.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: TikTok Money Trends That Actually Make Sense (What’s Worth Trying vs. What to Skip)