Table of Contents

America’s Holiday Spending Problem Is Bigger Than You Think

Every December, millions of Americans step into the holiday season with excitement… and financial anxiety. Maybe you’ve been there: you promise yourself you’ll “keep it reasonable this year,” and then the gift list grows, travel costs spike, grocery bills climb, and suddenly you’re staring at a maxed-out credit card on January 1st.

If this sounds familiar, you’re not alone.

Christmas budgeting tips are more important than ever: the average American will spend $902 per person and $1,778 per household on Christmas in 2024 [How Much Do Americans Spend on Christmas?, Exploding Topics]. Spending is rising fast—holiday costs jumped 7.6% year-over-year, and inflation is impacting budgets by 8.8%.

The consequences are real. 24% of Americans go into holiday debt, averaging $1,012. Yet 78% still plan to spend the same or more [MoneyLion].

If you want to enjoy the holidays without the stress, these Christmas budgeting tips are your roadmap to financial sanity.

The State of U.S. Christmas Spending in 2024–2025

Before planning your budget, let’s see where the money goes.

How Much Americans Really Spend

-

$902 — average per person

-

$1,778 — average per household

-

$641 — gifts

-

$735 — travel

-

$238 — food

-

$507 — décor

Many Americans plan a budget, but 49% overspend anyway [2024 Holiday Spending Report, NerdWallet]. And 84% use credit cards, which can quickly lead to the $1,012 holiday debt average.

Why Overspending Happens

Several key reasons explain overspending:

-

Emotional pressure from family and social expectations

-

63% start shopping early to catch deals—but still overspend.

-

Credit card usage (84%) encourages impulse buys.

Christmas budgeting tips can help break this cycle.

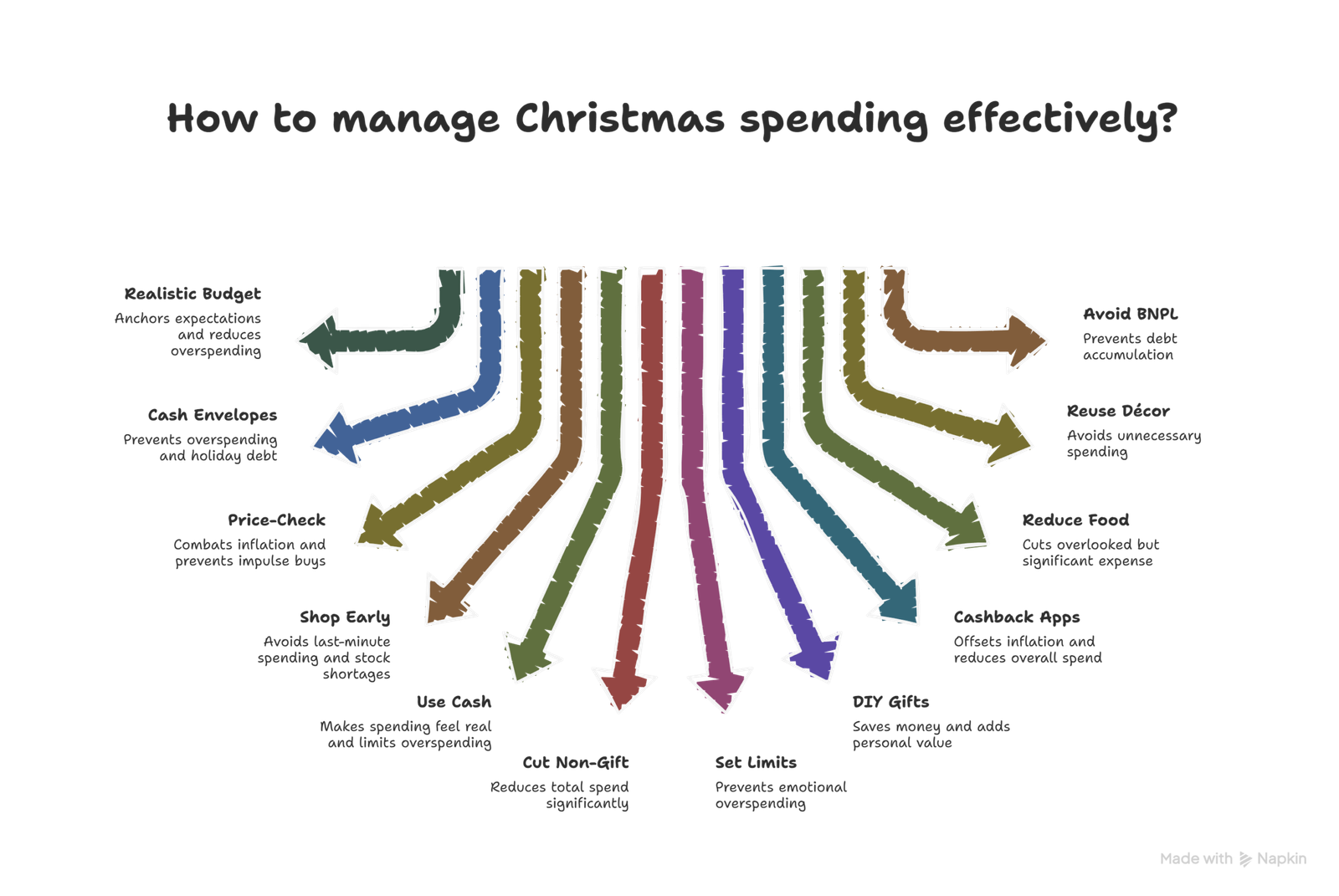

12 Genius Christmas Budgeting Tips to Save Big This Holiday

1. Start With a Realistic Budget Based on U.S. Averages

Most Americans budget emotionally. Instead, anchor your budget in reality:

-

$902 per person

-

$1,778 per household

-

Gifts $641, travel $735, food $238, décor $507

These benchmarks are the foundation for your Christmas budgeting tips. With 49% overspending despite a budget, realistic numbers matter.

2. Use Sinking Funds & Cash Envelopes

The most popular saving strategies in the U.S.:

-

Sinking funds

-

Cash envelopes

-

Cashback apps

These tools visually limit spending and prevent the typical $1,012 holiday debt. Incorporating this into your Christmas budgeting tips plan is crucial.

3. Price-Check Everything

Cleveland State Bank highlights price-checking as a top way to avoid overspending.

Combine with digital coupons (trending in 2024) to multiply savings. With 8.8% inflation affecting budgets, this tip is essential for anyone following Christmas budgeting tips.

4. Shop Early

Early shopping is a proven strategy:

-

63% of Americans shop early specifically to save.

-

Avoids emotional last-minute purchases.

-

Ensures better inventory and pricing.

This simple tip is a cornerstone of effective Christmas budgeting tips.

5. Switch to Cash for Non-Essentials

With 84% using credit cards, it’s easy to overspend. Cash-first purchases:

-

Limit impulse spending.

-

Reduce overspending (49% over budget).

-

Avoid interest and BNPL pitfalls.

Including this tip in your Christmas budgeting tips guide is a must.

6. Cut Back on Non-Gift Categories

Travel, food, and décor are budget killers:

-

Travel $735 per person

-

Décor $507

-

Food $238

Cutting these can dramatically reduce total spending. Add to your Christmas budgeting tips:

-

Reduce travel days

-

Host local gatherings

-

Repurpose décor

-

Plan potlucks

7. Set Hard Spending Limits (The Big #7 That Changes Everything)

Here’s the shocking fact:

-

24% go into holiday debt

-

Average debt: $1,012

CNBC recommends hard spending caps and communicating limits [CFP on How to Avoid Overspending, CNBC]. This is the tip that changes everything.

Benefits:

-

Reduces emotional gifting pressure

-

Keeps family expectations realistic

-

Prevents overspending in all categories

This tip is central to your Christmas budgeting tips plan.

8. DIY Gifts Save Big

DIY gifts are highlighted as a top saving strategy. Americans spend $641 on gifts, so even small DIY projects save hundreds.

Ideas:

-

Photo books

-

Handmade ornaments

-

Baked goods

-

Personalized letters

Integrating DIY is a key Christmas budgeting tip.

9. Use Cashback Apps and Browser Extensions

Inflation is squeezing budgets by 8.8%. Cashback tools, listed as popular saving strategies.

-

Amazon, Walmart, Target, Best Buy, Etsy

-

Save 5–15% automatically

-

Complement other Christmas budgeting tips

10. Reduce Food Spending

Food averages $238 per person.

Tips:

-

Potlucks and bulk meals

-

Plan menus early

-

Buy generics

-

Avoid last-minute grocery runs

This is a high-impact Christmas budgeting tip often overlooked.

11. Reuse Décor

Décor costs $507 per household.

Cost-saving strategies:

-

Repurpose last year’s items

-

Swap with friends

-

DIY ornaments

A simple but effective Christmas budgeting tip.

12. Avoid BNPL and Credit Cards Without a Repayment Plan

Credit cards drive 84% of purchases, leading to the $1,012 average holiday debt.

Your Christmas budgeting tips should include:

-

A repayment timeline

-

Weekly balance checks

-

Total credit limit caps

Prevent your holiday season from turning into financial stress.

Final Checklist: Your Christmas Budgeting Blueprint

Follow these steps:

-

Anchor your budget to national averages

-

Track spending weekly

-

Use sinking funds and envelopes

-

Set caps (#7)

-

Price-check every purchase

-

Use cash when possible

-

Cut travel, food, and décor costs

-

Leverage cashback apps

-

Avoid BNPL without a plan

Following these Christmas budgeting tips will make January stress-free.

Frequently Asked Questions (FAQs)

Q. Why do Americans overspend at Christmas?

- Because 49% overspend beyond their budget, despite planning.

Q. How much is the average holiday debt?

- $1,012

Q. How many Americans go into debt every holiday?

- 24%

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

A neatly expressed idea with clear professional merit.

Pingback: 10 Genius Ways to Save Money on Christmas Gifts—#4 Saves a Fortune!