Introduction: Why Minimum Balance Rules Matter

Minimum balance rules are one of the most misunderstood aspects of U.S. savings accounts. Many consumers open a savings account expecting it to be fee-free, only to later discover monthly charges or reduced interest because their balance fell below a required threshold. These rules are not arbitrary. Banks use minimum balance requirements to manage operating costs, profitability, and customer behavior.

Understanding how minimum balance rules work helps you avoid unnecessary fees, protect your interest earnings, and choose the right savings account for your financial habits. In this article, we break down how U.S. banks calculate minimum balances, what happens when you fall below them, how they affect interest, and practical ways to avoid penalties altogether.

What Is a Minimum Balance in a U.S. Savings Account?

A minimum balance is the lowest amount of money you must maintain in your savings account to avoid fees or qualify for certain benefits, such as earning interest or receiving a higher APY.

In the U.S., minimum balance rules typically serve one or more of the following purposes:

-

Waiving monthly maintenance fees

-

Qualifying for interest earnings

-

Unlocking higher interest rate tiers

-

Maintaining account eligibility

It is important to distinguish between:

-

Opening deposit: The amount required to open the account

-

Minimum balance requirement: The balance you must maintain on an ongoing basis

Many traditional banks impose minimum balance requirements, while online banks often eliminate them entirely.

How Banks Calculate Minimum Balance Requirements

U.S. banks use specific calculation methods to determine whether you meet minimum balance rules. The method used directly affects how easy or difficult it is to stay compliant.

Common Minimum Balance Calculation Methods

| Calculation Method | How It Works | Commonly Used By |

|---|---|---|

| End-of-Day Balance | Balance must stay above the minimum at the close of each business day | Traditional banks |

| Average Daily Balance (ADB) | Average of daily ending balances over a month | Most U.S. banks |

| Monthly Average Balance | Average balance over the full statement cycle | Relationship accounts |

| Minimum Daily Balance | Balance must never drop below a set amount | Older account structures |

Why Average Daily Balance Is Most Common

Average Daily Balance is widely used because it smooths out short-term fluctuations. If your balance dips briefly but remains healthy most of the month, you may still meet minimum balance rules.

Example (conceptual):

-

Higher balances early in the month can offset lower balances later

-

Frequent small withdrawals matter less than prolonged low balances

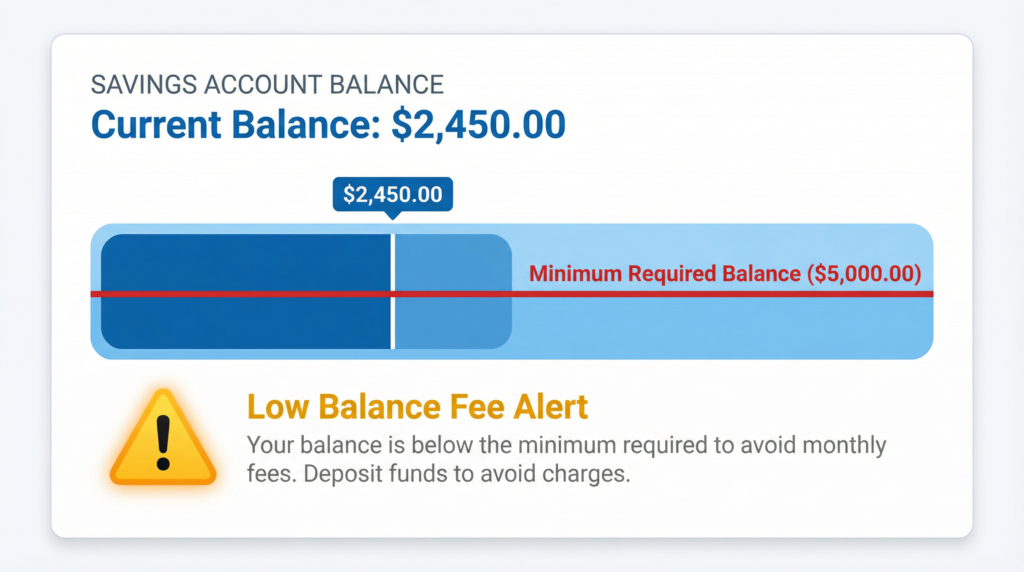

What Happens If You Fall Below the Minimum Balance?

Failing to meet minimum balance rules usually triggers financial consequences, most commonly monthly maintenance fees.

Typical Penalties for Falling Below the Minimum

| Consequence | Description |

|---|---|

| Monthly Maintenance Fee | Charged once per statement cycle |

| Reduced Interest Earnings | Interest may be lowered or eliminated |

| Tier Downgrade | Balance drops to a lower APY tier |

| Compounding Fee Impact | Fees reduce future interest potential |

Fees often range from $5 to $25 per month, depending on the bank and account type.

Over time, repeated fees can significantly erode savings, especially in low-balance accounts.

How Minimum Balance Rules Affect Savings Account Interest

Minimum balance rules are closely tied to how interest is earned in savings accounts. Many banks require customers to maintain a certain balance to earn interest at all.

Common Interest-Related Rules

-

Interest is only earned if the balance stays above the minimum

-

Higher balances unlock higher APYs

-

Falling below the minimum may reset interest to zero for the month

Balance Tier Example

| Balance Tier | APY Offered |

|---|---|

| Below $500 | 0.01% |

| $500–$4,999 | 0.50% |

| $5,000+ | 1.25% |

High-yield savings accounts often eliminate minimum balance rules but may still use balance tiers to differentiate rates.

Special Scenarios and Exceptions

Certain situations modify or temporarily waive minimum balance rules.

Common Exceptions in the U.S.

-

New accounts: Grace periods of 30–90 days

-

Student or youth accounts: Lower or zero minimums

-

Senior accounts: Fee waivers or reduced thresholds

-

Relationship accounts: Waivers when combined balances meet a requirement

-

Dormant accounts: Fees may still apply despite inactivity

Closing an account mid-cycle can also trigger fees if minimum balance rules were not met earlier in the month.

How Banks Decide Minimum Balance Amounts

Banks do not choose minimum balance requirements randomly. These thresholds are carefully designed based on internal economics.

Key Factors Banks Consider

-

Cost of servicing low-balance accounts

-

Expected customer transaction volume

-

Deposit profitability and liquidity needs

-

Competitive positioning in the market

Traditional banks often set higher minimums to offset branch and staffing costs. Online banks, with lower overhead, can afford to remove minimum balance rules entirely.

U.S. Regulations Governing Minimum Balance Rules

Minimum balance rules in the U.S. are regulated primarily under the Truth in Savings Act (Regulation DD).

What Banks Are Required to Disclose

-

Minimum balance requirements

-

Fee amounts and frequency

-

How balances are calculated

-

Conditions for waiving fees

Banks must clearly disclose these terms in account agreements and notify customers before making changes.

If disclosures are misleading or incomplete, consumers may have grounds for complaints or refunds.

How Consumers Can Avoid Minimum Balance Fees

Avoiding minimum balance rules is often easier than expected with the right strategies.

Practical Ways to Avoid Fees

| Strategy | Why It Works |

|---|---|

| Choose no-minimum accounts | Eliminates balance risk |

| Use balance alerts | Prevents accidental dips |

| Automate transfers | Keeps the balances stable |

| Bundle accounts | Qualifies for relationship waivers |

| Switch to online banks | Lower fees and fewer restrictions |

Monitoring balances weekly rather than monthly is often enough to stay compliant.

Conclusion: Key Takeaways on Minimum Balance Rules

Minimum balance rules exist to protect bank profitability, not to confuse consumers. In U.S. savings accounts, these rules determine whether you pay fees, earn interest, or qualify for higher APYs. By understanding how balances are calculated, how penalties are applied, and what exceptions exist, you can avoid unnecessary charges and maximize your savings.

Choosing the right account—and actively managing your balance—can make minimum balance rules irrelevant to your financial life.

Also Read – How Banks Calculate Average Monthly Balance Internally

FAQs

Q. What are the minimum balance rules in U.S. savings accounts?

- Minimum balance rules require account holders to maintain a certain balance in their savings account to avoid monthly fees or qualify for interest earnings. U.S. banks use these rules to manage account servicing costs and deposit profitability.

Q. How do banks calculate whether I meet the minimum balance requirement?

- Most U.S. banks use the average daily balance method, which calculates the average of your account’s ending balance each day over the statement period. Some banks may instead use an end-of-day or monthly average balance method.

Q. What happens if my savings account balance falls below the minimum?

- If your balance falls below the required minimum, the bank may charge a monthly maintenance fee, reduce or eliminate interest earnings, or move your account to a lower interest tier for that statement cycle.

Q. Do all savings accounts in the U.S. have minimum balance rules?

- No. Many online and high-yield savings accounts have no minimum balance requirements, while traditional brick-and-mortar banks are more likely to impose minimums to offset higher operating costs.

Q. How can I avoid minimum balance fees on my savings account?

- You can avoid fees by choosing no-minimum savings accounts, setting up automatic transfers, monitoring balances with alerts, or qualifying for relationship-based fee waivers through linked accounts or combined balances.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.