Table of Contents

Introduction

Investment funds have now become the cornerstone of financial planning for investors across the globe. It makes wealth-building diversified while it lessens one’s risk with maximum possible returns. For a novice investor or a seasoned one, knowing where to invest in 2025 will be able to make all the difference in reaching their financial goal. Here‘s a look at the top five investment funds to consider, the benefits they may bring, the potential return, and even where to invest.

1. Index Funds: The Low-Cost Favorite

What Are Index Funds?

Index funds are investing vehicles that work to replicate the performance of a specific market index, such as the S&P 500 or Nasdaq. By pooling funds from investors, they enable you to own a diversified portfolio of stocks with minimal effort.

Benefits

- Low Fees: Since these funds have a passively managed approach, the fees associated with such funds are much lower than those that have an actively managed approach.

- Diversification: By investing in an index fund, your money gets spread to various companies and industries, thus minimizing risk.

- Consistent Growth: Historically, index funds represent steady long-term returns and are usually greater than actively managed funds.

Potential Returns

The average annual return is usually around 7-10% after adjusting for inflation, depending on the selected market index.

Best Platforms to Invest

- Vanguard: Known for its low-cost index funds.

- Fidelity: Available with the zero-fee index fund, which is also available in select markets.

- Charles Schwab: Range of low-cost index funds.

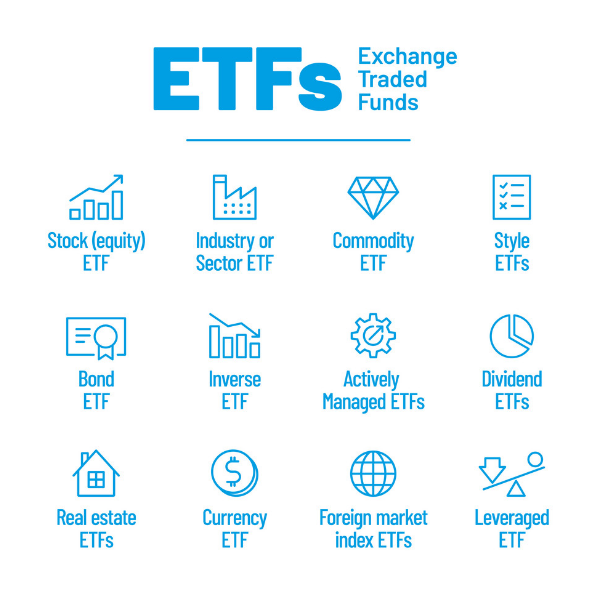

2. Exchange-Traded Funds (ETFs): The Flexible Option

What Are ETFs?

ETFs share the characteristics of index funds but trade on stock exchanges, like individual stocks. They offer the advantages of mutual funds with the flexibility of trading in the stock market.

Benefits

- Liquidity: Bought and sold throughout the trading day.

- Tax Efficiency: Usually more tax-efficient than mutual funds.

- Lower Initial Investment: Investment in ETF can be made at a cost as low as one share.

Potential Returns

Returns differ depending on the type of ETF; however, equity ETFs usually achieve returns closest to their underlying index, and on average, this is 7-12% a year.

Best Platforms to Invest

- Robinhood: It offers commission-free ETF trading.

- E*TRADE: Known for its user-friendly interface and robust research tools.

- Interactive Brokers: Best for international ETF investors.

3. Mutual Funds: The Time-Tested Choice

What Are Mutual Funds?

Mutual funds are shared pools of money from many investors to invest in stocks, bonds, or other securities, managed by professional portfolio managers.

Benefits

- Professional Management: Your money is handled by experts.

- Diversification: Mutual funds invest in a wide range of assets.

- Customization: Choice ranges from aggressive growth to conservative income funds.

Potential Returns

The type of fund determines the returns. For example, a bond-intensive portfolio carries a return between 4% and 10% or more for an equity-intensive portfolio.

Best Platforms to Invest

- T. Rowe Price: Best for variety that is actively managed.

- Morningstar: Best for details about mutual fund searching and analysis.

- Vanguard: Best for its reliability and also low fees.

4. Real Estate Investment Trusts (REITs): Passive Income Generator

What Are REITs?

REITs are companies involved in owning or financing income-producing real estate. Through a REIT, you receive dividends on real estate without buying property.

Benefits

- Guaranteed Income: Investment in REITs implies that you receive 90% of the taxable income made by REITs in dividend forms.

- Liquidity: REIT shares, unlike physical properties, can easily be sold and bought.

- Portfolio Diversification: Allows a real estate component to your investment portfolio

Potential Returns

The average dividend yield of REITs is between 5% and 8%, with the possibility of earning capital appreciation.

Best Platforms to Invest

- Fundrise: This platform is ideal for beginners who want to invest in private REITs.

- Realty Mogul: Invests in both public and private REITs.

- Public.com: Anyone can invest in fractional shares of REITs.

5. Target-Date Funds: Set-It-And-Forget-It Investing

What Are Target-Date Funds?

Target-date funds automatically adjust their asset allocation based on your selected retirement or financial goal date. As the target date approaches, they become more conservative.

Benefits

- Convenience: Suitable for passive investors.

- Professional Allocation: Balances risk and reward with time.

- Diversification: It usually consists of a combination of equities, bonds, and more.

Potential Returns

Returns will depend on the target date and risk profile, averaging 5-8% annually.

Best Platforms to Invest

- Betterment: Offers automated investing in target-date portfolios.

- Wealthfront: Offers comprehensive planning with target-date funds.

- Fidelity: Very wide range of low-fee options in target-date funds.

Conclusion: Why Investment Funds Are Your Best Bet in 2025

Investment funds make wealth-building easy and accessible for all investors. There are many ways to diversify a portfolio and take advantage of professional skills while reducing risk towards realizing financial goals. For those who like the simplicity of index funds, the flexibility of ETFs, or the income potential of REITs, investment funds in 2025 will have something to suit your needs.

Start taking action today, get on to a reputable platform, initiate small, and soon watch your investments mature.

FAQs

What Are Investment Funds?

- Investment funds are financial products that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, real estate, or other assets. These funds are managed by professional fund managers, who make investment decisions on behalf of the investors.

How Can I Start Investing in Investment Funds in 2025?

To start investing in investment funds, follow these steps:

- Choose a Fund Type: Decide whether you want to invest in index funds, ETFs, mutual funds, REITs, or target-date funds.

- Select a Platform: Use a reliable investment platform or brokerage. Popular platforms include Vanguard, Fidelity, Charles Schwab, and Robinhood.

- Open an Account: Create an account on your chosen platform and complete any required documentation.

- Deposit Funds: Transfer money into your investment account.

- Start Investing: Select the fund(s) you wish to invest in and allocate your funds according to your strategy.

- Monitor Your Investments: Regularly review your portfolio and adjust as necessary to meet your financial goals.

Are Investment Funds Safe?

While no investment is entirely risk-free, investment funds generally offer a safer way to invest compared to individual stocks due to their diversification. Risk levels vary based on the type of fund you choose. For example:

- Index Funds & ETFs are generally lower-risk due to diversification.

- REITs carry some real estate market risk but offer high dividend yields.

- Mutual Funds can vary greatly in risk based on the fund’s focus (stocks, bonds, or a mix).

Pingback: 7 Investment Fund Myths Busted - Paisewaise

Pingback: 10 Secrets to Grow Your Personal Money Like the Rich - Paisewaise

It was a great article! Appreciate it for sharing your insights.