Introduction: Why Savings Account Rates Are Not Random

Many Americans believe that savings account interest rates are simply arbitrary numbers banks post on their websites, or worse, that all banks pay roughly the same rates. Neither assumption is correct. In reality, the interest rate you earn on your savings account is the result of a complex decision-making process that balances multiple economic factors, competitive pressures, and regulatory requirements.

U.S. savings account rates change frequently—sometimes monthly, sometimes even weekly—because they respond to shifts in the broader economy, Federal Reserve policy, and each bank’s individual business needs. Unlike fixed-rate products such as certificates of deposit (CDs), most savings accounts offer variable rates that banks can adjust at their discretion. Understanding the difference between what the Federal Reserve controls and what individual banks decide is crucial for anyone looking to maximize their savings.

This article breaks down exactly how banks determine savings account interest rates, from macroeconomic influences to product-level pricing strategies. You’ll learn why rates vary so dramatically between institutions, when banks typically make changes, and what these decisions mean for your money.

The Foundation: Federal Reserve Influence on Savings Rates

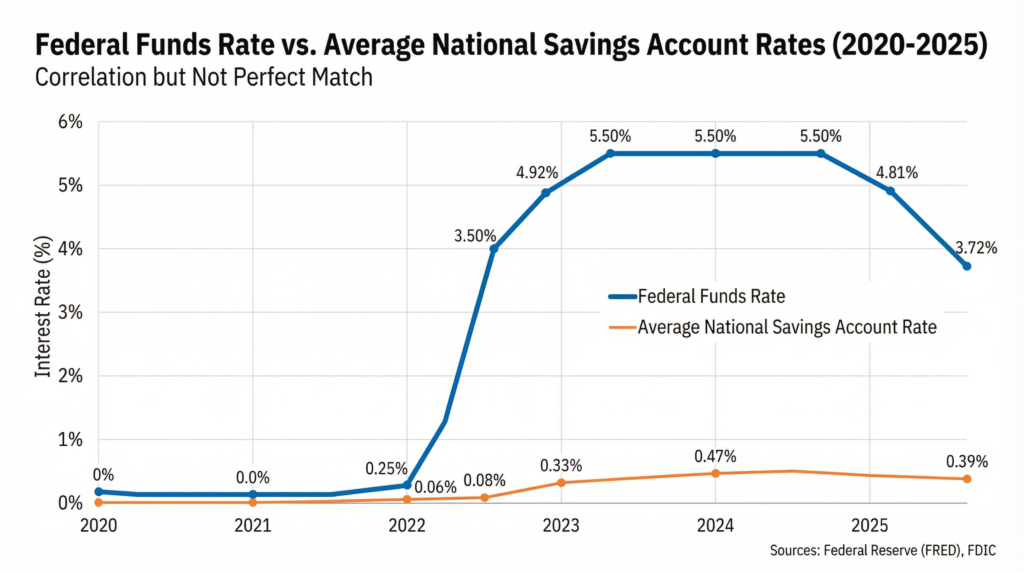

The starting point for understanding savings account interest rates is the federal funds rate—the interest rate at which banks lend money to each other overnight. Set by the Federal Reserve, this benchmark rate doesn’t directly determine what your savings account pays, but it establishes the economic environment in which all banks operate.

When the Federal Reserve raises the federal funds rate, it becomes more expensive for banks to borrow money. This higher cost of borrowing typically flows through to consumers in two ways: loan rates increase, and deposit rates (including savings account interest rates) also tend to rise because banks need to attract deposits to fund their lending activities. Conversely, when the Fed cuts rates, banks face lower funding costs and generally reduce the interest they offer on deposits.

However, savings account interest rates don’t move in lockstep with Fed decisions. There’s often a time lag between when the Federal Reserve announces a rate change and when individual banks adjust their savings rates. This delay can range from a few days to several weeks, depending on each bank’s funding needs and competitive strategy. Some banks respond immediately to Fed rate hikes by raising their savings rates, while others wait to see what competitors do first.

Why do banks respond differently to the same Fed move? The answer lies in their individual circumstances. A bank with strong loan demand and insufficient deposits might raise savings account interest rates aggressively after a Fed hike to attract more funds. Meanwhile, a bank flush with deposits might raise rates only modestly, or not at all. This variation explains why you’ll find such wide disparities in savings rates across different institutions, even when the Fed’s policy direction is clear.

The relationship between the federal funds rate and savings account interest rates is therefore influential but not deterministic. The Fed sets the boundaries, but individual banks make the final pricing decisions based on their unique strategic considerations.

Bank Funding Costs and Liquidity Needs

To understand why banks set particular savings account interest rates, you need to grasp how they think about deposits. For banks, your savings account represents a source of funding—money they can use to make loans, invest in securities, or meet regulatory requirements. This funding comes at a cost, which bankers refer to as the “cost of funds.”

Banks have multiple ways to raise money beyond customer deposits. They can borrow from other banks in the wholesale funding markets, issue bonds, or tap Federal Reserve lending facilities. Each funding source has a different cost, and banks constantly evaluate which option provides the best value. When wholesale funding becomes expensive, banks typically increase savings account interest rates to make deposits more attractive relative to other funding sources. When wholesale funding is cheap, there’s less incentive to compete aggressively for deposits.

Liquidity needs drive much of this decision-making. When a bank has robust loan demand—perhaps because mortgage applications are surging or businesses are seeking credit—it needs more deposits to fund those loans. In this scenario, the bank might raise its savings account interest rates to pull in additional funds quickly. Think of it as supply and demand: high demand for loans creates high demand for deposits, which pushes deposit rates upward.

The opposite scenario also occurs. When banks are sitting on excess liquidity—more deposits than they can profitably lend out—they have little reason to offer competitive savings account interest rates. In fact, some banks in this position intentionally keep rates low to discourage new deposits. This counterintuitive strategy makes economic sense: why pay for deposits you don’t need and can’t productively use?

The relationship between loan demand and deposit pricing is particularly important during economic transitions. During periods of economic expansion, loan demand typically increases, putting upward pressure on savings account interest rates. During recessions or slowdowns, loan demand weakens, and banks become less aggressive in their deposit pricing.

Competition and Market Positioning

Not all banks compete for deposits in the same way, which explains the vast differences in savings account interest rates across the industry. Traditional brick-and-mortar banks with extensive branch networks often pay significantly lower rates than online-only banks or digital neobanks. This disparity reflects different business models and cost structures.

Online banks typically offer higher APYs (annual percentage yields) because they have lower overhead costs—no expensive branch real estate, smaller staff, and streamlined operations. These savings allow them to pass higher interest rates to customers. Digital banks also use competitive savings account interest rates as their primary customer acquisition tool, since they can’t rely on convenient physical locations to attract depositors.

Banks benchmark their rates against competitors, but which competitors they track depends on their market positioning. A community bank in Ohio might monitor rates from other regional institutions and perhaps a few national brands, but won’t necessarily match the highest rates offered by online-only banks. They’re competing for customers who value branch access and personal relationships over maximum interest earnings.

Geographic markets still matter, even in the digital age. Local competitive dynamics influence rate decisions, particularly for banks that draw most deposits from a specific region. A bank with a strong market share in a particular metro area might maintain lower savings account interest rates than a competitor trying to break into that market.

Promotional and teaser rates serve as powerful competitive weapons. Many banks offer elevated rates for new customers or for a limited time period, then reduce rates after the promotional window closes. These tactics help banks attract deposits during specific periods when they need funding, without committing to higher rates indefinitely. Rate shoppers who move money to capture these promotional offers can significantly impact how aggressively banks price their standard savings products.

Risk Management and Profitability Constraints

Banks would love to offer the highest savings account interest rates in the market to attract maximum deposits, but profitability constraints prevent this. The key metric is net interest margin (NIM)—the difference between what banks earn on loans and investments and what they pay on deposits and other funding sources.

When banks pay higher interest on savings accounts, they squeeze their net interest margin unless they can simultaneously charge more for loans. However, loan pricing faces its own competitive pressures. If a bank raises its mortgage rates too high, borrowers will go elsewhere. This creates a balancing act: banks must price deposits competitively enough to attract funding while maintaining sufficient spread to remain profitable.

Interest rate risk further complicates these decisions. Most savings accounts have variable rates that banks can adjust, but many loans (especially mortgages) have fixed rates. When banks raise savings account interest rates aggressively, they increase their interest expense immediately, but if their loan portfolio is locked into lower fixed rates, they can’t increase revenue to match. This mismatch can damage profitability and even threaten a bank’s financial stability if managed poorly.

Regulatory capital requirements also affect rate-setting decisions. Banks must maintain certain capital ratios relative to their assets, and excessively thin profit margins can make it difficult to build capital through retained earnings. A bank that pays unsustainably high savings account interest rates might boost its deposit base but undermine its long-term financial strength.

These profitability constraints explain why banks cannot engage in unlimited rate competition. There’s a ceiling on savings account interest rates determined not just by the Fed or market conditions, but by the fundamental economics of banking: banks must earn more on their assets than they pay on their liabilities, or they eventually fail.

How Savings Account Type Affects Interest Rates

Not all savings accounts are created equal, and the type of account significantly influences the interest rate offered. Traditional savings accounts at major banks often pay minimal interest—sometimes as low as 0.01% APY—while high-yield savings accounts from the same or different institutions might pay 4.00% APY or more.

This distinction reflects different product positioning and customer targeting. Traditional savings accounts often serve as basic relationship products, bundled with checking accounts and other services. Banks view these accounts as part of a broader customer relationship rather than standalone deposit products, which allows them to offer lower rates. Customers who value branch access, integrated banking services, or simply prefer banking where they’ve always banked may accept lower savings account interest rates in exchange for these conveniences.

High-yield savings accounts target rate-sensitive customers willing to manage their money digitally and maintain accounts at multiple institutions. These products compete primarily on APY, so banks price them much more aggressively. The trade-off often includes higher minimum balance requirements, limited transactions, or fewer integrated services.

Many banks use tiered balance structures to differentiate rates based on account size. You might earn 0.50% APY on balances up to $10,000, but 2.00% APY on amounts above that threshold. This structure encourages larger deposits while limiting the bank’s interest expense on smaller accounts. Tiered pricing also allows banks to compete for different customer segments simultaneously—offering competitive rates to larger depositors while maintaining lower overall funding costs.

Minimum balance requirements serve a similar purpose. Accounts requiring a $25,000 minimum balance can afford to pay higher savings account interest rates because they attract substantial, stable deposits that banks can reliably lend out. Accounts with no minimums must price more conservatively to account for smaller, more volatile balances that provide less value to the bank.

Understanding these product distinctions helps explain why your savings account interest rates might be much lower than the advertised rates you see elsewhere. You may be comparing different products designed for different purposes and customer segments.

| Account Type | Typical APY Range | Minimum Balance | Best For |

|---|---|---|---|

| Traditional Savings | 0.01% – 0.25% | Often $0 | Branch access, relationship banking |

| High-Yield Savings | 3.50% – 5.00% | Usually $0 | Rate maximizers, digital-first customers |

| Money Market | 0.50% – 4.50% | Often $1,000-$10,000 | Higher balances, limited check writing |

| Tiered Savings | Varies by balance | Varies | Customers with varying deposit amounts |

How and When Banks Change Savings Account Rates

Banks don’t follow a universal schedule for adjusting savings account interest rates. Some institutions review rates weekly, others monthly, and some change rates only when significant market shifts occur. The decision-making process typically involves pricing committees that include treasury, finance, and retail banking executives who analyze current funding needs, competitive rates, and market conditions.

When the Federal Reserve announces a rate change, many banks initiate an immediate review process, but the timeline for implementation varies. Large national banks with sophisticated treasury operations might adjust rates within 24-48 hours of a Fed announcement. Smaller institutions might take a week or two to analyze implications and decide on appropriate changes.

Rate changes don’t always occur at month-end or other predictable intervals. A bank facing an unexpected loan demand surge might raise savings account interest rates mid-month to accelerate deposit growth. Similarly, a bank that suddenly finds itself with excess liquidity might cut rates at any time. This unpredictability is one reason why variable-rate savings accounts can feel unstable compared to fixed-rate products.

Banks must notify customers of rate changes, but the advance notice requirements are minimal for savings accounts. Unlike some other deposit products, savings account rates can typically change without advance notice, though banks must disclose the new rate according to regulatory standards. You might discover that your savings account interest rate changed only when you review your monthly statement or notice different interest earnings.

The variable nature of most U.S. savings account interest rates gives banks flexibility to respond to market conditions quickly. This benefits consumers when rates are rising (banks can increase rates promptly), but also means rates can fall just as quickly when economic conditions shift. Understanding this variability helps set appropriate expectations for your savings account returns.

Regulatory and Disclosure Rules in the U.S.

The Truth in Savings Act, implemented through Regulation DD, governs how banks must disclose savings account interest rates and terms. This federal regulation ensures consumers receive clear, standardized information to compare deposit products across institutions.

Banks must disclose the annual percentage yield (APY) rather than just the nominal interest rate, because APY accounts for compounding and provides a more accurate picture of what you’ll actually earn. The APY must be calculated using a standard formula, ensuring consistency across the industry. When banks advertise savings account interest rates, they must prominently display the APY and cannot mislead consumers with partial or unclear rate information.

Rate change disclosures have specific requirements. Banks must provide periodic statements showing the APY earned during the statement period, and these statements must clearly indicate if rates have changed since the previous statement. For promotional rates, banks must disclose the duration of the promotional period and the rate that will apply afterward.

Regulation DD also limits misleading advertising practices. Banks cannot advertise “up to” rates without disclosing the required balance tiers, and they must clearly distinguish between introductory promotional rates and standard ongoing rates. If a bank advertises a high-yield savings account rate, it must disclose any material terms or conditions required to earn that rate.

Consumers have rights if banks fail to provide accurate disclosures. If you discover that your bank calculated your savings account interest incorrectly or failed to apply a disclosed rate, you can file a complaint with the Consumer Financial Protection Bureau (CFPB) or your bank’s primary regulator. Banks face penalties for systematic disclosure violations, creating incentives for compliance.

These regulatory protections don’t prevent rates from being low or changing frequently, but they do ensure you receive transparent information about savings account interest rates so you can make informed decisions about where to keep your money.

What Savings Rate Decisions Mean for Consumers

When banks adjust savings account interest rates, the impact on your monthly earnings can be substantial or minimal, depending on your balance. On a $10,000 savings balance, the difference between a 0.01% APY and a 4.00% APY is approximately $399 per year—meaningful money that could cover several months of groceries or other expenses. On a $1,000 balance, that same rate difference equals about $40 annually, less dramatic but still worth considering.

Customer loyalty doesn’t automatically result in higher savings account interest rates. In fact, the opposite often occurs. Banks know that many customers stick with their current bank due to inertia, relationship ties, or the hassle of switching. This allows banks to maintain lower rates for existing customers while offering promotional rates to attract new deposits. If you’ve had the same savings account for years without checking the rate, you’re likely earning far less than you could elsewhere.

Switching savings accounts makes financial sense when the rate differential justifies the effort. Moving $25,000 from an account earning 0.05% APY to one earning 4.50% APY generates an additional $1,112 per year in interest, worth a few hours of paperwork for most people. However, switching a $500 balance for the same rate improvement only yields $22 annually, which may not justify the time investment.

The trade-offs between convenience and higher interest are real. Online banks offering premium savings account interest rates may lack physical branches, require digital-only communication, and integrate less smoothly with your checking account. Traditional banks with lower rates might provide easier access to your money, better customer service, or bundled benefits. Your personal banking preferences and financial situation should guide these decisions.

Monitoring and comparing savings account interest rates effectively requires periodic review. Check your current rate quarterly, compare it against high-yield options using online rate comparison tools, and evaluate whether switching makes sense given your balance and banking needs. Setting a calendar reminder ensures you don’t let years pass while earning minimal interest on substantial savings.

Conclusion: Key Takeaways on How Banks Set Savings Rates

Banks determine savings account interest rates through a multi-factor decision process that balances Federal Reserve policy, internal funding needs, competitive dynamics, and profitability requirements. The federal funds rate sets the broad economic context, but individual banks make pricing decisions based on their specific circumstances—how much liquidity they hold, how aggressive their loan demand is, and how they position themselves competitively in the market.

This explains why savings account interest rates vary dramatically across institutions. A traditional bank with excess deposits and moderate loan demand has little incentive to offer high rates, while an online bank using competitive APYs as its primary customer acquisition tool will price far more aggressively. Both approaches are rational responses to different business models and market positions.

For consumers, understanding these dynamics creates opportunities to earn significantly more on savings by choosing accounts strategically rather than settling for whatever your current bank offers. The banks that pay the highest savings account interest rates aren’t necessarily better or worse institutions—they simply have different economics and competitive strategies that benefit rate-conscious savers.

Staying informed about how banks price deposits, monitoring your current rates regularly, and being willing to move money when the math makes sense are the practical applications of this knowledge. Your savings account might be one of your simplest financial products, but the interest rate you earn on it reflects a sophisticated set of banking decisions worth understanding and acting upon.

Also Read – How Minimum Balance Rules Work in Savings Accounts

FAQs

Q. How do banks decide savings account interest rates in the U.S.?

- U.S. banks set savings account interest rates based on several factors, including Federal Reserve policy rates, market liquidity, deposit demand, competition, and the bank’s own funding needs. Rates are adjusted to balance attracting deposits while maintaining profitability.

Q. What role does the Federal Reserve play in savings account interest rates?

- The Federal Reserve influences savings rates indirectly through changes to the federal funds rate. When this benchmark rate rises or falls, banks adjust their savings account APYs to reflect higher or lower borrowing and funding costs.

Q. Why do savings account interest rates vary between banks?

- Savings rates differ because banks have different liquidity requirements, cost structures, and competitive strategies. Online and digital banks often offer higher rates due to lower operating costs compared to traditional brick-and-mortar banks.

Q. How often do banks change savings account interest rates?

- Banks can change savings account interest rates at any time, especially after Federal Reserve announcements or shifts in market conditions. Most savings accounts have variable rates, meaning APYs are not fixed.

Q. Why do high-yield savings accounts offer higher interest rates?

- High-yield savings accounts typically offer higher rates because banks use them to attract deposits quickly, often relying on digital platforms with lower overhead costs and passing those savings to customers in the form of higher APYs.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Pingback: How Savings Account Withdrawal Limits Work

Pingback: How Savings Account Transactions Are Tracked by Banks