How Movies and TV Shows Portray Money (and What We Can Learn)

We’ve all seen it: the struggling artist who suddenly lands in a penthouse, the tech genius who builds an empire overnight, or the villain whose wealth seems to justify their moral corruption. How movies and TV shows portray money often feels disconnected from reality, yet these images stick with us far longer than we’d like to admit. Entertainment doesn’t just reflect our relationship with wealth—it actively shapes it, planting subtle seeds about what success looks like, how quickly it should arrive, and what we’re willing to sacrifice to get there. This article peels back the curtain on Hollywood’s money myths, examining why filmmakers choose certain financial narratives, how these stories influence our real-world expectations, and what practical lessons we can extract from fiction without falling for its most dangerous lies.

What Does “Money Portrayal” in Movies and TV Actually Mean?

When we talk about how movies and TV shows portray money, we’re examining more than just dollar amounts or bank balances. We’re looking at the visual language of wealth—the sprawling estates, the designer wardrobes, the casual ordering of champagne—and the emotional weight these symbols carry in storytelling. Money becomes a character itself, representing power, freedom, security, or corruption depending on the narrative’s needs. Filmmakers use financial status as a storytelling shortcut: show someone in a luxury car, and audiences instantly understand their success without needing exposition. The gap between financial reality and cinematic symbolism is vast. On screen, wealth appears as an aesthetic choice rather than the result of specific financial behaviors, while poverty serves as a plot device rather than a complex economic condition requiring systemic understanding.

Why Do Movies Exaggerate Wealth and Poverty?

Hollywood operates on emotional extremes because moderate financial stability doesn’t sell tickets. The storytelling incentives are clear: drama requires contrast, and nothing creates visual and emotional impact quite like the collision between extreme wealth and desperate poverty. A middle-class family managing their budget responsibly might be realistic, but it lacks the cinematic punch of a billionaire’s yacht party or a family facing eviction. How movies and TV shows portray money through these exaggerated lenses makes financial sense from an entertainment perspective—audiences need clear visual markers to quickly understand a character’s status and the stakes they face. The problem emerges when viewers internalize these extremes as normal reference points. When film consistently shows only the ultra-rich or the desperately broke, it distorts perception of what constitutes financial success or struggle, making middle-class stability seem like failure rather than achievement.

Why Are Wealthy Characters Often Shown as Villains or Geniuses?

The wealthy character in film typically falls into two narrow archetypes: the morally bankrupt villain or the brilliant outsider who earned every penny through pure genius. The “evil billionaire” appears across genres—the corporate raider destroying communities for profit, the tech mogul playing god with others’ lives, the inherited-wealth socialite dripping with contempt for the working class. This trope suggests that extreme wealth corrupts absolutely, that you cannot accumulate significant money without moral compromise. Conversely, the “brilliant outsider” represents the acceptable face of wealth: Tony Stark’s genius justifies his billions, while tech founders in biopics earn their fortunes through innovation rather than exploitation.

Commonwealth Stereotypes in Film:

| Character Type | Common Traits | Implied Message |

|---|---|---|

| Evil Billionaire | Ruthless, disconnected, morally empty | Wealth corrupts character |

| Genius Entrepreneur | Brilliant, driven, socially awkward | Wealth requires exceptional talent |

| Inherited Rich | Shallow, incompetent, privileged | Unearned money breeds worthlessness |

| Self-Made Hero | Humble beginnings, hardworking, noble | Wealth is okay if you suffered first |

What this binary teaches viewers—consciously or unconsciously—is that wealth itself carries moral weight. You’re either evil for having it or exceptional for earning it, with little room for ordinary people who accumulate wealth through consistent, ethical work over decades.

How Do Movies Glamourize Easy Money and Luxury Lifestyles?

How movies and TV shows portray money through luxury aesthetics creates perhaps their most dangerous illusion: the idea that wealth flows effortlessly once achieved. Characters enjoy passive income without ever checking their investments, live in homes that would require massive ongoing maintenance costs, and upgrade their lifestyles without visible financial planning. The spending happens, but the earning remains mysteriously off-screen. We see the champagne lunch but never the quarterly tax payment. We admire the character’s wardrobe but never witness the budget meeting that funds it.

This portrayal distorts expectations about earning and lifestyle inflation in several ways. First, it normalizes spending as the primary expression of wealth rather than saving or investing. Second, it suggests that once you reach a certain income level, money worries disappear entirely—an illusion that traps real people in golden handcuffs as their expenses scale with their income. Third, it presents luxury as the default setting of success rather than a choice that involves trade-offs. The tech executive in the modern loft never seems to question whether their rent could be better deployed in index funds, and the fashion editor never shops at Target despite her stated student loans.

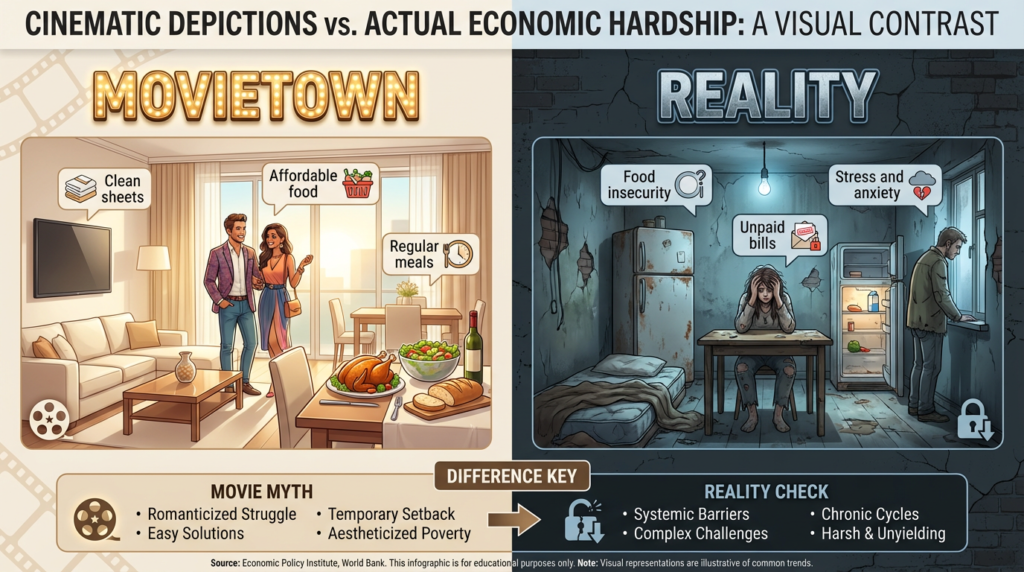

How Do Films Portray Poverty and Financial Struggle?

The “struggling but noble” narrative dominates how movies and TV shows portray money scarcity. Financial hardship becomes a crucible that reveals true character: the single mother working three jobs but never missing her daughter’s recital, the young artist choosing passion over a stable paycheck, the family whose love transcends their empty refrigerator. These stories carry emotional power and often highlight real resilience, but they trade economic realism for narrative satisfaction.

Film Poverty vs. Economic Reality

| Aspect | Movie Version | Real-World Reality |

|---|---|---|

| Housing | Surprisingly spacious apartments | Overcrowded, unstable housing situations |

| Appearance | Clean, stylish despite circumstances | Financial stress is visible in multiple ways |

| Resolution | Usually overcome through opportunity | Often requires systemic support and time |

| Health Impact | Minimal physical/mental toll shown | Significant documented health consequences |

| Support Systems | Individual determination wins | Community resources and policy matter most |

The emotional storytelling serves the plot but obscures the complexity of poverty. Escaping financial hardship looks simpler on screen because movies compress timelines, ignore systemic barriers, and resolve through plot devices—the sudden inheritance, the discovered talent, the benefactor who appears at the crucial moment. Real poverty typically requires navigating bureaucratic systems, building skills while managing survival needs, and benefiting from policy changes or economic shifts that have nothing to do with individual virtue.

Do Movies Oversimplify Rags-to-Riches Stories?

The overnight success narrative represents one of entertainment’s most persistent myths about how movies and TV shows portray money and class mobility. These stories appeal to something fundamental in the human psyche—the belief that dramatic change is possible, that tomorrow could be radically different from today. The struggling musician gets discovered at a coffee shop, the startup founder pitches their way to millions, and the athlete signs the contract that changes everything.

What’s usually missing from these narratives reveals their fiction: time, failure, and systemic barriers. The montage compresses years of skill development into three minutes of film. The rejection letters, failed pitches, and false starts get edited out for pacing. The role of timing, market conditions, social networks, and accumulated advantages gets replaced by pure determination and a single lucky break. How these stories influence ambition and risk-taking creates a double-edged effect. They inspire people to pursue dreams and take chances, which can lead to genuine achievement. But they also encourage poor risk assessment, suggesting that passion alone justifies leaving stable income, that preparation matters less than opportunity, and that the odds are better than they actually are for most ventures.

How Do TV Shows and Movies Ignore Debt, Bills, and Financial Stress?

Perhaps the most glaring omission in how movies and TV shows portray money is the absence of ongoing financial obligations. Characters live in apartments they couldn’t afford on their stated salaries, never mention student loans despite their recent graduate status, and treat unexpected expenses as minor plot points rather than budget-destroying events. The barista in the West Village studio never discusses rent. The journalist covering international stories never mentions the health insurance gap between freelance gigs. The young lawyer never seems to carry law school debt despite joining a public interest firm.

Financial Realities Rarely Shown in Entertainment

- Monthly budget meetings or financial check-ins

- Debt payment strategies or refinancing decisions

- Tax preparation or quarterly estimated payments

- Insurance coverage gaps and healthcare costs

- Emergency fund depletion and rebuilding

- Retirement planning or long-term savings concerns

- Cost-of-living calculations affecting major decisions

Why debt is rarely part of the storyline comes down to dramatic utility. Financial obligations create constraints that limit plot possibilities and slow narrative momentum. But the danger of normalizing unrealistic financial freedom extends beyond simple escapism. When viewers never see characters they identify with managing debt, they miss models for healthy financial behavior. When spending appears consequence-free, lifestyle creep becomes normalized. When financial stress exists only as a temporary plot obstacle rather than an ongoing management challenge, viewers develop unrealistic timelines for their own financial goals.

Why Is Illegal or Fast Money Often Shown as Exciting?

Heist films, scam artists, and crime-driven wealth represent an entire genre built around how movies and TV shows portray money obtained outside legal channels. These stories trade on the thrill of transgression: the perfectly planned casino robbery, the con artist outsmarting the corrupt wealthy, the drug empire built from nothing. The planning montages, the clever tricks, the characters’ chemistry—all designed to make illegal wealth accumulation not just exciting but somehow justified or admirable within the story’s moral framework.

The thrill versus the real-world consequences creates a dangerous disconnect. On screen, the clever plan unfolds smoothly, the characters enjoy their ill-gotten gains, and even when caught, they often receive treatment as antiheroes rather than criminals. The actual consequences—prison time that destroys families, violence that traumatizes communities, the long-term impossibility of building a legitimate life with illegitimate funds—get minimized or romanticized. How glamorized risk affects real financial decision-making is subtle but measurable. Studies show that exposure to financial crime dramas correlates with increased risk tolerance and decreased perception of consequences. While most viewers won’t attempt heists, the underlying message—that shortcuts are clever, that rules are for the unimaginative, that fast money beats slow wealth—can influence legal but unwise financial choices like excessive speculation or avoidance of steady accumulation strategies.

How Do Movies Shape Our Expectations About Success and Wealth?

How movies and TV shows portray money creates powerful, media-driven definitions of “making it” that influence real-world financial goals. Success in entertainment looks like: the corner office with the skyline view, the Tesla in the reserved parking spot, the ability to pick up the check without looking at prices, the spontaneous international vacation, the wardrobe that signals arrival. These visual markers become internalized benchmarks even for people who consciously know they’re watching fiction.

The role of comparison and aspiration creates a feedback loop. We compare our actual financial situations to fictional ones, find them lacking, then adjust our goals upward to match the mediated version of success we’ve internalized. A comfortable middle-class life that would satisfy our actual needs feels like failure when measured against the standard set by characters whose wealth serves narrative rather than economic logic. How repeated exposure rewires money goals and timelines happens gradually. Watch enough shows where thirty-somethings own homes in expensive cities on single incomes, and your timeline for homeownership adjusts. See enough characters who “made it” by their early thirties, and your own pace feels inadequate even if it’s objectively strong.

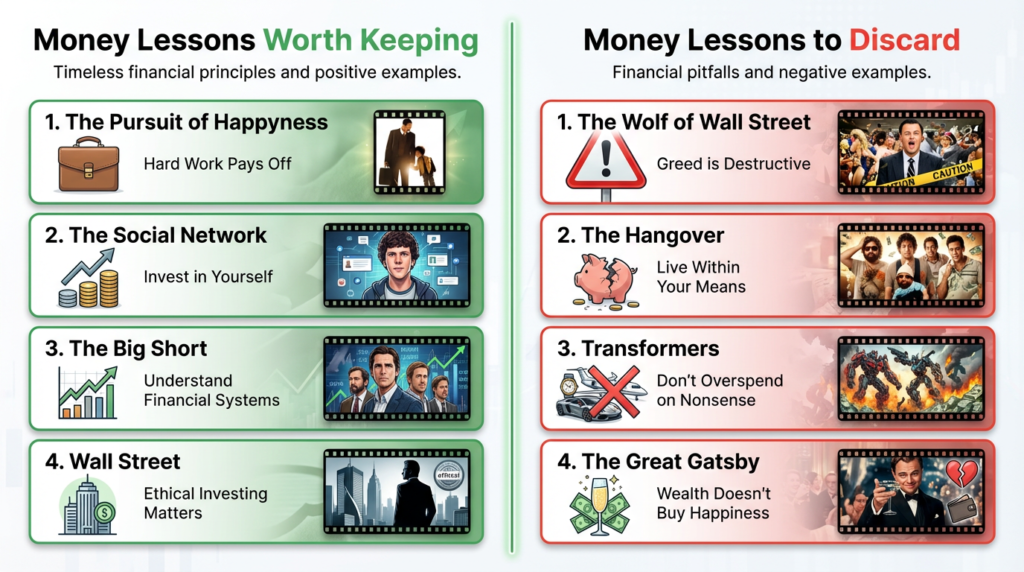

What Financial Lessons Should Viewers Not Learn From Movies?

Understanding how movies and TV shows portray money means recognizing which common beliefs deserve immediate unlearning. The myth that hard work alone guarantees wealth pervades film narratives, but ignores how opportunity, timing, and systemic factors significantly impact outcomes. Movies suggest that luck strikes the prepared, but they oversample lucky outcomes—we don’t see films about the equally prepared people who never caught a break. The instant rewards fallacy teaches that payoff comes quickly after effort, compressing years of wealth accumulation into montage sequences that make gradual progress seem inadequate.

Money Myths Entertainment Promotes

| Movie Myth | Why It’s Wrong | Better Framework |

|---|---|---|

| Follow your passion; money follows | Most passions don’t monetize well | Develop valuable skills; fund passions separately |

| One big break changes everything | Sustainable success requires multiple steps | Build through consistent small wins |

| Rich people work less than you think | Wealth requires sustained effort in some form | Different work, not necessarily less |

| You can spend your way to happiness | Hedonic adaptation negates spending | Fulfillment comes from purpose and connection |

| Debt doesn’t matter if you’re successful | Debt constraints regardless of income | Debt management matters at every level |

Entertainment definitively does not equal financial advice, yet viewers unconsciously extract lessons from repeated patterns. When every film shows the risk-taker winning and the cautious planner missing opportunities, it builds bias against prudent financial behavior. When debt appears only in poverty narratives and never affects successful characters, it suggests that wealth makes financial obligations disappear rather than change form.

What Positive Money Lessons Do Movies Get Right?

Despite their distortions, how movies and TV shows portray money occasionally captures genuinely valuable lessons. Stories about delayed gratification—characters who sacrifice immediate comfort for long-term goals—model patience that serves real financial planning. Films that show resilience through setbacks demonstrate that financial paths rarely run straight, that recovery from mistakes is possible, and that persistence matters more than perfection. Movies that portray meaningful success beyond money, showing characters who define achievement through impact, relationships, or mastery rather than account balances, offer a corrective to materialistic messaging.

When films portray purpose-driven work, they highlight a genuine truth: that finding meaning in how you earn creates more sustainable motivation than chasing income alone. The teacher who transforms lives, the scientist pursuing discovery over patents, the craftsperson perfecting their skill—these narratives don’t pretend money doesn’t matter, but they properly subordinate it to larger purposes. How to extract healthy lessons from fictional stories requires active viewing: notice when characters make financial sacrifices for meaningful reasons, observe how fictional communities support each other economically, pay attention to stories where wealth creates responsibility rather than just freedom.

How Can Viewers Separate Entertainment From Financial Reality?

Watching money stories with critical thinking transforms passive consumption into active financial awareness. Understanding how movies and TV shows portray money means viewing with a filmmaker’s eye—recognizing that every financial detail serves story rather than reality, that writers compress timelines for pacing, that visual wealth signals character rather than depicting actual accumulation strategies. Questions viewers should ask themselves after watching include: What financial steps did the character skip? What ongoing costs aren’t shown? How much time actually passed in this “overnight success”? What systemic advantages did the character have? What would this lifestyle actually cost?

Developing a critical viewing practice means noticing patterns: which financial shortcuts appear repeatedly across shows, which money consequences never seem to arrive, which demographics get which money narratives. Track how often characters of different backgrounds access wealth through different means—does inheritance appear more for some groups while “hustle” appears for others? Notice who gets to be financially irresponsible without consequences and who faces harsh penalties for similar choices.

Critical Viewing Checklist

- ☐ What does this character’s lifestyle actually cost?

- ☐ What’s their realistic income based on their job?

- ☐ What financial obligations are ignored (debt, taxes, insurance)?

- ☐ How much time would their success actually require?

- ☐ What systemic advantages helped them that aren’t acknowledged?

- ☐ Would this financial behavior work in my actual situation?

- ☐ What healthy money behavior am I seeing that I could model?

- ☐ What money myth is this narrative promoting?

Turning passive entertainment into active financial awareness doesn’t mean you can’t enjoy escapist fiction—it means you enjoy it without internalizing its economics. You can thrill to the heist film while knowing real wealth builds differently. You can root for the underdog while understanding that systematic planning beats lucky breaks. You can appreciate the aesthetic of luxury while choosing your own financial priorities based on your actual values rather than mediated ones.

Conclusion: Watching Smarter, Not Richer

How movies and TV shows portray money matters more than we typically acknowledge because these narratives operate below conscious awareness, shaping our financial intuitions and expectations through repeated exposure. Every unrealistic apartment, every consequence-free spending spree, and every overnight success story plants small seeds about what’s normal, what’s possible, and what we should aspire to achieve. The value of financial literacy in a media-driven world lies not in rejecting entertainment but in developing the critical lens to separate its useful truths from its profitable fictions.

Understanding these portrayals empowers you to enjoy the story without copying the script. Watch the billionaire genius and appreciate the drama while building your own wealth through index funds and patience. Thrill to the risk-taker’s victory while maintaining your emergency fund. Let fictional wealth inspire you toward your real goals rather than someone else’s narrative goals. The screen will always show more glamorous wealth and more dramatic poverty than most of us will ever experience—and that’s exactly why we need to view it as entertainment rather than education, as inspiration rather than instruction, as story rather than strategy.

FAQs

Q. Why do movies and TV shows portray money unrealistically?

- Movies exaggerate wealth and poverty to create drama, simplify storytelling, and trigger emotional engagement, often at the cost of financial realism.

Q. How do films influence our perception of wealth and success?

- Repeated exposure to luxury lifestyles and instant success shapes unrealistic expectations about income, timelines, and happiness.

Q. Why are rich characters often villains or geniuses?

- This trope simplifies complex wealth narratives and reinforces cultural beliefs that money is tied to power, corruption, or exceptional intelligence.

Q. Do movies encourage unhealthy financial expectations?

- Yes. Many films normalize effortless wealth, ignore debt and expenses, and downplay risk, which can distort real-world money decisions.

Q. Are rags-to-riches stories realistic?

- Most are oversimplified. They often exclude time, failure, privilege, and systemic barriers that exist in real financial journeys.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.