How to Track Your Spending Using Just Your Phone

Gone are the days of keeping receipts in shoeboxes or scribbling expenses in paper ledgers. Today, your smartphone—the device already in your pocket—can become your most powerful financial tool. With just a few taps, you can track your spending, monitor every dollar you spend, identify money leaks, and take control of your financial future.

Learning to track your spending isn’t just about knowing where your money goes; it’s about building awareness, making smarter decisions, and creating a sustainable path toward your financial goals. Whether you’re trying to pay off debt, save for a vacation, or simply stop wondering where your paycheck disappeared, the ability to track your spending is the foundation of financial success.

This comprehensive guide will walk you through everything you need to know about using your phone to track your spending—from choosing the right apps to building habits that stick. Let’s transform your smartphone into a personal finance command center where you can track your spending effortlessly.

Why is tracking daily spending important in the first place?

Financial awareness is the first step toward financial freedom. When you track your spending, you shine a light on your money habits, revealing patterns you might not even realize exist. That daily coffee run? It could be costing you $150 a month. Those “just browsing” online shopping sessions? They might explain why your credit card balance never seems to shrink.

The Power of Knowing Where Your Money Goes

When you track your spending consistently, you gain unprecedented control over your finances. Instead of reaching the end of the month wondering where everything went, you’ll have concrete data showing exactly how you allocated your resources. This knowledge transforms abstract financial anxiety into actionable insights.

Studies show that people who actively track their spending spend 15-20% less on average than those who don’t. Why? Because awareness naturally leads to more conscious decision-making. When you see that you spent $200 on takeout last month, you’re more likely to cook at home this month. The simple act of choosing to track your spending creates immediate behavioral changes.

Breaking the Debt Cycle

One of the most critical reasons to track your spending is debt prevention and elimination. Many people fall into debt not because of major financial catastrophes, but through the slow accumulation of small, untracked expenses. A subscription here, an impulse purchase there—these seemingly minor transactions compound over time.

When you track your spending religiously, you create a buffer between impulse and action. Before making a purchase, you might ask yourself: “Do I want to log this expense later?” This simple question—triggered by your commitment to track your spending—can prevent countless unnecessary purchases.

Long-Term Benefits: Smarter Budgeting and Increased Savings

The data you collect when you track your spending becomes the foundation for effective budgeting. Unlike arbitrary budgets based on guesswork, the practice of tracking your spending gives you real numbers to work with. You’ll know that you actually spend $400 on groceries, not the $250 you estimated, allowing you to create realistic budgets you can actually stick to.

Over time, this practice compounds into significant savings. As you identify and eliminate wasteful spending, redirect money toward savings, and make more intentional financial choices, you’ll find your net worth steadily climbing. The phone in your pocket becomes not just a tracking tool, but a wealth-building instrument when you consistently track your spending.

Can I really track all my expenses using only my phone?

Absolutely—and it’s easier than you might think. Modern smartphones are equipped with everything you need to track your spending across virtually every financial transaction you make. From sophisticated apps that automatically help you track your spending to simple note-taking tools, your phone can handle it all.

What Types of Expenses Can You Track?

Your phone can help you track your spending across virtually every category:

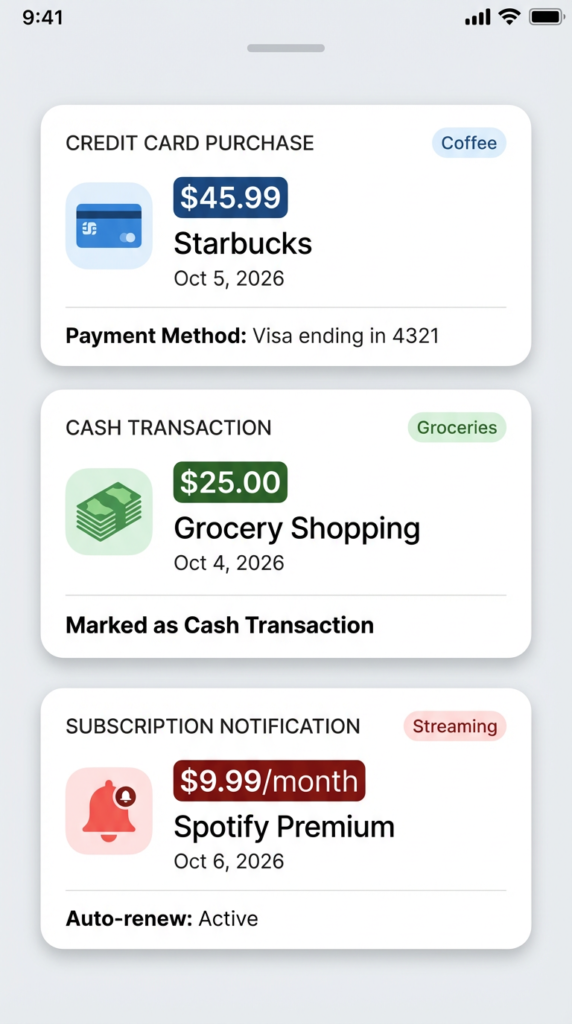

- Card payments: Debit and credit card transactions can be automatically imported to track your spending

- Cash expenses: Manually logged immediately after transactions to track your spending accurately

- Digital payments: Venmo, PayPal, Apple Pay, and other digital wallet transactions you can track

- Subscriptions: Recurring monthly or annual charges that are easy to track your spending on

- Bills: Utilities, rent, insurance, and other fixed expenses to track your spending patterns

- Online purchases: E-commerce transactions from Amazon, eBay, and other retailers you need to track

Limitations Compared to Traditional Methods

While using your phone to track your spending is incredibly powerful, it’s worth understanding a few considerations:

Compared to desktop spreadsheets, tracking your spending on your phone might feel slightly more cramped when reviewing months of data simultaneously. However, most modern apps that help you track your spending sync across devices, allowing you to analyze on your computer while you track your spending on your phone.

Compared to paper ledgers, using your phone to track your spending requires battery life and occasional connectivity, but offers exponentially better features like automatic calculations, visual charts, and backup capabilities that make it easier to track your spending effectively.

The truth is, these “limitations” are minimal compared to the advantages. Your phone goes everywhere you do, making it the ideal tool for capturing expenses in real-time when you track your spending—something no desktop computer can match.

Even Simple Methods Are Surprisingly Effective

You don’t need a complicated system to track your spending successfully. Even the most basic approach—typing expenses into your phone’s notes app—provides valuable insights when you track your spending. The key isn’t the sophistication of your tool; it’s the consistency of your commitment to track your spending.

Many people find that starting simple helps build the habit to track your spending. Once tracking becomes second nature, you can graduate to more feature-rich solutions that provide deeper insights and automation to help you track your spending more efficiently.

What are the best free expense-tracking apps available?

The right app can make it effortless to track your spending. Here’s a detailed comparison of the top free apps designed to help you track your spending effectively:

| App Name | Best For | Key Features | Limitations |

|---|---|---|---|

| Mint | Automatic tracking | Bank sync, bill tracking, credit score monitoring, and budget creation to track your spending | Ads require bank login credentials |

| Money Manager | Manual tracking | Simple interface to track your spending, expense/income tracking, multiple accounts, no ads | No automatic bank sync |

| Wallet | Visual insights | Beautiful charts when you track your spending, budget planning, bill reminders, and family sharing | Limited features in the free version |

| Goodbudget | Envelope budgeting | Envelope system to track your spending, sync across devices, and debt tracking | Limited to 20 envelopes in the free version |

| PocketGuard | Spending limits | “In My Pocket” feature helps track your spending, bill negotiation, and subscription tracking | Limited accounts in the free version |

| Spendee | Collaborative tracking | Shared wallets to track your spending together, automatic categorization, and custom categories | Some features require a premium |

Understanding App Features

Most apps that help you track your spending share core features that make the process seamless:

- Automatic transaction import connects to your bank accounts and credit cards, automatically logging purchases without manual entry so you can track your spending effortlessly. This feature alone can save hours each month while ensuring you never miss a transaction when you track your spending.

- Smart categorization uses artificial intelligence to automatically sort your expenses into categories like groceries, dining, transportation, and entertainment as you track your spending. While not perfect, these systems learn from your corrections and become more accurate over time, making it easier to track your spending by category.

- Budget alerts and notifications keep you informed when you’re approaching spending limits in specific categories as you track your spending. These gentle nudges help prevent overspending before it happens.

- Visual reports and charts transform raw data into actionable insights when you track your spending, showing spending trends, category breakdowns, and month-over-month comparisons at a glance.

Tips for Choosing the Right App

Selecting an app to track your spending depends on your specific needs and preferences:

- If you hate manual entry, choose apps with strong bank sync capabilities like Mint or PocketGuard that automatically track your spending. These will help you track your spending with minimal input required.

- If you’re privacy-conscious, opt for apps that don’t require bank login credentials to track your spending, such as Money Manager or Spendee. You’ll trade automation for peace of mind while you track your spending.

- If you use the envelope budgeting method, Goodbudget is specifically designed around this approach, making it easy to track your spending and allocate funds to different spending categories.

- If you want family coordination, look for apps with sharing features like Wallet, which allows multiple users to track their spending together toward common goals.

Try several apps to find the one that feels most intuitive when you track your spending. The best app to track your spending is the one you’ll actually use consistently.

Can I track spending without installing any app?

You don’t need specialized software to track your spending effectively. Your phone comes equipped with several built-in tools that can serve as surprisingly capable ways to track your spending. While they may lack the bells and whistles of dedicated apps, these native solutions offer simplicity, privacy, and zero learning curve when you track your spending.

Using Your Phone’s Notes App

The most straightforward method to track your spending is simply typing expenses into your phone’s notes app. Create a new note for each month and log expenses as they occur to track your spending:

January 2026 Expenses

---

1/16 - Coffee - $4.50

1/16 - Lunch - $12.00

1/16 - Gas - $45.00

1/17 - Groceries - $87.32

1/17 - Movie tickets - $28.00Pros: Immediate access to track your spending, no setup required, works offline, completely private

Cons: No automatic calculations when you track your spending, no visual reports, requires discipline to total expenses manually

Leveraging Built-in Spreadsheet Apps

Both Google Sheets (Android/iOS) and Apple Numbers provide more structured ways to track your spending. Create a simple template with columns for date, category, description, and amount to track your spending:

| Date | Category | Description | Amount |

|---|---|---|---|

| 1/16 | Food | Morning coffee | $4.50 |

| 1/16 | Food | Lunch downtown | $12.00 |

| 1/16 | Transport | Gas fill-up | $45.00 |

| 1/17 | Food | Weekly groceries | $87.32 |

Spreadsheets offer automatic summation when you track your spending, allowing you to see totals by category or time period instantly. The learning curve is minimal if you’re already familiar with basic spreadsheet functions and want to track your spending this way.

Photos and Screenshots as Expense Records

Your phone’s camera can become a powerful tool to track your spending. Simply photograph receipts as you receive them, creating a visual record when you track your spending. Many people create a dedicated album called “Receipts” or “Expenses” to keep everything organized as they track their spending.

This method works particularly well for cash transactions where you have physical receipts to track your spending. Later, you can review photos and transfer the data to your preferred tracking system during a weekly review session when you track your spending.

Manual vs. App-Based Tracking: The Real Comparison

Manual tracking has advantages when you track your spending:

- Complete privacy and data control as you track your spending

- No subscriptions or in-app purchases to track your spending

- Works without internet connectivity when you track your spending

- Customizable to your exact needs as you track your spending

- No learning curve with familiar tools to track your spending

Manual tracking has disadvantages when you track your spending:

- Time-consuming data entry to track your spending

- No automatic categorization when you track your spending

- Limited analysis and reporting as you track your spending

- Easy to forget or procrastinate logging when you track your spending

- No automatic bank reconciliation to verify that you track your spending accurately

App-based tracking has advantages when you track your spending:

- Automatic transaction import to help you track your spending

- Instant calculations and totals as you track your spending

- Visual charts and insights when you track your spending

- Reminder notifications to help you track your spending consistently

- Cross-device synchronization when you track your spending

App-based tracking has disadvantages when you track your spending:

- Privacy concerns with bank credentials to track your spending

- Potential subscription costs to track your spending

- Learning curve for new software to track your spending

- Requires internet connectivity to track your spending

- Less customization flexibility when you track your spending

The choice between manual and app-based methods to track your spending often comes down to personal preference and priorities. Privacy-focused individuals might prefer manual methods to track their spending, while those seeking convenience and automation will benefit from dedicated apps. Many people start with manual tracking to build the habit to track your spending, then graduate to apps once they’re committed to the practice.

How do I track cash expenses using my phone?

Cash transactions are the silent budget killers. Unlike card purchases that leave digital trails, cash spending can evaporate from your wallet with barely a trace. Yet learning to track your spending in cash is crucial—studies suggest that people spend 15-30% more when using cash versus cards, simply because these transactions go unrecorded and unexamined when they don’t track your spending.

Methods for Logging Cash Transactions

The key to successfully tracking your cash spending is capturing transactions immediately. The longer you wait, the more likely you are to forget the exact amount or the purchase entirely when you try to track your spending.

- The immediate entry method involves pulling out your phone right after each cash purchase and logging it instantly to track your spending. This takes just 10-15 seconds but ensures 100% accuracy when you track your spending. Set up a shortcut on your home screen to your tracking app or note to minimize friction when you track your spending.

- The receipt collection method works well if you receive receipts for most cash purchases when you track your spending. Keep cash receipts in a designated pocket or wallet compartment, then photograph or manually enter them during a set time each evening to track your spending.

- The round-up estimation method is useful for very small cash purchases where exactness matters less when you track your spending. Keep a mental tally throughout the day and log the total as “miscellaneous cash” each evening. While less precise, this approach is better than not choosing to track your spending at all.

Creating Categories for Cash Spending

Cash expenses typically fall into predictable patterns when you track your spending. Common cash spending categories include:

- Food & Dining: Coffee, snacks, meals at cash-only establishments, you need to track

- Transportation: Parking meters, tolls, public transit expenses to track your spending

- Personal Care: Haircuts, tips for services when you track your spending

- Entertainment: Cover charges, street vendors, and local markets to track your spending

- Miscellaneous: Small purchases under $5, you should track

When you track your spending in cash across categories, patterns emerge. You might discover that your daily coffee habit costs $150 monthly, or that parking fees are draining $80 from your budget when you track your spending. This awareness creates opportunities for intentional change.

Tips for Remembering to Log Cash Transactions Consistently

Building the habit to track your spending in cash requires a strategy:

- Set location-based reminders: Configure your phone to remind you to track your spending when you arrive home each evening. This catches any transactions you didn’t log immediately when you track your spending.

- Use the “wallet check” method: Before putting cash back in your wallet after a purchase, log the expense first to track your spending. Make it a non-negotiable sequence: pay, log, wallet, as you track your spending.

- Keep minimal cash on hand: Carry only the cash you expect to need so it’s easier to track your spending. When your wallet has less cash at day’s end, you’ll more easily remember what you spent it on when you track your spending.

- Create a daily ritual: Link expense logging to an existing habit, such as having your morning coffee or brushing your teeth before bed, to help you track your spending consistently. This “habit stacking” technique makes it automatic to track your spending.

- Forgive yourself and continue: If you forget to track your spending in cash for a day or two, don’t abandon the practice entirely. Simply estimate what you can, make a note, and resume diligent efforts to track your spending going forward.

The goal isn’t perfection when you track your spending—it’s developing enough consistency to capture the majority of your cash transactions and gain visibility into this often-overlooked aspect of your finances as you track your spending.

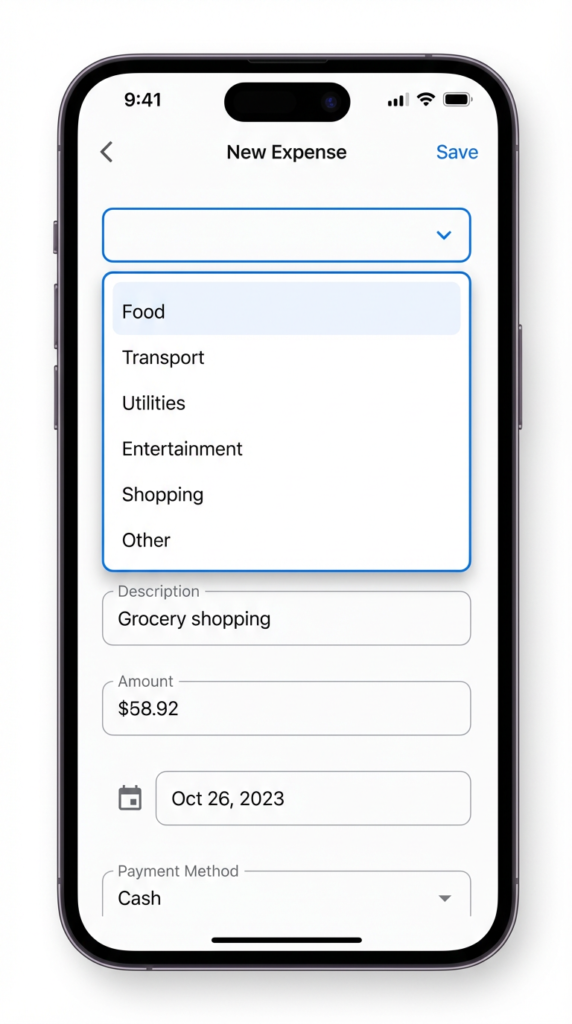

How can I categorize expenses easily on a mobile device?

Categories transform chaotic data into actionable insights when you track your spending. When you track your spending across well-defined categories, you move beyond simply knowing how much you spent to understanding where your money actually goes. This understanding is what enables meaningful financial improvement as you track your spending.

Why Categories Matter

Imagine trying to lose weight by only tracking total calories without knowing whether those calories came from vegetables or candy. That’s essentially what happens when you track your spending without categories—you have data, but you lack context.

Categories provide that context when you track your spending. They reveal that while you spent $2,400 last month, $800 went to necessary housing costs, $300 to essential groceries, but $450 disappeared into restaurant meals—a discretionary expense you could potentially reduce when you track your spending.

Standard Categories That Work for Most People

Here’s a proven category structure that balances simplicity with usefulness when you track your spending:

| Category | Examples | Typical Budget % |

|---|---|---|

| Housing | Rent, mortgage, property tax, and home insurance to track | 25-35% |

| Transportation | Car payment, gas, insurance, maintenance, and public transit, you track | 10-20% |

| Food – Groceries | Supermarket purchases, meal ingredients to track your spending | 8-12% |

| Food – Dining | Restaurants, takeout, delivery, and coffee shops, when you track your spending | 5-10% |

| Utilities | Electric, gas, water, internet, and phone expenses to track | 5-10% |

| Healthcare | Insurance premiums, copays, prescriptions to track your spending | 5-12% |

| Personal Care | Haircuts, toiletries, and gym membership when you track your spending | 3-5% |

| Entertainment | Movies, streaming, hobbies, and events to track your spending | 3-8% |

| Shopping | Clothing, electronics, and household items you track | 5-10% |

| Savings | Emergency fund, investments, retirement, and to track your spending | 10-20% |

| Debt Payments | Credit cards, student loans, and personal loans to track | Variable |

| Miscellaneous | Everything else, unexpected purchases, when you track your spending | 3-5% |

Examples of Categorization in Apps and Spreadsheets

Most apps designed to help you track your spending automatically categorize transactions based on merchant names. When you buy gas at Shell, the app recognizes the merchant and assigns it to “Transportation” as you track your spending. When you shop at Whole Foods, it goes to “Groceries” when you track your spending.

However, automatic categorization isn’t perfect when you track your spending. Apps might categorize Target purchases as “Shopping” when you actually bought groceries, or mark your dentist visit as “Healthcare” when you want to track it separately under “Medical” as you track your spending.

The solution is regular review and manual adjustment when you track your spending. Spend five minutes weekly reviewing your categories and correcting misassignments. Most apps make this simple—just tap a transaction and select the correct category from a dropdown menu as you track your spending.

If you’re using a spreadsheet to track your spending, create a dropdown list of categories in your Category column. This ensures consistency (no accidentally using “Dining” one day and “Restaurants” another) and makes data analysis much easier when you track your spending.

Keeping Categories Simple but Effective

The biggest mistake beginners make when they first track their spending is creating too many categories. When you have 30+ categories, expense logging becomes a frustrating decision-making process: “Is this ‘Entertainment’ or ‘Hobbies’ or ‘Recreation’?” This friction kills the habit of tracking your spending.

Start with 8-12 categories maximum when you track your spending. You can always subdivide later if needed, but beginning simply keeps it effortless to track your spending.

Consider creating a “Catch-All” or “Miscellaneous” category for expenses that don’t fit neatly elsewhere when you track your spending. If you find yourself using this category frequently for similar types of purchases, that signals you might need a new category as you track your spending.

Avoid perfectionism when you track your spending. If you’re 80% consistent with categorization, you’ll still gain valuable insights. The goal is progress and awareness, not creating a perfect accounting system as you track your spending.

Some helpful principles when you track your spending:

- Combine similar categories (“Entertainment” instead of separate “Movies,” “Games,” “Concerts”) to track your spending efficiently

- Split high-spending areas (separate “Groceries” and “Dining Out” rather than combined “Food”) when you track your spending

- Align categories with your budget goals (if you’re focused on reducing coffee spending, create a specific “Coffee” subcategory) as you track your spending

- Review and refine quarterly—your category needs will evolve as you track your spending

When you track your spending with clear, consistent categories, you create a powerful feedback loop. You’ll see exactly where your money goes, which categories are over budget, and where you have room for adjustments. This visibility is what transforms the act of tracking your spending from a passive recording exercise into an active tool for financial improvement.

Should I track expenses in real time or at the end of the day?

The timing of when you track your spending significantly impacts both accuracy and sustainability. While financial experts often debate the “best” approach, the truth is that the optimal strategy to track your spending depends on your personality, lifestyle, and what you’ll actually stick with consistently.

Real-Time Tracking: The Immediate Capture Method

Real-time tracking means you track your spending the moment expenses occur—standing in the checkout line, sitting in your car after pumping gas, or immediately after handing cash to a barista.

Benefits when you track your spending in real time:

- Perfect accuracy: You’ll never forget a transaction or misremember the amount when you track your spending immediately. The receipt is in your hand, and the details are fresh.

- Complete coverage: Small cash purchases that often slip through the cracks get captured when you track your spending right away. That $2 parking meter or $3 bottle of water makes it into your records.

- Reduced evening workload: When you get home, your efforts to track your spending are already done. No need to reconstruct your day’s spending from memory or receipts.

- Immediate awareness: Logging purchases as they happen creates a mental pause that can curb impulse spending when you track your spending. The act of recording a purchase makes you more conscious of it.

Challenges when you track your spending in real time:

- Interrupts daily flow: Stopping to track your spending can feel disruptive, especially during busy errands or social situations.

- Requires discipline: You need the self-control to pull out your phone after every transaction to track your spending, even when it’s inconvenient.

- Not always practical: Some situations make it difficult to immediately track your spending—imagine pulling out your phone during a business lunch or while wrangling kids through the grocery store.

End-of-Day Tracking: The Daily Summary Method

End-of-day tracking involves setting aside 5-10 minutes each evening to review receipts, check bank transactions, and log all the day’s expenses in one sitting when you track your spending.

Benefits when you track your spending at day’s end:

- Batch efficiency: Logging multiple transactions at once can be faster than doing it piecemeal throughout the day when you track your spending.

- Convenient routine: A consistent evening ritual (perhaps while watching TV or having coffee) makes it feel less burdensome to track your spending.

- Natural review opportunity: As you log expenses, you automatically reflect on your spending patterns for the day when you track your spending.

- Less social awkwardness: No need to pull out your phone in restaurants or stores when you track your spending later.

Challenges when you track your spending at day’s end:

- Memory lapses: Even waiting a few hours can result in forgotten transactions, especially small cash purchases, when you track your spending.

- Requires saved receipts: You’ll need to collect and organize receipts throughout the day, which itself requires discipline when you track your spending.

- Can feel like homework: After a long day, the last thing you might want is another task to track your spending, making it easy to skip “just this once.”

- Less spending awareness: Delayed logging means you don’t get the psychological benefit of consciously acknowledging purchases in the moment when you track your spending.

Finding Your Personal Sweet Spot

Rather than adopting a rigid all-or-nothing approach when you track your spending, consider these hybrid strategies:

- The major-minor split: Log large purchases (over $20) immediately to track your spending accurately, batch-enter small purchases at day’s end. This captures significant expenses with perfect accuracy while streamlining minor transactions.

- The convenience approach: Track your spending in real-time when it’s easy, and end-of-day when immediate entry would be awkward. Trust yourself to judge what works in each situation when you track your spending.

- The weekly review backup: Regardless of when you do primary logging to track your spending, conduct a weekly review comparing your tracked expenses against bank statements to catch anything you missed.

Tips for Staying Consistent with Either Method

For real-time trackers who track your spending immediately:

- Create a home screen shortcut to your tracking app for one-tap access when you track your spending

- Use voice-to-text to track your spending hands-free while driving or multitasking

- Make logging the last step before putting away your wallet—pay, log, wallet—when you track your spending

- Start with just one week of perfect real-time efforts to track your spending to build the habit

For end-of-day trackers who track your spending later:

- Set a daily alarm for your logging time to help you consistently track your spending

- Keep a dedicated envelope or wallet pocket for receipts throughout the day so you can track your spending accurately

- Take quick phone photos of receipts as a backup memory aid when you track your spending

- If you miss a day when you track your spending, review your bank statements to fill in the gaps

For everyone who wants to track their spending:

Most people find that consistency matters more than timing when you track your spending. An imperfect system followed religiously beats a perfect system followed sporadically when you track your spending. The method you’ll actually use is better than the theoretically optimal method you’ll abandon after two weeks when you try to track your spending.

Experiment with both approaches for a month each to track your spending, then evaluate which felt more natural and resulted in more complete tracking. Your phone can support either strategy when you track your spending—the choice is about finding what works for your life and personality.

How does tracking spending help with budgeting?

Tracking and budgeting are two sides of the same coin. While efforts to track your spending show you where your money went, budgeting tells you where you want it to go. Together, they create a powerful closed-loop system for financial control: you plan spending (budget), track your spending to record actual expenditures, compare the two, and adjust accordingly.

The Foundation: Data-Driven Budget Creation

Most people approach budgeting backward. They pull numbers from thin air—”I’ll spend $200 on groceries this month”—only to discover that their actual spending bears no resemblance to their plan when they track their spending. When budgets consistently fail, people assume they lack discipline, when actually they lack accurate data from efforts to track their spending.

When you track your spending for several weeks or months first, you build a foundation of truth. You discover that you actually spend $350 on groceries, not $200, when you track your spending. Your transportation costs run $280 monthly, not the $150 you estimated when you tracked your spending. Those subscriptions you barely remember drain $87 from your account each month when you track your spending.

This is the critical insight: Effective budgets must be rooted in reality. Your actual spending patterns—revealed through diligent efforts to track your spending—provide the baseline from which sustainable budgets emerge.

From Tracking to Budget: A Practical Example

Here’s how your efforts to track your spending transform into an actionable budget:

| Category | Tracked Spending (3-month average) | Initial Budget | Optimized Budget |

|---|---|---|---|

| Housing | $1,200 | $1,200 | $1,200 |

| Groceries | $380 | $400 | $350 |

| Dining Out | $340 | $200 | $250 |

| Transportation | $245 | $250 | $240 |

| Entertainment | $125 | $100 | $100 |

| Shopping | $280 | $150 | $200 |

| Subscriptions | $87 | $50 | $45 |

| Personal Care | $95 | $75 | $85 |

| Miscellaneous | $148 | $100 | $100 |

| TOTAL | $2,900 | $2,525 | $2,570 |

Notice how this person’s initial budget ($2,525) was completely unrealistic compared to the actual spending ($2,900) they discovered when they track your spending. By choosing to track your spending first, they could create an informed budget that’s still $330 less than current spending, but actually achievable because it’s based on reality from when they track your spending.

How Tracking Prevents Overspending

The simple act of recording expenses when you track your spending creates a psychological barrier to wasteful spending. When you know you’ll have to log a purchase because you track your spending, you naturally become more selective. This phenomenon—sometimes called the “logging effect”—can reduce spending by 10-20% without any additional effort when you track your spending.

Beyond psychology, when you track your spending, you gain concrete early warning signals. Most expense apps allow you to set category budgets and receive notifications when you’re approaching limits as you track your spending:

- “You’ve spent $180 of your $200 dining budget this month” (from tracking your spending)

- “Entertainment spending at 85% with 10 days remaining” (because you track your spending)

- “Warning: Grocery spending has exceeded budget by $45” (visible when you track your spending)

These gentle nudges help you course-correct in real time rather than discovering overspending after the fact when you track your spending. When you actively track your spending, you can make mid-month adjustments: eating at home more often, postponing non-essential purchases, or being more mindful about small daily expenses.

Enabling Smarter Savings Through Spending Insights

Perhaps the most powerful connection between efforts to track your spending and budgeting is how visibility creates savings opportunities. When you can see your complete spending picture because you track your spending, you identify areas for reduction that you never knew existed:

- Subscription creep discovered when you track your spending: Tracking reveals you’re paying for three streaming services but only watch one, a gym membership you haven’t used in months, and a premium app subscription you forgot about entirely.

- Category inflation is visible when you track your spending: You notice that your “morning coffee” ritual costs $140 monthly when you track your spending—a revelation that makes brewing at home suddenly very appealing.

- Timing inefficiencies are apparent when you track your spending: Data shows you’re making multiple small shopping trips weekly, each including impulse purchases, versus one planned trip that would save both money and time.

- Wasteful patterns exposed when you track your spending: Records reveal that you spend $60 monthly on food delivery fees, or that ATM fees are costing you $25 monthly, or that late fees have added $40 to your expenses.

These insights don’t emerge from budgeting alone—they require the granular visibility that comes when you consistently track your spending. Once identified, you can redirect this wasteful spending toward meaningful financial goals: building an emergency fund, eliminating debt, or saving for something important.

The Feedback Loop: Continuous Improvement

The true magic happens when you track your spending, compare it to your budget, and then refine both based on what you learn:

- Track diligently for a month when you track your spending

- Compare your actual spending to your budget using data from when you track your spending

- Analyze categories where you went over or under when you track your spending

- Adjust your budget to be more realistic or challenge yourself to spend less based on insights from when you track your spending

- Implement specific strategies to align spending with goals as you track your spending

- Repeat the cycle, gradually optimizing your finances as you track your spending

Over time, this feedback loop creates remarkable financial progress when you track your spending. Your budgets become more accurate. Your spending becomes more intentional. The gap between what you plan and what you do narrows when you track your spending. And most importantly, you free up money that can be directed toward building wealth rather than disappearing into forgotten purchases and unconscious spending—all visible because you track your spending.

How often should I review my spending data on my phone?

Review frequency is the difference between expense tracking as a passive record and expense tracking as an active financial management tool. Logging expenses captures data, but reviewing that data transforms it into actionable insights. The question isn’t whether to review your spending, but when and how often to do so for maximum benefit.

The Three-Tier Review System

The most effective approach uses multiple review intervals, each serving a different purpose:

- Daily reviews (1-2 minutes): Quick check to verify all expenses are logged.

- Weekly reviews (10-15 minutes): Assess category spending and identify early patterns.

- Monthly reviews (30-45 minutes): Deep analysis and budget adjustments

Let’s explore each in detail.

Daily Reviews: Ensuring Data Accuracy

Daily reviews are less about analysis and more about quality control. Spend just a minute or two before bed scrolling through the day’s expenses, asking:

- Did I capture everything I spent today?

- Are all transactions categorized correctly?

- Do the amounts match my receipts or bank statement?

- Are there any duplicate entries?

This quick daily check catches errors while your memory is fresh. It’s far easier to remember that Tuesday morning coffee purchase on Tuesday evening than when reviewing the entire week on Sunday.

For people who use apps with automatic bank synchronization, daily reviews ensure the automation is working correctly and catch miscategorizations before they compound.

Best practices for daily reviews:

- Attach the review to an existing habit (while brushing teeth, during evening tea, after dinner)

- Keep it brief—2 minutes maximum

- Focus solely on completeness and accuracy, not analysis

- Use this time to add any missing notes or tags to transactions

Weekly Reviews: Spotting Trends and Course-Correcting

Weekly reviews are where expense tracking becomes genuinely powerful. This mid-cycle check-in allows you to track your spending patterns as they develop, creating opportunities for real-time adjustment rather than end-of-month discoveries.

During your weekly review, examine:

- Category progress: How much have you spent in each category compared to your budget? If you’ve spent $160 of a $200 dining budget by mid-month, you know to be more cautious the next two weeks.

- Unusual patterns: Are you spending more on transportation than normal? Has grocery spending spiked? Catching unusual patterns early helps you understand whether it’s a one-time variance or the start of a trend.

- Upcoming expenses: Review the week ahead for known expenses (bills due, planned purchases) and ensure they’ll fit within remaining budget allocations.

- Quick wins: Identify one small improvement you can make this week. Perhaps you’ll meal prep to avoid costly lunches, or cancel a subscription you’re not using.

Weekly review template:

- Open your tracking app and navigate to weekly summary (5-10 minutes)

- Review each major category’s spending versus the budget

- Identify your highest spending category this week

- Note any surprises or unexpected expenses

- Set one specific intention for the coming week

- Check for any subscriptions or recurring charges you can eliminate

Monthly Reviews: Deep Dives and Strategic Planning

The monthly review is your comprehensive financial check-up. This is when you take a step back from daily transactions to see the bigger picture and make strategic decisions.

Allocate 30-45 minutes for your monthly review, ideally within the first few days of the new month, while the previous month is fresh in your mind.

What to examine during monthly reviews:

- Overall spending versus income: Did you spend less than you earned? If not, what caused the deficit?

- Category-by-category analysis: Which categories stayed within budget? Which exceeded it? Why?

- Month-over-month trends: How does this month compare to previous months? Are you improving or backsliding?

- Largest expenses: What were your top 10 individual purchases this month? Were they necessary and valuable?

- Budget adjustments: Based on this month’s data, do you need to revise any budget categories up or down?

- Goal progress: If you’re tracking your spending toward specific financial goals (paying off debt, building savings), are you on track?

Monthly Review Checklist

| Review Item | Questions to Ask | Action Items |

|---|---|---|

| Total Spending | Did I spend more or less than I earned? | Adjust next month’s discretionary spending accordingly |

| Category Analysis | Which categories exceeded budget? Why? | Identify specific causes and preventive measures |

| Savings Rate | What percentage of my income did I save? | Set next month’s savings target |

| Waste Identification | What expenses delivered no real value? | Eliminate or reduce these categories |

| Unexpected Expenses | What surprise costs occurred? | Add a buffer to the budget or build an emergency fund |

| Budget Accuracy | Were my budget allocations realistic? | Adjust budgets to reflect reality |

| Next Month Planning | What known expenses are coming? | Set aside funds for upcoming bills or purchases |

The Power of Pattern Recognition

The real value of regular reviews emerges over time as you track your spending across months and even years. You’ll discover powerful patterns:

- Seasonal spending: You might notice that utility bills spike in summer and winter, entertainment spending increases during summer months, or holiday shopping creates December budget stress.

- Emotional spending triggers: Tracking and reviewing can reveal that you spend more when stressed, bored, or celebrating—awareness that helps you develop healthier coping mechanisms.

- Lifestyle inflation: Year-over-year reviews show whether your spending is increasing faster than your income, a warning sign of lifestyle creep.

- Success metrics: Comparing this quarter to last quarter shows tangible improvement, providing motivation to continue good habits.

Finding Your Review Rhythm

While the three-tier system works well for most people, customize it based on your needs:

- If you’re just starting, focus on weekly reviews for the first month. Daily might feel overwhelming, and monthly reviews aren’t yet valuable without several weeks of data.

- If you’re very busy, prioritize weekly reviews over daily ones. Missing a daily review matters less than missing weekly pattern detection.

- If you have irregular income, consider bi-weekly reviews aligned with your pay schedule rather than calendar months.

- If you’re paying off debt aggressively, weekly reviews keep you motivated by showing progress and preventing backsliding.

The key principle: Reviews must happen regularly enough to enable course correction but not so frequently that they become burdensome. When you track your spending consistently and review it thoughtfully, you transform raw data into financial wisdom—and financial wisdom into lasting wealth.

How do I stay consistent with expense tracking?

Consistency is the difference between expense tracking as a useful tool and expense tracking as abandoned data. Most people who fail at expense tracking don’t fail because they don’t understand how to do it—they fail because they don’t do it consistently enough for long enough to build the habit and see results.

The good news? Consistency is a skill you can develop through specific strategies, systems, and psychological approaches. Here’s how to make expense tracking a permanent part of your financial life.

Building Your Tracking Routine

Habits form through consistency of timing and context. Rather than relying on motivation or remembering to track your spending, build it into your existing daily rhythm.

The Trigger-Routine-Reward Loop

Habit researchers have identified that durable habits follow a simple pattern:

- Trigger: Something that prompts the behavior

- Routine: The behavior itself (tracking)

- Reward: Something positive that reinforces the behavior

For expense tracking, this might look like:

- Trigger: Getting into bed each evening

- Routine: Review the day’s expenses in your app (2 minutes)

- Routine: Check tomorrow’s calendar and budget

- Reward: The satisfaction of maintaining your streak, perhaps combined with a pleasant activity like listening to music

Habit Stacking

Link tracking to an established habit you already do consistently:

- “After I pour my morning coffee, I’ll review yesterday’s expenses.”

- “While waiting for my computer to boot up at work, I’ll log any cash expenses.”

- “During my commute home, I’ll add the day’s purchases to my app.”

The existing habit serves as a reliable trigger, dramatically increasing your consistency.

Using Technology to Enforce Consistency

Your phone itself can become your accountability partner through strategic use of notifications and automation.

Strategic reminders:

- Set a daily phone alarm for your designated tracking time

- Use location-based reminders (when you arrive home, your phone prompts you to log expenses)

- Enable app notifications for unusual spending or when you haven’t logged anything for 24 hours

Automation to reduce friction:

Choose tracking methods that require minimal effort:

- Apps that automatically import and categorize bank transactions

- Voice-to-text logging while driving: “Note: $45 gas station.”

- Quick-add widgets on your home screen for one-tap expense entry

- Digital receipt forwarding to apps that auto-extract amounts

The less effort required to track your spending, the more likely you’ll maintain the habit even on difficult days.

The Power of Streaks and Gamification

Human psychology responds powerfully to visible progress. Leverage this by tracking your tracking:

Many apps include streak counters showing consecutive days of logging. Watching that number climb—3 days, 10 days, 30 days, 100 days—creates intrinsic motivation to continue. Breaking a 47-day streak feels genuinely disappointing, which paradoxically keeps you going.

Create external streak tracking if your app doesn’t:

- Mark calendar days when you successfully logged all expenses

- Use a habit tracking app alongside your expense tracker

- Share your tracking streak on social media for social accountability

- Reward yourself for milestone achievements (30 days, 90 days, 180 days)

Starting Small and Building Gradually

One of the biggest consistency killers is overcommitment. People decide to track every penny, categorize in minute detail, and review spending daily—all at once. This comprehensive approach feels overwhelming within days.

Instead, build gradually:

- Week 1-2: Focus solely on logging expenses, no categorization needed

- Week 3-4: Add basic categorization (Food, Transport, Shopping, Other)

- Week 5-6: Implement weekly reviews

- Week 7-8: Set budget targets for your largest categories

This progressive approach builds competence and confidence gradually. By week eight, you’re doing everything a sophisticated tracker does, but you built toward it rather than burning out trying to do it all from day one.

Recovering from Lapses

You will miss days. This is certain. Life gets chaotic, you get sick, you travel, you simply forget. The key to long-term consistency isn’t preventing these lapses—it’s recovering from them effectively.

The 48-Hour Recovery Rule:

If you realize you forgot to track your spending yesterday, you have 48 hours to do a catch-up entry before it becomes a pattern break rather than a simple lapse. Pull up your bank statement, review yesterday’s receipts, estimate cash purchases, and get back on track.

Never let a single missed day become a missed week. The biggest threat to consistency isn’t forgetting once—it’s the psychological spiral: “I missed yesterday, so I’ve already failed, so there’s no point catching up, so I might as well quit.”

Reframe lapses as normal occurrences rather than failures. Even tracking 80% of days is vastly better than the 0% you had before starting.

Simplicity as a Consistency Strategy

The simpler your system, the more likely you’ll stick with it. Complexity is the enemy of consistency.

Signs your system is too complex:

- Deciding which category takes more than 3 seconds

- You have more than 15 categories

- Each entry requires multiple fields of data

- You dread your review sessions

- The thought of tracking makes you anxious

Simplified alternatives:

- Reduce to 8-10 broad categories maximum

- Track only amounts above $5 (let the small stuff go)

- Use rough estimates rather than exact amounts for cash

- Focus on consistency over precision—80% accurate data you actually collect beats 100% accurate data you don’t

Accountability and Social Support

Consistency increases when others know about your commitment. Consider:

- Tracking together: Find a friend or partner also committed to expense tracking. Share weekly summaries, challenges, and successes. Even a simple weekly text—”Week 12, still tracking!”—creates powerful accountability.

- Public commitment: Tell people about your goal. Post about it on social media. The social pressure to follow through enhances consistency.

- Financial goals community: Join online communities focused on budgeting and expense tracking. Reddit’s r/personalfinance, YNAB’s forums, or similar communities provide support and inspiration.

Keeping the “Why” Visible

Motivation fades, but purpose endures. When tracking feels tedious—and it will sometimes—reconnecting with your deeper reasons sustains consistency.

Write down why you started tracking your spending:

- “To stop feeling anxious about money.”

- “To save $10,000 for a home down payment.”

- “To eliminate credit card debt once and for all.”

- “To feel in control of my financial life.”

- “To model good financial habits for my kids.”

Keep this statement visible: in your tracking app notes, as your phone wallpaper, or on a sticky note on your bathroom mirror. When motivation wanes, your purpose remains.

The 90-Day Commitment

Behavioral research suggests it takes about 66 days for behaviors to become automatic. Commit to tracking your spending perfectly for 90 days—roughly three months. Mark the date on your calendar.

During these 90 days:

- Track every single day without exception

- Use all the consistency strategies above

- Build the muscle memory that makes tracking automatic

- Experience enough complete months to see patterns and results

After 90 days, expense tracking likely won’t require significant willpower—it will simply be something you do, like brushing your teeth or checking email. The behavior becomes embedded in your identity: you’re a person who tracks spending.

This is the transformation that creates lasting financial change. Consistency isn’t about perfection; it’s about showing up regularly enough and long enough that tracking becomes part of who you are rather than something you force yourself to do.

What mistakes do beginners make when tracking spending?

Learning from others’ mistakes is faster than making them all yourself. While everyone’s expense tracking journey is unique, beginners consistently stumble over the same predictable obstacles. Recognizing and avoiding these common pitfalls dramatically increases your chances of building a sustainable tracking practice.

Mistake #1: Overcomplicating the System

- The error: Creating elaborate tracking systems with 30+ categories, subcategories, tags, notes fields, and multiple tracking methods simultaneously.

- Why it fails: Decision fatigue sets in immediately. “Is this smoothie Health & Wellness, Food, or Breakfast?” Spending more time tracking than the purchases took drains motivation fast.

- The solution: Start with 8-10 broad categories maximum. You can always subdivide later if needed, but beginning simple keeps friction low. When you track your spending in just Food, Housing, Transport, Shopping, and Entertainment, categorization takes 2 seconds instead of 20.

- Real example: Sarah started with 35 categories, including separate tracking for “Coffee Shop,” “Fast Food,” “Casual Dining,” and “Fine Dining.” By day four, she was exhausted by constant categorization decisions. She simplified to just “Food – Groceries” and “Food – Dining Out” and has now tracked consistently for 14 months.

Mistake #2: Forgetting Small Cash Purchases

- The error: Diligently logging all card purchases while letting cash transactions go unrecorded, especially small amounts under $5.

- Why it fails: Small cash purchases add up astonishingly fast. That daily $3.50 coffee is $105 monthly. The $2 parking meters total $40. Untracked cash can represent 15-30% of total spending, creating a meaningless gap in your data.

- The solution: Make cash transactions a priority, not an afterthought. Log them immediately or keep all cash receipts in a dedicated pocket for end-of-day entry. If exact amounts are difficult to remember, estimate conservatively high—better to slightly overestimate than ignore cash entirely.

- Real example: Marcus wondered why his tracked spending never matched his bank account changes until he realized his $200 weekly ATM withdrawals were completely unaccounted for. He was spending $800 monthly in untracked cash, mostly on lunches and convenience store purchases.

Mistake #3: Not Reviewing the Data

- The error: Faithfully tracking your spending every day but never actually looking at the accumulated data, running reports, or analyzing patterns.

- Why it fails: Tracking without reviewing is like weighing yourself without looking at the scale—you’re going through the motions but not gaining the insights that drive change. The value of expense tracking comes from the analysis, not the data entry.

- The solution: Schedule weekly 10-minute and monthly 30-minute review sessions. Put them in your calendar like appointments. During reviews, look for your highest spending categories, compare to previous periods, and identify one actionable improvement.

- Real example: Elena tracked meticulously for six months but never reviewed her data. When she finally ran a report, she discovered she’d been paying for three streaming services she never used, spending $450 monthly on dining out, and that her actual housing costs were 45% of income, far above recommended levels. Six months of tracking with no action because she never reviewed.

Mistake #4: Abandoning After Missing a Few Days

- The error: Missing 2-3 days of tracking and concluding “I’ve already failed” or “I’ve ruined my data,” then abandoning the practice entirely rather than simply catching up.

- Why it fails: All-or-nothing thinking kills habits. No one is perfect, and expecting perfection guarantees eventual failure and abandonment.

- The solution: Treat lapses as normal and recoverable. If you miss tracking, do a quick catch-up session using your bank statement and receipts, estimate what you can’t remember, and continue. Even incomplete data is infinitely more valuable than no data.

- Real example: David abandoned his first three attempts at expense tracking, each time quitting after missing a few days. On his fourth attempt, he adopted the “never miss twice” rule—missing one day was fine, but he never allowed himself to miss two consecutive days. He’s now tracked consistently for two years despite dozens of single-day lapses.

Mistake #5: Choosing the Wrong Tool

- The error: Selecting a tracking tool based on features, reviews, or recommendations rather than what actually fits your personal habits and preferences.

- Why it fails: The “best” app is worthless if you won’t use it. A simple notes app you’ll actually use beats a sophisticated finance tool you’ll abandon.

- The solution: Try 2-3 different approaches (app-based, manual, spreadsheet) for one week each. Choose the method that feels most natural and requires the least willpower. Your tracking tool should fit your life, not force you to adapt to it.

- Real example: Lisa spent hours researching the “perfect” expense tracking app, finally choosing one with robust features and great reviews. She hated the interface and abandoned it within weeks. She switched to simply photographing receipts and manually entering them into Google Sheets weekly—less sophisticated but sustainable for her.

Mistake #6: Obsessing Over Precision

- The error: Spending 5 minutes deciding whether to categorize a purchase as $12.47 or $12.48, or agonizing over whether shared dinner expenses should be logged in your account or your partner’s.

- Why it fails: Perfectionism creates paralysis. When tracking becomes stressful or time-consuming, it doesn’t last.

- The solution: Accept that approximate data is better than no data. If you’re 80-90% accurate, you’ll still gain valuable insights. Round to the nearest dollar for small purchases. Use rough estimates for split expenses. Focus on patterns, not perfection.

- Real example: Thomas would spend 20 minutes each evening perfectly categorizing every transaction, splitting shared expenses to the penny, and adding detailed notes. The process became so burdensome he quit within a month. When he restarted with a “good enough” mindset, he could review and categorize a full week’s expenses in 15 minutes.

Mistake #7: Not Adjusting Budgets to Reality

- The error: Creating an idealistic budget without first tracking actual spending, then repeatedly failing to stay within unrealistic allocations and feeling like a failure.

- Why it fails: Budgets based on wishes rather than reality are doomed. If you actually spend $400 on groceries but budget $250, you’ll exceed that budget every single month and feel perpetually unsuccessful.

- The solution: Track your spending for at least 30 days before creating budgets. Use that data as your baseline. Then make incremental reductions where reasonable, not dramatic cuts that aren’t sustainable.

- Real example: Amanda created a “perfect” budget allocating $1,800 monthly for all expenses. Her actual spending was $2,600. For six months, she “failed” every month, feeling terrible about her finances. When she finally created a realistic $2,400 budget based on tracked data, she successfully stayed within it and gradually reduced from there.

Common Mistakes vs. Solutions

| Mistake | Impact | Solution | Timeline to Fix |

|---|---|---|---|

| Overcomplicated system | Abandonment within 1-2 weeks | Simplify to 8-10 categories | Immediate |

| Forgetting cash | 15-30% of spending is untracked | Log immediately or keep receipts | 1-2 weeks to habit |

| Not reviewing data | Zero actionable insights | Schedule weekly/monthly reviews | Ongoing practice |

| Quitting after lapses | Never build a lasting habit | Expect and recover from gaps | Mindset shift |

| Wrong tool choice | Daily friction and frustration | Test multiple methods first | 2-3 weeks trial |

| Excessive precision | Burnout and abandonment | Accept 80-90% accuracy | Immediate |

| Unrealistic budgets | Constant “failure” feelings | Track first, budget second | 30-60 days |

How to Avoid These Mistakes and Stay Motivated

- Start with a pilot program: Commit to just 30 days of simple tracking using one method and minimal categories. Evaluate what worked and what didn’t. Adjust and continue.

- Celebrate small wins: Each week you track consistently is an achievement. Acknowledge your progress, not just your ultimate goal.

- Find your “why”: Connect tracking to a meaningful goal—eliminating debt, buying a home, achieving financial security. When motivation wanes, your purpose keeps you going.

- Join a community: Online forums and groups provide support, answer questions, and remind you that everyone struggles with the same challenges.

- Forgive yourself: Mistakes are part of learning. The goal isn’t perfection; it’s progress. When you make one of these mistakes—and you will—simply adjust and continue. Every expert tracker has made all of these errors at some point.

- Remember the transformation timeline: Most people see meaningful results after 3-6 months of consistent tracking. That’s when patterns become clear, waste gets eliminated, and conscious spending becomes automatic. The beginners’ mistakes happen in weeks 1-8. Push through this initial period, and tracking your spending becomes dramatically easier and more rewarding.

Can phone-based tracking improve savings over time?

The connection between tracking and saving isn’t theoretical—it’s mathematical. When you track your spending consistently on your phone, you inevitably save more money. This isn’t about willpower or discipline; it’s about visibility creating awareness, awareness driving behavioral change, and behavioral change producing measurable financial results.

The Data Behind Tracking and Savings

Research and real-world experience consistently demonstrate the savings impact of expense tracking:

- Study findings: A University of Pennsylvania study found that people who tracked spending reduced expenses by an average of 15-20% within the first year, without making any other changes to their financial behavior. Simply observing their spending patterns led to more conscious choices.

- Consumer financial data: Surveys of expense-tracking app users reveal that 68% report saving more money within three months of starting to track consistently. The average reported increase in monthly savings is $312.

- Compound effect: Even modest reductions compound dramatically. Cutting spending by just $200 monthly and investing that amount at 7% annual return yields over $130,000 in 20 years.

How Tracking Creates Savings: The Mechanisms

Visibility eliminates waste: When you track your spending and review the data, you discover waste you didn’t know existed. That $87 in monthly subscriptions you forgot about. The $140 coffee shop habit. The $65 in ATM fees and late charges. These “invisible” expenses become glaringly obvious when tracked.

- Awareness prompts questions: Recording a $45 restaurant meal forces you to ask: “Was this worth it? Do I want to spend this way?” You start evaluating purchases against your values and priorities rather than making unconscious spending decisions.

- Categorization reveals patterns: When you track your spending in categories and see that dining out consumed 22% of your income last month, you’re confronted with a choice: Is this category worth more than one-fifth of your earnings? Often the answer is no, prompting voluntary reduction.

- Accountability changes behavior: The simple act of knowing you’ll have to log a purchase creates a pause—a moment to decide whether you really want to make it. Studies show this “logging effect” reduces impulse purchases by 10-15%.

Real-World Examples of Tracking-Driven Savings

Case Study 1: The Subscription Revelation

Jennifer, a 34-year-old marketing manager, started tracking her spending in March 2024. During her first monthly review, she discovered she was paying for:

- Two streaming services she used regularly ($28)

- One streaming service she hadn’t opened in months ($15)

- A meal kit subscription she’d meant to cancel ($120)

- A premium app subscription she’d forgotten about ($10)

- A gym membership she visited twice monthly ($45)

Total monthly waste identified: $218

She canceled the unused streaming service, meal kit, and app subscription, switched to a pay-per-visit gym option, and redirected $180 monthly to savings. Annual impact: $2,160 saved

After two years of tracking, Jennifer has eliminated $4,320 in wasteful spending and built a robust emergency fund she never had before.

Case Study 2: The Coffee Shop Awakening

Marcus tracked his spending religiously for 90 days and was shocked to discover he’d spent $387 on coffee shops—mostly morning lattes at $4.75 each.

He didn’t quit coffee entirely but made a strategic change: invested $120 in a quality home espresso machine and premium coffee beans. His monthly coffee expense dropped to $85 while maintaining quality.

Monthly savings: $302 First-year savings (minus equipment): $3,504

Marcus used these savings to pay off a credit card balance, eliminating $480 annually in interest charges—a compounding benefit of the initial tracking insight.

Case Study 3: The Dining Out Reality Check

The Patterson family began tracking their spending after feeling perpetually broke despite decent income. Their monthly review revealed stunning numbers:

- Restaurant dinners: $425

- Lunch takeout during work: $340

- Weekend breakfast cafes: $160

- Food delivery fees: $85

- Total dining out: $1,010 monthly

Meanwhile, their grocery spending was just $380. They were spending nearly three times more eating out than cooking at home.

The family didn’t eliminate dining out but made it intentional rather than default. They committed to cooking five nights weekly and packing lunches four days weekly.

New dining out spending: $425 monthly (58% reduction) Monthly savings redirected to children’s college fund: $585 Projected 18-year value at 6% return: $246,000

Tracking-Based Savings Strategies

- The 30-day challenge: After tracking for a month, identify your highest discretionary spending category. Challenge yourself to reduce it by 25% the following month while tracking continuously. Most people discover this reduction is easier than expected once they’re aware of the target.

- The small-expense elimination: Review your tracked expenses and identify 3-5 small recurring expenses under $20 each that deliver minimal value. Cancel them. These “death by a thousand cuts” expenses often total $50-150 monthly—$600-1,800 annually.

- The conscious upgrade swap: Use tracking data to identify an expensive convenience (like food delivery or takeout lunches). Invest in an alternative that reduces long-term costs (quality cookware, meal prep containers, coffee maker). Calculate the break-even point and watch savings accumulate.

- The comparison shop strategy: Track your spending on recurring purchases (groceries, gas, phone service). Spend time finding cheaper alternatives. Shopping at a different grocery store might save $60 monthly ($720 annually). Switching cell phone plans might save $35 monthly ($420 annually).

Setting Goals and Measuring Progress

Your tracking app becomes a motivational tool when you set specific savings targets and monitor progress:

Short-term goals (1-3 months):

- Reduce dining out by $200 monthly

- Eliminate three unused subscriptions

- Cut transportation costs by 15%

Medium-term goals (3-12 months):

- Build a $1,000 emergency fund

- Pay off one credit card

- Save $2,000 for vacation

Long-term goals (1-5+ years):

- Achieve 15% savings rate

- Build a 6-month emergency fund

- Save down payment for home

Many expense-tracking apps include goal-tracking features. Set a savings goal, and the app shows progress with each reduction in spending. This gamification makes the process engaging rather than restrictive.

The Compound Effect Over Years

Perhaps the most powerful aspect of phone-based expense tracking is the long-term compound effect on savings:

| Tracking Duration | Typical Savings Rate Improvement | Example Monthly Savings Increase | 10-Year Value at 7% |

|---|---|---|---|

| First 3 months | 5-10% | $150 | $26,000 |

| 6 months | 10-15% | $300 | $52,000 |

| 1 year | 15-20% | $450 | $78,000 |

| 2+ years | 20-25% | $600 | $104,000 |

These numbers assume moderate income and demonstrate how tracking your spending doesn’t just create immediate savings—it fundamentally reshapes your financial trajectory. The person who tracks diligently for years doesn’t just have more money; they develop a completely different relationship with spending and saving.

Beyond Dollar Savings: Psychological Benefits

- Financial stress reduction: Knowing exactly where your money goes eliminates the anxiety of wondering. You’re in control rather than feeling controlled by money.

- Decision confidence: Tracking provides data to support financial decisions. Should you take that vacation? Your spending data shows you’ve saved enough and can afford it without guilt or worry.

- Goal achievement satisfaction: Few things feel better than tracking your progress toward a meaningful goal and watching the numbers move in your favor month after month.

- Habit and identity shift: Over time, tracking your spending changes who you are. You become a person who makes intentional financial choices, plans ahead, and builds wealth—not through dramatic sacrifice, but through awareness and small, consistent improvements.

The bottom line

Can phone-based tracking improve savings over time? Not only can it—it reliably does for anyone who commits to the practice for more than a few months. The phone in your pocket isn’t just a tracking device; it’s a wealth-building tool that, when used consistently, can transform your financial future one logged transaction at a time.

Conclusion

Your journey to financial awareness starts with a single logged expense. Throughout this guide, we’ve explored how tracking your spending using just your phone can transform your financial life—from revealing wasteful patterns to enabling realistic budgets, from reducing stress to building substantial savings.

The beauty of phone-based expense tracking lies in its simplicity and accessibility. You don’t need specialized equipment, expensive software, or financial expertise. The device already in your pocket contains everything necessary to gain unprecedented insight into your spending patterns and take control of your financial future.

Key Takeaways

When you track your spending consistently on your phone, you gain:

Visibility: Clear understanding of where every dollar goes, eliminating the mystery of disappearing paychecks

Control: The power to make conscious spending decisions rather than unconscious ones

Savings: Real, measurable reductions in wasteful expenses—typically 15-20% within the first year

Peace of mind: Reduced financial anxiety through data-driven confidence

Goal achievement: A clear path from current reality to future financial objectives

Start Simple, Build Momentum

Remember, the best tracking system is the one you’ll actually use. Don’t wait for the perfect app, the ideal method, or the right moment. Start today with whatever tool feels most natural:

- Open your phone’s notes app and log today’s expenses

- Download a free tracking app like Mint or Money Manager and connect your bank

- Create a simple spreadsheet with columns for date, amount, and category

- Take photos of receipts throughout the day as a first step toward awareness

Begin with just one week of consistent tracking. Don’t worry about categories, budgets, or complex analysis—simply capture your spending. After that first week, you’ll have more insight into your finances than most people gain in years.

Building the Habit

As you move forward, remember the principles that create lasting success:

Consistency trumps perfection: Tracking 80% of expenses every day beats tracking 100% of expenses occasionally

Simplicity sustains: Start with minimal categories and basic methods, adding complexity only when simple systems feel effortless

Review drives results: Tracking without reviewing is like collecting data without reading it—schedule weekly and monthly check-ins

Recovery is normal: Everyone misses days; the key is getting back on track immediately rather than abandoning the practice

Progress, not perfection: Celebrate improvements, not flawlessness

The Call to Action: Start Today

Financial transformation doesn’t require dramatic life changes or painful sacrifice. It begins with a simple commitment: track your spending for the next 30 days.

Choose your method right now:

- Pick an app to download (or decide to use your phone’s built-in tools)

- Log today’s expenses—everything you’ve spent so far

- Set a daily reminder for your chosen tracking time

- Mark your calendar for weekly and monthly reviews

That’s it. These four steps, executed today, can be the beginning of a financial awakening that changes your life. Thirty days from now, you’ll have insights about the spending you’ve never had before. Ninety days from now, tracking will feel automatic. A year from now, you’ll likely have saved thousands of dollars and built financial habits that compound for decades.

Your financial future isn’t determined by how much you earn—it’s determined by how consciously you spend. The tool to unlock that consciousness is already in your hand. All that remains is the decision to use it.

Start tracking your spending today. Your future self will thank you.

FAQs

Q: What are the best free apps to track spending?

- Popular free apps include Mint, Goodbudget, Wallet, and Money Manager. They help automate tracking, categorize spending, and provide budgeting insights.

Q: How do I track cash expenses on my phone?

- You can use a notes app, spreadsheet, or even expense tracker apps to log cash transactions daily, making sure nothing is forgotten.

Q: How often should I review my spending data?

- Reviewing weekly helps spot patterns and adjust your budget, while monthly reviews give a big-picture overview of your finances.

Q: Can tracking spending on my phone really improve savings?

- Absolutely. By tracking expenses consistently, you can identify unnecessary spending, set realistic budgets, and gradually increase your savings.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.