The “Soft Saving” Trend: Why Gen Z Is Rejecting Traditional Budgeting

For decades, personal finance experts have preached the gospel of meticulous budgeting: track every dollar, categorize every expense, and stick to your numbers religiously. But walk into any conversation with Gen Z adults today, and you’ll hear a different story. “Budgeting doesn’t work anymore,” they say—and they’re not just complaining. They’re opting out entirely.

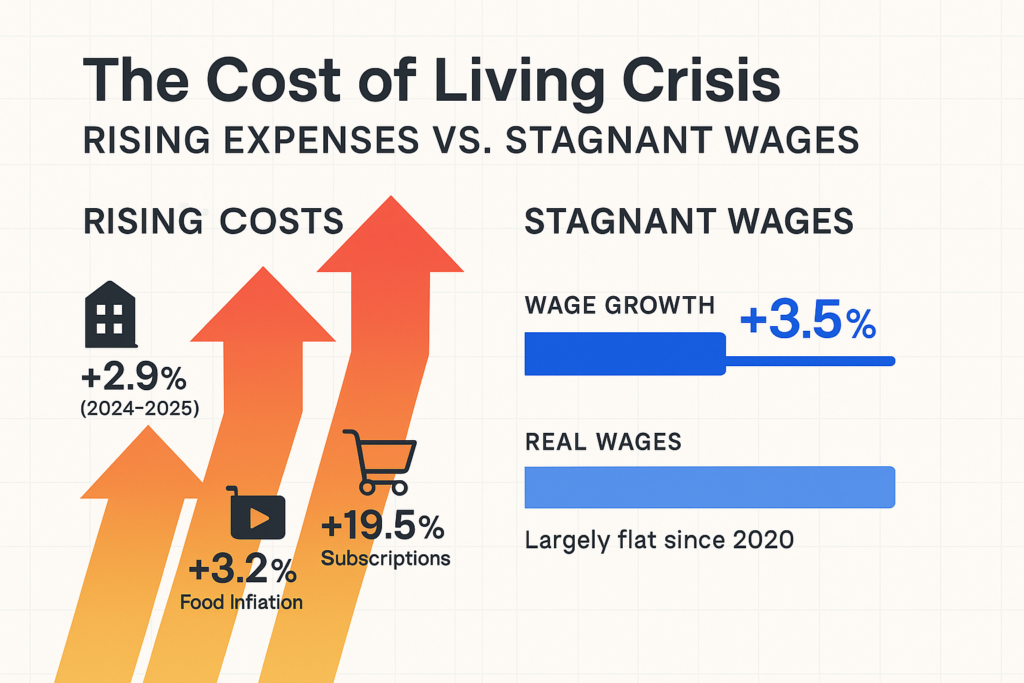

Traditional budgeting promises control, clarity, and financial freedom. Instead, for many young adults, it delivers stress, guilt, and burnout. Rising costs, unstable income streams, and pervasive economic uncertainty have made rigid budget frameworks feel not just difficult but fundamentally unrealistic. When rent takes 50% of your paycheck, and your income fluctuates month to month, a zero-based budget starts to feel like a cruel joke.

Enter the soft saving trend: a loser, mindset-driven approach to money that prioritizes sustainability over strictness. But is this shift a smart adaptation to modern financial realities—or a risky abandonment of proven principles?

What Is the “Soft Saving” Trend?

The soft saving trend represents a fundamental departure from traditional budgeting methods. Rather than adhering to fixed savings percentages or strict spending categories, soft saving focuses on “saving what feels sustainable” without rigid rules or guilt-inducing targets.

Core Principles of Soft Saving

- Flexibility over fixed numbers

- Saving based on what’s emotionally and financially manageable

- Prioritizing life enjoyment alongside financial responsibility

- Reducing financial shame and anxiety

- Adaptability to income fluctuations

How It Differs from Traditional Budgeting

| Traditional Budgeting | Soft Saving |

|---|---|

| Fixed monthly savings targets | Variable savings based on capacity |

| Detailed expense categories | Lose spending awareness |

| Zero-based budgeting principles | Intuitive money management |

| Strict tracking and reconciliation | Minimal tracking, maximum mindfulness |

| Guilt when deviating from the plan | Acceptance of financial ebbs and flows |

Real-World Example: Maya, a 24-year-old freelance graphic designer, embodies the soft savings approach. Rather than committing to save $500 monthly (which her variable income makes impossible), she transfers “whatever feels right” after covering essentials—sometimes $200, sometimes $700. She doesn’t use budget categories. Instead, she asks herself: “Do I need this, or do I just want it right now?” Her savings grow inconsistently, but they grow without the anxiety that made her abandon budgeting apps two years ago.

Why Gen Z Is Rejecting Traditional Budgeting

The soft saving trend didn’t emerge in a vacuum. Gen Z’s rejection of traditional budgeting stems from fundamental differences in their economic reality and relationship with money compared to older generations.

The Income Instability Factor

Gen Z workers are increasingly cobbling together income from multiple sources. According to various surveys, nearly 50% of Gen Z workers participate in the gig economy, whether through rideshare driving, content creation, freelance work, or side hustles. This income volatility makes fixed-percentage budgeting nearly impossible to implement.

Key Reasons for Rejection

- Irregular income streams: Gig work and contract positions mean paychecks vary wildly month to month

- Multiple revenue sources: Juggling a day job, side hustle, and creative projects creates unpredictable cash flow

- Lack of faith in traditional financial promises: Witnessing economic crashes and instability has eroded trust in long-term planning

- Preference for adaptability: Rigid systems feel constraining when circumstances change constantly

- Mental health prioritization: The stress of budget failures outweighs the benefits of tracking

Generational Contrast

Consider Sarah, a 38-year-old millennial with a salaried marketing position earning $65,000 annually. She budgets with precision: 50% needs, 30% wants, 20% savings. Her income is predictable, her spreadsheet is color-coded, and she knows exactly where every dollar goes.

Now meet Jake, a 25-year-old Gen Z content creator. He earns anywhere from $2,000 to $8,000 monthly, depending on brand deals, ad revenue, and freelance projects. Some months, he’s flush; others, he’s scraping by. A fixed budget would require him to live at his lowest income level year-round—financially sound, perhaps, but psychologically crushing when he’s having a good month.

Economic Pressure Is Driving the Shift

The soft saving trend isn’t just about preference; it’s a response to crushing economic realities that make traditional budgeting feel disconnected from lived experience.

The Affordability Crisis

Rising Costs Eroding Budgets

| Expense Category | Impact on Gen Z |

|---|---|

| Rent | Consuming 40-50% of income in major cities |

| Food & Groceries | Inflation is making meal planning budgets obsolete |

| Subscriptions | Death by a thousand small recurring charges |

| Student Loans | Median debt of $20,000-$30,000 for graduates |

| Healthcare | High-deductible plans make medical costs unpredictable |

Delayed Financial Milestones

Gen Z faces unprecedented delays in traditional wealth-building milestones. Home ownership, once considered a rite of passage for young adults, now feels like a distant dream. Marriage and family planning are pushed back due to financial insecurity. When the goalposts keep moving further away, aggressive saving for them feels futile.

The Psychological Impact

“Why save aggressively when the future feels unstable?” This question, posed by countless Gen Z adults, captures the existential tension underlying the soft saving trend. When you doubt you’ll ever afford a house, when retirement feels like science fiction, when emergency after emergency depletes your savings, maintaining rigid budget discipline starts to feel less like wisdom and more like self-punishment.

Is Soft Saving a Strategy—or a Mindset Shift?

Understanding the soft saving trend requires recognizing that it’s less a mathematical framework and more a philosophical repositioning of money’s role in life.

Beyond the Numbers

Soft saving represents a fundamental rejection of financial shame. Traditional budgeting often frames money management in moral terms—you’re “good” when you stick to your budget, “bad” when you don’t. This moralization creates cycles of guilt that many Gen Z adults find toxic and counterproductive.

The Mindset Components

- Emotional sustainability over mathematical optimization: Prioritizing approaches you can maintain without mental health costs

- Self-compassion in financial planning: Accepting imperfection rather than striving for unattainable precision

- Money as a quality-of-life tool: Viewing finances as enabling experiences, not just accumulation

- Process over outcomes: Focusing on sustainable habits rather than hitting specific targets

- Psychological safety: Creating financial systems that reduce rather than increase anxiety

Redefining Financial Success

The soft savings trend challenges conventional definitions of financial responsibility. Success isn’t measured by net worth alone, but by sustainable practices, reduced anxiety, and the ability to enjoy life while still building some financial buffer. It’s optimization for wellbeing, not just wealth.

Does Soft Saving Actually Reduce Financial Stress?

![Image suggestion: Before/after comparison showing a person stressed with a budget app versus a calm person checking a simple savings balance]

The central promise of the soft savings trend is reduced financial anxiety. But does it deliver—or does flexibility create new problems down the line?

The Case for Reduced Stress

Budget Guilt and Failure Cycles

Traditional budgeting creates what psychologists might call “failure cascades.” You overspend in one category, feel guilty, abandon tracking for a few days, fall further behind, and eventually give up entirely. This cycle repeats monthly for millions of would-be budgeters.

Soft saving eliminates this cycle. Without rigid targets to miss, there’s no failure to feel guilty about. You saved $50 this month instead of $500? That’s still $50 more than zero, and there’s no spreadsheet screaming disappointment at you.

Benefits Reported by Soft Savers

- Feeling in control without micromanagement

- Reduced daily financial anxiety

- Better sleep and mental health

- Ability to make decisions without constant guilt

- More sustainable long-term engagement with finances

Real-World Case Study

Marcus, a 26-year-old teacher, spent three years battling budget apps. He’d meticulously track expenses for weeks, then miss one Starbucks entry and abandon the whole system. His savings account hovered near zero despite good intentions.

After switching to soft saving—checking his account weekly, mentally noting his buffer, and transferring “something” to savings whenever he felt stable—Marcus built a $2,000 emergency fund over 10 months. It’s not the $10,000 financial advisors recommend, but it’s infinitely more than the $0 his perfect budgets had achieved.

The Mental Health Trade-Off

However, there’s a complexity here. While soft saving reduces immediate stress, some financial professionals worry it may increase long-term anxiety when emergencies arise without adequate buffers.

The Risks of Rejecting Traditional Budgeting

While the soft saving trend addresses real problems, completely abandoning structured financial planning carries genuine risks that deserve honest examination.

Potential Pitfalls

1. Inconsistent Savings Growth

Without targets, savings can stagnate. “Save what feels comfortable” might mean $200 one month and $0 the next six months when life gets expensive or comfortable feels like zero.

2. Emergency Unpreparedness

Financial advisors recommend 3-6 months of expenses in emergency savings. Soft savings’ flexibility might never reach this threshold, leaving practitioners vulnerable to unexpected job loss, medical bills, or major repairs.

3. Delayed Wealth Building

Compound interest requires consistency. Starting retirement savings at 35 instead of 25 costs hundreds of thousands in long-term wealth due to lost compounding years.

Risk Comparison Table

| Risk Area | Traditional Budgeting | Soft Saving |

|---|---|---|

| Savings consistency | High (forced discipline) | Low to moderate (motivation-dependent) |

| Emergency preparedness | Structured fund building | Ad hoc accumulation |

| Retirement readiness | Systematic contributions | Often delayed or minimal |

| Debt reduction | Scheduled, aggressive payoff | Flexible, potentially slower |

| Impulse spending protection | Category limits enforce control | Relies on self-awareness |

The Balanced Perspective

The soft saving trend works best not as a complete replacement for budgeting, but as a modified approach that maintains some guardrails. Pure financial flexibility without any structure can slide into financial chaos, especially for those without high or stable incomes.

A Hybrid Solution: Soft Saving with Structure

The most sustainable approach may not be choosing between traditional budgeting and soft saving, but rather creating a hybrid model that captures the benefits of both.

The Middle Path

Flexible Saving Targets Instead of Fixed Percentages

Rather than “save exactly 20% every month,” commit to “save between 10-25% depending on the month’s realities.” This provides direction without rigidity.

Automate Minimum Safety Nets

Set up automatic transfers for a small, manageable amount—perhaps $50-$100 monthly. This baseline savings happens regardless of motivation, while additional contributions remain flexible based on capacity.

Intentional Spending, Not Impulsive Spending

Soft saving shouldn’t mean mindless spending. The key distinction is between intentional choices (“I’m buying this concert ticket because live music matters to me”) versus impulsive ones (“I’m buying this because it appeared in my Instagram feed”).

Practical Hybrid Framework

“Save Something First, Adjust the Rest Later” Approach

- Identify your minimum: What’s the smallest amount you can commit to saving no matter what? Automate this.

- Set flexible ranges: Create saving ranges (10-30%) rather than fixed targets

- Check in weekly: Brief money awareness moments instead of detailed tracking

- Adjust with circumstances: Give yourself permission to scale back during tight months

- Celebrate all progress: $20 saved is better than $0, always

Example Implementation

| Income Month | Minimum Auto-Save | Additional Flexible Save | Total Saved | Percentage |

|---|---|---|---|---|

| Low ($2,500) | $100 | $50 | $150 | 6% |

| Average ($4,000) | $100 | $400 | $500 | 12.5% |

| High ($6,000) | $100 | $1,100 | $1,200 | 20% |

This approach adapts to the soft saving trend’s emphasis on sustainability while maintaining the structured security of traditional budgeting’s safety nets.

Is Soft Saving the Future of Personal Finance?

As the soft saving trend gains momentum, a crucial question emerges: Is this a temporary reaction to current economic conditions, or a permanent shift in how we approach money management?

The Fintech Evolution

Financial technology is already adapting to support the soft savings trend. Apps like Digit, Qapital, and various neobanks have moved away from rigid budgeting tools toward flexible, behavior-based savings mechanisms. These platforms use AI to analyze spending patterns and automatically save variable amounts based on what you can afford.

Signals of Lasting Change

- Personalization over prescription: Fintech increasingly offers customized recommendations rather than one-size-fits-all rules

- Mental health integration: Financial apps partnering with wellness platforms, recognizing the psychological dimension of money management

- Flexibility features: Traditional banks are adding “skip a month” options for automated savings

- Values-based spending tools: Tech that helps align spending with priorities rather than just limiting it

Budgeting Evolving, Not Disappearing

The future likely isn’t the complete abandonment of budgeting principles, but their evolution. Core financial wisdom—spend less than you earn, build emergency funds, invest for the future—remains sound. How we implement these principles is what’s changing.

Generational Redefinition

Gen Z is actively redefining what financial success looks like:

- From “maximize net worth” to “optimize for wellbeing with financial security.”

- From “sacrifice now for future comfort” to “balance present joy with future preparation.”

- From “financial discipline as moral virtue” to “financial sustainability as practical wisdom.”

The Broader Implications

If the soft saving trend continues gaining traction, we may see shifts in financial education, workplace benefits, and even policy. Imagine employer retirement plans with flexible contribution ranges, or financial literacy programs that teach adaptability rather than rigid rules.

Conclusion: Rigidity vs. Realism in Modern Finance

The debate between traditional budgeting and soft saving presents a false choice. This isn’t about responsibility versus recklessness, or discipline versus laziness. It’s about rigidity versus realism in an era where economic conditions have fundamentally changed the financial landscape for young adults.

Reframing the Conversation

Gen Z isn’t rejecting financial responsibility—they’re rejecting financial systems designed for a different economic reality. When your parents could budget with precision on a single stable income and afford a house by 30, strict budgeting made sense. When you’re juggling three income streams, watching inflation devour your savings, and doubting you’ll ever afford that house, strict budgeting feels disconnected from reality.

The Real Insight

The soft saving trend represents an adaptation to uncertainty, not an abandonment of prudence. It’s young adults saying, “We’ll engage with financial planning, but on terms that acknowledge our actual lives.” This is wisdom, not weakness.

The Future Is Flexible—Not Careless

The most financially successful Gen Z adults will likely be those who find their own balance between structure and flexibility. Some need more guardrails; others thrive with minimal constraints. The key is honest self-awareness about what actually works for your psychology, income, and goals.

Final Thought

Maybe the most important financial principle isn’t about percentages or categories. Maybe it’s this: saving doesn’t have to hurt to work. If your financial system makes you miserable, you’ll abandon it eventually—and then you’ll save nothing. Better to save imperfectly but consistently than to perfectly plan savings you’ll never actually make.

The soft savings trend isn’t the end of financial planning. It’s the beginning of financial planning that’s actually sustainable for the realities of modern life.

FAQs

Q. What is the soft saving trend?

- Soft saving is a flexible approach to money where people save what feels sustainable instead of following strict budgeting rules or fixed percentages.

Q. Why is Gen Z rejecting traditional budgeting?

- Many Gen Z earners face irregular income, high living costs, and financial uncertainty, making rigid budgets feel unrealistic and stressful.

Q. Is soft saving better than traditional budgeting?

- Soft saving isn’t better or worse—it prioritizes mental well-being and adaptability, but works best when combined with basic financial guardrails.

Q. Can you build wealth with soft savings?

- Yes, but only if soft saving includes consistency, emergency funds, and some long-term planning rather than purely reactive spending.

Q. Is soft saving just a social media trend?

- Social media helped popularize it, but the shift reflects bigger economic and psychological changes in how Gen Z views money.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: 8 Things People Regret Buying After the Hype Fades (And How to Avoid the Same Mistake)