Introduction

Growing personal money is a goal shared by many, though few know how to achieve the same. The rich have mastered this art of making their money work for them. In the article, we will unveil 10 secrets the wealthy use to increase their wealth effectively. Implement these strategies and take control over your personal finances, and then build a secure financial future.

2. Invest in Stocks

The stock market has proven to be a great way to build wealth over the long term.

- How much return: Of course, the long-term return is closer to 7% to 10% per year.

- How to: Start small on platforms like Robinhood, E*TRADE, or Fidelity. Invest in index funds like the S&P 500 to minimize risk.

3. Diversify Your Investments

The rich don‘t put all their eggs in one basket. They diversify across various asset classes.

- How to: Allocate funds in stocks, bonds, real estate, and mutual funds. Tools like Betterment and Wealthfront can help create diversified portfolios.

4. Leverage Real Estate

Real estate is a solid investment that gives cash flow and appreciation over time.

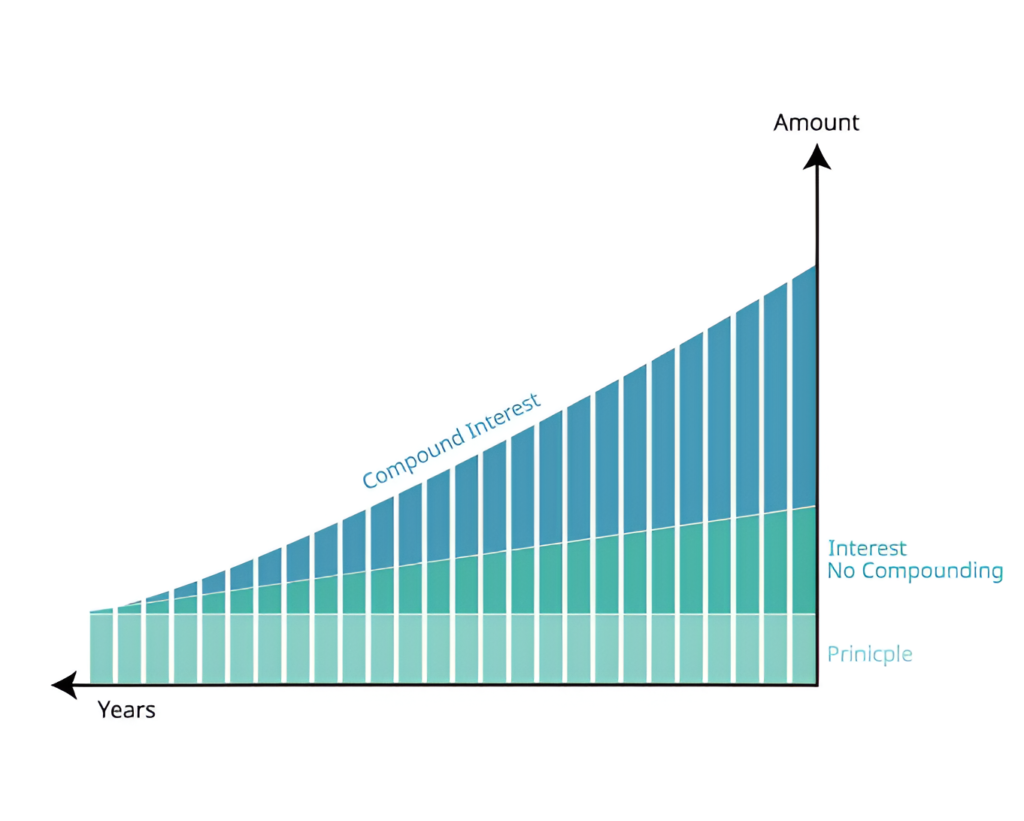

7. Use Compound Interest to Your Advantage

Compound interest grows your money exponentially over time.

- How much return: With regular contributions to an account earning 8% annually, $10,000 can grow to $50,000 in 20 years.

- How to: Open a high-yield savings account or a retirement account like an IRA.

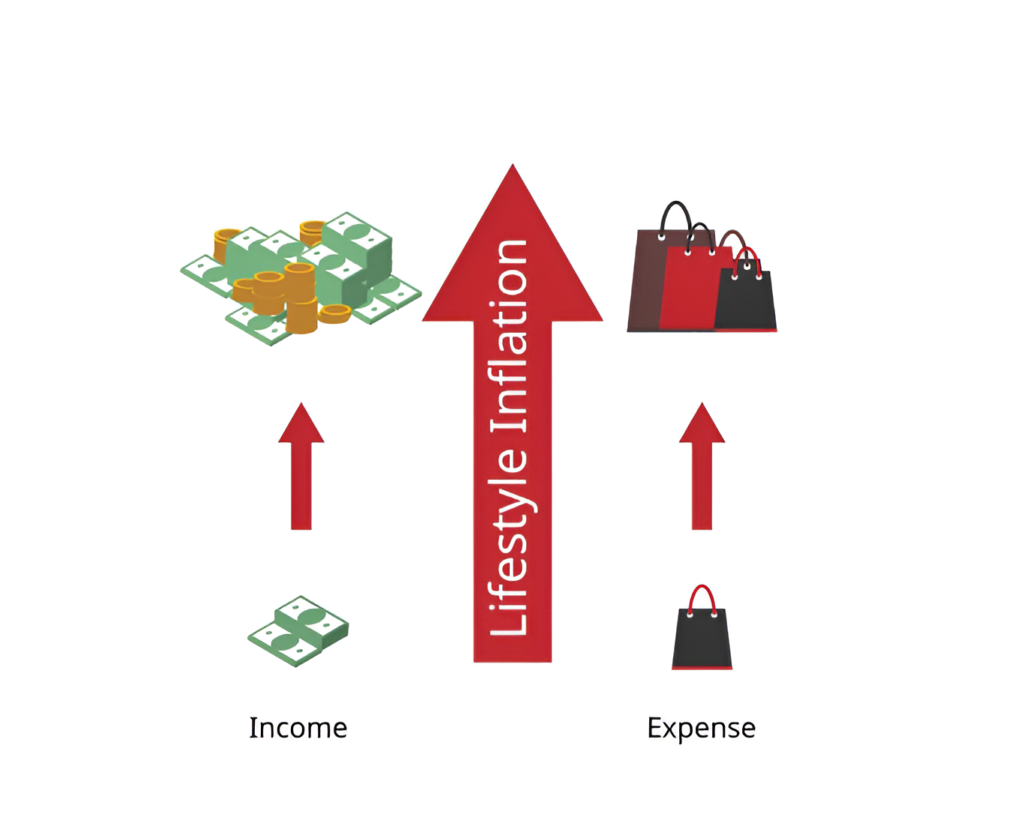

8. Avoid Lifestyle Inflation

The wealthy control their expenses even when their income increases.

- How to: Lead a modest lifestyle. Apps like PocketGuard will notify you if you are overspending.

Conclusion

Growing personal money like the rich is no luck; it is a matter of good decision-making, discipline, and long-term thinking. With these 10 secrets, start building that roadmap to financial freedom today.

By using those platforms, tools, and strategies outlined above, you will be far along in maximizing your financial potential. Start now, and let your money grow like the rich!

FAQs

What is personal money growth?

Answer: Personal money growth refers to strategies and practices that increase an individual’s wealth over time, including savings, investments, and building multiple income streams.

Is it safe to invest online?

Answer: Yes, as long as you use trusted platforms with proper security measures like encryption. Always verify a platform’s legitimacy before investing.

How can I use compound interest to grow my money?

Answer: Start early, invest consistently, and let your money stay invested to earn interest on both the principal and the accrued interest.

Owner of Paisewaise

I’m a friendly finance expert who helps people manage money wisely. I explain budgeting, earning, and investing in a clear, easy-to-understand way.

The article is very engaging and well-written. Thanks for sharing your knowledge and expertise with your readers.

This post reinforced me of some crucial lessons I had overlooked.