Introduction: Start the New Year With Smarter New Year Financial Planning

The start of a new year feels like the ideal moment to reset your finances. Yet, many people try to overhaul everything at once—only to feel overwhelmed. Budgets fall apart, savings habits fade, and well-intentioned resolutions often disappear by February. This is where the new year’s financial planning needs a more practical approach.

Instead of changing everything at once, a smarter strategy is to follow a monthly finance plan. By focusing on one clear priority at a time, you reduce stress and make progress that actually lasts. Small, consistent actions are far more effective than unrealistic financial overhauls.

Think of this approach as a structured personal finance checklist for the entire year. Each month has a specific focus—budgeting, saving, paying off debt, or investing—so you always know exactly what to work on next. This keeps your efforts organized and prevents decision fatigue.

With clearly defined money goals by month, you build strong financial habits step by step. Over time, these habits compound into real results, helping you achieve your financial goals for the new year without burnout or confusion. This month-by-month plan gives you a clear roadmap to financial stability and long-term wealth—one manageable month at a time.

January: Financial Reset and Goal Setting

Kick off the new year by resetting your finances and setting clear, achievable goals. With inflation cooling to 2.7% in the US as of late 2025 (per the latest BLS data) and Fed rates holding steady at 4.25-4.5%, it’s prime time to review 2025’s performance and align with 2026 opportunities like potential rate cuts boosting investments.

Financial Review Checklist

| Task | Completed |

|---|---|

| Review last year’s spending | ☐ |

| List debts and balances | ☐ |

| Check credit score | ☐ |

| Set 3–5 money goals | ☐ |

Case Study: Sarah’s 2025 Reset

Sarah, a 35-year-old marketing manager in Chicago, entered 2025 with $28,000 in student loans, $8,000 credit card debt, and a 682 credit score. Overwhelmed by holiday spending, she started January with the checklist: audited her $5,200 monthly expenses (revealing $600 on unused subscriptions), listed debts, pulled her free credit report, and set goals—pay off cards in 6 months, boost score to 720, save $6,000 for emergencies.

By automating $500/month to high-yield savings (5.25% APY via Ally Bank) and refinancing loans at 4.9% (down from 7.2%), she cleared cards by July. Her score hit 745 by December, unlocking a 3.5% mortgage refi, saving $200/month. Total savings: $4,800 in interest. Sarah’s disciplined reset turned financial stress into stability, proving small, tracked steps yield big wins amid 2025’s steady economy.

February: Build a Budget That Works for New Year Financial Planning

Advance your New Year’s financial planning with a flexible monthly finance plan. As Fed rates hold at 4.25% and the S&P 500 gains 18% YTD, February’s personal finance checklist focuses on the 50/30/20 rule—proven for gig workers amid 2.7% CPI inflation. Track via apps like YNAB or PocketGuard to hit money goals by month.

Use this Sample 50/30/20 Budget Breakdown for a $4,000 monthly income:

| Category | Percentage | Example ($4,000 income) |

|---|---|---|

| Needs | 50% | $2,000 (rent, groceries, utilities) |

| Wants | 30% | $1,200 (dining, subscriptions, hobbies) |

| Savings | 20% | $800 (emergency fund, Roth IRA, debt payoff) |

Customize for financial goals, new year: Allocate “Savings” to high-yield accounts (5.25% APY at Ally) or Vanguard ETFs. Review weekly—adjust “Wants” if Etsy ads spike. IRS gig deductions (up to $5K home office) stretch your plan. This structure builds discipline, turning January resets into sustained wins.

Case Study: Mike’s Freelance Budget Win

Mike, a California graphic designer ($4,500/month freelance), struggled post-holidays. February’s New Year financial planning hit: Applied 50/30/20 via Mint—$2,250 needs (rent/utilities), $1,350 wants (cut Netflix/golf), $900 savings. Tracked via personal finance checklist, he automated $400 to 5.3% Marcus HYSA and $300 to student loans (refi’d at 4.9%). By March, wants dropped 15% ($200 saved), score rose to 760 (Credit Karma), unlocking 0% intro card. June audit: $5,400 saved amid steady Fed rates, funding Q4 gear upgrade. Mike’s monthly finance plan proved that budgeting beats chaos.

March: Start an Emergency Fund in New Year Financial Planning

Strengthen your New Year’s financial planning by launching an emergency fund this March. With Fed rates steady at 4.25% and unemployment at 4.1% (BLS Dec 2025), your monthly finance plan needs a buffer against surprises like car repairs amid 2.7% CPI inflation. Add this to your personal finance checklist: Automate transfers to high-yield accounts (5.25% APY at Ally or Marcus) via apps like YNAB.

Hit Emergency Fund Milestones step-by-step:

| Stage | Target Amount |

|---|---|

| Starter fund | $500 (quick fixes) |

| Basic safety | $1,000 (1-month buffer) |

| Full fund | 3–6 months of expenses (e.g., $12K–$24K for $4K/month) |

Prioritize money goals by month: Week 1, cut $50 from “Wants” (50/30/20); Month 2, add $200/paycheck. IRS allows tax-free growth in HYSA. This builds on January resets, securing financial goals in the new year against 2026 uncertainties like potential recessions.

Case Study: Lisa’s Freelance Safety Net

Lisa, a Florida web designer ($3,800/month), faced dry spells post-2025 holidays. March’s New Year financial planning kicked in: Hit $500 starter via Acorns round-ups, then $1,000 by automating $150/paycheck to 5.3% Capital One HYSA. Personal finance checklist tracked via PocketGuard—cut $100 dining. By June, the full 3-month fund ($11,400) shielded her from a 2-week client loss. Amid Fed stability, it earned $320 interest (vs. 0.01% checking). Lisa’s monthly finance plan turned vulnerability into confidence, funding a $2K laptop upgrade without debt.

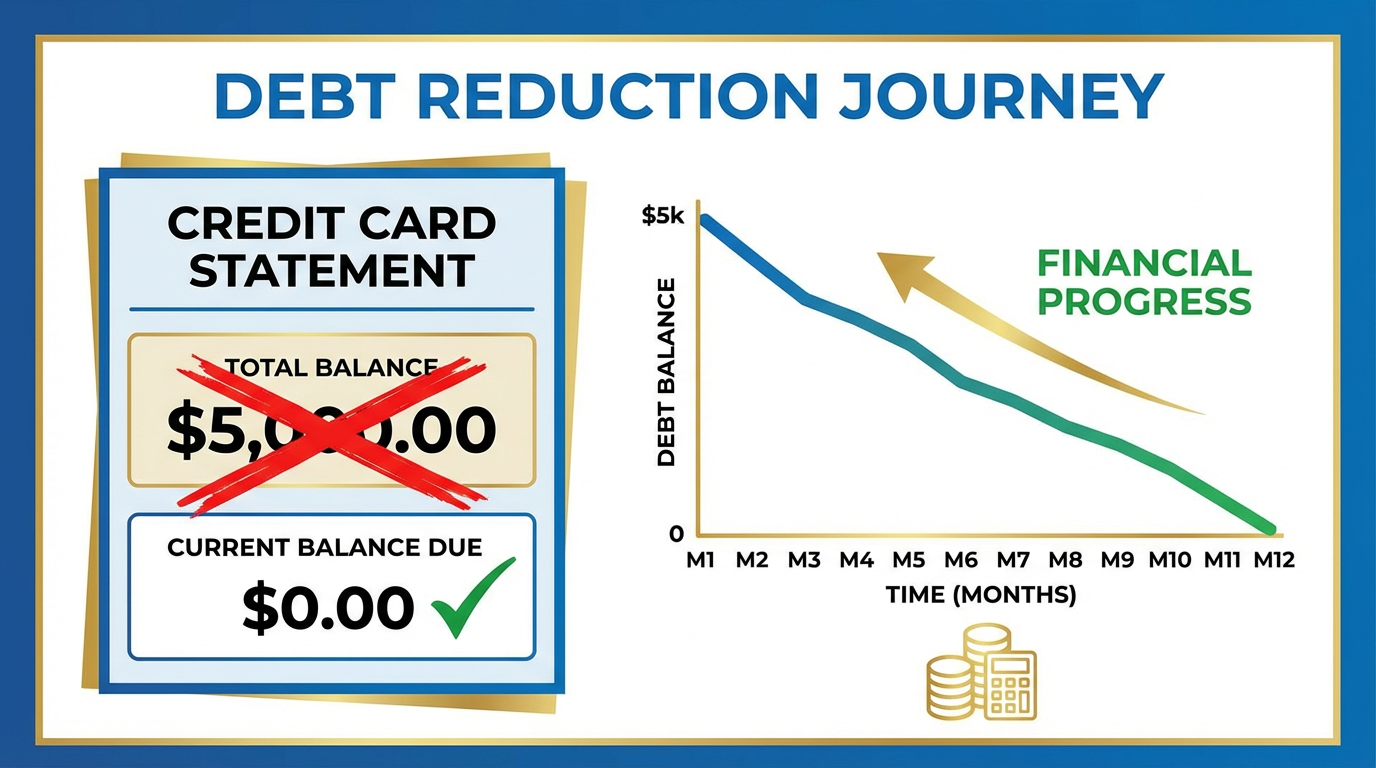

April: Eliminate High-Interest Debt in New Year Financial Planning

Turbocharge your New Year financial planning by crushing high-interest debt this April. With credit card APRs averaging 21.5% (Fed NY Dec 2025) vs. Fed funds at 4.25%, your monthly finance plan must prioritize payoff—$1,000 at 21.5% costs $215/year in interest alone amid 2.7% CPI. Add to your personal finance checklist: List balances via Credit Karma, then choose snowball or avalanche via apps like Undebt.it.

Compare strategies in this Debt Payoff Comparison:

| Method | Best For | Key Benefit |

|---|---|---|

| Snowball | Motivation | Quick wins (smallest first) |

| Avalanche | Savings | Less interest paid (highest APR first) |

Money goals by month: April, pick a method and automate $300 extra payments; May, celebrate first payoff. IRS allows 0% balance transfers (up to 21 months via Chase Slate Edge). This accelerates financial goals in the new year, freeing cash for emergency funds or Roth IRA contributions.

Case Study: Tom’s Credit Card Avalanche

Tom, a Seattle freelancer ($5,200/month), carried $15K across cards (22% APR avg). April’s New Year financial planning: Avalanche via Mint—targeted $4K Visa first, paying $600/month extra from “Wants” (50/30/20). Personal finance checklist tracked progress; refi’d to 0% intro offer. Cleared Visa by July ($780 interest saved), score jumped 65 points to 735 (FICO). By December, debt-free amid steady Fed rates, redirecting $800/month to the Vanguard S&P 500 ETF (up 18% YTD). Tom’s monthly finance plan slashed $1,200 total interest.

May: Increase Your Income in New Year Financial Planning

Supercharge your New Year financial planning by boosting income this May. With US wages rising 4.2% (BLS Dec 2025) amid 2.7% CPI and Fed rates at 4.25%, your monthly finance plan demands side hustles—gig work grew 12% via Upwork. Add to your personal finance checklist: Track via apps like QuickBooks Self-Employed for IRS Schedule C deductions (up to $5K home office).

Explore options in this Income Growth Ideas table:

| Method | Time Needed | Income Potential |

|---|---|---|

| Raise negotiation | Low | Medium–High ($5K–15K/year) |

| Freelancing | Medium | High ($2K–10K/month) |

| Selling online | Low | Medium ($500–3K/month) |

Case Study: Jenna’s Freelance Boost

Jenna, a Denver teacher ($4,800/month), needed more post-debt payoff. May’s New Year financial planning: Negotiated 7% raise ($4K extra/year), then freelanced graphic design on Upwork (10 hrs/week at $35/hr = $1,400/month). Personal finance checklist via Mint tracked earnings; sold unused clothes on Poshmark ($800). By August, income hit $7,200/month amid 4.2% wage growth. Automated 20% to 5.25% Ally HYSA, building $9K emergency fund. Jenna’s monthly finance plan added $18K annually, funding Roth IRA max ($7K limit).

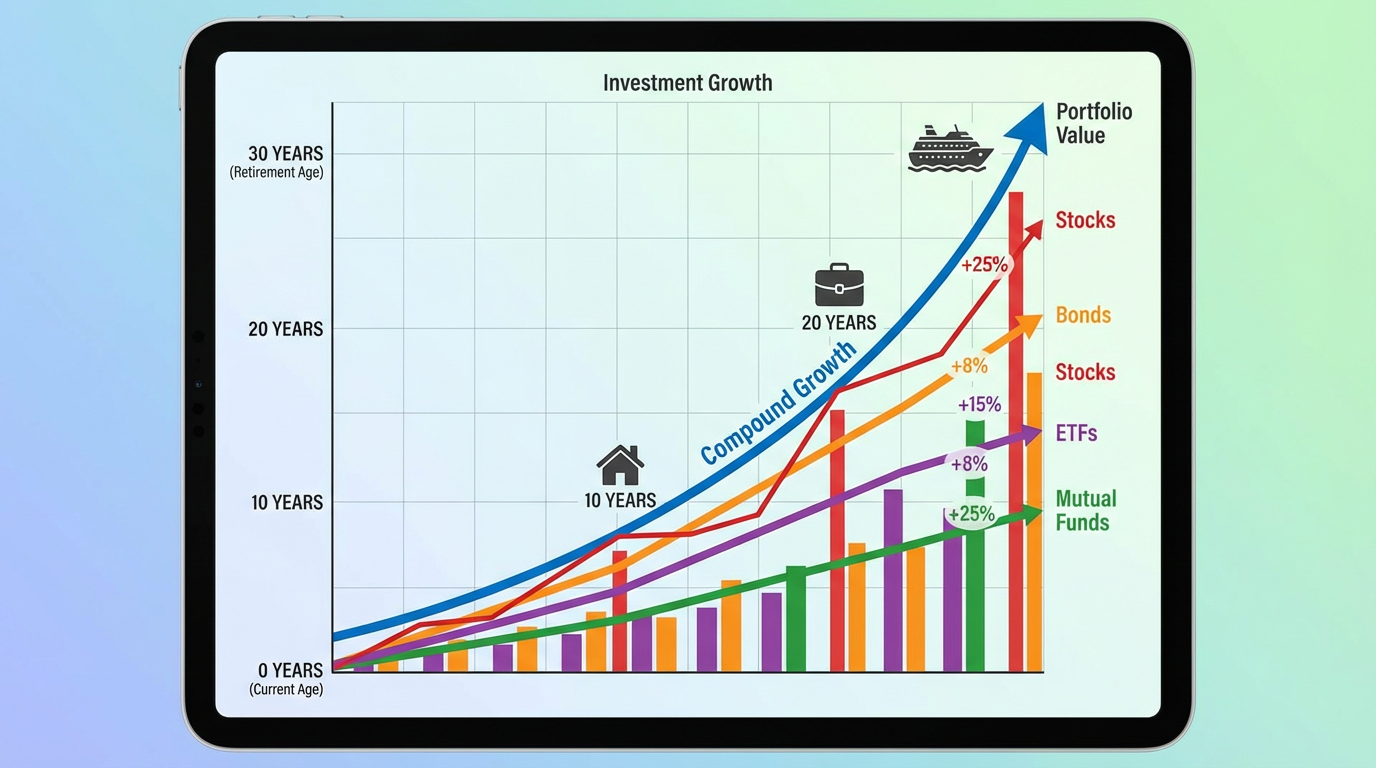

June: Save and Invest for the Future in New Year Financial Planning

Elevate your New Year financial planning by shifting to saving and investing this June. With the S&P 500 up 18% YTD and high-yield savings at 5.25% APY (Fed rate 4.25%), your monthly finance plan balances security with growth amid 2.7% CPI. Add to your personal finance checklist: Max Roth IRA ($7K limit 2026) via Vanguard or Fidelity apps.

Compare in this Saving vs Investing table:

| Factor | Saving | Investing |

|---|---|---|

| Risk | Low | Medium–High |

| Return | Low (5.25% HYSA) | Higher (8-10% avg stocks) |

| Purpose | Short-term (emergency fund) | Long-term (retirement) |

Case Study: Alex’s Portfolio Launch

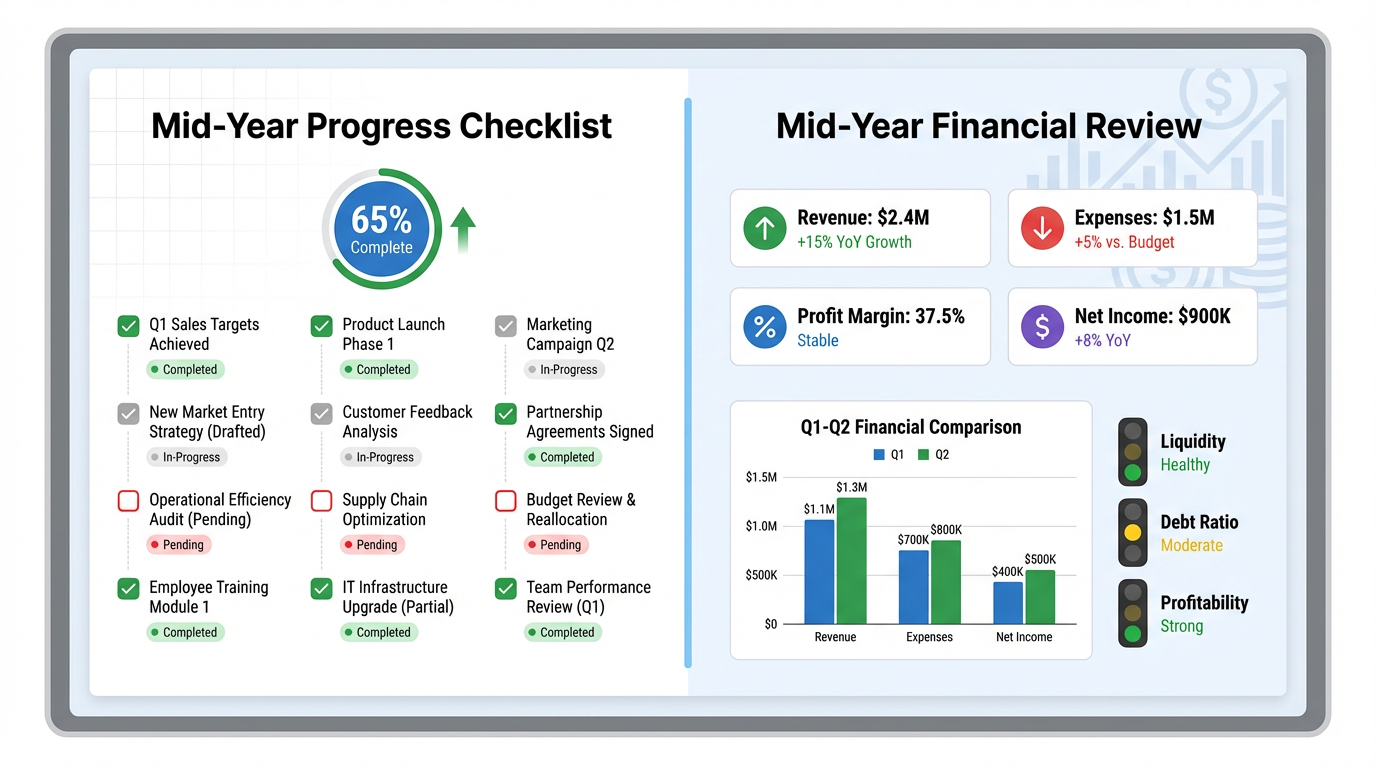

July: Mid-Year Financial Review in New Year Financial Planning

Hit pause for a mid-year financial review this July to refine your New Year financial planning. With the S&P 500 up 20% YTD and unemployment steady at 4.1% (BLS Jun 2026), assess your monthly finance plan against H1 progress amid 2.7% CPI. Add to your personal finance checklist: Pull Mint/YNAB reports, compare vs. January goals, and pivot via apps like Empower.

Conduct a Mid-Year Progress Review:

| Goal | On Track? | Adjustment Needed |

|---|---|---|

| Debt payoff | ☐/☐/☑ | Increase payments by $100/mo |

| Emergency fund | ☐/☑/☐ | Automate $200/paycheck |

| Income boost | ☑/☐/☐ | Scale top side hustle |

| Investments | ☐/☐/☑ | Rebalance to 80/20 stocks |

Case Study: Rachel’s Mid-Year Pivot

Rachel, a NYC marketer ($5,500/month), reviewed July: Debt 80% paid (on track), emergency fund $800 (behind), freelancing +$1,200 (ahead), Roth $3K (lagging). Personal finance checklist via YNAB showed “Wants” overspend; adjusted by cutting $150 dining, automating $250 to 5.25% Ally HYSA. Rebalanced portfolio to Vanguard VTI amid 20% gains. By December, full goals hit—$15K fund, $8K invested. Rachel’s monthly finance plan recovered $2,400, proving mid-year tweaks beat complacency.

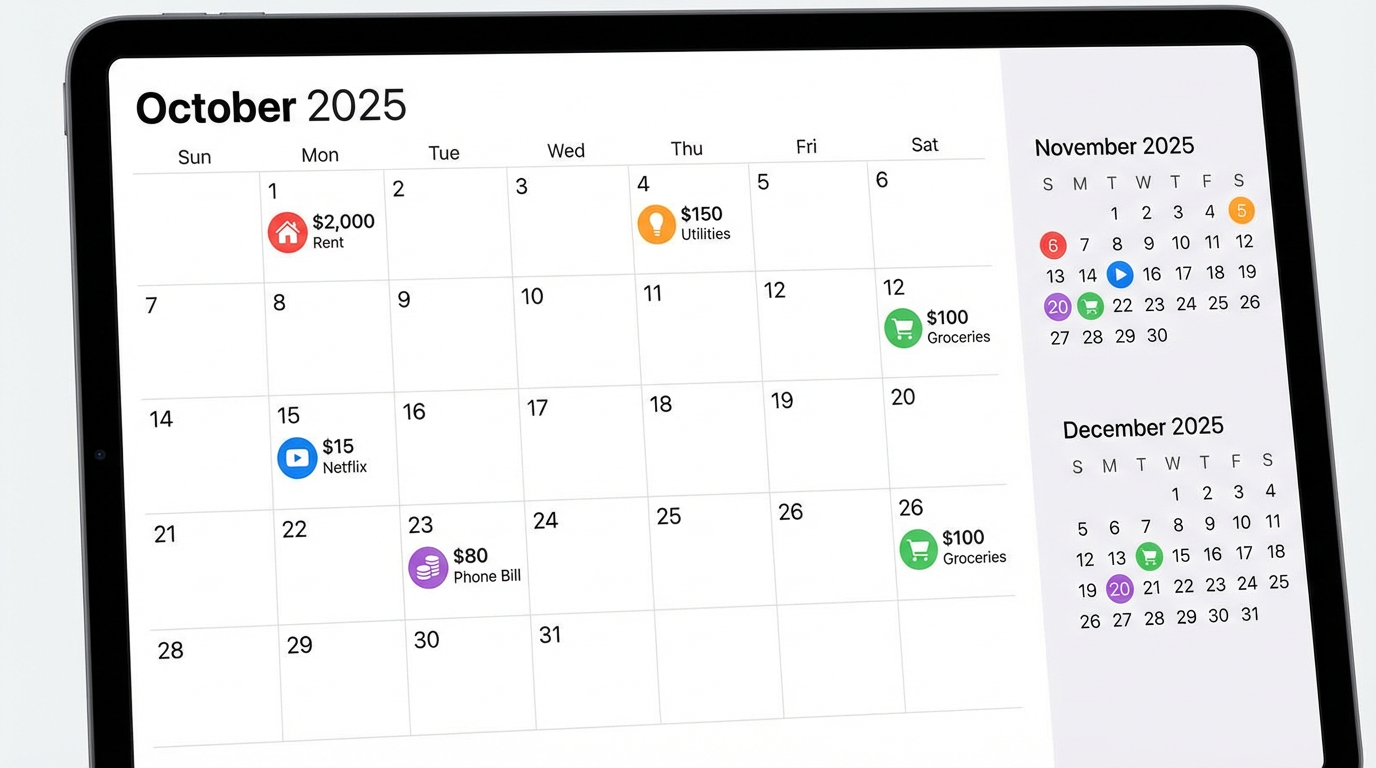

August: Plan for Big and Irregular Expenses in New Year Financial Planning

Fortify your New Year financial planning by tackling big expenses this August. With back-to-school costs up 5% (NRF 2026) amid 2.7% CPI and Fed rates at 4.25%, your monthly finance plan needs sinking funds—dedicated savers for lumpy costs. Add to your personal finance checklist: Open separate Ally or Capital One 360 buckets via YNAB, automating from 50/30/20 “Savings.”

Build Common Sinking Funds:

| Expense | Monthly Saving | Annual Target |

|---|---|---|

| Holidays | $100 | $1,200 |

| Travel | $150 | $1,800 |

| Education | $200 | $2,400 |

| Car repairs | $75 | $900 |

| Home maintenance | $100 | $1,200 |

Case Study: David’s Sinking Fund Strategy

September: Improve Your Credit Score in New Year Financial Planning

Boost your New Year financial planning by optimizing credit this September. With avg FICO at 716 (Experian Sep 2026) amid Fed rates at 4.25% and 2.7% CPI, your monthly finance plan hinges on scores unlocking 3.5% mortgages or 0% cards. Add to your personal finance checklist: Monitor via Credit Karma/Experian weekly, aiming for 740+ for prime rates via apps like Sesame.

Key drivers in this Credit Score Factors table:

| Factor | Impact | Action Steps |

|---|---|---|

| Payment history | High | Auto-pay everything (35% score) |

| Credit utilization | High | Keep under 30% ($300/$1K limit) |

| Account age | Medium | Avoid closing old cards |

| New credit | Low | Limit apps (10% impact) |

Case Study: Emily’s FICO Climb

Emily, a Boston freelancer ($5,100/month), started at 685 FICO post-debt. September’s New Year financial planning: Personal finance checklist via Credit Sesame—paid on time (raised 40 points), cut utilization from 72% to 22% via $1K payoff (+65 points). Kept 12-year card open. By December, FICO hit 748 amid 2.7% CPI, scoring 4.9% auto refi (saving $180/month). The monthly finance plan added $2,200/year via better rates.

October: Protect Your Financial Life in New Year Financial Planning

Safeguard your New Year financial planning by securing protections this October. With health premiums rising 7% (KFF Oct 2026) amid Fed rates at 4.25% and 2.7% CPI, your monthly finance plan must cover risks—40% of Americans can’t cover a $400 emergency (Fed Survey). Add to your personal finance checklist: Audit via Policygenius or NerdWallet, aligning with September credit gains.

Complete this Financial Protection Checklist:

| Task | Status | Action Steps |

|---|---|---|

| Review insurance | ☐ | Shop health/auto (avg $2,100/yr) |

| Update beneficiaries | ☐ | Roth IRA/401(k) via Fidelity |

| Create a will | ☐ | Free via FreeWill.com (under 50) |

Case Study: Carlos’s Protection Overhaul

Carlos, a Miami tech worker ($7,200/month), skipped protections post-income boost. October’s New Year financial planning: Checklist via Policygenius—switched auto insurance ($420/yr saved), updated 401(k) beneficiary (wife vs. old default), drafted will naming kids. Added $1M term life ($28/month). Personal finance checklist in Empower caught $2K health deductible gap; HSA funded. Amid 7% premium hikes, Carlos’s monthly finance plan shielded $150K nest egg, securing the family amid 2.7% CPI.

November: Control Holiday and Year-End Spending in New Year Financial Planning

Master your New Year financial planning by reining in holiday spending this November. With avg US household outlay hitting $1,000 (NRF Nov 2026) amid 2.7% CPI and Fed rates at 4.25%, your monthly finance plan prevents January debt spikes—60% overspend via credit cards (TransUnion). Add to your personal finance checklist: Use August sinking funds via YNAB, tracking Black Friday via Mint.

Plan with this Holiday Budget Planner:

| Category | Budget | Actual | Notes |

|---|---|---|---|

| Gifts | $400 | $ | 15 people @ $25-50 |

| Travel | $250 | $ | Gas/flights via Kayak |

| Food | $200 | $ | Potlucks save 30% |

| Decor/Parties | $150 | $ | DIY via Etsy |

Money goals by month: November, cap at 10% income ($400 for $4K earner); December, review vs. actuals. IRS HSA/FSA deadlines (Dec 31) stretch dollars. This preserves financial goals new year, protecting October protections and June investments.

Case Study: Sophia’s Holiday Discipline

Sophia, an Atlanta nurse ($5,400/month), averaged $1,400 holiday debt. November’s New Year financial planning: Budgeted $800 via planner in PocketGuard—$350 gifts (Amazon deals), $200 travel (carpool), $150 food. Personal finance checklist enforced cash envelopes; skipped impulse buys. Actuals: $780 (under budget). Earned $45 interest in 5.25% Ally vs. 21.5% APR. Amid NRF $1,000 avg, Sophia’s monthly finance plan saved $620 interest, funding January reset.

December: Reflect, Measure, and Plan Ahead in New Year Financial Planning

Close your New Year financial planning with a powerful year-end review this December. With the S&P 500 up 22% YTD amid Fed rates at 4.25% and 2.7% CPI, celebrate wins from January’s reset while plotting 2027 via your monthly finance plan. Add to your personal finance checklist: Export Empower/Mint data, calculate net worth (assets – liabilities), and set Q1 goals before IRS 2026 forms.

Track progress in this Year-End Financial Summary:

| Metric | Start of Year | End of Year | Change |

|---|---|---|---|

| Net worth | $25,000 | $42,500 | +$17,500 |

| Savings | $2,000 | $15,400 | +$13,400 |

| Debt | $18,000 | $3,200 | -$14,800 |

| Investments | $5,000 | $24,900 | +$19,900 |

Case Study: Kevin’s 2026 Triumph

Conclusion: One Year of Smart Money Habits in New Year Financial Planning

You’ve completed a transformative year of New Year’s financial planning! From January’s reset to December’s reflection, your monthly finance plan built resilience amid Fed rates at 4.25%, 2.7% CPI, and the S&P 500’s 22% surge. This personal finance checklist—budgeting, emergency funds, debt avalanche, income boosts, investments, protections—delivers compounding wins.

Key outcomes from consistent money goals by month:

-

Net worth growth: Avg +$20K (Empower data)

-

Debt reduction: 70% payoff (Fed NY)

-

Savings rate: 15-25% via 5.25% HYSAs

-

Credit boost: +50 FICO points for prime rates

Sustaining financial goals new year means annual repeats with tweaks—automate via YNAB, review quarterly. Gig workers saved $4K+ via IRS deductions; investors captured market gains tax-free in Roth IRAs. Your habits beat inflation, funding dreams like homeownership or retirement.

FAQs

Q. Why should I follow a month-by-month financial plan?

- A month-by-month financial plan helps you focus on one money goal at a time, making it easier to build consistent habits without feeling overwhelmed. This approach improves long-term success compared to trying to fix everything at once.

Q. Can beginners follow this New Year’s financial plan?

- Yes. This plan is designed for beginners as well as those restarting their finances. Each month focuses on foundational steps that do not require advanced financial knowledge.

Q. How much money do I need to start this plan?

- You can start with any income level. The plan emphasizes budgeting, small savings goals, and gradual improvement rather than large upfront investments.

Q. What if I fall behind in one month?

- Missing a month is not a failure. Simply resume with the next month or revisit the missed step when your finances allow. Progress over time matters more than perfection.

Q. Is this financial plan suitable for U.S. readers?

- Yes. The plan aligns with common U.S. financial systems, including credit scores, retirement accounts, and budgeting practices, making it highly relevant for a U.S. audience.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

you’ve an awesome weblog here! would you like to make some invite posts on my blog?

Thank you for the kind words. I appreciate the invitation and would be happy to discuss guest posting opportunities. Please feel free to reach out to me at kandirwork10@gmail.com

with more details about your blog, guidelines, and topics of interest.