Introduction: Why Most People Struggle With Money (And How a Budget Fixes It)

If you’re living paycheck to paycheck, watching your bank account dwindle before the month ends, or feeling anxious every time you check your balance, you’re not alone. According to recent surveys, nearly 78% of Americans live paycheck to paycheck, and over 60% say they couldn’t cover a $1,000 emergency without going into debt.

The problem isn’t that you’re bad with money—it’s that money flows in and out of your life without a clear system to guide it. Learning how to create a budget is the solution most people overlook.

That’s where budgeting comes in. A budget isn’t about restricting yourself or living like a monk. It’s simply a spending plan that tells your money where to go instead of wondering where it went. Think of it like a GPS for your finances: it helps you navigate from where you are to where you want to be.

In this guide, you’ll learn exactly how to create a budget that works for your life, with real examples, simple methods, and practical tools. Whether you earn $2,000 or $10,000 a month, understanding how to create a budget will help you take control. By the end of this article, you’ll know how to create a budget from scratch, even if you’ve never done it before.

What Is a Budget?

Before we dive into how to create a budget, let’s define what a budget actually is.

A budget is a plan that shows how much money you have coming in and how you’ll spend or save it each month.

That’s it. Nothing complicated. When you learn how to create a budget, you’re simply learning to organize your money intentionally.

What a Budget Is NOT:

- Not punishment: You’re not forbidding yourself from enjoying life

- Not rigid: Good budgets have flexibility built in

- Not only for people in debt: Everyone benefits from knowing their numbers

- Not a one-time thing: Budgets evolve as your life changes

Why Budgets Fail When Misunderstood

Many people try to figure out how to create a budget once, feel restricted, break it within a week, and give up forever. The mistake? Treating it like a diet instead of a lifestyle. A working budget adapts to your reality and helps you make intentional choices, not perfect ones.

Benefits of Creating a Budget

Understanding how to create a budget gives you:

- Complete visibility: Know exactly where every dollar goes each month

- Control over spending: Stop overspending on impulse purchases

- Financial security: Build savings and emergency funds consistently

- Reduced stress: No more anxiety, wondering if you can afford something

- Goal achievement: Reach milestones like buying a car, a home, or a vacation faster

- Debt freedom: Pay off credit cards and loans strategically

Think of learning how to create a budget as giving yourself a raise—not by earning more, but by keeping more of what you already earn.

Step 1: Calculate Your Monthly Income

The first step in creating a budget is knowing exactly how much money you have to work with. Before you can plan where money goes, you need to know how much is coming in.

If You Have a Steady Salary

When learning how to create a budget with a steady paycheck, calculate your net income (take-home pay after taxes, not your gross salary).

Example:

- Gross annual salary: $60,000

- After taxes, 401(k), health insurance: $3,800/month take-home

- Your budgetable income: $3,800

If You Have Variable or Freelance Income

If you’re wondering how to create a budget with irregular income, look at the last 3-6 months and calculate your average monthly income.

Example:

January: $4,200

February: $3,100

March: $5,400

April: $3,800

May: $4,500

June: $3,900

---

Total: $24,900 ÷ 6 months = $4,150 averagePro tip: When figuring out how to create a budget with variable income, budget based on your lowest earning month for safety, then treat extra income as bonus money for savings or goals.

Don’t Forget Side Income

As you learn how to create a budget, include:

- Freelance work

- Side hustles (Uber, DoorDash, Etsy)

- Rental income

- Investment dividends

Important: Always use net income (what actually hits your bank account), not gross income. This is one of the biggest mistakes people make when learning how to create a budget.

Step 2: Track and List All Your Expenses

The second critical step in creating a budget is understanding where your money currently goes. You can’t manage what you don’t measure. Spend 30 days tracking every single expense.

Fixed Expenses (Same Every Month)

When you’re learning how to create a budget, start by listing these predictable costs:

- Rent or mortgage: $1,200

- Car payment: $350

- Car insurance: $120

- Health insurance: $180

- Phone bill: $70

- Internet: $60

- Streaming subscriptions: $45

- Student loan payment: $200

- Gym membership: $35

Variable Expenses (Change Monthly)

These fluctuate, but average out when you learn how to create a budget accurately:

- Groceries: $400-500

- Gas: $150-200

- Dining out: $200-300

- Entertainment: $100-150

- Personal care: $50-100

- Clothing: $100-200

- Household items: $75-125

How to Track Effectively

Option 1: Bank/Credit Card Statements Review the past 2-3 months and categorize every transaction. Time-consuming but thorough for anyone learning how to create a budget.

Option 2: Budgeting Apps

- Mint (free, automatic tracking)

- YNAB (You Need A Budget) – $14.99/month

- PocketGuard (free version available)

- EveryDollar (free or premium)

Option 3: Spreadsheet Download free Google Sheets or Excel templates and manually enter expenses daily. This hands-on approach helps you really understand how to create a budget.

Option 4: Cash Envelope + Receipt Tracking Keep every receipt for 30 days and tally weekly.

The 30-Day Tracking Method: Start on the 1st of any month. Write down or app-track every expense, no matter how small. That $4 coffee? Track it. The $12 Amazon impulse buy? Track it. After 30 days, you’ll have a crystal-clear picture of your spending patterns—essential knowledge for how to create a budget that actually works.

Step 3: Categorize Expenses (Needs vs Wants vs Savings)

The third step in how to create a budget is organizing your expenses into three buckets:

NEEDS (Essential for Living)

- Housing

- Utilities

- Groceries

- Transportation

- Insurance

- Minimum debt payments

- Basic clothing

WANTS (Enhance Your Life)

- Dining out

- Entertainment

- Subscriptions (Netflix, Spotify)

- Hobbies

- Non-essential shopping

- Vacations

SAVINGS (Future You)

- Emergency fund

- Retirement contributions

- Debt payments beyond minimums

- Investment accounts

- Specific goal savings (house, car, wedding)

Common Beginner Mistake

Many people learning how to create a budget classify wants as needs. Your $150/month takeout habit? That’s a want. The $50 gym membership you never use? Want. Be honest with yourself—this clarity is powerful when you’re figuring out how to create a budget.

Best Budgeting Methods (Choose What Works for You)

There’s no single answer to how to create a budget. Here are three proven methods for creating a budget that matches your lifestyle:

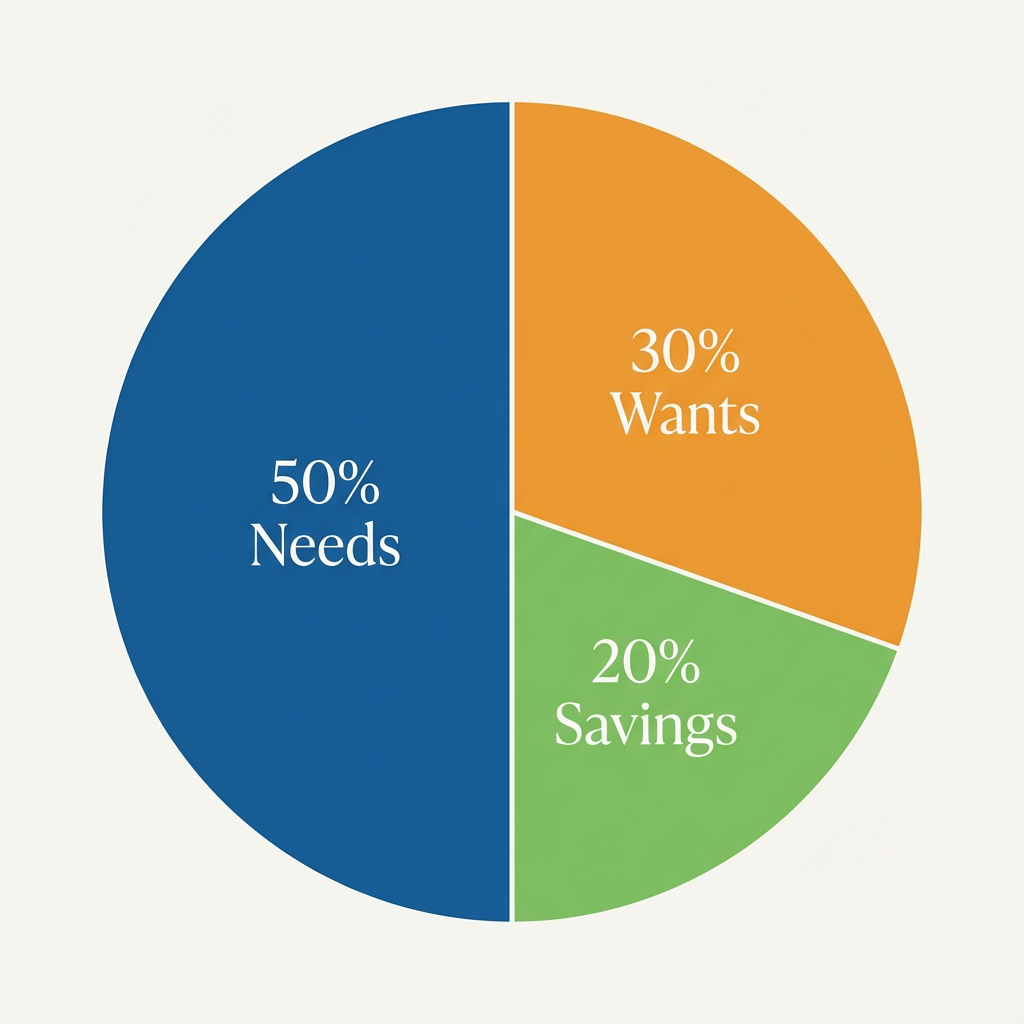

1. The 50/30/20 Budget Rule (Simple & Popular)

This is often the easiest method when learning how to create a budget for the first time.

How it works:

- 50% of income goes to needs

- 30% goes to wants

- 20% goes to savings/debt

Best for: Beginners who want to know how to create a budget without tracking every penny.

Example with $4,000 monthly income:

| Category | Percentage | Amount |

|---|---|---|

| Needs (rent, bills, groceries) | 50% | $2,000 |

| Wants (fun, dining, hobbies) | 30% | $1,200 |

| Savings/Debt (emergency fund, 401k) | 20% | $800 |

Real-life application: Sarah earns $3,500/month after taxes as a marketing coordinator in Austin, Texas. When she learned how to create a budget using the 50/30/20 method, her finances transformed:

- Needs ($1,750): $900 rent (roommate), $120 car insurance, $250 groceries, $80 utilities, $150 gas, $250 minimum debt payments

- Wants ($1,050): $200 dining out, $150 entertainment, $100 shopping, $50 subscriptions, $550 flexible spending

- Savings ($700): $400 emergency fund, $300 extra debt payment

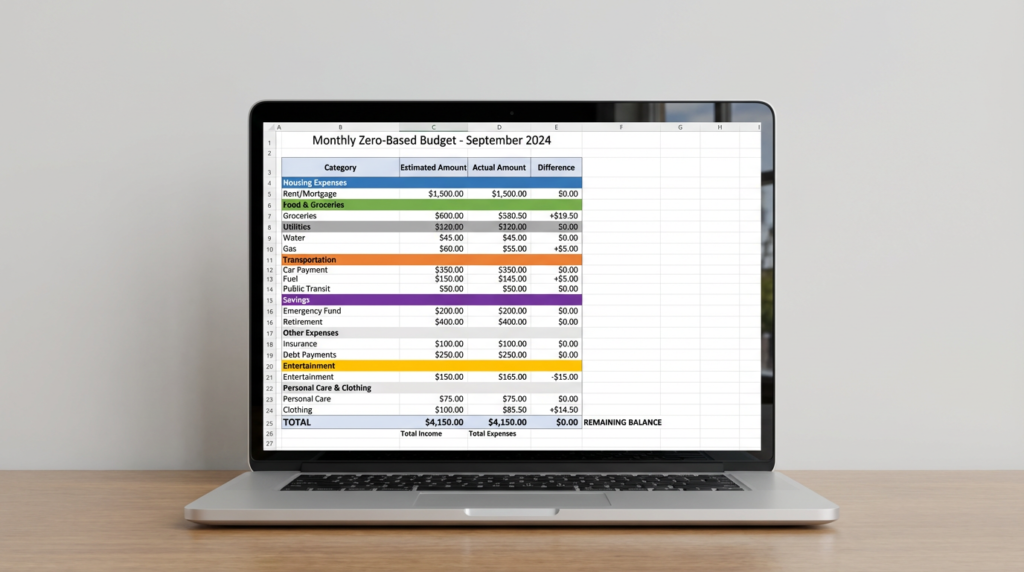

2. Zero-Based Budgeting

Another powerful approach to creating a budget is the zero-based method.

How it works: Every dollar gets assigned a job until you reach zero. Income minus all expenses and savings equals $0.

Formula: Income – (Expenses + Savings + Debt) = $0

Best for: People paying off debt aggressively or wanting maximum control over how to create a budget.

Example with $5,000 monthly income:

| Category | Amount |

|---|---|

| INCOME | $5,000 |

| Rent | $1,400 |

| Utilities | $180 |

| Groceries | $500 |

| Transportation | $350 |

| Insurance | $280 |

| Phone/Internet | $130 |

| Dining Out | $250 |

| Entertainment | $150 |

| Personal Care | $100 |

| Credit Card Payment | $800 |

| Emergency Fund | $500 |

| Retirement (401k) | $250 |

| Fun Money | $110 |

| TOTAL ALLOCATED | $5,000 |

| REMAINING | $0 |

Real-life application: Marcus, a 28-year-old teacher in Phoenix with $15,000 in credit card debt, learned how to create a budget using the zero-based method to throw every available dollar at his debt while covering essentials.

3. Envelope Budgeting Method

This tactile approach to creating a budget works wonders for visual learners.

How it works: Allocate cash into physical (or digital) envelopes for each spending category. Once an envelope is empty, you stop spending in that category.

Best for: Visual learners and chronic overspenders who need hard limits when learning how to create a budget.

Physical Envelope Example:

| Envelope | Weekly Amount | Monthly Total |

|---|---|---|

| Groceries | $100 | $400 |

| Gas | $50 | $200 |

| Dining Out | $50 | $200 |

| Entertainment | $25 | $100 |

| Personal Care | $25 | $100 |

Modern Digital Version: Apps like GoodBudget and Mvelopes create virtual envelopes without needing cash—perfect for those learning how to create a budget in the digital age.

Real-life application: Jennifer, a 32-year-old nurse in Chicago, struggled with overspending on clothes and dining out. When she learned how to create a budget using physical envelopes for discretionary categories, she cut her overspending by 60% in three months.

Monthly Budget Examples (With Real Numbers)

Let’s look at practical examples of how to create a budget for different life situations.

Example 1: College Student Monthly Budget

Here’s how to create a budget when you’re a student with limited income.

Income: $1,800/month (part-time job + parental support)

| Category | Amount | Notes |

|---|---|---|

| Rent (shared apartment) | $600 | Roommates split 3 ways |

| Groceries | $200 | Meal prep, student discounts |

| Transportation | $80 | Gas + parking permit |

| Phone Bill | $40 | Family plan |

| Utilities | $50 | Split with roommates |

| Textbooks/Supplies | $100 | Averaged monthly |

| Entertainment | $150 | Movies, coffee, socializing |

| Eating Out | $120 | 1-2 times per week |

| Personal Care | $60 | Haircuts, toiletries |

| Emergency Fund | $200 | Building cushion |

| Subscriptions | $30 | Spotify, Netflix |

| Discretionary | $170 | Flexible buffer |

| TOTAL | $1,800 |

Example 2: Single Professional Budget

Here’s how to create a budget on a full-time professional salary.

Income: $4,500/month (take-home from $65,000 salary)

| Category | Amount | Percentage |

|---|---|---|

| NEEDS | ||

| Rent (1BR apartment) | $1,350 | 30% |

| Utilities | $150 | 3.3% |

| Groceries | $450 | 10% |

| Car Payment | $380 | 8.4% |

| Car Insurance | $140 | 3.1% |

| Gas | $180 | 4% |

| Health Insurance | $200 | 4.4% |

| Phone | $75 | 1.7% |

| Student Loan | $250 | 5.6% |

| WANTS | ||

| Dining Out | $300 | 6.7% |

| Entertainment | $150 | 3.3% |

| Gym | $45 | 1% |

| Subscriptions | $50 | 1.1% |

| Shopping | $200 | 4.4% |

| Hobbies | $100 | 2.2% |

| SAVINGS | ||

| 401(k) Match | $180 | 4% |

| Emergency Fund | $400 | 8.9% |

| Vacation Fund | $150 | 3.3% |

| Extra Debt | $150 | 3.3% |

| TOTAL | $4,500 | 100% |

Example 3: Freelance/Irregular Income Budget

Here’s how to create a budget when your income varies month to month.

Average Income: $5,200/month (ranges from $3,800-$7,000)

Strategy: Budget on the lowest month ($3,800), allocate extra in good months

| Category | Base Budget | Good Month Bonus |

|---|---|---|

| Rent | $1,200 | – |

| Utilities | $120 | – |

| Groceries | $400 | – |

| Transportation | $200 | – |

| Insurance | $350 | – |

| Phone/Internet | $110 | – |

| Business Expenses | $300 | – |

| Dining/Entertainment | $250 | +$200 |

| Emergency Fund | $400 | +$600 |

| Tax Savings | $350 | +$400 (30% of extra) |

| Debt Payment | $120 | +$200 |

| Base Total | $3,800 | |

| Good Month Total | $5,200+ |

Freelancer pro tip: When learning how to create a budget as a freelancer, save 25-30% of every payment for quarterly taxes in a separate account.

Step 4: Create Your Budget (Putting It All Together)

Now it’s time to actually implement what you’ve learned about how to create a budget. Here’s how to create a budget step by step:

The Creation Process:

1. Choose your method (50/30/20, zero-based, or envelope)—pick the approach to creating a budget that fits your personality

2. List your total monthly income (net, after taxes)

3. List all expenses from your 30-day tracking

4. Assign dollar amounts to each category—this is where how to create a budget becomes real

5. Subtract expenses from income

- If you have money left over: Add to savings or goals

- If you’re short: Cut wants first, negotiate needs second

6. Prioritize savings first (pay yourself first method)

Budget Adjustment Formula:

If your expenses exceed income when you’re learning how to create a budget, make cuts in this order:

- Wants (entertainment, subscriptions, dining out)

- Negotiable needs (shop for cheaper insurance, find a roommate)

- Income increase (side hustle, sell items, ask for a raise)

Never cut: Minimum debt payments, essential insurance, basic nutrition, or housing that keeps you safe.

Best Tools to Create and Manage a Budget

Once you understand how to create a budget, you need the right tools to maintain it. Here’s how to create a budget using different platforms:

| Tool | Cost | Best For | Pros | Cons |

|---|---|---|---|---|

| Google Sheets | Free | DIY customizers learning how to create a budget | Fully customizable, accessible anywhere | Manual entry, no automation |

| Mint | Free | Automatic tracking | Syncs with bank, free, user-friendly | Ads, less control |

| YNAB | $14.99/mo | Zero-based budgeters | Excellent method, great support, teaches how to create a budget effectively | Costs money, learning curve |

| EveryDollar | Free/$17.99 | Ramsey fans | Simple interface, aligned with Dave Ramsey principles on how to create a budget | Premium needed for bank sync |

| PocketGuard | Free/$12.99 | Overspenders | Shows “safe to spend” amount | Limited free features |

| Printable PDF | Free | Pen & paper people | No tech needed, tangible way to learn how to create a budget | Time-consuming, easy to lose |

My recommendation for beginners: Start with a simple Google Sheets template or the free version of Mint when learning how to create a budget. Once you’re comfortable, upgrade if needed.

How to Stick to Your Budget (Most Important Section)

Knowing how to create a budget is one thing—sticking to it is another. Here’s how to create a budget that you’ll actually follow:

1. Automate Everything Possible

Set up automatic transfers on payday:

- Emergency fund: $200 → Savings account

- Retirement: 10% → 401(k)

- Bills: Auto-pay from checking

Why it works: You can’t spend money that’s already gone. This makes creating a budget much easier to maintain.

2. Do Weekly Budget Check-Ins

Every Sunday, spend 15 minutes reviewing:

- What did you spend this week

- What’s left in each category

- Upcoming expenses

- Adjustments needed

Real example: Jake checks his budget every Sunday morning with coffee. It’s become a ritual that keeps him aware without feeling overwhelmed—his secret to successfully maintaining how to create a budget practice.

3. Identify Your Spending Triggers

Common triggers when learning how to create a budget:

- Stress → Retail therapy

- Boredom → Online shopping

- Social pressure → Expensive outings

- Celebrations → Overspending on dining

Solution: Create a list of free/cheap alternatives for each trigger.

4. Build in a Buffer Category

Life happens. Budget $50-100 for “miscellaneous” or “buffer” each month for unexpected expenses. This prevents total budget collapse when something comes up—a crucial tip for how to create a budget that lasts.

5. Use the 24-Hour Rule

For any non-essential purchase over $50, wait 24 hours. Add it to a wishlist. If you still want it tomorrow, budget for it next month.

6. Make Wants Conditional

“I can go out to dinner this weekend IF I stay under budget in groceries this week.” Creates positive motivation instead of restriction.

7. Celebrate Small Wins

Hit your savings goal? Stayed under budget for a whole month? Celebrate with something small (but budgeted!). Positive reinforcement works when you’re learning how to create a budget and stick to it.

Common Budgeting Mistakes Beginners Make

Avoid these pitfalls when learning how to create a budget:

Mistake #1: Underestimating Expenses

The problem: Thinking groceries cost $200 when you actually spend $400.

The fix: Track ruthlessly for 60 days before setting final numbers. This is essential when figuring out how to create a budget accurately.

Mistake #2: Forgetting Irregular Expenses

The problem: Car registration, annual subscriptions, holiday gifts, and vet bills destroy your budget.

The fix: List all irregular expenses for the year, divide by 12, and save that amount monthly. This is a critical step in creating a budget that doesn’t fail.

Example:

- Car registration: $150

- Amazon Prime: $139

- Holiday gifts: $600

- Car maintenance: $400

- Annual total: $1,289 ÷ 12 = $107/month into “irregular expenses” fund

Mistake #3: Being Too Restrictive

The problem: Cutting all fun leads to burnout and binge spending.

The fix: Budget for enjoyment. Even $50-100/month for guilt-free spending makes budgets sustainable. Remember this when learning how to create a budget for long-term success.

Mistake #4: Not Tracking Consistently

The problem: Creating a perfect budget, then never looking at it again. You learned how to create a budget, but didn’t maintain it.

The fix: Make tracking a habit. Daily 2-minute check-ins or weekly 15-minute reviews.

Mistake #5: Comparing to Others

The problem: Feeling bad because your coworker saves 40% while you’re at 10%.

The fix: Your budget is personal. Progress, not perfection. How to create a budget is different for everyone—compare yourself to your past self only.

Mistake #6: Quitting After One Bad Month

The problem: Overspending once and assuming “how to create a budget doesn’t work for me.”

The fix: Budgeting is a skill. You wouldn’t quit guitar after one bad practice. Adjust and continue.

What to Do If Your Budget Isn’t Working

Even when you know how to create a budget, sometimes adjustments are needed:

Problem: Expenses Exceed Income Every Month

Solutions:

- Cut ruthlessly: Cancel unused subscriptions, reduce dining out, and shop for cheaper groceries

- Increase income: Side hustle, sell unused items, ask for a raise

- Negotiate bills: Call insurance, internet, and phone providers for better rates

- Change living situation: Get a roommate, move to cheaper housing (if feasible)

Problem: You Keep Overspending in Certain Categories

When learning how to create a budget, overspending happens. Here’s how to fix it:

Solutions:

- Switch to cash: Physically seeing money leave your wallet reduces spending

- Separate the temptation: Remove saved payment info from shopping sites

- Reduce the budget: Maybe $300/month dining out isn’t realistic yet—try $150

- Accountability partner: Share your goals with a friend who checks in weekly

Problem: Unexpected Expenses Keep Derailing You

Solutions:

- Build an emergency fund faster: Even $500-1,000 prevents most crises

- Increase your buffer category: Budget more for “miscellaneous.”

- Review irregular expenses: You might be missing predictable costs when you learned how to create a budget

- Consider income-based repayment: For student loans, explore options

How Often Should You Review Your Budget?

After learning how to create a budget, maintain it with these review schedules:

- Daily: Quick spending check (2 minutes)

- Weekly: Category review and adjustments (15 minutes)

- Monthly: Full budget assessment and next month planning (30-60 minutes)

- Quarterly: Big picture review, adjust for life changes

- Annually: Complete budget overhaul, set new goals

FAQs About Creating a Budget

Q. How often should I update my budget?

- Review weekly, update monthly, or whenever your income/expenses significantly change (new job, moving, major purchase). Learning how to create a budget is just the beginning—maintaining it requires regular updates.

Q. Is budgeting necessary if I don’t earn much?

- Absolutely! Learning how to create a budget is MOST important when money is tight. It helps you stretch every dollar and avoid the debt trap. Even on minimum wage, knowing where your money goes creates opportunities to save small amounts that grow over time.

Q. Can budgeting help with debt?

- Yes! Understanding how to create a budget is the foundation of debt payoff. By tracking spending and cutting waste, you free up money for extra payments. Methods like zero-based budgeting are specifically powerful for debt elimination.

Q. How long does it take to see results?

- Most people who learn how to create a budget notice reduced financial stress within 2-4 weeks. Tangible results (savings growth, debt reduction) typically show within 2-3 months. Life-changing results (emergency fund fully funded, debt eliminated) take 6-24 months depending on goals.

Q. What if my income varies every month?

- When learning how to create a budget with variable income, budget based on your lowest-earning month for essentials. When you earn more, allocate extra to savings, debt, or goals. Build a larger emergency fund (3-6 months) to smooth out the gaps.

Q. Should I include my spouse’s income?

- If you share expenses, yes. When figuring out how to create a budget as a couple, create a combined budget with shared goals while allowing each person personal spending money (no questions asked). Communication is key.

Final Thoughts: Budgeting Is a Skill, Not a One-Time Task

Here’s the truth: your first attempt at how to create a budget will be imperfect. You’ll forget expenses. You’ll overspend in some categories and underspend in others. You’ll feel restricted, then wonder why you bothered.

That’s completely normal.

Learning how to create a budget is like learning to cook. The first meal might be burnt, but with practice, you develop instincts. Eventually, you won’t need to measure everything—you’ll just know.

Start simple: Pick the 50/30/20 method, track for 30 days, and adjust as you learn how to create a budget that fits your life.

Be consistent: Check in weekly, even when it’s uncomfortable.

Show yourself grace: One bad spending week doesn’t erase your progress in learning how to create a budget.

Remember why you started: Whether it’s eliminating debt, buying a home, or simply sleeping better at night, your “why” will carry you through the process of how to create a budget and stick with it.

The difference between people who achieve financial freedom and those who don’t isn’t income—it’s intention. Understanding how to create a budget gives you that intention.

You don’t need to be perfect. You just need to start. Now that you know how to create a budget, the only thing left is to take action.

Ready to take control? You now know exactly how to create a budget from start to finish. Remember, everyone who’s financially successful today once had to learn how to create a budget—just like you’re doing right now. You’ve got this.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.