How to Invest in the S&P 500 in the USA (Beginner-Friendly Guide)

If you’re looking to build wealth through the stock market, learning how to invest in the S&P 500 is one of the smartest first steps you can take. This isn’t just investment advice—it’s the strategy that legends like Warren Buffett recommend for ordinary Americans.

The beauty of S&P 500 investing? You don’t need to be a Wall Street expert, you don’t need thousands of dollars to start, and you don’t need to spend hours picking individual stocks. In this guide, I’ll walk you through everything you need to know about investing in the S&P 500, from understanding what it is to making your first investment today.

What Is the S&P 500 and Why Does It Matter to the U.S? Investors

What the S&P 500 represents

The S&P 500 is a stock market index that tracks the performance of approximately 500 of the largest publicly traded companies in the United States. When you learn how to invest in the S&P 500, you’re essentially buying a tiny piece of America’s corporate giants—companies like Apple, Microsoft, Amazon, Google, Tesla, and hundreds of others that shape our daily lives.

Think of it this way: every time you search on Google, shop on Amazon, use an iPhone, or fill up at a Chevron station, you’re interacting with S&P 500 companies. By investing in the index, you become a partial owner of these businesses.

Why is the benchmark of the U.S. stock market

The S&P 500 has earned its reputation as the gold standard benchmark for the U.S. stock market for several compelling reasons. It represents roughly 80% of the total U.S. stock market value, making it an excellent snapshot of American corporate health and economic performance.

Here’s what makes it special: unlike the Dow Jones Industrial Average (which only tracks 30 companies), the S&P 500 gives you broad diversification across all major sectors—technology, healthcare, finance, consumer goods, energy, and more. When financial professionals, economists, and news anchors talk about “how the market performed today,” they’re usually referring to the S&P 500.

Historically, the S&P 500 has delivered average annual returns of about 10% over the long term (though this varies significantly year to year). That means if you’d invested $10,000 in an S&P 500 fund 30 years ago and simply left it alone, you’d have over $174,000 today—even through multiple recessions, market crashes, and crises.

Who manages it (S&P Dow Jones Indices)

The S&P 500 is maintained by S&P Dow Jones Indices, a division of S&P Global. They’re responsible for deciding which companies make the cut and which get removed from the index.

A company doesn’t automatically qualify just because it’s large. To be included, a company must meet specific criteria: it must be based in the U.S., have a market capitalization of at least $14.5 billion (as of 2025), demonstrate positive earnings over the most recent quarter and over the previous four quarters combined, maintain adequate liquidity, and have sufficient public float.

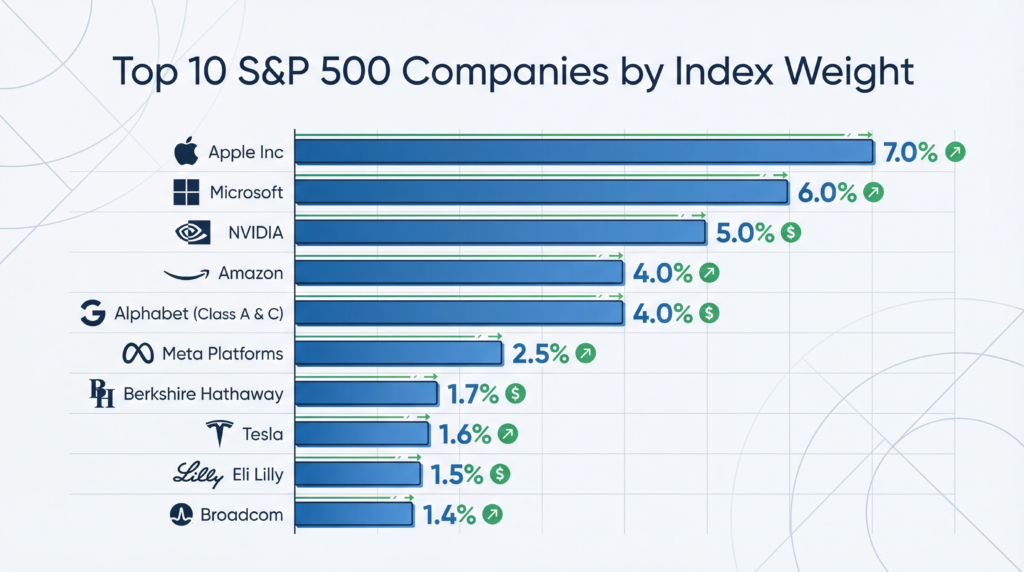

The index is market-capitalization weighted, which means bigger companies have more influence on the index’s performance. Apple, for instance, represents a much larger percentage of the index than a smaller company like Hasbro.

How to Invest in the S&P 500 for Beginners (USA)

Understanding how to invest in the S&P 500 as a beginner doesn’t require a finance degree or deep market knowledge. In fact, its simplicity is one of its greatest strengths. Let me break down exactly who should consider this investment strategy and how to determine if it’s right for you.

Who should invest in the S&P 500

The S&P 500 is ideal for investors who want long-term growth without the complexity of picking individual stocks. It’s particularly well-suited for:

- Beginners who are just starting their investment journey

- Busy professionals who don’t have time to actively manage investments

- Retirement savers building a nest egg over decades

- Anyone who wants diversification without buying hundreds of individual stocks

You don’t need to be wealthy to start. Thanks to fractional shares and low-cost index funds, you can begin learning how to invest in the S&P 500 with as little as $1 through many modern brokerages.

Risk tolerance and time horizon

Before you dive into how to invest in the S&P 500, honestly assess your risk tolerance and time horizon. The stock market goes up over the long term, but it can be a wild ride in the short term.

Consider this reality: the S&P 500 has experienced several major declines in recent decades. During the 2008 financial crisis, it dropped about 57% from peak to trough. In early 2020, it fell roughly 34% in just over a month during the COVID-19 panic. More recently, it declined about 25% during 2022.

Here’s the crucial part: if you had invested right before any of these crashes and simply held on, you would have recovered your losses and gone on to see substantial gains. The key is having a long enough time horizon—ideally at least 5 years, but preferably 10 years or more.

Time Horizon Guide:

| Your Timeline | S&P 500 Suitability |

|---|---|

| Less than 3 years | Not recommended—too risky for short-term needs |

| 3-5 years | Possible, but only for the money you can afford to see decline |

| 5-10 years | Good fit—enough time to ride out most downturns |

| 10+ years | Ideal—historical data shows consistent positive returns |

| 20+ years (retirement) | Excellent—maximum time to benefit from compound growth |

Is the S&P 500 enough for first-time investors?

For many first-time investors learning how to invest in the S&P 500, a simple S&P 500 fund can be a perfectly adequate core holding. Warren Buffett famously instructed that after his death, the trustee managing money for his wife should put 90% in an S&P 500 index fund and 10% in short-term government bonds.

That said, as your portfolio grows and your investment knowledge expands, you may want to diversify beyond just the S&P 500. Some considerations:

- The S&P 500 only includes U.S. companies, so you miss out on international opportunities

- It’s heavily weighted toward large-cap stocks, excluding small and mid-sized companies that sometimes outperform

- It doesn’t include bonds, real estate, or other asset classes that can provide stability

For beginners, my recommendation is simple: start with the S&P 500 to build the habit of consistent investing, then gradually expand into broader diversification as you learn more, and your portfolio grows.

How to Invest in an S&P 500 Index Fund

One of the most popular ways to learn how to invest in the S&P 500 is through index funds. These investment vehicles offer simplicity, low costs, and automatic diversification—making them perfect for beginners and experienced investors alike.

What is an S&P 500 index fund?

An S&P 500 index fund is a mutual fund designed to replicate the performance of the S&P 500 index. When you buy shares of an index fund, the fund manager uses your money (along with thousands of other investors’ money) to buy shares of all 500 companies in the index in the same proportions as the index itself.

The beauty of index funds is their simplicity. You’re not paying a fund manager to pick “winning” stocks—you’re just tracking the entire index. This passive approach typically results in very low fees, which means more of your money stays invested and compounds over time.

Popular U.S. index funds (FXAIX, VFIAX, SWPPX)

When exploring how to invest in the S&P 500 through index funds, three options dominate the landscape, each offered by a major investment company:

Fidelity 500 Index Fund (FXAIX)

- Expense ratio: 0.015% (just $1.50 per year for every $10,000 invested)

- Minimum investment: $0

- Provider: Fidelity Investments

- Perfect for investors who want the lowest possible fees

Vanguard 500 Index Fund Admiral Shares (VFIAX)

- Expense ratio: 0.04%

- Minimum investment: $3,000

- Provider: Vanguard Group

- Note: Vanguard also offers VFINX with a $1,000 minimum but slightly higher fees

- Ideal for investors who appreciate Vanguard’s investor-owned structure

Schwab S&P 500 Index Fund (SWPPX)

- Expense ratio: 0.02%

- Minimum investment: $0

- Provider: Charles Schwab

- Great for those who prefer Schwab’s platform and customer service

All three funds are excellent choices for anyone learning how to invest in the S&P 500. The differences in expense ratios are minimal—over 30 years, the difference between 0.015% and 0.04% on a $10,000 investment would be less than $100. Choose based on which brokerage you prefer to work with.

Minimum investment and expense ratios

One of the most investor-friendly developments in recent years is the elimination of minimum investments for many index funds. Both Fidelity and Schwab now allow you to start with $0, making it easier than ever to learn how to invest in the S&P 500 regardless of your budget.

Expense ratios—the annual fee expressed as a percentage of your investment—are critically important for long-term wealth building. Here’s why: if you invest $10,000 and it grows at 10% annually for 30 years, you’d end up with $174,494. But if you paid just 1% in annual fees (reducing your return to 9%), you’d only have $132,677—a difference of over $41,000!

This is why index funds with their rock-bottom expense ratios (under 0.05%) are so powerful for building wealth. You’re keeping almost all the returns for yourself rather than paying them to fund managers.

Expense Ratio Impact Over 30 Years on $10,000:

| Expense Ratio | Net Annual Return | Final Value | Lost to Fees |

|---|---|---|---|

| 0.02% | 9.98% | $173,830 | $664 |

| 0.10% | 9.90% | $170,263 | $4,231 |

| 0.50% | 9.50% | $152,203 | $22,291 |

| 1.00% | 9.00% | $132,677 | $41,817 |

Best accounts to hold index funds (IRA, 401k)

The account type you choose when figuring out how to invest in the S&P 500 can significantly impact your long-term returns due to taxes. Here are your primary options:

401(k) through your employer: If your employer offers a 401(k) and especially if they match your contributions, this should typically be your first stop. The employer match is free money—an instant 50% or 100% return on your contribution. Many 401(k) plans offer an S&P 500 index fund option.

Traditional IRA: Contributions are tax-deductible (up to income limits), reducing your current taxable income. Your investments grow tax-deferred, and you pay taxes when you withdraw in retirement. The 2025 contribution limit is $7,000 ($8,000 if you’re 50 or older).

Roth IRA: You contribute after-tax dollars, but your investments grow completely tax-free, and withdrawals in retirement are tax-free too. This is incredibly powerful for young investors who have decades of tax-free growth ahead.

Taxable brokerage account: If you’ve maxed out retirement accounts or need flexibility to access money before retirement age, a regular brokerage account works fine. You’ll pay taxes on dividends and capital gains, but you have complete flexibility.

How to Invest in an S&P 500 ETF

Another popular method for learning how to invest in the S&P 500 is through exchange-traded funds (ETFs). ETFs offer similar benefits to index funds but with some unique characteristics that might better suit your investing style.

What an S&P 500 ETF is

An exchange-traded fund (ETF) that tracks the S&P 500 is very similar to an index fund with one key difference: ETFs trade on stock exchanges throughout the day, just like individual stocks, while mutual funds only trade once per day after the market closes.

For practical purposes, S&P 500 ETFs accomplish the same goal as index funds—they give you instant diversification across 500 companies with minimal fees. The choice between an ETF and an index fund often comes down to personal preference and which fits better with your investment strategy.

Popular ETFs (VOO, SPY, IVV)

When exploring how to invest in the S&P 500 through ETFs, three giants dominate:

- Expense ratio: 0.03%

- Average daily trading volume: Very high (millions of shares)

- Dividend yield: Around 1.5%

- Ideal for: Long-term buy-and-hold investors

- Current share price: Approximately $450-500

- Expense ratio: 0.0945%

- Average daily trading volume: Highest of all ETFs (often 80+ million shares per day)

- Dividend yield: Around 1.5%

- Ideal for: Active traders who value liquidity (though more expensive for long-term holders)

- Current share price: Approximately $450-500

iShares Core S&P 500 ETF (IVV)

- Expense ratio: 0.03%

- Average daily trading volume: Very high

- Dividend yield: Around 1.5%

- Ideal for: Long-term investors seeking low costs

- Current share price: Approximately $450-500

For long-term investors learning how to invest in the S&P 500, VOO and IVV are typically the best choices due to their lower expense ratios. SPY is the original S&P 500 ETF and remains popular with traders, but its higher fees make it less ideal for buy-and-hold investors.

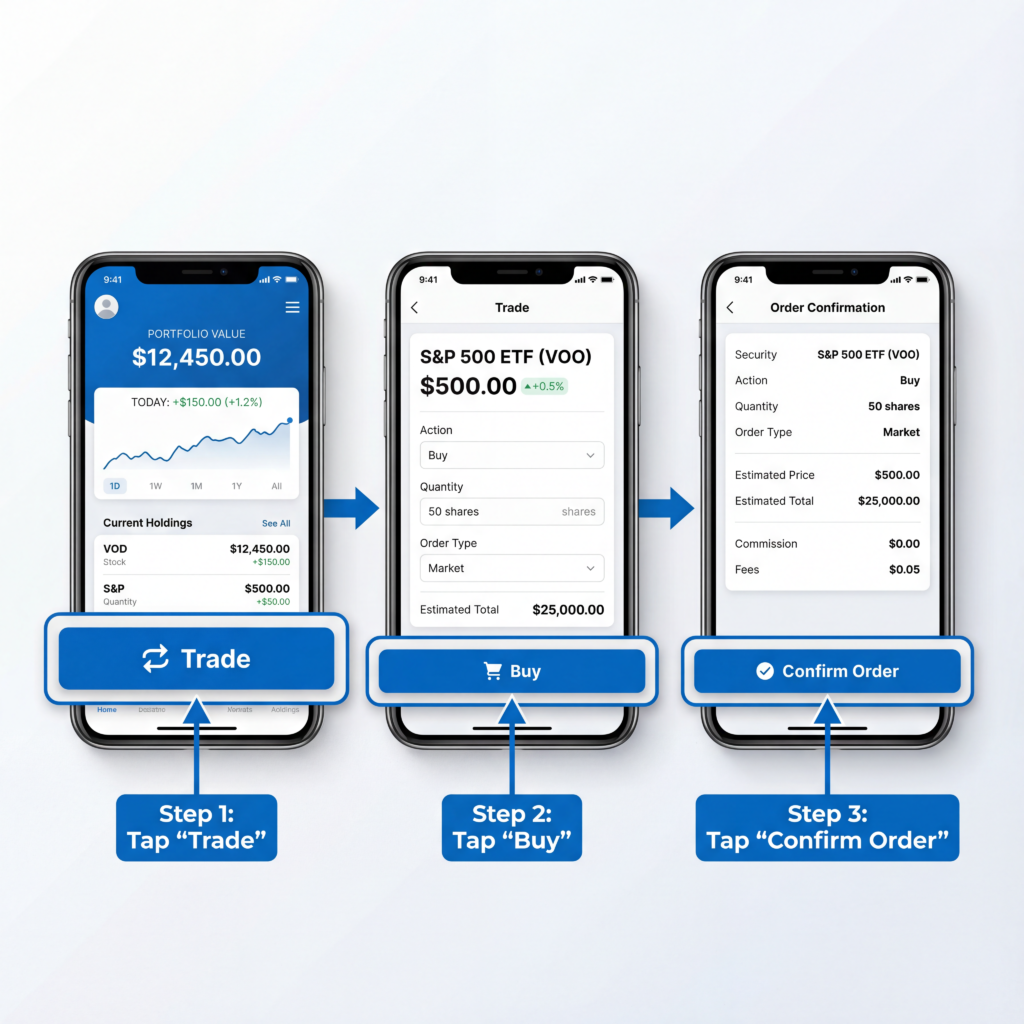

How to buy ETFs through a U.S. brokerage

Buying an S&P 500 ETF is remarkably simple once you have a brokerage account set up. Here’s the step-by-step process for how to invest in the S&P 500 using ETFs:

- Open and fund your brokerage account (more details in the next section)

- Navigate to the trading section of your brokerage platform

- Search for the ETF ticker symbol (VOO, SPY, or IVV)

- Enter the number of shares you want to buy, or the dollar amount if your broker offers fractional shares

- Select “market order” for immediate purchase at the current price, or “limit order” to specify your maximum price

- Review and confirm your purchase

Most major brokerages now offer commission-free ETF trading, so you won’t pay a transaction fee. Many also offer fractional shares, meaning you can invest any dollar amount rather than needing enough money to buy a full share (which might cost $400-500, depending on the current price).

ETF vs index fund: which is better for you?

Both ETFs and index funds tracking the S&P 500 will give you nearly identical returns over time, but here are the practical differences when deciding how to invest in the S&P 500:

Choose an ETF if:

- You want to trade throughout the day (though as a long-term investor, you probably shouldn’t care about this)

- You like seeing a real-time price

- You want flexibility in the order types you can use

- You prefer the convenience of buying through any brokerage

Choose an index fund if:

- You’re setting up automatic monthly investments (easier with mutual funds)

- You want to invest exact dollar amounts every time

- You prefer the simplicity of not thinking about share prices

- You’re already using that fund company’s brokerage

Honestly? For most beginners, figuring out how to invest in the S&P 500, it truly doesn’t matter much. The important thing is that you start investing regularly, not whether you choose the ETF or mutual fund version.

Step-by-Step: How to Invest in the S&P 500 in the USA

Now let’s get practical. Here’s your complete, actionable guide on exactly how to invest in the S&P 500 from start to finish. Follow these steps, and you’ll have your first investment completed within the week.

Choose a U.S. brokerage account

Your first step in learning how to invest in the S&P 500 is selecting a brokerage—the company that will hold your investments and execute your trades. Here are the top options for U.S. investors in 2025:

- Pros: No account minimums, outstanding customer service, commission-free stock and ETF trades, excellent S&P 500 index fund (FXAIX)

- Best for: Beginners who want a user-friendly platform

- Website: fidelity.com

- Pros: Similar features to Fidelity, strong research tools, low-cost S&P 500 fund (SWPPX), excellent mobile app

- Best for: Investors who want robust research capabilities

- Website: schwab.com

- Pros: Pioneer of index investing, investor-owned structure, legendary low-cost funds

- Best for: Long-term investors committed to index investing

- Website: vanguard.com

- Note: Platform is more basic but perfectly functional

- Pros: Advanced tools, international investing options

- Best for: More experienced investors

- Website: interactivebrokers.com

To open an account, you’ll need:

- Social Security number

- Driver’s license or government ID

- Bank account information for funding

- Employment information

- The process takes about 10-15 minutes online

Pick Ean TF or an index fund

Based on everything we’ve discussed about how to invest in the S&P 500, make your choice:

- Opening a Fidelity account? FXAIX (the index fund) is a natural choice

- At Schwab? Consider SWPPX

- At Vanguard? Choose VFIAX if you have $3,000 to start, or VOO (the ETF version) if you’re starting smaller

- Want maximum flexibility? Any of the three major ETFs (VOO, IVV, SPY) works with any brokerage

Can’t decide? Flip a coin. Seriously. The difference in returns between these top S&P 500 funds will be negligible. What matters is that you start investing.

Place your first investment

Once your account is funded, it’s time to make your first investment. Here’s exactly how to invest in the S&P 500 with your first purchase:

- Log in to your brokerage account

- Navigate to the trade or buy section

- Search for your chosen fund or ETF by ticker symbol

- Enter the amount you want to invest

For your first investment, don’t worry about “timing the market” or waiting for a dip. Time in the market beats timing the market. Studies consistently show that investors who try to wait for the perfect moment often end up waiting forever while the market climbs higher.

A practical approach: If you have a lump sum to invest and you’re nervous about market timing, consider dollar-cost averaging by investing one-third now, one-third in a month, and one-third in two months. But if that’s just an excuse for procrastination, invest it all today.

Set up automatic investing

The single best way to build wealth when learning how to invest in the S&P 500 is to automate your investments. Set up automatic monthly transfers from your bank account to your brokerage and automatic purchases of your chosen fund or ETF.

Most brokerages make this easy. You can specify that you want to invest $500 (or $100, or $1,000) on the 1st or 15th of every month, and the brokerage will automatically execute the purchase. This takes emotion out of investing and ensures you’re consistently buying shares regardless of whether the market is up or down.

This is dollar-cost averaging in action: when prices are high, your fixed dollar amount buys fewer shares; when prices are low, it buys more shares. Over time, this averages out to a reasonable cost basis.

Example of Dollar-Cost Averaging:

| Month | Amount Invested | Share Price | Shares Purchased | Total Shares |

|---|---|---|---|---|

| January | $500 | $450 | 1.11 | 1.11 |

| February | $500 | $430 | 1.16 | 2.27 |

| March | $500 | $470 | 1.06 | 3.33 |

| April | $500 | $440 | 1.14 | 4.47 |

| Total | $2,000 | Avg: $447.50 | 4.47 shares | Value: $1,967 |

By investing consistently, you bought shares at different prices and ended up with an average cost of $447.50 per share—without trying to time the market.

How Much Should You Invest in the S&P 500?

One of the most common questions when people learn how to invest in the S&P 500 is: “How much money do I actually need?” The answer might surprise you with how accessible it truly is.

Minimum investment (fractional shares)

Thanks to fractional shares, you can literally start learning how to invest in the S&P 500 with just $1. Both Fidelity and Schwab allow fractional share purchases of their index funds, and many brokerages now offer fractional ETF shares as well.

That said, because of the wonders of compound interest, the more you can invest early and regularly, the more dramatic your long-term results will be.

Monthly investing examples

Let’s look at realistic scenarios for different income levels, assuming a 10% average annual return (the historical average for the S&P 500):

$100 per month for 30 years

- Total invested: $36,000

- Final value: Approximately $217,000

- Great for: Entry-level workers or students just starting out

$300 per month for 30 years

- Total invested: $108,000

- Final value: Approximately $651,000

- Great for: Mid-career professionals building wealth

$500 per month for 30 years

- Total invested: $180,000

- Final value: Approximately $1,086,000—over a million dollars!

- Great for: Serious savers focused on early retirement

$1,000 per month for 30 years

- Total invested: $360,000

- Final value: Approximately $2,172,000

- Great for: High earners maximizing retirement savings

Notice how the power of compound returns means you end up with 5-6 times what you actually contributed. This is why starting early with how to invest in the S&P 500 matters so much—every year you delay costs you exponentially.

Portfolio allocation by age

A common rule of thumb when deciding how to invest in the S&P 500 is to subtract your age from 110 to determine the percentage of stocks (including S&P 500 investments) in your portfolio, with the remainder in bonds:

| Age | Suggested S&P 500/Stocks % | Bonds % | Rationale |

|---|---|---|---|

| 20-30 | 90-100% | 0-10% | A long time horizon allows you to ride out volatility |

| 30-40 | 80-90% | 10-20% | Still plenty of time for growth |

| 40-50 | 70-80% | 20-30% | Balancing growth with stability |

| 50-60 | 60-70% | 30-40% | Moving toward the protection of accumulated wealth |

| 60-70 | 50-60% | 40-50% | Near or in retirement, reducing volatility |

| 70+ | 40-50% | 50-60% | Preserving capital for income needs |

These are guidelines, not rules. Your individual situation—risk tolerance, other income sources, financial obligations—should guide your decisions about how to invest in the S&P 500 and allocate your overall portfolio.

Best Accounts for S&P 500 Investing (Tax Considerations)

Understanding the tax implications is a crucial part of mastering how to invest in the S&P 500. The right account can save you thousands—or even hundreds of thousands—of dollars over your investing lifetime.

Taxable brokerage account

A regular taxable brokerage account is the most flexible option when learning how to invest in the S&P 500. You can deposit and withdraw money anytime without penalties, there are no contribution limits, and you can use the money for any purpose at any age.

The downside? Taxes. You’ll pay taxes on dividends each year (even if you reinvest them), and you’ll pay capital gains taxes when you sell shares at a profit.

However, not all tax treatment is bad. If you hold your S&P 500 investment for more than one year, you’ll qualify for long-term capital gains rates, which are significantly lower than ordinary income tax rates. For 2025, long-term capital gains rates are 0%, 15%, or 20%, depending on your income, compared to ordinary income rates that can reach 37%.

Best for: Money you might need before retirement, investments beyond what you can contribute to retirement accounts, or if you’re already maxing out all tax-advantaged options.

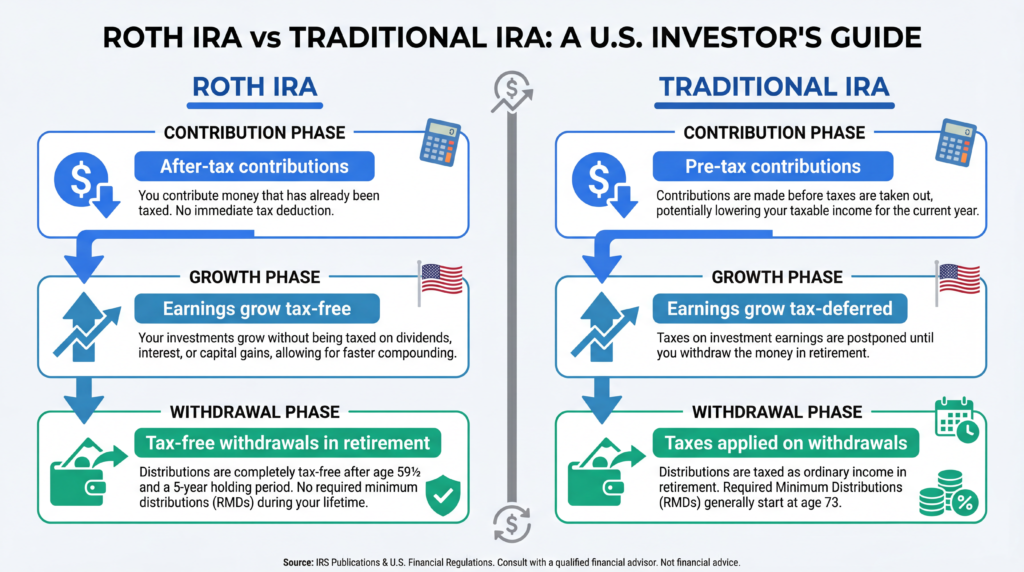

Roth IRA vs Traditional IRA

Both types of Individual Retirement Accounts offer powerful tax advantages for understanding how to invest in the S&P 500, but they work differently:

Traditional IRA:

- Contributions may be tax-deductible now (reducing current taxable income)

- Investments grow tax-deferred

- Pay ordinary income tax on withdrawals in retirement

- Required Minimum Distributions start at age 73

- 2025 contribution limit: $7,000 ($8,000 if 50+)

Roth IRA:

- Contributions are not tax-deductible (made with after-tax dollars)

- Investments grow completely tax-free

- Withdrawals in retirement are tax-free

- No Required Minimum Distributions during your lifetime

- 2025 contribution limit: $7,000 ($8,000 if 50+)

- Income limits apply to contributions

The Roth IRA advantage for young investors: If you’re early in your career and in a lower tax bracket now, paying taxes on the contribution today and then never paying taxes again—even on decades of growth—is an incredible deal. Imagine investing $7,000 per year from age 25 to 65, watching it grow to over $3 million, and never paying a penny of tax on withdrawals.

When a Traditional IRA makes sense: If you’re in a high tax bracket now and expect to be in a lower bracket in retirement, the immediate tax deduction of a Traditional IRA can be more valuable.

401(k) and employer retirement plans

If your employer offers a 401(k) with matching contributions, this should typically be your first investment priority when considering how to invest in the S&P 500. An employer match is free money—if your company matches 50% of contributions up to 6% of salary, and you earn $60,000, that’s an extra $1,800 per year you’re leaving on the table if you don’t contribute.

Many 401(k) plans include an S&P 500 index fund option, often with very low expense ratios. Look for fund names that include “S&P 500 Index” or “500 Index” in your plan’s investment options.

The 2025 contribution limit for 401(k) plans is $23,500 ($31,000 if you’re 50 or older). This is separate from IRA limits, so you can max out both if your budget allows.

A smart strategy for how to invest in the S&P 500 across accounts:

- Contribute enough to your 401(k) to get the full employer match

- Max out a Roth IRA ($7,000 in 2025)

- Go back and increase 401(k) contributions if you have more to invest

- Use a taxable brokerage account for additional savings

Capital gains and dividend taxes (U.S.)

Understanding the tax implications helps you make smarter decisions about how to invest in the S&P 500:

Dividend taxes: The S&P 500 currently yields about 1.5% in dividends annually. These dividends are typically “qualified dividends” if you hold the investment for more than 60 days, which means they’re taxed at the favorable long-term capital gains rates (0%, 15%, or 20%) rather than ordinary income rates.

Capital gains taxes: When you sell your S&P 500 investment at a profit, you’ll owe capital gains tax. Hold for more than one year to qualify for lower long-term rates. Short-term gains (held less than one year) are taxed as ordinary income.

2025 Long-Term Capital Gains Tax Rates:

| Filing Status | 0% Rate | 15% Rate | 20% Rate |

|---|---|---|---|

| Single | Up to $47,025 | $47,026-$518,900 | Over $518,900 |

| Married Filing Jointly | Up to $94,050 | $94,051-$583,750 | Over $583,750 |

Tax-loss harvesting: If your S&P 500 investment declines in a taxable account, you can sell it to realize the loss (which offsets gains elsewhere) and immediately buy a similar but not identical fund. For example, you could sell an S&P 500 fund and buy a total U.S. stock market fund to maintain similar exposure while capturing the tax loss.

Why retirement accounts are powerful: In a Roth IRA or 401(k), you don’t worry about any of this. The dividends are reinvested without creating a tax bill, and you never think about capital gains while you’re rebalancing or adjusting your portfolio.

Risks of Investing in the S&P 500

Understanding the risks is just as important as knowing how to invest in the S&P 500. Let’s be honest about what you’re signing up for so you can make informed decisions and avoid panic-selling during inevitable downturns.

Market volatility and drawdowns

The S&P 500 does not go straight up. It experiences regular declines called “drawdowns,” and some of them can be stomach-churning.

Since 1950, the S&P 500 has experienced an average intra-year decline of about 14%. That means in a typical year, at some point, your investment will be down 14% from its peak that year—even if it ends the year positive overall.

Bigger declines happen, too. History shows us some painful examples:

- 2000-2002 dot-com crash: S&P 500 dropped about 49%

- 2007-2009 financial crisis: 57% decline

- 2020 pandemic crash: 34% drop in just over a month

- 2022 bear market: 25% decline

Here’s the critical lesson for anyone learning how to invest in the S&P 500: every single one of these crashes has been followed by recovery and new all-time highs. The investors who lost money were those who panicked and sold at the bottom. Those who held on, or better yet, continued buying during the crash, were rewarded handsomely.

Real-world example: Imagine you invested $10,000 in an S&P 500 fund at the peak of the market in October 2007, right before the financial crisis. Terrible timing, right? By March 2009, your investment would have been worth about $4,300—a gut-wrenching 57% loss. But if you just held on and didn’t sell, by 2013 you were back to breaking even, and by January 2025, that $10,000 investment would be worth over $40,000, despite living through the worst financial crisis since the Great Depression.

Historical Recoveries from Major Crashes:

| Market Crash | Peak to Trough Decline | Time to Break Even | Value 10 Years Later |

|---|---|---|---|

| 2000 Dot-com | -49% | 7 years | +95% from peak |

| 2008 Financial Crisis | -57% | 5.5 years | +150% from peak |

| 2020 COVID-19 | -34% | 5 months | +90% from peak |

Sector concentration risk

The S&P 500, while diversified across 500 companies, can become concentrated in particular sectors during bull markets. As of early 2025, technology companies make up a significant portion of the index—far more than their representation in the economy overall.

This concentration means that if the tech sector struggles, the entire S&P 500 can drag down even if other sectors are performing well. We saw this play out in 2022 when rising interest rates particularly hurt high-growth tech stocks.

The top 10 companies in the S&P 500 currently represent about 30-35% of the entire index value. This means the performance of just ten companies has enormous influence over your returns when you learn how to invest in the S&P 500.

Current S&P 500 Sector Weightings (approximate):

- Technology: ~28%

- Financials: ~13%

- Healthcare: ~12%

- Consumer Discretionary: ~10%

- Communication Services: ~9%

- Industrials: ~8%

- Consumer Staples: ~6%

- Energy: ~4%

- Utilities: ~3%

- Real Estate: ~2%

- Materials: ~2%

This isn’t necessarily bad—these companies are large precisely because they’ve been successful—but it’s something to be aware of.

Inflation and long flat periods

While the S&P 500 has historically provided excellent long-term returns, there have been extended periods where returns were disappointing or even negative when adjusted for inflation. This is an important consideration when learning how to invest in the S&P 500.

The most famous example: if you invested in the S&P 500 in early 2000, you would have barely broken even by 2013—a “lost decade” plus three years where you earned essentially nothing. After inflation, you actually lost purchasing power.

These flat periods test investor patience, but they’re relatively rare and have always been followed by strong bull markets. The key is having a long enough time horizon that you can outlast the flat periods and capture the recovery.

Why this still shouldn’t scare you: Even with these flat periods, someone who invested consistently throughout the 2000-2013 period through dollar-cost averaging would have done quite well, as they were buying shares at depressed prices during the down years.

S&P 500 vs Other Investment Options

As you master how to invest in the S&P 500, you’ll naturally wonder how it compares to other investment strategies. Let’s explore the alternatives and when you might want to diversify.

S&P 500 vs total stock market fund

A common question when learning how to invest in the S&P 500: Should you invest in an S&P 500 fund or a total U.S. stock market fund?

A total stock market fund includes everything the S&P 500 includes, plus thousands of additional smaller companies (mid-cap and small-cap stocks). Examples include Vanguard Total Stock Market Index Fund (VTSAX) or the ETF version (VTI).

The differences:

- The S&P 500 represents about 80% of the total market value

- Total market funds add exposure to about 3,500 additional smaller companies

- Historically, returns have been very similar—within 0.5% annually

- Small-cap stocks sometimes outperform, sometimes underperform large-caps

Comparison Table:

| Factor | S&P 500 Fund | Total Market Fund |

|---|---|---|

| Number of companies | ~500 | ~3,500+ |

| Market cap focus | Large-cap | All caps |

| U.S. market coverage | ~80% | ~100% |

| Historical returns | 10% annually | 10% annually |

| Expense ratios | 0.02-0.04% | 0.03-0.04% |

| Simplicity | Very simple | Very simple |

My take: For most investors, either choice is excellent, and the difference in long-term returns will be minimal. If you want the absolute broadest U.S. exposure, choose a total market fund. If you prefer the simplicity and focus of owning the 500 largest companies, stick with the S&P 500.

S&P 500 vs international diversification

When considering how to invest in the S&P 500, remember that it includes only U.S. companies, which means you’re missing out on exposure to companies based in Europe, Asia, and emerging markets. International stocks can provide diversification benefits since they don’t always move in lockstep with U.S. stocks.

Arguments for adding international exposure:

- The U.S. represents only about 60% of the global stock market value

- International stocks have occasionally outperformed U.S. stocks for extended periods

- True diversification should include global exposure

- Currency diversification can protect against dollar weakness

Arguments for staying U.S.-focused:

- Many S&P 500 companies are global businesses (Apple, Microsoft, Coca-Cola all generate significant international revenue)

- U.S. stocks have outperformed international stocks over the past decade

- Simpler to manage

- Lower fees (international funds sometimes have slightly higher expense ratios)

A balanced approach: Many financial advisors recommend holding 20-40% of your stock allocation in international stocks. You could accomplish this by holding 60-80% in an S&P 500 fund and 20-40% in an international fund, or by using a total world stock fund that automatically combines U.S. and international exposure.

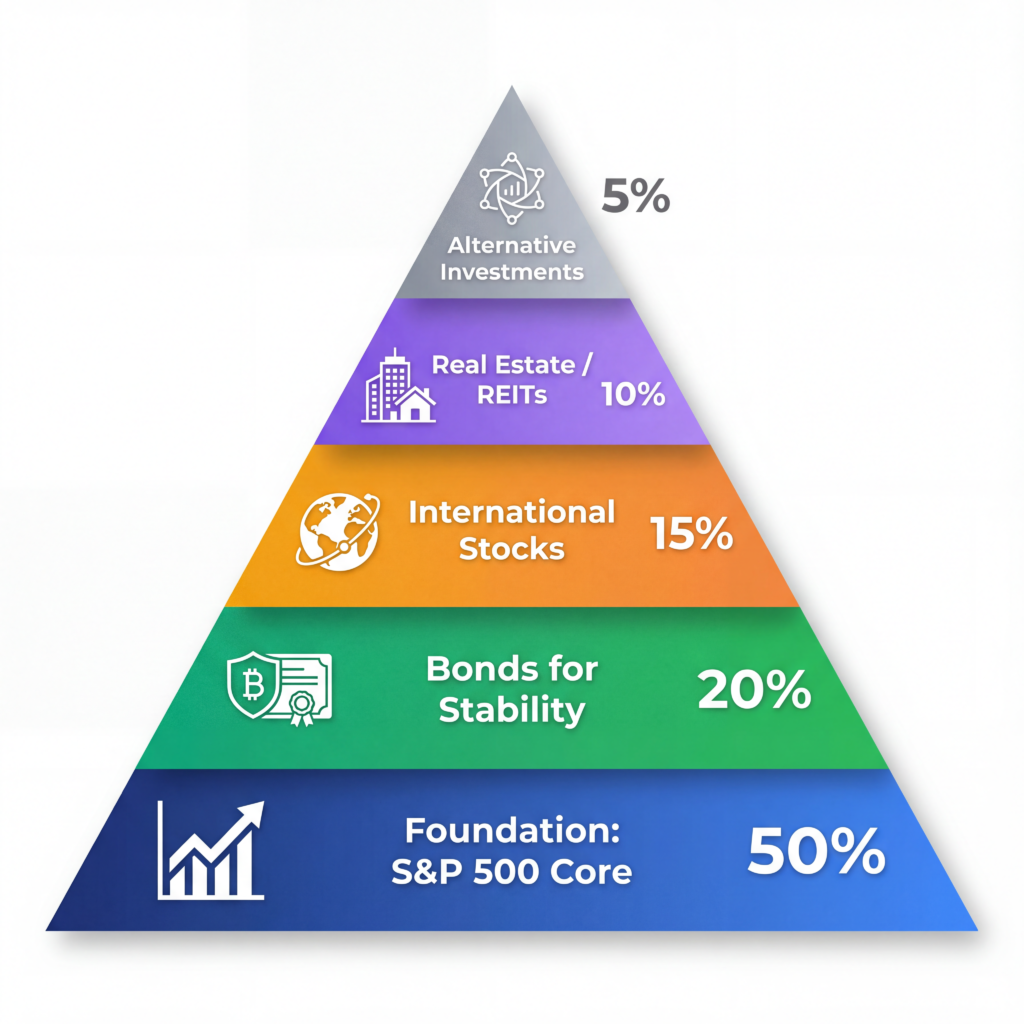

When to diversify beyond the S&P 500

You should consider expanding beyond just learning how to invest in the S&P 500 when:

Your portfolio reaches $50,000-100,000: At this level, adding bonds for stability and international stocks for diversification makes more sense. With a small portfolio, the simplicity of a single S&P 500 fund is fine.

You’re within 10-15 years of retirement: As you approach retirement, protecting what you’ve accumulated becomes more important than maximum growth. Adding bonds, real estate investment trusts (REITs), and other assets can reduce volatility.

You want to reduce risk: If market swings are keeping you up at night, adding bonds or other less-volatile investments can help you sleep better—and staying invested is more important than having the theoretically optimal portfolio.

You’ve developed more investing knowledge: As you learn more about investing beyond how to invest in the S&P 500, you might identify opportunities in small-cap value stocks, real estate, or other asset classes that complement your S&P 500 core holding.

You’ve maxed out the basics: If you’re consistently maxing out retirement accounts and have thoroughly automated your S&P 500 investing, you can explore additional diversification without it becoming a distraction.

Final Thoughts: Is the S&P 500 Right for You?

Now that you understand how to invest in the S&P 500, let’s bring everything together to help you decide if this strategy aligns with your financial goals and circumstances.

When it works best

Understanding how to invest in the S&P 500 and actually doing it works beautifully when you:

- Have a long time horizon (10+ years) before needing the money

- Want simplicity without constantly monitoring investments

- Believe in the long-term strength of the U.S. economy

- Are comfortable with market volatility in exchange for higher long-term returns

- Want to keep costs rock-bottom with index funds or ETFs

- Prefer a passive, “set it and forget it” approach to investing

It’s particularly powerful for retirement investing, where you can set up automatic contributions and largely forget about your investments for decades while they compound. The strategy that Buffett recommends—90% S&P 500 index fund, 10% bonds—is simple enough for anyone to implement yet sophisticated enough to build substantial wealth.

When to expand beyond it

Consider expanding your investment strategy beyond just how to invest in the S&P 500 when you’re:

- Approaching retirement and need more stability

- Accumulating significant wealth and wanting more sophisticated diversification

- Working toward specific financial goals with different timelines

- Interested in exploring other asset classes like real estate or bonds

- Seeking more international exposure

- Comfortable with more complex portfolio management

Remember: the S&P 500 can be your core holding even when you expand. Having 50-70% of your portfolio in an S&P 500 fund with the remainder in bonds, international stocks, and other assets is a perfectly reasonable strategy. You don’t have to abandon what you’ve learned about how to invest in the S&P 500 to diversify—you’re just building around a solid foundation.

Long-term consistency mindset

The most important factor in successful S&P 500 investing isn’t your exact choice of fund, your perfect market timing, or your clever asset allocation. It’s your ability to consistently invest, month after month, year after year, through bull markets and bear markets, through crashes and recoveries, without panicking and without giving up.

An imperfect investment plan that you actually stick with will always beat a “perfect” plan that you abandon during the first market downturn.

Your action plan for how to invest in the S&P 500:

- This week: Open a brokerage account (Fidelity, Schwab, or Vanguard)

- This week: Choose an S&P 500 index fund (FXAIX, SWPPX, VFIAX) or ETF (VOO, IVV)

- This week: Make your first investment, even if it’s just $50 or $100

- This week: Set up automatic monthly contributions from your bank account

- Every year: Increase contributions whenever you get a raise (even 1% makes a huge difference)

- Quarterly at most: Check your account—resist the urge to check daily or weekly

- During downturns: Resist the urge to sell (this is when you should be buying more)

- For decades, let compound returns work their magic

Learning how to invest in the S&P 500 is one of the most valuable financial skills you can develop. It’s simple enough for complete beginners yet powerful enough to build substantial wealth over time. The market will fluctuate, your portfolio will sometimes decline, and you’ll occasionally question whether you made the right choice. But if you maintain consistency and patience, history suggests you’ll be richly rewarded.

The final truth about how to invest in the S&P 500: The best time to start was yesterday. The second-best time is today. Every day you delay is a day of potential compound returns you’ll never get back.

Warren Buffett, one of history’s greatest investors, put it simply: “If you like spending six to eight hours per week working on investments, do it. If you don’t, then dollar-cost average into index funds.” For the vast majority of Americans, learning how to invest in the S&P 500 through low-cost index funds or ETFs, investing consistently, and staying the course is the clearest path to financial security and wealth.

What are you waiting for? Open that brokerage account today and take the first step toward building your financial future. Your 30-year-from-now self will thank you.

FAQs

Q. Can beginners invest in the S&P 500?

- Yes. The S&P 500 is one of the most beginner-friendly investments for U.S. investors because it provides instant diversification across 500 large U.S. companies and requires minimal ongoing management.

Q. What is the best way to invest in the S&P 500?

- The most common and cost-effective way is through an S&P 500 ETF or index fund, such as VOO, SPY, IVV, FXAIX, or VFIAX, using a U.S. brokerage or retirement account.

Q. How much money do I need to start investing in the S&P 500?

- You can start with as little as $1–$100 using fractional shares at most U.S. brokerages. There is no fixed minimum for ETFs, and many index funds have low or no minimum investment requirements.

Q. Is the S&P 500 safe for long-term investing?

- While the S&P 500 experiences short-term volatility, it has historically delivered strong long-term returns for investors who stay invested for 10 years or more.

Q. Is it better to invest in the S&P 500 through an ETF or an index fund?

- Both are effective. ETFs offer more flexibility and are ideal for taxable accounts, while index mutual funds are better suited for automatic investing in retirement accounts like IRAs and 401(k)s.

Disclaimer: This article is for educational purposes only and should not be considered personalized financial advice. Past performance of the S&P 500 does not guarantee future results. Consider consulting with a licensed financial advisor before making investment decisions.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.