Why Earning More Money Didn’t Make Me Feel Richer

On paper, I was earning more than ever. My salary had doubled in three years. I’d climbed the ladder, collected the raises, and checked all the boxes that were supposed to equal financial security. Yet somehow, in real life, I felt more stressed, more anxious, and strangely poorer than I had when I was making less.

The numbers told one story. My bank account told another. And my nervous stomach at the end of each month? That told a third story entirely.

This isn’t an article about budgeting tips or investment strategies. This is about why earning more money often fails to deliver the feeling we expect—and why so many of us find ourselves trapped in a cycle where higher income somehow translates to higher anxiety instead of the peace we were promised.

The Moment I Realized More Money Wasn’t Helping

It happened on a Tuesday evening. I was sitting at my kitchen table, logged into my banking app, staring at a balance that should have made me feel secure. The number was higher than it had been in years. I’d just received a substantial bonus on top of my increased salary.

But instead of relief, I felt a knot in my stomach.

Earlier that day, I’d hesitated before buying a $12 sandwich for lunch. I’d transferred money between accounts to cover an unexpected car repair. I’d felt that familiar flutter of panic when my credit card statement arrived.

The disconnect was jarring. Why was I, someone earning more than ever, still feeling financially fragile? Why didn’t the numbers match the emotion? Many of my friends were experiencing the same thing—better jobs, higher salaries, yet no sense of breathing room.

The problem wasn’t my income. It was everything else that had quietly changed around it.

When Earning More Quietly Changed My Lifestyle

Here’s what I didn’t see coming: my life upgraded in lockstep with my income, so smoothly that I barely noticed it happening.

When I earned less, I lived in a modest apartment with a roommate. When I started earning more money, I moved to a nicer place—alone. It felt like a natural progression, not an extravagance. The rent was only $400 more per month. Reasonable, right?

Then came the small upgrades that felt insignificant in isolation:

- Subscriptions: Netflix became Netflix + Spotify + HBO + a meal kit service + cloud storage + a meditation app. Each one was $10-15, but together they added up to $120/month.

- Convenience spending: Uber instead of the bus. Takeout instead of cooking. Dry cleaning instead of doing laundry. These weren’t luxuries—they were time-savers for my busier, higher-paying job.

- “Quality” purchases: Better coffee, nicer clothes, upgraded tech. None of it felt wasteful. It felt appropriate for someone at my level.

| Lifestyle Category | Before Raise | After Earning More | Monthly Increase |

|---|---|---|---|

| Housing | $800 (shared) | $1,200 (solo) | +$400 |

| Transportation | $90 (bus pass) | $280 (Uber + gas) | +$190 |

| Food | $300 (cooking) | $650 (takeout mix) | +$350 |

| Subscriptions | $20 | $120 | +$100 |

| Total | $1,210 | $2,250 | +$1,040 |

The extra money never felt extra. It just disappeared into a lifestyle that had become the new normal. Lifestyle inflation had erased my raise before I could even appreciate it.

Why Feeling Rich Is More Mental Than Financial

After months of this pattern, I realized something uncomfortable: earning more money had actually increased my stress.

With my original salary, I knew my limits. I lived within clear boundaries. There was no ambiguity about what I could and couldn’t afford. But with more income came more options, more decisions, and paradoxically, more anxiety.

The psychology is backed by research. A study published in the Proceedings of the National Academy of Sciences found that while income correlates with well-being up to a certain point, the relationship is complex. Beyond basic needs, security comes from predictability and control, not just higher numbers.

Here’s what I experienced

- Higher stakes: More income meant more to lose. Every financial decision felt weightier.

- Raised expectations: My family expected me to contribute more to gatherings. Friends assumed I could always pick up the tab.

- Comparison pressure: I was now comparing myself to people who earned even more, making my income feel inadequate.

The truth: Feeling rich is largely mental. It’s about the gap between what you have and what you think you need. When earning more money raises that bar faster than it fills your account, you end up feeling poorer despite objective improvements.

If you’ve ever worried more after a raise, this is why.

The Comparison Trap That Ruined the Feeling of Wealth

When I was earning $45,000 a year, I compared myself to my college friends who were making similar amounts. We commiserated about student loans and celebrated small wins together. I felt average—and that felt fine.

When I started earning more money—jumping to $85,000—everything shifted. Suddenly, my reference group changed. My new colleagues drove nicer cars. They vacationed in Europe, not camping trips upstate. They talked about investment portfolios and real estate.

Instead of feeling wealthy compared to my old peer group, I felt behind compared to my new one.

The Research Behind Relative Wealth

Economist Richard Easterlin’s research on the “hedonic treadmill” shows that our sense of well-being depends heavily on relative comparisons, not absolute wealth. We measure our financial success against those around us, and when earning more money moves us into a new comparison bracket, the goalpost moves with us.

Social media amplified this exponentially. My Instagram feed went from friends posting about their cats to influencers posting about their “humble” beach houses and “simple” morning routines in kitchens that cost more than my annual salary.

The paradox: The more I earned, the poorer I felt relative to my new reference points. Wealth had become relative, not absolute. The number in my bank account mattered less than the gap between my life and the lives I was now comparing myself to.

Earning More but Having Less Time and Freedom

The cruelest irony of earning more money was discovering what it cost me.

My higher salary came with expectations: longer hours, weekend emails, and the implicit requirement to be “always on.” I was earning 60% more but working 70% more hours. The math didn’t favor me.

What I Traded Without Realizing It

| What I Gained | What I Lost |

|---|---|

| $40,000 more annually | 15+ hours per week |

| Senior title | Flexible schedule |

| Better health insurance | Mental peace |

| Nicer apartment | Time to enjoy it |

I stopped cooking because I was too tired. I missed friends’ birthdays because I was traveling for work. I paid for a gym membership I never used because I left the office after dark. The money was supposed to buy freedom, but instead, it had purchased a more expensive cage.

Case study: My friend Marcus took a VP position with a 45% raise. Within six months, he was on anxiety medication. His marriage was strained. He could afford a vacation but had no time to take one. When he calculated his effective hourly rate, including unpaid overtime, his “raise” had actually decreased his per-hour earnings.

The relationship between income and freedom isn’t linear. Sometimes, earning more money costs you the very things money is supposed to provide: choice, control, and peace.

Why My Net Worth Didn’t Grow With My Income

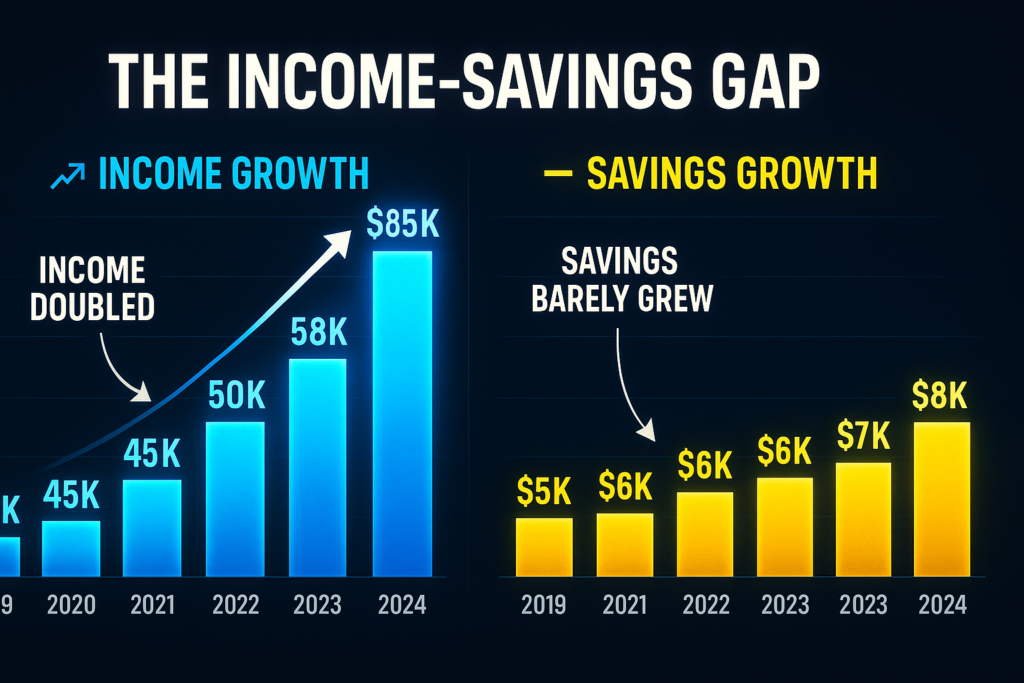

Here’s what confused me most: I was earning significantly more money, but my net worth was barely budging.

I’d confused two completely different things: cash flow and wealth.

The Critical Distinction

Cash flow = Money moving through your life

Wealth = Money you keep and grow

I had optimized for the former without building the latter. My income statement looked impressive. My balance sheet told a different story.

Example from my own finances

- Year 1 (Lower income): Earned $48,000, saved $6,000 (12.5% savings rate)

- Year 3 (Higher income): Earned $82,000, saved $7,500 (9.1% savings rate)

I was earning 70% more but saving only 25% more. My savings rate had actually declined. The extra income had been absorbed entirely by lifestyle inflation, leaving me with less financial cushion relative to my expenses.

This is the illusion that traps so many people: earning more feels like progress, but if your spending rises proportionally (or faster), you’re running faster on the same treadmill. You haven’t actually moved forward.

The harsh truth: Income makes you feel busy. Wealth makes you feel secure. I had plenty of the first and not enough of the second.

The Real Definition of “Feeling Rich”

After years of chasing higher income and feeling perpetually broke, I had to completely redefine what “feeling rich” meant to me.

Old Definition vs. New Definition

| What I Thought Made Me Rich | What Actually Makes Me Feel Rich |

|---|---|

| Higher salary | Lower financial anxiety |

| Luxury purchases | Emergency fund with 6 months of expenses |

| Impressive job title | Control over my calendar |

| Ability to buy anything | Ability to say no to things |

| Maximum income | Comfortable margin |

| Keeping up with peers | Living below my means by choice |

Feeling rich now means

- Sleeping through the night without money worries

- Not checking my bank account before making routine purchases

- Having the option to take an unpaid day off without panic

- Turning down overtime because I value the evening more

- Choosing based on preference, not price

This realization was profound: wealth isn’t about the size of the number—it’s about the size of the gap between that number and your needs. It’s about margin, choice, and calm.

A person earning $60,000 with $20,000 saved and low expenses can feel richer than someone earning $150,000 with $5,000 saved and high expenses. The feeling comes from security, not income.

The emotional shift: Once I stopped measuring “rich” by what I could buy and started measuring it by how calm I felt, everything changed.

The Solution — What I Changed Instead of Chasing More Income

I didn’t quit my job or take a pay cut. I didn’t become an extreme minimalist. Instead, I made three strategic shifts that changed how earning more money affected my life.

1. I Slowed Lifestyle Upgrades

When I got my next raise, I made a rule: wait six months before upgrading anything. This created space between income increases and lifestyle increases. The money that would have gone to a nicer apartment went to savings instead. The result? I started actually feeling my raises instead of immediately absorbing them.

2. I Prioritized Margin Over Maximum Income

I turned down a job offer that paid $15,000 more because it required 60-hour weeks and constant travel. Instead, I negotiated remote work at my current job. I earned less on paper but gained 10 hours per week. The trade-off made me feel wealthier than any raise ever had.

3. I Valued Predictability and Time

I started tracking not just money but energy and time. I realized that earning more money at the cost of my evenings and weekends was a bad deal. I restructured my work to be project-based when possible, creating predictable busy periods and genuine downtime.

What Changed

Before these shifts

- Earning more money → higher expenses → same anxiety

- Every raise felt temporary

- Financial stress despite higher income

After these shifts

- Earning more money → intentional saving → growing security

- Each raise created actual breathing room

- Peace without earning any additional income

The feeling of richness improved not because I earned more, but because I changed the relationship between what I earned and what I needed.

The Question Worth Asking Before Chasing More Money

Before you negotiate that raise, accept that promotion, or take on that side hustle, ask yourself this:

“What am I actually trying to feel?”

If the answer is “secure,” more income might not be the solution. Security comes from margin, not income. It comes from the gap between what you earn and what you need.

If the answer is “successful,” recognize that success means different things at different life stages. Sometimes success is earning more money. Sometimes it’s protecting your time. Sometimes it’s simply worrying less.

Here’s what I wish someone had told me earlier: Money solves financial problems, not emotional ones. It pays bills, but it doesn’t automatically create peace. It expands options, but it doesn’t guarantee you’ll feel free.

The trap isn’t earning more money. The trap is believing that earning more, by itself, will make you feel rich. It won’t—not unless you also change how you think about money, how you spend it, and what you’re ultimately chasing.

The deepest feeling I’ve ever had didn’t come from my biggest paycheck. It came from the first month, I didn’t check my bank balance out of fear. That’s worth more than any raise.

Key Takeaways

- Earning more money often triggers lifestyle inflation that erases the benefit of higher income

- Feeling rich is more about psychology and margin than absolute income numbers

- Comparison with new peer groups can make higher earners feel poorer than before

- Trading time and freedom for income can reduce overall quality of life despite higher pay

- Net worth matters more than income—cash flow doesn’t equal wealth

- True financial security comes from the gap between earnings and needs, not the size of the paycheck alone

What question will you ask yourself before chasing your next raise?

FAQs

Q: Why doesn’t earning more money always make people feel richer?

- Because expenses, expectations, and stress often rise alongside income, canceling out the emotional benefit of earning more.

Q: What is lifestyle inflation, and why is it dangerous?

- Lifestyle inflation happens when spending increases with income, quietly eliminating the financial gains of earning more.

Q: Is feeling rich more about mindset than money?

- Yes. Feeling rich is often tied to peace, control, and financial margin—not just how much you earn.

Q: What’s the difference between income and wealth?

- Income is what you earn. Wealth is what you keep and control. Many people increase their income without building wealth.

Q: How can someone feel financially secure without earning more?

- By reducing financial pressure, avoiding lifestyle creep, and building buffers that create calm and predictability.

Q: Is chasing higher income the wrong goal?

- Not always—but chasing income without clarity, margin, or freedom often leads to stress instead of satisfaction.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.