The Real Truth About Saving Money in Your 20s (That No One Actually Tells You)

The Silent Money Struggle in Your 20s

You’re doing everything “right”—you landed a job, you’re paying rent, you even opened a savings account. So why does your bank balance still look depressing?

Here’s the brutal truth about saving money in your 20s: everyone tells you to do it, but almost no one explains why it feels impossible. You’re caught between two competing narratives. One side says, “You’re young—enjoy life while you can!” The other warns, “Save now or regret it forever.”

Meet Sarah, 24, working her first marketing job at $42,000 a year. She packs lunch three days a week, skips the daily Starbucks, and religiously transfers $100 to savings each month. Yet somehow, she still feels financially behind. Her college friend just bought a car. Her cousin is planning a European trip. And Sarah? She’s wondering if she’ll ever stop living paycheck to paycheck.

If this sounds familiar, you’re not alone—and you’re not failing. This article cuts through the noise to reveal what actually works when saving money in your 20s, including the uncomfortable truths that most financial advice conveniently ignores.

The Truth No One Admits: Feeling Behind Is Normal

Is it normal to feel behind financially in your 20s?

Absolutely. In fact, it’s practically universal.

Social media has created a toxic highlight reel that makes everyone else’s financial life look effortless. Your feed shows vacations, new apartments, and dining experiences—but it doesn’t show the family money that funded the down payment, the credit card debt behind the vacation, or the trust fund quietly supporting that “self-made” lifestyle.

The reality? Some of your peers are getting parental help. Others landed in high-paying tech or finance roles. Many are drowning in debt but won’t admit it. And some are genuinely thriving—but they’re the exception, not the rule.

Here’s what matters: Comparing your financial chapter 3 to someone else’s chapter 10 is pointless. Feeling behind doesn’t mean you’re failing. It means you’re aware—and awareness is the first step toward actually building wealth.

Why Most Saving Advice Doesn’t Work in Your 20s

Most saving advice is written by people who’ve forgotten what your 20s actually look like.

They tell you to “save 20% of your income” without acknowledging that your income might fluctuate wildly. They push rigid budgeting spreadsheets that assume you have consistent paychecks, stable expenses, and zero financial surprises.

But here’s your reality

- You might be freelancing with irregular income

- You’re job-hopping to increase your salary

- Your rent just increased by $200

- You got hit with an unexpected car repair

- Your industry is going through layoffs

Traditional budgeting advice falls apart when your income varies month to month. Following a strict budget when you earned $2,800 in January but $4,200 in March isn’t just difficult—it’s often counterproductive.

The shift you need: Stop chasing perfect consistency. Start building flexible systems that work whether you earn $3,000 or $5,000 this month.

The Real Battle: Psychology Over Math

Here’s something financial experts rarely admit: most saving “failures” aren’t mathematical—they’re psychological.

You know the math. Spend less than you earn. Save the difference. Simple, right?

Except you had one expensive month—maybe your best friend’s wedding, a medical bill, or just a rough week where you stress-ordered takeout four times. Now you feel guilty. You’ve “ruined” your savings streak. So you give up entirely.

This is the shame spiral, and it destroys more savings plans than any actual financial hardship.

Case Study: Marcus, 27, Software Developer

Marcus started strong in January, saving $500 monthly. By March, an unexpected $800 expense wiped out his progress. Instead of adjusting and continuing, he abandoned saving entirely for six months—convinced he’d “failed.” He lost $3,000 in potential savings, not because of the $800 expense, but because of the psychological defeat.

The antidote: Progress beats perfection. Saving $50 in a tough month is infinitely better than saving $0 because you couldn’t hit your $500 goal.

Income vs. Expenses: What Actually Moves the Needle

Should you focus more on increasing income or cutting expenses when saving money in your 20s?

The honest answer: Both, but strategically.

In your 20s, your income has massive growth potential. A 25-year-old earning $45,000 who focuses on career development might be earning $75,000 by 30. That $30,000 income increase creates far more saving power than clipping coupons ever will.

However, small daily expenses compound faster than you realize:

| Daily Habit | Monthly Cost | Annual Cost | 5-Year Total |

|---|---|---|---|

| $5 coffee | $150 | $1,800 | $9,000 |

| $12 lunch | $360 | $4,320 | $21,600 |

| $8 subscription (unused) | $8 | $96 | $480 |

The balanced approach

- Control the small leaks (subscriptions you don’t use, daily convenience purchases)

- Negotiate or strategize the big ones (rent, car payments, insurance)

- Simultaneously invest in income growth (skills, networking, side income streams)

You don’t need to choose between cutting costs and earning more. Do both, but weight your energy toward income growth—it has a higher ceiling.

Lifestyle Inflation: The Trap You Don’t Notice Until It’s Too Late

Lifestyle inflation is the silent killer of saving money in your 20s.

Here’s how it happens: You get your first real job. You upgrade from your college phone. That feels good, so you upgrade your apartment. That new apartment needs furniture. Better furniture means you’re hosting more, so you’re dining out more. Before you know it, you’re earning $60,000 but saving less than when you earned $35,000.

Real Example: Jessica’s Lifestyle Creep

- Age 23, earning $38,000: Saved $300/month, lived with roommates, used public transit

- Age 26, earning $58,000: Saved $150/month, lived alone, bought a car, upgraded wardrobe

Jessica’s income increased by 53%. Her savings decreased by 50%.

The solution: Lock your savings before you upgrade your lifestyle. When you get a raise:

- Immediately increase your automatic savings by 50% of the raise

- Enjoy the other 50% guilt-free

- Never let lifestyle upgrades outpace savings growth

The Big Mistake: Saving Too Hard, Too Early

Here’s a contrarian truth: Saving too aggressively in your 20s can actually backfire.

When you adopt extreme frugality—eating rice and beans, refusing all social invitations, never buying anything beyond essentials—you create unsustainable pressure. Eventually, you snap. The binge spending that follows often erases months of extreme saving.

Case Study: David’s Burnout Cycle

David committed to saving 60% of his income. For four months, he succeeded—living on the bare minimum, declining every social event, buying nothing. Then he broke. One weekend trip turned into $2,000 in impulsive purchases, undoing his entire streak. He spent the next year in the “screw it” mindset, saving nothing.

The sustainable alternative

- Save 10-20% consistently rather than 60% temporarily

- Build guilt-free spending categories

- Recognize that saving is a marathon, not a sprint

Consistency over intensity. Always.

Emergency Funds Before Everything Else

Is it a mistake to prioritize investing before building real savings?

Yes—and it’s one of the most common mistakes young savers make.

Investment advice dominates social media: “Start investing in your 20s!” “Compound interest is magic!” It’s all true, but it misses the critical foundation: you need stability before growth.

The Priority Hierarchy for Saving Money in Your 20s

| Priority Level | Goal | Target Amount | Why It Matters |

|---|---|---|---|

| 1. Emergency Fund (Starter) | Basic safety net | $1,000 | Prevents a debt spiral from minor emergencies |

| 2. High-Interest Debt | Eliminate toxic debt | $0 balance | 18-25% interest destroys wealth faster than investing builds it |

| 3. Emergency Fund (Full) | True stability | 3-6 months expenses | Protects against job loss, major medical issues |

| 4. Retirement/Investment | Long-term growth | 10-15% of income | Now compound interest works for you |

Real scenario: Mia invested $300/month in index funds with zero emergency savings. When her car broke down ($1,200 repair), she had no cash. She sold her investments at a loss during a market dip and paid early withdrawal penalties. Total cost: $1,600 for a $1,200 problem.

The rule: Build a cash cushion before you build an investment portfolio.

Social Pressure: The Hidden Expense No One Budgets For

How much is FOMO costing you?

Social pressure is a real budget category that almost no one accounts for. Weddings, bachelor parties, birthday dinners, weekend trips, concerts, “we’re all doing it” purchases—these aren’t in your budget, but they’re definitely in your life.

The invisible drain

- Average bachelor/bachelorette party: $500-$1,000

- Destination wedding guest cost: $1,000-$2,500

- “Just one drink” after work: $15-30 (×4/month = $120)

In your 20s, you’re in peak social pressure years. Everyone’s getting married, traveling, celebrating, and posting about it. Saying “I can’t afford it” feels like admitting defeat.

Strategic solutions

- Budget for social spending (yes, actually create a “social life” line item)

- Master the soft no: “I’m saving for [specific goal], but let’s do [cheaper alternative].”

- Propose alternatives: “Skip the $80 dinner, host a potluck instead.”

- Remember: True friends respect your financial boundaries

You can have a social life while saving money in your 20s. You just can’t have an unlimited social life.

How Much Should You Actually Save in Your 20s?

The question everyone asks: What’s the right number?

Financial experts love to throw out percentages—”Save 20% of your gross income!” But what if 20% is literally impossible on your current income and cost of living?

The realistic framework

| Income Situation | Recommended Savings Rate | What This Looks Like |

|---|---|---|

| Entry-level, high cost of living | 5-10% | Focus on building the habit |

| Stable income, moderate expenses | 10-15% | Balanced saving and living |

| Higher income or lower expenses | 15-25% | Aggressive wealth building |

| Variable/freelance income | 20% of good months, 0-5% of lean months | Flexibility is key |

The critical insight: Saving something consistently matters more than hitting a specific percentage.

Example trajectories:

- Alex: Saves 8% consistently for 8 years = $30,720 (assuming $40K average income)

- Jordan: Saves 25% for 2 years, then nothing for 6 years = $20,000 (same income)

Consistency wins.

The Simplest Saving System That Actually Works

Forget complicated budgeting apps. The best saving system is the one you’ll actually use.

Should you save monthly, weekly, or automatically?

The answer: Automatically, immediately after income hits your account.

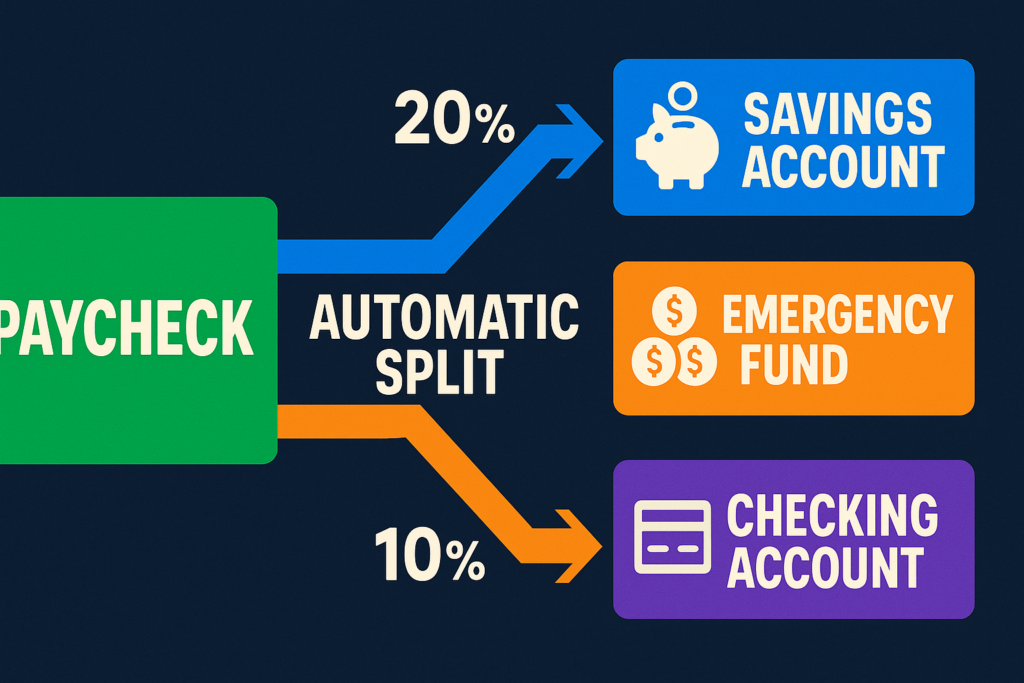

The “Pay Yourself First” system

- Set up automatic transfer for payday (or the day after)

- Transfer savings before you see the money

- Live on what’s left

Why this works: It removes willpower from the equation. You’re not deciding to save every month—you already decided once, and now it just happens.

Example setup

Paycheck deposits Friday → Saturday morning:

- 10% automatically transfers to savings

- 5% automatically transfers to emergency fund

- Remaining 85% stays in checking for bills and lifeAdvanced variation for irregular income

If your income fluctuates, use a percentage-based system:

- Make $3,000 this month? Save $300 (10%)

- Make $5,500 next month? Save $550 (10%)

- Make $2,200 the following month? Save $220 (10%)

You’re saving different amounts, but the habit stays consistent.

Saving Without Feeling Like You’re Wasting Your Youth

The guilt question: “How do I save without feeling like I’m wasting my youth?”

This is the emotional core of saving money in your 20s. You’re supposed to be living your life, making memories, having experiences—not hoarding every dollar in a savings account.

Here’s the reframe you need

Saving isn’t punishment. Saving is buying future freedom.

- Saving money now means you can quit a toxic job later

- Saving money now means you can take a career risk at 30

- Saving money now means an emergency won’t destroy you

The experience budget

Create a dedicated “experiences and joy” category:

| Category | Monthly Amount | Annual Total | Purpose |

|---|---|---|---|

| Travel fund | $100 | $1,200 | One meaningful trip/year |

| Social experiences | $150 | $1,800 | Concerts, dinners, events |

| Personal joy | $50 | $600 | Whatever makes you happy |

Total: $300/month for living your life while still saving.

Real example: Taylor’s balanced approach

- Income: $50,000/year ($3,200/month after tax)

- Savings: $400/month (12.5%)

- Experiences: $300/month (9.4%)

- Essentials: $2,500/month (78.1%)

Taylor travels once a year, sees friends regularly, and still builds $4,800 in savings annually. No guilt, no regret.

You don’t have to choose between living and saving. You just have to be intentional about both.

What Your Future Self Wishes You Knew

Imagine yourself at 35, looking back at your 20s. What would you wish you’d known about saving money in your 20s?

The top three insights from those who’ve been there

- Start smaller than you think you need to “I wish I’d saved just $100/month instead of trying for $500 and giving up entirely.” —Priya, 34

- The habit matters more than the amount. “My $50/month savings at 23 taught me discipline that made saving $1,000/month at 30 feel natural.” —James, 36

- Emergency funds aren’t optional. “That $2,000 emergency fund saved me from $8,000 in credit card debt when I lost my job.” —Carmen, 33

The pattern: No one regrets starting small and staying consistent. Everyone regrets waiting for the “perfect time” that never came.

Final Takeaway: Saving in Your 20s Is a Skill, Not a Scorecard

Is financial stability a destination or a skill?

It’s a skill—and like any skill, you’ll be terrible at it at first.

You’ll overspend in some months. You’ll forget to transfer to savings. You’ll make impulsive purchases. You’ll compare yourself to others and feel behind. This is all part of learning.

The core lesson of saving money in your 20s

Start messy. Stay consistent. Progress compounds.

You don’t need to be rich by 30. You need to build the financial muscles that will carry you for the next 50 years. Every $50 you save is practice. Every month you stick with it builds the discipline that will define your financial future.

Your 20s aren’t about perfection—they’re about building the foundation for everything that comes next.

Your move: What’s one savings automation you can set up in the next 24 hours? Not tomorrow. Not next month. Today. The best time to start saving was five years ago. The second-best time is right now.

FAQs

Q. Why is saving money so hard in your 20s?

- Saving is difficult in your 20s because income is often low or unstable, expenses rise quickly, and social pressure encourages spending before financial stability is built.

Q. How much money should you save in your 20s?

- A realistic goal is saving 10–20% of your income, but consistency matters more than the exact percentage—especially when income fluctuates.

Q. Should you invest or save first in your 20s?

- Building an emergency fund should come first. Investing without savings can lead to financial stress when unexpected expenses arise.

Q. Is it okay to enjoy life and still save money?

- Yes. Sustainable saving includes spending on meaningful experiences. The key is intentional spending, not deprivation.

Q. What is the biggest saving mistake people make in their 20s?

- Trying to save too aggressively. Extreme frugality often leads to burnout and quitting altogether.

Q. How do I save money if my income is inconsistent?

- Use percentage-based saving, automate transfers when possible, and focus on building habits rather than perfect monthly numbers.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: 7 Money Habits That Look Boring but Work Surprisingly Well