SPY Stock: Everything You Need to Know About America’s Most Popular ETF

When investors talk about tracking the stock market’s pulse, one ticker symbol dominates the conversation: SPY. As the oldest and most heavily traded exchange-traded fund in the United States, SPY stock is trending across financial platforms as both seasoned traders and newcomers seek to understand this market bellwether.

What is SPY Stock?

SPY, formally known as the SPDR S&P 500 ETF Trust, is an exchange-traded fund that tracks the S&P 500 index. Launched in January 1993 by State Street Global Advisors, SPY was revolutionary for its time—it was the first ETF ever listed in the United States.

Key Features of SPY Stock

- Diversification: Provides exposure to 500 of America’s largest publicly traded companies in a single trade

- Low Cost: Expense ratio of approximately 0.09% annually

- High Liquidity: Average daily trading volume exceeds 80 million shares

- Dividend Payments: Quarterly distributions from underlying holdings

- Trading Flexibility: Trades throughout the day like a regular stock

Top Holdings in SPY (Approximate Weightings)

| Company | Sector | Weight |

|---|---|---|

| Apple Inc. | Technology | ~7% |

| Microsoft | Technology | ~6% |

| NVIDIA | Technology | ~5% |

| Amazon | Consumer Discretionary | ~3.5% |

| Meta Platforms | Technology | ~2.5% |

Why is SPY Stock Trending Now?

SPY stock is trending for several compelling reasons that keep it in the spotlight of financial discussions:

Current Factors Driving SPY’s Popularity

- Federal Reserve Policy: Interest rate decisions directly impact stock valuations and investor sentiment

- Market Milestones: Recent all-time highs or significant volatility triggers widespread attention

- Economic Indicators: Jobs reports, inflation data, and GDP announcements create trading opportunities

- Earnings Season: Quarterly corporate results from 500 major companies influence fund performance

- Retail Investor Growth: Increased accessibility through mobile trading platforms

- Options Trading: SPY remains the most actively traded options contract globally

Why Investors Are Watching SPY

| Investor Type | Primary Interest |

|---|---|

| Day Traders | High liquidity and tight spreads |

| Long-term Investors | Broad market exposure and growth |

| Options Traders | Deep options market with weekly expirations |

| Retirement Savers | Diversified portfolio foundation |

| Market Analysts | Real-time market sentiment indicator |

How SPY Reacts to Market Events

SPY’s responsiveness to market events makes it both a valuable indicator and an actively traded instrument. Understanding these reactions helps investors anticipate movements.

SPY’s Typical Reactions

Economic Data Releases

- Strong jobs report → Generally positive movement

- Higher-than-expected inflation → Often negative pressure

- GDP growth surprises → Typically bullish response

- Consumer confidence data → Moderate correlation

Geopolitical Events

- Trade war announcements → Sharp volatility increases

- Military conflicts → Flight to safety, SPY declines

- Peace agreements → Risk-on sentiment, SPY rallies

- Election uncertainty → Increased volatility patterns

Federal Reserve Actions

- Rate cuts → Usually positive for stocks

- Rate hikes → Mixed reaction depending on economic context

- Quantitative easing → Historically bullish

- Hawkish statements → Often trigger selloffs

Historical Crisis Performance

| Event | SPY Peak to Trough | Recovery Time |

|---|---|---|

| COVID-19 Crash (2020) | -34% | 5 months |

| Financial Crisis (2008) | -57% | 4 years |

| Dot-com Bubble (2000-02) | -49% | 5 years |

| 2022 Bear Market | -25% | 10 months |

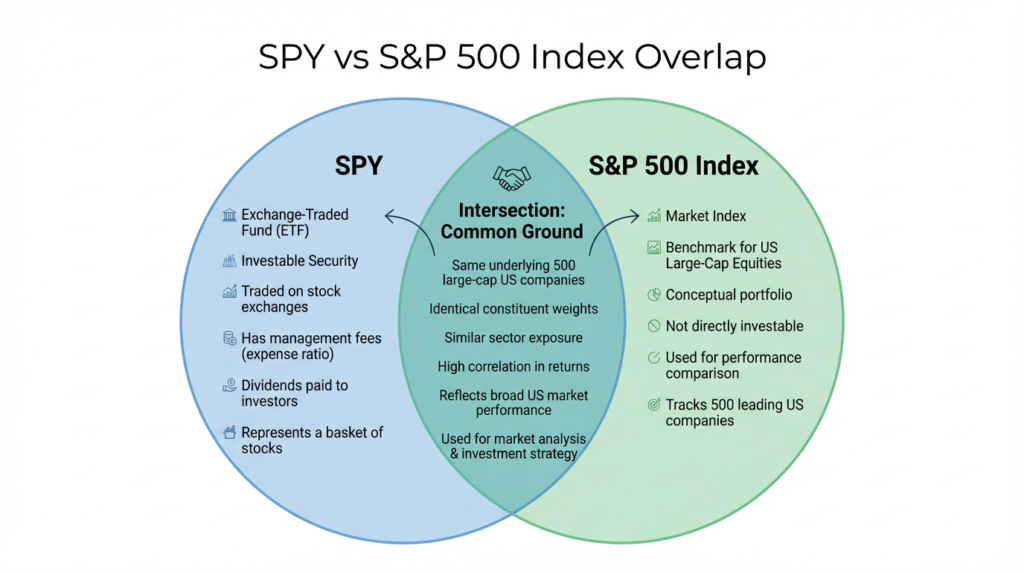

SPY vs S&P 500

Many investors wonder about the relationship between SPY and the S&P 500. Understanding this distinction is crucial for informed investing.

Key Differences

| Feature | S&P 500 Index | SPY ETF |

|---|---|---|

| Nature | Mathematical benchmark | Tradable security |

| Direct Investment | Not possible | Yes, through brokerage |

| Expense Ratio | N/A | 0.09% annually |

| Trading | Cannot trade | Trades like a stock |

| Dividends | Theoretical | Actual quarterly payments |

| Tracking | Exact (100%) | 99.9%+ correlation |

Alternative S&P 500 ETFs

- VOO (Vanguard): Lower expense ratio (0.03%), less liquidity

- IVV (iShares): Expense ratio (0.03%), institutional favorite

- SPLG (SPDR Portfolio): Lowest cost option, smaller fund size

Why Choose SPY Over Alternatives

- Superior liquidity for active trading

- Most robust options market

- Longest track record (since 1993)

- Institutional preference for large trades

Is SPY Risky?

Every investment carries risk, and SPY is no exception. However, understanding the specific risk profile helps investors make informed decisions.

Risk Assessment

Lower Risk Factors

- Diversification across 500 companies

- Exposure to multiple economic sectors

- No single-company risk concentration

- Highly liquid (easy to buy/sell)

- Transparent holdings updated daily

Higher Risk Factors

- Full exposure to market downturns

- No downside protection during crashes

- Sector concentration (heavy in technology)

- Currency risk for international investors

- Interest rate sensitivity

Risk Comparison Table

| Investment Type | Risk Level | Diversification | Volatility |

|---|---|---|---|

| Individual Stocks | High | None | Very High |

| SPY Stock | Moderate | Broad | Moderate |

| Bond ETFs | Low-Moderate | Moderate | Low |

| Savings Account | Very Low | N/A | None |

Suitability by Investor Profile

- Conservative: 20-40% allocation alongside bonds

- Moderate: 50-70% as core equity holding

- Aggressive: 80-100% all-equity portfolio

- Short-term traders: Use with appropriate risk management

- Retirement savers: Excellent long-term foundation

What People Usually Search Next

After researching SPY stock, investors typically explore these related topics:

Investment Mechanics

- “How to buy SPY stock.”

- “Best brokerage for SPY trading”

- “Minimum investment for SPY”

- “SPY commission-free trading”

Performance & Returns

- “SPY dividend yield and payment schedule”

- “SPY historical returns by year”

- “SPY stock price prediction”

- “When to buy SPY stock.”

Comparative Analysis

- “SPY vs QQQ” (Nasdaq-100 tracking)

- “SPY vs DIA” (Dow Jones tracking)

- “SPY vs VOO comparison”

- “Growth stocks vs SPY”

Advanced Strategies

- “SPY options strategies for beginners”

- “SPY covered call strategy”

- “Dollar-cost averaging with SPY.”

- “Tax implications of SPY dividends”

FAQs

Q. Can I get rich investing in SPY stock?

- SPY can build substantial wealth over time through compound growth, but it’s designed for steady, long-term returns rather than quick riches. Historical annual returns average around 10%, meaning $10,000 could grow to approximately $67,000 over 20 years (excluding dividends and taxes).

Q. Does SPY pay dividends?

- Yes, SPY distributes dividends quarterly, typically in March, June, September, and December. The current dividend yield hovers around 1.3-1.5% annually, reflecting dividend payments from the 500 underlying companies.

Q. Is SPY stock good for beginners?

- Absolutely. SPY’s broad diversification, low costs, and simplicity make it an excellent choice for beginning investors. It eliminates the need to research individual companies while providing comprehensive market exposure.

Q. Why is SPY stock trending on social media?

- SPY stock is trending whenever significant market movements occur, major economic data releases happen, or during earnings seasons. Its role as the market’s primary benchmark makes it a constant topic of discussion among investors and financial media.

Q. How much should I invest in SPY?

- Investment amounts depend on your financial situation, goals, and risk tolerance. Many advisors recommend SPY or similar index funds as 50-80% of equity portfolios for long-term investors. Start with what you can afford and consider dollar-cost averaging for consistent investing.

Q. Can SPY go to zero?

- Theoretically extremely unlikely. For SPY to reach zero, all 500 of America’s largest companies would need to simultaneously fail—an unprecedented scenario. However, SPY can experience significant temporary declines during market crashes.

Final Thoughts

SPY stock is trending because it represents the simplest, most effective way to invest in America’s economic growth. Whether you’re a beginner building your first portfolio or an experienced trader seeking liquid market exposure, understanding SPY is fundamental to navigating modern investing.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Market conditions can change rapidly, and individuals should consider their own risk tolerance before making investment decisions.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.