Introduction: From Confused to Confident Investor

If you’ve ever felt overwhelmed by the idea of the stock market, you’re not alone. The terms. The risks. The charts. It’s confusing.

But here’s the truth: anyone can learn how to start investing and use the stock market to grow their money—regardless of income, age, or experience.

In this beginner-friendly guide, you’ll learn:

How the stock market works (explained like a story)

The safest ways to get started

Mistakes to avoid

Strategies to multiply your money long-term

Let’s take the fear out of investing—step-by-step.

What is the Stock Market? (Storytelling Style)

The Marketplace of Dreams

Imagine walking through a massive, buzzing bazaar. Instead of spices and fabrics, booths are selling ownership in businesses. You see Apple, Tesla, Starbucks—all offering you a piece of their future.

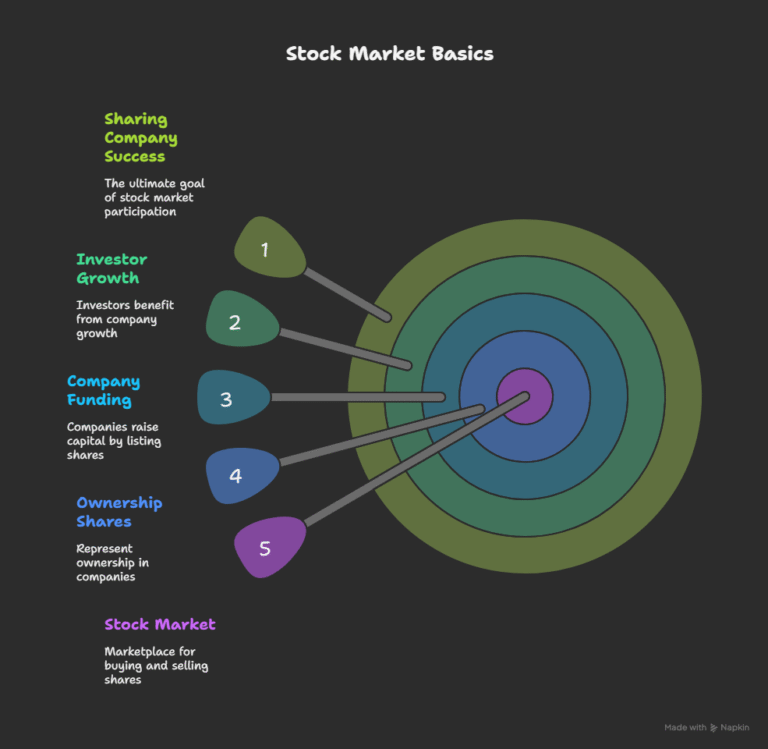

That’s the stock market: a public marketplace where people buy and sell shares of companies. These shares represent ownership.

Companies list their stock to raise money. Investors buy those shares hoping the business will grow, so their investment grows too. This is the heart of stock market basics: sharing in a company’s success.

Why You Should Invest in the Stock Market

1. Grow Your Money Over Time

The stock market has returned 7%–10% annually over decades. A $5,000 investment at 8% grows to over $50,000 in 30 years.

2. Outpace Inflation

Inflation quietly kills your savings. Investing helps preserve and grow your buying power.

3. Build Long-Term Wealth

You don’t need to be rich to start investing. But to get rich, investing helps.

4. Own What You Use

Love Apple? Use Starbucks? Invest in what you believe in.

Preparing to Start Investing

Step 1: Set Clear Goals

What are you investing for—retirement? A house? Knowing your goal helps you plan your strategy.

Step 2: Build an Emergency Fund

Save 3–6 months of expenses before investing. It gives you peace of mind.

Step 3: Pay Off High-Interest Debt

Why earn 8% returns if you’re paying 20% interest on credit cards? Clear that first.

Step 4: Know Your Risk Tolerance

Ask yourself: Can I handle short-term losses for long-term gain?

Stock Market Basics: Investment Types

1. Individual Stocks

Own a single company. High reward, high risk.

2. ETFs (Exchange-Traded Funds)

A group of stocks you can buy like one. Great for beginners.

3. Mutual Funds

Managed funds made up of many assets. Professional oversight, higher fees.

4. Index Funds

Track a market index like the S&P 500. Simple, low-cost, and effective for long-term growth.

How to Start Investing Step-by-Step

Step 1: Pick a Brokerage

Popular choices:

Step 2: Open an Account

Choose a brokerage or retirement account (IRA, PPF, etc.).

Step 3: Fund It

Start with any amount. Even $100 is enough to begin.

Step 4: Choose Investments

Start with index funds or ETFs. Add individual stocks slowly.

Step 5: Automate Contributions

Set monthly auto-deposits. Consistency wins.

Mistakes to Avoid

| Mistake | Why It Hurts |

|---|---|

| Timing the market | Impossible to predict. Time in market matters more. |

| Following trends blindly | Hot tips cool fast. Do your research. |

| No diversification | One bad stock can wipe you out. Spread risk. |

| Reacting emotionally | Stay calm during dips. Markets recover. |

| Ignoring fees | High fees silently eat your returns. |

How to Grow Your Money in the Stock Market

1. Dollar-Cost Averaging

Invest fixed amounts regularly. Reduces risk over time.

2. Reinvest Dividends

Compound growth = snowball effect. Don’t take payouts—reinvest.

3. Increase Contributions Over Time

As income grows, so should your investments.

4. Stay Invested

Markets rise long-term. Don’t sell out during drops.

Best Tools & Resources

Books

YouTube Channels

Platforms & Apps

FAQs

Q: Is the stock market safe for beginners?

Yes, with proper diversification and long-term focus, it’s one of the safest ways to grow wealth.

Q: How much money do I need to start investing?

As little as $10–$100.

Q: Can I lose all my money in the stock market?

Only if you put everything in one stock. Diversify to reduce risk.

Conclusion

You now understand stock market basics, how to start investing, and strategies to grow your money long term. The most important step? Start.

Open an account. Choose one index fund. Invest your first $100. That’s it. You’re now an investor.

With time, patience, and consistency—you will build wealth.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

Good post! We will be linking to this particularly great post on our site. Keep up the great writing